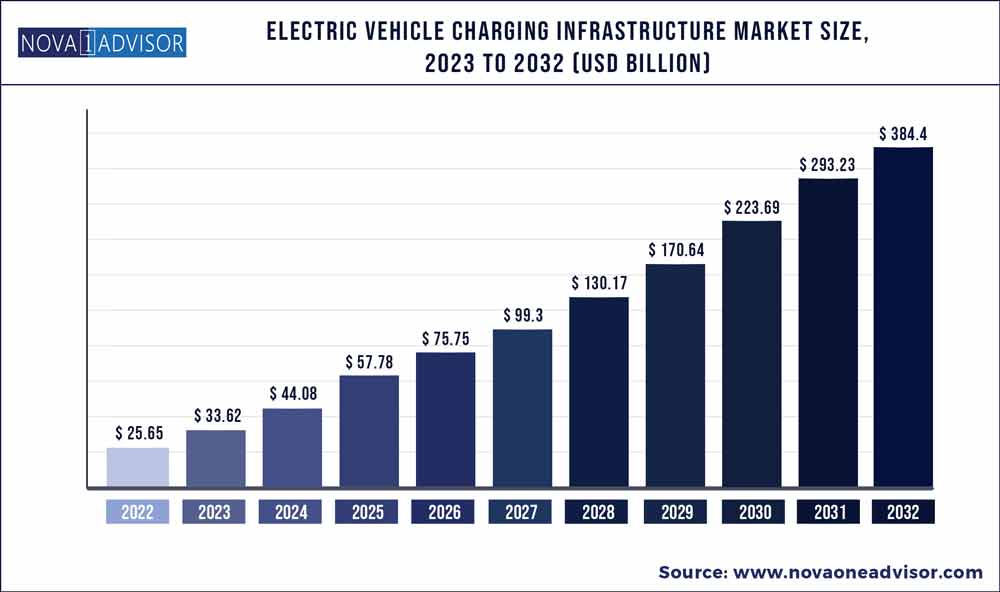

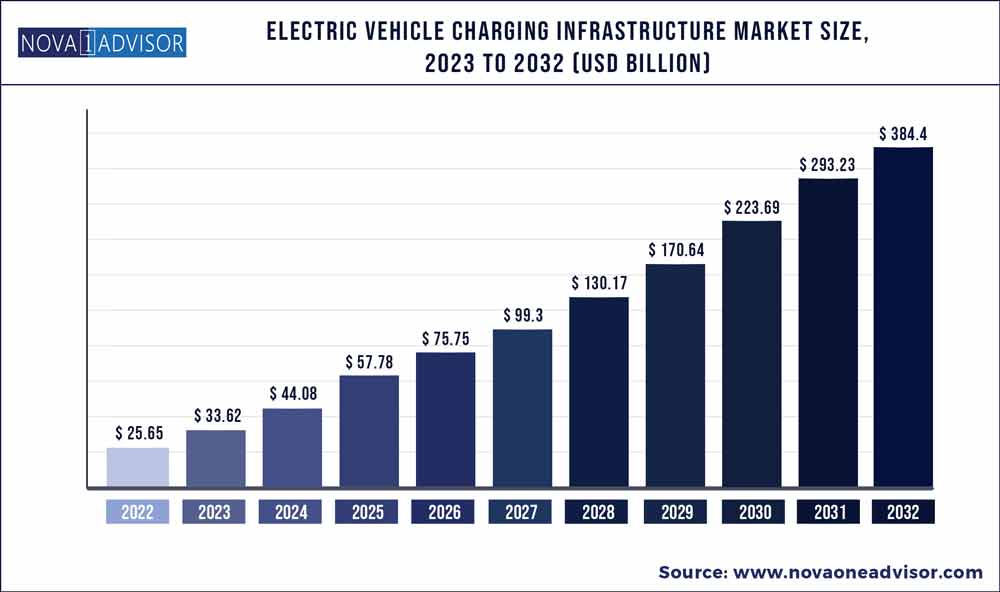

The global electric vehicle charging infrastructure market size accounted for USD 25.65 billion in 2022 and is estimated to achieve a market size of USD 384.4 billion by 2032 growing at a CAGR of 31.09% from 2023 to 2032.

Key Takeaway :

- By type, U.S. electric vehicle charging infrastructure market was valued at USD 4.1 billion in 2022.

- The fast charger segment led the market and accounted for more than 73.0% share of the global revenue in 2022.

- The others segment dominated the market and accounted for more than 66.0% share of the global revenue in 2022.

- The level 2 segment dominated the market and accounted for more than 53.0% share of the global revenue in 2022.

- The non-connected charging stations segment dominated the market and accounted for over 83.0% share of the global revenue in 2022.

- The commercial segment accounted for over 51.0% share of the market in 2022.

- The Asia Pacific segment dominated the market and accounted for more than a 68.0% share of the global revenue in 2022.

- By application, the commercial segment was reached at US$ 17,406.4 million in 2022 and will grow at a 34.79% CAGR over the forecast period 2020 to 2032.

- The residential application segment was surpassed at US$ 3,207.5 million in 2022 and will reach at a 32.19% CAGR over the forecast period 2023 to 2032.

- China EV charging infrastructure market size was valued at 20182.9 million in 2022 and is projected to reach US$ 83,131.9 million 2032.

- Japan EV charging infrastructure market was valued at 942.5 million in 2022 and is predicted to reach US$ 3967.3 million 2032.

- South Korea EV charging infrastructure market size was estimated at 645.1 million in 2022 and is expected to surpass US$ 1835.5 million 2032.

- US EV charging infrastructure market was reached at 4,059.9 million in 2022 and expected to hit US$ 15,317.4 million 2032.

- Germany EV charging infrastructure market was estimated at 2175.0 million in 2022 and to reach valuation US$ 9,633.4 million 2032.

- UK EV charging infrastructure market was accounted at 1058.3 million in 2022 and projected to surpass US$ 5155.8 million 2032.

- Netherlands EV charging infrastructure market was valued at 1887.9 million in 2022 and expected to reach US$ 8042.5 million 2032.

Electric Vehicle Charging Infrastructure Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 33.62 Billion |

| Market Size by 2032 |

USD 384.4 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 31.09% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Charger type, connector type, level of charging, connectivity, application, and region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AeroVironment Inc.; ABB; BP Chargemaster; ChargePoint, Inc.; ClipperCreek; Eaton; General Electric; Leviton Manufacturing Co., Inc.; SemaConnect, Inc.; Schneider Electric; Siemens; Tesla, Inc.; Webasto |

The rising levels of carbon emissions and other harmful gases stemming from transportation have triggered the necessity of adopting electric vehicles. As a result, the demand for an electric vehicle charging infrastructure among commercial and residential applications. Moreover, the increasing partnerships between car manufacturers for charging facilities by providing a subscription model is expected to further drive the market.

The technological progress of both electric vehicles charging software and hardware is expected to change the way electric vehicle owners use and benefit from electric vehicle charging applications. Technologies such as Smart car API and charging networks precisely determine an electric vehicle’s charge time even before the car driver plugs the car into a station. Additionally, green energy is expected to play a significant role in both public and residential electric vehicle charging space. Electric vehicle owners are majorly concerned about carbon emissions. To address these concerns, companies are making rapid advancements in the charging technologies of their electric vehicle charging networks.

The market penetration of electric vehicle charging equipment is significantly high at commercial spaces as compared to residential places. The number of commercial charging stations is predicted to increase in line with the growing adoption of electric vehicles. Efforts toward strengthening the charging infrastructure in commercial spaces would be decisive toward encouraging the adoption of electric vehicles, as overnight charging at residential complexes or individual home would not be sufficient for long-distance journeys. Moreover, public charging infrastructure would also facilitate the ultra-fast charging capabilities necessary for long-distance journeys. However, electric vehicle chargers for residential spaces can also offer significant growth potential as they provide a cheaper and convenient mode for charging electric vehicles as compared to commercial charging stations.

EV charging infrastructuremanufacturers are collaborating with the car rental service to integrate chargers in the existing infrastructure. For instance, In January 2020, Eaton announced its partnership with Green Motion car rental service provider in order to provide integrated chargers into the building with energy storage. Various automotive manufacturers, such as Volkswagen Group, BMW Group, and General Motors, among others, are investing in the development of Car2X technology for charging infrastructure that is further driving the market growth.

Countries such as France, India, the Netherlands, and Canada have introduced several campaigns to boost the adoption of electric vehicles. However, due to the COVID-19 outbreak, the global automobile industry is expected to face a slowdown as several countries across the globe have restricted the production of electric vehicles. This is expected to adversely impact the electric vehicle charging infrastructure market. As governments across the globe are focusing on emerging from this global pandemic with a stronger and more resilient economy, electric vehicles are expected to continue to gain significant attention. For instance, in the U.S., California is emerging with strong electric vehicle targets, which is expected to have a positive impact post-pandemic and boost the growth of the market.

Charger Type Insights

The fast charger segment led the market and accounted for more than 73.0% share of the global revenue in 2022. The segment is also anticipated to grow at highest CAGR during the forecast period. The growth is attributed to the increasing initiatives by various governments for accelerating the deployment of public fast-charging infrastructure. Most of the organizations have deployed Level 3 DC fast chargers or Level 2 AC charging stations that can fully charge an electric vehicle within 30 minutes to 4 hours.

Besides, automotive manufacturers are emphasizing the installation of electric vehicle charging stations for their employees as part of the efforts to raise awareness about their electric cars. For instance, the installation of 100 Level 2 electric vehicle charging stations at the parking lots of General Motors Company’s Detroit facility has led to an increase in demand for the company’s Chevrolet Volts electric cars from the employees.

The slow charger segment is expected to register significant growth during the forecast period. The slow chargers are mostly adopted by the residential applications which are used for overnight charging. Moreover, most of the electric vehicles manufacturers such as Volkswagen Group, BMW of America, and General Motors provide slow chargers along with the purchase of electric vehicles, which is further driving the segment growth. For instance, General Motors provides a slow charger with the purchase of its electric car model.

Connector Insights

The others segment dominated the market and accounted for more than 66.0% share of the global revenue in 2022. The others segment includes connectors such as GB/T, Mennekes, J1772, and others. The dominance of this segment can be attributed to the high adoption of GB/T connectors in China. The official EV plug standard in China is GB/T connector, which is used by all the EV chargers. Highest sales of electric vehicles followed by largest number of EV charging infrastructure in China is anticipated to fuel the segment growth. According to Grandview Research analysis, in 2022, there were 7,082,307 EV chargers in China.

The CCS segment is expected to expand at the highest CAGR during the forecast period owing to increased preference by major automobile manufactures on the adoption of CCS connectors in their electric vehicles. For instance, in July 2019, Tesla announced the introduction of a CCS connector to support Model 3, with expected future compatibility with Model S and Model X in Europe.

Furthermore, CCS connectors are available in two types, usually denoted as CCS Type1, and CCS Type 2. CCS Type 1 connectors are extensively utilized in the U.S. while CCS Type 2 are utilized in Europe. Moreover, the support from major auto manufacturers and OEMs, including Daimler AG, Ford Motor Company, General Motor Company, and Volkswagen Group, is expected to drive the demand for the CCS segment during the forecast period.

Level Of Charging Insights

The level 2 segment dominated the market and accounted for more than 53.0% share of the global revenue in 2022. Level 2 charging is in the range of 208 volts to 240 volts, and it is suitable for locations such as houses, workplaces, and public charging stations. Since level 2 charging infrastructure is easy to install it is the most commonly used level of charging for electric vehicles as of 2022. Level 2 charging can replenish between 12 to 80 miles of range per hour, depending on the vehicle’s maximum charge rate and power output of the level 2 charger. Due to this charging time and convenience of installation, level 2 chargers are mostly seen installed in urban areas, which is where EVs are currently the most popular. Level 2 chargers are able to charge electric vehicles up to 10 times quicker than level 1 charging, contributing to the dominating share of the segment in 2022.

The level 3 segment is expected to expand at the highest CAGR during the forecast period owing to its fast-charging abilities. Level 3 chargers are the fastest type of charging available, and they can charge electric vehicles at a rate of 3 to 20 miles per minute, using direct current. The voltage used by level 3 chargers is higher than level 1 and level 2, which is why is not seen installed at residential places as of now. However, as the number of electric vehicle users grows, companies and public spaces will implement charging infrastructure, which is quick and convenient, in order to fulfill the large demand. This in turn, is expected to drive the growth of the level 3 charging level segment during the forecast period.

Connectivity Insights

The non-connected charging stations segment dominated the market and accounted for over 83.0% share of the global revenue in 2022. Non-connected charging solutions are also known as non-networked or standalone charging solutions. Non-connected charging solutions offer users safe and secure charging without the hassle of recurring fees of a charging network. Non-connected charging solutions mimic the experience of the traditional fuel pump, and allows consumers to pay for the charging facilities peruse.

Some of the non-connected charging solutions couple their hardware with software platforms to monitor the health of their chargers and view detailed diagnostic data. Moreover, non-connected chargers have lower ongoing and installation costs, as other recurring networking and activation fees are not applicable. The low infrastructure costs for owners, and hassle-free charging experience for EV users provided by non-connected charging solutions, are expected to contribute to the segment’s growth during the forecast period.

The connected charging stations segment is expected to expand at the highest CAGR over the forecast period. Connected charging solutions, also referred to as a network charger is a charging network, which is managed with network software systems. With connected charging solutions, electric vehicles are equipped with capabilities beneficial for drivers and hosts. For instance, site hosts can access network access facilities such as advanced analytics, energy management, remote management features, and 24/7 customer support, while drivers can access it to locate and reserve via applications, among other use cases. As the number of electric vehicle drivers increases over the course of the next few years, these features will be essential, which is expected to drive the adoption of connected charging solutions in the forecast period.

Application Insights

The commercial segment accounted for over 51.0% share of the market in 2022. The segment is further divided into destination charging stations, highway charging stations, bus charging stations, fleet charging stations, and other charging stations. The dominant share of the segment is owing to the initiatives and allocation of funding by the governments and automobile manufacture for expanding public EVCI. Furthermore, the development of supporting infrastructure at public places is EV charging infrastructure necessary as overnight charging or charging at homes would not be sufficient for long distance travel.

Furthermore, several public transport agencies are partnering with automotive manufacturers for the installation of charging stations for electric buses that is driving the growth of the commercial segment. For instance, TRAFIKSELSKABET MOVIA signed an agreement Siemens for the installation of electric bus charging stations with a top-down pantograph for electric buses operated by 45 municipalities, including the City of Copenhagen and Region Zealand.

The residential segment is expected to register substantial growth during the forecast period. The segment is further bifurcated as private houses and apartments.Various manufacturers of chargers such as Efacec; EVE Australia Pty Ltd.; and Tesla, Inc. are partnering with contractors that are developing residential complexes. For instance, in October 2020, the Pend Oreille Public Utility District announced the launch of a new EV charging pilot system with SemaConnect Inc.

This charging station will enable visitors to PUD’s Newport Administration Building to charge their electric cars for free. Vehicle charger manufacturers are now focusing on the development of residential and commercial EV chargers to ensure higher availability and increased vehicle range. OEMs are collaborating with EV manufacturers, charging network operators, corporates, and utility service providers to deploy fast-charging stations to expand their geographical presence and to enable cost-effective deployment of the EV charging network.

Regional Insights

The Asia Pacific segment dominated the market and accounted for more than a 68.0% share of the global revenue in 2022. Countries such as China, Japan, and South Korea are the hub of electric vehicle are heavily investing in the development of charging infrastructure. For instance, in January 2022, the Chinese Government announced its intention to invest in the deployment of EV infrastructure to accomplish its target of supporting 20 million EVs, on-road, by 2025.

Besides, South Korea announced an investment of around USD 180.3 million for expanding the EV charging infrastructure across the nation as its endeavor to promote eco-friendly vehicles in the transportation sector. Moreover, Japan’s electric charging station surpassed the number of petrol stations with more than 40,000 charging outlets in 2020.

Various European countries have set ambitious targets for curbing carbon emission and electric car stock commitments by 2020. For instance, in July 2018, the U.K. government passed the Automated and Electric Vehicles (AEV) Act. It provides the government with new powers to ensure the rapid development of EVCI on motorways and fuel stations. Other European countries, such as France, the U.K, Germany, and Belgium, are also focusing on developing the electric vehicle charging and support infrastructure to enable interoperability across different electric vehicles throughout the region.

Recent Devlopments

- In January 2023, ABB E-mobility introduced its ‘Terra Home’ charging solution at the Consumer Electronics Show held in Las Vegas. The charging solution is able to prioritize electricity automatically from renewable residential sources such as wind or solar, addressing consumers’ modern preference to act sustainably

- In April 2023, bp announced a global mobility agreement with Uber that would enable the acceleration of Uber’s commitment to decarbonization globally by 2040. The 2 companies will initially focus on collaborating in key markets such as the US, the UK, and Europe, which would be followed by developments in Australia and New Zealand

- In June 2023, ChargePoint announced the availability of NACS (North American Charging Standard) solutions for both existing and new deployments. This development, in addition to the Combined Charging System (CCS) solutions, would allow customers to address the charging requirement of any electric vehicle in any parking area

- In February 2023, Enphase Energy carried out a successful demonstration of the company’s bidirectional EV charger that would enable vehicle-to-grid and vehicle-to-home functionality. The product leverages the benefits of Ensemble energy management technology and grid-forming IQ8 Microinverters for integrating into Enphase home energy systems

- In July 2023, Eaton announced the addition of NACS connector options for the company’s Green Motion EV chargers, starting 2024. The development involves Eaton providing NACS retrofit solutions for its currently installed level two AC chargers

- In April 2023, Leviton announced the release of major enhancements to the My Leviton application for smart EV charging stations. Some of the enhancements include remote start and stop of the charging, scheduling of charging sessions, and the option to enable/disable access control

- In June 2022, Blink Charging announced the acquisition of SemaConnect, which provides extensive EV charging infrastructure solutions in the North American region. The acquisition, at the time, made Blink Charging the only company offering complete vertical integration, from R&D and manufacturing to electric vehicle charger operations and ownership

- In June 2023, Webasto Charging Systems announced the imminent launch of the NACS connector option for its charging solution portfolio. The announcement is expected to help the company address the rapidly evolving requirements of the EV market in North America

- In July 2023, Siemens announced that it had been selected by ENGIE Vianeo to equip advanced EV charging stations in 64 rest areas in freeways across France. These stations deliver modular power from 160 kW to 300 kW, charging 80% of the EV in 20 minutes. The charger is also extremely efficient, thus helping optimize energy expenditures

Key Companies & Market Share Insights

The market players are continuously working towards new product development and up-gradation of their existing product portfolio. For strategic growth, these players prefer collaborations with other players or EV manufacturers. In May 2022, ABB, in collaboration with Shell, announced its plan to launch the worldwide network of Terra 360s, an all-in-one electric car charger. Moreover, over 200 Terra 360 chargers are planned to be launched in Germany over the next 12 months. ABB and Shell ensured to offer better-charging speed and charger availability to over 1.7 million electric car drivers in Germany.

Moreover, these players are consolidating their market shares by undertaking M&A activities and partnerships. For instance, In June 2022, ChargePoint, Inc. announced its partnership with National Electrical Contractors Association (NECA) to fast-track the deployment of EV charging. Through this partnership, ChargePoint, Inc. and NECA were able to develop training curriculums for their electrical contract members who installed EV charging stations. Such initiatives are expected to drive the market’s growth over the forecast period. Some prominent players in the electric vehicle charging infrastructure market include:

- AeroVironment Inc.

- ABB

- BP Chargemaster

- ChargePoint, Inc.

- ClipperCreek

- Eaton

- GENERAL ELECTRIC

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Schneider Electric

- Siemens

- Tesla, Inc.

- Webasto

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Xxx market.

By Charger Type

- Slow Charger

- Fast Charger

By Connector Type

By Level of Charging

By Connectivity

- Non-connected charging stations

- Connected charging stations

By Application

- Commercial

- Destination Charging Stations

- Highway Charging Stations

- Bus Charging Stations

- Fleet Charging Stations

- Other Charging Stations

- Residential

- Private Houses

- Apartments

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)