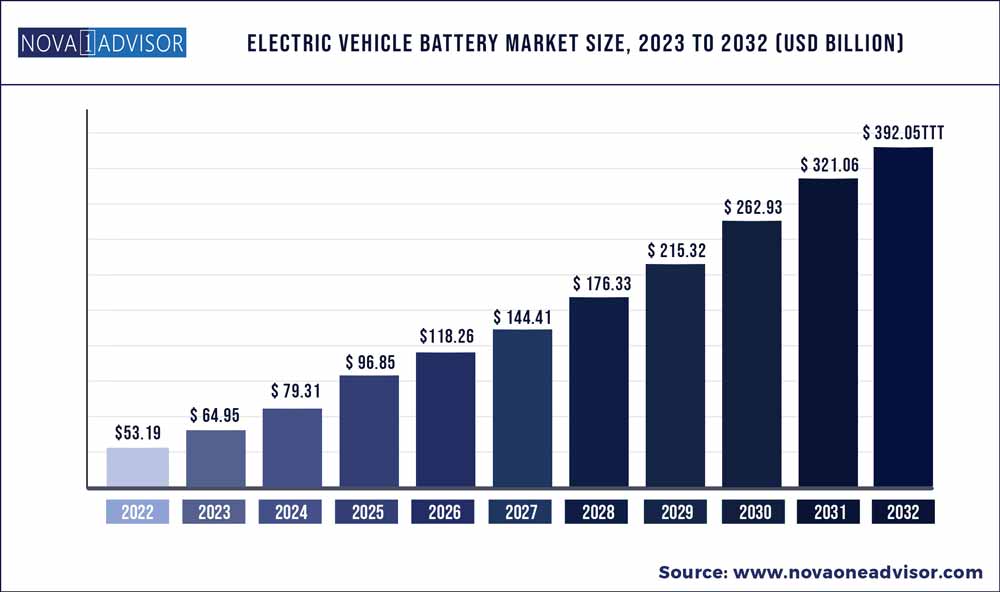

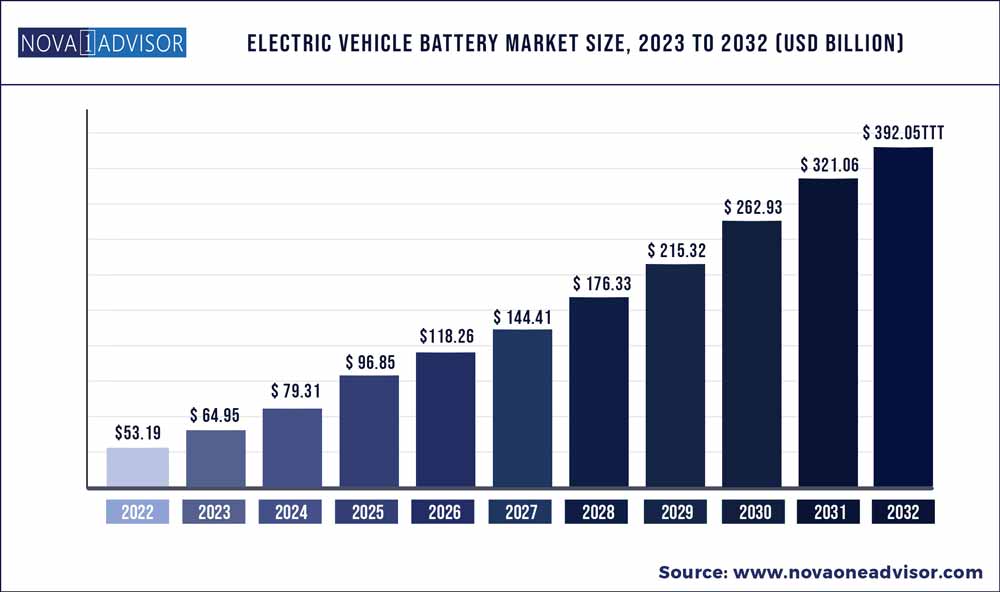

The global electric vehicle battery market size was exhibited at USD 53.19 billion in 2022 and is projected to hit around USD 392.05 billion by 2032, growing at a CAGR of 22.11% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific has held revenue share of around 39.99% in 2022.

- By battery type, lithium-ion battery segment has generated the highest revenue share of 64.69% in 2022.

- By li-ion battery component, seperator has captured 32.46% revenue share in 2022.

- By vehicle type, commercial vehicles has accounted for 56.19% revenue share in 2022.

- By propulsion, hybrid electric vehicle has exhibited revenue share of 34.59% in 2022.

- By capacity, 50-110 kWh segment hold 32.25% revenue share in 2022.

- By material, manganese segment hold 26.9% revenue share in 2022.

- By battery form, pouch segment has generated revenue share of over 42.92% in 2022.

Electric Vehicle Battery Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 53.19 Billion

|

|

Market Size by 2032

|

USD 392.05 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 22.11%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Battery Type, Vehicle Type, Propulsion, Li-ion Battery Component, Method, Capacity, Battery Form, Material Type, End User

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Hitachi, Sony, ATLASBX Co. Ltd., Narada Power Source Co., Ltd., TCL Corporation, Huanyu New Energy Technology, C&D Technologies, Inc., Duracell, Crown Battery Manufacturing, EnerSys, Inc., Panasonic, NEC Corporation, North Star, GS Yuasa Corp., BB Battery Co.

|

The fundamental piece of any electric vehicle (EV) is its battery. A battery is a device that converts chemical energy into electric energy by means of an electrochemical reaction. An electrochemical reaction involves the transfer of electrons from one material to another in an electronic circuit. The battery is often designed in such a way that all the requirements of the motor(s) and charging system that an electric vehicle needs, are met. A common pack of EV battery is composed of blocks of 18-30 parallel cells in series to achieve a desired voltage for propulsion.

Presently, automobile companies are focusing on production of advanced electric vehicle systems such as downsized engines & batteries that are expected to have lower emission at relatively lowers costs. For batteries used in electric vehicles, lithium-nickel-manganese-cobalt-oxide (NMC) is now the most used material. Moreover, lithium-nickel-cobalt-aluminum oxide (NCA) is used in electric vehicles in the U.S. (Tesla Model X, S, and 3). For instance, in March 2020, BYD Motors Inc. launched the new blade battery for electric vehicles that optimizes the battery pack structure by above 50%, as compared to the traditional lithium iron phosphate batteries. It also exponentially increases battery safety.

In addition, governments around the world are supporting purchase of electric vehicles, in terms of tax credits and incentives. Moreover, central governments of few countries such as India, China, and Japan are providing exemption from highway toll tax for electric vehicles. For instance, for faster adoption of electric vehicles, the government of India plans to lower the goods & service tax (GST) on e-vehicles from 5% to 12%. Similarly, the government of South Korea has announced that it will be providing $900 million tax exemptions and subsidies for development and purchase of electric and fuel cell vehicles. Thus, increase in government support for development and purchase of electric vehicles, in terms of tax credits, subsidies and incentives, is one of the major factors that propel the demand for electric vehicles, which is in turn predicted to create lucrative market opportunity for EV battery market share in the forecast period.

The factors such as the growth in demand for zero emission vehicles, reduction in cost of electric vehicle batteries, and technological advancement in battery system, supplement the growth of the electric vehicle battery market. However, stringent lead pollution norms, instability in the prices of the raw material, and high import taxes on EV batteries are the factors expected to hamper the growth of the market. In addition to this, the evolution of lithium-ion technology and proactive government initiatives are projected to generate market opportunities for the key players operating in the market

Increase in global concerns regarding the negative effect of climate change along with alarming pollution levels recorded in the major cities have created a significant demand for electric vehicles. This involves the use of electric vehicles, which do not use gas and are more economical than conventional vehicles. An electric vehicle converts over 50% of the electrical energy from the electric power system (battery) to power at the wheels, whereas the gas-powered vehicle only manages to convert about 17%–21% of the energy stored in gasoline. The demand for fuel-efficient vehicles has increased recently owing to rise in prices of petrol and diesel. This has also resulted due to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from these oil reserves. Thus, these factors give rise to the need for advanced fuel-efficient technologies, further leading to a surge in demand for electrically powered vehicles for travel.

Some of the prominent players in the Electric Vehicle Battery Market include:

- Hitachi, LTD.

- Sony Group Corporation

- ATLASBX Co. Ltd.

- Zhejiang Narada Power Sour

- BB Battery Co.

- Panasonic Energy Co., Ltd.

- Narada Power Source Co., Ltd.

- Robert Bosch LLC

- Crown Battery

- EnerSys, Inc.

- GS Yuasa Corporation

- TCL Corporation

- Huanyu New Energy Technology

- C&D Technologies, Inc.

- Duracell

- NEC Corporation

- North Star

- GS Yuasa Corp.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric Vehicle Battery market.

By Battery Type

- Lead-Acid Battery

- Lithium-ion Battery

- Sodium-ion Battery

- Nickel-Metal Hydride Battery

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Propulsion

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- By Li-ion Battery Component

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

By Method

- Wire Bonding

- Laser Bonding

By Capacity

- <50 kWh

- 50-110 kWh

- 111-200 kWh

- 201-300 kWh

- >300 kWh

By Battery Form

- Prismatic

- Cyindrical

- Pouch

By Material Type

- Lithium

- Cobalt

- Manganese

- Natural Graphite

By End User

- Electric Vehicle OEMs

- Battery Swapping Stations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)