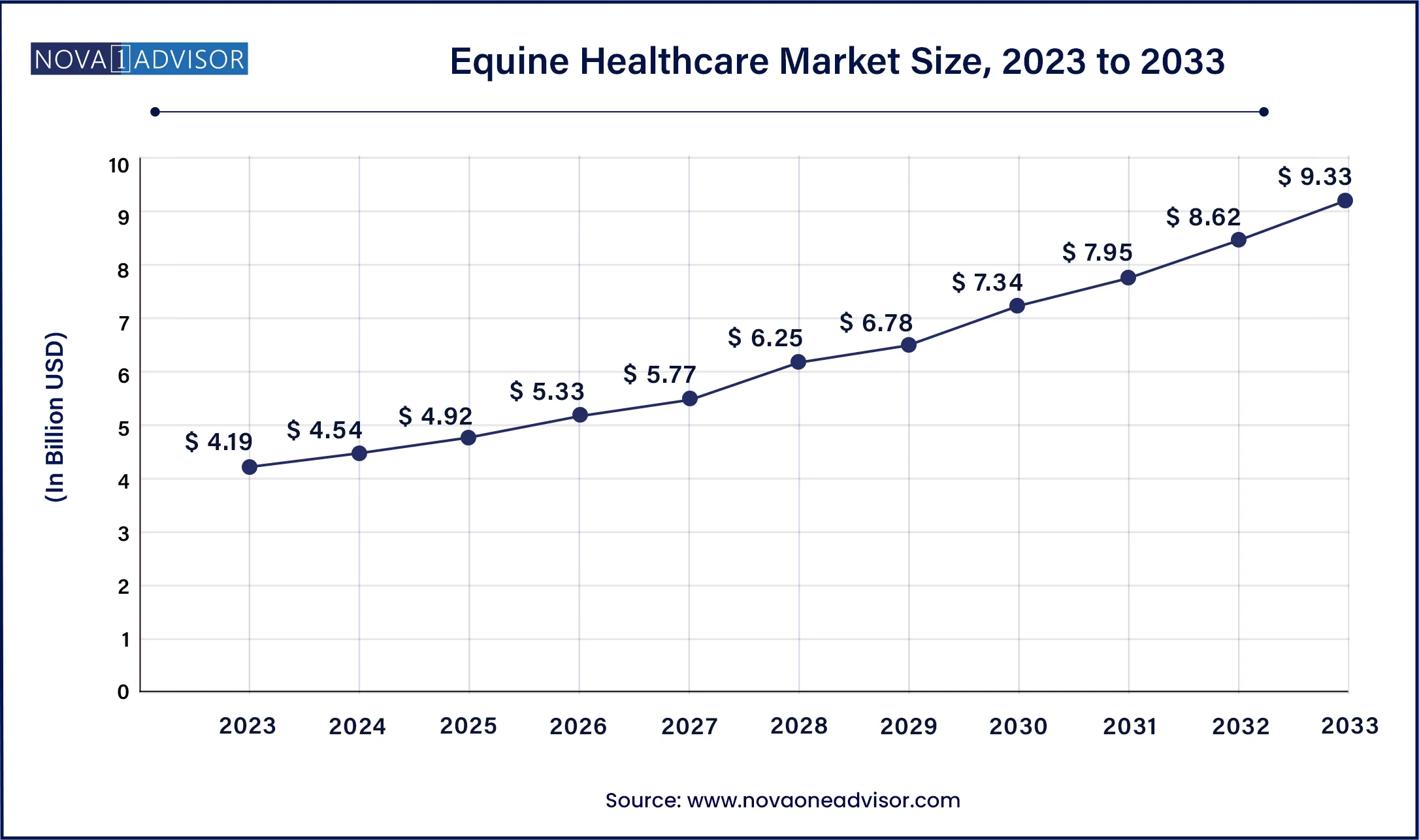

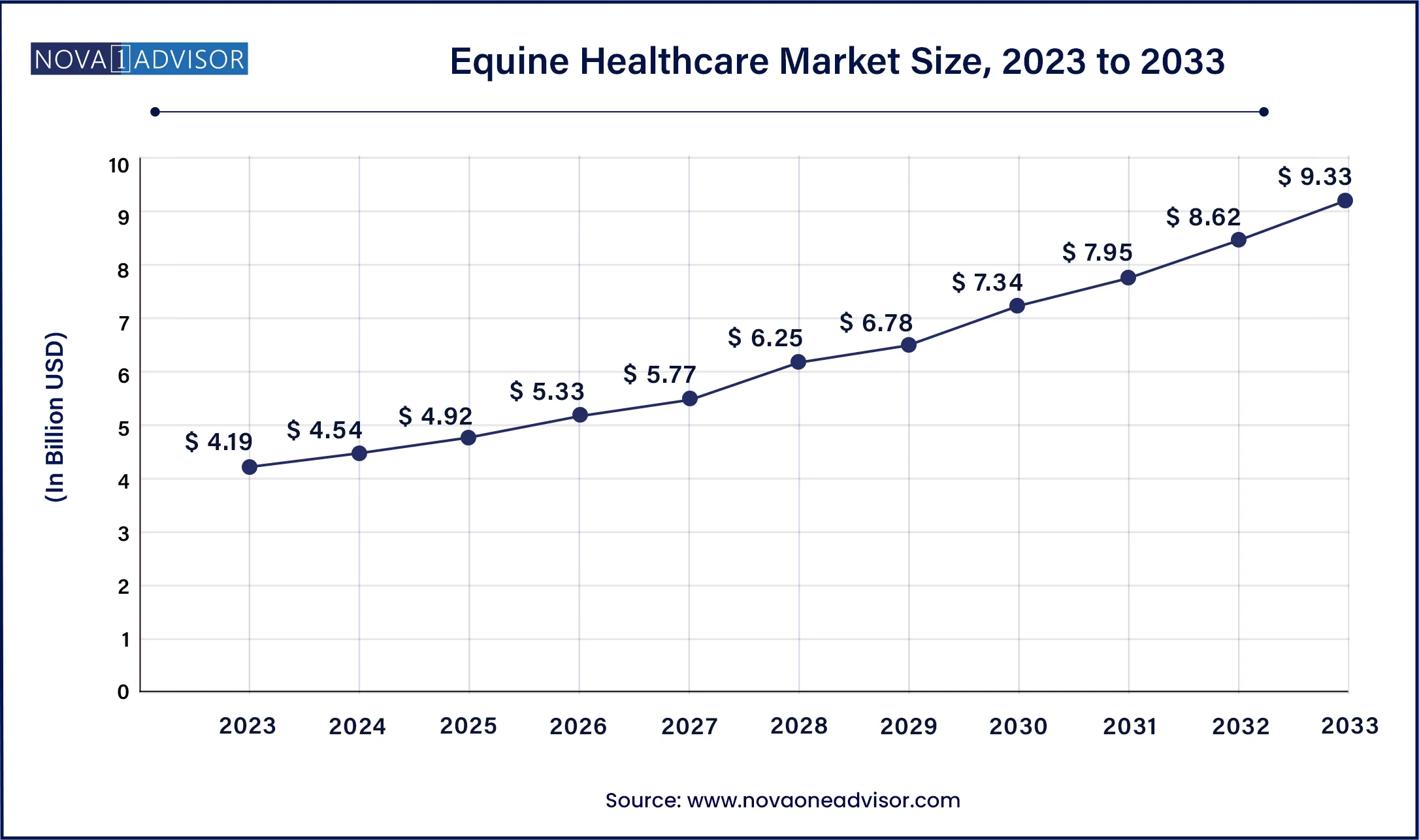

Equine Healthcare Market Size and Growth

The global equine healthcare market size was valued at USD 4.19 billion in 2023 and is anticipated to reach around USD 9.33 billion by 2033, growing at a CAGR of 8.34% from 2024 to 2033.

Equine Healthcare Market Key Takeaways

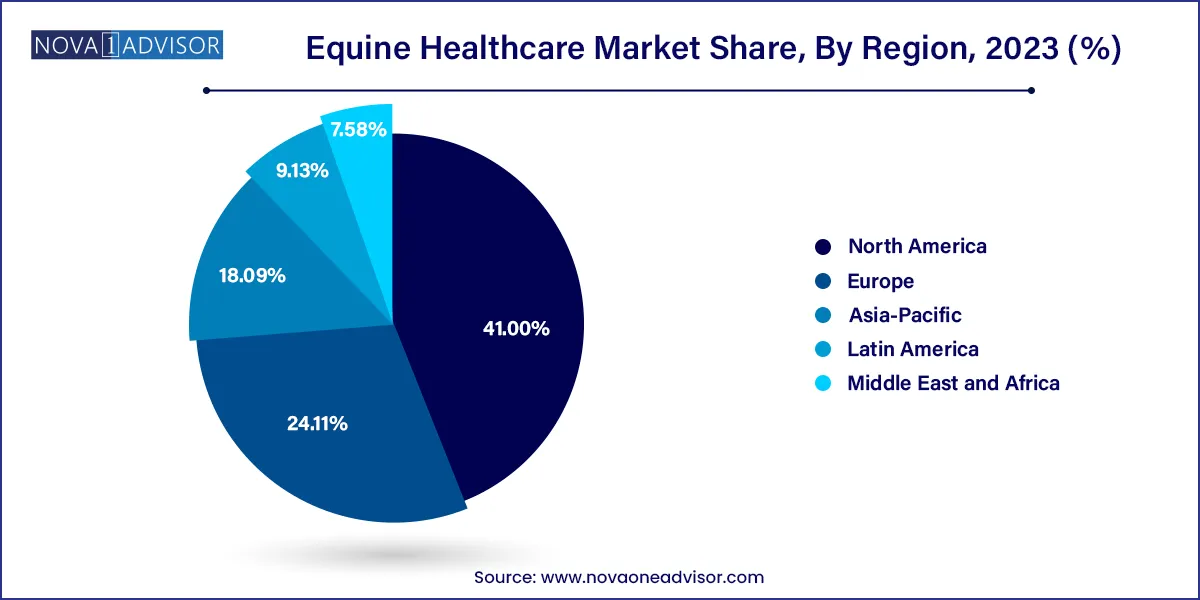

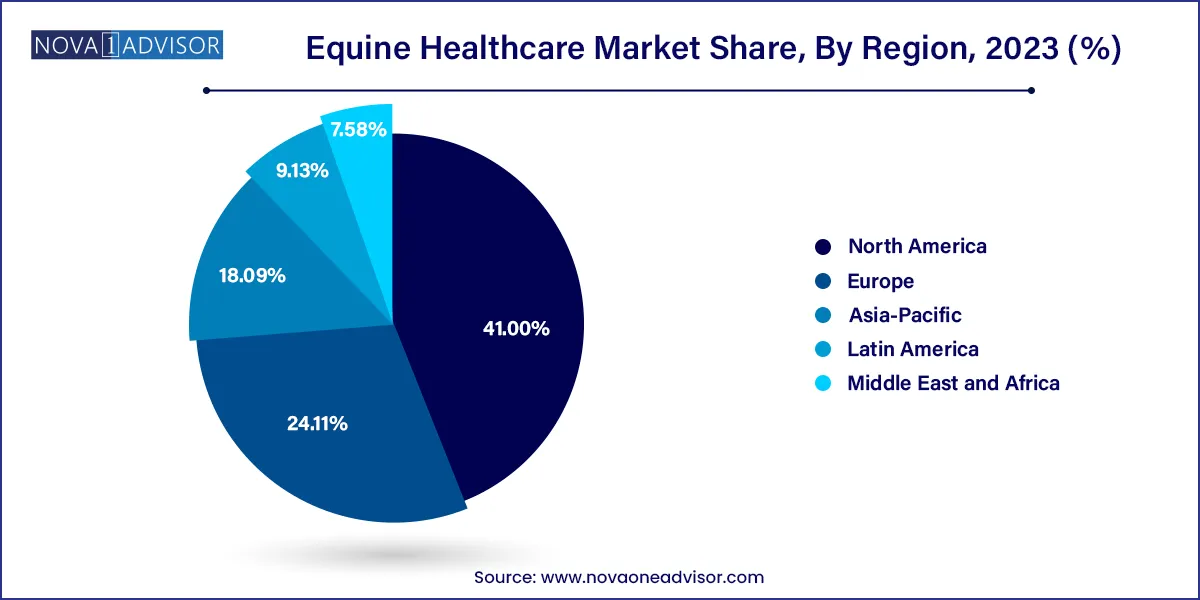

- North America equine healthcare market accounted for the largest share of 41.00% in 2023.

- Asia Pacific (APAC) equine healthcare market is growing at highest CAGR of over 11.02% over the forecast period.

- The pharmaceuticals segment had the largest revenue share of 26.11% in 2023.

- The software segment is anticipated to grow at the fastest CAGR over the forecast period.

- The parasitic infections segment dominated the market with a market share of 27.16% in 2023.

- The Equine Herpes Virus (EHV) segment is expected to showcase lucrative growth over the forecast period.

- The sports/racing segment dominated the market with a share of over 57.11% in 2023

- The recreation segment is expected to grow with the highest CAGR in the market over 2024-2033.

- The veterinary hospitals & clinics segment dominated the market in terms of share in 2023.

- The e-commerce segment is anticipated to grow at the highest CAGR over the forecast period.

Market Overview

The equine healthcare market is an essential component of the veterinary healthcare industry, driven by the increasing adoption of horses for various purposes such as racing, sports, and leisure activities. As horses are vital animals in many cultures, their healthcare requirements have spurred demand for a variety of products and services to ensure their well-being and performance. This market encompasses a wide range of products and services, including vaccines, pharmaceuticals, orthobiologics, diagnostic tools, and even software designed to support veterinary practice management.

Horses, like all animals, are vulnerable to various diseases and conditions, some of which can have severe implications for both the animal and its owner. With the global focus on animal health and well-being, advancements in veterinary medicine, diagnostic tools, and healthcare products have significantly enhanced the quality of care for horses. The equine healthcare market also plays a critical role in improving the performance of racehorses and competition animals, where health monitoring is pivotal for success.

Increasing awareness of the need for regular equine healthcare, particularly in high-demand regions like North America, Europe, and parts of Asia, has driven market growth. Additionally, the growing focus on sports performance and competition animals has led to the development of specialized health products for horses. As the equine industry continues to evolve, the market for equine healthcare products and services is expected to expand, driven by continued innovation and increased investment in equine healthcare infrastructure.

Major Trends in the Market

-

Technological Advancements in Diagnostics: The introduction of advanced diagnostic tools and equipment has significantly improved the detection and treatment of diseases in horses.

-

Growing Demand for Preventative Healthcare: Pet and animal owners are focusing more on preventative care, which has led to an increase in the demand for vaccines and regular health monitoring.

-

Increase in Equine Sports and Racing: The rise in participation in equine sports and racing has driven the demand for specialized healthcare products aimed at enhancing performance.

-

Telemedicine and Telehealth Services: The adoption of telemedicine has transformed the way equine healthcare services are delivered, allowing for remote consultations and monitoring of horses.

-

Rise in Orthobiologics: With growing awareness of non-invasive treatments, the use of orthobiologics such as stem cell therapy for musculoskeletal disorders in horses has gained traction.

-

Integration of Software in Practice Management: More veterinary practices are integrating software solutions for better management of equine health records, diagnostics, and treatment plans.

-

Focus on Equine Vaccination: As infectious diseases pose a significant threat to horses, the market for equine vaccines has seen consistent growth with a strong emphasis on new, effective vaccines.

Equine Healthcare Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 4.54 Billion |

| Market Size by 2033 |

USD 9.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.34% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, indication, activity, distribution channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Zoetis; Arthrex Inc.; Dechra Pharmaceuticals; Boehringer Ingelheim International GmbH; Ceva Sante Animale; Heska Corporation; Merck & Co. Inc; Esaote SPA; IDEXX Laboratories, Inc.; Covetrus Inc.; Elanco; Cargill |

Driver: Rising Demand for Vaccines

One of the most significant drivers of the equine healthcare market is the increasing demand for vaccines. Vaccines play an essential role in preventing the spread of infectious diseases among horses, ensuring their long-term health and reducing the economic impact of outbreaks. Diseases like Equine Herpesvirus (EHV), West Nile Virus, and Equine Influenza are some of the major threats to the equine population, leading to a consistent need for vaccination.

As awareness around the importance of preventative healthcare grows, more equine owners, particularly those involved in racing or competition, are investing in vaccination programs for their horses. For instance, racehorses, whose performance and careers depend heavily on their health, are often vaccinated against common diseases to ensure they remain fit for competition. Moreover, in areas where equine diseases are prevalent, vaccination is a standard practice in maintaining the overall health of the equine population.

This growing need for vaccinations is being met by continued innovation in vaccine development. Companies are now focused on developing multi-disease vaccines that can be administered in a single shot, reducing the number of injections required and improving convenience for both veterinarians and horse owners. The trend toward customized vaccination schedules tailored to the specific needs of individual horses also reflects a shift toward more personalized care in equine healthcare.

Restraint: High Cost of Advanced Treatment Options

While the equine healthcare market is experiencing significant growth, one of the primary restraints is the high cost associated with advanced treatments, especially for premium products like orthobiologics, stem cell therapy, and diagnostic testing. Many of these treatments require specialized knowledge and equipment, which can be expensive for equine owners, particularly in regions where the cost of veterinary care is already high.

For example, stem cell therapies, which are increasingly being used for treating musculoskeletal injuries in racehorses, can cost thousands of dollars per treatment. While these treatments offer significant benefits in terms of recovery time and improved performance, the financial burden can be too high for smaller-scale horse owners or those involved in recreational activities.

Additionally, the price of diagnostic equipment, such as imaging software and diagnostic test kits, has also risen with technological advancements. Many smaller veterinary practices, especially in rural areas, may not be able to afford such high-end equipment, limiting their ability to offer state-of-the-art care to their equine patients. This cost barrier can slow the adoption of advanced healthcare services in certain regions, hindering overall market growth.

Opportunity: Expansion of Telemedicine Services

One of the most promising opportunities in the equine healthcare market is the expansion of telemedicine services. Telemedicine allows veterinarians to conduct remote consultations and follow-up visits, which is especially beneficial for horse owners in rural or remote areas where access to specialized veterinary care may be limited. It also provides an opportunity for veterinarians to offer ongoing health monitoring and management of chronic conditions without requiring the horse to be physically present in the clinic.

With the increasing adoption of telemedicine, many equine healthcare providers are integrating telehealth platforms that allow for real-time communication between horse owners and veterinarians. These services can significantly reduce costs and increase the accessibility of veterinary care, which is expected to drive market growth, especially in developing countries.

For example, in regions like Asia-Pacific, where access to veterinary clinics may be limited in certain areas, telemedicine could become a game-changer in delivering quality equine healthcare. This opportunity is enhanced by the growing popularity of wearable health monitors for horses, which could transmit real-time health data to veterinarians for remote analysis and treatment advice. This not only expands the potential for healthcare services but also provides a more cost-effective solution for horse owners.

Equine Healthcare Market By Product Insights

The pharmaceutical segment, especially parasiticides and anti-infectives, dominates the equine healthcare market due to the high prevalence of parasitic infections in horses. Parasites such as worms, ticks, and mites are common among horses and can significantly affect their health and performance. The demand for parasiticides, therefore, remains strong, as they are essential in ensuring the horse's well-being.

Furthermore, anti-infective drugs are critical in treating infections, which are common in both recreational and competitive horses. The growth of the pharmaceutical segment is driven by the increasing incidence of diseases that require long-term management, such as arthritis and respiratory infections. As a result, the pharmaceutical segment remains the largest and fastest-growing category in equine healthcare.

The diagnostics segment is growing at a rapid pace, with an increasing focus on early disease detection and management. Innovations in diagnostic test kits and equipment have made it easier for veterinarians to detect diseases in horses before they become severe. Technologies such as PCR (polymerase chain reaction) testing and rapid antigen tests for diseases like Equine Herpesvirus are fueling this growth. The ability to diagnose diseases accurately and swiftly ensures timely treatment, reducing the economic impact of outbreaks.

Equine Healthcare Market By Regional Insights

North America, particularly the United States, dominates the equine healthcare market due to the large equine population and the high demand for equine healthcare services, especially for racehorses and sport horses. The presence of a well-developed veterinary infrastructure, along with an increasing focus on equine performance and health, has contributed to the dominance of this region. The market is further bolstered by advancements in diagnostic technologies and treatment options available for horses.

The Asia-Pacific region is witnessing the fastest growth in the equine healthcare market. The growing adoption of horses for racing, recreational purposes, and agricultural work has increased the demand for healthcare products and services. Countries like China, Japan, and India are investing in improving their veterinary services for horses. Additionally, the growing popularity of equine sports in these regions is driving demand for specialized treatments and health monitoring products, leading to rapid market expansion.

Equine Healthcare Market Top Key Companies:

- Zoetis

- Arthrex Inc.

- Dechra Pharmaceuticals

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Heska Corporation

- Merck & Co. Inc

- Esaote SPA

- IDEXX Laboratories, Inc.

- Covetrus Inc.

- Elanco

- Cargill

Equine Healthcare Market Recent Developments

-

April 2025: Merck Animal Health launched a new vaccine for Equine Herpesvirus (EHV) in the U.S. market, offering enhanced protection for horses against one of the most prevalent and potentially devastating diseases.

-

March 2025: Zoetis introduced a new range of anti-inflammatory and analgesic treatments for horses, aimed at improving the management of chronic pain in older horses.

-

January 2025: Elanco Animal Health partnered with a leading telemedicine platform to integrate remote veterinary services for horses, enabling horse owners to access healthcare advice and treatment from anywhere.

Equine Healthcare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Equine Healthcare market.

By Product Type

- Vaccines

- Pharmaceuticals

- Parasiticides

- Anti-infectives

- Anti-inflammatory & Analgesics

- Other Pharmaceuticals

- Medicinal Feed Additives

- Orthobiologics

- Diagnostics

- Diagnostic Test Kits

- Diagnostic Equipment

- Software & Services

- Practice Management Software

- Imaging Software

- Telehealth Software

- Other Software

- Other Products

By Indication

- Musculoskeletal Disorders

- Parasitic Infections

- Equine Herpes Virus

- Equine Viral Arteritis (EVA)

- Equine Influenza

- West Nile Virus

- Tetanus

- Other Indications

By Activity

- Sports/Racing

- Recreation

- Other Activities

By Distribution Channel

- Veterinary Hospitals & Clinics

- E-commerce

- Equestrian Facilities

- Other Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)