Europe In Vitro Diagnostics Market Size and Trends

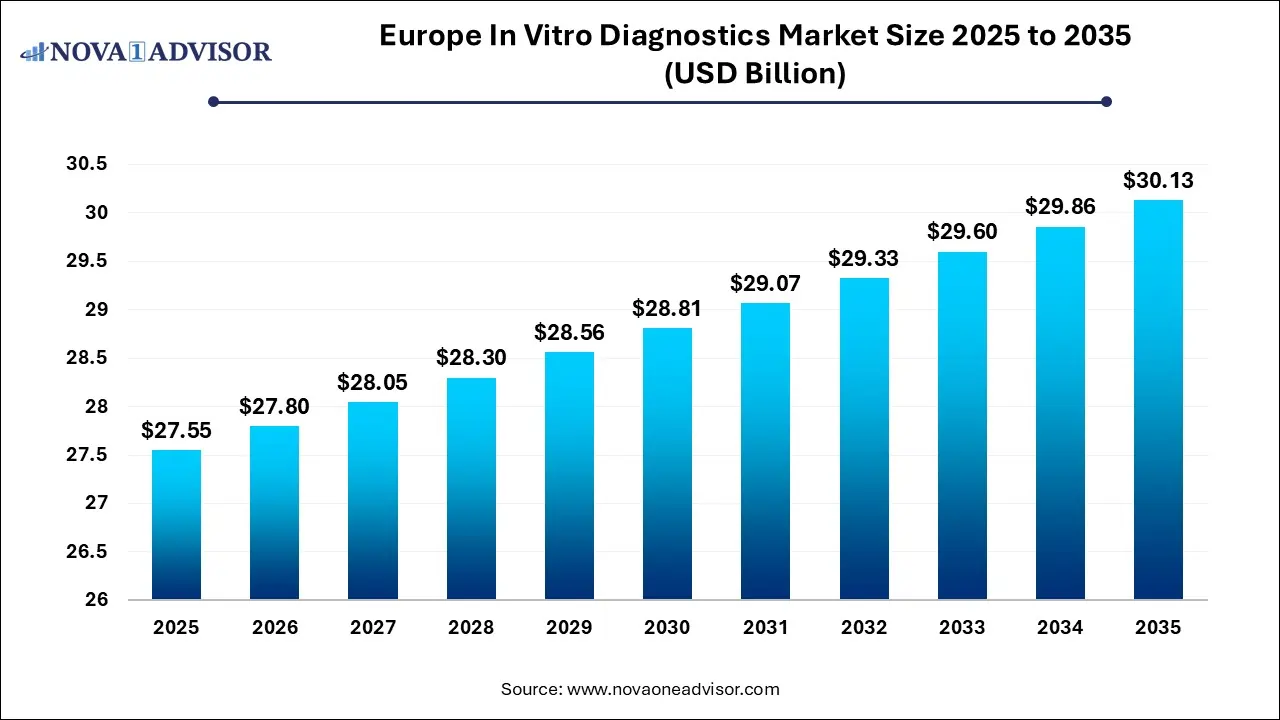

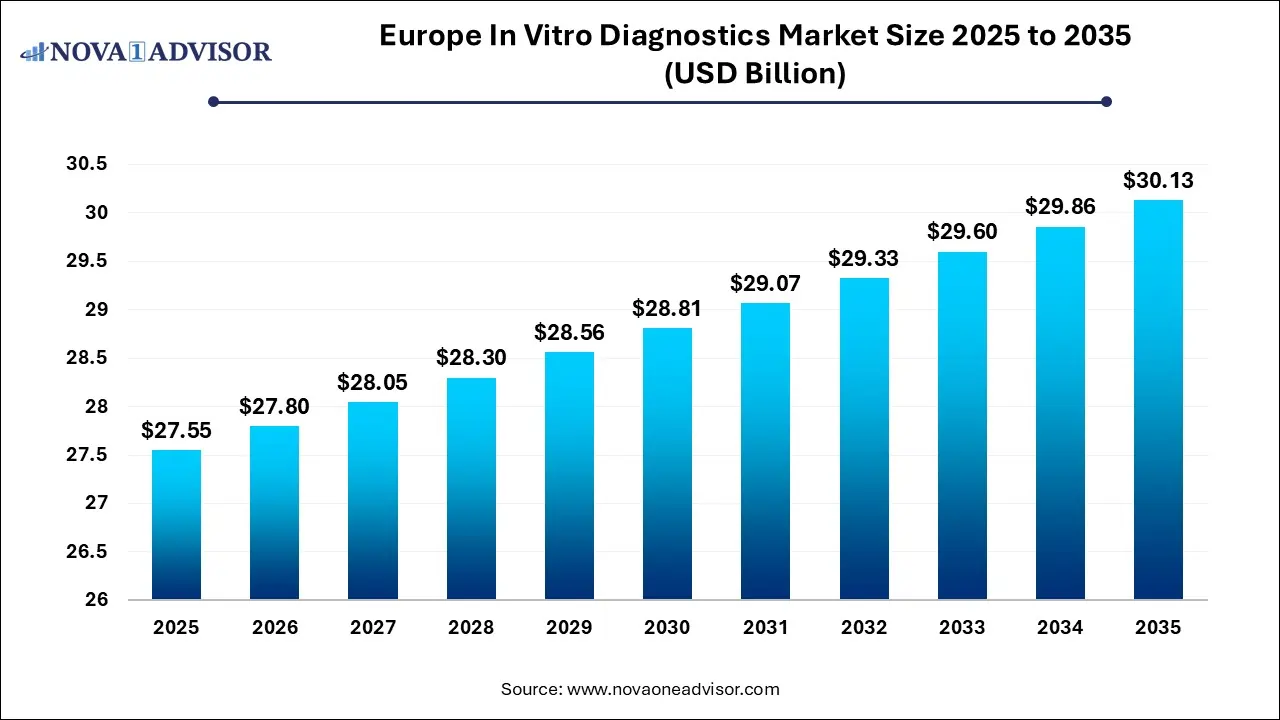

The Europe in vitro diagnostics market size was exhibited at USD 27.55 billion in 2025 and is projected to hit around USD 30.13 billion by 2035, growing at a CAGR of 0.9% during the forecast period 2026 to 2035.

Europe In Vitro Diagnostics Market Key Takeaways:

- The reagents segment dominated the market with a revenue share of around 65% in 2025.

- The instruments segment held the second largest share in 2025.

- The immunoassay segment held the largest revenue share of over 37.0% in 2025

- The microbiology and clinical chemistry segments are estimated to register the fastest CAGR of 4.4% over the forecast period of 2026 to 2035.

- The European in vitro diagnostics market is segmented by end use into hospitals, laboratories, home care, and others.

- The UK, France, Germany, and other countries have a large market for IVD.

Market Overview

The Europe In Vitro Diagnostics (IVD) Market is a dynamic and integral segment of the region’s healthcare industry. IVD involves the analysis of human samples such as blood, tissue, urine, and saliva for diagnosing diseases, monitoring health conditions, and guiding treatment decisions. From rapid point-of-care tests to complex molecular diagnostics, the role of IVD has expanded significantly, driven by the region’s emphasis on early detection, personalized medicine, and healthcare digitization.

As of 2025, Europe stands as one of the most mature IVD markets globally, with Germany, the UK, and France leading in terms of technological adoption and test volumes. The COVID-19 pandemic accelerated the adoption of molecular and antigen-based testing, and the post-pandemic landscape is witnessing continued investment in laboratory automation, multiplex assays, and home-based diagnostics. Chronic diseases such as diabetes, cardiovascular disorders, and cancer remain primary drivers of test demand, along with emerging applications in genetic screening and infectious disease surveillance.

European healthcare systems, being predominantly publicly funded, emphasize cost-effective, evidence-based care. This has increased the demand for diagnostic tools that not only improve clinical outcomes but also reduce downstream healthcare costs. The EU’s implementation of the In Vitro Diagnostic Regulation (IVDR) is also shaping the market, mandating higher standards of test validation and post-market surveillance.

Major Trends in the Market

-

Transition to Value-based Testing: IVD is increasingly judged on clinical utility, influencing reimbursement decisions and procurement strategies.

-

Rise of Point-of-Care Testing (POCT): Demand for rapid, decentralized testing is growing in outpatient clinics, pharmacies, and home settings.

-

Growth of Molecular Diagnostics: Applications in oncology, infectious diseases, and genetic disorders are fueling this high-precision segment.

-

IVD for Personalized Medicine: Companion diagnostics are being developed alongside targeted therapies, especially in oncology and autoimmune disorders.

-

Integration of AI and Automation: Automated platforms and AI-assisted image analysis are improving speed, accuracy, and standardization of results.

-

Regulatory Transformation under IVDR: Stricter EU regulations are requiring recertification, reshaping market access timelines and competitive dynamics.

-

Expansion of Home Diagnostics: Growth in over-the-counter (OTC) test kits for glucose, cholesterol, fertility, and COVID-19/flu is reshaping consumer behavior.

Report Scope of Europe In Vitro Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 27.80 Billion |

| Market Size by 2035 |

USD 30.13 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 0.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Technology, End use, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Bio-Rad Laboratories, Inc; Abbott; Sysmex Corporation; BD; BIOMÉRIEUX; Danaher; F. Hoffmann-La Roche Ltd; Siemens; QIAGEN; Thermo Fisher Scientific, Inc. |

Key Market Driver: Demand for Early and Accurate Disease Detection

The primary driver of the IVD market in Europe is the rising need for early and accurate disease detection. European countries are increasingly adopting preventive healthcare strategies to reduce the long-term burden of chronic and infectious diseases. Early-stage diagnosis not only improves prognosis but also lowers treatment costs and enhances quality of life.

For example, population-wide screening programs for cervical cancer (via HPV testing), colorectal cancer (through fecal occult blood tests), and diabetes (HbA1c monitoring) have become staples of preventive care across Europe. In the oncology space, liquid biopsy-based tests are gaining attention for their ability to detect cancer-associated mutations from a simple blood draw, enabling earlier intervention. IVD technologies also played a pivotal role during the COVID-19 pandemic, reinforcing their value as frontline tools in public health responses.

This emphasis on early diagnosis, combined with technological innovations in molecular testing and real-time analytics, continues to propel the market forward.

Key Market Restraint: Regulatory and Compliance Burdens under IVDR

A significant restraint in the European IVD market is the regulatory burden introduced by the new In Vitro Diagnostic Regulation (IVDR), which came into effect in May 2022. Replacing the previous In Vitro Diagnostic Directive (IVDD), IVDR introduces stricter requirements for clinical evidence, performance evaluation, and post-market surveillance. While this enhances patient safety and product reliability, it also increases compliance costs and time-to-market for manufacturers.

Many small and mid-sized diagnostic companies face resource constraints in recertifying existing products, developing new technical files, and maintaining post-market oversight. Even larger companies are recalibrating portfolios, withdrawing low-margin tests, and consolidating SKUs to manage regulatory overhead. Additionally, there are delays in notified body designations and capacity constraints, slowing down approvals and market entry of new technologies. This evolving regulatory environment, while beneficial in the long run, presents short- to mid-term growth challenges.

Key Market Opportunity: Expansion of Personalized and Companion Diagnostics

The most promising opportunity in the Europe IVD market lies in the expansion of personalized and companion diagnostics. With the rise of targeted therapies, particularly in oncology and autoimmune diseases, there is a growing need for diagnostic tests that predict drug response, guide treatment decisions, and monitor therapeutic efficacy.

Companion diagnostics, often co-developed with drugs, enable stratification of patients based on biomarker expression—ensuring only responsive individuals receive a given therapy. Europe is witnessing increased investment in biomarker discovery, genomic profiling, and multiplex assays that can assess multiple molecular targets simultaneously. For example, next-generation sequencing (NGS)-based panels are now being used to profile tumor mutations across multiple cancer types.

As the European Medicines Agency (EMA) promotes personalized medicine initiatives, diagnostic companies have the opportunity to partner with pharmaceutical firms, develop clinically validated assays, and play a central role in precision healthcare delivery.

Europe In Vitro Diagnostics Market By Product Insights

Reagents accounted for the largest share in the Europe IVD market, owing to their indispensable role in daily diagnostic operations across laboratories and hospitals. Reagents are used in immunoassays, PCR, hematology, clinical chemistry, and molecular diagnostics, and are frequently replenished, making them a recurring source of revenue. Their utility spans both routine and specialized tests, and companies are focusing on developing more stable, sensitive, and automation-compatible reagent kits to meet the growing test volumes in Europe.

Services are the fastest-growing product segment, especially those associated with data interpretation, remote diagnostics, and lab outsourcing. As healthcare systems focus on operational efficiency, hospitals and diagnostic centers are increasingly outsourcing test interpretation, digital pathology, and genomics services to specialized providers. This trend is further accelerated by the adoption of AI in image analysis and cloud-based platforms that facilitate centralized data review and reporting.

Europe In Vitro Diagnostics Market By Technology Insights

Immunology is the dominant technology in Europe’s IVD landscape, largely due to its widespread use in disease detection, hormone monitoring, infection screening, and allergy diagnostics. Enzyme-linked immunosorbent assays (ELISA), chemiluminescence assays, and lateral flow immunoassays are standard methods in most European labs. High specificity, scalability, and automation compatibility make immunology tests an essential part of laboratory menus, especially in centralized hospital labs.

Molecular diagnostics is the fastest-growing technology, spurred by demand for high-sensitivity pathogen detection, cancer genomics, and pharmacogenomics. Techniques such as real-time PCR, NGS, and digital PCR are transforming the detection of infectious agents (like HPV, HIV, and COVID-19 variants) and oncogenic mutations. Molecular diagnostics has also penetrated the point-of-care and at-home testing spaces with rapid molecular COVID-19 kits and flu panels, enhancing accessibility and reducing turnaround times.

Europe In Vitro Diagnostics Market By Application Insights

Infectious diseases remain the leading application area, with consistent demand for detecting bacterial, viral, and fungal pathogens. Routine screening for HIV, hepatitis, tuberculosis, and hospital-acquired infections (e.g., MRSA) drives a significant portion of test volumes. The continued threat of emerging and re-emerging infectious diseases (e.g., RSV, influenza, COVID-19 subvariants) further fuels demand for diagnostic solutions that are rapid, scalable, and precise.

Oncology/cancer diagnostics is the fastest-growing segment, reflecting the rising cancer burden in Europe and the shift toward early detection and personalized medicine. IVD applications in oncology include tumor marker detection, mutation profiling, circulating tumor cell enumeration, and companion diagnostics. Liquid biopsy tests are gaining traction for non-invasive cancer screening, treatment monitoring, and recurrence prediction. These innovations are being integrated into national screening programs and clinical practice guidelines across Europe.

Europe In Vitro Diagnostics Market By End-use Insights

Hospitals are the primary end users, accounting for the largest share of diagnostic test usage due to their high patient throughput, comprehensive testing capabilities, and integration with treatment workflows. Most advanced diagnostic technologies—including molecular platforms and automated immunoassay analyzers—are installed in tertiary care hospitals and academic medical centers, particularly in countries like Germany, France, and Italy.

Home care settings are witnessing the fastest growth, driven by the availability of user-friendly, accurate, and affordable self-testing kits. Blood glucose monitors, cholesterol test strips, ovulation/fertility kits, and COVID-19 antigen tests have become common in European households. The convergence of wearable health devices and IVD (e.g., digital urinalysis, smart diagnostics) is expanding this segment’s boundaries, empowering patients to manage chronic conditions proactively.

Country Insights

Germany is the largest and most advanced market for in vitro diagnostics in Europe. Its well-established healthcare infrastructure, universal insurance coverage, and robust laboratory network make it an ideal environment for both test development and deployment. The German healthcare system supports both centralized laboratories and decentralized point-of-care testing, ensuring widespread access and adoption of diagnostics.

Public health authorities such as the Robert Koch Institute actively support disease surveillance and diagnostic innovation. Germany was also among the leaders in implementing mass testing strategies during the COVID-19 pandemic, driving large-scale adoption of molecular and rapid antigen diagnostics. Post-pandemic, the focus has shifted toward expanding capabilities in cancer screening, antimicrobial resistance monitoring, and genomics-based diagnostics.

German companies like Siemens Healthineers and Qiagen play a prominent role in shaping the national and regional IVD landscape. The government's support for digital health transformation and personalized medicine further enhances Germany’s position as a critical growth engine within the European IVD market.

Some of the prominent players in the Europe in vitro diagnostics market include:

- Bio-Rad Laboratories, Inc

- Abbott

- Sysmex Corporation

- BD

- BIOMÉRIEUX

- Danaher

- F. Hoffmann-La Roche Ltd

- Siemens

- QIAGEN

- Thermo Fisher Scientific Inc

Recent Developments

-

In April 2025, Roche Diagnostics launched a new AI-powered clinical decision support tool for oncology diagnostics across European hospitals, integrated with their existing immunohistochemistry platforms.

-

Siemens Healthineers, based in Germany, introduced a next-generation automated immunoassay analyzer in March 2025, improving test throughput for hospitals and large laboratories.

-

bioMérieux announced in February 2025 the expansion of its molecular diagnostic assay portfolio for respiratory infections, including multiplex PCR panels targeting RSV, influenza, and SARS-CoV-2.

-

In January 2025, Qiagen collaborated with a UK-based genomics startup to develop next-gen NGS kits for companion diagnostics in rare cancers.

-

Abbott Laboratories gained CE mark approval in May 2025 for its combined rapid flu-COVID-19 antigen test, aimed at pharmacies and physician offices across Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Europe in vitro diagnostics market

By Product

- Instruments

- Reagents

- Services

By Technology

- Immunology

- Haematology

- Clinical Chemistry

- Molecular Diagnostics

- Coagulation

- Microbiology

- Others

By Application

- Infectious Diseases

- Diabetes

- Oncology/Cancer

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Other

By End Use

- Hospitals

- Laboratories

- Home Care

- Others

By Regional

-

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Norway

- Denmark