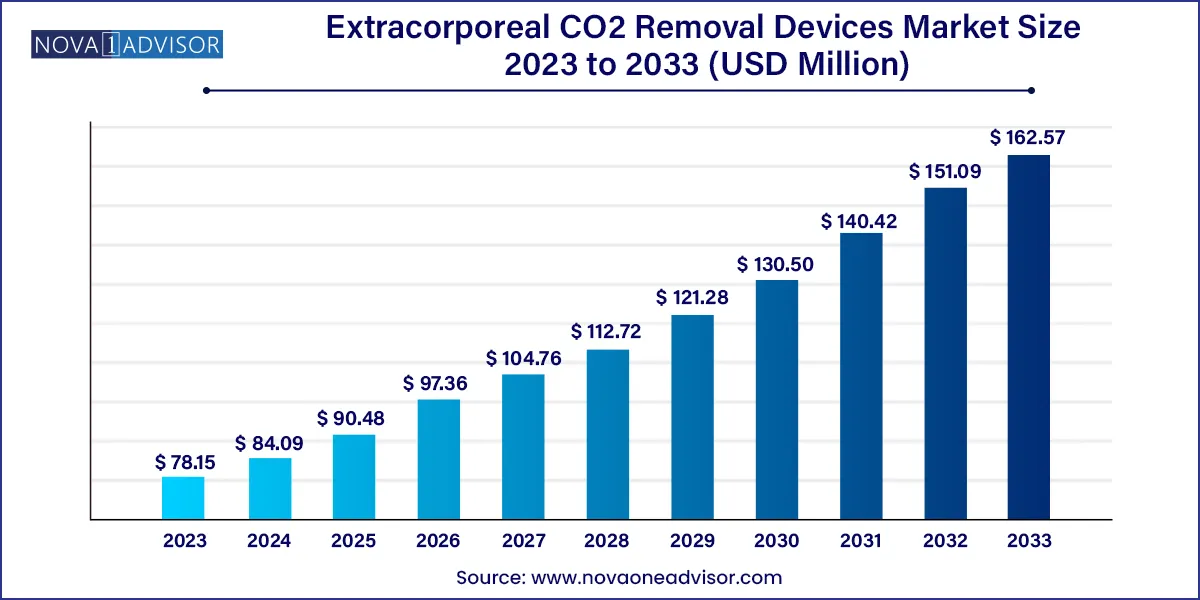

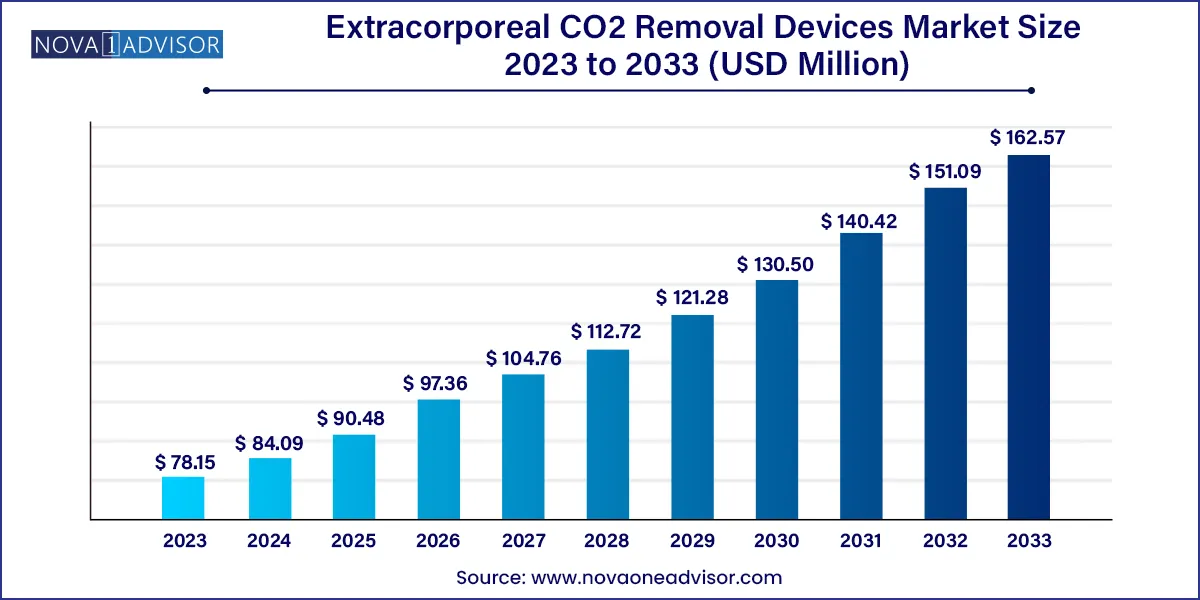

The global extracorporeal CO2 removal devices market size was exhibited at USD 78.15 million in 2023 and is projected to hit around USD 162.57 million by 2033, growing at a CAGR of 7.6% during the forecast period 2024 to 2033.

Key Takeaways:

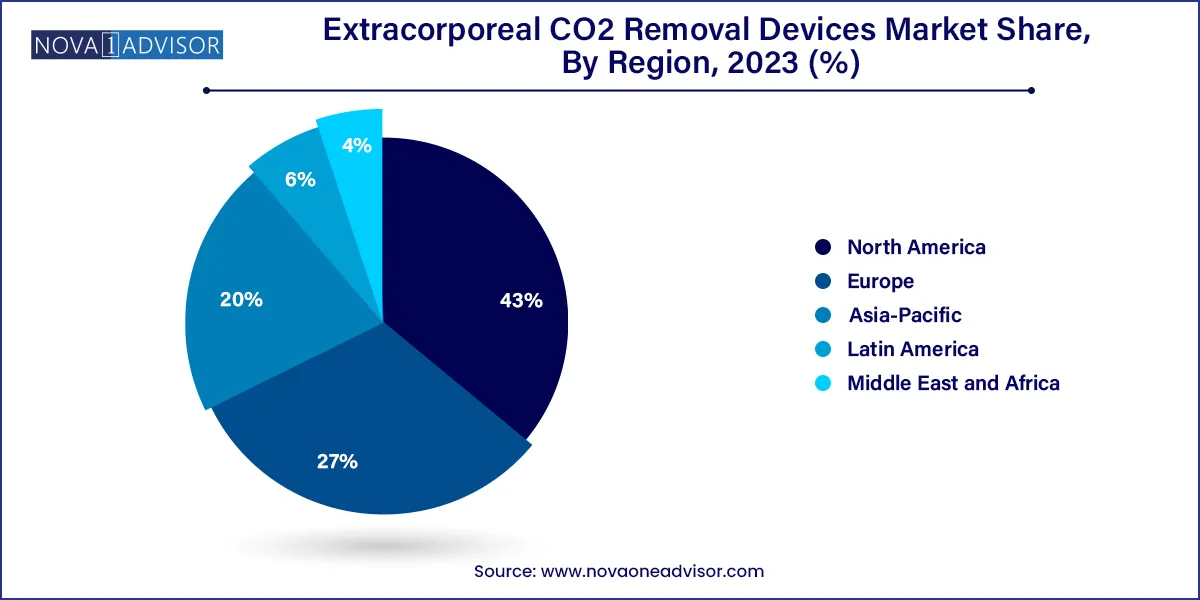

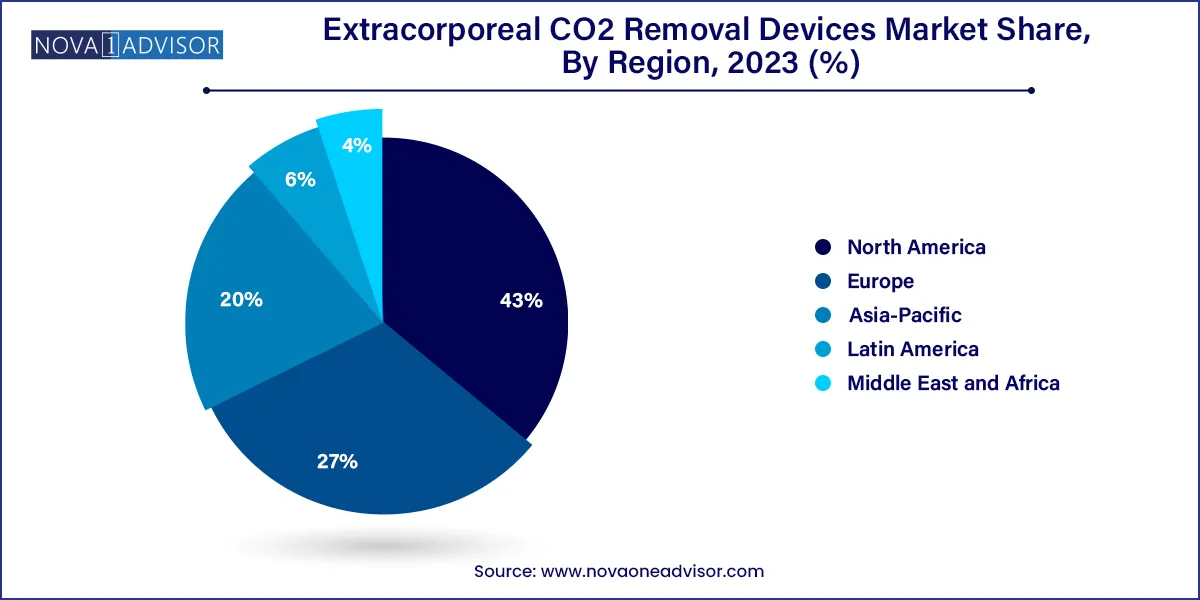

- North America dominated the market and accounted for the largest revenue share of 43.0% in 2023

- The extracorporeal CO2 removal machines segment accounted for the largest revenue share of 52.4% in 2023.

- The bridge to lung transplant segment held the largest revenue share of 40.0% in 2023.

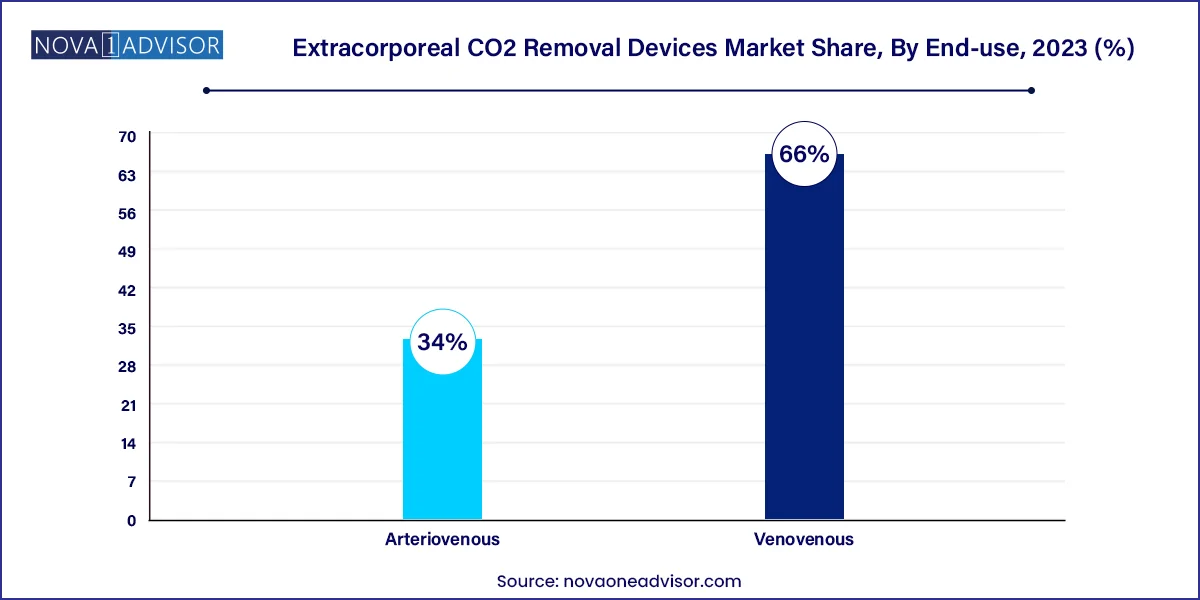

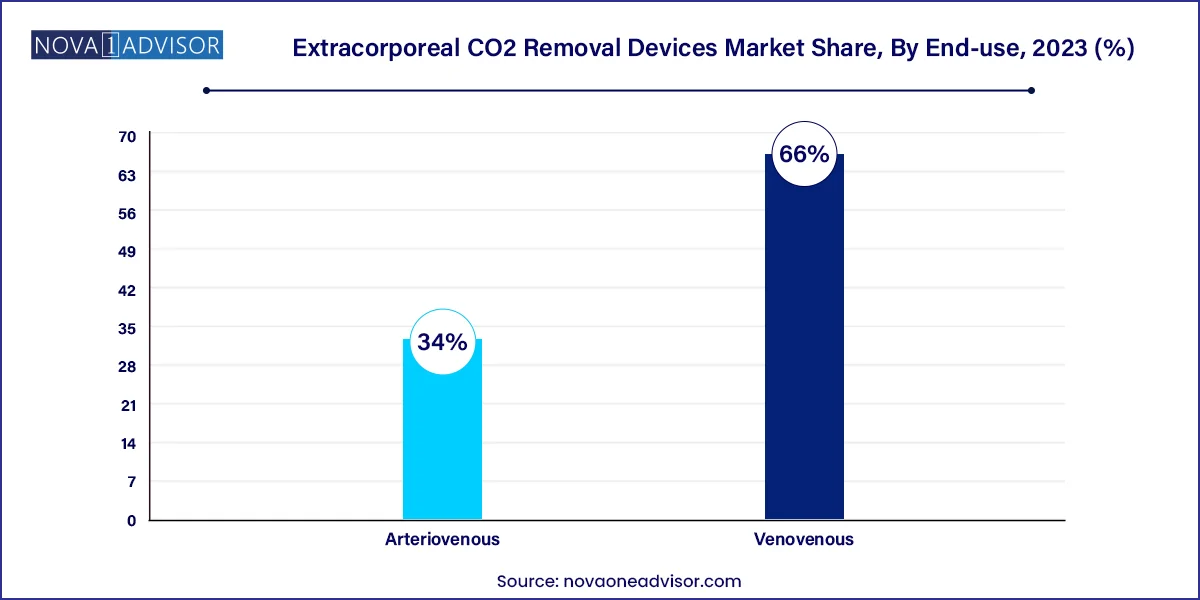

- The venovenous segment held the largest revenue share of 66.0% in 2023.

- The hospitals segment held the largest revenue share of 46.3% in 2023 and is also expected to grow at the fastest CAGR of 7.6% over the forecast period.

Market Overview

The Extracorporeal COâ‚‚ Removal (ECCOâ‚‚R) Devices Market is an emerging yet rapidly evolving segment of the advanced respiratory support market. ECCOâ‚‚R devices serve a critical role in managing patients with severe respiratory failure, particularly those suffering from Acute Respiratory Distress Syndrome (ARDS), Chronic Obstructive Pulmonary Disease (COPD), and as a bridge to lung transplantation. These systems support partial removal of carbon dioxide from the blood while minimizing the need for invasive mechanical ventilation, thereby reducing the risk of ventilator-induced lung injury (VILI).

As a less invasive alternative to ECMO (extracorporeal membrane oxygenation), ECCOâ‚‚R devices utilize lower blood flow rates, making them suitable for a broader patient population and applicable in settings with lower resource capacity. They are increasingly used in both ICU and surgical environments for lung protection strategies and as part of multimodal ventilation approaches.

Global growth in critical care units, prevalence of COPD, and expansion of ICU capacities post-COVID-19 are directly fueling the demand for ECCOâ‚‚R systems. With rising awareness of ventilator-induced complications and the push for lung-protective ventilation strategies, these devices are seeing increased integration into protocols for patients who are difficult to ventilate or who require weaning support.

Despite being in a relatively early commercialization phase compared to mechanical ventilators or ECMO, ECCOâ‚‚R technologies are rapidly gaining interest due to technological innovation, clinical trial support, and improved outcomes in respiratory distress scenarios. Furthermore, the ongoing shift toward minimally invasive and personalized intensive care solutions is expected to boost market adoption across both developed and developing economies.

Major Trends in the Market

-

Increasing Use of ECCOâ‚‚R in ARDS Management: As part of lung-protective strategies to avoid high tidal volume ventilation.

-

Growing Focus on Minimally Invasive Venovenous Access Devices: Favored for better hemodynamic stability and ease of catheter insertion.

-

Expansion of Hybrid Devices with Integrated Monitoring: Combining COâ‚‚ removal with oxygenation and real-time respiratory monitoring.

-

Development of Portable and Modular ECCOâ‚‚R Systems: To support transport scenarios and flexible ICU integration.

-

Rising Use as a Bridge to Lung Transplantation: Helping stabilize patients who are awaiting transplant availability.

-

Clinical Trials Validating ECCOâ‚‚R Efficacy in Hypercapnic Respiratory Failure: Especially in COPD exacerbations unresponsive to NIV.

-

Integration with AI for Flow Regulation and COâ‚‚ Removal Efficiency Optimization

| Report Coverage |

Details |

| Market Size in 2024 |

USD 84.09 Million |

| Market Size by 2033 |

USD 162.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Access, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic; Getinge AB; Xenios AG; ALung Technologies, Inc.; ESTOR S.P.A.; Medica S.P.A.; Aferetica srl |

Market Driver: Rising Prevalence of Respiratory Disorders Requiring Advanced Ventilation Support

A major driver of the ECCOâ‚‚R devices market is the increasing global burden of respiratory diseases, particularly ARDS, COPD, and respiratory failure post-surgery or trauma. According to the WHO, over 3 million deaths annually are linked to COPD, and ARDS is a leading cause of mortality in ICUs globally. For many of these patients, standard mechanical ventilation poses risks of barotrauma and does not adequately remove carbon dioxide, especially in cases of hypercapnic respiratory failure.

ECCOâ‚‚R offers a low-flow extracorporeal method to remove COâ‚‚ without the complications of full ECMO, and allows clinicians to reduce ventilator settings and protect lung tissue. During the COVID-19 pandemic, a surge in ARDS cases led to broader awareness and experimental use of ECCOâ‚‚R, expanding its visibility in intensive care protocols. As ICUs continue to emphasize lung-protective ventilation, ECCOâ‚‚R is increasingly considered a key part of modern respiratory therapy.

Market Restraint: High Cost and Limited Reimbursement Policies

Despite its clinical potential, the ECCOâ‚‚R market faces significant barriers due to the high cost of devices and disposable components, along with a lack of consistent reimbursement policies in many countries. ECCOâ‚‚R systems require specialized catheters, oxygenators, and pumps, which can be cost-prohibitive for smaller hospitals and low-income regions. Additionally, the procedural cost per patient is high compared to conventional ventilation strategies.

Moreover, regulatory frameworks in the U.S. and Europe have not uniformly established ECCOâ‚‚R-specific billing codes or reimbursement mechanisms, which hampers adoption. Limited clinical evidence from randomized controlled trials also restricts payers from categorizing ECCOâ‚‚R as standard of care, making it accessible primarily in tertiary care and research-oriented ICUs.

Market Opportunity: Integration of ECCOâ‚‚R with Multimodal Respiratory Support Protocols

An emerging opportunity lies in the integration of ECCOâ‚‚R systems into standardized multimodal respiratory protocols, especially those emphasizing lung-protective strategies. In patients who cannot tolerate non-invasive ventilation (NIV) or high PEEP, ECCOâ‚‚R can serve as an adjunct to avoid or shorten invasive mechanical ventilation.

Moreover, with growing research on combined ECCOâ‚‚R and oxygenation platforms, the ability to offer modular support across various phases of respiratory compromise is expanding. Future ECCOâ‚‚R devices could be used not just for bridge therapy, but also for early intervention in hypercapnic respiratory failure, helping to prevent the escalation of care.

As artificial intelligence, real-time monitoring, and compact system design continue to evolve, the next generation of ECCOâ‚‚R devices will likely enable safer, more automated, and cost-efficient deployment making them suitable even for smaller or remote critical care units.

Segments Insights:

By Product

Extracorporeal COâ‚‚ machines dominate the product segment, as they form the core of the therapy setup. These machines are used in conjunction with external oxygenators and blood pumps to filter carbon dioxide from venous blood. They are primarily found in large hospitals and tertiary ICU centers and are engineered for integration with real-time monitoring systems, fluid dynamics control, and hemocompatibility.

However, disposables are the fastest-growing segment, due to their recurring nature and essential role in each ECCOâ‚‚R session. Catheters, circuits, COâ‚‚ scrubbers, and membrane oxygenators must be replaced regularly, driving high-volume sales. As more hospitals adopt ECCOâ‚‚R protocols, the demand for consumables per patient rises substantially, making this a profitable sub-segment for manufacturers and an area of focus for innovation in cost reduction and safety enhancement.

By Application

ARDS (Acute Respiratory Distress Syndrome) dominates the application segment, as it is one of the most common and severe causes of respiratory failure requiring ECCOâ‚‚R. In ARDS patients, ECCOâ‚‚R allows ultra-protective ventilation by removing COâ‚‚ while maintaining low tidal volumes and reducing pressure-induced lung injury. ICU teams use ECCOâ‚‚R to improve oxygenation and reduce ventilator settings, often delaying or avoiding ECMO deployment.

Bridge to lung transplant is the fastest-growing application, supported by increasing organ transplant activity and broader awareness of its clinical benefits. ECCOâ‚‚R stabilizes hypercapnic patients awaiting donor lungs and improves their eligibility by reducing the physiological burden. The ability to maintain patients in a stable state without deep sedation or high-pressure ventilation makes ECCOâ‚‚R a valuable option in pre-transplant ICUs.

By Access Insights

Venovenous access is the dominant access type, as it offers ease of cannulation, fewer complications, and minimal impact on systemic hemodynamics. VV access can be performed peripherally using dual-lumen catheters, making it less invasive and feasible in a wide range of settings. It is preferred in patients with stable blood pressure and no circulatory collapse, and thus is widely adopted in routine ICU protocols.

In contrast, arteriovenous access is used in specific scenarios, particularly where higher blood flows are necessary or in centers with ECMO infrastructure. While less commonly employed due to vascular complications and perfusion concerns, it remains relevant in specialized surgical or trauma cases.

By End-use

Hospitals are the leading end-use segment, primarily due to their access to ICU resources, trained intensivists, and advanced respiratory support infrastructure. The majority of ECCOâ‚‚R cases are managed in tertiary hospital ICUs or academic medical centers participating in clinical trials and translational care programs.

Ambulatory surgical centers and specialized clinics are emerging as the fastest-growing segments, especially in high-income countries. These facilities are integrating ECCOâ‚‚R systems for post-surgical respiratory support and managing COPD exacerbations in semi-critical units, extending the reach of these devices beyond traditional ICUs.

By Regional Insights

North America dominates the global ECCOâ‚‚R market, driven by the U.S.'s strong presence in intensive care infrastructure, clinical trial participation, and funding for respiratory innovations. Hospitals in the U.S. and Canada are early adopters of extracorporeal technologies, and the region houses major manufacturers and R&D hubs for ECCOâ‚‚R systems. High COPD prevalence, growing elderly population, and rising adoption of lung-protective ventilation protocols further fuel market leadership.

Europe is the fastest-growing region, supported by government-backed healthcare reforms, widespread access to advanced ICU systems, and growing involvement in multicenter ECCOâ‚‚R studies. Countries like Germany, Italy, and the U.K. have shown high clinical engagement in extracorporeal techniques, while the European Respiratory Society is actively promoting non-ECMO extracorporeal support. Additionally, regional collaborations are pushing for unified ECCOâ‚‚R protocols and cross-border equipment deployment.

- Medtronic

- Getinge AB

- Xenios AG

- Medica S.P.A.

- Aferetica srl

- ALung Technologies, Inc.

- ESTOR S.P.A.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global extracorporeal CO2 removal devices market.

Product

- Extracorporeal CO2 Machines

- Disposables

- Others

Application

- Acute Respiratory Distress Syndrome (ARDS)

- Chronic Obstructive Pulmonary Disease (COPD)

- Bridge to Lung Transplant

- Others

Access

End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)