Europe Nutrition And Supplements Market Size and Research

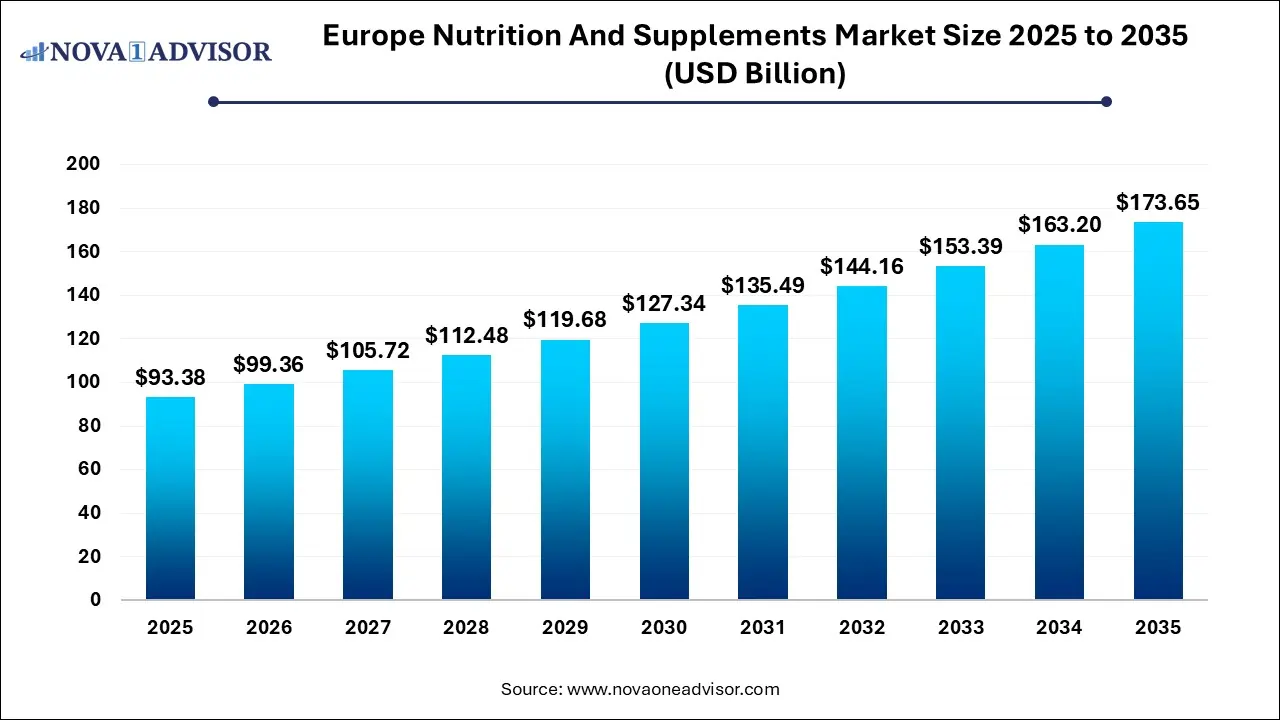

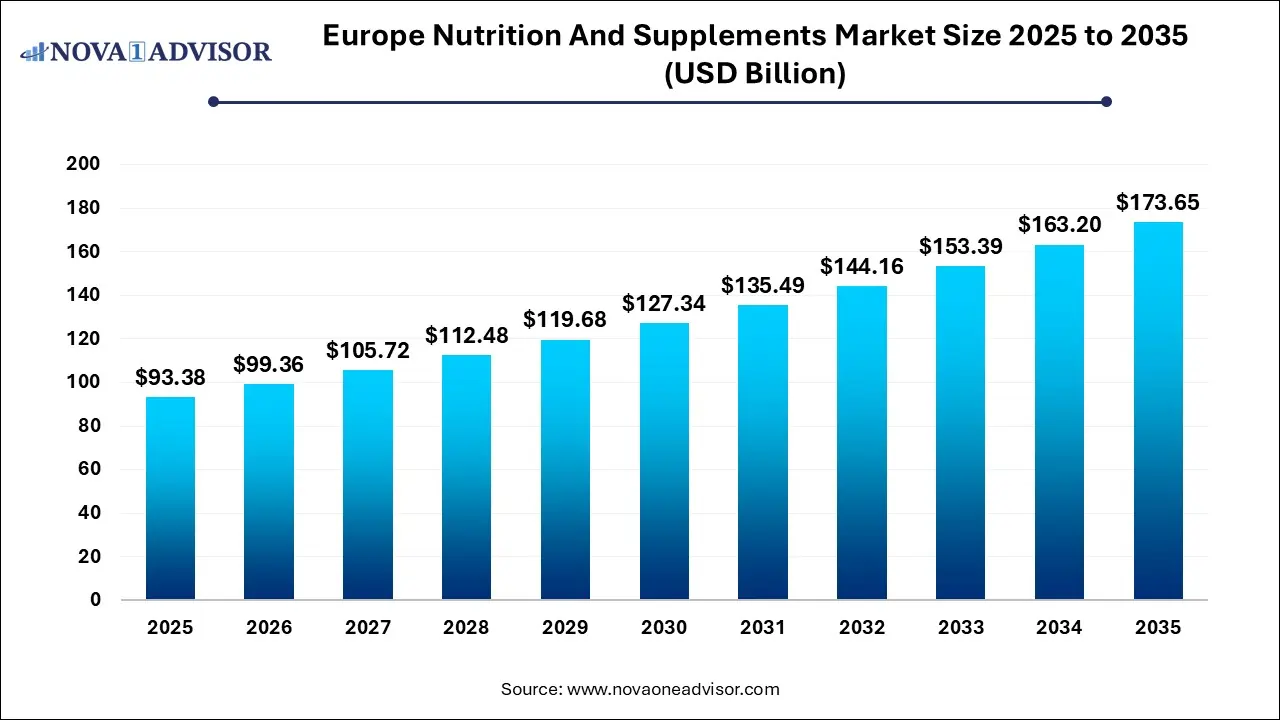

The Europe nutrition and supplements market size was exhibited at USD 93.38 billion in 2025 and is projected to hit around USD 173.65 billion by 2035, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Europe Nutrition And Supplements Market Key Takeaways:

- The functional foods and beverages segment held the largest revenue share of 48.90% in 2025.

- The sports nutrition segment is expected to grow at the fastest CAGR of 7.3% during the forecast years.

- The powder segment held the largest revenue share of over 38.12% in 2025.

- The capsule segment is expected to grow at the fastest CAGR of 8.4% during the forecast years.

- Weight management held the largest share of 23.94% in the European nutrition and supplements industry in 2025.

- Sports & athletics is expected to grow at the highest CAGR of 11.2% over the forecast period.

- Adults held the largest revenue share in the European nutrition and supplements industry in 2025.

- The brick-and-mortar sales channel segment dominated the industry for nutrition and supplements and held a revenue share of 66.0% in 2025.

- The e-commerce segment is expected to grow at the fastest CAGR during the forecast years.

Market Overview

The Europe Nutrition and Supplements Market has emerged as one of the most dynamic sectors in the region’s health and wellness industry. Driven by increasing consumer awareness about preventive health, aging demographics, rising healthcare costs, and a cultural shift toward proactive wellness, the demand for nutrition supplements has soared across Europe. From sports nutrition and dietary supplements to functional foods and personalized nutrition solutions, the market is evolving rapidly in scope and sophistication.

Europe’s diverse consumer base ranging from health-conscious millennials and working professionals to elderly populations and fitness enthusiasts has led to a diversified product portfolio. Countries such as Germany, the UK, France, and the Nordics have shown a significant uptick in both consumption volume and value, with digital transformation, e-commerce, and brand innovation accelerating this momentum. Post-COVID-19, there has been a marked increase in interest toward immunity-boosting, gut health, mental wellness, and anti-aging supplements, shaping a new narrative for the market.

Government support for food fortification programs, the rise in vegan and plant-based dietary habits, and growing participation in fitness regimes are contributing to the rising uptake of nutrition products. Additionally, Europe’s regulatory framework, although stringent, ensures product safety, thereby enhancing consumer trust and long-term market growth.

Major Trends in the Market

-

Personalized Nutrition: Companies are increasingly offering DNA-based and lifestyle-customized supplements tailored to individual health needs.

-

Clean Label & Plant-Based Products: Growing demand for natural, organic, allergen-free, and sustainably sourced supplements.

-

E-commerce Boom: Direct-to-consumer sales through online platforms are gaining dominance over traditional brick-and-mortar retail.

-

Functional Foods Convergence: Blurring of lines between supplements and food products with fortified beverages and snacks.

-

Focus on Immunity and Mental Health: Post-pandemic consumer behavior has shifted towards products enhancing immune function and stress reduction.

-

Geriatric Nutrition Innovation: Specialized formulations for bone health, joint care, and memory enhancement are being targeted at Europe’s aging population.

-

Sustainable Packaging & Transparency: Eco-conscious consumers are pushing brands toward biodegradable packaging and full ingredient disclosure.

Report Scope of Europe Nutrition And Supplements Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 99.36 Billion |

| Market Size by 2035 |

USD 173.65 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Formulation, Sales Channel, Application, Consumer Group, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Herbalife International of America, Inc.; Amway; Bayer AG; Sanofi; Abbott; Nestle; Pfizer; General Nutrition Centers, Inc.; LivaNova PLC |

Key Market Driver: Rising Health Awareness and Preventive Wellness Culture

One of the primary drivers of the European nutrition and supplements market is the growing shift in consumer behavior from reactive healthcare to proactive wellness. Europeans are increasingly adopting a holistic approach to health, driven by lifestyle-induced conditions such as obesity, cardiovascular disease, and vitamin deficiencies. This cultural evolution has led to a widespread embrace of dietary supplements as a daily health ritual.

Consumers across the UK, Germany, and Scandinavia are not just using supplements for treatment, but also for disease prevention and performance enhancement. Moreover, the influence of wellness influencers, fitness apps, and social media campaigns has normalized supplement consumption among younger demographics. Regulatory campaigns promoting vitamin D in northern European countries or omega-3 for cardiovascular support further fuel public engagement. As more consumers adopt supplements to maintain general well-being and longevity, the European market continues to expand its consumer base beyond niche health segments.

Key Market Restraint: Regulatory Complexities and Labeling Challenges

Despite robust demand, the European market faces hurdles due to its complex and often fragmented regulatory landscape. The European Food Safety Authority (EFSA) plays a central role in approving health claims and ensuring product safety. However, individual EU member states often enforce additional national regulations, resulting in a patchwork of rules for product labeling, ingredient thresholds, and permissible claims.

For example, a product approved in Germany may require reformulation or re-labeling for sale in Italy or France. This inconsistency increases compliance costs for manufacturers and complicates cross-border trade within the region. Furthermore, restrictions on health claims for certain botanicals and lack of harmonized rules for novel ingredients often delay time-to-market for innovative products. Smaller companies and startups, in particular, struggle to navigate these regulatory intricacies, limiting their ability to scale quickly across multiple European countries.

Key Market Opportunity: Rise of Targeted Nutrition for Life Stages and Health Conditions

An emerging opportunity lies in the development of targeted nutrition solutions tailored to specific life stages and health concerns. Instead of one-size-fits-all supplements, consumers increasingly seek products that address age, gender, lifestyle, or medical conditions. Whether it’s prenatal multivitamins, immunity boosters for children, menopause supplements, or joint support for the elderly, this micro-targeting allows brands to build deeper consumer trust and loyalty.

In Europe, this trend is exemplified by a surge in “silver economy” products aimed at the 50+ population, and “mom-and-baby” nutrition targeting maternal health. Additionally, increasing diagnoses of conditions such as IBS, ADHD, and metabolic syndromes are fueling demand for specialized formulas—such as probiotics, omega-3 blends, and gut-brain axis supplements. With advances in nutrigenomics, microbiome research, and real-time diagnostic tools, this segment is poised for exponential growth.

Europe Nutrition And Supplements Market By Product Insights

Dietary supplements dominated the market, owing to their widespread daily usage and broad consumer reach. Vitamins and minerals such as vitamin D, vitamin C, magnesium, and zinc are popular across all age groups for general health maintenance. The simplicity, affordability, and preventive health value of dietary supplements make them the foundation of Europe’s nutrition market. Countries like Germany and the UK have well-established supplement consumption cultures, with pharmacies and health food stores being primary purchase points. As awareness grows about nutrient deficiencies even in developed nations the demand for standalone and multivitamin supplements continues to rise.

Sports nutrition is the fastest-growing product category, especially driven by the popularity of protein powders, amino acids, and energy bars among athletes, gym-goers, and young adults. The segment is expanding beyond professional sports to encompass recreational fitness, CrossFit, cycling, and running communities. Plant-based proteins such as pea, lentil, and hemp are gaining traction in France, Sweden, and the Netherlands, as consumers seek dairy-free alternatives to traditional whey protein. Moreover, gender-specific products and formulations for endurance, recovery, and muscle gain are adding depth to the category.

Tablets held the largest market share, thanks to their convenience, ease of storage, and familiarity among users. Multivitamins, minerals, and herbal extracts are commonly formulated into tablets for daily supplementation. They are widely available across both online and offline retail, and most trusted by older demographics.

Powders are the fastest-growing formulation type, especially in the sports and meal replacement categories. Protein powders, pre-workout blends, and green superfood powders are popular among fitness enthusiasts. Their versatility—allowing users to mix them with beverages or foods—has widened appeal among younger and health-conscious consumers. Additionally, powdered probiotics and plant-based blends have gained traction as digestion-focused products.

Europe Nutrition And Supplements Market By Application Insights

General health leads all application segments, encompassing multivitamins, immunity support, and gut health supplements. The broad appeal of general wellness, especially post-COVID, has normalized daily supplementation as a routine for millions across Europe.

Weight management is the fastest-growing application, driven by rising obesity rates and body-conscious culture. Fat burners, fiber blends, protein shakes, and thermogenic products are in high demand, particularly in Germany, the UK, and France. The combination of meal replacement drinks with clean-label claims has found favor among young professionals and fitness-conscious consumers.

Europe Nutrition And Supplements Market By Consumer Group Insights

Adults between 31–50 years of age are the dominant consumers, driven by active lifestyles, peak career stress, and health optimization goals. This demographic heavily consumes vitamins, minerals, probiotics, and amino acids for general wellness, energy, immune support, and cognitive function.

The geriatric group (51+ years) is the fastest-growing segment, aligned with the region’s aging population and growing emphasis on healthy aging. Supplements for bone and joint health (e.g., calcium, magnesium, collagen), heart health (omega-3), and cognitive function (vitamin B complex, CoQ10) are gaining popularity. Functional formulations addressing sarcopenia, vision, and mobility support are being developed specifically for this demographic.

Europe Nutrition And Supplements Market By Sales Channel Insights

Brick-and-mortar retail channels continue to dominate, especially health food shops, pharmacies, and supermarket chains. European consumers often rely on professional advice from pharmacists or dietitians, especially for first-time purchases. Countries like Italy and Spain maintain strong traditional retail preferences, where supplements are purchased during routine health visits.

E-commerce is the fastest-growing sales channel, accelerated by post-pandemic digital shopping habits. Platforms such as Amazon, MyProtein, iHerb, and niche wellness startups provide vast assortments, reviews, subscription models, and personalized recommendations. Online sales are particularly strong in the UK and Nordic countries, where digital literacy and health awareness are high.

Country Insights

Germany stands as the largest and most influential market in the European nutrition and supplements space. With a mature consumer base, robust regulatory oversight by the Federal Institute for Risk Assessment (BfR), and a well-developed retail pharmacy network, Germany offers a strong platform for both legacy brands and innovative startups. Germans are among the highest per capita consumers of vitamins and dietary supplements in Europe.

Post-COVID, the German market has seen a significant increase in vitamin D, omega-3, and immune-boosting product sales. The country also has a thriving organic and clean-label segment, with plant-based sports nutrition and vegan protein alternatives rapidly gaining popularity. Additionally, Germany’s emphasis on sustainability has encouraged brands to invest in biodegradable packaging and ethical sourcing. With an aging population, the demand for joint, memory, and cardiovascular support supplements continues to climb, making Germany a prime market for targeted innovation.

Some of the prominent players in the Europe nutrition and supplements market include:

- Herbalife International of America, Inc.

- Amway

- Bayer AG

- Sanofi

- Abbott

- Nestle

- Pfizer

- General Nutrition Centers, Inc.

- LivaNova PLC

Europe Nutrition And Supplements Market Recent Developments

-

Nestlé Health Science announced in April 2025 the expansion of its “Persona Nutrition” personalized vitamin packs into the German and French markets, leveraging AI-driven diagnostics.

-

Huel, a leading meal replacement brand from the UK, launched new protein and supplement lines across European e-commerce channels in March 2025, catering to vegan and gluten-free consumers.

-

Bayer AG, headquartered in Germany, introduced a new line of gummy supplements for immune and bone health under its Redoxon brand in February 2025, expanding beyond traditional tablets.

-

In January 2025, MyProtein (The Hut Group) partnered with a German biotechnology startup to develop next-gen sports supplements using fermented pea protein and personalized amino acid blends.

-

Nature’s Bounty, a U.S.-based supplement giant, expanded its European footprint by acquiring a Dutch e-commerce wellness platform in May 2025, signaling increased competition in direct-to-consumer wellness retail.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Europe nutrition and supplements market

By Product

-

-

-

- Egg Protein

- Soy Protein

- Pea Protein

- Lentil Protein

- Hemp Protein

- Casein

- Quinoa Protein

- Whey Protein

-

-

-

-

- Whey Protein Isolate

- Whey Protein Concentrate

-

-

-

- Calcium

- Potassium

- Magnesium

- Iron

- Zinc

-

-

-

- BCAA

- Arginine

- Aspartate

- Glutamine

- Beta Alanine

- Creatine

- L-carnitine

-

-

- Probiotics

- Omega -3 fatty acids

- Carbohydrates

-

-

-

- Maltodextrin

- Dextrose

- Waxy Maize

- Karbolyn

-

-

- Detox Supplements

- Electrolytes

- Others

-

-

- Isotonic

- Hypotonic

- Hypertonic

-

-

- Protein Bars

- Energy Bars

- Protein Gels

-

- Meal Replacement Products

- Weight Loss Products

-

- Green Tea

- Fiber

- Protein

- Green Coffee

- Others

-

-

- Multivitamin

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

-

- Minerals

- Enzymes

- Amino Acids

- Conjugated Linoleic Acids

- Others

- Functional Foods & Beverages

-

- Probiotics

- Omega -3

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

By Sales Channel

-

- Direct Selling

- Chemist/Pharmacies

- Health Food Shops

- Hyper Markets

- Super Markets

By Consumer Group

-

- 21-30 years

- 31-40 years

- 41-50 years

- 51-65 years

By Application

- Sports & Athletics

- General Health

- Bone & Joint Health

- Brain Health

- Gastrointestinal Health

- Immune Health

- Cardiovascular Health

- Skin/Hair/Nails

- Sexual Health

- Women’s Health

- Anti-aging

- Weight Management

- Others

By Country

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway