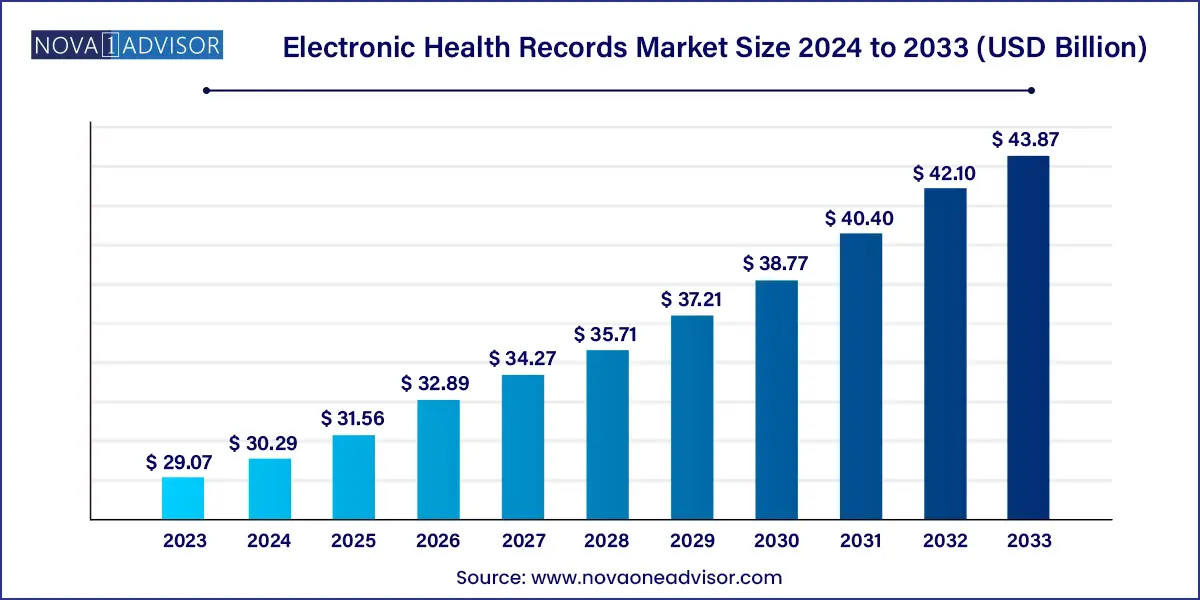

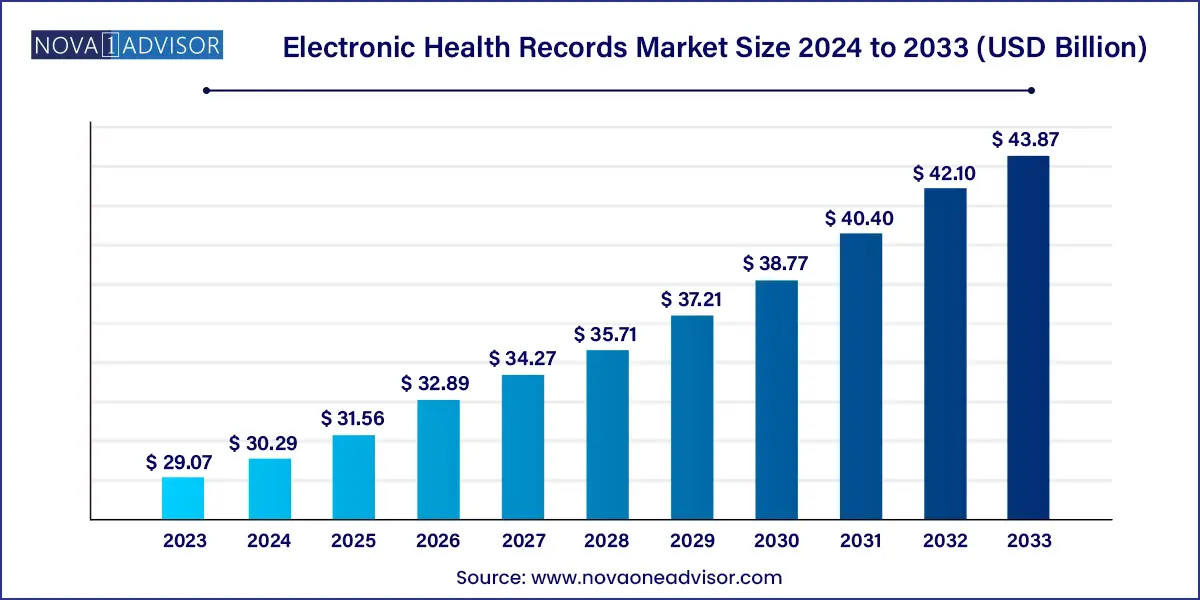

The global electronic health records market size was exhibited at USD 29.7 billion in 2023 and is projected to hit around USD 43.87 billion by 2033, growing at a CAGR of 4.20% during the forecast period of 2024 to 2033.

Key Takeaways:

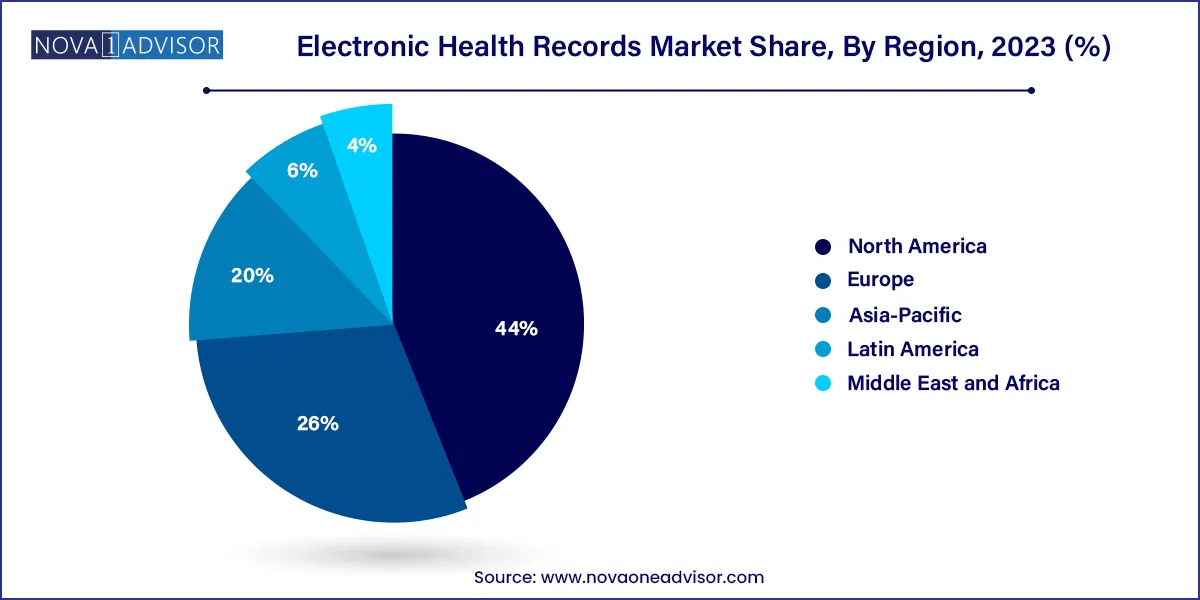

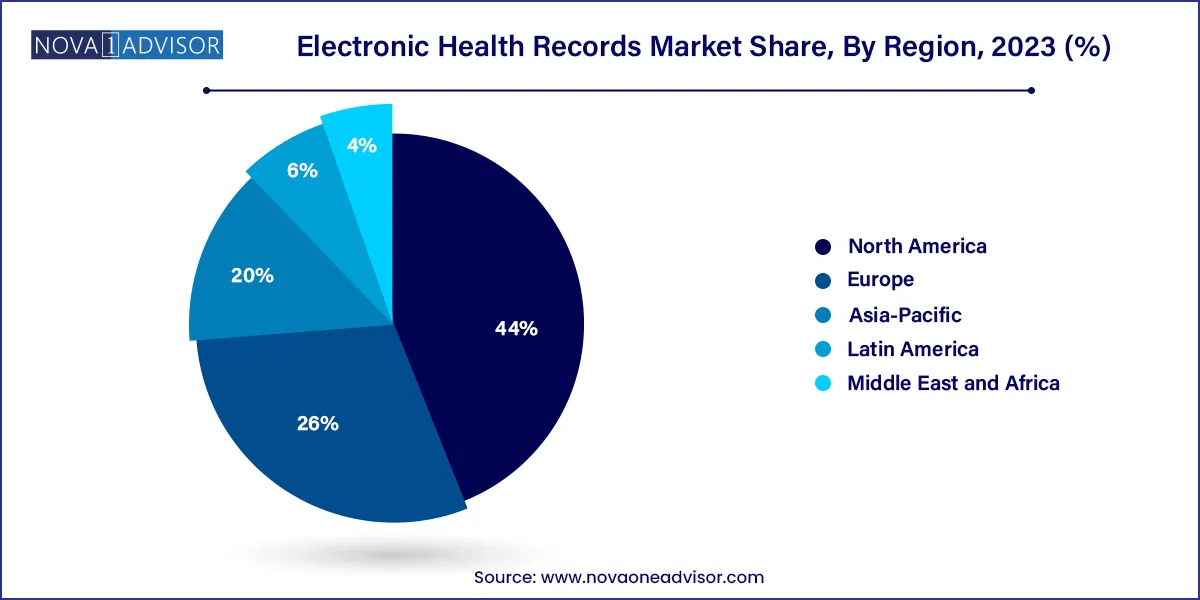

- North America dominated the market, accounting for about 44.0% share of global revenue in 2023.

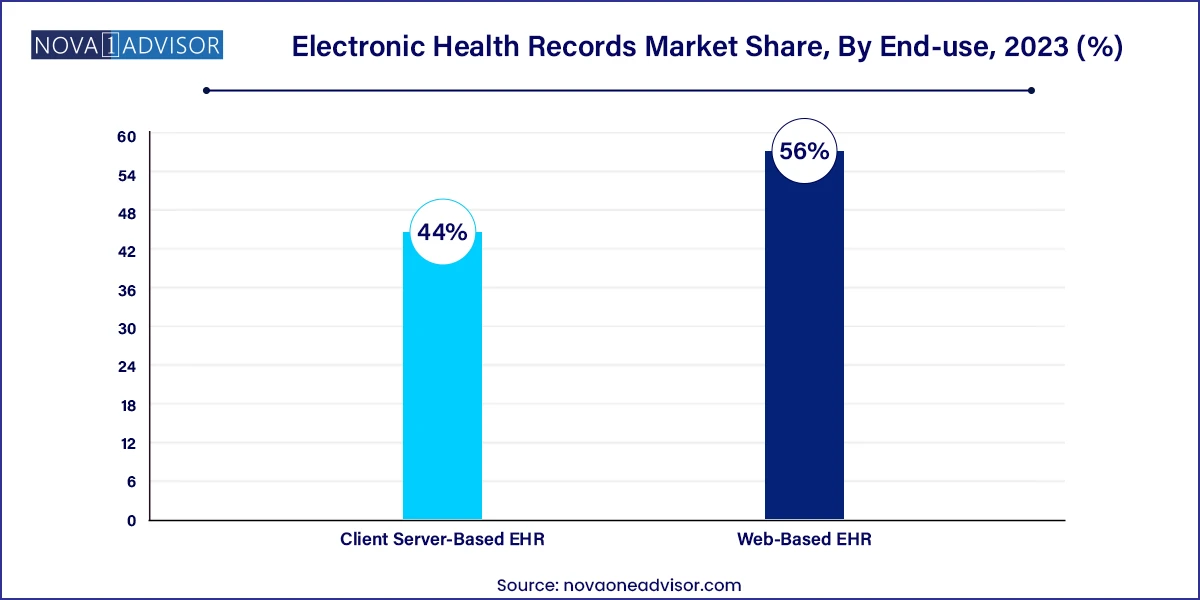

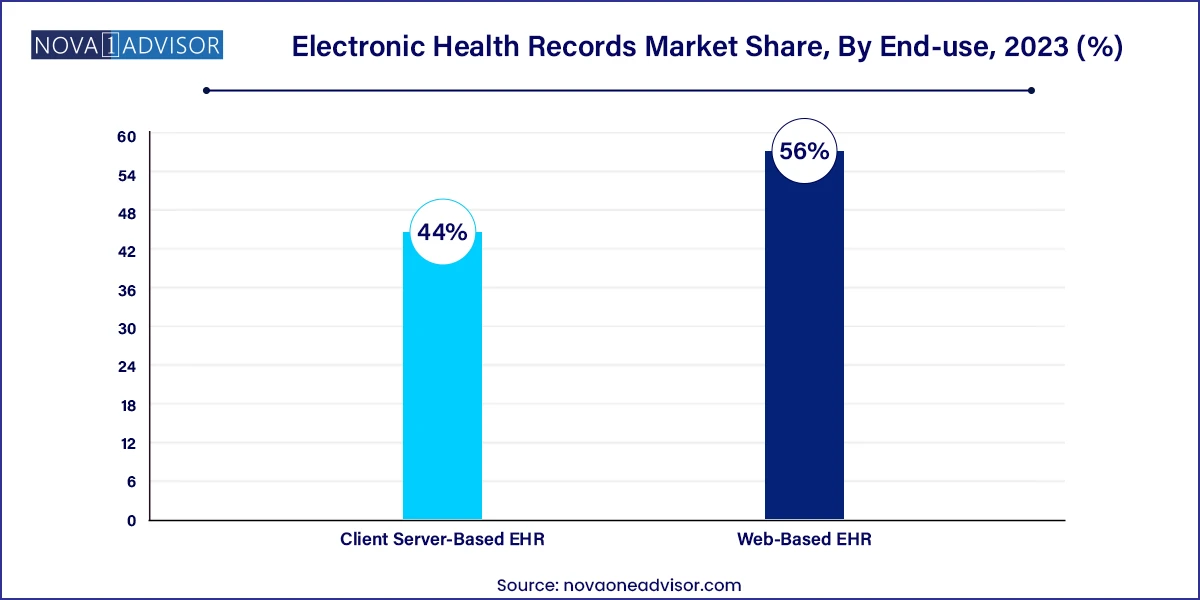

- The web-based EHR segment led the market and accounted for more than 56% share of the global revenue in 2023.

- The acute EHR segment held the largest market share in 2023

- The hospitals' segment held the largest market share in 2023.

- The professional services segment held the largest market share of in 2023.

Market Overview

The Electronic Health Records (EHR) Market represents a vital and dynamic segment within the global digital health industry. EHR systems are digital versions of patients' paper charts, providing a comprehensive and real-time view of patient data. These systems are designed to streamline clinical workflows, improve patient safety, enhance the quality of care, and facilitate data-driven decision-making. The EHR market sits at the intersection of healthcare and information technology, evolving rapidly alongside innovations in cloud computing, artificial intelligence (AI), and health data interoperability.

Historically, EHRs were confined to basic digital charting and storage. However, in recent years, their functionalities have expanded significantly, encompassing clinical decision support, patient engagement portals, telemedicine integration, population health analytics, and secure interoperability with other healthcare systems. Governments around the world have recognized the transformative potential of EHRs and have responded with regulatory mandates, financial incentives, and national digital health strategies. For example, the U.S. Centers for Medicare & Medicaid Services (CMS) Meaningful Use program catalyzed widespread adoption of EHRs among hospitals and physicians.

In today’s landscape, EHRs are no longer optional they are a foundational component of modern healthcare delivery. With the increasing demand for value-based care, chronic disease management, and personalized medicine, the role of EHRs is becoming even more critical. As healthcare providers aim for integrated, patient-centric models, EHRs serve as the central nervous system that connects diagnostics, treatments, outcomes, and patient interactions across various care settings.

Major Trends in the Market

-

Shift Toward Cloud-Based EHR Solutions: Web-based and cloud-deployed systems are increasingly replacing on-premise models due to cost-efficiency, scalability, and remote access.

-

AI and Predictive Analytics Integration: AI is being embedded into EHRs for clinical decision support, early diagnosis, and risk stratification.

-

Rise of Interoperability and FHIR Standards: Health systems are investing in APIs and platforms that support HL7 FHIR to enable seamless data exchange.

-

Mobile Access and Patient Portals: EHR platforms are integrating mobile-friendly portals that empower patients to access their health records and communicate with providers.

-

Expansion of EHRs in Specialty Practices: Tailored EHR modules are being developed for cardiology, oncology, neurology, and behavioral health.

-

Telehealth Integration: COVID-19 accelerated the blending of telemedicine with EHRs, supporting real-time patient-provider interactions and documentation.

-

Blockchain for Data Security and Integrity: Pilot projects are exploring the use of blockchain to ensure tamper-proof EHR transactions.

-

Regulatory Emphasis on Data Transparency: Initiatives like the U.S. 21st Century Cures Act are pushing vendors toward open and interoperable platforms.

Electronic Health Records Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 29.7 Billion |

| Market Size by 2033 |

USD 43.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.20% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, End use, Business Models, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cerner Corporation (Oracle),GE Healthcare, Veradigm LLC (Allscripts Healthcare, LLC), Epic Systems Corporation, eClinicalWorks, Greenway Health, LLC, NextGen Healthcare, Inc., Medical Information Technology, Inc. (Meditech), Health Information Management Systems, CPSI, AdvancedMD, Inc., CureMD Healthcare, McKesson Corporation. |

Key Market Driver: Growing Need for Coordinated and Value-Based Healthcare

A major driver for the EHR market is the increasing demand for coordinated, value-based care delivery, which requires real-time access to comprehensive patient information across providers and settings. EHRs serve as the digital backbone that enables this model by centralizing patient data, supporting population health initiatives, and enabling performance tracking.

Under value-based reimbursement models, providers are incentivized not just for the volume of services, but for outcomes and efficiency. EHRs help in identifying at-risk patients, monitoring chronic diseases, tracking medication adherence, and ensuring that best practice guidelines are followed. For instance, integrated EHR platforms can alert clinicians when patients are due for screenings or flag potential adverse drug interactions. These capabilities are not just improving care quality but are also reducing avoidable hospitalizations and redundant testing. As value-based care becomes more widespread globally, EHR adoption and sophistication are expected to accelerate.

Key Market Restraint: High Initial Costs and Technical Challenges of Implementation

Despite their long-term benefits, the high upfront costs and technical challenges associated with EHR implementation continue to pose barriers, particularly for smaller healthcare providers. Licensing fees, hardware procurement, data migration, training of staff, and integration with existing systems can result in significant expenses.

Furthermore, technical glitches, poor user interface design, and lack of customization can lead to clinician burnout and reduce efficiency rather than improving it. For example, some physicians report spending more time entering data than interacting with patients. Resistance to change and concerns about data breaches further slow down adoption in certain settings. While cloud-based and subscription models are helping to mitigate these challenges, cost and complexity remain significant hurdles, especially in low- and middle-income countries.

As healthcare systems strive to become more integrated and patient-centric, there is a growing opportunity in developing EHR platforms that are fully interoperable and built on open architectures. These platforms allow seamless exchange of health information between hospitals, clinics, labs, pharmacies, and even wearable devices or patient-owned health records.

The adoption of interoperability standards such as HL7 FHIR (Fast Healthcare Interoperability Resources) and the push by governments to mandate data sharing are catalyzing this shift. Open APIs are being developed to allow third-party applications—such as clinical decision support tools, mobile health apps, and analytics dashboards—to plug into EHR systems. This ecosystem approach is fostering innovation and giving rise to EHR marketplaces where providers can choose functionalities that best fit their needs. Vendors that embrace openness and interoperability are likely to gain a competitive edge in a rapidly evolving market.

Segments Insights:

Product Insights

Web-based EHRs dominate the product segment, thanks to their flexibility, lower upfront costs, and ease of deployment. Unlike client-server models that require on-site servers and IT infrastructure, web-based solutions can be accessed from any internet-connected device, making them ideal for small to mid-sized practices. Vendors such as Athenahealth and Practice Fusion have capitalized on this trend by offering cloud-native platforms with regular updates, compliance tools, and scalable storage. The convenience of web deployment has made it the preferred model in outpatient and ambulatory settings, as well as in developing countries with limited IT resources.

Client-server-based EHRs are seeing slower but steady demand, particularly in large hospitals and healthcare networks with in-house IT departments. These systems offer more control over data privacy, customization, and integration with legacy hospital systems. However, the need for ongoing maintenance, data backup, and physical space makes them less attractive for smaller setups. As cloud infrastructure becomes more secure and reliable, a migration trend from client-server to web-based EHRs is expected to continue.

Type Insights

Acute care EHRs dominate the type segment, as large hospitals and trauma centers require robust, feature-rich platforms capable of handling high patient volumes, complex workflows, and multiple departments. Acute EHRs often come integrated with modules for emergency medicine, surgical documentation, intensive care monitoring, and in-patient administrative workflows. Companies such as Epic and Cerner have specialized acute care solutions that are widely adopted by top-tier hospitals worldwide.

Post-acute care EHRs are the fastest-growing type, especially as long-term care, rehabilitation, and skilled nursing facilities are being brought under the umbrella of value-based care. These settings require specialized documentation, coordination tools, and regulatory compliance features distinct from acute hospitals. Increasing regulatory scrutiny and the need for care continuity across the healthcare continuum are driving EHR adoption in post-acute environments.

End Use Insights

Hospitals represent the largest end-use segment, owing to their scale, funding capabilities, and need for enterprise-wide health IT solutions. Hospitals rely on EHRs for everything from clinical documentation and order entry to billing, patient engagement, and regulatory reporting. The complexity of hospital operations necessitates comprehensive EHR solutions that can integrate with laboratory information systems (LIS), radiology systems (RIS), and pharmacy platforms.

Ambulatory clinics are the fastest-growing end-use segment, particularly physician offices, standalone diagnostic labs, and outpatient specialty centers. These providers are increasingly adopting modular EHR systems that are easy to deploy, offer specialty-specific templates, and support telehealth functionality. The focus on outpatient care, preventive medicine, and cost containment is shifting more clinical activity into ambulatory settings, thus creating demand for flexible and interoperable EHRs.

Business Model Insights

Licensed software still holds a significant share, especially in larger organizations that prefer to purchase perpetual licenses and host their data on internal servers. These models offer customization and privacy control but often require a large upfront investment and IT support.

Subscription models are the fastest-growing, driven by demand for cost-effective, scalable, and cloud-based solutions. In this model, users pay a monthly or annual fee that covers software use, updates, and technical support. Subscription-based EHRs are particularly attractive to small and medium-sized practices and are gaining traction in regions adopting digital health for the first time.

Regional Insights

North America dominates the global EHR market, with the U.S. leading due to early adoption, regulatory incentives, and technological infrastructure. The HITECH Act of 2009 allocated over $30 billion to incentivize EHR adoption among American providers. As a result, over 85% of hospitals and physicians in the U.S. now use some form of EHR. The region also benefits from a high concentration of key vendors, robust internet penetration, and mature healthcare reimbursement models that reward data-driven care.

Asia-Pacific is the fastest-growing region, supported by rising healthcare digitization, government eHealth initiatives, and expanding private sector investment. Countries like China, India, and Australia are investing in national digital health programs to improve healthcare access, reduce administrative inefficiencies, and enhance public health surveillance. For example, India’s National Digital Health Mission (NDHM) envisions the creation of a unified health data platform using EHRs and health IDs. Rapid urbanization, medical tourism, and growing awareness among providers are also contributing to the region’s growth momentum.

Recent Developments

-

March 2025: Oracle Health (formerly Cerner) announced a partnership with the U.S. Department of Veterans Affairs to accelerate its $16 billion EHR modernization project, aiming for full interoperability across federal agencies.

-

February 2025: Epic Systems launched its new Cosmos AI Suite, integrating predictive analytics and machine learning models into clinical workflows within its EHR ecosystem.

-

January 2025: Allscripts Healthcare Solutions rebranded as Veradigm, signaling a shift toward data analytics, population health, and value-based care enablement through its EHR platforms.

-

December 2024: Athenahealth introduced a telehealth-native EHR interface optimized for remote primary and behavioral care clinics.

-

November 2024: MEDITECH partnered with Google Cloud to transition its Expanse EHR platform to a fully cloud-hosted model, offering improved scalability and uptime.

Some of the prominent players in the electronic health records market include:

- Cerner Corporation (Oracle)

- GE Healthcare

- Veradigm LLC (Allscripts Healthcare, LLC)

- Epic Systems Corporation

- eClinicalWorks

- Greenway Health, LLC

- NextGen Healthcare, Inc.

- Medical Information Technology, Inc. (Meditech)

- Health Information Management Systems

- CPSI

- AdvancedMD, Inc.

- CureMD Healthcare

- McKesson Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electronic health records market.

Product

- Client Server-Based EHR

- Web-Based EHR

Type

- Acute

- Ambulatory

- Post-Acute

End Use

- Hospital Use

- Ambulatory Use

-

- Physician’s Clinic

- Laboratories

- Pharmacy

Business Models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

Application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)