The global ePharmacy market size was exhibited at USD 70.00 billion in 2023 and is projected to hit around USD 467.05 billion by 2033, growing at a CAGR of 20.9% during the forecast period 2024 to 2033.

Key Takeaways:

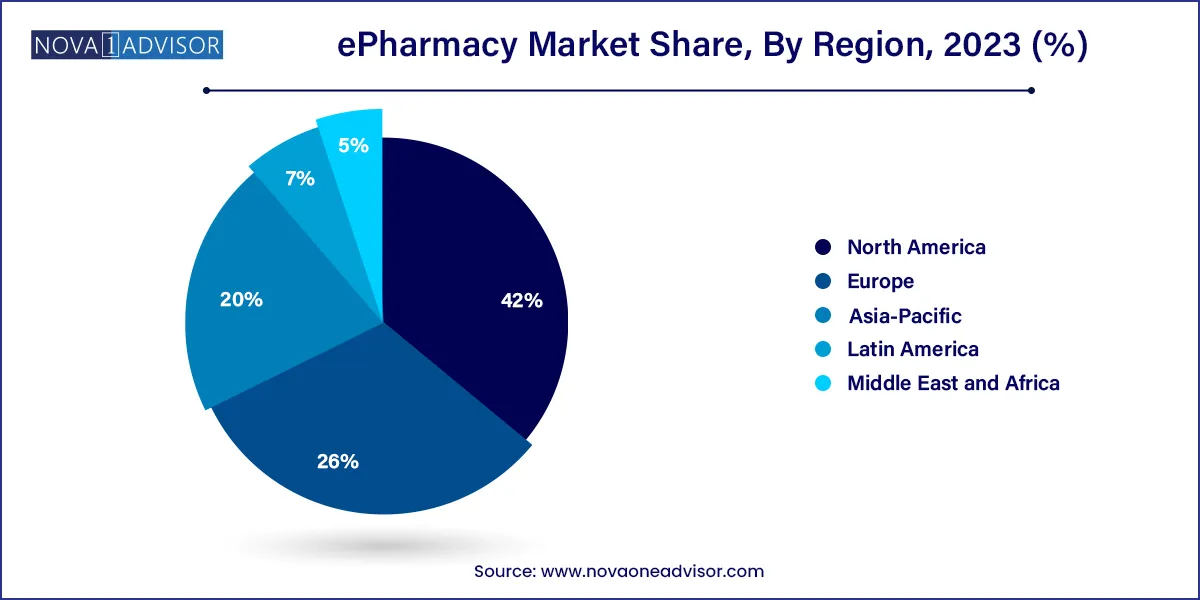

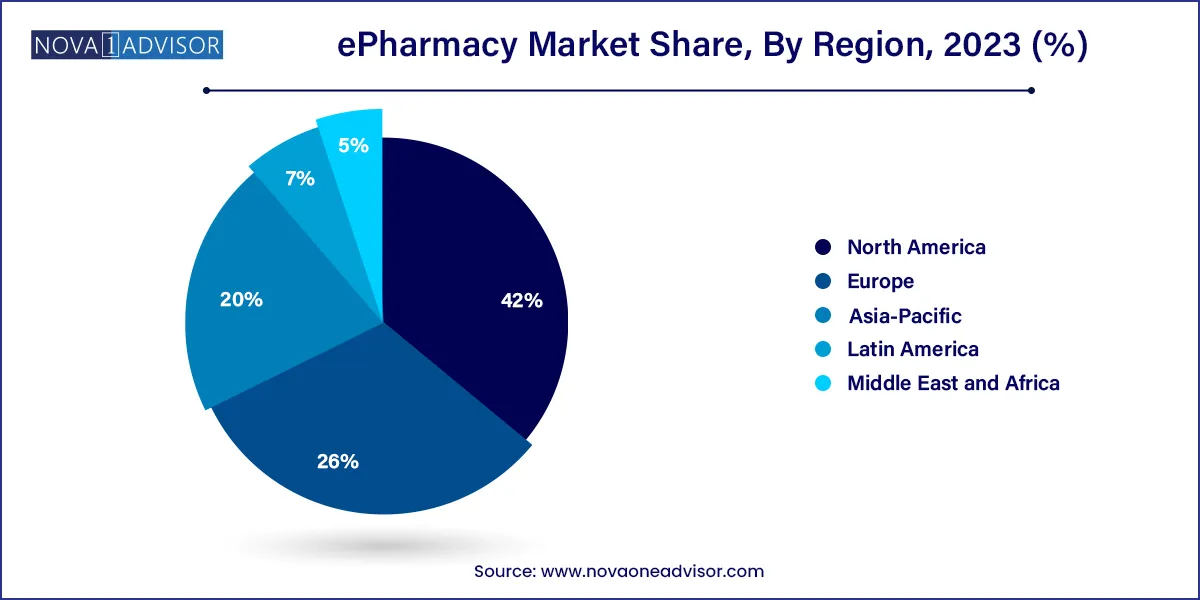

- North America accounted for the largest market share of over 42.0%% in 2023.

- Asia Pacific is anticipated to register the fastest CAGR during the forecast period.

Market Overview

The ePharmacy market represents a revolutionary transformation in pharmaceutical retail, leveraging digital platforms to deliver medications directly to consumers. This online pharmaceutical service has emerged as a disruptive force, driven by technological innovation, changing consumer preferences, and the need for accessible healthcare solutions. ePharmacies allow patients to order prescription and over-the-counter (OTC) medications via web portals or mobile apps, often with added services such as teleconsultations, digital prescriptions, and automated refills.

This market gained significant traction during the COVID-19 pandemic when physical movement was restricted, prompting a surge in online medical purchases. However, its momentum has continued in the post-pandemic world, with customers appreciating the convenience, transparency, and competitive pricing. Governments and healthcare systems are also increasingly recognizing the potential of ePharmacies to improve drug adherence and reach underserved areas.

In mature markets like the U.S. and Europe, ePharmacies are evolving into comprehensive digital health ecosystems offering diagnostics, chronic disease management, and wellness services. In emerging markets like India, Brazil, and Southeast Asia, they are bridging healthcare access gaps in rural and remote areas where brick-and-mortar pharmacies are scarce. Additionally, the proliferation of smartphones, growing internet penetration, and the rising geriatric population are amplifying demand globally.

Despite facing challenges such as regulatory ambiguities and concerns over counterfeit drugs, the ePharmacy sector is set to witness sustained growth. Strategic partnerships, advanced logistics infrastructure, and integration with health-tech platforms are making ePharmacies a permanent fixture in modern healthcare delivery.

Major Trends in the Market

-

Rising Demand for Contactless Healthcare: Consumers are prioritizing digital alternatives for medication purchase post-COVID-19.

-

Integration with Telemedicine Services: Platforms are offering bundled services including doctor consultations, e-prescriptions, and medicine delivery.

-

Subscription Models and Loyalty Programs: ePharmacies are adopting subscription-based refill services and discounts for chronic patients.

-

AI-Based Personalized Recommendations: Use of AI to suggest medication adherence tips, dosage reminders, and product suggestions.

-

Digital Payment and Insurance Integration: Seamless payment gateways and partnerships with insurers are streamlining reimbursements.

-

Growth of B2B2C Distribution Channels: ePharmacies are linking with hospitals and clinics to serve patients directly post-consultation.

-

Expansion into Rural and Tier-II/Tier-III Markets: Using mobile vans and hybrid models to penetrate remote areas.

-

Omni-Channel Models by Traditional Pharmacies: Brick-and-mortar stores launching apps and websites to compete.

-

Government Regulations and Digital Health Frameworks: Increasing support for ePharmacy operations under national health initiatives.

-

Sustainability and Eco-Friendly Packaging: Focus on minimizing waste and carbon footprint in logistics.

ePharmacy Market Report Scope

| Report Coverage |

Details

|

| Market Size in 2024 |

USD 84.63 Billion |

| Market Size by 2033 |

USD 467.05 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 20.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

The Kroger Co.; Walgreen Co.; Giant Eagle, Inc.; Walmart, Inc.; Express Scripts Holding Company; CVS Health; Optum Rx, Inc.; Rowlands Pharmacy; DocMorris (Zur Rose Group AG);Cigna Corporation (Express Scripts Holdings); Amazon.com Inc.; Axelia Solutions (Pharmeasy); Apex Healthcare Berhad (Apex Pharmacy); Apollo Pharmacy; Netmeds |

Key Market Driver: Increasing Internet Penetration and Smartphone Usage

The most influential driver in the ePharmacy market is the increasing penetration of smartphones and internet connectivity, particularly in emerging economies. With over 5 billion smartphone users globally and improving network coverage in rural areas, digital platforms have become accessible to wider populations, even those previously disconnected from formal healthcare systems.

For example, India’s internet users crossed 850 million in 2024, enabling the rise of regional ePharmacies like 1mg and NetMeds to serve customers across 19,000+ pincodes. These platforms have leveraged vernacular languages, voice-enabled search, and simplified interfaces to bring first-time digital users into the fold. As digital literacy improves, even elderly populations are beginning to trust and use ePharmacies for regular prescriptions and wellness products.

The democratization of internet access has made ePharmacies not only feasible but highly scalable. It has drastically reduced customer acquisition costs, while allowing real-time tracking, feedback collection, and CRM integration. This digital infrastructure continues to fuel the rapid expansion of the market.

Key Market Restraint: Regulatory Uncertainty and Counterfeit Drug Concerns

A major challenge hampering ePharmacy adoption is regulatory uncertainty and the risk of counterfeit or substandard drug distribution. The legality and guidelines around ePharmacies vary significantly between countries, and in some cases, even within regions of a country. These regulatory grey areas affect investor confidence and operational consistency.

Moreover, the risk of counterfeit or expired drugs reaching consumers through unverified sellers on e-marketplaces raises significant safety and ethical concerns. In nations lacking strong pharmaceutical regulation and enforcement, rogue players can operate without accountability. While established ePharmacy brands implement rigorous quality checks, last-mile delivery in decentralized systems still poses monitoring issues.

To build long-term trust, regulators must establish clear ePharmacy frameworks, digital prescription norms, licensing criteria, and penalties for violations. In the absence of strong regulation, the market risks fragmentation and reputational damage that could stifle growth.

Key Market Opportunity: Integration with National Healthcare Systems

A promising opportunity lies in the integration of ePharmacies with national healthcare frameworks, especially under universal health coverage (UHC) schemes. Governments increasingly recognize that ePharmacies can reduce prescription errors, enhance drug traceability, and improve medication adherence through digital tracking.

Countries like the UK and India have already started integrating online pharmacies into public health initiatives. For instance, India’s National Digital Health Mission (NDHM) promotes electronic health records and interoperable platforms where ePharmacies play a key role. In the UK, the NHS has partnered with platforms like Pharmacy2U to distribute chronic medications efficiently.

Such collaborations open massive scale-up potential, provide steady revenue streams through bulk procurement, and reinforce the role of ePharmacies as public health enablers rather than commercial disruptors. With the rise of chronic disease management programs and decentralized care models, ePharmacies are poised to become indispensable.

Segments Insights:

By Drug Type

Prescription drugs dominate the ePharmacy market, accounting for a significant portion of revenue. These include medications for chronic conditions like diabetes, hypertension, asthma, and mental health disorders, which require regular refills and adherence. ePharmacies have built mechanisms for uploading e-prescriptions, physician validation, and scheduled delivery to facilitate patient compliance. Chronic patients particularly benefit from auto-refill options, SMS reminders, and discounted subscriptions that reduce treatment burden and costs.

Furthermore, partnerships with hospitals and diagnostic chains have led to integrated prescription-to-delivery services, where medications are shipped directly after teleconsultation. This ecosystem reduces manual intervention, speeds up treatment initiation, and ensures the right drug reaches the patient with minimal effort.

The over-the-counter (OTC) drug segment is the fastest-growing, driven by consumer demand for wellness products, immunity boosters, skincare, nutraceuticals, and basic medications. With increasing health consciousness, consumers are proactively purchasing vitamins, supplements, antacids, and allergy medications online without doctor consultations.

OTC drug purchases are typically less regulated, making them easier to market and distribute via digital channels. ePharmacies are also integrating AI-driven recommendation engines that suggest OTC products based on browsing history or previous purchases. Seasonal campaigns (e.g., cold and flu season) and bundling with wellness services further accelerate sales in this segment.

By Regional Insights

North America leads the global ePharmacy market, owing to advanced healthcare infrastructure, high smartphone penetration, and robust logistics networks. The U.S. ePharmacy landscape is marked by major players like Amazon Pharmacy, CVS Health, and Walgreens, who have established large-scale prescription fulfillment operations. These platforms integrate insurance, offer secure digital consultations, and operate within well-defined legal frameworks that inspire consumer confidence.

Moreover, the adoption of electronic prescriptions (eRx) and digital patient records supports seamless integration between prescribers, payers, and pharmacies. Medicare and private insurers also reimburse for mail-order prescriptions, further fueling market growth. The U.S. market has seen major consolidation and vertical integration, enabling scalable and personalized ePharmacy solutions.

Asia-Pacific is the fastest-growing region, driven by massive population bases, expanding internet coverage, and increasing chronic disease burden. India, China, and Indonesia are at the forefront of ePharmacy adoption. In India, startups like PharmEasy, Tata 1mg, and Netmeds have transformed the pharmaceutical supply chain, offering discounted medicines, lab test bookings, and teleconsultation bundles.

Regulatory recognition is also evolving, with digital health missions and standardized prescription validation emerging. In China, Alibaba Health and JD Health dominate with massive customer bases, leveraging big data and AI to personalize medicine delivery. Southeast Asia is also seeing strong momentum with localized platforms catering to multilingual, low-bandwidth environments.

The region’s healthcare infrastructure, while still evolving, is increasingly supported by government-backed digital health efforts, offering fertile ground for ePharmacy innovation and investment.

Some of the prominent players in the EPharmacy market include:

- The Kroger Co.

- Walgreen Co.

- Giant Eagle, Inc.

- Walmart, Inc.

- Express Scripts Holding Company

- CVS Health

- Optum Rx, Inc.

- Rowlands Pharmacy

- DocMorris (Zur Rose Group AG)

- Cigna Corporation (Express Scripts Holdings)

- Amazon.com Inc.

- Axelia Solutions (Pharmeasy)

- Apex Healthcare Berhad (Apex Pharmacy)

- Apollo Pharmacy

- Netmeds

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ePharmacy market.

Drug type

- Prescription drug

- Over-the-counter drug (OTC)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)