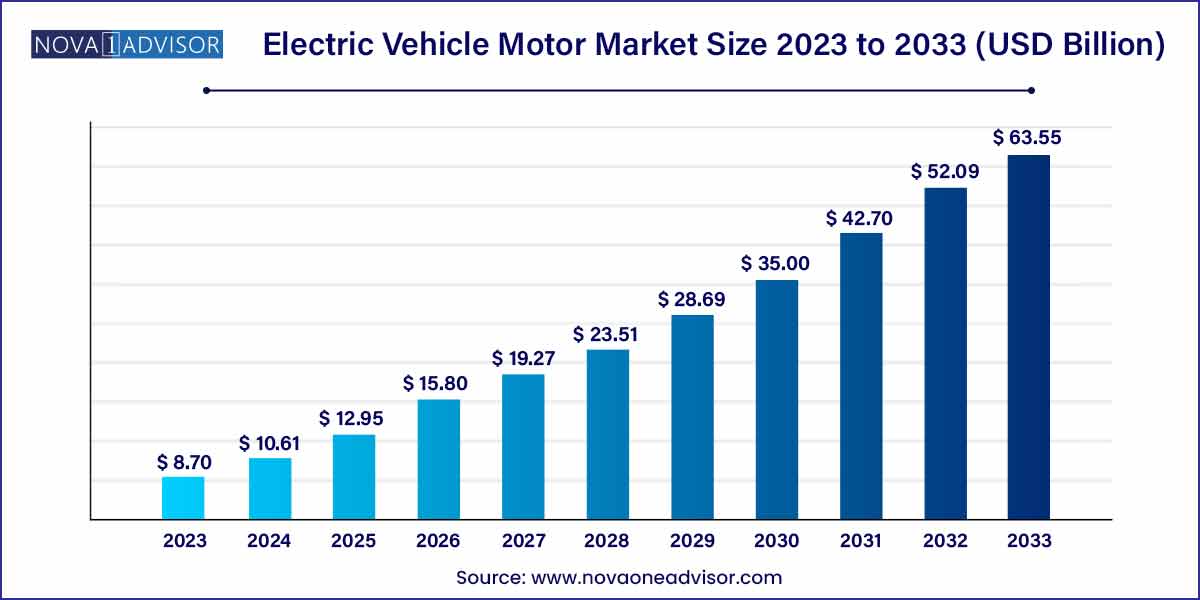

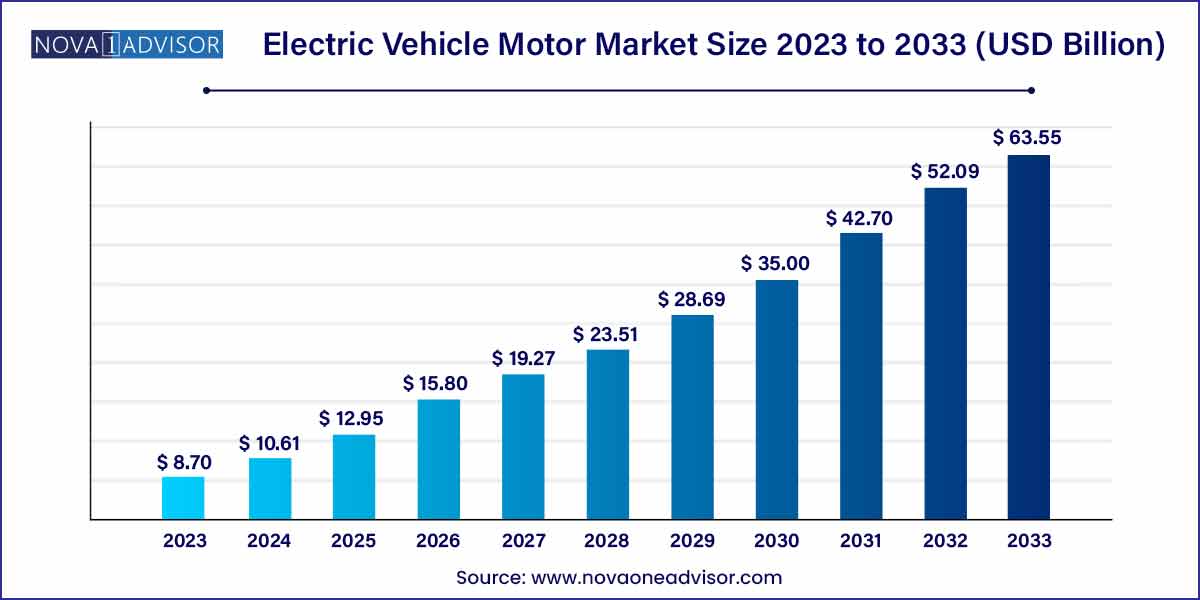

The global electric vehicle motor market size was exhibited at USD 8.70 billion in 2023 and is projected to hit around USD 63.55 billion by 2033, growing at a CAGR of 22.00% during the forecast period of 2024 to 2033.

Key Takeaways:

- AC motor type segment accounted 60% of revenue share in 2023.

- DC motor type segment garnered 43% revenue share in 2023.

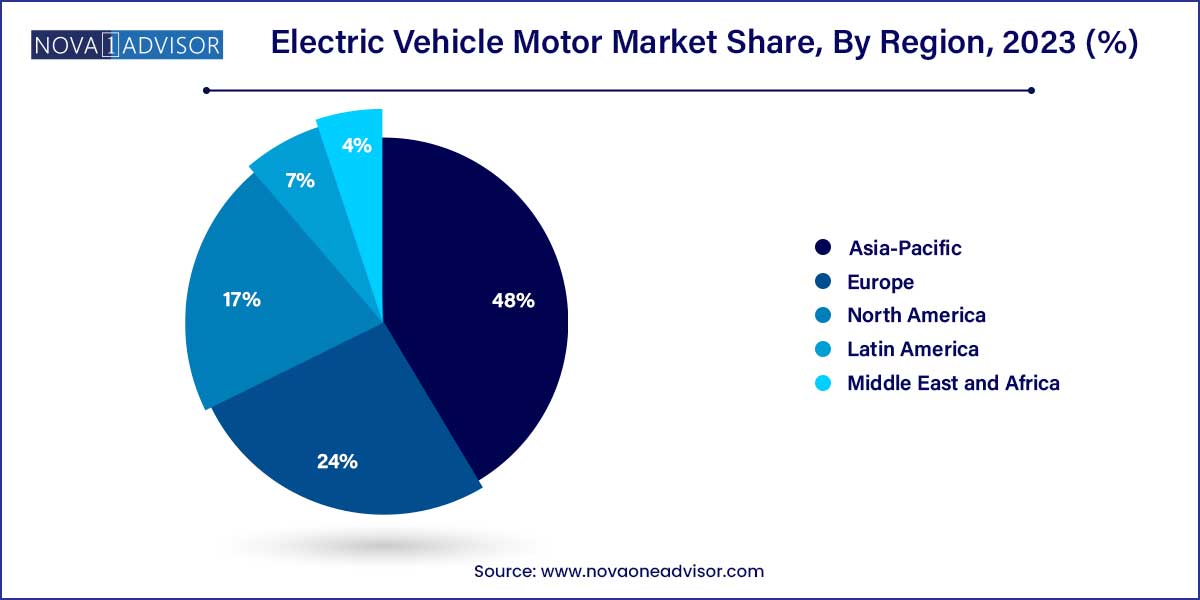

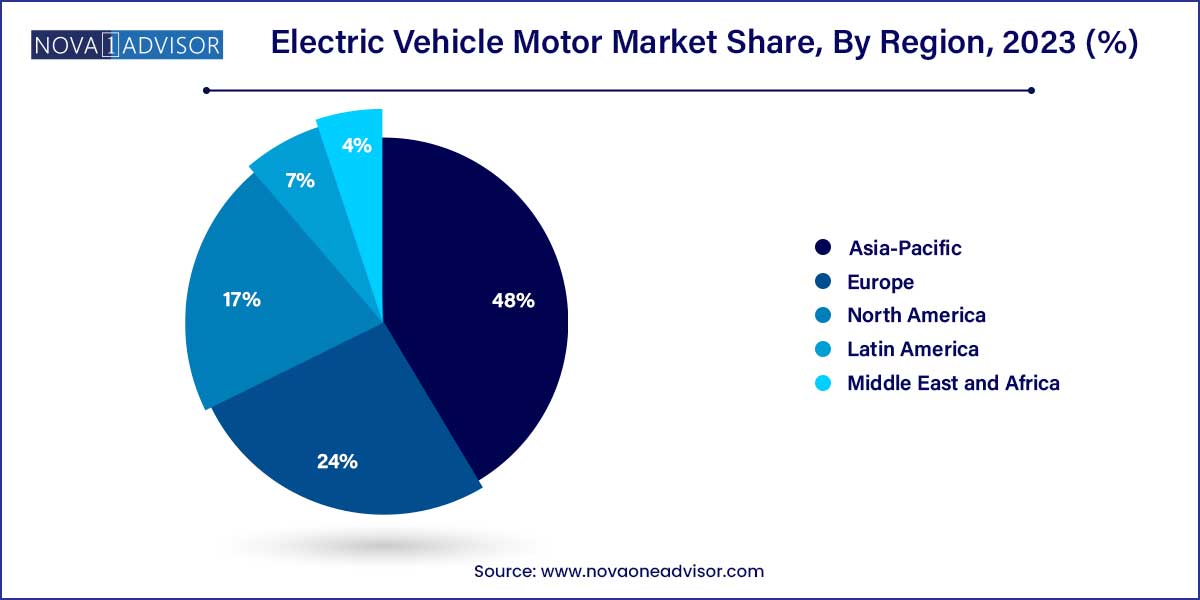

- Asia Pacific region accounted market share of around 48% in 2023.

- Latin America and the Middle East and Africa are expected to grow at a remarkable CAGR from 2023 to 2033.

Market Overview

The Electric Vehicle (EV) Motor Market has emerged as a cornerstone of the global transition towards sustainable transportation. At its core, EV motors are responsible for converting electrical energy into mechanical energy to propel vehicles—playing a pivotal role in vehicle performance, efficiency, and overall user experience. The surging adoption of electric mobility, fueled by government incentives, stringent emission regulations, and growing environmental awareness, has bolstered demand for high-performance electric motors across a variety of vehicle platforms.

The proliferation of electric passenger cars, two-wheelers, commercial vehicles, and innovative configurations such as quad-motor setups is propelling the EV motor market into a new era. Governments around the world have initiated numerous policy measures and financial support systems to encourage EV adoption. For instance, the U.S. government’s Inflation Reduction Act and Europe’s Fit for 55 program both include aggressive EV targets and subsidies.

With advancements in motor technology, such as the shift from brushed to brushless motors and the exploration of synchronous and switched reluctance motors, manufacturers are offering solutions that enhance power density, reduce weight, and improve thermal management. The market is also being reshaped by consumer preferences for longer driving ranges, better torque characteristics, and fast acceleration.

Major Trends in the Market

-

Rise in Dual and Multi-Motor Configurations: Performance EVs are increasingly using dual, triple, or even quad motor setups for enhanced torque vectoring and AWD capabilities.

-

Transition Toward Brushless Motors: Brushless DC motors (BLDCs) are rapidly replacing brushed variants due to their improved lifespan and lower maintenance.

-

Integration with Power Electronics: Motor systems are increasingly integrated with inverters and controllers for better efficiency and compact design.

-

Lightweight and Compact Motors: Manufacturers are innovating on compact designs that offer higher power-to-weight ratios, particularly for two-wheelers and commercial vehicles.

-

Customization by Application: OEMs are focusing on motors tailored to specific vehicle classes, from micro-mobility to high-performance sedans and electric trucks.

-

Increase in Switched Reluctance Motor (SRM) Development: SRMs are gaining traction due to their rugged construction and high-efficiency potential without permanent magnets.

-

Aftermarket Expansion: A growing number of companies now provide retrofitting solutions, allowing internal combustion vehicles to be converted to electric.

-

Localization of Motor Manufacturing: Countries like India and the U.S. are focusing on local manufacturing of EV motors to reduce import dependency and enhance domestic capabilities.

Electric Vehicle Motor Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 8.70 Billion |

| Market Size by 2033 |

USD 63.55 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.00% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Vehicle Type, Motor Type, Power Rating, Application, Powertrain Type, Marketplace, End User, Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Yasakawa Electric, Gkn Driveline, Toshiba, Continental, Denso, Baldor Electric, Hitachi Automotive Systems. |

Key market Drivers

Increase in demand for electric vehicles

A primary factor influencing the growth of the electric vehicle engines, which has an impact on the market's growth during the forecast period, is the rise in popularity for expanding the range of electric cars. The electric vehicle powertrain control frameworks have a significant impact on the electric vehicle's range. The implementation of strict administrative restrictions is another important factor in industry expansion.

Many governments have established stringent discharge standards to reduce GHG emissions and mitigate the causes of unnatural weather change. It thus anticipates automakers to develop zero-discharge automobiles to abide by tougher emission regulations. These laws have resulted in a more significant focus on the production of more capable electric car, which will fuel market expansion during the forecast period.

Increased demand for HVAC systems in residential, commercial, and industrial end-users

HVAC which is also known as heating, ventilation, and air conditioning systems uphold the quality of interior air and provide thermal comfort. They are among the basic elements of modern infrastructures, especially for massive office or commercial complexes. Electric DC motors are frequently used in HVAC systems to increase the efficiency of the airflow system and extend the life of the motors.

HVAC systems are becoming more and more necessary as the region's industrial and commercial sectors continue to grow, especially in China and India. According to a study by the market intelligence company Timetric Construction Intelligence Center, USD 1.08 trillion is expected to be invested in the global construction sector over the course of the next four to five years, primarily for the development of industrial structures (CIC).

Key Market Challenges

- changing costs of raw materials from China

A small number of Chinese producers are in charge of setting the costs of raw materials including speciality alloys, copper wires, permanent magnets, steel bars, and thin precision metals required to create electric motors. The price of the product defines the dominance of specific providers in the market because there is little to no product differentiation. The other producers and suppliers in the market must bear the ensuing price changes. For instance, manufacturers and suppliers are unable to pass on price changes to end-user consumers when rare-earth permanent magnet costs fluctuate during the production processes. As a result, raw material suppliers' profit margins are impacted significantly.

Key market opportunities

- Growing robotics technology and the global automotive industry's transition to electric cars

The worldwide automotive industry is making a technological shift toward electric means of transport. The encouraging steps made in Europe to decarbonize people are encouraging an increase in the usage of electric cars which are embedded with electric motors. Also, the cost associated with batteries has decreased, and innovations related to batteries have improved time for charging. Increasing government assistance such as tax breaks and incentives to peruse the utilization of electric motors in eco-friendly electric cars is also acting as a development opportunity for the electric motor market.

Segments Insights:

Vehicle Type Insights

Pure Electric Vehicles (PEVs) lead the market, accounting for the highest revenue share as global sales of fully electric cars surpass hybrids. Automakers such as BYD, Tesla, and Hyundai are expanding their pure EV lineups with long-range, high-power models equipped with efficient motor technologies like permanent magnet synchronous motors (PMSMs).

Plug-in Hybrid Electric Vehicles (PHEVs) are the fastest-growing segment due to their flexibility. They combine electric motor systems with combustion engines, making them suitable for regions where charging infrastructure is limited. Recent PHEV launches like Toyota’s Prius Prime and Mitsubishi Outlander PHEV highlight the increasing consumer demand for transitional mobility solutions that bridge current infrastructure gaps.

Type Insights

AC motors dominated the market, owing to their superior efficiency, better torque performance, and durability compared to DC counterparts. Within the AC category, synchronous AC motors are widely favored in premium EVs due to their ability to maintain constant speed regardless of load, a feature particularly beneficial in highway driving. Tesla’s Model S and Model X, for instance, utilize AC induction motors for enhanced performance and efficiency.

On the other hand, brushless DC motors (BLDCs) are the fastest-growing sub-segment within the DC category. Their compactness and ease of control make them ideal for electric scooters, bikes, and three-wheelers. Startups focused on urban micro-mobility are driving innovation in this segment by incorporating regenerative braking and modular architecture into BLDC motor systems.

Application Insights

Electric passenger cars are the largest application segment, supported by global sales from brands like Tesla, BYD, and Hyundai. The surge in personal EV adoption is driving demand for high-efficiency, quiet, and compact motors that enhance cabin comfort while offering long-range capabilities.

Electric commercial vehicles, including electric buses and delivery vans, are the fastest-growing application. With cities imposing zero-emission zones and e-commerce booming, logistics players are rapidly electrifying their fleets. Companies like Rivian, Arrival, and Volvo Trucks are leading this space with purpose-built electric vans and trucks.

End User Insights

The transportation sector dominates motor demand, with public transit systems and commercial fleets making up large volumes. Electric buses and ride-hailing EVs constitute a growing share of total motor consumption, driven by governmental sustainability goals.

However, private end use is expanding the fastest as EVs become mainstream. Improved affordability, better charging networks, and rising environmental consciousness are encouraging individuals to adopt electric mobility solutions for personal use.

Geography Insights

Asia-Pacific leads the electric vehicle motor market, both in production and consumption. China alone accounts for over half of the world’s electric vehicle sales, thanks to its robust manufacturing base, government incentives, and strong domestic demand. Major players such as BYD, Nidec, and Huawei Technologies have vertically integrated motor production facilities that support everything from two-wheelers to heavy-duty trucks.

Japan and South Korea further reinforce the region’s leadership with technological advancements in hybrid systems and next-generation motor designs. The region’s early adoption of electrification in public transit and urban mobility solidifies its dominant position.

Europe is the fastest-growing region, driven by regulatory pressure, aggressive carbon neutrality targets, and high consumer awareness. The EU’s commitment to phasing out internal combustion engine vehicles by 2035 is spurring unprecedented EV growth.

Germany, France, and the Nordic countries are spearheading this transformation, with local automakers like Volkswagen, Mercedes-Benz, and Volvo scaling up motor production and integrating new technologies such as magnet-free motors and integrated inverter systems. Government subsidies and the rapid expansion of charging infrastructure are accelerating adoption across passenger and commercial segments alike.

Key market developments

-

March 2025: Tesla announced a new magnet-free motor technology under development aimed at reducing dependence on rare earth metals.

-

February 2025: Nidec Corporation completed construction of a new EV motor plant in Serbia, aimed at expanding supply for European automakers.

-

January 2025: Hyundai Motor Group revealed its next-gen E-GMP platform featuring ultra-compact motors with integrated power electronics.

-

December 2024: Bosch unveiled a high-torque EV motor targeted at light commercial vehicles, designed for low-noise and high-efficiency operation.

-

November 2024: Mahindra Electric launched a new electric powertrain division focusing on 2- and 3-wheeler applications using indigenously developed BLDC motors.

Some of the prominent players in the electric vehicle motor market include:

- Shenzhen V&T Technologies Co. Ltd.

- Time High-Tech Co. Ltd.

- Shanghai E-drive Co. Ltd.

- Kelly Controls LLC

- BYD

- Zhuhai Enpower Electric Co. Ltd.

- Delta Electronics

- Profile

- Chroma ATE Inc.

- DEC Dongfeng Electric Machinery Co. Ltd.

- Canadian Electric Vehicles Ltd

- Fujian Fugong Power Technology Co. Ltd.

- Hunan CRRC Times Electric Vehicle Co. Ltd.

- Nidec (Beijing) Drive Technologies Co. Ltd.

- Jing-Jin Electric Technologies (Beijing) Co. Ltd.

- United Automotive Electronic Systems Co. Ltd. (UAES)

- Shenzhen Inovance Technology Co. Ltd.

- JEE Automation Equipment Co. Ltd.

- Shandong Deyang Electronics Technology Co. Ltd.

- Beijing Siemens Automotive E-Drive System Co. Ltd.

- Zhongshan Broad-Ocean Motor Co. Ltd.

- Parker

- Prestolite E-Propulsion Systems (Beijing) Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric vehicle motor market.

By Type

-

- Synchronous AC Motor

- Induction AC Motor

-

- Brushed DC Motor

- Brushless DC Motor

By Vehicle Type

- Pure Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle (FCEV)

By Motor Type

- Induction Motor

- Synchronous Motor

- Switched Reluctance Motor

By Power Rating

- Up to 60 KW

- 60 to 90 KW

- Above 90 KW

By Application

- Electric Two-Wheeler

- Electric Three-Wheeler

- Electric Commercial Vehicles

- Electric Passenger Cars

By Powertrain Type

- Single Motor

- Dual Motor

- Triple Motor

- Four Motor

By Marketplace

By End User

- Agribusiness

- Transportation

- Private

- Business

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)