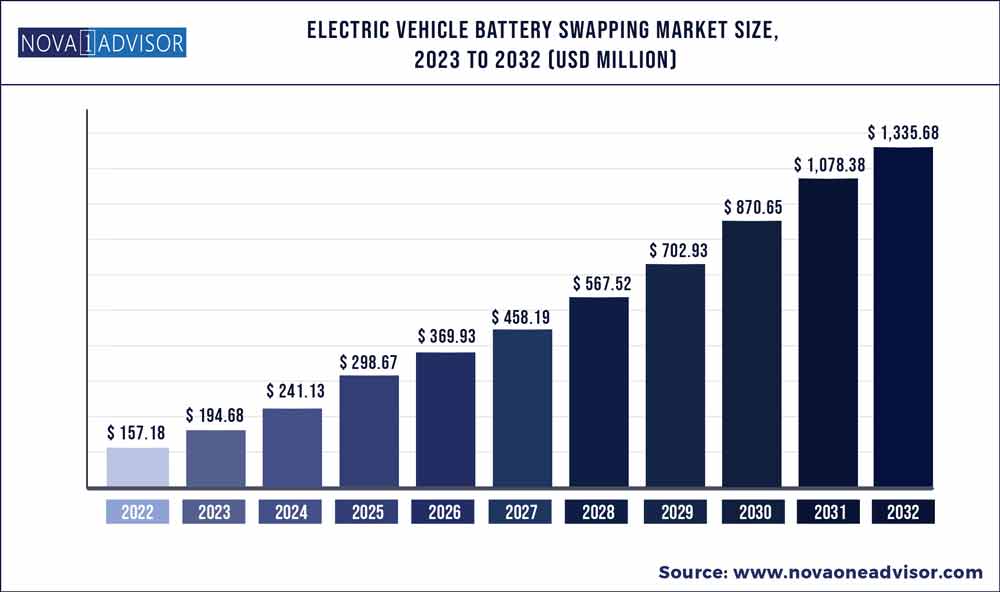

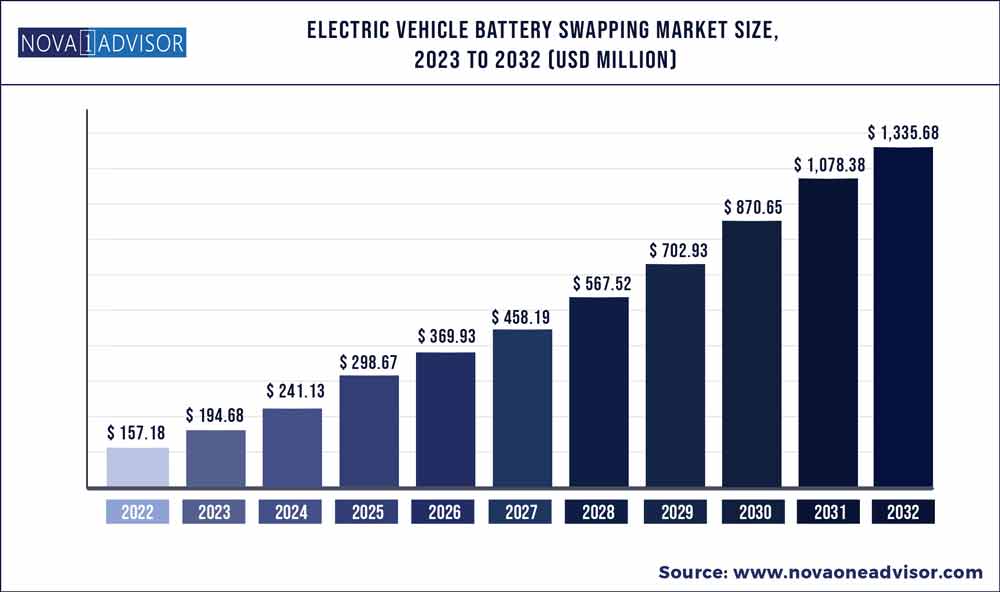

The global electric vehicle battery swapping market size was exhibited at USD 157.18 million in 2022 and is projected to hit around USD 1,335.68 million by 2032, growing at a CAGR of 23.86% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific electric vehicle battery swapping market was valued at USD 72 million in 2022

- By vehicle type, the two-wheeler segment garnered largest revenue share of 69% in 2022

- In 2022, Asia pacific region accounted largest market share of around 44%

- Europe will show good growth rate in near future

- By service type, the subscription segment accounted 68% revenue share in 2022

Electric Vehicle Battery Swapping Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 194.68 million

|

|

Market Size by 2032

|

USD 1,335.68 million

|

|

Growth Rate From 2023 to 2032

|

CAGR of 23.86%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Vehicle Type, Service Type

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Numocity, BAIC, ChargeMyGaadi, NIO, KYMCO, Amplify Mobility, Gogoro, Sun Mobility, Lithion Power, Ample, ECHARGEUP, Amara Raja, Aulton New Energy Automotive Technology, Others

|

Electric vehicle battery swapping is a place at which an electric vehicle's discharged battery or battery pack can be immediately swapped for a fully charged one, eliminating the delay involved in waiting for vehicle's battery to charge. Battery swapping stations offer a quicker solution to address range anxiety, where each battery swap takes less than 10 minutes and requires much smaller space to install compared to charging stations. In addition, battery-as-a-service (BaaS) is another solution gaining traction in the battery swapping industry, given its impact on reducing high upfront price of electric vehicles by separating battery ownership. Moreover, battery swapping reduces down-time and acquisition cost of a vehicle as customer pays only for the energy.

Rapid spread of COVID-19 had a significant impact on the global automotive industry, with a downturn in demand for new and old vehicles. Impact of the current global economic conditions and market sentiment directly affect business of key players. Although, many challenges lie ahead, coronavirus could accelerate some beneficial trends. For instance, electrification is expected to increase in select segments, such as two-wheel (2W) and three-wheel (3W) vehicles, and shared mobility could also increase, owing to growth of various use cases such as last-mile delivery, ride hailing, and rentals. As they prepare for the future, a solid understanding of changed landscape can help OEMs and other stakeholders update their strategies for the electric vehicle battery swapping market.

Rise in demand for electric vehicles, coupled with lack of adequate public charging facilities and reduced time for electric vehicle charging are anticipated to drive the market growth. However, differentiation in battery technology and design and high initial set-up and operating cost of battery swapping station hamper the market growth. Further, rapid emergence of shared e-mobility and introduction of innovative & advanced battery swapping model and services by market players are some of the factors that are expected to offer lucrative opportunities for the electric vehicle battery swapping market growth during forecasted period.

The market is segmented on the basis of service type, vehicle type and region. On the basis of service type, it is bifurcated into subscription model and pay-per-use model. On the basis of vehicle type, it is categorized into Two-Wheeler, Three-Wheeler Passenger vehicle, Three-Wheeler Light commercial vehicle, Four Wheeler Light commercial vehicle, Buses, and Others. By region, the market is segmented across North America, Europe, Asia-Pacific and LAMEA.

Popularity of electric vehicles has increased over years as they are more efficient and eco-friendlier. In addition, growth in consumer demand to maximize vehicle efficiency and minimize fuel costs has led to consistent technological advancements in electric vehicles. Moreover, rise in costs of gasoline, coupled with stringent governmental regulations pertaining to carbon dioxide emissions are pushing adoption of electric vehicles in developed regions such as North America and Europe. However, driving range of electric vehicles per single charge is limited and may need to charge twice a day based on usages, which requires up to 6 to 10 hours to full charge a battery. Thus, battery swapping leads to near zero down time for electric vehicles as compared to 6-10 hours daily down time with traditional charging. Furthermore, lack of adequate public charging facilities for electric vehicle charging and lack of standardization of charging infrastructure also fuels demand for battery swapping stations. Therefore, such factors collectively drive growth of the electric vehicle battery swapping market.

Some of the prominent players in the Electric Vehicle Battery Swapping Market include:

- Numocity

- BAIC

- ChargeMyGaadi

- NIO

- KYMCO

- Amplify Mobility

- Gogoro

- Sun Mobility

- Lithion Power

- Ample

- ECHARGEUP

- Amara Raja

- Aulton New Energy Automotive Technology

- Others

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric Vehicle Battery Swapping market.

By Vehicle Type

- Two-Wheeler

- Three-Wheeler Passenger vehicle

- Three-Wheeler Light commercial vehicle

- Four Wheeler Light commercial vehicle

- Buses

- Others

By Service Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)