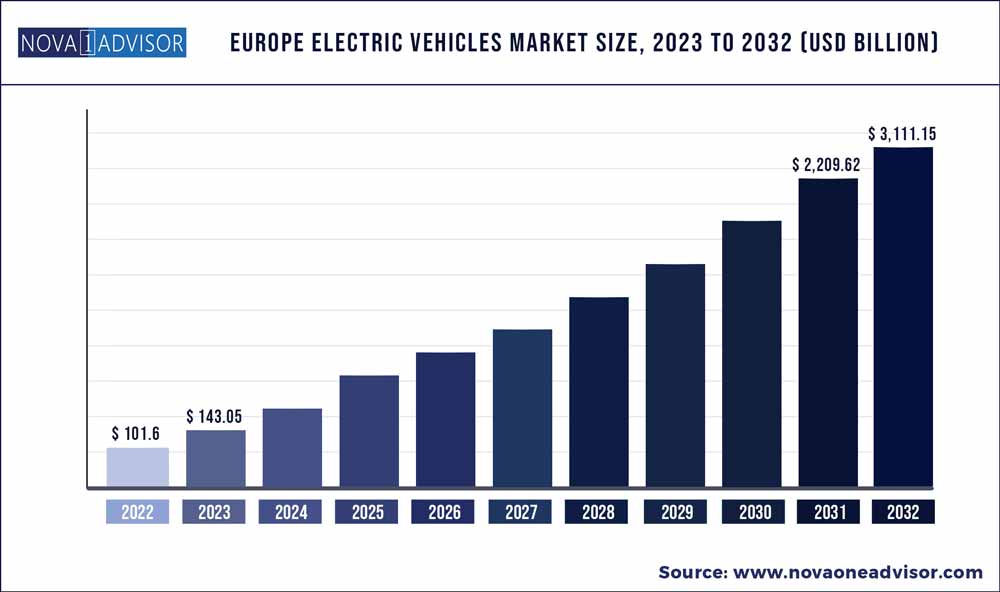

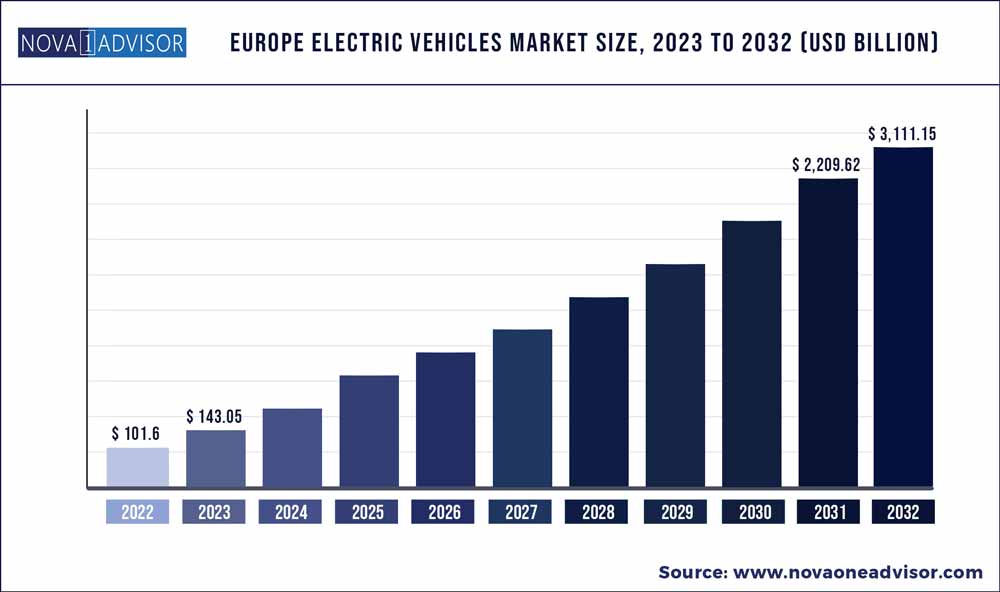

The Europe electric vehicles market size was estimated at USD 101.6 billion in 2022 and is expected to hit around USD 3,111.15 billion by 2032, poised to reach at a notable CAGR of 40.8% during the forecast period 2023 to 2032.

Europe Electric Vehicles Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 143.05 Billion |

| Market Size by 2032 |

USD 3,111.15 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 40.8% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Vehicle Type , Propulsion Type, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BMW AG, AUDI AG., Ford Motor Company, Mercedes-Benz Group AG., BYD Company Ltd., Geely Auto, Hyundai Motor Company, MITSUBISHI MOTORS CORPORATION., Nissan Motor Co., Ltd., Renault, Tesla, Volvo Car Corporation, Volkswagen AG |

The European electric vehicles (EV) market refers to the industry and market segment focused on electric-powered vehicles in Europe. It consists of the production, sale, and adoption of electric cars, electric buses, electric motorcycles, and other electric-powered vehicles across European countries. The market includes both battery-electric vehicles (BEVs), which run solely on electricity, and plug-in hybrid electric vehicles (PHEVs), which combines electric and internal combustion engine power. The European EV market has experienced significant growth in recent years, driven by government incentives, stricter emissions regulations, increasing environmental awareness, and advancements in EV technology. It includes various manufacturers, charging infrastructure providers, and supportive policies that aim to accelerate the transition to sustainable transportation and reduce carbon emissions.

The trend towards sustainable transportation is contributing to the growth of the electric vehicle market in Europe. Many consumers are now turning to electric vehicles as an eco-friendly alternative to traditional petrol or diesel vehicles. Advanced and efficient battery technology is important for the growth of the electric vehicle market. For instance, according to European Automobile Manufacturers' Association (ACEA) in 2022, the European car market declined for a while, yet the registrations of new electric vehicles kept on growing in terms of numbers and continued the growth trend. Moreover, the market share of EVs increased to 12.1% which was 3.0% better than the previous year.

The availability of more charging stations across Europe is facilitating the ownership and use of electric vehicles. By increasing the infrastructure for charging electric vehicles, fears about running out of electricity while driving are removed. Electric vehicles are becoming a feasible option for a wider group of consumers since there are more charging stations available. The growing availability of charging stations is fueling the demand for electric vehicles and fostering the expansion of the Europe market. For instance, In July 2021, the European Union introduced the "Fit for 55 Package," explaining its ambitious goals for reducing emissions and combating climate change. The package aims to achieve a minimum 55% reduction in emissions by 2032, measured against 1990 levels. In addition, the EU envisions becoming the world's first climate-neutral continent by 2050, striving for a balance between emissions produced and emissions removed from the atmosphere. These targets demonstrate the EU's commitment to leading global efforts in addressing climate change and transitioning to a sustainable, carbon-neutral future.

The growth of the electric car sector in Europe is being significantly aided by partnerships between automobile makers. Collaborations and alliances enable the sharing of assets, knowledge, and technology, growing the production and adoption of electric vehicles. With the use of joint ventures and strategic alliances, businesses are splitting the cost of infrastructure creation, infrastructure maintenance, and infrastructure research, lowering the price of and increasing customer access to electric vehicles. For instance, NIO, a leading Chinese electric vehicle manufacturer, and Shell, a global energy company, jointly launched the first electric vehicle battery swap station in Europe in April 2023. This innovative service allows NIO EV owners to quickly exchange their depleted batteries for fully charged ones, eliminating the need for lengthy charging times. The battery swap station aims to enhance the convenience and accessibility of electric vehicle usage, further promoting the adoption of electric vehicles in Europe.

The global COVID-19 pandemic has had an impact on the European electric vehicle market, as lockdown procedures enacted in numerous important European nations have forced the closure of electric vehicle manufacturing facilities. Production, supply chains, and the general market were all affected by the limitations and closures. Electric vehicle availability was hampered as consumer demand couldn't be met quickly due to the temporary closure of manufacturing facilities.

The electric vehicle market in Europe is experiencing significant growth owing to the countries such as the UK and Germany, implementing favorable policies, incentives, and investments to promote the adoption of electric vehicles. With robust charging infrastructure, government support, and a growing awareness of environmental benefits, the electric vehicle market in these countries is expanding rapidly. The increased availability of electric vehicle models and improved range capabilities further contribute to the growth.

Some of the prominent players in the Europe Electric Vehicles Market include:

- BMW AG

- AUDI AG.

- Ford Motor Company

- Mercedes-Benz Group AG.

- BYD Company Ltd.

- Geely Auto

- Hyundai Motor Company

- MITSUBISHI MOTORS CORPORATION.

- Nissan Motor Co., Ltd.

- Renault

- Tesla

- Volvo Car Corporation

- Volkswagen AG

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Europe Electric Vehicles market.

By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Propulsion Type

- Battery Electric

- Hybrid Electric

By End Use

By Region

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway