Europe Funeral Homes and Services Market Size and Growth 2026 to 2035

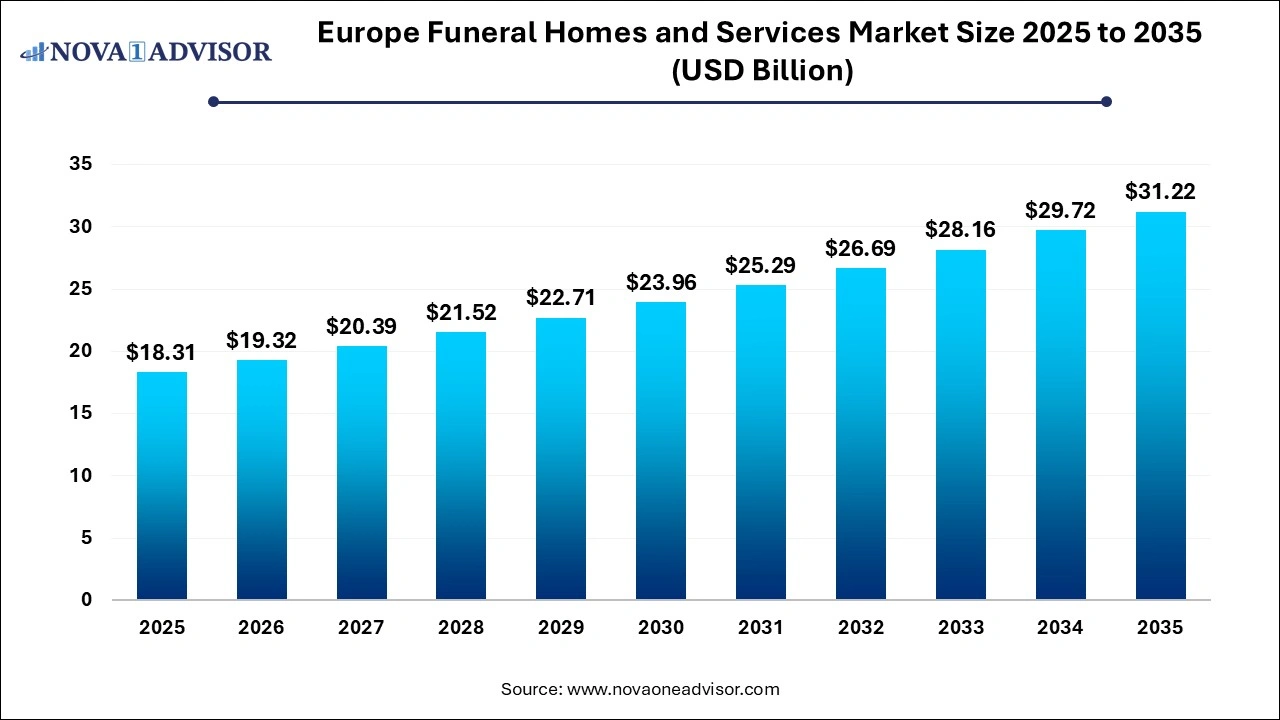

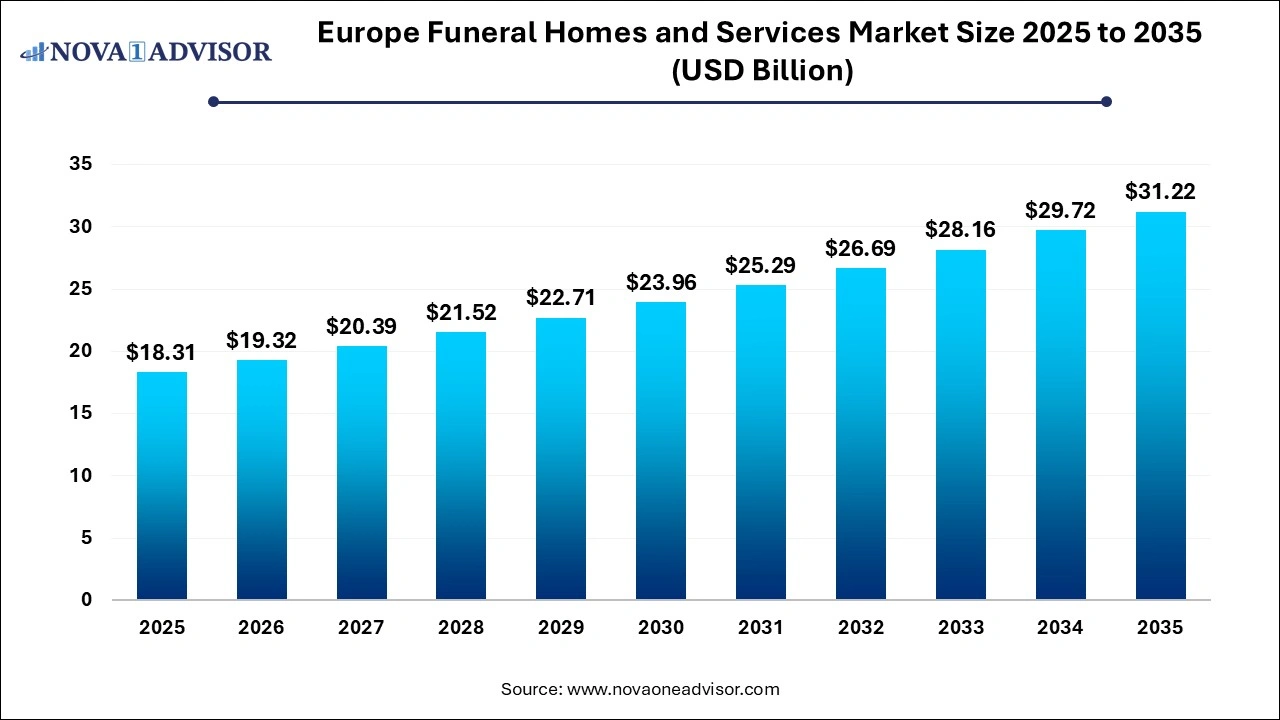

The Europe funeral homes and services market size was exhibited at USD 18.31 billion in 2025 and is projected to hit around USD 31.22 billion by 2035, growing at a CAGR of 5.48% during the forecast period 2026 to 2035. The growth the Europe funeral homes and services market is driven by rising mortality rates, evolving consumer needs and increased acceptance of cremation.

Europe Funeral Homes and Services Market Key Takeaways:

- Based on services, the funeral homes segment held the largest revenue share of over 60.97% in 2025.

- Based on ownership, the family-owned funeral homes segment held the largest revenue share of over 52.36% in 2025.

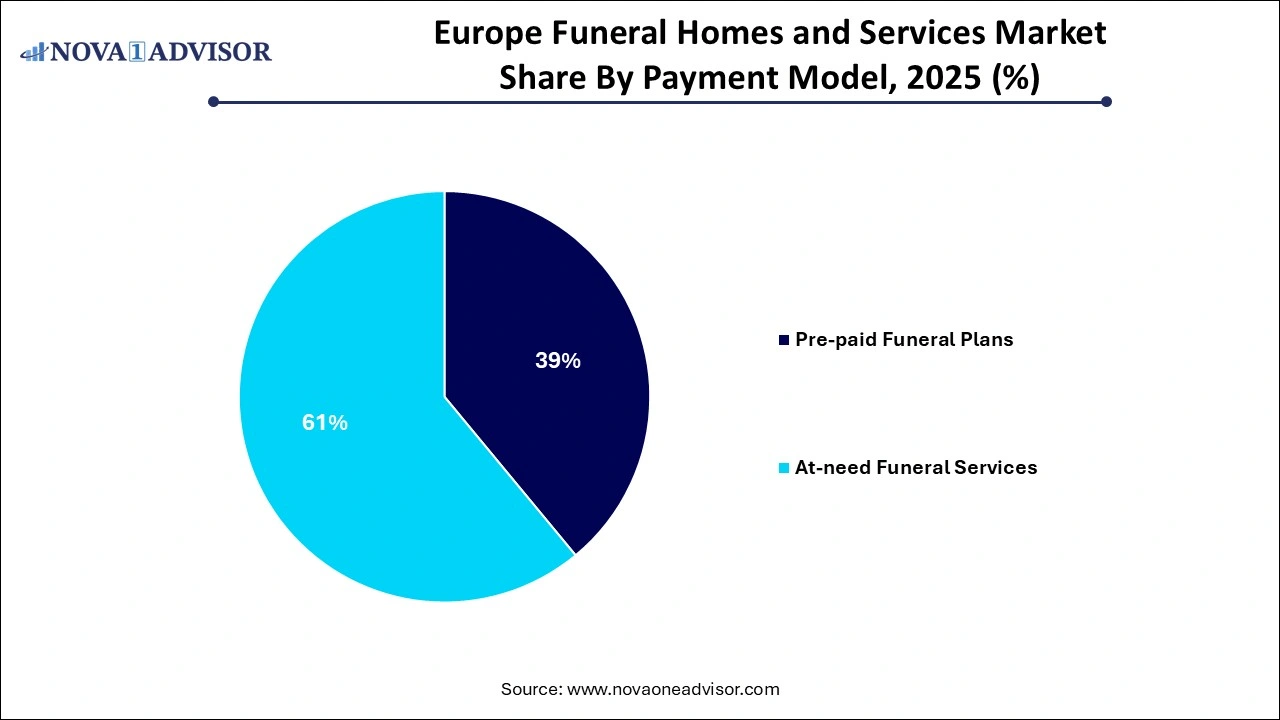

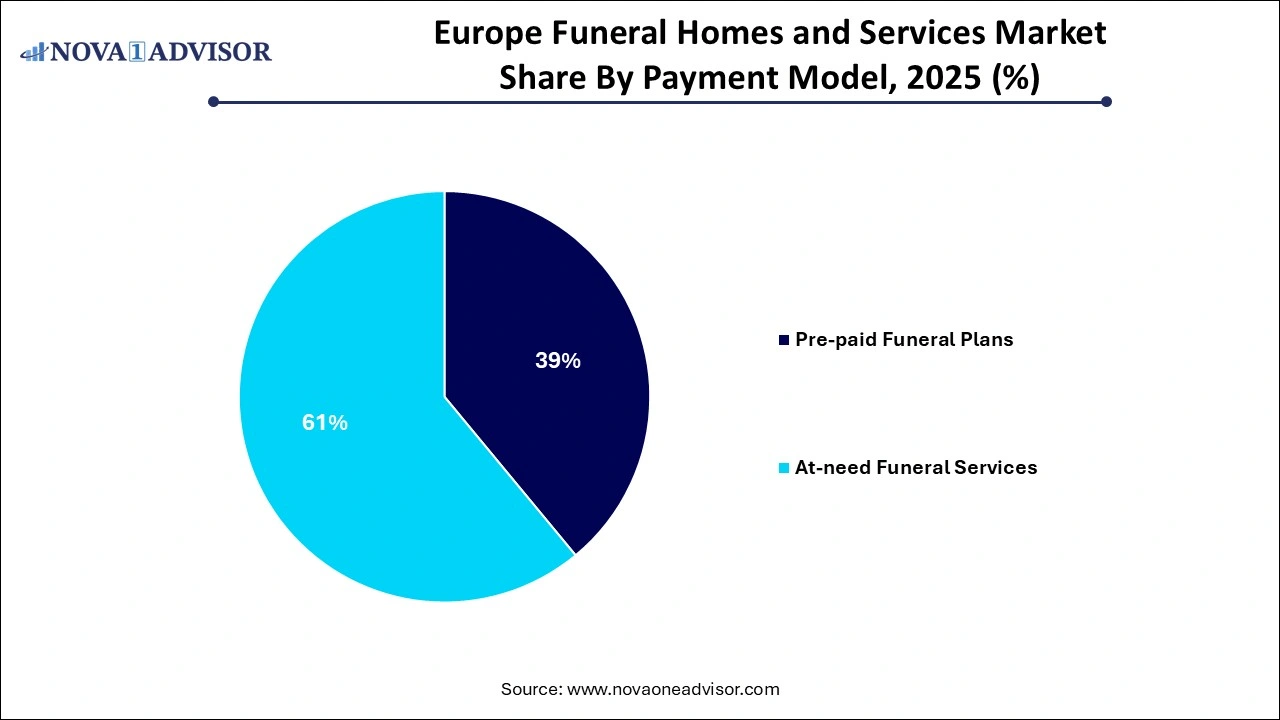

- Based on payment model, the at-need funeral services segment held the largest revenue share of over 61% in 2025.

- The pre-paid funeral plans segment is anticipated to grow at the fastest CAGR over the forecast year.

Europe Funeral Homes and Services Market Overview

The Europe funeral homes and services market is an essential segment within the broader death care industry, encompassing a range of services from traditional funeral ceremonies to cremation, pre-planning, green burials, and memorialization. This sector plays a crucial socio-cultural role in facilitating end-of-life rituals and providing emotional, spiritual, and logistical support to grieving families. Across Europe, a steadily aging population, increasing mortality rates, and evolving consumer preferences are driving a structural transformation in how funeral services are conceptualized and delivered.

In recent decades, the European funeral landscape has seen a gradual shift from rigid traditional customs to more personalized, sustainable, and cost-effective services. Cremation rates are rising across the region, especially in countries like the UK, Switzerland, and the Netherlands, while interest in eco-friendly or “green” funerals has seen significant growth in Scandinavia and Western Europe. Pre-paid and pre-planned funeral arrangements are gaining popularity as aging individuals and their families seek to alleviate financial and emotional stress during bereavement.

The market includes a diverse range of providers—from centuries-old family-run funeral homes that emphasize local traditions to multinational corporations offering scalable and standardized services. Digitalization is also influencing the market, with online memorials, virtual funeral planning, and e-commerce platforms for urns and caskets emerging as new industry verticals. The COVID-19 pandemic further accelerated innovation in remote services and prompted a reevaluation of capacity planning, health compliance, and customer engagement strategies.

Governments across Europe regulate the sector stringently, ensuring public health, consumer protection, and cultural integrity. However, policy frameworks vary widely, with some countries encouraging privatization and market competition, while others maintain tightly controlled municipal systems. Against this backdrop, the funeral homes and services industry in Europe is navigating a complex but opportunity-rich terrain defined by demographic inevitability, cultural transition, and technological adaptation.

Major Trends in the Europe Funeral Homes and Services Market

-

Rising Cremation Rates Across Europe: Many European countries are transitioning from traditional burials to cremation due to cost, environmental impact, and shifting beliefs.

-

Surge in Green and Eco-Friendly Funerals: Biodegradable caskets, natural burial grounds, and carbon-neutral services are increasingly in demand, especially in the Nordic countries.

-

Growth in Pre-paid and Pre-planned Services: Consumers are planning their funerals in advance to control costs and reduce the emotional burden on their families.

-

Digitalization of Funeral Services: Online funeral planning, live-streamed memorials, and digital tributes are becoming mainstream across Europe.

-

Consolidation Among Funeral Homes: Corporate acquisitions and partnerships are reducing fragmentation, with large players gaining market share across borders.

-

Diversification of Funeral Offerings: Providers are expanding into grief counseling, legacy services, and personalized event planning.

-

Cultural Diversification in Urban Centers: Multiculturalism is shaping funeral formats and services in metropolitan areas to cater to diverse ethnic and religious communities.

-

Post-pandemic Service Innovation: Hybrid funeral events (in-person and virtual) and contactless arrangements are being adopted widely.

How Are Fundraisers Influencing Europe’s Funeral Homes and Services Market?

Fundraisers usually refer to individuals, groups or private organizations raising money for a cause. In Europe, the rise of online crowdfunding platforms such as JustGiving and WhyDonate are increasing access to financial support for individuals and families for covering funeral expenses, further expanding potential client base for funeral homes by enabling a dignified funeral service to more people. Increased penetration of digital technologies and social media influence are amplifying the reach of fund raising campaigns. Government initiatives such as the Funeral Expenses Payment in UK indirectly contribute to the market growth.

Predictable cashflows in the funeral industry is attracting investments by various organizations. Private equity firms in Europe are actively investing in funeral homes and crematoria to strengthen and expand their geographical presence. Significant capital brought by private equity fuels the infrastructure development in funeral services market with modern facilities and integration of digital technologies.

Report Scope of Europe Funeral Homes and Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 19.32 Billion |

| Market Size by 2035 |

USD 31.22 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.48% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Services, By Ownership, By Payment Model |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Service Corporation International (Dignity Memorial); Funecap Group; OGF Groupe; Dignity; Mémora Group; Mapfre's Funespaña (Enalta); Albia Servicios Funerarios; Co-op Funeralcare; Westerleigh Group; Funeral Partners Ltd. (Includes LM Funerals after acquisition); Pütz-Roth; Àltima; Fonus; Grupo ASV Funeral Services; Ahorn Group; Berlin Memorial Funeral Home; mymoria GmbH; Pure Cremation; Memento Funeral Chapel; Friedhöfe Wien GmbH; Sereni NV |

Europe Funeral Homes and Services Market

Driver

Demographic Aging and Increasing Mortality Rates

One of the most fundamental drivers of the Europe funeral homes and services market is the demographic shift toward an older population. Eurostat projections indicate that by 2030, more than one-quarter of Europeans will be aged 65 or older. With life expectancy stabilizing and birth rates remaining low, the continent is seeing a natural rise in mortality rates, particularly in countries with significant aging populations such as Germany, Italy, and France.

This demographic trend is not only increasing the absolute number of deaths annually but also reshaping consumer needs and expectations. Aging individuals are becoming more proactive in planning their end-of-life journeys, opting for services that align with their personal values and spiritual beliefs. The growing senior population is also fueling demand for pre-paid funeral plans, which offer financial predictability and customization. In essence, demographic aging is expanding the market while simultaneously diversifying its offerings and deepening its societal relevance.

Restraint

Cultural Sensitivity and Regulatory Fragmentation

A major restraint affecting the European funeral services market is the significant variation in cultural norms and legal frameworks across countries. Funeral customs remain deeply rooted in religious, ethnic, and regional identities. For example, while cremation is prevalent in the UK and Sweden, it remains relatively rare in Greece and parts of Eastern Europe due to religious doctrines and societal norms. These cultural factors influence service demand, pricing structures, and even permissible funeral practices.

Regulatory fragmentation adds another layer of complexity. Countries like France have stringent municipal controls over funeral services, while others like the UK allow for privatized and competitive market models. This creates a difficult operating environment for multinational firms seeking to scale across borders. Additionally, licensing requirements, cemetery zoning laws, and environmental regulations vary considerably, complicating efforts to standardize operations and innovate uniformly across the continent.

Opportunity

Expansion of Digital Funeral Platforms and Virtual Planning

Digitalization presents a compelling opportunity for funeral homes and service providers in Europe. A new generation of tech-savvy consumers, especially younger family members planning services on behalf of aging relatives, is increasingly turning to digital platforms for research, price comparison, and service booking. As a result, companies offering online funeral planning tools, digital legacy management, and virtual ceremony coordination are gaining traction.

Startups and established players alike are integrating features like virtual memorials, video tributes, and live-streamed services—particularly valuable in an era of global mobility and remote participation. Digital funeral platforms also enable personalized planning interfaces, where users can customize caskets, select music, and plan eco-conscious farewells in just a few clicks. This growing market for end-to-end digital solutions is bridging accessibility gaps, enhancing customer experience, and opening doors for cross-border service integration.

Europe Funeral Homes and Services Market Segmental Insights

By Services Insights

Traditional funeral services dominate the European market, as many consumers continue to prefer in-person ceremonies that adhere to established cultural and religious norms. These services typically include viewings, religious rituals, eulogies, processions, and burials, supported by professional staff and funeral directors. Despite the rise of alternative formats, traditional funerals remain a standard for many families, particularly in Southern Europe, where religious institutions maintain a strong societal role. These services provide closure and community support, and funeral homes that specialize in managing these complex, often multi-day events maintain strong market positioning.

Green and environmental funerals are the fastest-growing sub-segment, gaining momentum in environmentally conscious countries like Sweden, Norway, the Netherlands, and parts of Germany. These services avoid embalming chemicals, use biodegradable caskets, and often take place in natural burial grounds without headstones or markers. Consumers seeking minimal environmental impact or alternative spirituality are increasingly attracted to these options. Funeral homes that offer natural options and carbon-neutral processes are capitalizing on this trend, often integrating green practices into their broader brand identity.

By Ownership Insights

Family-owned funeral homes continue to dominate the European market, particularly in rural areas and smaller cities. These businesses often have deep community ties, personalized services, and a strong reputation built over generations. Clients frequently choose them for their local knowledge, cultural sensitivity, and flexible pricing. Even in countries with growing corporate presence, many consumers prefer the empathy and familiarity that family-run establishments offer.

Corporate-owned funeral homes are the fastest-growing ownership segment, especially in Western and Northern Europe. Large players are acquiring independent operators or establishing branches in key metropolitan markets, offering standardized quality, digital convenience, and scalable services. These companies often provide package deals, loyalty programs, and integrated memorial planning, appealing to busy urban professionals. The trend toward corporate consolidation is expected to continue as margins shrink and operational complexity increases.

By Payment Model Insights

Based on payment model, the at-need funeral services segment held the largest revenue share of over 61.0% in 2025. This model remains prevalent due to the sudden nature of many deaths and cultural tendencies to avoid discussing end-of-life planning. Families rely on immediate service providers to guide them through the process, often selecting from bundled packages offered by funeral homes. Despite rising costs, this model continues to thrive, especially among older populations unfamiliar with pre-paid options.

Pre-paid funeral plans are the fastest-growing payment model, as consumers become more financially proactive and conscious of future expenses. These plans allow individuals to lock in today’s prices, specify service details, and reduce stress on surviving family members. Financial institutions and funeral homes are partnering to offer insurance-backed plans with installment options. The UK, France, and Germany are seeing the fastest uptake, driven by public awareness campaigns and supportive regulatory frameworks.

Country-Level Analysis

The Europe funeral homes & services market is primarily driven by an aging population and increasing death rates, particularly in countries with higher elderly demographics. As per a report by the Barcelona Institute for Global Health (ISGlobal), over 47,000 people lost their lives in Europe due to extreme heat in 2023, with the southern countries being the most affected. Cultural shifts towards personalized and eco-friendly funerals are anticipated to grow the industry. Consumers increasingly seek tailored services, including green burials and cremation alternatives, prompting funeral service providers to diversify offerings to align with these evolving preferences and environmental concerns.

- United Kingdom: The UK remains one of the most advanced funeral service markets in Europe, characterized by high cremation rates (over 70%), a growing pre-paid market, and digital service integration. The Funeral Planning Authority regulates pre-paid providers, ensuring transparency. Companies like Dignity PLC and Co-op Funeralcare dominate the corporate landscape, while online services like Pure Cremation are disrupting traditional models.

- Germany: Germany has a deeply regulated and tradition-focused funeral market. However, cremation is on the rise, and demand for eco-conscious funerals is growing. Local municipalities often control burial grounds, and consumer expectations revolve around dignity, order, and environmental stewardship. Family-run homes dominate but face pressure from digital startups offering lower-cost alternatives.

- France: French consumers rely heavily on family-owned operators, with funeral planning often bundled into insurance products. Funeral services are highly personalized, and legislation mandates transparency in pricing. Recent shifts toward cremation and eco-burials are challenging the traditional Catholic ceremony structure.

- Italy: Italy maintains a largely traditional market, with strong religious influence on rituals. However, regional variations exist, and cremation is gaining popularity in urban centers. The market remains fragmented, with most providers being local, family-operated homes.

- Scandinavia (Norway, Sweden, Denmark): These countries lead in environmental and green funeral practices. Cremation is widely accepted, and digital innovations in planning and memorialization are standard. Government regulations emphasize sustainability, and burial practices are often minimalistic and natural.

Some of the prominent players in the Europe funeral homes and services market include:

- Service Corporation International (Dignity Memorial)

- Funecap Group

- OGF Groupe

- Dignity

- Mémora Group

- Mapfre's Funespaña (Enalta)

- Albia Servicios Funerarios

- Co-op Funeralcare

- Westerleigh Group

- Funeral Partners Ltd. (Includes LM Funerals after acquisition)

- Pütz-Roth

- Àltima

- Fonus

- Grupo ASV Funeral Services

- Ahorn Group

- Berlin Memorial Funeral Home

- mymoria GmbH

- Pure Cremation

- Memento Funeral Chapel

- Friedhöfe Wien GmbH

- Sereni NV

Europe Funeral Homes And Services Market Recent Developments

-

On 20 March 2025, the official start of the work on the future crematorium in Thonon-les-Bains with the laying of the foundation stone was marked. The construction of establishment is driven by shortage of crematoriums compared to the high demand and services for the same will be provided by the Funecap company with construction cost of €3.5 million.

-

In February 2025, Funeral Partners successfully acquired Cornwall-based Personal Choice Funeral Directors, further expanding its geographical reach with potential for growth in future.

-

In October 2024, Dignity, a funeral service provider, acquired the U.K.-based end-of-life services provider, Farewill in an all-shares deal valued at $16.8 million.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Europe funeral homes and services market

Services

-

- Traditional Funeral Services

- Cremation Services

- Green/Environmental Funerals

- Pre-planned/Pre-paid Funeral Services

-

- Funeral Planning Services

- Direct Cremation

- Memorial Services

- Other Services

By Ownership

- Corporate-Owned Funeral Homes

- Family-Owned Funeral Homes

By Payment Model

- Pre-paid Funeral Plans

- At-need Funeral Services

By Country

- UK

- Germany

- France

- Italy

- Spain

- Norway

- Denmark

- Sweden

- Switzerland

- Netherland

- Czech Republic

- Hungary

- Belgium