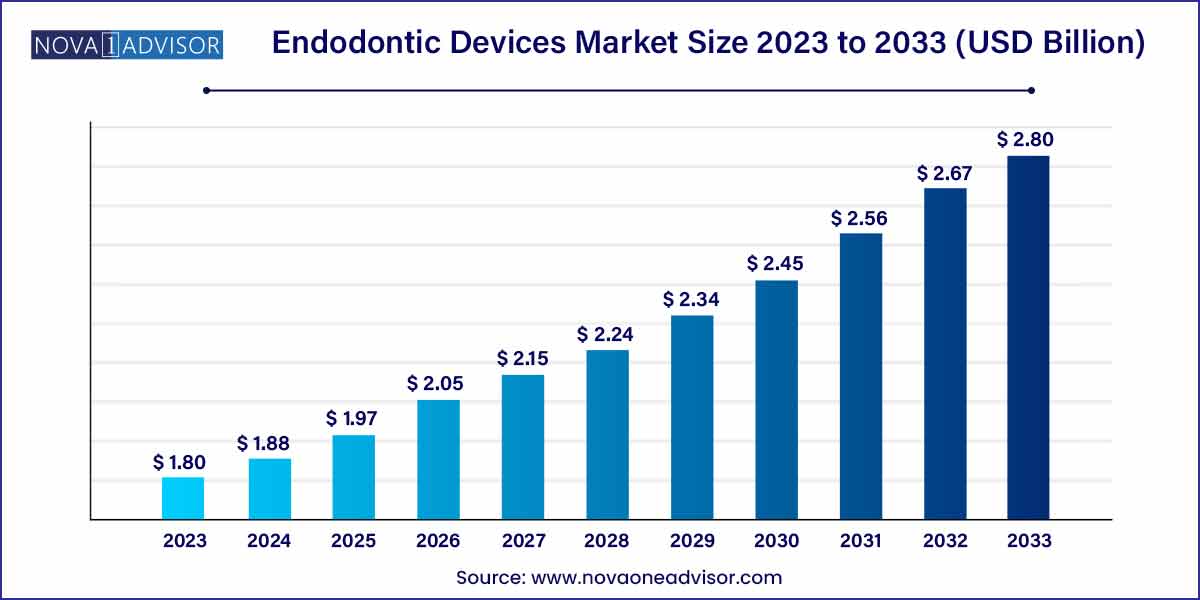

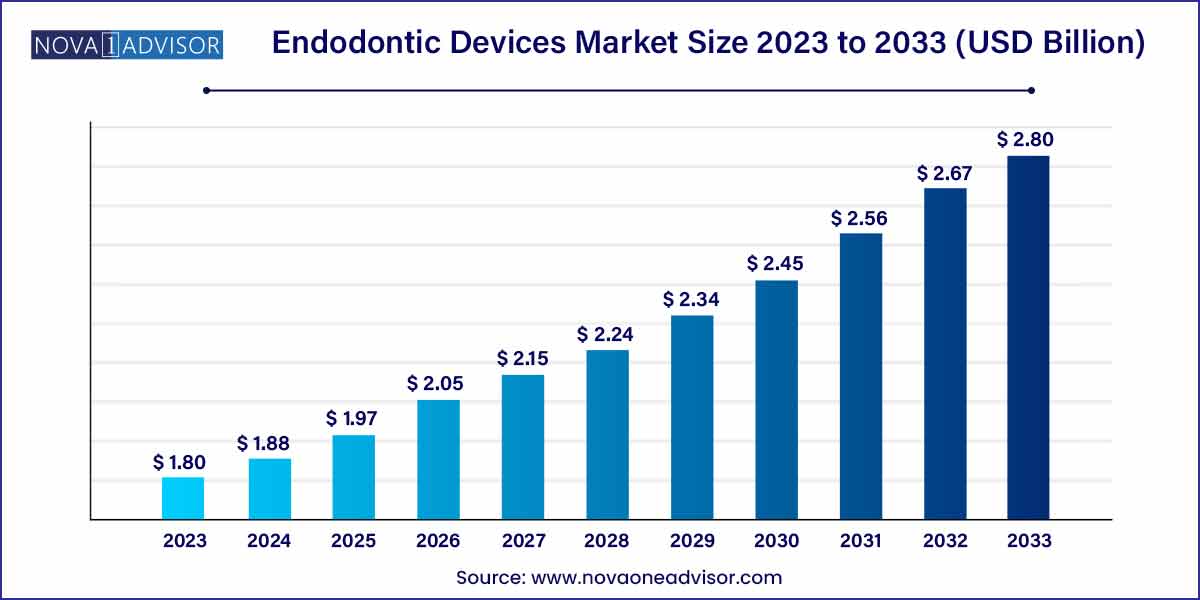

The global endodontic devices market size was exhibited at USD 1.80 billion in 2023 and is projected to hit around USD 2.80 billion by 2033, growing at a CAGR of 4.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- The instruments segment led the global market in 2023 with a revenue share of over 55%.

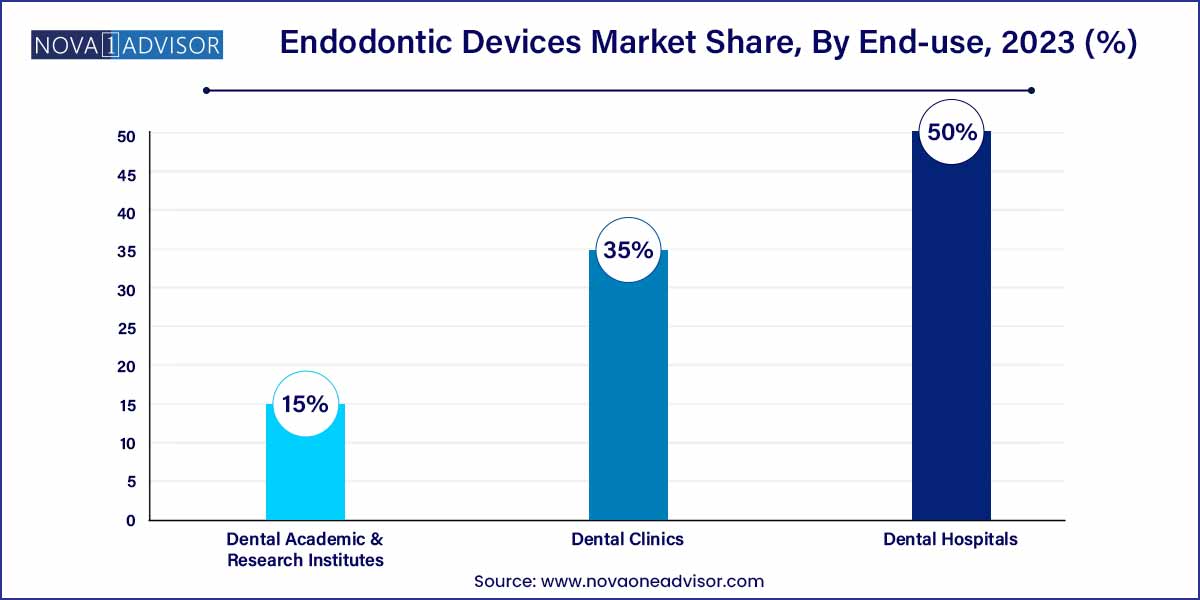

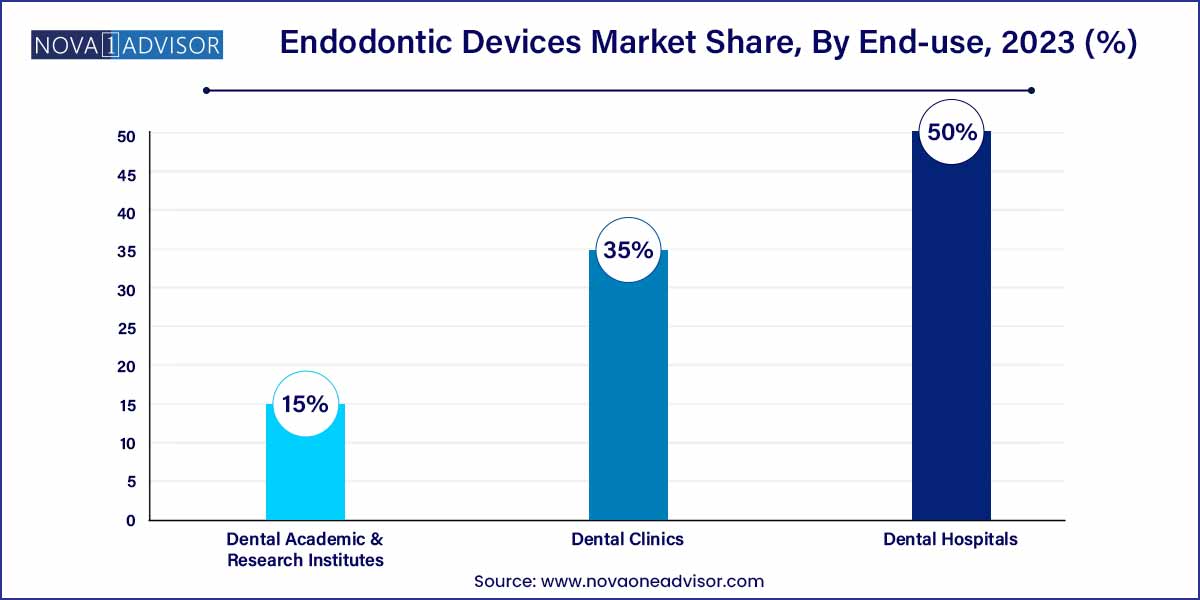

- The dental hospitals end-use segment dominated the global market in 2023 and accounted for the highest market share of more than 50.00%.

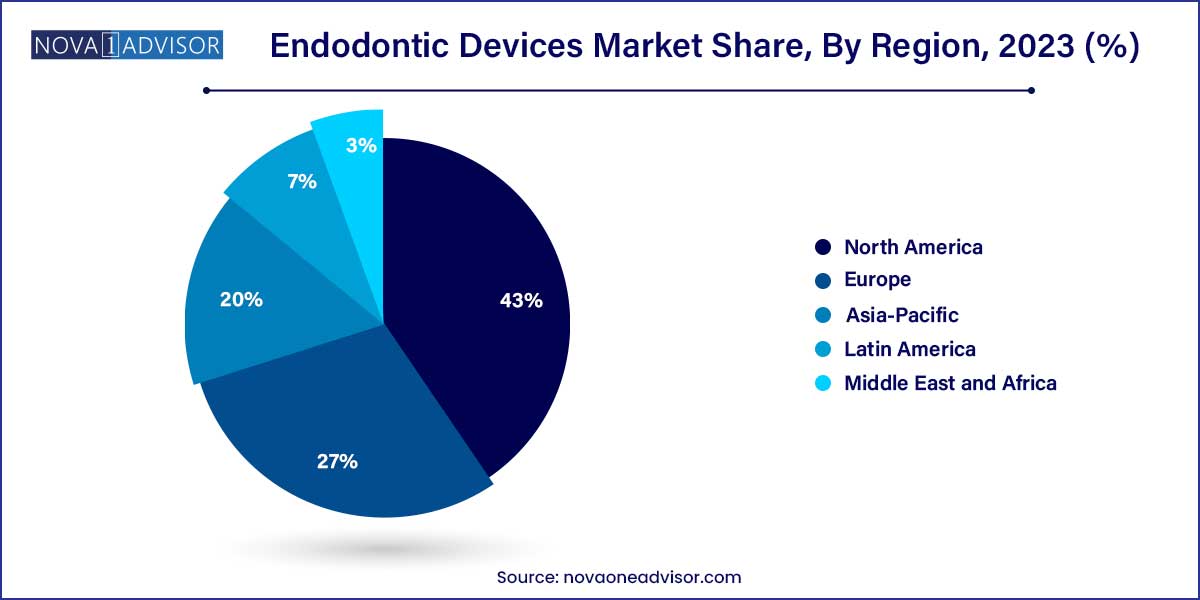

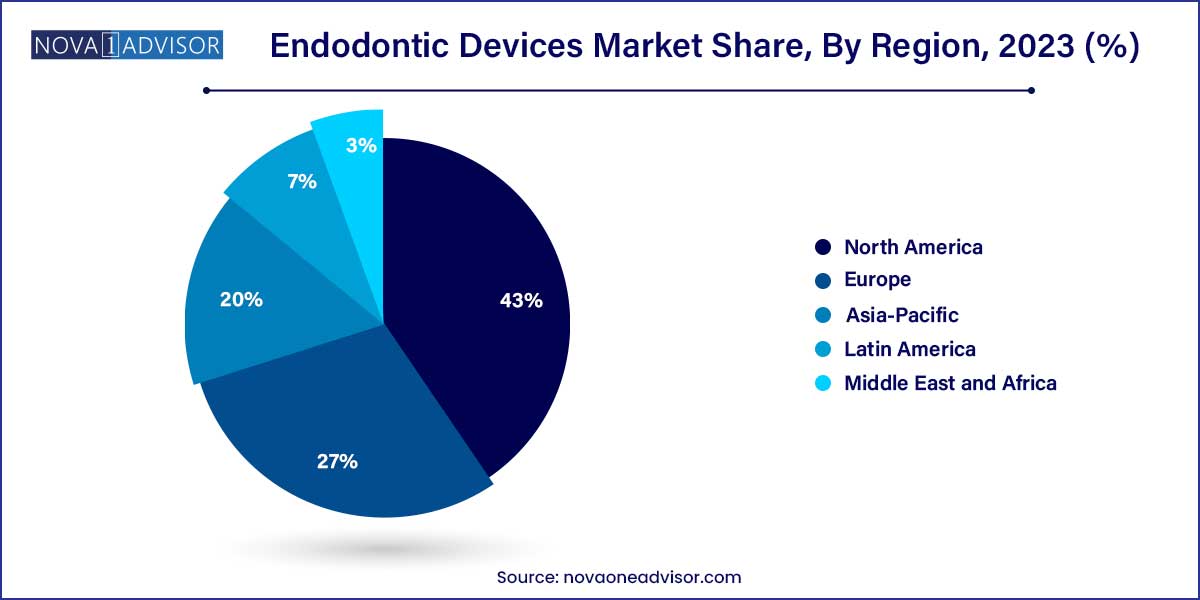

- North America emerged as the largest regional market and accounted for the maximum share of more than 43.00% in 2023.

Market Overview

The Endodontic Devices Market is an essential segment of the broader dental equipment industry, focused on the diagnosis, prevention, and treatment of diseases related to the dental pulp and periapical tissues. Endodontic procedures, particularly root canal treatments, require a highly specialized range of devices, including advanced instruments and consumables, that ensure precision, efficiency, and patient safety.

The rising global burden of dental diseases, particularly dental caries and traumatic injuries, is significantly fueling demand for endodontic treatment. According to the World Health Organization (WHO), oral diseases affect nearly 3.5 billion people worldwide, with untreated dental caries in permanent teeth being the most prevalent condition. The aging global population, increasing awareness about oral health, growth in dental tourism, and technological innovations in endodontic procedures are key forces propelling the market forward.

Endodontic practices are undergoing rapid modernization with the introduction of machine-assisted obturation systems, advanced apex locators, rotary endodontics, laser-assisted root canal treatments, and biocompatible filling materials. These innovations enhance procedural success rates, minimize patient discomfort, and shorten recovery times.

Furthermore, favorable reimbursement frameworks in developed countries, investments in dental infrastructure, and the expansion of dental insurance coverage are encouraging more patients to seek timely endodontic care, further bolstering the market. In emerging markets, improving dental healthcare access and growing disposable incomes are opening up new avenues for growth.

Major Trends in the Market

-

Technological Advancements in Endodontic Instruments: Innovations such as smart apex locators, high-torque endodontic motors, and AI-assisted diagnostic tools are redefining treatment standards.

-

Shift Toward Minimally Invasive Endodontics: Emphasis on preserving natural tooth structures is driving the adoption of small-diameter files and conservative access cavity designs.

-

Increasing Demand for Rotary and Reciprocating Instruments: Enhanced efficiency and reduced operator fatigue are promoting the use of machine-assisted endodontic shaping devices.

-

Integration of Laser Technology: Endodontic lasers are gaining popularity for pulp capping, disinfection, and minimal-invasive canal cleaning.

-

Growing Preference for Bioceramic Materials: Bioceramics are increasingly used for obturation and sealing, offering superior biocompatibility and sealing properties.

-

Expansion of Dental Tourism: Countries like India, Mexico, and Hungary are witnessing surging demand for high-quality, affordable endodontic procedures, boosting device sales.

-

Rising Importance of Continuing Dental Education (CDE): Dentists’ focus on staying updated with new techniques is driving demand for advanced instruments and consumables.

-

Customization and Ergonomic Product Design: Endodontic device manufacturers are investing in user-centric designs that enhance clinician comfort and procedural outcomes.

Endodontic Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.80 Billion |

| Market Size by 2033 |

USD 2.80 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End Use, & Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Danaher; Dentsply Sirona; FKG Dentaire; Ultradent Products; Ivoclar Vivadent; Septodont; COLTENE; Micro-Mega; Brasseler Holdings LLC; DiaDent Group International. |

Key Market Driver

Rising Global Prevalence of Dental Diseases

The increasing prevalence of dental diseases such as dental caries, pulpitis, and periapical infections is one of the primary drivers of the endodontic devices market. Poor oral hygiene practices, high sugar consumption, aging populations, and rising incidences of dental trauma are leading to a growing need for endodontic interventions worldwide.

For example, the Global Burden of Disease Study 2020 highlighted that approximately 2.3 billion people suffer from caries of permanent teeth. Root canal therapy remains the definitive treatment for infected or inflamed pulp tissue, necessitating the use of precision endodontic instruments and materials. Furthermore, heightened public awareness campaigns promoting oral health and preventive dental care are leading to earlier diagnosis and intervention, spurring demand for advanced endodontic devices across both developed and developing markets.

Key Market Restraint

High Cost of Advanced Endodontic Devices

Despite technological advancements, the high cost associated with advanced endodontic devices poses a significant barrier to market growth. Sophisticated instruments such as apex locators, endodontic motors, and laser systems involve substantial capital investment, making them financially burdensome for small dental clinics and independent practitioners, particularly in emerging economies.

Additionally, the cost of consumables used during endodontic procedures—such as nickel-titanium (NiTi) files, irrigation solutions, and obturation materials—can add to treatment expenses, often deterring price-sensitive patients from opting for root canal therapy. The high initial and maintenance costs of cutting-edge equipment can thus limit their adoption, especially in regions where dental insurance penetration is low.

Key Market Opportunity

Emerging Markets and Dental Tourism

Expanding access to dental care in emerging economies presents a massive opportunity for the endodontic devices market. Rising disposable incomes, improving healthcare infrastructure, and increasing public awareness about oral health are driving greater demand for advanced dental services in countries such as India, China, Brazil, and Mexico.

Dental tourism is flourishing as patients from high-cost countries seek affordable, high-quality care abroad. Many countries have positioned themselves as hubs for dental tourism, offering endodontic procedures at a fraction of the cost compared to the United States or Western Europe. Clinics catering to international patients are increasingly investing in state-of-the-art endodontic devices to meet global standards, thus fueling demand for sophisticated instruments and consumables.

Additionally, government initiatives to promote public-private partnerships in healthcare delivery are creating favorable environments for market expansion in emerging regions.

Type Insights

The Endodontic Instruments segment dominated the market, encompassing a wide range of tools essential for diagnosis, canal preparation, cleaning, shaping, and obturation during root canal procedures. Instruments such as apex locators, endodontic motors, rotary and reciprocating files, lasers, and machine-assisted obturation systems are widely used in routine endodontic practices.

Technological innovations have transformed traditional hand filing methods into mechanized, precise procedures. Devices like electronic apex locators help clinicians determine working length accurately, minimizing the risk of perforations, while rotary motors enhance efficiency and reduce treatment times. These factors, combined with growing adoption of minimally invasive endodontics, are reinforcing the dominance of the instruments segment.

In contrast, the Endodontic Consumables segment is witnessing the fastest growth. Consumables including access burs, irrigation solutions, cleaning and shaping files, sealers, gutta-percha cones, and obturation systems are indispensable in every endodontic procedure. The recurrent need for consumables ensures continuous demand, and innovations in bioceramic-based obturation materials and enhanced irrigants are driving growth. Companies are launching bioactive and antimicrobial products, which are rapidly gaining acceptance for improving treatment outcomes and reducing procedural failures.

End-use Insights

Dental Clinics captured the largest end-user share of the endodontic devices market. Standalone dental practices and specialty endodontic clinics are increasingly investing in advanced devices to enhance diagnostic accuracy, treatment efficiency, and patient satisfaction. Clinics prefer compact, easy-to-use, and ergonomic instruments that enable faster turnaround times and higher patient volumes.

The growing trend of group dental practices and corporate dental chains, particularly in developed economies, is further driving centralized procurement of sophisticated endodontic equipment, contributing to the dominance of this segment.

Meanwhile, Dental Academic & Research Institutes are projected to grow at the fastest pace. Rising emphasis on training dental students in advanced endodontic techniques, increasing number of dental schools globally, and growing research activities in biomaterials and regenerative endodontics are driving investments in state-of-the-art endodontic devices by academic institutions. Partnerships between industry players and universities to develop and test innovative endodontic products are also bolstering this segment's growth.

Regional Insights

North America holds the largest share of the global endodontic devices market, led by the United States. Factors contributing to this dominance include a highly developed healthcare infrastructure, widespread adoption of advanced dental technologies, strong presence of leading market players, and a high incidence of dental caries and endodontic procedures.

Government initiatives promoting oral health, favorable reimbursement policies, and the high rate of dental insurance coverage also support robust market dynamics. Furthermore, the presence of renowned dental schools and research institutions fosters innovation and accelerates the commercialization of advanced endodontic devices.

Asia-Pacific is witnessing the fastest growth in the endodontic devices market, driven by rapid urbanization, increasing awareness about oral hygiene, expanding middle-class populations, and improving healthcare accessibility. Countries such as China, India, South Korea, and Japan are at the forefront, experiencing surging demand for both preventive and restorative dental procedures.

The expansion of dental tourism in Asia-Pacific, particularly in India and Thailand, is contributing to rising investments in modern dental clinics equipped with advanced endodontic devices. Government support for oral healthcare campaigns and the establishment of new dental colleges are expected to further propel regional growth over the coming years.

Some of the prominent players in the endodontic device market include:

- Danaher

- Dentsply Sirona

- FKG Dentaire

- Ultradent Products

- Ivoclar Vivadent

- Septodont

- COLTENE

- Micro-Mega

- Brasseler Holdings LLC

- DiaDent Group International

Recent Developments

-

April 2025 – Dentsply Sirona launched its ProTaper Ultimate rotary file system, featuring enhanced flexibility and cutting efficiency for shaping root canals, aiming to improve patient outcomes.

-

March 2025 – Coltene Holding AG announced the launch of CanalPro Jeni, an AI-assisted endodontic motor designed to optimize rotary file movements in real-time during canal preparation.

-

February 2025 – FKG Dentaire SA introduced RACE EVO files, offering superior flexibility and cyclic fatigue resistance for safe and efficient canal shaping.

-

January 2025 – Danaher Corporation's KaVo Kerr unit expanded its endodontic product portfolio with the Elements Connect Obturation System, featuring wireless connectivity and enhanced heating mechanisms for efficient obturation.

-

December 2024 – Brasseler USA collaborated with leading dental universities to develop new-generation endodontic handpieces designed for minimally invasive access preparation techniques.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global endodontic devices market.

Endodontic Devices Type

-

- Apex Locators

- Endodontic Motors

- Endodontic Scalers

- Handpieces

- Endodontic Lasers

- Machine Assisted Obturation Systems

- Others

-

- Access Preparation

- Shaping & Cleaning

- Obturation

Endodontic Devices End-use

- Dental Hospitals

- Dental Clinics

- Dental Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)