Enzymatic DNA Synthesis Market Size and Growth Forecast 2025-2034

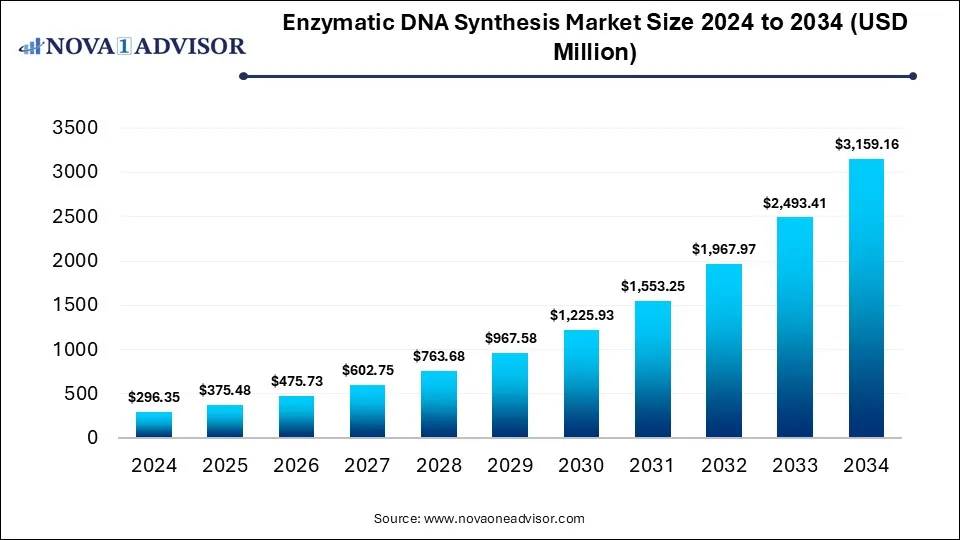

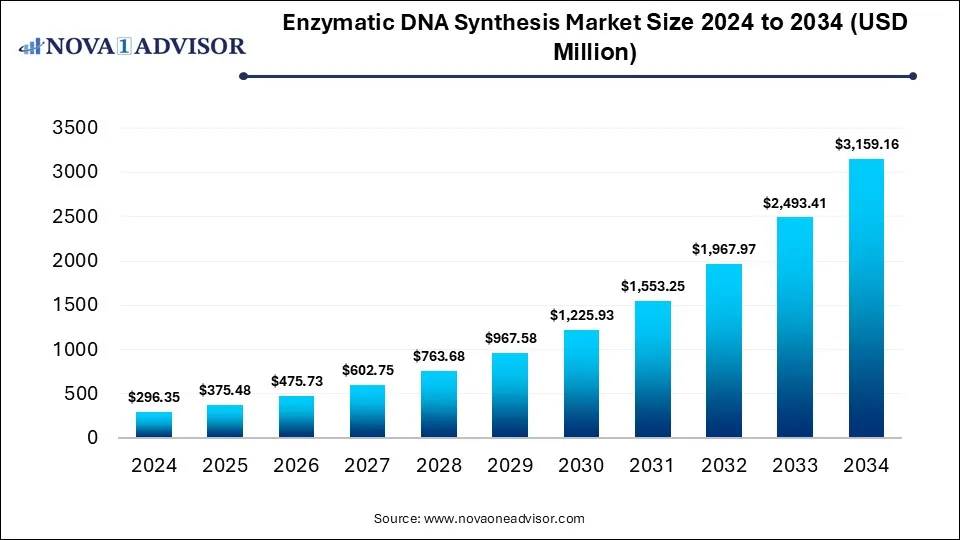

The global enzymatic DNA synthesis market size was valued at USD 296.35 million in 2024 and is anticipated to reach around USD 3,159.16 million by 2034, growing at a CAGR of 26.7% from 2025 to 2034. The enzymatic DNA synthesis market growth is driven by the rising demand of synthetic DNA for development of diagnostic tools and genetic research, advancements in enzymatic synthesis methods, automation, and increased emphasis on personalized medicine approaches.

Enzymatic DNA Synthesis Market Key Takeaways

- North America dominated the market and accounted for a 50.81% share in 2024

- The enzymatic DNA synthesis market in Asia Pacific is anticipated to witness the fastest CAGR of 27.4% from 2025 to 2034

- The synthetic biology segment dominated the market in terms of revenue in 2024 with a market share of 36.49% and is expected to grow at the fastest CAGR over the forecast period.

- Vaccine development is anticipated to grow at a significant CAGR of 26.7% over the forecast period.

- The oligonucleotide synthesis segment held the largest market share in 2024.

- The gene synthesis segment is expected to grow at the fastest CAGR over the forecast period.

- Biopharmaceutical companies held the largest market share of 48.92% in 2024.

- The contract research organizations segment is expected to witness the fastest CAGR over the forecast period

Market Overview

The enzymatic DNA synthesis (EDS) market represents a significant technological advancement within the synthetic biology and genomics landscape. Unlike traditional phosphoramidite chemical synthesis, EDS utilizes enzymatic reactions to construct DNA sequences with higher fidelity, speed, and environmental safety. This method mimics natural DNA replication and leverages engineered polymerases or template-independent enzymes, unlocking new possibilities for the production of longer, purer, and more functional DNA strands.

The global demand for synthetic DNA is escalating due to its application in emerging areas like cell and gene therapy, vaccine development, diagnostics, agricultural genomics, and DNA data storage. However, chemical synthesis methods face scalability limitations, error accumulation, and environmental concerns from reagent waste. EDS addresses these limitations by offering a greener, faster, and more flexible alternative that aligns with the evolving demands of synthetic biology workflows.

While EDS technology is still in the early commercialization phase, multiple biotech companies and academic labs are actively refining the approach, aiming for high-throughput, automated, and cost-efficient synthesis platforms. Its potential to revolutionize gene synthesis and oligonucleotide production is driving investor interest and attracting collaborations between synthetic biology firms and pharmaceutical giants. As the biotechnology industry pivots toward sustainable and scalable solutions, enzymatic DNA synthesis is positioned to become a cornerstone of next-generation molecular biology manufacturing systems.

Major Trends in the Market

-

Transition from Chemical to Enzymatic Methods: A growing number of companies are phasing out traditional phosphoramidite-based synthesis for enzymatic alternatives.

-

Automation and Miniaturization of Synthesis Platforms: Microfluidic and benchtop systems are being developed to enable on-demand DNA synthesis in research and clinical settings.

-

Longer and Error-Free Oligonucleotide Production: EDS allows for the synthesis of longer DNA strands (>300 bases) with significantly fewer errors.

-

Rising Application in DNA Data Storage: As tech firms explore molecular data storage, EDS is being evaluated for its potential in producing high-integrity storage strands.

-

Growth of Custom Gene Synthesis Services: Personalized gene constructs for therapeutic and diagnostic use are boosting demand for enzymatic synthesis providers.

-

Environmentally Friendly DNA Manufacturing: EDS aligns with sustainable biotech initiatives by eliminating toxic solvents and reducing hazardous waste.

-

Emergence of Academic-Industrial Collaborations: Universities and startups are working together to commercialize novel enzymes and protocols.

-

Integration with CRISPR and Genome Editing: Faster DNA construct production via EDS is accelerating genome editing research and CRISPR applications.

Artificial intelligence (AI) integration in enzymatic DNA synthesis is expected to revolutionize its application across various fields such as from biotechnology and medicine to materials science and data storage. In enzyme engineering, Generative AI models can be used for designing novel enzymes with particular functions, whereas machine learning algorithms can be applied for enhancing enzyme performance. Deployment of AI-driven models in optimizing synthesis reactions can help in predicting ideal reactions conditions by analyzing the chemical environment for enzymatic DNA synthesis. AI-powered high-throughput platforms can allow researchers to screen a huge number of variants and rapid identification of optimal sequences by automating the process of synthesizing and testing DNA sequences.

Enzymatic DNA Synthesis Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 375.48 Million |

| Market Size by 2034 |

USD 3,159.16 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 26.5%

|

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Service, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Telesis Bio Inc.; Twist Bioscience Corporation; GenScript Biotech Corp.; Evonetix; Ansa Biotechnologies, Inc.; Camena Bio; Molecular Assemblies; DNA Script; Touchlight; Kern Systems |

Key Market Driver – Demand for Sustainable, Scalable, and Accurate DNA Synthesis

One of the most powerful drivers behind the enzymatic DNA synthesis market is the demand for sustainable and scalable DNA synthesis technologies that improve accuracy while reducing environmental and operational costs. Traditional chemical synthesis relies on hazardous organic solvents and generates considerable waste. Additionally, it becomes inefficient and error-prone when synthesizing longer DNA strands, which are increasingly required in synthetic biology, gene therapy, and DNA computing.

In contrast, EDS offers a clean, efficient alternative by using water-based enzymatic reactions, resulting in significantly less toxic byproducts. It also supports longer read lengths and reduced sequence errors, enabling the reliable production of functional genetic constructs. As industries and regulatory bodies push for greener biomanufacturing practices and faster turnaround times, enzymatic synthesis technologies provide an attractive, scalable solution. Companies that can offer plug-and-play EDS systems for automated gene and oligo synthesis will be positioned at the forefront of the industry.

Key Market Restraint – High Cost and Limited Commercial Scalability

Despite its advantages, the enzymatic DNA synthesis market faces a critical restraint in the form of high costs and limited scalability for commercial-grade production. The enzymes used in EDS—such as terminal deoxynucleotidyl transferase (TdT) and engineered polymerases—are expensive to produce and stabilize. Furthermore, the reagents required for base-by-base synthesis remain costly, particularly when precision incorporation or modified bases are needed.

Additionally, while many EDS platforms have demonstrated feasibility at a laboratory scale, few have successfully transitioned to large-scale, commercial throughput operations. In contrast, chemical synthesis platforms have decades of industrial optimization, supply chain integration, and regulatory familiarity. As a result, widespread adoption of EDS may remain limited until per-base costs decline and production volumes can match those of established platforms.

Key Market Opportunity – DNA Synthesis for Precision Medicine and Advanced Therapeutics

A significant opportunity for the enzymatic DNA synthesis market lies in the rising need for personalized DNA sequences in precision medicine and therapeutic development. As biopharmaceutical companies increasingly explore custom-engineered constructs for gene therapy, mRNA vaccines, and synthetic biology-based treatments, the demand for fast, accurate, and reliable DNA synthesis is reaching unprecedented levels.

EDS enables on-demand synthesis of therapeutic-grade DNA sequences with higher integrity and fewer impurities, which is especially important in regulated applications. For example, vaccine developers can benefit from rapid synthesis of variant-specific antigens, while gene therapy firms need long, pure sequences for viral vector packaging. By offering automated EDS platforms for decentralized production—potentially even within hospital or clinic labs—companies can create rapid-response solutions tailored to individual patient needs or emerging infectious threats.

Enzymatic DNA Synthesis Market By Application Insights

Synthetic biology led the application segment, reflecting the field’s rapid expansion and reliance on custom DNA sequences. From engineered microbes for sustainable chemical production to synthetic enzymes and genetic circuits, synthetic biology applications require quick, scalable DNA synthesis workflows. Enzymatic synthesis platforms, with their high adaptability and minimal contamination risks, are emerging as foundational tools in synthetic biology labs and biofoundries.

Vaccine development is emerging as the fastest-growing application, particularly in the post-COVID-19 era. The need to respond quickly to emerging variants has pushed developers toward platforms that can rapidly design, synthesize, and test vaccine candidates. EDS is ideally suited for such a dynamic environment, providing rapid turnarounds and enabling high-fidelity production of antigen-encoding sequences. mRNA vaccine developers, in particular, rely on synthetic DNA templates, and enzymatic methods offer the speed and safety required in this sensitive domain.

Enzymatic DNA Synthesis Market By Service Insights

Oligonucleotide synthesis dominated the market in 2024, driven by the widespread need for custom primers, probes, and small DNA fragments in research, diagnostics, and sequencing workflows. Oligonucleotides are essential in PCR, qPCR, DNA hybridization, CRISPR, and synthetic gene assembly. Enzymatic DNA synthesis enhances oligonucleotide production by allowing error-free incorporation of specific bases in a highly controlled manner. Furthermore, the ability to synthesize oligos directly in automated desktop systems offers cost savings and turnaround time advantages for labs and biotech startups alike.

Gene synthesis is the fastest-growing service segment, owing to the rising adoption of synthetic biology and engineered therapeutic platforms. Full-length genes, including large or complex constructs, are increasingly being synthesized de novo using enzymatic approaches. With EDS offering higher fidelity, the construction of synthetic operons, plasmids, or expression cassettes becomes more efficient and less error-prone. This is particularly crucial for vaccine development, metabolic engineering, and DNA origami applications, where time-to-market and functional accuracy are paramount. Enzymatic methods reduce dependency on lengthy cloning and correction steps, accelerating innovation cycles.

Enzymatic DNA Synthesis Market By End-use Insights

Biopharmaceutical companies dominate the end-use segment, due to their extensive requirements for synthetic DNA in drug discovery, gene therapy, and vaccine development. These firms seek rapid synthesis of functional genes and regulatory elements that can be scaled for production. Enzymatic DNA synthesis supports these needs by offering longer fragments, lower error rates, and reduced purification steps, helping to accelerate research pipelines and reduce regulatory hurdles.

Academic and research institutes are the fastest-growing end-use category, bolstered by increased funding in genomics, bioengineering, and life sciences. Universities and government research centers are exploring enzymatic synthesis for basic science, genome editing, and environmental DNA applications. These institutions often serve as early adopters, helping to validate and refine new EDS technologies before wider commercialization. As access to enzymatic synthesis becomes more affordable, its adoption is expected to rise sharply across research labs worldwide.

Enzymatic DNA Synthesis Market By Regional Insights

North America held the largest share of the global enzymatic DNA synthesis market in 2024, thanks to its mature biotech ecosystem, leading research institutions, and favorable investment climate. The U.S. is home to pioneering companies in EDS technology such as DNA Script and Molecular Assemblies, alongside major synthetic biology firms like Ginkgo Bioworks and Twist Bioscience. Government agencies, including the NIH and DARPA, have also funded enzymatic synthesis research, recognizing its potential in biosecurity and pandemic response. Moreover, the regulatory infrastructure supports rapid translation of novel DNA technologies into clinical and commercial applications.

U.S. Enzymatic DNA Synthesis Market Trends

The U.S. is a major contributor to the market in North America. The high demand for synthetic DNA in various applications, including research, therapeutics, and diagnostics is a primary driver. The rising investments by pharmaceutical and biotechnology companies as well as government funding in R&D utilizing DNA synthesis for drug discovery, development of vaccines and for exploring personalized medicine approaches are supporting the market growth. Advancements in gene editing technologies such as CRISPR, requiring custom DNA sequences for research purposes are driving the demand for enzymatic DNA synthesis. Furthermore, the rising prevalence of chronic diseases, adoption of automated and high-throughput synthesis platforms, as well as strategic alliances among companies for expanding their manufacturing capabilities for synthetic DNA are bolstering the market growth.

Asia-Pacific is the fastest-growing market, fueled by increased biotech investments, expansion of genomic research, and a growing pool of synthetic biology startups. Countries like China, India, South Korea, and Singapore are actively developing national bioeconomy strategies, where DNA synthesis plays a central role. Additionally, APAC governments are supporting DNA manufacturing capacity as part of strategic healthcare independence and innovation initiatives. As local firms adopt or co-develop enzymatic synthesis tools, and with demand rising for custom DNA in agriculture, diagnostics, and therapeutics, the region is poised for strong compound annual growth.

China Enzymatic DNA Synthesis Market Trends

China is leading the enzymatic DNA synthesis market in Asia Pacific, driven by factors such as the rising incidences of chronic diseases like cancer, further creating a growing demand for synthetic for research and diagnostics, personalized medicine, and therapeutics. The country’s strong and expanding biopharmaceutical sector leveraging DNA synthesis technologies for drug discovery and vaccine development purposes is supporting the market growth. Government initiatives like the “Made in China 2025” are encouraging the development of domestic DNA synthesis facilities. Additionally, the rising number of outsourcing providers such as Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) paired with the cost-effectiveness of manufacturing, availability of skilled workforce and large number of ongoing clinical trials is attracting local as well as international pharmaceutical companies to China for outsourcing their DNA synthesis needs, further driving the market

Enzymatic DNA Synthesis Market Top Key Companies:

- Telesis Bio Inc.

- Twist Bioscience Corporation

- GenScript Biotech Corp.

- Evonetix

- Ansa Biotechnologies, Inc.

- Camena Bio

- Molecular Assemblies

- DNA Script

- Touchlight

- Kern Systems

Enzymatic DNA Synthesis Market Recent Developments

- In May 2025, Ansa Biotechnologies, Inc., a reliable partner for DNA synthesis, launched its 50 kb DNA synthesis early access program, which will offer customers with extremely long and complex DNA sequences in less than four weeks through the company’s ultra-rapid and highly accurate enzymatic DNA synthesis technology.

- In May 2025, Ribbon Bio GmbH, a company specializing in DNA synthesis, introduced its first commercial product, MicroSynth DNA, which is built on Ribbon’s proprietary algorithm-driven technology and precision enzymatic assemble process. The product is designed to fulfil the increasing need for complex and highly-accurate synthetic DNA molecules.

- In May 2024, Molecular Assemblies, Inc., launched its Partnering Program for licensing Molecular Assemblies' Fully Enzymatic Synthesis (FES) technology for onsite synthesis. The company also declared the availability of oligonucleotides up to 400mer in length, for early ordering.

Enzymatic DNA Synthesis Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Enzymatic DNA Synthesis market.

By Service

- Oligonucleotide Synthesis

- Gene Synthesis

By Application

- Synthetic Biology

- Genetic Engineering

- Vaccine Development

- Others

By End-use

- Biopharmaceutical Companies

- Academic & Research Institutes

- Contract Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)