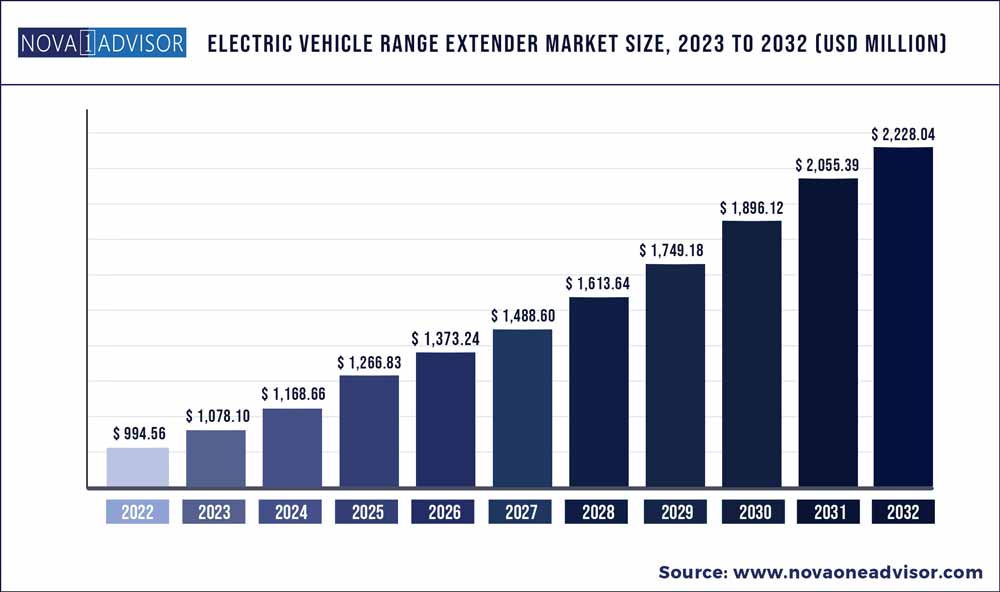

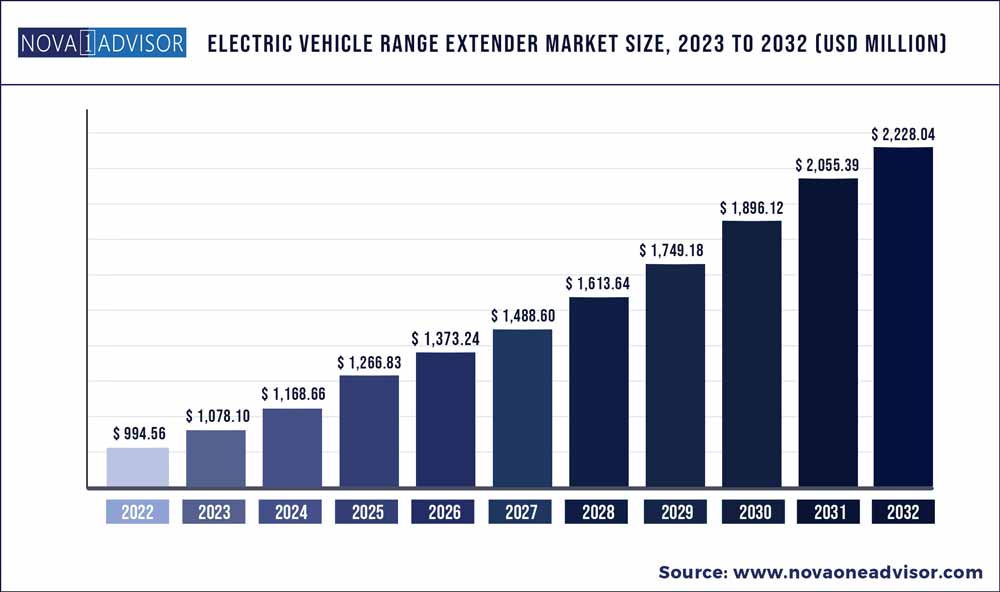

The Electric Vehicle Range Extender market size accounted for USD 994.56 million in 2022 and is estimated to achieve a market size of USD 2,228.04 million by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Key Pointers:

- In 2022, the ICE segment accounted for the largest market share of a little over 80.1% owing to increasing demand and lower cost.

- The battery packs segment accounted for around 50.9% of the total demand in 2022.

- In 2022, the passenger vehicles segment accounted for over 90.0% of the overall market demand.

- In 2022, the passenger vehicles segment accounted for over 90.0% of the overall market demand.

- The Europe market is expected to exhibit a CAGR of 10.4% from 2023 to 2032.

- Asia Pacific is projected to acquire the largest market share with a market share of 42.10%.

Electric Vehicle Range Extender Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 1,078.10 million

|

|

Market Size by 2032

|

USD 2,228.04 million

|

|

Growth Rate from 2023 to 2032

|

CAGR of 8.4%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, Vehicle, Component, Geography

|

|

Key companies profiled

|

Nissan, Delta Motorsport, Magna International, General Motors, Ballard Power Systems, Mahle, Ceres Power, BMW, Rheinmetall, Plug Power

|

Electric Vehicle (EV) Range Extender Market – Trends and Opportunities

Increased demand for Electric Vehicle (EV) Range Extender and engine downsizing is expected to boost the global Electric Vehicle (EV) Range Extender market. The increased production and sales of electric vehicles have compelled manufacturers to create vehicle range extender solutions. This is due to the fact that the battery deployed in electric vehicles has a finite power storage capacity that is depleted based on the vehicle's usage. Moreover, the lack of suitable vehicle charging infrastructure complicates the implementation of such systems for electric vehicles in order to give a pleasant driving experience and eliminate the need for battery charge after a set period. As a result, a rise in demand for electric vehicle driving range extension is a major factor that is likely to fuel the growth of the Electric Vehicle (EV) Range Extender market over the forecast period.

Engine downsizing is the process of using a smaller but more powerful engine in a vehicle rather than a specific large engine built to accomplish the same duty. Engine downsizing allows vehicle manufacturers to produce more efficient vehicles with lower emissions due to the engine's less weight. Numerous automobile manufacturers have made advancements in engine reduction, which has bolstered the concept. The Volkswagen Group, for example, substituted their 1.6 and 2.0-liter gasoline engines with the 1.4 TSI unit. This resulted in a 5% reduction in fuel consumption over the older engines, allowing the manufacturer to improve the product to a much greater level. As a result, analogous additional improvements in the global engine downsizing market are likely to boost the Electric Vehicle (EV) Range Extender market during the forecast period.

Furthermore, major vehicle manufacturers such as BMW, Audi, and others have introduced various fuel cell-based electric vehicles, which has aided the global growth of electric vehicles. Additionally, compared to basic battery-powered vehicles, fuel cell-powered vehicles are more efficient in propulsion.

Product Insights

Based on product type, the market has been segmented into ICE, fuel cell, and others. In 2022, the ICE segment accounted for the largest market share of a little over 80.1% owing to increasing demand and lower cost. Companies such as BMW Group and General Motors have introduced ICE EV range extenders for BMW i3 and Volt models respectively. Moreover, hybrid electric vehicles accounted for more than 70% in terms of sale in the global electric vehicles market in 2022.

On the other hand, fuel cell vehicles are expected to witness relatively lower adoption. The operability of fuel cell vehicles relies on the availability of hydrogen and methanol, which are produced from natural gases. This acts as a hindrance in their adoption. However, their lower carbon emission footprint as compared to ICE extenders is expected to act as an advantage, which is likely to boost segment growth over the forecast period. In 2022, Magna International, Inc. launched its first fuel cell range extender at the Geneva auto show.

Component Insights

Based on component, the EV range extender market has been segmented into battery packs, generators, electric motors, and power converters. The battery packs segment accounted for around 50.9% of the total demand in 2022. Standard battery packs are expected to have a life expectancy of up to five years, which is higher than that offered by other components.

Manufacturers are focused on developing new battery technologies to significantly reduce the cost of battery packs. This is expected to drive the adoption of standalone battery packs. For instance, in 2022, Nomadic Power GmbH developed towable batteries for EVs that provide on-demand battery recharge facilities.

Vehicle Insights

In 2022, the passenger vehicles segment accounted for over 90.0% of the overall market demand. Key players are focused on offering innovative fuel cell range extenders for passenger vehicles. Governments across countries such as China, U.S., and Germany are offering tax rebates and other incentives for the purchase of low/zero emission range extender electric cars. Additionally, companies such as BMW Group, Volvo Car Corporation, Nissan Motors Corporation, and General Motor Company are looking to incorporate range extender technologies into their new models.

Growing product adoption in commercial vehicles across developed countries such as the U.S., Canada, and the U.K. is expected to drive the commercial vehicle segment over the forecast period. Range extended electric commercial vehicles can help reduce additional payload and costs along with minimizing the deployment of costly charging infrastructure at depots. For instance, Tevva Motors Limited offers extended range electric trucks ranging from 7.5 tons to 14 tons with long

Regional Insights

North America accounted for approximately 49.0% of the overall market in 2022. Market growth can be attributed to significant adoption of hybrid and pure EVs, along with a lack of charging infrastructure across the region. Factors such as increasing demand for improved battery range, high adoption of new technologies such as towable generators and batteries, and government initiatives promoting zero emission vehicles in the U.S. are expected to help increase demand for range extenders over the forecast period.

The Europe market is expected to exhibit a CAGR of 10.4% from 2023 to 2032. This can be attributed to high sales of electric vehicles in key countries such as the U.K., Germany, Norway, and France as well as the wide presence of key manufacturers in the region. Manufacturers such as BMW Group and Volvo Car Corp. are aiming to launch the new Range Extended Electric Vehicle (REEV), which is expected to drive the regional market over the coming years.

Asia Pacific is projected to acquire the largest market share with a market share of 42.10%. Due to the rising influence of EVs in the region, Asia Pacific is predicted to have a higher Compound Annual Growth Rate (CAGR) during the forecast period. China and India are the most important markets in Asia Pacific, as all major automakers have manufacturing facilities there and are major exporters of electric vehicles worldwide. High urbanization and smart cities are predicted to move the EV sector forward, boosting the market development of electric car range extenders. Growing sales of electric vehicles and demand for electric vehicles in the global market are two main reasons driving the growth of the Global Electric Vehicle Range Extender Market. Electric car use has surged in both developed and developing countries as environmental concerns have grown. Furthermore, the governments of these regions are giving incentives and subsidies to encourage the market adoption of electric vehicles.

Key Developments

The investors are focusing towards electric vehicle companies to fund on hydrogen power in the electric vehicle range extender market and Hyzon Motors will receive USD 570 million from SPAC in February 2022, backed by fuel cell technology. This collaboration will focus on new product development.

Robert Bosch GmbH boosted its equity participation in Ceres from c.4 percent to c.18 percent in January 2021, according to Ceres Power Holdings PLC, a global producer of low-cost solid oxide fuel cell technology.

Some of the prominent players in the Electric Vehicle Range Extender Market include:

- Nissan

- Delta Motorsport

- Magna International

- General Motors

- Ballard Power Systems

- Mahle

- Ceres Power

- BMW

- Rheinmetall

- Plug Power

Segments Covered in the Report

This report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Electric Vehicle Range Extender market.

By Product

- ICE Range Extender

- Fuel Cell Range Extender

- Others

By Vehicle

- Passenger vehicles

- Commercial vehicles

By Component

- Battery pack

- Automotive

- Power Converter

- Electric Motor

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)