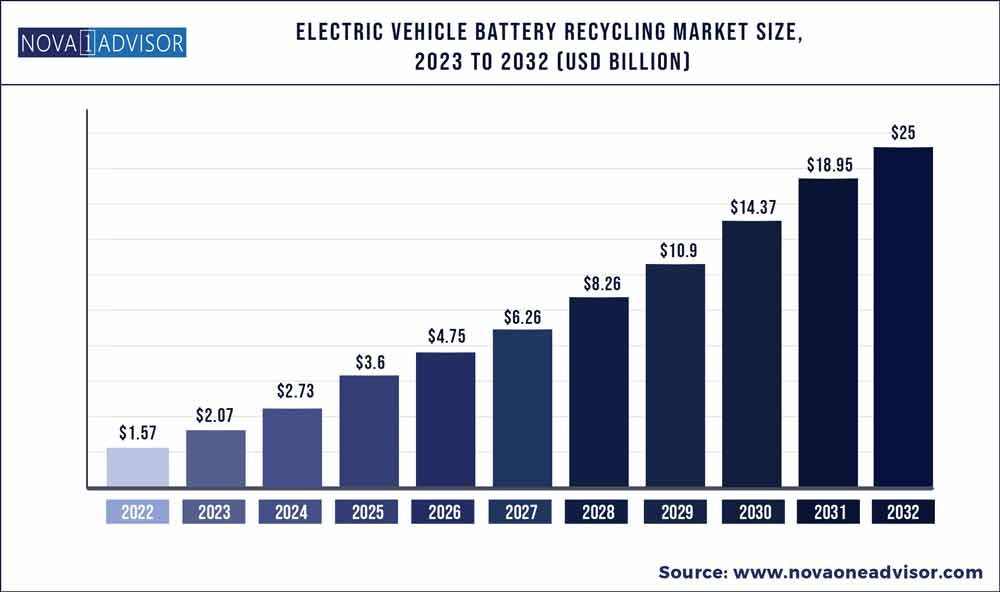

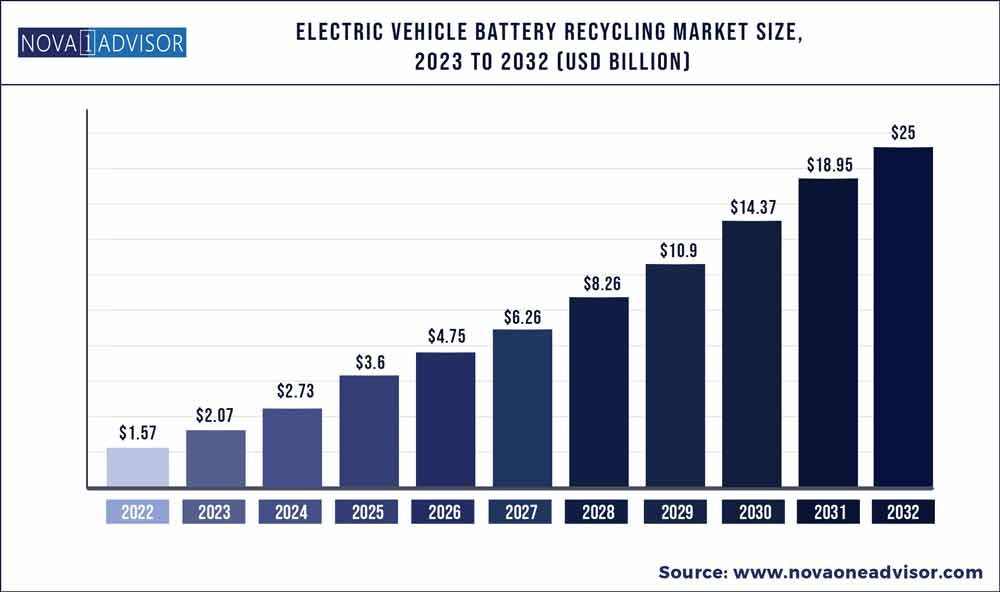

The global electric vehicle battery recycling market size was exhibited at USD 1.57 billion in 2022 and is projected to hit around USD 25 billion by 2032, growing at a CAGR of 31.89% during the forecast period 2023 to 2032.

Key Pointers:

- The lithium-ion battery segment has accounted 47% revenue share in 2022.

- The lead-acid battery segment had significant market share of over 31% in 2022.

- By application, the electric cars held 40.9% market share in 2022.

- In 2022, Asia Pacific held a sizeable market share of over 52%.

Electric Vehicle Battery Recycling Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 2.07 Billion

|

|

Market Size by 2032

|

USD 25 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 31.89%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Chemistry, Process, Application, End User

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

ACCUREC Recycling GmbH (Germany), American Manganese Inc. (Canada), Battery Solutions (US), Li-Cycle Corp. (Canada), G & P Batteries (UK), Recupyl (France), Retriev Technologies (US), Australian Battery Recycling Initiative (Australia), Snam S.p.A. (Italy), Umicore N.V. (Belgium)

|

The market for electric vehicle (EV) battery recycling is advancing due to the increasing demand from EV manufacturers and government bodies to recycle the waste generated by the automotive industry. Batteries have become one of the major components of electric vehicles as they replace the traditional internal combustion engine fuel tank. Batteries used in electric vehicles have a limited life span that ranges from 5 to 15 years and must be replaced after their operational life ends. The price of raw material components is increasing as the electric vehicle production increases. This has prompted market players to invest in battery recycling technology to increase the number of rare metals recovered, such as platinum and vanadium. Increasing raw material prices have made recycling financially competitive in the market. Governments around the world are implementing new policies to promote recycling and reduce the overall carbon emissions caused by electric vehicles.

Market players are investing in recycling facilities and increasing the amount of recycled raw material in their manufacturing process. Regulatory bodies in many countries have been implementing regulations mandating that a certain portion of the manufactured battery is derived from recycled material. This is expected to boost the market growth, as companies start to invest in battery recycling infrastructure over the forecast period.

The increasing sales of electric vehicles in the U.S. owing to the formulation of supportive federal policies such as the Responsible Battery Recycling Act of 2022, California, as well as the presence of leading market players are expected to drive the demand for lithium-ion batteries in the country over the forecast period. The Responsible Battery Recycling Act of 2022, California instructs each battery retailer in the state to have a system for the collection of used rechargeable batteries for recycling and reusing purposes, as well as for their disposal.

The U.S. has emerged as a growing market for the recycling of EV lithium-ion batteries, owing to the presence of large lithium-ion recycling facilities in the country. For instance, in October 2022, Li-cycle Corp. inaugurated its new lithium-ion recycling facility with a 120,000-square feet warehousing space. This facility can process 10,000 tons of battery material obtained from electric vehicles annually. The company possesses the capacity to recycle 60,000 electric vehicle batteries across North America.

In September 2022, General Motors and LG announced a joint venture worth USD 2.5 billion to develop battery manufacturing facilities in Ohio, Tennessee, and Michigan, to be financed by the U.S. Energy Department. The increase in the establishment of battery recycling facilities in the country and the surge in the number of joint ventures among electric vehicle and battery manufacturers in the U.S. are expected to fuel the demand for battery recycling activities in the country in the coming years.

Segmental Insights

Chemistry Insights

The lithium-based sub-segment is estimated to grow the quickest, generating $6.2 billion in sales by 2032. The lithium-based subsegment of the worldwide electric vehicle battery recycling market is growing due to factors such as good high-temperature performance, high power-to-weight ratio, and low self-discharge, all of which provide significant environmental benefits over other fossil fuel alternatives. With the increasing growth of electric cars, an immediate impact on carbon emissions reduction is envisaged. Such critical aspects might have a substantial influence on market growth throughout the forecast period. All of these reasons contribute to an increase in the demand for lithium ion automotive batteries.

The lead-acid battery sub-segment is forecasted to have a significant market share in the market and generate $3.7 billion in sales during the forecast period. Lead-acid batteries are regarded as a perfect source of power since they are heavy, cost-effective, and require little maintenance. The increased use of lead-acid batteries in a variety of applications, including backup power supplies, electric scooters, and maritime applications, as well as factors such as simplicity, price, and energy efficiency, are likely to fuel the expansion of this sub-segment. In the United States and Europe, more than 97% of lead-acid batteries are recycled, and around 75% of the lead used in new lead-acid batteries is generated from recycled batteries. All of these reasons contribute to the gradual increase in demand for lead-acid batteries.

End User Insights

The electric automobiles sub-segment is expected to expand the quickest, surpassing $5.6 billion by 2032 with a CAGR of 38.5%. Cars emit a large amount of carbon dioxide into the atmosphere, making people sensitive to pollution. An electric automobile is a significant step forward in terms of favourably assisting the environment. Electric vehicles have no exhaust emissions, making them greener, cleaner, and better for the environment than gasoline or diesel vehicles.

Geography Insights

- In 2022, Europe region dominated the market with highest revenue share. The recycling rate of batteries is anticipated to increase as a result of the European Union's recycling efficiency standards. According to the regulations, about 75.0%, 65.0%, and 50% of the weight of battery must be recovered as recycled material for nickel-cadmium, lead-acid, and other chemistries, respectively.

- In North America, used lead acid batteries are recycled at a rate of roughly 100%. Around 99.0% of the lead in used items gets recovered in the U.S. Additionally, it is anticipated that the presence of important recyclers such as Call2Recycle, Aqua Metals, Enersys, and Battery Solutions, Inc. will fuel demand during the forecast period along with the rising demand for UPS systems in commercial infrastructure and the rising popularity of electric vehicles.

- Due to an increase in foreign investment, Central and South America is predicted to experience significant market expansion. For instance, the Cochrane Coal-fired Power Plant in Chile has a large lithium-ion battery storage system constructed by GS Yuasa Corporation in 2017. During the projected period, large-scale passenger and commercial vehicle manufacturing in Latin America is anticipated to fuel lithium battery demand.

- Over the course of the projected period, Asia Pacific is anticipated to have the quickest CAGR of 8.5%. Due to the increasing demand from end-use sectors like the automobile, nations like China, India, and Japan are predicted to see rapid development.

Recent developments

- In March 2022, Retriev Technologies, which is a lithium battery recycling and management firm based in the United States of America, paid an undisclosed sum for Battery Solutions. Retriev Technologies' experience in the battery-centric logistics network, cross-chemistry collection, and end-of-life battery sorting services is projected to grow as a result of this purchase.

- In July 2022, Samsung SDI broke ground on their second battery manufacturing facility in Seremban, Malaysia. In 2024, this factory will begin producing PRiMX 21700 cylindrical batteries. The corporation plans to invest USD 1.4 billion in phases until 2025. The batteries manufactured at the factory will largely be utilised in electric cars (EV), micromobility, and other applications.

Some of the prominent players in the Electric Vehicle Battery Recycling Market include:

- ACCUREC Recycling GmbH (Germany)

- American Manganese Inc. (Canada)

- Battery Solutions (US)

- Li-Cycle Corp. (Canada)

- G & P Batteries (UK)

- Recupyl (France)

- Retriev Technologies (US)

- Australian Battery Recycling Initiative (Australia)

- Snam S.p.A. (Italy)

- Umicore N.V. (Belgium)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric Vehicle Battery Recycling market.

By Chemistry

- Lithium-ion Battery

- Lead-acid

- Nickel

- Others

By Process

- Pyrometallurgical

- Hydrometallurgical

- Others

By Application

- Electric Cars

- Electric Buses

- Energy Storage Systems

- Others

By End User

- Transportation

- Consumer electronics

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)