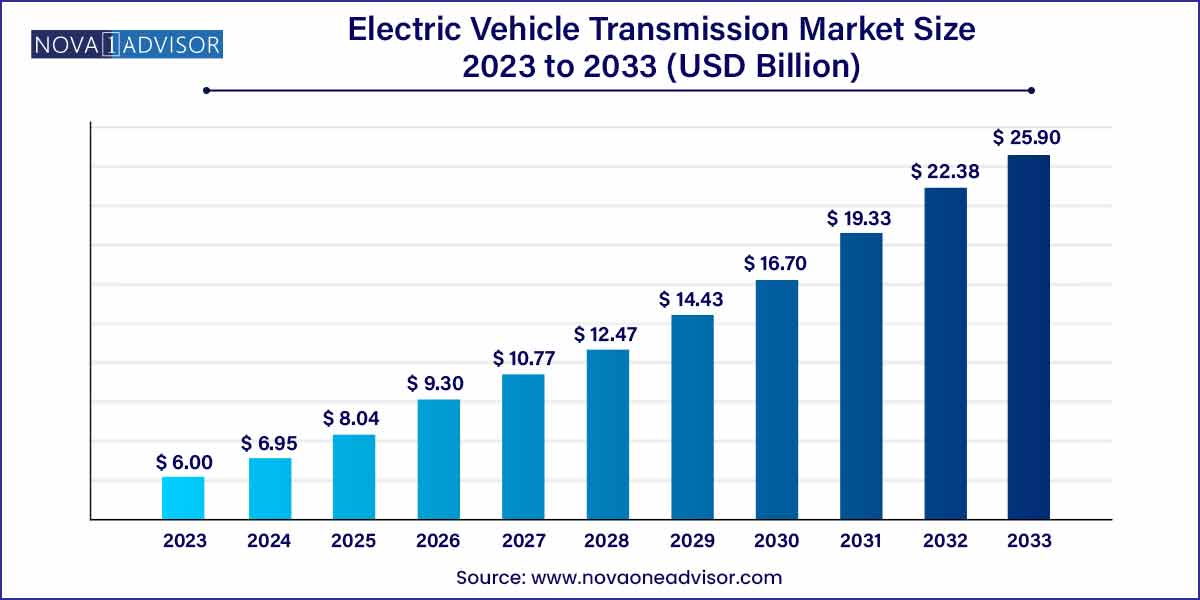

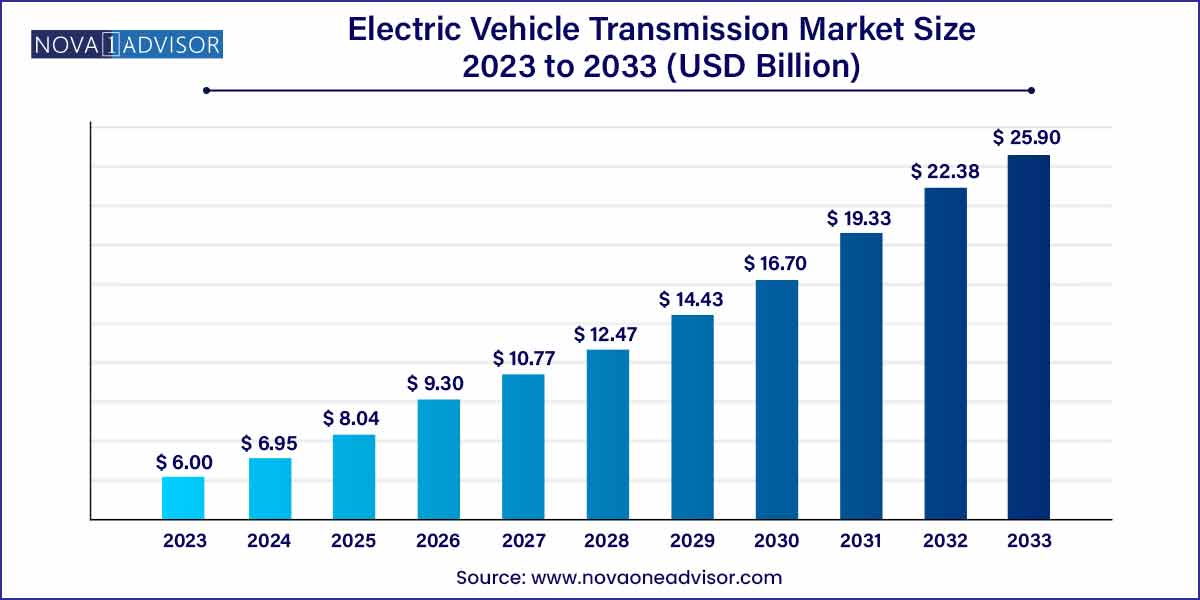

The global electric vehicle transmission market size was exhibited at USD 6.00 billion in 2023 and is projected to hit around USD 25.90 billion by 2033, growing at a CAGR of 15.75% during the forecast period of 2024 to 2033.

Key Takeaways:

- The Europe region has made up 47% revenue share in 2023.

- The battery EV is expected to hit an opportunity of more than USD 20,000 million from 2023 to 2033.

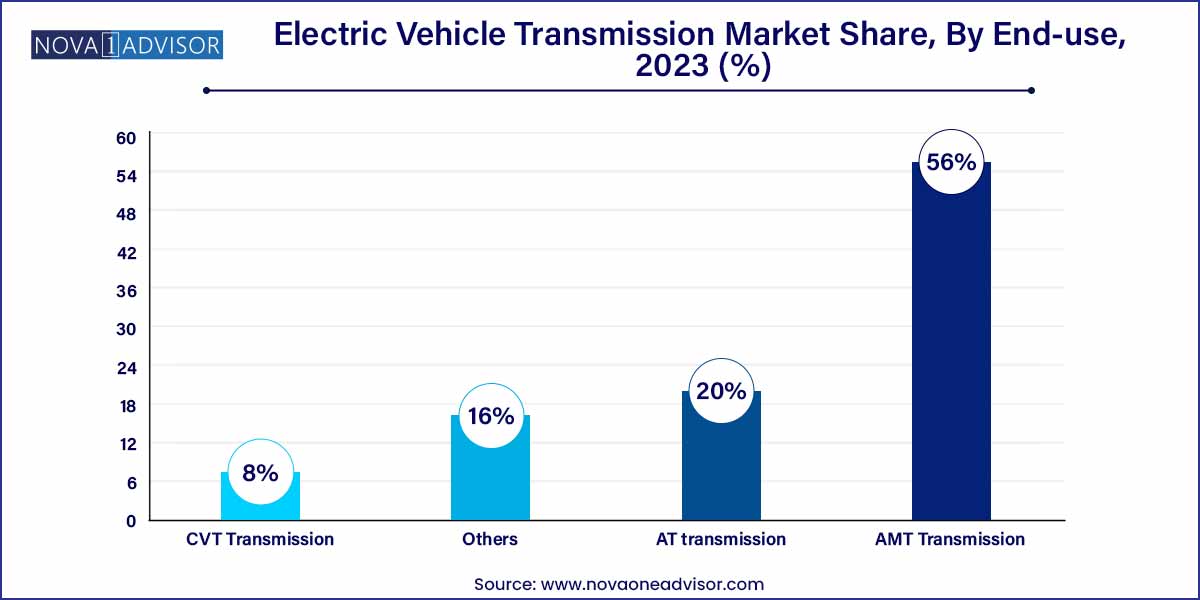

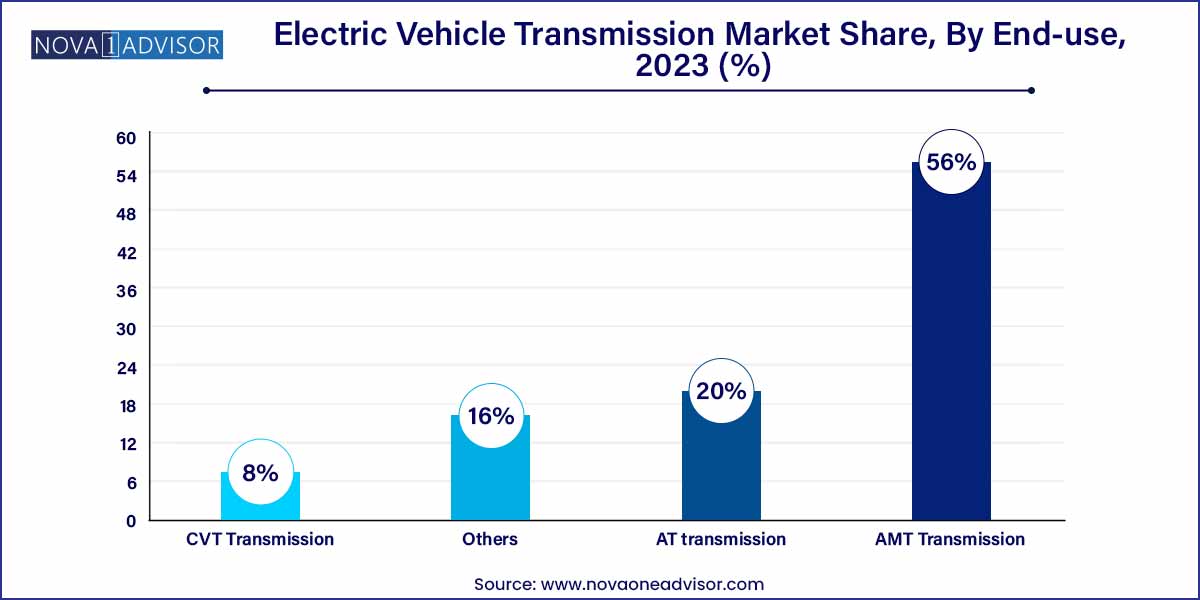

- The AT transmission system segment has accounted revenue share of around 56% in 2023.

- By vehicle, the cars segment accounted 61% revenue share in 2023.

- The offline segment is expected to grow at a CAGR of 22.39% from 2023 to 2033.

Electric Vehicle Transmission Market: Overview

The global Electric Vehicle (EV) Transmission Market is undergoing a significant transformation, driven by the increasing adoption of electric mobility, environmental concerns, and evolving government regulations on carbon emissions. Unlike internal combustion engine (ICE) vehicles that require complex multi-gear systems, electric vehicles generally operate efficiently with simpler transmissions. However, as EV technology evolves and customer demands for performance, efficiency, and driving comfort grow, the need for advanced transmission systems has increased considerably.

Electric vehicle transmissions are designed to transfer power from the motor to the wheels. While many electric cars use single-speed transmissions, innovations in the sector have introduced multi-speed options that enhance performance in high-speed and heavy-duty applications. This market is witnessing the entry of established automotive giants as well as innovative startups that are exploring next-generation drivetrains and smart transmission systems.

The proliferation of battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) is expanding the scope for various transmission technologies, including automatic manual transmissions (AMT), continuously variable transmissions (CVT), and automatic transmissions (AT). As companies seek to differentiate their offerings through performance, efficiency, and driving experience, the electric vehicle transmission market is expected to experience robust growth through 2034.

Major Trends in the Market

-

Rising Adoption of Multi-Speed Transmissions in High-Performance EVs

While most EVs have relied on single-speed systems, high-performance electric cars like the Porsche Taycan and Tesla Roadster are turning to multi-speed gearboxes to improve acceleration and top speed.

-

Integration of Smart and Adaptive Transmission Controls

Manufacturers are embedding AI-based and software-driven control units into transmissions, enabling dynamic torque distribution and gear shifting based on driving behavior and terrain.

-

Shift Towards Lightweight and Compact Transmission Designs

The demand for lightweight components is encouraging the development of compact gear assemblies that reduce overall vehicle weight and increase energy efficiency.

-

Increased Focus on Thermal Management in Transmission Systems

EV transmissions are now integrating thermal management solutions to maintain performance across a wide range of driving conditions, especially in heavy-duty and high-speed segments.

-

Collaborations and Mergers for Technology Co-development

Automotive OEMs and component manufacturers are forming strategic alliances to accelerate innovation, like Magna's partnership with LG for e-powertrain components.

Electric Vehicle Transmission Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.00 Billion |

| Market Size by 2033 |

USD 25.90 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.75% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Transmission System,By Vehicle Type,By by Type,By and by region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Allison Transmission Inc., Aisin Seiki Co., Ltd., AVL List GmbH, Continental AG, BorgWarner Inc., Dana Limited, EATON Corporation, Denso Corporation, GKN Plc, Hitachi Automotive Systems Ltd., Hewland Engineering Ltd., JATCO Ltd., Mando Corporation, Magna International, Porsche AG, Schaeffler Technologies AG & Co. KG, Robert Bosch GmbH, Xtrac Ltd, ZF Friedrichshafen AG. |

Key Market Drivers

Growing demand for low-emission and fuel-proficient automobiles to spur growth: Because gasoline is a fossil fuel and not a renewable energy supply, it is expected to be depleted in the near future. In compared to typical autos, electric vehicles do not use fuel and emit minimal levels of pollution. Fuel-powered cars transfer around 16%-20% of the energy stored in fuel to wheels, whereas electric vehicles convert more than 50% of the electric energy from the power source to the wheels.

Increase in adoption of electric vehicles: The global increase in the purchasing of electric cars is boosting the growth rate of the EV transmission sector. For example, in the first half of 2021, Volkswagen Group's global deliveries of full-electric cars more than quadrupled, owing mostly to demand in Europe. Europe was the automaker's leading electric vehicle market, with 128,078, a 156 percent increase. As a result of such high demand, the global electric vehicle market's growth pace accelerates significantly.

Growing Concerns related to carbon emissions: With the present revolution centred on the depletion of fossil resources, several nations are seriously contemplating implementing measures to benefit the environment, and hence society and the community at large. Every year, 995 metric tonnes of CO2 are emitted in India. People are adopting EV strategies as a result of such worrying data, which indirectly raises demand for the EV transmission business.

Key Market Challenges

Lack of charging infrastructure - The governments of several nations are encouraging the usage of electric cars for business purposes in order to minimize greenhouse gas emissions into the environment. However, the absence of electric car charging infrastructure is a barrier to the electric vehicle industry. For example, the Indian government intends to have exclusively electric automobiles on the road by 2033. However, one of the most important criteria for ensuring the adoption of electric vehicles is the development of a solid electric vehicle infrastructure. Unfortunately, most developing nations' electric vehicle charging infrastructure is still insufficient and has yet to catch up to satisfy the demand, stifling the expansion of the electric car industry. As a result, the absence of charging infrastructure is limiting the expansion of the electric car transmission industry.

Key Market Opportunities

Downsizing of transmission system is a vital trend

Because of their potential to emit zero emissions, electric vehicles are expected to outperform conventional vehicles during the projection period. It will consequently increase demand for electric car transmission. Furthermore, manufacturers of electric car transmissions are always exploring for materials that might minimize the entire weight of the transmission system without sacrificing performance. All of these things will very certainly increase demand for electric automobiles.

Aside from that, effective utilization of the power stored in EV battery packs is critical, prompting manufacturers to design specific transmission systems to satisfy the performance and close tolerances of batteries. Volkswagen, for example, launched an effort to build superlight automobiles by decreasing their weight by 85 kg using a multi-material strategy.

Increase in the manufacturing of electric vehicles

Electric car demand and manufacturing have increased dramatically in recent years due to various benefits that electric vehicles have over gasoline-powered autos. Fan belts, air cleaners, oil, timing belts, head caskets, cylinder heads, and spark plugs do not need to be replaced, making them less expensive and more efficient for the expansion of the fuel-powered automotive industry. As a result, increased electric car manufacturing fuels the growth of the electric vehicle transmission industry.

Segments Insight

Transmission System Insights

The automatic transmission (AT) segment dominated the market in 2024 and is anticipated to maintain its leadership position over the coming years. Automatic transmissions offer seamless gear shifting and better torque handling, making them especially suitable for urban and luxury electric vehicles. OEMs such as Tesla and Lucid Motors are incorporating optimized versions of AT systems in their performance and premium segments to improve user experience and driving comfort. Furthermore, advances in automatic transmission fluid (ATF) technology are enhancing the durability and efficiency of these systems, encouraging their widespread adoption.

The fastest growing segment is the continuously variable transmission (CVT), owing to its smooth operation and excellent efficiency at various speeds. CVTs are gaining traction in electric hybrids and plug-in hybrids, particularly in markets such as Japan and the U.S. Their ability to continuously change gear ratios allows EVs to maximize battery usage and reduce wear on components. Toyota’s hybrid lineup, for example, relies heavily on CVT systems to deliver optimal energy performance and fuel savings.

Vehicle Type Insights

Battery electric vehicles (BEVs) dominated the market due to their rising global demand, zero-emission operation, and expanding charging infrastructure. Countries like China and Germany have heavily invested in BEV adoption through subsidies and infrastructure development. Tesla’s entire vehicle portfolio utilizes highly optimized transmission systems that operate without gear shifts, reducing energy losses and mechanical wear. As more consumers shift toward BEVs, the demand for specialized single and multi-speed transmissions that complement electric motors is expected to soar.

Plug-in Hybrid Electric Vehicles (PHEVs) represent the fastest-growing segment, especially in transitional markets where full EV adoption is still maturing. PHEVs combine the benefits of electric and ICE drivetrains and require more complex transmission architectures. Leading models like the BMW 530e and Toyota Prius Prime use advanced multi-mode transmissions that adapt seamlessly between gas and electric modes, enhancing driving efficiency while reducing emissions.

Transmission Type Insights

The single-speed segment currently leads the market, favored for its simplicity, cost-effectiveness, and sufficient performance for most passenger EVs. Many mainstream electric vehicles like the Nissan Leaf and Chevrolet Bolt rely on single-speed gearboxes, as electric motors can deliver high torque from standstill without the need for multiple gears. Their low maintenance requirements also make them attractive for budget-conscious buyers.

However, the multi-speed transmission segment is witnessing the fastest growth, fueled by the need for better efficiency in heavy-duty vehicles and high-performance electric sports cars. Automakers like Porsche and Rivian are exploring two-speed and multi-speed architectures to enhance acceleration, improve energy consumption at high speeds, and extend the range of EVs. These innovations are pushing the limits of traditional EV design and laying the groundwork for a new generation of electric powertrains.

Regional Insights

Asia-Pacific holds the largest share in the global EV transmission market, primarily due to the massive adoption of EVs in China, which is the world’s largest electric vehicle market. China alone accounted for over 60% of global EV sales in 2024, driven by strong government support, local manufacturing incentives, and consumer subsidies. Major Chinese manufacturers like BYD, NIO, and SAIC Motor have heavily invested in proprietary transmission systems that optimize performance and reduce reliance on foreign technology. Japan and South Korea also contribute significantly, with their expertise in hybrid vehicles and innovations in CVT technology, especially from companies like Toyota and Hyundai.

Europe is the fastest-growing region for electric vehicle transmissions, backed by aggressive decarbonization policies, increasing fuel taxes, and bans on ICE vehicle sales in countries like Norway (by 2025) and the UK (by 2030). The region is home to a well-established automotive industry with companies such as Volkswagen, BMW, Mercedes-Benz, and Renault, which are now pivoting toward electric mobility. These OEMs are developing in-house transmission units or collaborating with Tier 1 suppliers to create integrated and efficient EV transmission solutions. The EU’s emphasis on climate goals, battery manufacturing, and supply chain localization is further accelerating the regional EV market and associated component demands.

Recent Developments

-

February 2025: Magna International announced a new partnership with REE Automotive to co-develop next-generation EV transmissions for modular electric vehicle platforms, aimed at reducing component weight and improving drivetrain flexibility.

-

January 2025: ZF Friedrichshafen AG unveiled a new two-speed transmission system for high-performance electric SUVs, aimed at improving both torque output and energy efficiency.

-

December 2024: GKN Automotive expanded its UK innovation center to focus on multi-speed eDrive systems, including active torque vectoring and AI-powered transmission controls.

-

November 2024: BorgWarner Inc. completed the acquisition of Santomeri e-Mobility Solutions, enhancing its portfolio of hybrid and electric vehicle transmission components across Europe and North America.

Some of the prominent players in the electric vehicle transmission market include:

- Allison Transmission Inc.

- Aisin Seiki Co.

- Ltd.,

- AVL List GmbH

- Continental AG,

- BorgWarner Inc.,

- Dana Limited,

- EATON Corporation,

- Denso Corporation,

- GKN Plc,

- Hitachi Automotive Systems Ltd.

- Hewland Engineering Ltd.

- JATCO Ltd.

- Mando Corporation

- Magna International

- Porsche AG

- Schaeffler Technologies AG & Co. KG

- Robert Bosch GmbH

- Xtrac Ltd

- ZF Friedrichshafen AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric vehicle transmission market.

Transmission System

- AMT Transmission

- CVT Transmission

- AT transmission

- Others

By Vehicle Type

- Electric Vehicle Battery

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

By Transmission Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)