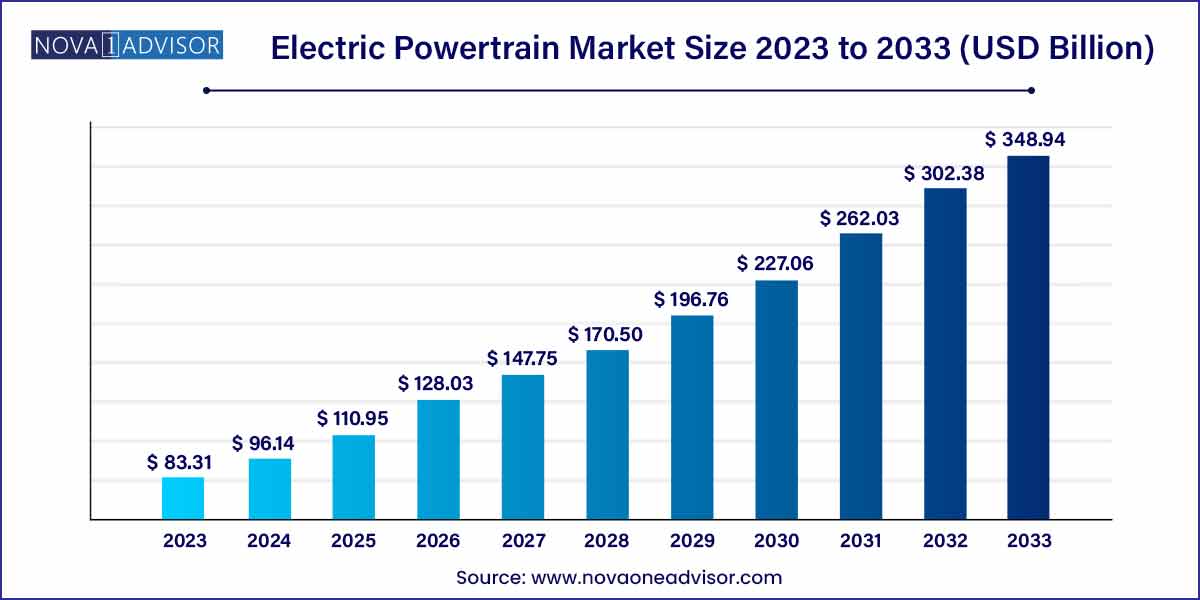

The global electric powertrain market size was exhibited at USD 83.31 billion in 2023 and is projected to hit around USD 348.94 billion by 2033, growing at a CAGR of 15.4% during the forecast period of 2024 to 2033.

Key Takeaways:

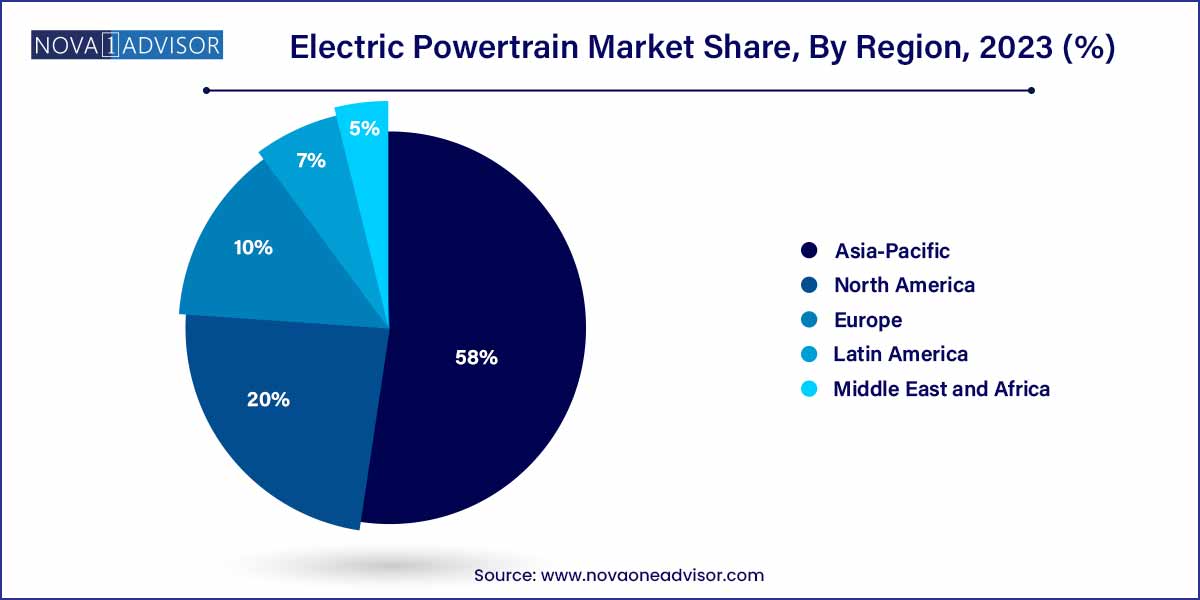

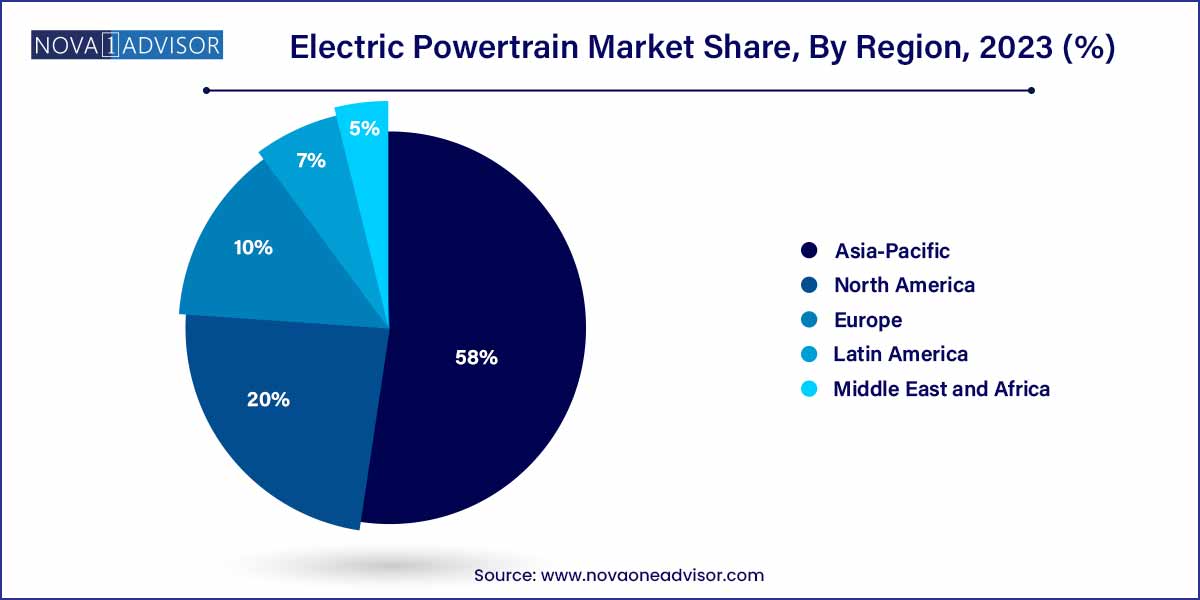

- Asia Pacific captured the largest revenue share of over 58.0% in 2023.

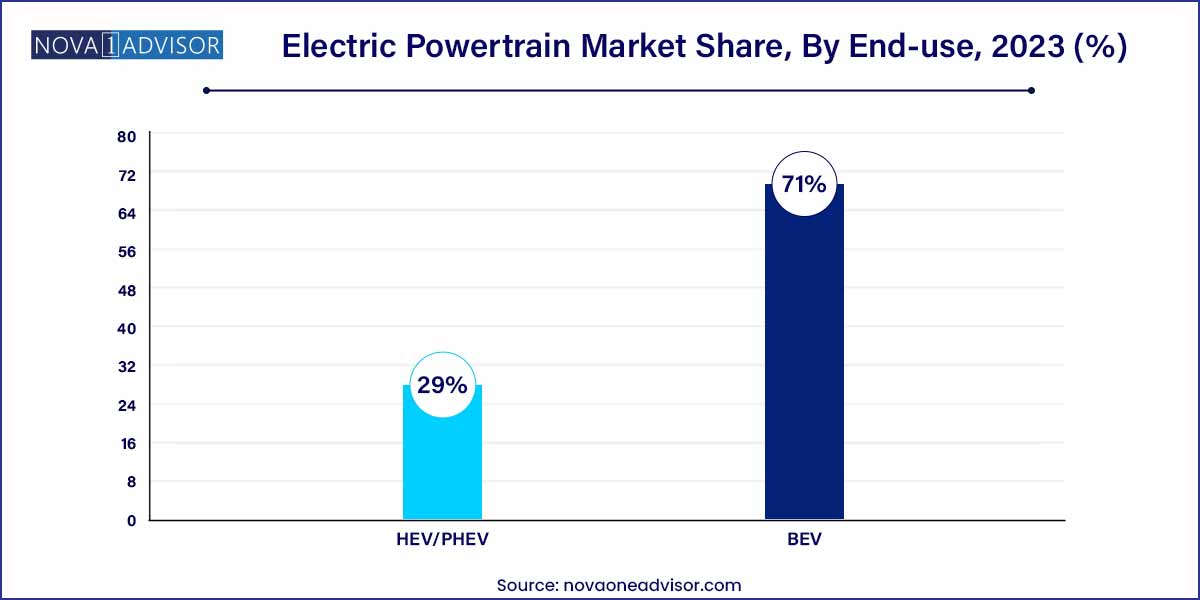

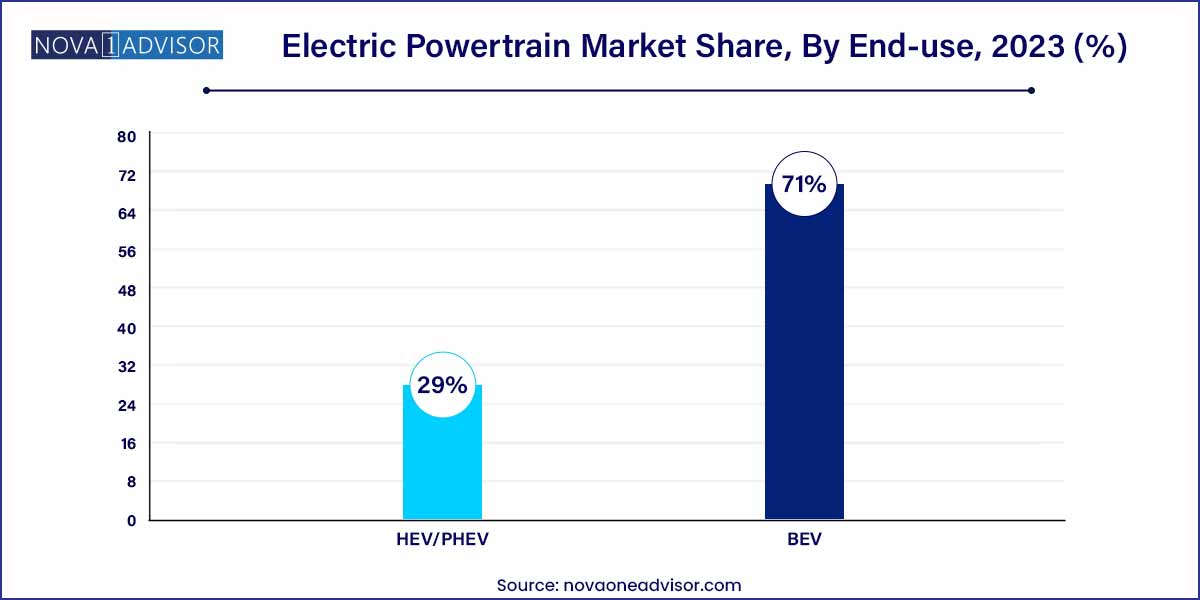

- The BEV segment accounted for the largest share of around 71% of the overall market in 2023.

- The battery segment accounted for the largest share of 63.6% in 2023.

Electric Powertrain Market: Overview

The electric powertrain market represents a cornerstone of the rapidly evolving electric vehicle (EV) industry, serving as the fundamental system that converts energy into propulsion in electric and hybrid electric vehicles. As the automotive landscape transitions from internal combustion engines (ICEs) to electric mobility, the powertrain is undergoing a radical transformation, driven by sustainability mandates, stringent emissions regulations, and advancements in component technologies.

At the heart of every electric vehicle lies the electric powertrain, comprising critical components such as the battery, motor/generator, power electronics controller, converter, onboard charger, and transmission system. These systems must not only deliver high performance and efficiency but also offer compatibility with varying driving conditions, vehicle architectures, and energy storage systems.

Governments worldwide are catalyzing this shift by implementing favorable policies, offering subsidies for EVs, and investing in charging infrastructure. For example, the European Union has mandated a ban on new ICE vehicles by 2035, while the United States and China have committed billions to develop their EV supply chains. In this context, electric powertrain technologies are at the epicenter of innovation, drawing attention from automakers, component manufacturers, and tech startups alike.

From Battery Electric Vehicles (BEVs) to Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs), the market for powertrain components is expanding in both scope and complexity. Moreover, the growing demand for high-performance, cost-effective, and compact solutions is pushing R&D investment into areas such as silicon carbide (SiC) power electronics, solid-state batteries, and modular electric drivetrains.

Major Trends in the Market

-

Shift Toward Silicon Carbide (SiC) Power Electronics: SiC-based power devices are replacing traditional silicon for faster switching, improved efficiency, and better thermal performance in EV inverters and converters.

-

Integration of Powertrain Components: OEMs are increasingly integrating motors, inverters, and transmissions into a single module to reduce space, cost, and weight.

-

Emergence of 800V Architectures: Automakers are moving to 800V systems for faster charging and better power efficiency, adopted by players like Porsche and Hyundai.

-

Thermal Management Innovation: Efficient cooling systems for batteries, motors, and electronics are critical for maintaining performance and extending lifespan.

-

Lightweight Materials Adoption: Aluminum alloys, carbon fiber, and composite housings are being used to reduce the weight of electric powertrain components.

-

Rise of Software-Defined Vehicles: The incorporation of over-the-air updates, diagnostics, and adaptive control in powertrain systems is transforming performance optimization and maintenance.

-

Battery-as-a-Service (BaaS): Powertrain configurations are increasingly aligning with battery swapping and leasing models, especially in urban fleet operations.

Electric Powertrain Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 83.31 Billion |

| Market Size by 2033 |

USD 348.94 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Electric Vehicle, Component, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BorgWarner Inc.; Continental AG; Cummins Inc.; Hitachi Ltd; Magna International Inc.; Marelli Holdings Co., Ltd. |

Electric Powertrain Market Dynamics

- Increasing Adoption of Electric Vehicles (EVs):

The electric powertrain market is dynamically shaped by the surging adoption of electric vehicles (EVs) worldwide. With a growing emphasis on sustainable and eco-friendly transportation solutions, consumers are increasingly embracing EVs. This shift is propelled by heightened environmental consciousness and a desire for reduced carbon footprints. As a result, automakers are prioritizing the development and integration of electric powertrains to meet the rising demand for cleaner and more efficient mobility options.

- Stringent Emission Regulations:

A significant driving force behind the electric powertrain market dynamics is the imposition of stringent emission regulations by governments globally. As environmental concerns escalate, regulatory bodies are enacting stricter norms to curb vehicular emissions. To comply with these regulations, automotive manufacturers are increasingly turning to electric powertrains, which offer a cleaner and more sustainable alternative to traditional internal combustion engines. This regulatory push not only shapes the current landscape of the electric powertrain market but also sets the stage for continued growth as emissions standards continue to evolve.

Electric Powertrain Market Restraint

- Infrastructure Challenges:

A significant restraint in the electric powertrain market stems from the challenges associated with the development of charging infrastructure. While the demand for electric vehicles is on the rise, the lack of a widespread and efficient charging network can impede market growth. Consumers' concerns about the availability of charging stations and the time required for charging may act as deterrents to the widespread adoption of electric vehicles. Overcoming these infrastructure challenges is crucial for fostering consumer confidence and accelerating the market penetration of electric powertrains.

Cost Barriers:

Cost considerations remain a notable restraint in the electric powertrain market. Despite advancements in battery technology, electric vehicles often come with a higher upfront cost compared to their traditional counterparts. The cost of manufacturing high-capacity and durable batteries contributes significantly to the overall price of electric vehicles, limiting their affordability for a broader consumer base. Overcoming cost barriers through ongoing research and development, economies of scale, and government incentives will be essential for fostering wider acceptance of electric powertrains in the automotive market.

Electric Powertrain Market Opportunity

- Government Incentives and Policies:

A substantial opportunity in the electric powertrain market lies in the increasing support from governments worldwide through incentives and policies. Many countries are offering financial incentives, tax credits, and subsidies to promote the adoption of electric vehicles, thereby creating a favorable environment for the electric powertrain market. Governments are also investing in charging infrastructure development, further bolstering the prospects of widespread electric vehicle adoption. Capitalizing on these supportive policies presents a significant opportunity for stakeholders in the electric powertrain sector to expand their market share and accelerate the transition to sustainable transportation.

- Technological Advancements and Innovation:

The ongoing technological advancements in electric powertrain components, particularly in battery technology and electric motors, present a compelling opportunity for market growth. Continuous research and development efforts are focused on enhancing the efficiency, energy density, and lifespan of batteries, making electric vehicles more appealing to consumers. Innovations in power electronics and regenerative braking systems contribute to the overall performance and sustainability of electric powertrains. Companies investing in cutting-edge technologies and embracing innovation have the potential to gain a competitive edge in the market and capitalize on the evolving landscape of electric mobility.

Electric Powertrain Market Challenges

- Limited Range and Charging Infrastructure:

One of the primary challenges faced by the electric powertrain market revolves around the limited driving range of electric vehicles (EVs) and the associated infrastructure for charging. Range anxiety, or the fear of running out of battery power before reaching a charging station, remains a concern for potential EV buyers. Despite advancements in battery technology, achieving longer ranges on a single charge is an ongoing challenge. Additionally, the need for an extensive and efficient charging infrastructure to support long-distance travel and accommodate the increasing number of electric vehicles on the road is crucial. Overcoming these limitations is essential to addressing consumer concerns and promoting wider EV adoption.

- High Initial Costs and Affordability:

The high initial costs of electric vehicles pose a significant challenge for the widespread adoption of electric powertrains. While advancements have been made in reducing the cost of electric vehicle components, such as batteries, EVs still tend to have a higher upfront price compared to traditional internal combustion engine vehicles. Affordability remains a critical factor influencing consumer decisions, and until electric vehicles achieve price parity with their conventional counterparts, market penetration may be hindered. Overcoming cost barriers through economies of scale, technological advancements, and supportive government policies will be essential to make electric powertrains more accessible to a broader consumer base.

Segments Insights:

Electric Vehicle Insights

Battery Electric Vehicles (BEVs) dominate the electric powertrain market due to their fully electric nature, which relies entirely on electric propulsion systems. These vehicles eliminate the need for ICE components, making the electric powertrain critical for their performance and efficiency. Tesla, BYD, and Hyundai are leading the BEV segment with aggressive model rollouts, extensive battery innovation, and vertically integrated powertrain strategies. BEVs are gaining consumer preference because they offer longer driving ranges, zero tailpipe emissions, and a lower cost of ownership over time compared to hybrid vehicles. The increasing availability of fast-charging infrastructure further boosts BEV adoption, particularly in Europe, North America, and China.

On the other hand, the HEV/PHEV segment is the fastest growing, especially in transitional markets where full electrification faces infrastructure or range anxiety challenges. Plug-in hybrids offer the flexibility of dual power sources—combustion and electric—appealing to consumers seeking both performance and eco-friendliness. Brands like Toyota (with its Prius models), Honda, and Volvo have successfully captured market share with hybrid offerings. The HEV segment is also supported by fleet applications in regions where full EV charging networks are still under development. As battery and electric motor efficiency improves, PHEVs are becoming more range-capable, accelerating their acceptance in suburban and semi-urban regions.

Component Insights

Within BEV powertrain components, batteries hold the dominant share as they are the most expensive and technically critical part of an electric vehicle. The performance, range, and lifespan of a BEV are directly tied to battery capacity and chemistry. Lithium-ion technology remains the industry standard, although innovations in solid-state batteries are on the horizon. OEMs such as Tesla and BYD have established proprietary battery technologies and gigafactories to ensure cost control and scalability. Moreover, battery management systems (BMS) play a vital role in ensuring safety, performance optimization, and thermal management, adding to the value chain.

The electric motor/generator segment is the fastest growing within BEVs, driven by rising performance expectations and competition among automakers to differentiate on acceleration, torque, and regenerative braking capabilities. The trend toward dual-motor or tri-motor architectures in high-end EVs like the Tesla Model S Plaid or Lucid Air amplifies this demand. OEMs are also experimenting with axial flux and permanent magnet motors to enhance power-to-weight ratios. Furthermore, developments in magnet-free and copper rotor motors aim to reduce reliance on rare earth elements, promoting sustainability and cost-effectiveness.

Regional Insights

Asia-Pacific leads the global electric powertrain market, anchored by automotive giants like China, Japan, and South Korea. China, in particular, has emerged as the epicenter of electric vehicle manufacturing and consumption. With policy incentives, infrastructure investment, and a robust domestic supply chain, the Chinese market accounts for more than half of global EV sales. Companies like BYD, NIO, and XPeng have vertically integrated powertrain capabilities, while CATL and LG Energy Solution dominate the battery landscape. Japan and South Korea are also significant contributors, with Toyota, Nissan, and Hyundai aggressively expanding their electrified vehicle portfolios. The availability of low-cost skilled labor and government-backed R&D funding makes Asia-Pacific a manufacturing hub for electric powertrain components.

Europe is witnessing the fastest growth in the electric powertrain market, fueled by its strong regulatory push toward zero-emission mobility. The European Green Deal and country-specific mandates are compelling automakers to invest heavily in electric vehicle production. Germany, France, and the Nordic countries are leading the charge, with Volkswagen Group and Stellantis rolling out comprehensive EV lineups backed by local battery production facilities. Furthermore, government subsidies, urban low-emission zones, and rising fuel prices are accelerating consumer adoption. Europe’s technological capabilities in automotive engineering and energy systems have also enabled rapid innovation in electric powertrain architecture, contributing to its exponential market expansion.

Some of the prominent players in the electric powertrain market include:

- BorgWarner

- Bosch Limited

- Mitsubishi Electric Corp

- Magna International Inc.

- Schaeffler AG

- ZF Friedrichshafen AG

- Valeo

- Nidec Corporation

- Continental AG

- Magneti Marelli Ck Holdings

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric powertrain market.

Electric Vehicle

BEV Electric Powertrain Component

- Motor/Generator

- Battery

- Power Electronics Controller

- Converter

- Transmission

- On-Board Charger

HEV/PHEV Electric Powertrain Component

- Motor/Generator

- Battery

- Power Electronics Controller

- Converter

- Transmission

- On-Board Charger

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)