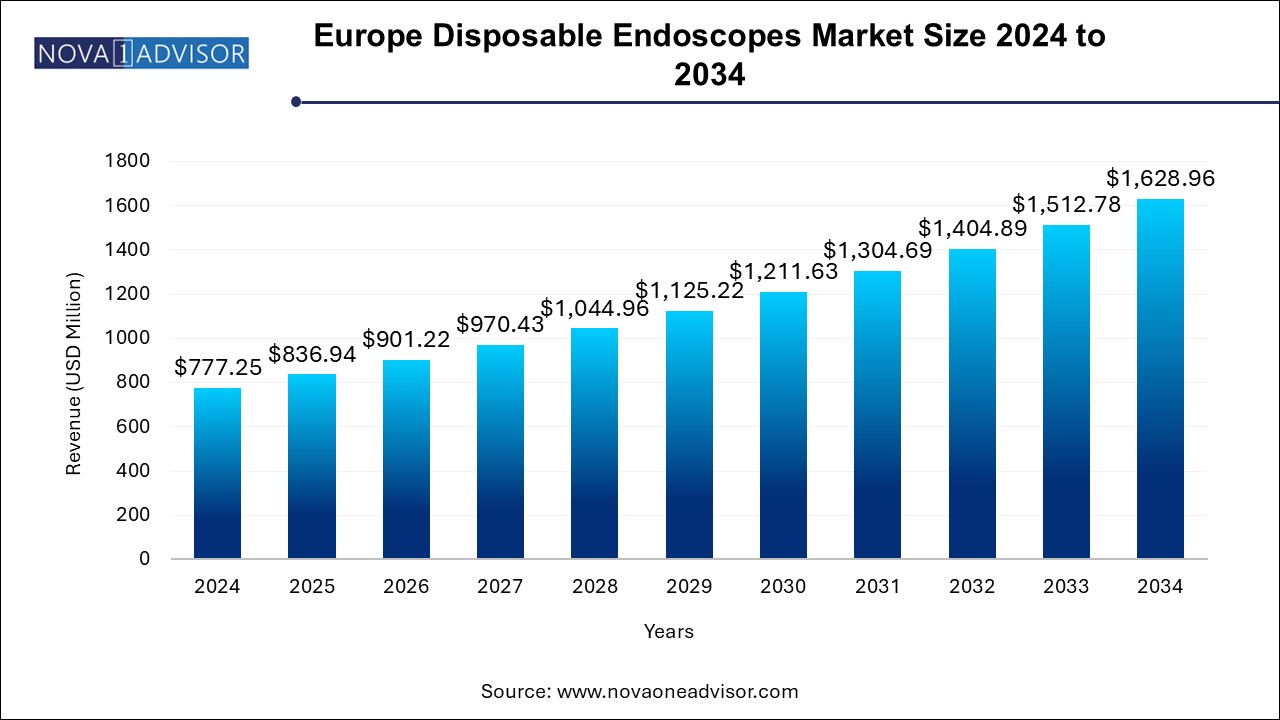

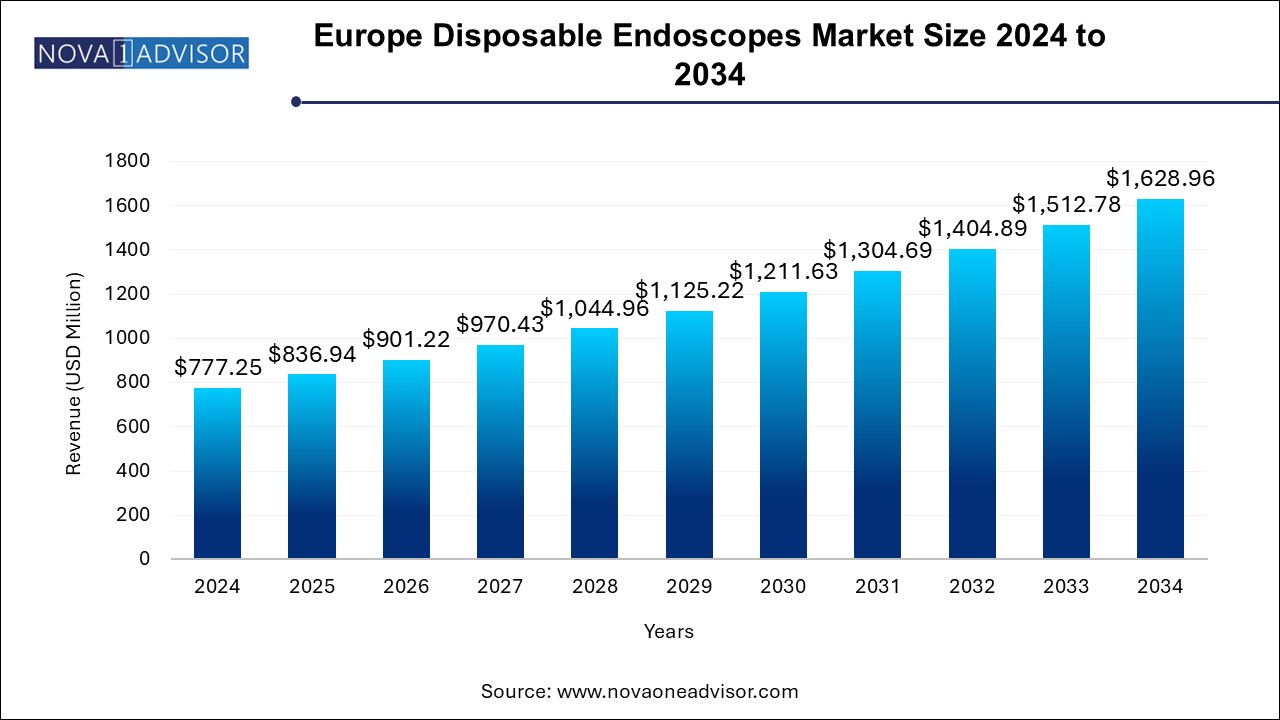

Europe Disposable Endoscopes Market Size and Growth

The Europe disposable endoscopes market size was exhibited at USD 777.25 million in 2024 and is projected to hit around USD 1628.96 million by 2034, growing at a CAGR of 7.68% during the forecast period 2024 to 2034.

Europe Disposable Endoscopes Market Key Takeaways:

- The gastrointestinal endoscopes segment dominated the market with a revenue share of 56.8% in 2024.

- The Laparoscopes segment is expected to witness the fastest CAGR growth from 2024 to 2034.

- The outpatient facilities segment dominated the market and accounted for the largest revenue share of 54.0% in 2024.

- Hospital segment is anticipated to register a significant growth from 2024 to 2034.

Market Overview

The Europe disposable endoscopes market is witnessing significant growth due to the rising adoption of minimally invasive surgeries across various medical specialties, including gastroenterology, urology, and gynecology. Disposable endoscopes, which offer reduced risk of infection and the convenience of avoiding sterilization, are gaining traction in hospitals and outpatient facilities. The increasing awareness about hygiene and patient safety is pushing healthcare providers in Europe to shift toward disposable devices. Additionally, advancements in endoscopic technologies, such as improved image quality, flexibility, and maneuverability, are contributing to the market’s expansion.

Major Trends in the Market

- Technological Advancements: Continuous improvements in endoscope imaging quality and flexibility.

- Growth in Minimally Invasive Surgeries: Surge in the number of surgeries performed with minimal incisions, driving endoscope usage.

- Increased Use in Outpatient Facilities: Rising adoption of disposable endoscopes in outpatient settings for convenience and cost-effectiveness.

- Focus on Infection Control: Growing emphasis on preventing cross-contamination, driving demand for single-use, disposable endoscopes.

- Regulatory Changes: Stricter regulations around healthcare-associated infections (HAIs) encouraging the use of disposable endoscopes to ensure patient safety.

Report Scope of Europe Disposable Endoscopes Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 836.94 Million |

| Market Size by 2034 |

USD 1628.96 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 7.68% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation, Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc. |

Driver: Rising Demand for Minimally Invasive Surgeries

The demand for minimally invasive surgeries is one of the key drivers of the Europe disposable endoscopes market. These surgeries are gaining popularity because they require smaller incisions, result in shorter recovery times, and offer reduced post-surgical complications compared to traditional open surgeries. As a result, there is a growing reliance on endoscopic devices to perform these procedures. Disposable endoscopes are especially preferred in such surgeries as they eliminate the need for sterilization between uses, enhancing both convenience and patient safety. With the continued expansion of minimally invasive procedures across various medical fields, disposable endoscopes are becoming an essential part of modern healthcare.

Restraint: High Cost of Disposable Endoscopes

A key restraint in the Europe disposable endoscopes market is the high cost of these devices. While disposable endoscopes offer enhanced hygiene and convenience, they are significantly more expensive than reusable models. This higher cost can be a barrier, especially in regions with budget constraints, where healthcare providers may opt for reusable endoscopes as a cost-saving measure. Furthermore, while the cost of reusable endoscopes is typically spread over many uses, disposable models require repeated purchasing, which can become an expensive practice for hospitals and outpatient centers. This financial consideration can limit the adoption of disposable endoscopes, especially in smaller healthcare facilities.

Opportunity: Technological Advancements in Endoscopic Devices

Technological advancements in disposable endoscopes present a major opportunity for the market. Innovations in optics, image resolution, and flexibility have made disposable endoscopes increasingly comparable to reusable models in terms of performance. Additionally, improvements in materials and manufacturing processes are leading to stronger and more durable disposable endoscopes. These advancements are driving greater adoption in healthcare facilities across Europe, as they improve the quality of procedures and provide better diagnostic capabilities. The growing demand for technologically advanced medical devices offers an opportunity for companies to innovate and develop next-generation disposable endoscopes, further expanding their market share.

Europe Disposable Endoscopes Market By Type Insights

The gastrointestinal endoscopes segment dominated the market with a revenue share of 56.8% in 2024. The increasing prevalence of gastrointestinal diseases such as colorectal cancer, gastroesophageal reflux disease (GERD), and irritable bowel syndrome (IBS) is driving the demand for gastrointestinal endoscopies. The need for frequent screening procedures like colonoscopies and gastroscopies further boosts the demand for disposable models in hospitals and outpatient centers. Disposable gastrointestinal endoscopes offer enhanced infection control and reduce the risk of cross-contamination, making them the preferred choice for healthcare providers. Given the large number of patients requiring regular gastrointestinal screenings, this segment continues to dominate the European market.

The Laparoscopes segment is expected to witness the fastest CAGR growth from 2024 to 2034. Laparoscopic surgery, which is minimally invasive, has gained widespread adoption in various specialties such as gynecology, urology, and general surgery. Disposable laparoscopes provide a cost-effective, hygienic, and convenient solution, particularly in outpatient facilities where maintaining high levels of sterilization is a challenge. As the demand for laparoscopic surgeries continues to rise, especially in countries with advanced healthcare systems like Germany and the UK, the disposable laparoscopes segment is experiencing rapid growth. These endoscopes are gaining popularity due to their performance and the increased patient preference for minimally invasive procedures.

Europe Disposable Endoscopes Market By End-use Insights

The outpatient facilities segment dominated the market and accounted for the largest revenue share of 54.0% in 2024. With the increasing number of minimally invasive procedures being performed outside of hospitals, outpatient centers are increasingly adopting disposable endoscopes. These facilities benefit from the convenience, cost-effectiveness, and reduced sterilization needs that disposable devices offer. The rise of procedures such as colonoscopies, gastroscopies, and bronchoscopies in outpatient settings, driven by an aging population and a greater emphasis on early detection, is further propelling the growth of this segment. As outpatient care continues to expand, disposable endoscopes are becoming an integral part of this sector's success.

Hospital segment is anticipated to register a significant growth from 2024 to 2034. Hospitals are the primary centers for complex surgeries, and their demand for disposable endoscopes is driven by the need to maintain a sterile environment and minimize the risk of infections during diagnostic and therapeutic procedures. The high cost of maintaining and sterilizing reusable endoscopes also influences hospitals to opt for disposable versions, particularly in high-volume surgical departments. As healthcare systems in Europe continue to prioritize infection control, hospitals will remain the largest consumers of disposable endoscopes, ensuring their dominance in the market.

Some of the prominent players in the Europe disposable endoscopes market include:

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

Europe Disposable Endoscopes Market Recent Developments

-

March 2025: Olympus Corporation announced the launch of a new range of disposable endoscopes with enhanced image clarity and a more ergonomic design. These devices are aimed at improving diagnostic outcomes in minimally invasive procedures.

-

February 2025: Medtronic introduced a new line of disposable laparoscopes designed for use in outpatient settings. The product features an affordable, high-quality imaging system that makes laparoscopic surgery more accessible to smaller healthcare facilities.

-

January 2025: Stryker Corporation expanded its disposable endoscope product offerings by releasing a series of disposable urology and gynecology endoscopes, designed to cater to the growing demand in these specialties.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe disposable endoscopes market

Type

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Otoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

-

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

End-use

- Hospitals

- Outpatient facilities

Regional

-

- Germany

- UK

- Spain

- Italy

- France

- Denmark

- Norway

- Sweden