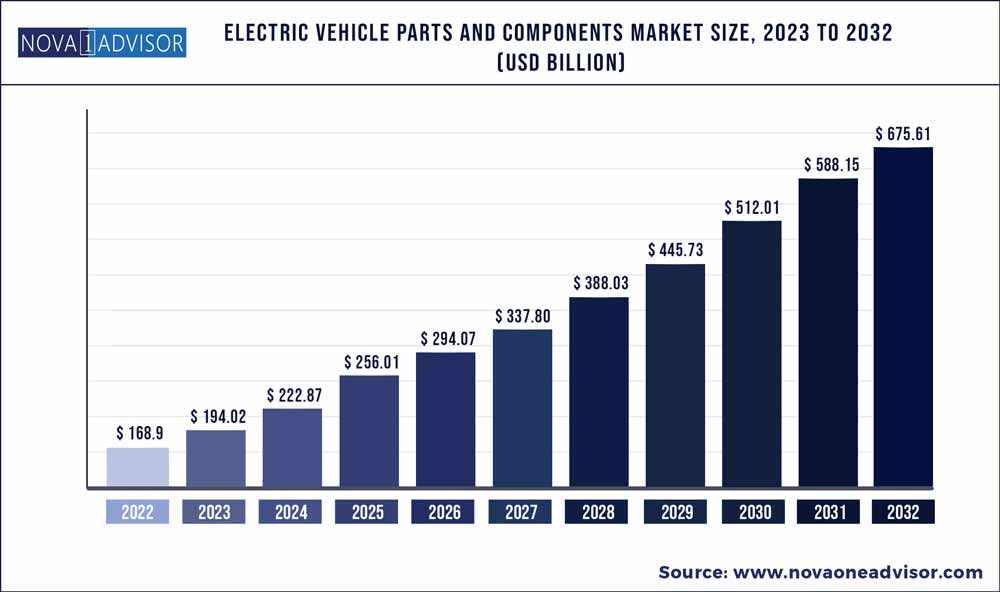

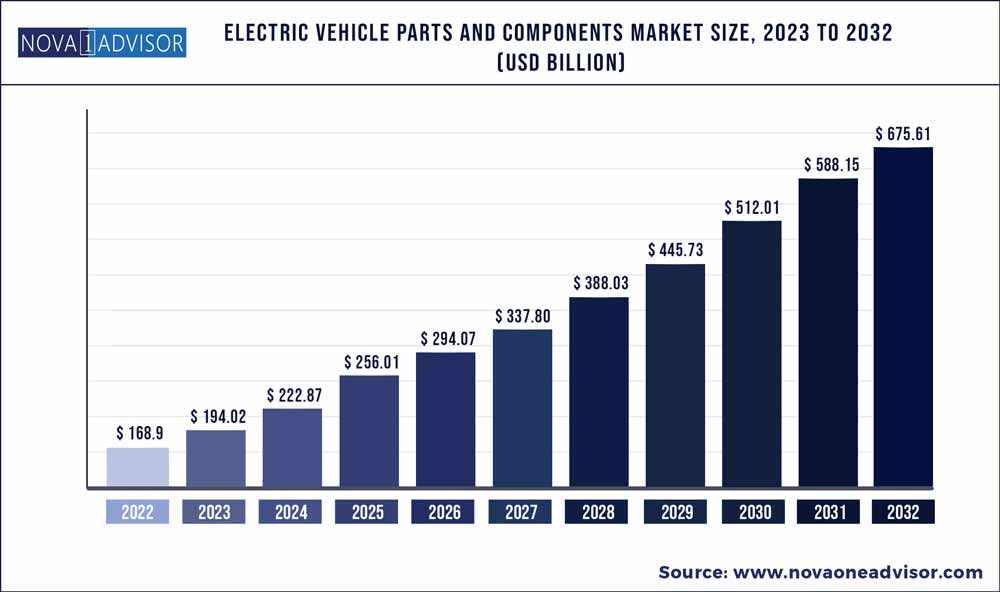

The global electric vehicle parts and components market size was exhibited at USD 168.9 billion in 2022 and is projected to hit around USD 675.61 billion by 2032, growing at a CAGR of 14.87% during the forecast period 2023 to 2032.

Key Pointers:

- The Asia Pacific region with the highest market growth rate with increased revenue share

- On the basis of the components, battery packs involved in the electric vehicle account for the largest growth with increased demands

- On the basis of the vehicle type, commercial electric vehicles with the highest market growth rate with increased revenue share

- On the basis of the propulsion type, battery EV charging with the highest market growth with increased revenue share

An electric charging vehicle that utilizes electric power for running the car in involves components like a motor, collector, battery, solar panels, fuel cells, generator, and others. Electric vehicles store the electrical energy in the battery through the collector system and also can be charged by solar panels. Electric vehicles are run on the developed technologies, for example, battery electric vehicles, plug-in hybrid electric vehicles, and hybrid range extender electric vehicles. The major components involved in the electric vehicle are the battery, electric engine, and motor controller, other components involved are displays, brakes, and other necessary components. An electric vehicle with enhanced benefits with an increased focus on the environment with zero emission of pollution from the vehicles.

Electric Vehicle Parts and Components Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 194.02 Billion |

| Market Size by 2032 |

USD 675.61 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 14.87% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Vehicle Type, Propulsion Type, Component Type, Sale Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Eastman Auto & Power Ltd, Sparco Batteries Pvt Ltd, Panasonic Corp, Amara Raja Batteries, Okaya Power Ltd, Maruti Suzuki, Ashok Layland, Bosch Limited, Exide Industries Pvt Ltd, ABB Group, Denso Corporation, Avtec Limited, Mahindra Electric Mobility Limited, Tata Motors Limited, SEG Automotive India Private Limited, Samsung SDI Co.Ltd, LG Chem Ltd, OptimunNoNO Energy Co. Ltd, Innotek Co. Ltd, and Others. |

Growth Factors

The electric vehicle parts and components market with increased demands from customers for electric vehicle charging, and fast charging of electric vehicles with the development of the infrastructure in the regions which helps to drive the market of electric vehicle parts and components to a larger extent during the forecast period. The increased economy of the nation with an increasing revenue share of the market in the components of electric vehicle charging with increasing prevalence towards the electric vehicles due to cost-effectivity and reduced environmental pollution with zero emission of fumes from the electric vehicles and reduced noise pollution has helped to grow the market growth rate of the electric vehicle parts and components.

Increased demands for electric vehicle components due to the increased prevalence of the customers towards electric vehicles with the increase in manufacturing of the electric vehicle components and enhanced production with increasing the efficiency and efficacy of the components involved in the electric vehicles boost the market with increased revenue share. Electric vehicles are popular due to increasing demands from customers. Governments from various regions providing funds for the development of new technologies in the market with increased research involved in the components drive the market growth and increased initiative for the development of the infrastructure with developing the new charging stations with developed technology and increased efficiency helps to expand the market of component of electric vehicle charging during the forecast period.

Increased demands from the customer due to increasing fuel rates, and reduced pollution due to zero emission of fumes from the vehicles. This led to increasing manufacturing and production of electric vehicles with increased quality and efficiency of the vehicles drives the market growth rate of components of electric vehicle charging. The key market players with increased investment in the automobile sector with the development of new technologies in electric vehicles, market players are the major role players that help the expansion of the market to a larger extent.

Electric Vehicle Parts And Components Market Trends

Increasing Investments in Electric Vehicles Driving the Market

- Electric vehicles have become an integral part of the automotive industry, and it represents a pathway toward achieving energy efficiency, along with reduced emission of pollutants and other greenhouse gases.

- The increasing environmental concerns, coupled with favorable government initiatives, are the major factors driving this growth. The annual sales volume of electric passenger cars is projected to cross the 5 million mark by the end of 2025, and it is expected to account for 15% of the overall vehicle sales by the end of 2025. However, logistics and e-commerce are also investing heavily to increase their electric vehicle fleets.

- In October 2022, Amazon.com Inc announced its ambitious plan to invest over 1 billion euros (equivalent to USD 974.8 million) in electric vans, trucks, and low-emission package hubs throughout Europe within the next five years. This strategic investment aims to accelerate Amazon's commitment to achieving net-zero carbon emissions and promote eco-friendly delivery solutions across the continent."

- Several manufacturers have raised the bar to go beyond the previous announcements related to electric vehicles (EVs) with an outlook beyond 2025. More than ten of the largest original equipment manufacturers (OEMs) have declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles.

- For instance, Mercedes-Benz is in the process of restructuring its strategy to increase profits by focusing on higher-priced luxury vehicles. As part of its plan to go all-electric by 2030, the manufacturer intends to upgrade its product portfolio and discontinue lower-cost models.

- Volkswagen is planning to spend USD 36 billion on electric cars across its mass-market brands by 2024. According to the company, by 2025, at least 25% of its global sales will be electric vehicles.

- Mahindra & Mahindra (M&M) is one of the leading vehicle manufacturers in Asia. The company is planning to launch new electric vehicles. At present, the company has only one electric model, eVerito.

- Volvo announced that it will only sell electric cars from 2030. Ford will only sell electric cars in Europe from 2030. General Motors plans to offer only electric vehicles after 2035. Volkswagen aims for 70% electric car sales in Europe and 50% in China and the United States by 2030. Stellantis aims for 70% of the electric car sales in Europe and 35% in the United States.

Segments Insight

Components Insights

On the basis of the components, battery packs involved in the electric vehicle account for the largest growth with increased demands from the customer for production and manufacturing of the electric vehicles with increased production of the components involved for integration in the electric vehicles with increased efficiency of the vehicles with increased quality of the vehicles drives the market growth rate during the forecast period. About 40-50% accounts for the largest growth in electric vehicles due to increased installation helps the expansion of the components market in electric vehicle charging.

Vehicle Type Insights

On the basis of the vehicle type, commercial electric vehicles with the highest market growth rate with increased revenue share and increased consumption of the electricity in the battery without the utilization of the fuels such as diesel, petrol, and gasoline and reduced pollution contribute to the protection of the environment helps to drive the market of the components of the electric vehicle with increased components in the vehicles. In recharging battery conversion of the electrical energy to mechanical energy with increased demands from the customer for commercial vehicles with the increased growth rate during the forecast period.

Propulsion Type Insights

On the basis of the propulsion type, battery EV charging with the highest market growth with increased revenue share in the components market of electric vehicle charging with onboard battery charging of the electric vehicle drives the market growth rate during the forecast period due to increased demands from the customers with developed technologies in the electric vehicles with increased benefits of the electric vehicles with an increasing number of components drives the market growth during the forecast period. Development of the charging stations with improving infrastructure helps to drive the growth rate during the forecast period.

Sale Channel Insights

On the basis of the sale channel, the original equipment manufacturer with increased demands from the customers and enhanced production of the components involved in the integration of electric vehicles with a faster growth rate with increased utilization of the electric vehicles with increased benefits from the vehicles and enhanced components drives the market growth rate with the adoption of the new technologies with continuous research helps to expand market during the forecast period.

Asia-Pacific Region Anticipated to Witness Significant Growth

- Rising government emphasis on increasing the adoption of electric vehicles and the availability of incentives from the government for electric vehicles are expected to drive the demand for electric vehicles during the forecast period. Governing bodies of several countries from Europe, North America, and Asia-Pacific have announced their plans to phase out fuel-powered vehicles during the upcoming 10 years. This will also have a positive impact on the growth of electric vehicles during the forecast period.

- Asia-Pacific is expected to grow at a faster rate, followed by Europe and North America, as countries such as China and Japan are inclined toward innovation, technology, and the development of advanced electric vehicles. Moreover, ASEAN countries are engaged in large electric mobility projects.

- China is a key player in the global electric vehicle industry. Moreover, the government of China is encouraging people to adopt electric vehicles. The country is planning to completely switch to electric mobility by 2040. The Chinese electric passenger car market is also one of the largest worldwide, and it has been growing rapidly over the last few years and is expected to grow higher in the forecast period, which is also going to have a positive impact on the demand for electric vehicle parts and components market.

- Japan has one of the best electric vehicle ecosystems in the world. Automotive companies like Toyota and Nissan are taking steps toward building electric vehicles in the country. The developments in the hybrid and electric vehicle market can be gauged by the presence of a number of players in the country. These favorable factors are expected to drive the market for hybrid and electric vehicles in Japan.

- The Indian government has been formulating various strategies to reduce pollution in the country. For instance, The country, with its FAME and FAME II policies, has been providing incentives to customers and attractive options for investors as well as manufacturers to set up EV plants to propel the nation toward the faster adoption of green vehicles. Additionally, automobile manufacturers in India are also taking initiatives and investing in R&D practices to provide affordable electric cars in India.

- For instance, in January 2023: Tata AutoComp Systems Limited (Tata AutoComp) displayed a wide range of parts that it has already localized and is offering to the EV segment. Tata AutoComp has also been working on lightweight products and solutions to help electric vehicles extend their range. Such factors are likely to drive market growth over the coming years.

Recent Developments

- In the year 2022 March, the Introduction of taking the Plant in the United States was announced by the Panasonic Corporation to boost the production and manufacturing of lithium-ion battery. Oklahoma, Tesla Electric vehicles, Tesla Inc, and increased benefit from the plant produced by the Panasonic Corporation

- In the year 2021 February, Introduction by the Hyundai for development of newly developed electric vehicles with increased cost-effectivity and increased manufacturing of the products. Collaboration of Hyundai and in sister brand Kia to increase the EV'S in India.

Some of the prominent players in the Electric Vehicle Parts and Components Market include:

- Eastman Auto & Power Ltd

- Sparco Batteries Pvt Ltd

- Panasonic Corp

- Amara Raja Batteries

- Okaya Power Ltd

- Maruti Suzuki

- Ashok Layland

- Bosch Limited

- Exide Industries Pvt Ltd

- ABB Group

- Denso Corporation

- Avtec Limited

- Mahindra Electric Mobility Limited

- Tata Motors Limited

- SEG Automotive India Private Limited

- Samsung SDI Co.Ltd

- LG Chem Ltd

- OptimunNoNO Energy Co. Ltd

- Innotek Co. Ltd

- Mitsubishi Electric Corp

- Hitachi Ltd

- Siemens AG

- Tesla Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric Vehicle Parts and Components market.

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion Type

- Battery Electric Vehicle

- Plug-in Hybrid Vehicle

- Fuel Cell Electric Vehicle

- Hybrid Electric Vehicle

By Component Type

- Battery Packs

- DC-DC Converters

- Controller & Inverter

- Motor

- Onboard Charger

- Others

By Sale Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)