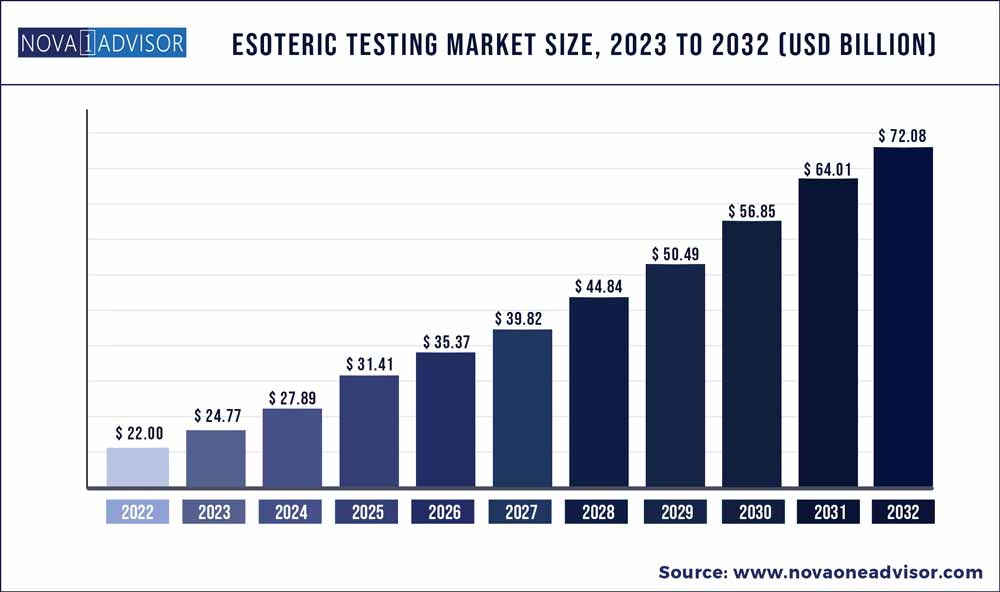

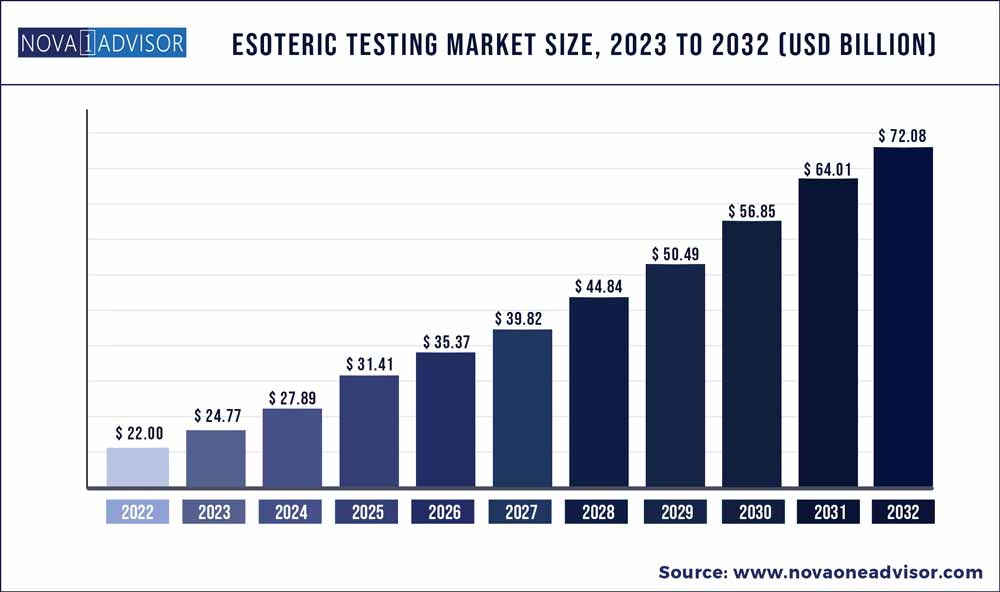

The global esoteric testing market size was exhibited at USD 22.00 billion in 2022 and is projected to hit around USD 78.08 billion by 2032, growing at a CAGR of 12.6% during the forecast period 2023 to 2032.The market growth is fueled by the high prevalent infectious and chronic diseases, advancing precision medicines, and early diagnosis.

Key Takeaways:

- Infectious disease testing segment dominated the esoteric testing market in 2022.

- CLIA held the largest share of the esoteric testing market during the forecast period.

- North America was the largest regional market for esoteric testing market in 2022.

Esoteric Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 22.00 Billion |

| Market Size by 2032 |

USD 78.08 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 12.6% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Type, Technology, End User and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Labcorp (US), Quest Diagnostics (US), and OPKO Health (US). The other players operating into this market include, H.U. Group Holdings, Inc. (Japan), Healius Limited (Australia), Sonic Healthcare (Australia), Mayo Foundation for Medical Education and Research (MFMER, US), Eurofins Scientific (Luxembourg), Stanford Clinical Pathology (US), Foundation Medicine (US), Kindstar Global (Beijing) Technology, Inc. (China), ARUP Laboratories (US), Georgia Esoteric & Molecular Laboratory, LLC (US), Thyrocare Technologies Ltd. (India), ACM Global Laboratories(US), BioAgilytix Labs (US), National Medical Services Inc. (NMS) (US), Baylor Esoteric and Molecular Laboratory (US), Cerba Xpert (Belgium), HealthQuest Esoterics (US), BUHLMANN Diagnostics Corp (BDC, US), BP Diagnostic Centre SDN BHD (Malaysia), Flow Health (US), and Leo Labs, Inc. (India). |

The Asian countries offer vast opportunities of growth in the market. However, the hindrance caused by the inadequate reimbursements may restrict the market growth to a certain limit. The esoteric testing market is segmented based on type, technology, end user and region.

COVID-19 impact on the esoteric testing market

The market growth has seen a decline in its pace, due to the sudden outbreak of the COVID-19. In the first quarter of 2022, companies faced certain operational and logistic challenges due to the imposition of lockdowns. Eventually, with the massive influx of COVID-19 patients and tremendous demand for mass scale diagnosis in various regions, companies escalated and deviated their focus from esoteric tests to the diagnostic offerings for COVID-19.

Global Esoteric Testing Market Dynamics

DRIVER:

Growing geriatric population, increasing prevalence of chronic and infectious diseases, advancing esoteric DNA sequencing technologies in precision medicine, early diagnosis of cancer and precision medici

The chronic diseases such as diabetes, cardiovascular diseases and cancer are on rise across the globe. The prevalence of infectious disease such as Dengue, Hepatitis B, C, HIV, Malaria, Tuberculosis, and others, are also increasing at an alarming rate. The awareness of the esoteric tests is increasing for the early and effective diagnosis of such diseases. The advancing technology of esoteric test are offering expedited results with higher efficacy, detection limits, and sensitivity. The increasing use of esoteric DNA sequencing, NGS technologies and whole genome sequencing in the early diagnosis of cancer, precision and personal medicine are also pushing the growth of the market.

RESTRAINT: Inadequate reimbursement of the esoteric tests

Inadequate reimbursement is a major factor restraining the growth of the esoteric testing market. The coverage of precision medicine and personalized medicine by Medicare are highly confined. In the past few years, there has been a decline in the reimbursement of diagnostic tests, which has negatively impacted the volume of tests. This resulted due to the increased controls over the utilization of laboratory services by Medicare, Medicaid, and other third-party payers, particularly managed care organizations (MCOs).

OPPORTUNITY: Emerging technologies in esoteric testing and emerging economies

Emerging technologies such as biomarker analysis, digital PCR, NGS, pyrosequencing, or Sanger sequencing, digital microfluidic platforms and advanced molecular phenotyping technologies are expected to thrust the growth of the market. The emerging economies such as India, China, and India are expected to offer potential growth opportunities for major players operating in the esoteric testing market. This can be attributed to the growing geriatric population, high prevalence of chronic and infectious diseases, improving healthcare infrastructure, and increasing disposable income in these countries.

CHALLENGES: Dearth of Skilled Professionals

The dearth of a skilled workforce has been a challenge for several decades, resulting in an aging workforce and declining enrolment in training programs. It takes almost five to ten years of continuous practice in clinical laboratory work for technicians to gain expertise. Esoteric tests are more advanced clinical laboratory tests than routine molecular tests.

Infectious disease testing segment dominated the esoteric testing market in 2022.

Based on type, the market is segmented into infectious disease testing, neurology testing, toxicology testing, endocrinology testing, genetic testing, immunology testing, oncology testing, and other testing. The infectious disease testing segment accounted the largest share in the market owing to the high demand technical advancement of the molecular testing. The improving healthcare infrastructure of the developing countries have also supported the large share of the segment. The genetic testing segment is expected to grow with the fastest CAGR due to the advancing NGS sequencing technology.

CLIA held the largest share of the esoteric testing market during the forecast period.

Based on technology, market is segmented into chemiluminescence immunoassay (CLIA), enzyme-linked immunosorbent assay (ELISA), flow cytometry, real-time PCR, DNA sequencing, mass spectrometry, and other technologies. CLIA accounted for the largest share in the market owing to its high performance and efficacy of diagnosis.

North America was the largest regional market for esoteric testing market in 2022.

The esoteric testing market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America held the largest share in the global market, followed by Europe. The dominance of North America is driven by the massive per capita healthcare expenditure, vast population base of geriatric and chronic disease patients and the presence of leading companies in the region.

Some of the prominent players in the Esoteric testing Market include:

- Labcorp (US),

- Quest Diagnostics (US),

- OPKO Health Inc. (US).

- H.U. Group Holdings,

- Healius Limited (Australia)

- Sonic Healthcare (Australia)

- Stanford Clinical Pathology (US)

- Foundation Medicine (US)

- Thyrocare Technologies Ltd

- HealthQuest Esoterics (US)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2032. For this study, Nova one advisor, Inc. has segmented the global Esoteric testing market.

By Type

- Infectious Diseases Testing

- Endocrinology Testing

- Oncology Testing

- Genetics Testing

- Toxicology Testing

- Immunology Testing

- Neurology Testing

- Other Testing

By Technology

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Mass Spectrometry

- Real-Time PCR

- DNA Sequencing

- Flow Cytometry

- Other Technologies

By End User

- Independent & Reference Laboratories

- Hospital-Based Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)