Embolization Product Market Size and Trends

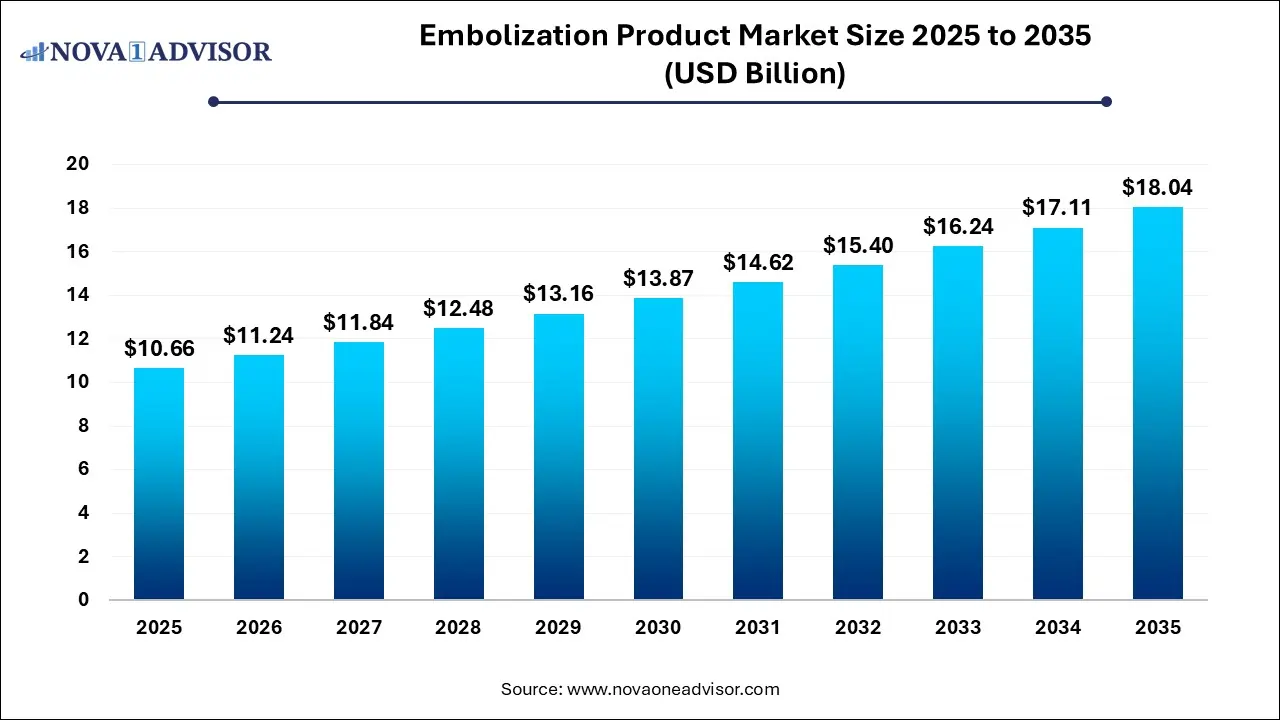

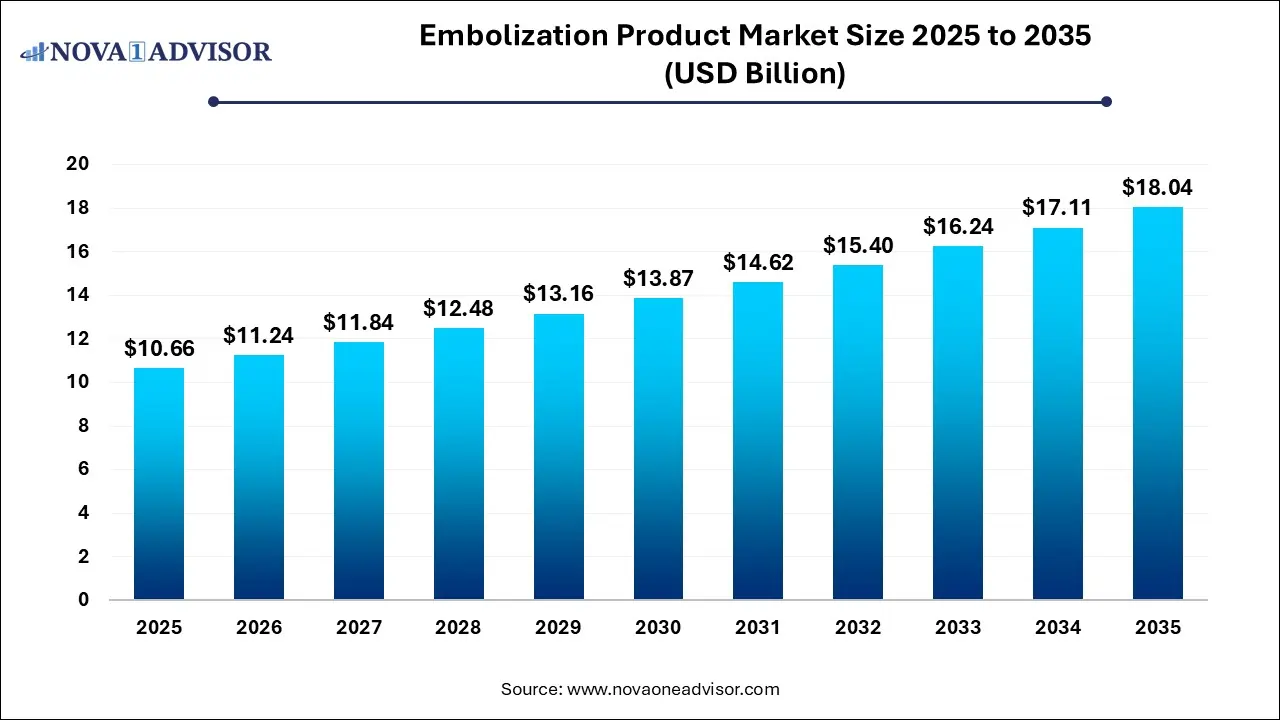

The global embolization product market size is calculated at USD 10.66 billion in 2025, grows to USD 11.24 billion in 2026, and is projected to reach around USD 18.04 billion by 2035.growing at a CAGR of 5.4% from 2026 to 2035. The market is growing due to the rising prevalence of chronic diseases like cancer and cardiovascular conditions. Advancements in minimally invasive procedures make embolization a preferred treatment option with faster recovery and fewer complications, and new product launches are enhancing the effectiveness and safety of these treatments.

Key Takeaways

- Asia-Pacific dominated the global embolization product market in 2025.

- Latin America is anticipated to grow at the Highest CAGR in the market during the forecast period.

- By product, the embolic coil segment held a dominant presence in the market in 2025.

- By product, the embolic plug system segment is anticipated to grow at the fastest CAGR in the market during the studied years.

- By procedure, the transcatheter arterial embolization (TAE) segment accounted largest share in the market in 2025 and is expected to grow at the highest CAGR in the market during the forecast period.

- By application, the peripheral segment was dominant in the market in 2025.

- By application, the neurovascular segment is predicted to grow at the fastest CAGR in the embolization product market.

Embolization Product: Outsourcing Expertise

An embolization product is a medical device or material used to deliberately block vessels during minimally invasive procedures to treat conditions such as tumors, aneurysms, or internal bleeding. The market is growing due to the rising prevalence of chronic diseases, increased demand for minimally invasive procedures, technological advancements, and expanding applications in oncology, neurology, and gynecology, driving greater adoption globally.

- For Instance, According to a 2024 article by the Brain Aneurysm Foundation, about 1 out of every 50 people in the United States is living with a brain aneurysm that hasn’t ruptured.

Embolization Product Market Trends

- In July 2023, Terumo Medical Corporation (TMC) launched the AZUR Vascular Plug, a groundbreaking device and the first of its kind that works with a microcatheter to block arteries up to 8mm in diameter. This latest innovation expands Terumo’s already strong range of embolization products and is specifically designed to slow down or stop blood flow in peripheral arteries.

- In April 2024, the U.S. Food and Drug Administration (FDA) approved Medtronic PLC for its Pipeline Flex Embolization Device featuring Shield Technology, designed mainly for treating brain aneurysms. The Shield Technology improves the device by reducing the risk of blood clot formation associated with its material.

How can AI affect the Embolization Product market?

AI can significantly impact the market by enhancing diagnostic accuracy, enabling personalized treatment planning, and improving procedural outcomes. Through advanced imaging analysis and predictive modeling, AI helps physicians identify target vessels more precisely and choose the most effective devices. Additionally, AI-driven automation can streamline workflows, reduce procedure times, and support innovation in product development, ultimately improving patient care and expanding market growth.

Report Scope of Embolization Product Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 11.24 Billion |

| Market Size by 2035 |

USD 18.04 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Product, By Procedure, By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Stryker Corporation, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson, Terumo Corporation, Cook medical, B. Braun Melsungen AG, Penumbra, Inc, BTG plc, Merit Medical Systems |

Market Dynamics

Driver

Rising Incidence of chronic cases

The rise in chronic conditions such as cancer, cardiovascular diseases, and aneurysms increases the demand for minimally invasive treatments like embolization. These conditions often require targeted therapies to block abnormal blood flow or tumors. Embolization offers a safer alternative to surgery with shorter recovery times, making it the preferred option. As chronic cases grow globally, the a need for effective embolization product market expansion.

- For Instance, In 2024, cardiovascular disease caused 16% of global deaths, while cardiovascular diseases led to 17.9 million deaths annually, accounting for 35% of worldwide mortality. About 85% of these were due to heart attacks and strokes. Ischemic heart disease affects 126 million people globally and is expected to rise to over 1,845 cases per 100,000 by 2030.

Restraint

High cost of biomarkers

High-cost biomarkers act as a restraint for the embolization product market by increasing overall treatment expenses, limiting affordability and accessibility, especially in developing regions. These costs deter healthcare providers from adopting advanced embolization techniques, reduce patient access, and slow market growth. Additionally, high research and validation expenses hinder innovation and the entry of new players into the market.

Opportunity

Advancements in Embolization Devices

Innovation, such as microcatheters such as bioresorbable materials, and image-guided systems, enhances procedural outcomes and expands the range of treatable conditions. These developments attract greater clinical adoption, drive demand across interventional radiology and oncology, and support the growing preference for minimally invasive procedures, ultimately boosting the embolization product market growth and competitiveness.

Segmental Insights

The Embolic Coil Segment Dominated

By product, the embolic coil segment held a dominant presence in the market in 2025 due to its widespread use in treating cerebral aneurysms and vascular abnormalities. These coils offer high precision, minimal invasiveness, and proven clinical efficacy, making them a preferred choice among interventional radiologists. Additionally, advancements in coil technology, such as detachable and micro-coils, have enhanced procedural safety and outcomes. Their reliability and established role in neurovascular procedures contribute significantly to market acceleration.

The Embolic Plug System Segment: Fastest CAGR

By product, the embolic plug system segment is anticipated to grow at the fastest CAGR in the market during the studied years. The rapid growth is driven by its advantages, such as precise deployment, reduced procedure time, and improved patient outcomes. Increasing adoption in minimally invasive surgeries and growing awareness among healthcare professionals are further fueling demand. Technological advancements and expanding indications also contribute to the embolization product market.

The Transcatheter Arterial Embolization (TAE) Segment Led & Highest CAGR

By procedure, the transcatheter arterial embolization (TAE) segment accounted largest share in the market in 2025 and is expected to grow at the highest CAGR in the market during the forecast period due to its minimally invasive nature, reduced recovery time, and lower complication risks. TAE is widely used for treating liver cancer, uterine fibroids, and trauma-related bleeding, all of which are increasing globally. Technological advancements in embolic agents, catheters, and imaging techniques have further improved procedural outcomes and safety. Additionally, the rising preference for non-surgical treatment options among patients and healthcare providers supports the growing adoption of TAE.

The Peripheral Segment Dominated

By application, the peripheral segment was dominant in the market in 2025, due to the high prevalence of orthopedic conditions and injuries affecting the limbs, such as fractures, sprains, and dislocations. These conditions often require external support like splints, braces, or casts for effective healing. Additionally, the growing aging population and increased participation in physical activities have contributed to higher injury rates, further driving demand for the peripheral embolization product market.

The Neurovascular Segment: Fastest CAGR

By application, the neurovascular segment is predicted to grow at the fastest CAGR in the embolization product market due to the rising prevalence of neurovascular disorders like aneurysms and strokes, especially among the aging population. Advancements in minimally invasive embolization techniques, along with improved diagnostic capabilities, are driving demand. Additionally, increasing awareness, better healthcare infrastructure, and favorable reimbursement policies in developed regions are contributing to the rapid adoption of neurovascular embolization procedures.

Regional Insights

Large Patient Population Propels Asia-Pacific

Asia-Pacific dominated the global embolization product market in 2025, due to a large patient population, increasing chronic diseases, and rising demand for minimally invasive procedures. Rapid improvements in healthcare infrastructure, growing investments in medical technologies, and supportive government initiatives further boosted market growth. Additionally, the presence of emerging economies like China and India, with expanding access to advanced treatment and a growing number of trained healthcare professionals, contributes significantly to the region's leading position in the embolization product market.

Rising Prevalence of Cancer Promotes Latin America

Latin America is anticipated to grow at the Highest CAGR in the market during the forecast period. The region is experiencing a rising prevalence of cancer, particularly in countries like Brazil, where cancer cases have doubled over the past three years. Additionally, an increase in the incidence of stroke and other neurovascular diseases is driving demand for embolization procedures. Improvements in healthcare infrastructure and greater awareness of minimally invasive treatments are further contributing to the market growth.

- For Instance, In Brazil, cancer ranks as the second most common cause of death among non-communicable chronic diseases. The country accounts for approximately 40% of all cancer diagnoses and 36% of cancer-related deaths in the Latin America and Caribbean region. According to projections from the Brazilian National Cancer Institute (INCA), around 704,000 new cancer cases are expected each year between 2023 and 2025.

Some of The Prominent Players in The Embolization Product Market Include:

Recent Developments in the Embolization Product Market

- In February 2025, the FDA's approval of the first vascular plug for peripheral embolization in 2004 marked a key milestone, offering a reliable alternative to coils. Since then, vascular plugs have advanced in design and use, gaining popularity due to benefits like lower migration risk, shorter procedures, and reduced fluoroscopy time. Today, they come in various sizes and types, enhancing safety and broadening their clinical use.

- In December 2023, Terumo Corporation introduced the AZUR HydroPack Peripheral Coil System in the U.S. This soft, hydrogel-coated platinum coil is designed to effectively fill space within blood vessels, offering improved stability and accurate placement. Its versatile design supports efficient procedures, making it a valuable tool for interventional radiologists and vascular surgeons aiming for optimal patient outcomes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Embolic Coil

- Embolic Plug

By Procedure

- Transcatheter Arterial Embolization

By Application

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)