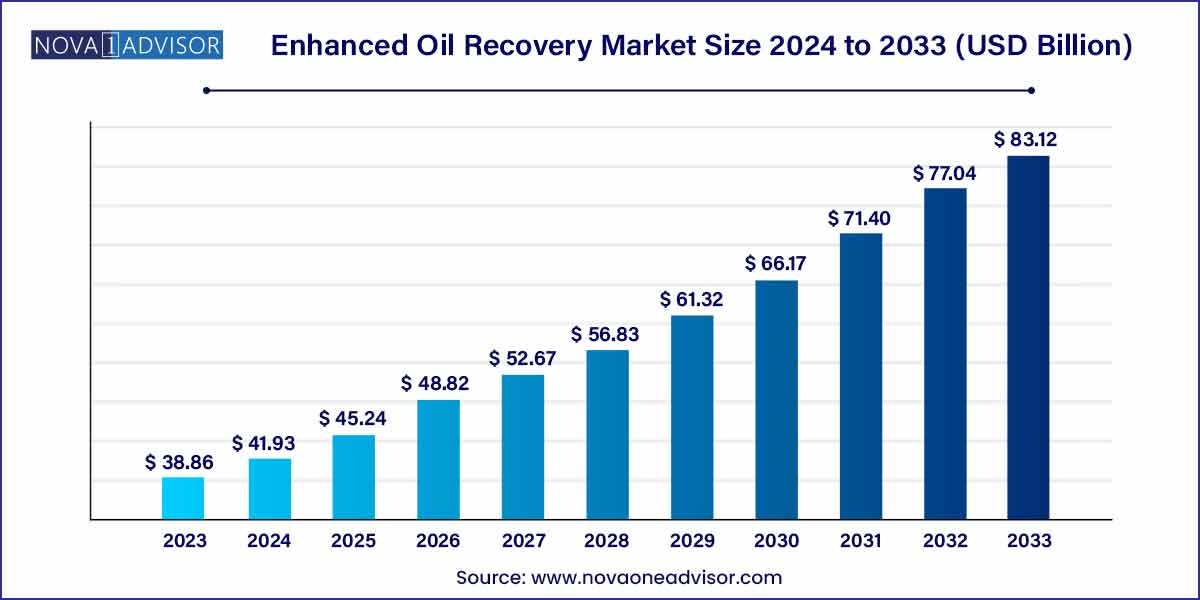

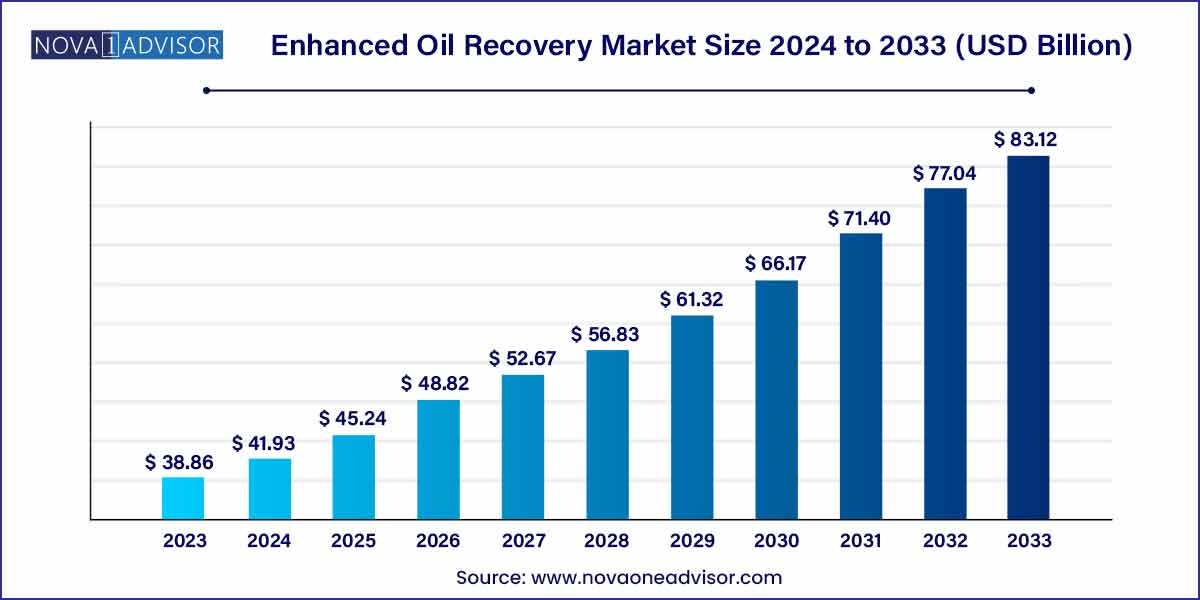

The global enhanced oil recovery market size was exhibited at USD 38.86 billion in 2023 and is projected to hit around USD 83.12 billion by 2033, growing at a CAGR of 7.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the market and accounted for a revenue share of more than 38.0% in 2023.

- The thermal segment occupied the largest revenue share of over 35.0% in 2023.

- The onshore segment occupied the largest revenue share of over 93.0% in 2023

Enhanced oil recovery market by Overview

An increasing number of aged wells, along with decreasing production from existing oilfields, is expected to drive the market demand over the forecast period.

Enhanced oil recovery (EOR) technology enhances oil production from mature and aged oil fields, by almost 10 to 20 percent when compared to conventional oil extraction methods. Mature wells are those oil reserves where production has reached its peak and has started to decline owing to poor permeability or exhibiting heavy oil. Technically, EOR increases the permeability of the reservoir so that hydrocarbons can flow through the pathways easily and into the targeting producing well.

The U.S. market is anticipated to witness significant growth on account of the growing exploration of unconventional oil and gas resources. Furthermore, government funding aimed at commercializing the EOR technology is anticipated to positively influence the industry landscape. For instance, the U.S. Department of Energy (DoE) provides funding to private companies and universities in order to carry out research for advancements in EOR technologies

Further, a number of CO2 injection-based EOR projects started from 2020 to 2023 in the U.S., which resulted in the dominating share of CO2 injection technology over other available technologies in the country. For instance, the oil production in the Permian Basin has shown a significant rise in oil production by the use of CO2-EOR technology. These market developments are expected to boost the growth of the market in the U.S. in the forecast period

Falling crude oil prices are expected to have a negative impact on the oil and gas industry and may restrain the market growth over the forecast period. The COVID-19 pandemic led to a drastic drop in oil prices in 2023. This resulted in reductions in planned capital expenditure and the implementation of cost-cutting actions by oil players across the globe, which is expected to hinder the growth of the market.

However, a rise in environmental concerns regarding carbon emissions has resulted in enhancing the demand for carbon capture and storage (CCS), which has emerged as a viable solution to limit carbon emissions. These factors are expected to positively impact the market growth as captured carbon in CCS projects is usually utilized by oil and gas companies for CO2 injection EOR technology.

Enhanced Oil Recovery Market Growth

The growth of the Enhanced Oil Recovery (EOR) market is driven by several key factors. Firstly, the increasing demand for oil, coupled with the depletion of conventional oil reserves, has led to a heightened focus on maximizing production from existing oil fields. EOR techniques offer the potential to extract additional hydrocarbons from reservoirs that would otherwise be unrecoverable using conventional methods. Moreover, technological advancements and innovations in EOR processes, such as steam injection, chemical flooding, and gas injection, have significantly improved their efficiency and effectiveness. Additionally, favorable government policies, incentives, and regulatory frameworks aimed at promoting domestic oil production further bolster market growth by encouraging investment in EOR projects. Furthermore, growing environmental concerns and the imperative to reduce carbon emissions have led to increased interest in EOR techniques that can enhance oil recovery while minimizing environmental impact. These factors collectively contribute to the expansion of the Enhanced Oil Recovery market, driving investment, innovation, and adoption of EOR technologies globally.

Enhanced Oil Recovery Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 38.86 Billion |

| Market Size by 2033 |

USD 83.12 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ExxonMobil Corporation; BP plc; China Petroleum & Chemical Corporation; Total SA; Royal Dutch Shell plc; Chevron Corporation; Petróleo Brasileiro S.A.; LUKOIL; Cenovus Energy, Inc.; Equinor ASA. |

Enhanced Oil Recovery Market Dynamics

- Technological Advancements:

The EOR market is continually evolving due to ongoing technological advancements aimed at enhancing the efficiency and effectiveness of recovery techniques. Innovations in reservoir characterization, enhanced imaging technologies, and advanced modeling and simulation tools enable more accurate assessment and optimization of reservoir properties and fluid behavior. Furthermore, research and development efforts focused on novel EOR methods, such as nanotechnology-enhanced fluids, microbial EOR, and electromagnetic heating, hold promise for unlocking additional hydrocarbon resources from challenging reservoirs.

- Economic and Regulatory Factors:

Economic and regulatory dynamics significantly influence the adoption and implementation of Enhanced Oil Recovery techniques. Fluctuations in oil prices, market conditions, and geopolitical factors impact the economic viability of EOR projects and investment decisions. Higher oil prices generally increase the incentive for operators to invest in EOR technologies, as they can justify higher capital expenditures based on expected returns from increased production. Moreover, government policies, incentives, and regulations play a critical role in shaping the EOR market landscape. Incentives such as tax credits, subsidies, and royalty relief programs can incentivize investment in EOR projects and accelerate technology deployment.

Enhanced Oil Recovery Market Restraint

- Capital-Intensive Nature:

One of the primary restraints hindering the widespread adoption of Enhanced Oil Recovery techniques is the significant capital investment required for implementation. EOR projects often involve high upfront costs associated with the deployment of advanced technologies, infrastructure development, and operational expenses. The capital-intensive nature of EOR projects poses challenges for smaller operators or companies with limited financial resources to undertake such investments. Moreover, the long-term nature of EOR projects, coupled with uncertainties in oil prices and market conditions, can deter investors from committing to large-scale EOR initiatives.

- Technical and Operational Challenges:

The implementation of Enhanced Oil Recovery techniques is often accompanied by technical and operational challenges that can impede project success and efficiency. Reservoir heterogeneity, fluid properties, and geomechanical complexities pose uncertainties and risks in reservoir characterization and modeling, which are crucial for designing effective EOR strategies. Furthermore, the selection and optimization of EOR methods require careful consideration of factors such as reservoir conditions, fluid compatibility, and injectant properties to ensure optimal performance and recovery efficiency. Operational challenges, including wellbore integrity, injectant delivery, and surface facilities constraints, also influence the feasibility and effectiveness of EOR projects.

Enhanced Oil Recovery Market Opportunity

- Mature Field Revitalization:

Enhanced Oil Recovery techniques offer a compelling opportunity for revitalizing mature oil fields and extending their productive life cycle. Many conventional oil fields globally have reached a stage of declining production, with significant volumes of oil remaining trapped in reservoirs. EOR methods, such as waterflooding, gas injection, and chemical flooding, provide the means to unlock these remaining hydrocarbon resources and boost production rates. By implementing EOR techniques, operators can enhance oil recovery factors, increase ultimate oil reserves, and maximize the economic value of existing assets. Moreover, the application of EOR can enable the efficient utilization of existing infrastructure and facilities, reducing the need for costly new developments and minimizing environmental footprint.

- Technological Innovation and Collaboration:

The evolving landscape of Enhanced Oil Recovery presents ample opportunities for technological innovation and collaboration among industry stakeholders. Advances in reservoir engineering, chemical formulations, and reservoir monitoring technologies enable the development of more efficient and cost-effective EOR solutions. Collaborative research and development initiatives between oil companies, technology providers, research institutions, and government agencies facilitate knowledge exchange, technology transfer, and the commercialization of innovative EOR technologies.

Enhanced Oil Recovery Market Challenges

- Geologic and Reservoir Complexity:

One of the primary challenges hindering the widespread adoption of Enhanced Oil Recovery techniques is the complexity of geologic formations and reservoir characteristics. Many oil reservoirs exhibit heterogeneity in terms of rock properties, fluid distribution, and reservoir geometry, which pose significant challenges for EOR implementation. Variations in permeability, porosity, and fluid mobility can impact fluid flow patterns and sweep efficiency, affecting the effectiveness of EOR methods. Furthermore, reservoir compartmentalization, faulting, and structural complexities can lead to uneven distribution of injectants and reservoir fluids, limiting the performance of EOR processes. Addressing geologic and reservoir complexity requires advanced reservoir characterization techniques, sophisticated modeling and simulation tools, and innovative EOR strategies tailored to specific reservoir conditions.

The economics of Enhanced Oil Recovery projects pose significant challenges, particularly in the current low oil price environment. EOR projects often involve substantial upfront capital investment for infrastructure development, technology deployment, and operational expenses. The high cost of implementing EOR techniques, coupled with uncertainties in oil prices and market conditions, can impact the economic viability and investment attractiveness of EOR projects. Moreover, the long-term nature of EOR projects and the extended payback periods associated with incremental production gains pose financial risks for operators and investors. Addressing cost and economics challenges requires innovative financing mechanisms, risk-sharing arrangements, and cost-effective technology solutions to improve project economics and enhance investment returns.

Segments Insights:

Technology Insights

Thermal EOR dominated the Enhanced Oil Recovery market in 2024.

Thermal recovery techniques, including steam flooding and cyclic steam stimulation, have been particularly effective in heavy oil reservoirs with high viscosity. These methods improve oil flow by reducing its viscosity through heating. Countries like Canada, Venezuela, and Indonesia have substantial heavy oil reserves where thermal EOR technologies are extensively applied. The sheer scale of projects such as Suncor’s Firebag and Imperial Oil’s Cold Lake projects in Canada demonstrate the dominance of thermal methods. Additionally, the relatively mature technology base, combined with favorable geological conditions in many prolific fields, ensures the continued leadership of thermal EOR in terms of market share.

However, the CO2 Injection segment is anticipated to be the fastest growing during the forecast period.

CO2-based EOR, also known as miscible flooding, is witnessing heightened interest globally, driven by climate regulations and improved CO2 capture technologies. Operators are increasingly seeing CO2 injection as a way to not only enhance oil recovery but also sequester captured CO2 underground, thus securing tax credits and fulfilling ESG commitments. For instance, Occidental Petroleum’s operations in the Permian Basin have pioneered scalable CO2 EOR projects, setting benchmarks for the industry. With government incentives such as the U.S. 45Q tax credit for carbon sequestration, CO2 EOR is expected to record the fastest growth rates among all EOR technologies.

Application Insights

Onshore EOR operations are typically more cost-effective, easier to manage, and quicker to deploy compared to their offshore counterparts. Mature onshore fields across North America, the Middle East, and Asia-Pacific have been prime candidates for EOR interventions. The economic attractiveness and relative simplicity of logistics have kept onshore applications ahead. Major onshore projects like the Belridge Field in California or the Daqing Field in China have extensively utilized EOR methods, contributing significantly to their long-term productivity.

With onshore fields maturing and easy reserves dwindling, offshore oil fields especially in the North Sea, Brazil’s deepwater pre-salt fields, and the Gulf of Mexico are witnessing pilot EOR projects. Offshore EOR poses unique challenges like higher costs and logistical complexities. Nevertheless, technological advancements in subsea processing and injection systems are making offshore EOR increasingly viable. Companies like Equinor and Petrobras are investing heavily in offshore EOR initiatives, seeking to maximize returns on their high-cost offshore investments.

Regional Insights

North America dominated the global EOR market in 2024.

The United States, particularly the Permian Basin region in Texas and New Mexico, leads the EOR landscape globally. The country’s vast network of CO2 pipelines, favorable geology for miscible CO2 flooding, and supportive policy environment, including the 45Q tax credit for carbon capture and sequestration, have propelled North America to the forefront. Notable projects such as Occidental Petroleum’s Century Plant (the world’s largest CO2 processing plant) underscore the scale of EOR activity. In addition, the abundance of captured CO2 from industrial and natural sources has made CO2 EOR a cost-effective and environmentally appealing proposition in this region.

Asia-Pacific is expected to be the fastest growing region during the forecast period.

Rapid industrialization, surging energy demand, and the presence of several aging oil fields in China, Indonesia, Malaysia, and India are driving interest in EOR solutions. Governments in the region are investing heavily in maximizing domestic production to reduce reliance on imports. For example, the China National Petroleum Corporation (CNPC) has deployed thermal and chemical EOR techniques extensively across its Daqing and Shengli fields. With rising energy security concerns and proactive regulatory support for domestic production initiatives, the Asia-Pacific EOR market is poised for accelerated expansion over the next decade.

Some of the prominent players in the enhanced oil recovery market include:

- BP plc

- Cenovus Energy, Inc.

- Chevron Corporation

- Equinor ASA

- ExxonMobil Corporation

- LUKOIL

- Petróleo Brasileiro S.A.

- Total SA

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global enhanced oil recovery market.

Technology

- Thermal

- CO2 Injection

- Chemical

- Others

Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)