The global EV platform market size was exhibited at USD 11.85 billion in 2023 and is projected to hit around USD 152.99 billion by 2033, growing at a CAGR of 29.15% during the forecast period of 2024 to 2033.

Key Takeaways:

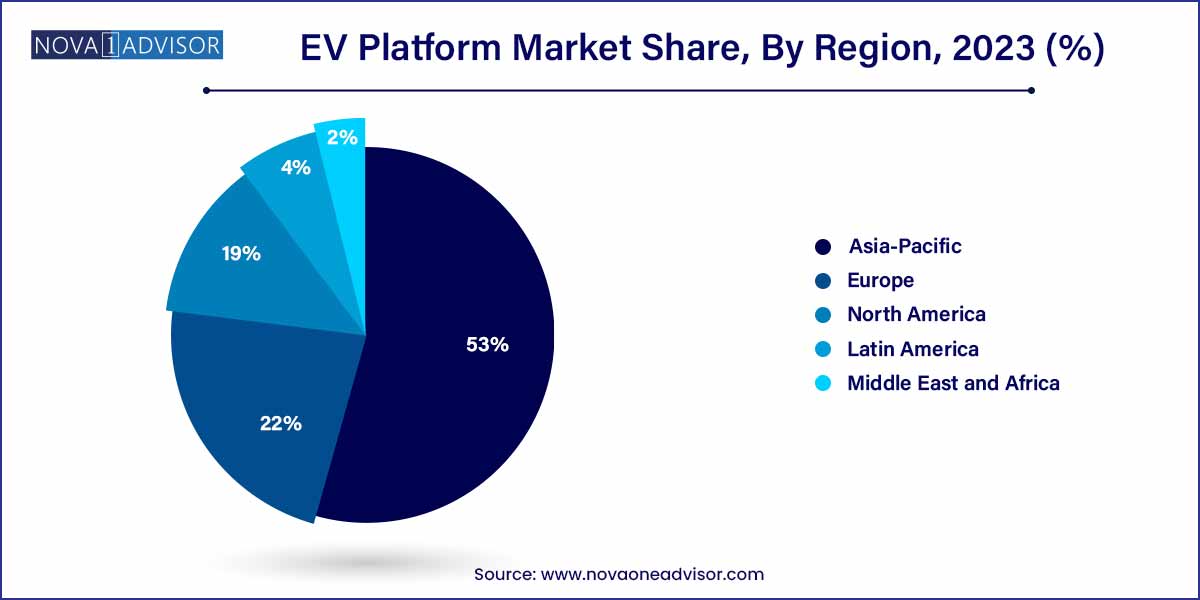

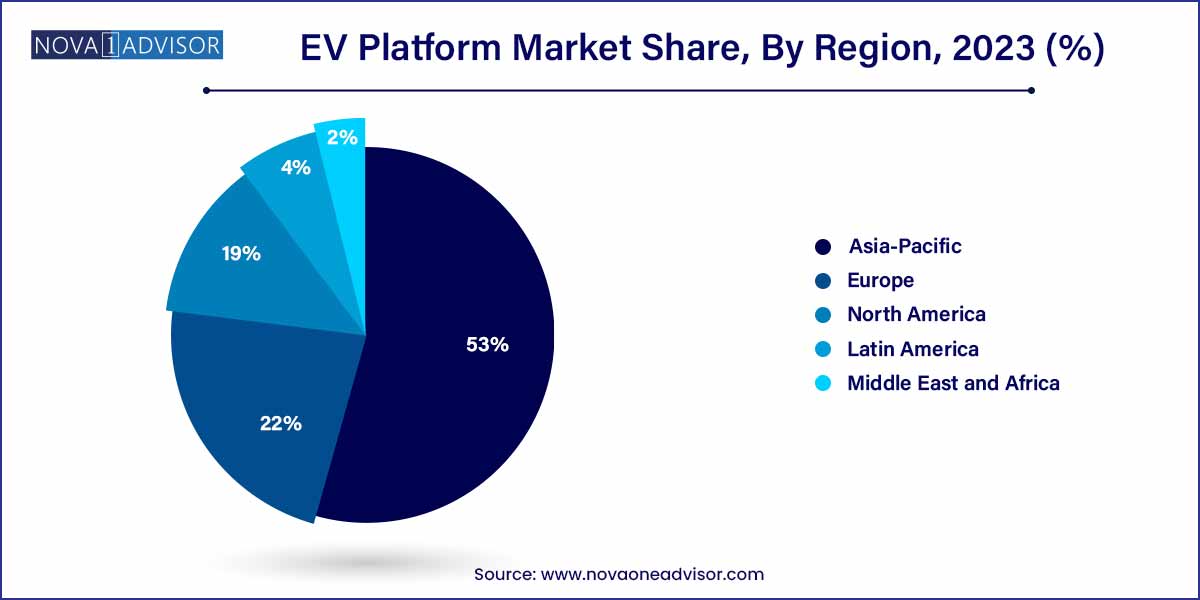

- Asia Pacific generated more than 53% of the revenue share in 2023.

- By component, the steering system segment is expected to expand at the fastest CAGR from 2023 to 2033.

- By electric vehicle type, the battery electric vehicle segment is expected to dominate the market with the highest revenue between 2023 and 2033.

- By vehicle type, the utility vehicle segment contributed to the largest market in 2023.

- By sale channel, the OEM segment is predicted to capture the largest market share from 2023 to 2033.

- By sale channel, the aftermarket segment is projected to register the largest CAGR from 2023 to 2033.

- By Application, the passenger vehicles segment holds the largest market share from 2023 to 2

The Electric Vehicle (EV) Platform Market has emerged as a transformative pillar within the global automotive industry. EV platforms serve as the foundational architecture for battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), integrating crucial components like the chassis, suspension, drivetrain, and battery systems. Unlike traditional internal combustion engine platforms, EV platforms are uniquely designed to maximize battery capacity, optimize vehicle dynamics, and provide modular flexibility across different vehicle types.

The market is witnessing rapid expansion due to the increasing global shift towards electrification, stringent emission regulations, and the growing consumer acceptance of electric mobility. Automakers are moving toward dedicated EV platforms rather than retrofitting internal combustion platforms, allowing for better performance, design freedom, and production efficiencies. Companies like Tesla, General Motors, Hyundai, and Volkswagen have developed proprietary EV platforms, signaling intense competition and innovation in this space.

Additionally, strategic collaborations between automakers and tech companies, the rise of skateboard platforms, and advancements in battery technologies are accelerating the growth trajectory of the EV platform market. This market is poised to play a crucial role in achieving the automotive industry's net-zero emission targets in the coming decades.

The growth of the electric vehicle (EV) platform market is driven by several key factors. Firstly, increasing environmental concerns and regulatory mandates aimed at reducing emissions have spurred a rapid shift towards electric mobility solutions. Additionally, advancements in battery technology and charging infrastructure have enhanced the practicality and appeal of electric vehicles, driving consumer adoption. Moreover, government incentives and subsidies aimed at promoting electric vehicle adoption have further catalyzed market growth. Furthermore, the growing emphasis on sustainability and corporate social responsibility among automotive manufacturers has led to significant investments in EV platform development. Lastly, the emergence of innovative startups and collaborations between established players and technology firms have injected dynamism and innovation into the market, fostering competition and driving further expansion.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.85 Billion |

| Market Size by 2033 |

USD 152.99 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 29.15% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Component, By Electric Vehicle Type, By Vehicle Type, By Sale Channel, and By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Nissan Motor, Open Motors, REE Auto, Rivian, Saic Motor, XAOS Motors, Baic Motor, BMW, BYD, Byton, Canoo, Toyota, Volkswagen, Volvo, Chery, Daimler, Faraday Future, Fisker, Ford, Geely, Zotye. |

- Technological Advancements:

The EV Platform market is dynamic and evolving, largely driven by continuous technological advancements. Key innovations in battery technology, power electronics, and vehicle architecture are reshaping the landscape, enabling manufacturers to enhance the performance, range, and efficiency of electric vehicles. Additionally, advancements in lightweight materials and modular platform designs are improving manufacturing processes, reducing costs, and increasing scalability. Moreover, the integration of smart connectivity features and autonomous driving capabilities is transforming the driving experience and unlocking new opportunities for innovation and differentiation within the market.

Government regulations and policy initiatives play a significant role in shaping the EV Platform market dynamics. Stringent emissions standards, fuel efficiency regulations, and mandates promoting electric vehicle adoption are driving automakers to invest in electrification strategies and develop advanced platform solutions. Additionally, incentives such as tax credits, subsidies, and rebates are encouraging consumers to purchase electric vehicles, stimulating demand and market growth. Furthermore, collaborative efforts between governments, industry stakeholders, and research institutions are fostering innovation and accelerating the development of sustainable transportation solutions, thereby shaping the future trajectory of the EV Platform market.

- Infrastructure Challenges:

One significant restraint facing the EV Platform market is the inadequacy of charging infrastructure. Despite the increasing adoption of electric vehicles, the availability of charging stations remains limited in many regions. This lack of infrastructure presents a barrier to widespread EV adoption, as consumers may be hesitant to invest in electric vehicles without convenient access to charging facilities. Moreover, the variability in charging standards and protocols further complicates the situation, hindering interoperability and complicating the development of standardized charging solutions.

Another restraint impacting the EV Platform market is the relatively high upfront cost of electric vehicles compared to traditional internal combustion engine vehicles. While the total cost of ownership for electric vehicles may be lower over the vehicle's lifetime due to lower fuel and maintenance expenses, the initial purchase price can deter some consumers from transitioning to electric vehicles. Additionally, the cost of developing and manufacturing advanced EV platforms with cutting-edge technology and materials can be prohibitively high for automakers, impacting profitability and pricing strategies.

- Expansion of Electric Vehicle Models:

One significant opportunity in the EV Platform market is the expansion of electric vehicle models across various segments. As consumer demand for electric vehicles continues to grow, automakers have the opportunity to diversify their product offerings and introduce electric versions of popular vehicle types, including sedans, SUVs, trucks, and commercial vehicles. By leveraging versatile EV platforms that support multiple vehicle configurations and powertrain options, manufacturers can cater to diverse market preferences and capture a larger share of the electric vehicle market.

- Collaboration and Partnerships:

Another significant opportunity in the EV Platform market lies in collaboration and partnerships among industry stakeholders. As the electric vehicle market continues to mature, collaboration between automakers, technology companies, utilities, and infrastructure providers is essential for driving innovation, addressing challenges, and accelerating market growth. Collaborative efforts can facilitate the development of standardized platforms, interoperable charging solutions, and integrated mobility ecosystems, making electric vehicles more accessible, convenient, and practical for consumers. Moreover, partnerships with government agencies and policymakers can help navigate regulatory challenges, secure incentives and funding, and foster a supportive environment for electric vehicle adoption.

One of the primary challenges facing the EV Platform market is range anxiety, which refers to the fear or concern among consumers regarding the limited driving range of electric vehicles. Despite advancements in battery technology, many electric vehicles still have a lower driving range compared to traditional internal combustion engine vehicles. This limitation can deter potential buyers, particularly those who regularly travel long distances or lack access to charging infrastructure.

- Battery Cost and Performance:

Another significant challenge in the EV Platform market is the cost and performance of batteries, which constitute a substantial portion of the overall vehicle cost and directly impact factors such as range, charging time, and longevity. While the cost of lithium-ion batteries has declined significantly in recent years, it remains a significant barrier to widespread electric vehicle adoption, particularly in price-sensitive market segments. Additionally, concerns about battery performance, including issues such as degradation over time and limited lifespan, can influence consumer perceptions and purchase decisions. Addressing these challenges requires ongoing research and development efforts to improve battery technology, increase energy density, reduce costs, and enhance durability.

Segments Insights:

By Component

Chassis dominated the component segment in 2024. The chassis forms the structural backbone of any EV platform, housing critical components such as the battery pack, powertrain, and suspension system. With the shift to skateboard chassis designs offering flat underbodies, improved crash safety, and modular scalability, the demand for specialized EV chassis solutions has surged. Major players like Rivian and Tesla have leveraged innovative chassis engineering to enhance vehicle performance and manufacturing efficiency.

Battery is projected to be the fastest-growing component segment. The battery is the heart of an electric vehicle and directly influences range, performance, and platform design. With ongoing advancements in battery chemistry, energy density, and thermal management, the battery component's importance within EV platforms continues to rise. Companies like CATL and LG Energy Solution are collaborating with automakers to integrate next-gen battery packs seamlessly into EV platforms.

By Electric Vehicle Type

Battery Electric Vehicles (BEVs) dominated the EV type segment in 2024. BEVs offer zero tailpipe emissions, lower maintenance costs, and are supported by a growing charging infrastructure network. Automakers are prioritizing the development of BEV-dedicated platforms, such as Hyundai's E-GMP and Volkswagen's MEB platforms, to maximize energy efficiency and driving range.

Hybrid Electric Vehicles (HEVs) are anticipated to be the fastest-growing segment in certain regions. While BEVs are gaining momentum, HEVs provide a transitional solution in markets where charging infrastructure is still underdeveloped. Platforms designed to accommodate hybrid powertrains, such as Toyota's TNGA platform, allow OEMs to cater to a broad consumer base seeking improved fuel economy without full EV adoption.

By Vehicle Type

Utility Vehicles dominated the vehicle type segment in 2024. SUVs, crossovers, and pickup trucks have become the preferred choice for consumers globally due to their versatility, spaciousness, and commanding road presence. Automakers are focusing on developing EV platforms capable of supporting large battery packs and all-wheel-drive systems suited for utility vehicles, with examples like Ford's F-150 Lightning built on the innovative Ford EV platform.

Sedans are expected to experience significant growth within the EV platform market. With their aerodynamic profiles and relatively lower weight compared to SUVs, sedans are ideal candidates for achieving maximum driving range and energy efficiency. Companies like Tesla (Model 3) and BMW (i4) have demonstrated how performance sedans built on dedicated EV platforms can capture substantial market share.

By Sale Channel

OEMs dominated the sales channel segment in the EV platform market. Established automakers are investing heavily in building proprietary EV platforms to differentiate themselves and ensure control over performance, brand identity, and manufacturing costs. Platforms like General Motors' Ultium and Volkswagen's MEB are being used across multiple brands and models, reflecting OEM dominance.

The aftermarket segment is poised to grow steadily. As the EV market matures, opportunities for retrofitting, battery upgrades, and platform component replacements will expand. Startups and specialized firms are exploring solutions like modular battery swaps and performance upgrades tailored for existing EV platforms, adding dynamism to the aftermarket landscape.

By Application

Passenger Vehicles dominated the application segment in 2024. The majority of EV sales globally are passenger vehicles, driven by consumer demand for sustainable personal transportation solutions. Dedicated EV platforms in this category offer advantages like extended range, fast charging, and innovative cabin designs, making them the cornerstone of manufacturers' EV strategies.

Commercial Vehicles represent the fastest-growing application. Electrification of commercial fleets, including delivery vans, buses, and medium-duty trucks, is gathering momentum. Governments and corporations are setting carbon neutrality targets, prompting significant investments in commercial EV platforms. Companies like Arrival and Rivian are at the forefront, offering modular platforms designed specifically for commercial applications.

Regional Insights:

Asia-Pacific dominated the global EV platform market in 2024. The region's leadership stems from the massive EV adoption rates in China, government incentives, strong supply chains, and significant investments by local giants such as BYD, NIO, and SAIC Motor. China's "New Energy Vehicle Industry Development Plan (2021-2035)" and aggressive EV policies in countries like Japan and South Korea are further propelling growth. Strategic collaborations, such as the one between Toyota and BYD for a new EV platform announced in February 2024, highlight Asia-Pacific's innovation leadership.

Europe is the fastest-growing region for EV platforms. The European Union's stringent emission regulations, extensive EV infrastructure rollout, and government subsidies have created a highly conducive environment for EV adoption. Automakers like Volkswagen, Stellantis, and Renault are launching extensive EV portfolios based on modular, scalable platforms. In March 2024, Stellantis unveiled its STLA Large platform aimed at premium electric SUVs and sedans, showcasing Europe's aggressive expansion in the EV platform space.

Recent Developments:

-

February 2024: Toyota and BYD announced the joint development of a new EV platform tailored for affordable compact electric cars targeting emerging markets.

-

January 2024: General Motors revealed upgrades to its Ultium platform, promising a 20% increase in energy density and faster charging capabilities.

-

March 2024: Stellantis introduced its new STLA Large platform designed for premium electric SUVs and sedans with 800V architecture and up to 500 miles range.

-

April 2024: Hyundai Motor Group announced the expansion of its E-GMP platform capabilities to support larger SUVs and pickup trucks by 2026.

-

March 2024: Foxconn revealed its MIH Open EV Platform expansion, partnering with over 50 companies to standardize and accelerate EV development.

- Nissan Motor

- Open Motors

- REE Auto

- Rivian

- Saic Motor

- XAOS Motors

- Baic Motor

- BMW

- BYD

- Byton

- Canoo

- Toyota

- Volkswagen

- Volvo

- Chery

- Daimler

- Faraday Future

- Fisker

- Ford

- Geely

- Zotye

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global EV platform market.

By Component

- Chassis

- Steering System

- Suspension System

- Drivetrain

- Battery

- Vehicle Interior

By Electric Vehicle Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

By Vehicle Type

- Sedan

- Hatchback

- Utility Vehicle

- Others

By Sale Channel

By Application

- Passenger Vehicles

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)