Europe Clinical Laboratory Services Market Size and Trends

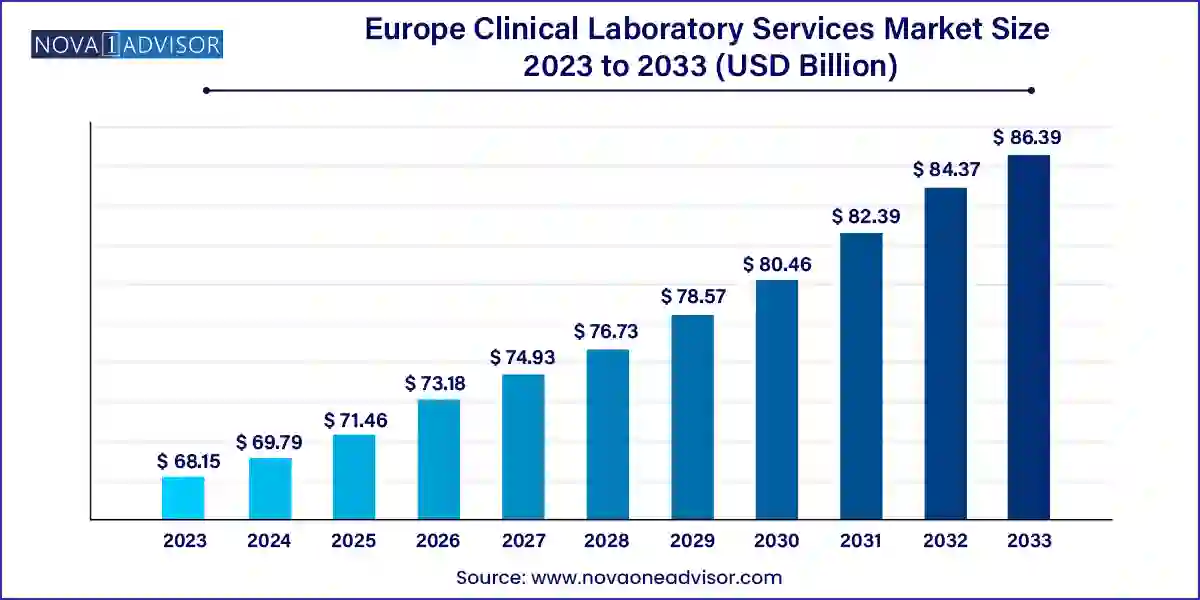

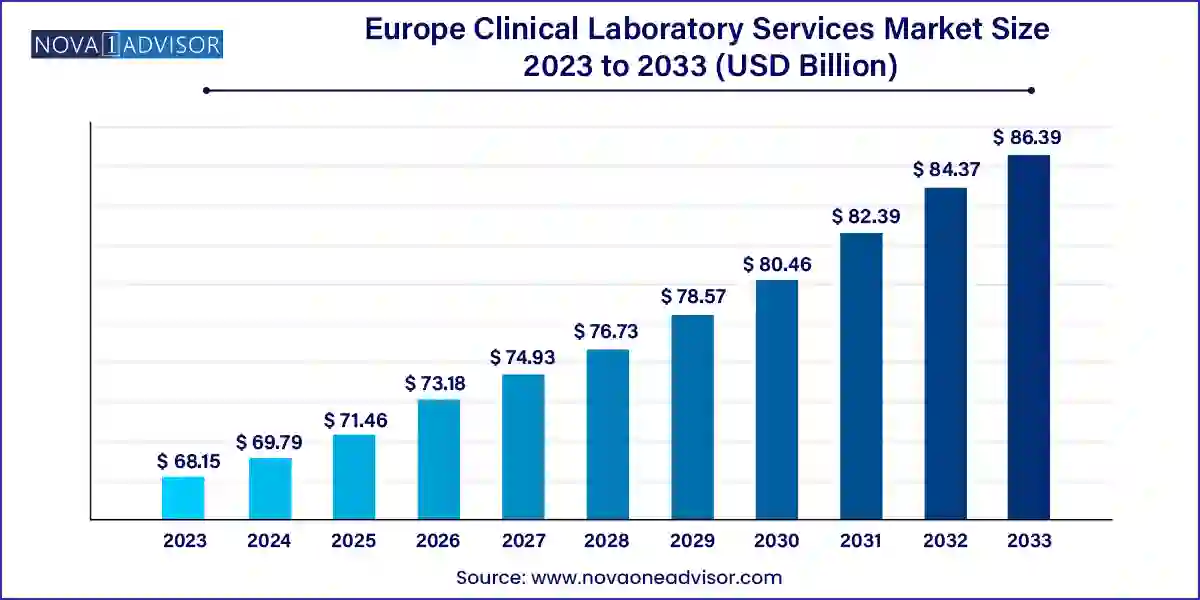

The Europe clinical laboratory services market size was exhibited at USD 68.15 billion in 2023 and is projected to hit around USD 86.39 billion by 2033, growing at a CAGR of 2.4% during the forecast period 2024 to 2033.

Key Takeaways:

- Clinical chemistry tests emerged as the dominant market segment in 2023, accounting for 51.2% of the total revenue.

- Human & tumor genetics testing is expected to experience the fastest CAGR of 6.5% over the forecast period.

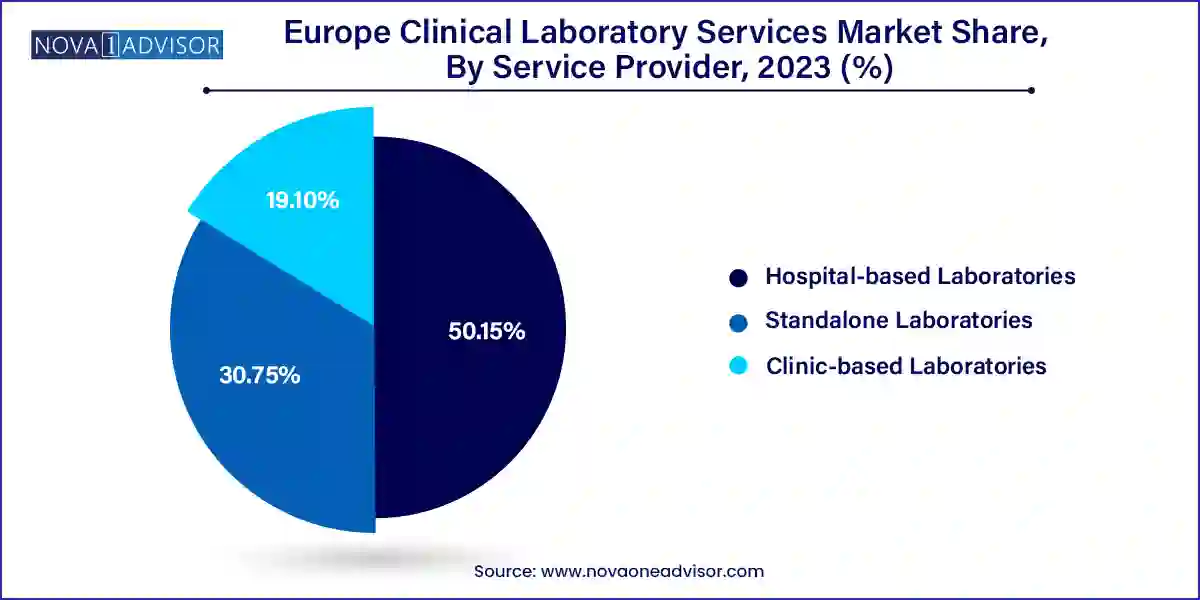

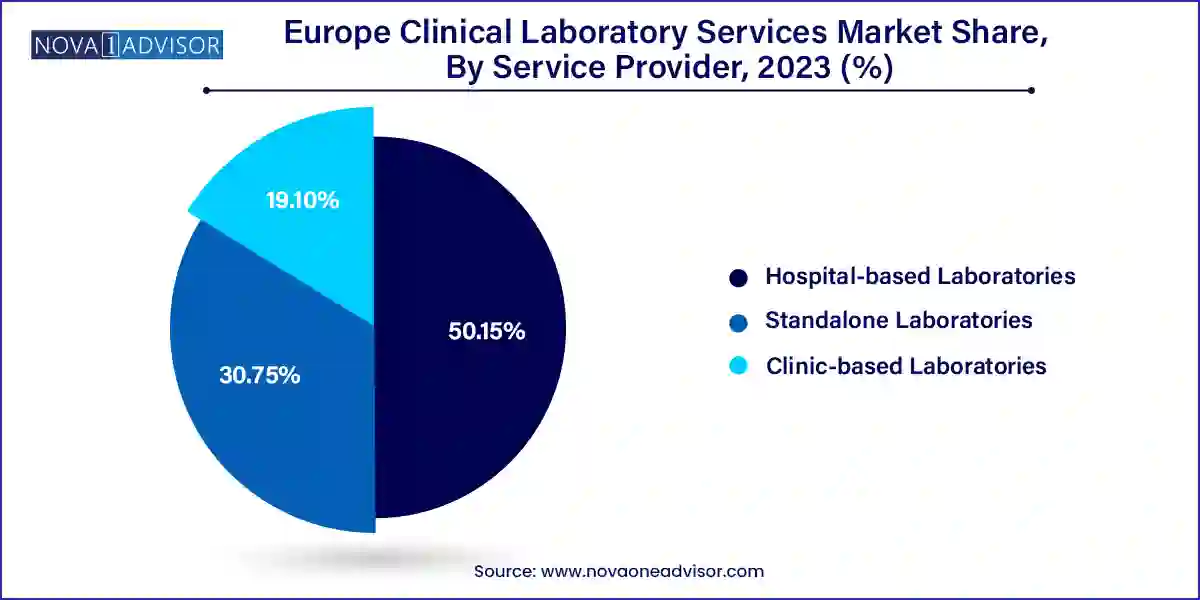

- In 2023, hospital-based laboratories led the service providers segment, accounting for over 50.15% of the total revenue.

- Clinic-based laboratories are expected to experience a lucrative CAGR of 3.2% over the forecast period.

- Bioanalytical & lab chemistry services held the largest market share in 2023, accounting for 53.9% of the total revenue.

- The toxicology testing services segment is anticipated to exhibit the most rapid growth, with a projected CAGR of 7.6% over the forecast period.

Market Overview

The Europe clinical laboratory services market is a fundamental pillar of the continent’s healthcare system, supporting disease diagnosis, treatment planning, health monitoring, and public health surveillance. As diagnostic technologies evolve and the demand for timely, reliable, and personalized healthcare grows, clinical laboratories in Europe are playing an increasingly critical role in improving patient outcomes and supporting value-based care.

Europe benefits from a mature diagnostic infrastructure, advanced medical regulations, and public health policies that promote preventive care and early disease detection. Clinical laboratory services span a broad array of tests, including routine biochemistry, hematology, cytology, microbiology, molecular diagnostics, and advanced esoteric testing. These services are provided through hospital-based laboratories, standalone diagnostic chains, and clinic-based labs, forming a decentralized yet highly coordinated network.

Several factors are propelling the growth of this market: an aging population with rising comorbidities, increasing prevalence of chronic and infectious diseases, strong government investments in healthcare, and technological innovations such as AI-driven pathology, liquid biopsy, and next-generation sequencing (NGS). The market is also being shaped by an expanding role for laboratories in drug discovery and development, personalized medicine, and support for clinical trials.

Key players such as SYNLAB, Eurofins Scientific, Cerba Healthcare, Roche Diagnostics, and Sonic Healthcare continue to dominate the landscape through M&A activity, digital integration, and international expansion. With governments across the European Union emphasizing data interoperability, precision medicine, and universal access, the market is well-positioned for sustained innovation and growth.

Major Trends in the Market

-

Adoption of AI and digital pathology to streamline diagnostics and address workforce shortages in pathology and radiology.

-

Expansion of personalized medicine and genomic diagnostics, increasing demand for specialized testing and companion diagnostics.

-

Growth in preventive health testing and wellness screening, supported by direct-to-consumer lab offerings.

-

Integration of laboratory services with clinical trial support, especially in oncology and rare disease research.

-

Rising importance of esoteric and molecular testing for oncology, hereditary diseases, and infectious disease panels.

-

Public-private partnerships (PPPs) and consolidation of lab networks to improve efficiency and standardize quality.

-

Cross-border sample transport and pan-European diagnostic networks, enabling fast turnaround for rare or high-complexity testing.

-

Decentralization of lab services through point-of-care and near-patient testing in rural and underserved areas.

Report Scope of Europe Clinical Laboratory Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 69.79 Billion |

| Market Size by 2033 |

USD 86.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test type, Service Provider, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

Germany; UK; France; Italy; RoE |

| Key Companies Profiled |

Eurofins Scientific; SYNLAB International GmbH; UNILABS; Quest Diagnostics Incorporated; Sonic Healthcare Limited; NeoGenomics Laboratories; ARUP Laboratories; Mayo Foundation for Medical Education and Research |

Key Market Driver: Aging Population and Chronic Disease Burden

One of the primary drivers of clinical laboratory services in Europe is the rising burden of chronic diseases among an aging population. According to Eurostat, over 21% of Europe’s population is aged 65 or older as of 2023, and this demographic trend is accelerating. Aging significantly increases the risk of conditions like cancer, cardiovascular disease, diabetes, and neurodegenerative disorders, which require ongoing diagnostic monitoring, therapeutic assessments, and early detection.

Clinical laboratories are crucial in supporting long-term care for these conditions, providing tools for baseline testing, therapy efficacy tracking, and comorbidity management. Routine panels in clinical chemistry, hematology, microbiology, and advanced biomarker testing help clinicians personalize treatment decisions. Simultaneously, geriatric health screening programs across countries such as Germany, France, and Italy are further driving demand for diagnostics as an integral component of population health strategies.

Key Market Restraint: Fragmented Infrastructure and Regulatory Heterogeneity

Despite its technological advancement, Europe’s clinical laboratory landscape is challenged by infrastructure fragmentation and regulatory heterogeneity. The presence of 27 different health systems under the European Union, each with unique policies, reimbursement schemes, and laboratory accreditation standards, complicates pan-European harmonization of lab services. While cross-border collaborations exist, labs must navigate distinct legal and regulatory environments, creating logistical and administrative hurdles.

Furthermore, in countries with decentralized healthcare models, access to high-quality lab services can vary significantly between urban and rural regions. Smaller or publicly operated labs may lack the funding to invest in high-throughput technologies or next-generation molecular platforms. The slow adoption of digital platforms, workforce shortages, and limited interoperability between laboratory information systems (LIS) further inhibit operational scalability, particularly for complex testing like genomics or advanced microbiology.

Key Market Opportunity: AI and Automation in Laboratory Diagnostics

A transformative opportunity in the Europe clinical laboratory services market lies in the adoption of artificial intelligence (AI) and automation technologies to improve diagnostic speed, accuracy, and efficiency. As demand for testing grows—particularly in oncology, infectious diseases, and rare disorders—labs are increasingly turning to AI-enabled systems for image analysis, pathology interpretation, and workflow optimization.

In March 2024, SYNLAB launched a continent-wide AI-powered diagnostics platform aimed at accelerating pathology reporting and enhancing early cancer detection. This platform integrates with lab data systems and leverages machine learning to support clinical decisions. Similarly, Cerba Healthcare and Roche Diagnostics are collaborating with AI firms to develop predictive models for biomarker-based disease progression and risk stratification.

Automation technologies including robotic sample processors, smart analytics, and real-time LIS are enabling laboratories to handle larger test volumes, reduce manual error, and improve turnaround times. These innovations not only support centralized labs but also expand the reach of diagnostic services into remote settings, reinforcing health equity across Europe.

Europe Clinical Laboratory Services Market By Test Type Insights

Clinical chemistry is the dominant test type within the Europe clinical laboratory services market, owing to its foundational role in diagnosing and monitoring systemic diseases. Common tests such as blood glucose, renal function panels, liver enzymes, and lipid profiles are performed across nearly every clinical setting—from general practitioners to hospitals and specialty centers. As chronic diseases like diabetes and hypertension remain prevalent across Europe, clinical chemistry maintains consistent, high-volume demand. The widespread availability of automated analyzers and reagent systems further supports this segment’s dominance.

Human and tumor genetics is the fastest-growing segment, driven by increasing adoption of personalized medicine, cancer diagnostics, and hereditary disease screening. Next-generation sequencing (NGS), gene panels, and liquid biopsy techniques are being deployed for detecting genetic mutations, therapy response markers, and inherited conditions. Countries like France and the UK have launched national genomic initiatives (e.g., the 100,000 Genomes Project) that involve clinical laboratories in sequencing, data interpretation, and reporting. Growth in this segment is further propelled by rising awareness among clinicians and patients, falling test costs, and increased availability of companion diagnostics in oncology and rare disease care.

Europe Clinical Laboratory Services Market By Service Provider Insights

Hospital-based laboratories dominate the service provider segment, as they are embedded in clinical workflows and benefit from institutional resources, patient volumes, and access to critical care cases. In countries with robust public health systems like Germany, the UK, and Sweden hospital labs manage a majority of inpatient and emergency diagnostic loads. These labs are often equipped with automated systems, on-call staff, and direct integration with hospital EMRs, allowing rapid decision-making and continuity of care.

Standalone laboratories are the fastest-growing service providers, propelled by private-sector investments, diagnostic chain expansion, and public-private partnerships. Independent lab networks such as Eurofins, Unilabs, and Biogroup are offering specialized and esoteric testing, home sample collection, and B2C wellness testing across Europe. These labs have the flexibility to invest in cutting-edge technology, scale across borders, and build customized client interfaces. As consumer health trends and outpatient testing rise, standalone labs are becoming essential for meeting demand outside traditional hospital environments.

Europe Clinical Laboratory Services Market By Application Insights

Bioanalytical and laboratory chemistry services dominate, encompassing a broad range of routine, chronic care, and acute diagnostics. These services underpin nearly all branches of medicine and include tests for metabolic panels, enzyme levels, hormones, and electrolytes. The stability of this segment is reinforced by physician referrals, insurance coverage, and incorporation into national screening programs for cancer, cardiovascular disease, and metabolic syndromes. Large-scale laboratory networks across Germany, France, and the UK handle millions of samples monthly in this domain.

Cell and gene therapy-related services are emerging as the fastest-growing application, supported by Europe’s leadership in regenerative medicine and advanced therapy medicinal products (ATMPs). Clinical laboratories are increasingly being tapped for eligibility testing, biomarker screening, and vector analysis in CAR-T, stem cell, and gene-based trials. National agencies like EMA’s CAT (Committee for Advanced Therapies) are fostering a favorable regulatory landscape for such innovations. As these therapies transition from experimental to mainstream, clinical labs must adapt to support high-complexity, individualized diagnostics, signaling a high-growth frontier for lab services.

Country Insights

Germany – Dominant Market

Germany is the largest and most technologically advanced clinical laboratory services market in Europe. The country has a dense network of public and private diagnostic laboratories integrated with its statutory health insurance system, which ensures widespread access to diagnostics. Key players such as SYNLAB, LADR Group, and Medicover operate hundreds of facilities across Germany, offering services from routine chemistry to advanced molecular testing. Germany's commitment to digital health, strict regulatory oversight (via RKI and PEI), and government initiatives in cancer genomics and precision diagnostics strengthen its leadership position in the European lab ecosystem.

France – Fastest-Growing Market

France is emerging as the fastest-growing market due to aggressive consolidation in the diagnostics sector, public health investments, and a growing emphasis on personalized diagnostics. The country is home to major players like Cerba Healthcare and Biogroup, both of which have expanded rapidly through acquisitions and cross-border partnerships. In the wake of COVID-19, France made significant investments in lab capacity, molecular testing, and data interoperability, which are now being leveraged to scale genomic and rare disease diagnostics. National efforts to digitize laboratory services and link them with electronic health records (EHR) are driving innovation and growth.

Recent Developments

-

March 2024 – SYNLAB announced the rollout of a continent-wide AI-powered diagnostics platform, designed to enhance early cancer detection and pathology workflows across Germany, France, and Spain.

-

February 2024 – Cerba Healthcare acquired a leading specialty lab in Italy to expand its esoteric testing capabilities, including endocrinology, toxicology, and rare autoimmune diseases.

-

January 2024 – Eurofins Scientific launched a new NGS lab in Belgium, supporting personalized oncology testing, liquid biopsies, and pharmacogenomic panels in partnership with regional hospitals.

-

December 2023 – Medicover Diagnostics upgraded its German labs with robotic systems and LIS integration to improve turnaround times for high-volume tests in metabolic and infectious diseases.

-

November 2023 – Roche Diagnostics collaborated with several academic centers in the UK and Netherlands to launch pilot studies using digital pathology AI for early-stage breast cancer detection.

Some of the prominent players in the Europe clinical laboratory services market include:

- Eurofins Scientific

- SYNLAB International GmbH

- UNILABS

- Quest Diagnostics Incorporated

- Sonic Healthcare Limited

- NeoGenomics Laboratories

- ARUP Laboratories

- Mayo Foundation for Medical Education and Research

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe clinical laboratory services market

Test Type

- Human & Tumor Genetics

- Clinical Chemistry

- Medical Microbiology & Cytology

- Other Esoteric Tests

Service Provider

- Hospital-based Laboratories

- Standalone Laboratories

- Clinic-based Laboratories

Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

Country

- Germany

- UK

- France

- Italy

- RoE