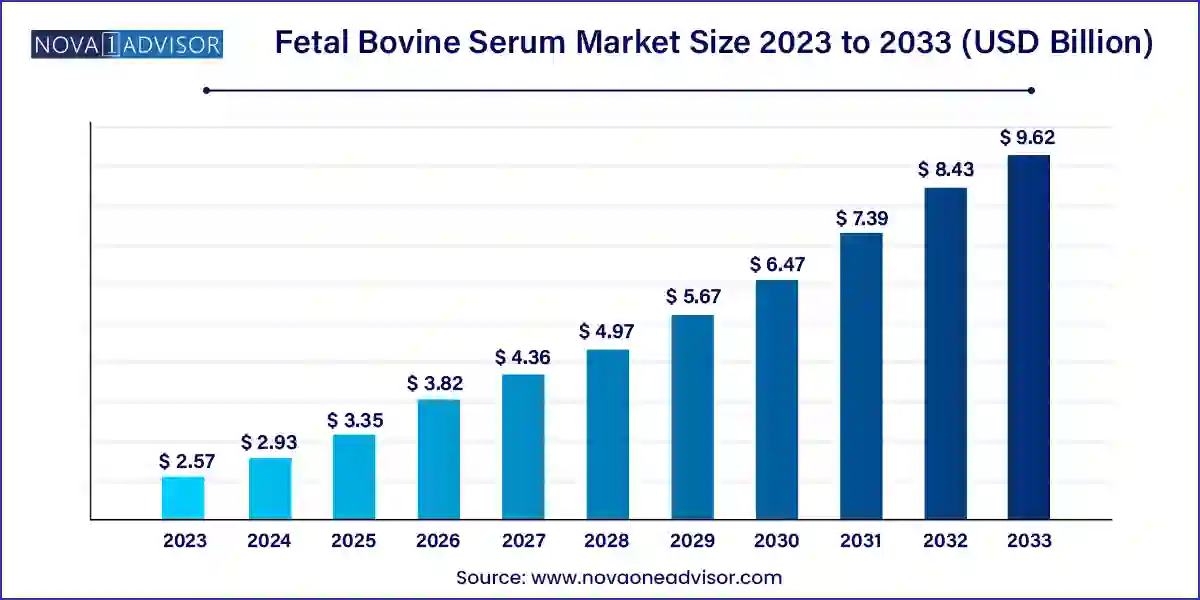

The global fetal bovine serum market size was exhibited at USD 2.57 billion in 2023 and is projected to hit around USD 9.62 billion by 2033, growing at a CAGR of 14.11% during the forecast period 2024 to 2033.

Key Takeaways:

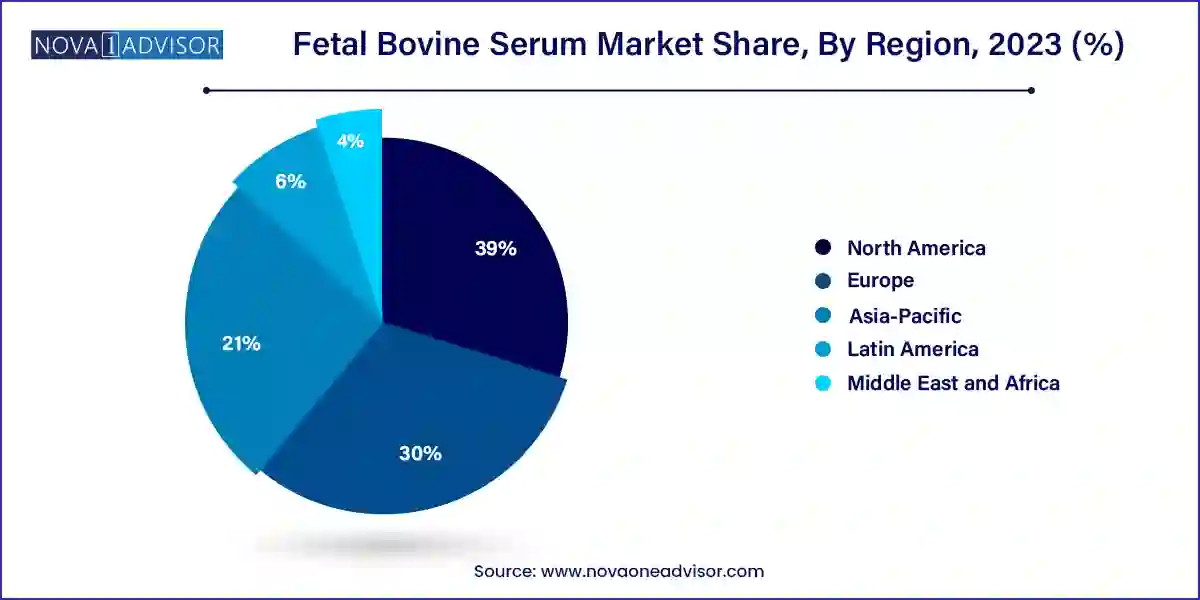

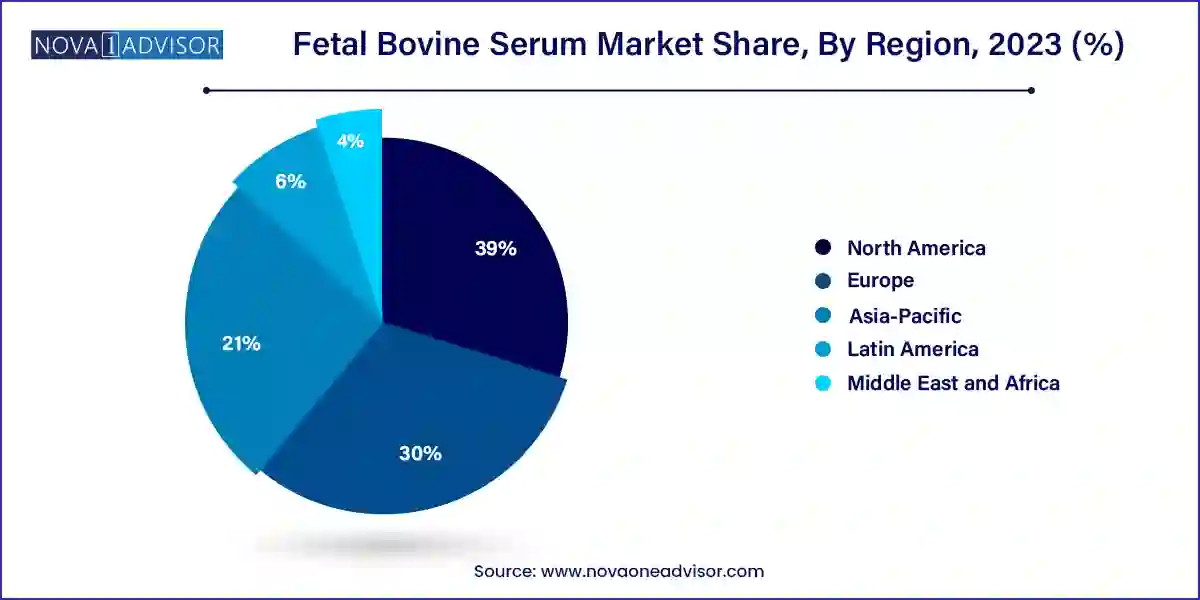

- North America dominated the global market with a share of 39.0% in 2023.

- The Asia Pacific is anticipated to undergo maximum growth with a CAGR of 15.6% from 2023 to 2033.

- In 2023, vaccine production segment dominated the global market by generating USD 448.6 million in revenues.

- The segment is expected to grow at a CAGR of 16.5% from 2023 to 2033.

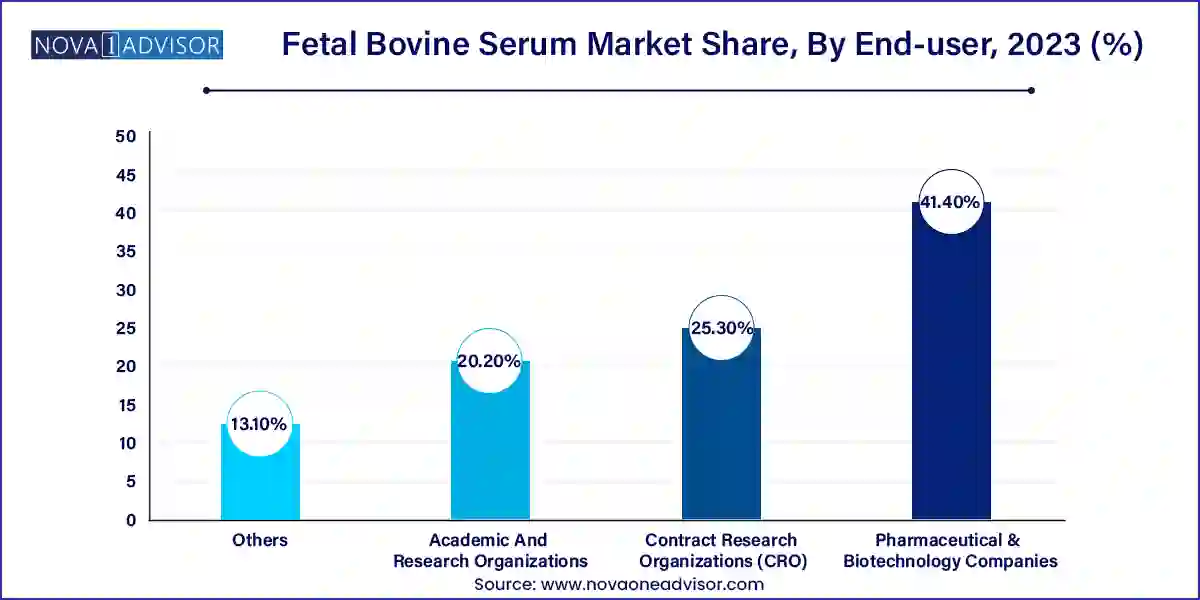

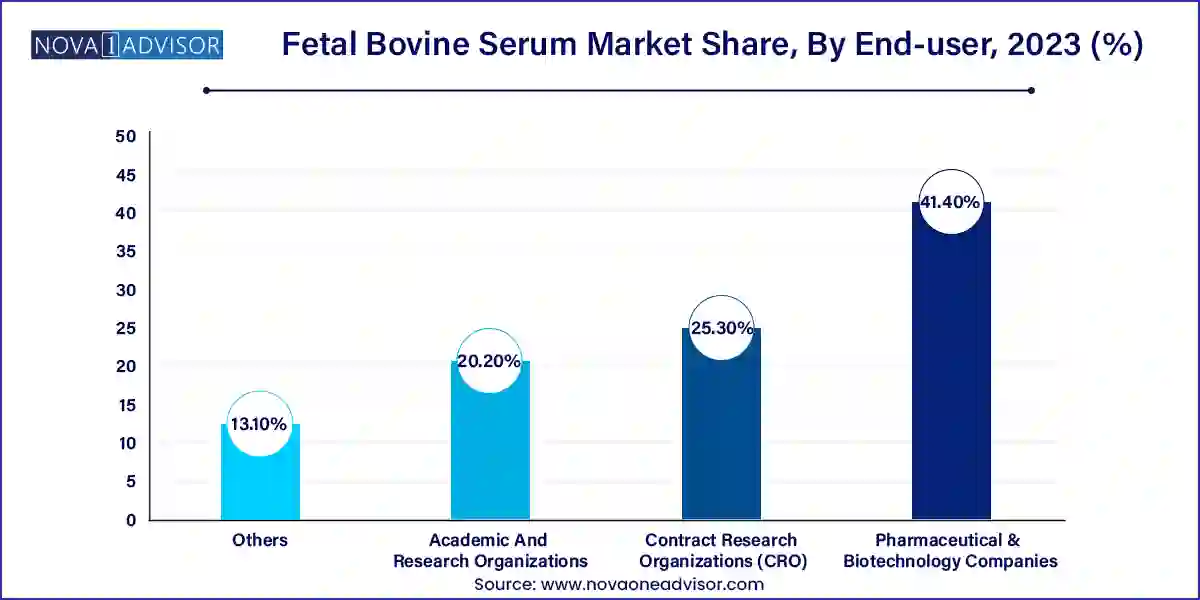

- The pharmaceutical & biotechnology companies segment held the highest market share of 41.4% in 2023.

- The Contract Research Organizations (CRO’s) segment is anticipated to register the fastest CAGR of 15.6% from 2023 to 2033.

Market Overview

Fetal bovine serum (FBS), derived from the blood of bovine fetuses, is an indispensable supplement in cell culture applications. It is rich in essential nutrients, growth factors, hormones, lipids, and attachment proteins that facilitate optimal cell survival and proliferation. As the most commonly used serum supplement for in vitro cell culture, FBS plays a critical role in biotechnology, pharmaceutical research, academic R&D, and diagnostic testing.

The growing dependence on cell-based assays for drug development, vaccine production, cancer research, regenerative medicine, and gene therapy has amplified the demand for high-quality and ethically sourced FBS. As an irreplaceable component in the culture of eukaryotic cells, its market expansion is closely tied to biopharma R&D pipelines and the global acceleration of biomedical innovation.

Although the product’s importance is undisputed, it sits in a unique niche market influenced by both scientific and ethical concerns. While its biological compatibility is unmatched, supply chain challenges, regulatory scrutiny, and rising demand have put pressure on pricing and sourcing practices.

The FBS market is no longer limited to legacy academic use. With the advent of advanced therapeutic platforms such as CAR-T therapies, stem cell treatments, and complex organoid models, demand for ultra-pure, traceable, and certified serum products is increasing. This evolution is driving differentiation within the market, where suppliers offer varying grades from standard to premium FBS to meet specific end-user requirements.

Major Trends in the Market

-

Rising Demand in Cell and Gene Therapies

The expansion of advanced therapies has led to increased usage of high-purity FBS during R&D and scale-up processes.

-

Ethical and Regulatory Oversight

Regulatory bodies are tightening sourcing and traceability standards to ensure humane collection and supply chain transparency.

-

Adoption of Certified and Premium-Grade Serum

Biopharma companies are increasingly opting for gamma-irradiated, virus-screened, and endotoxin-controlled serum to meet clinical-grade requirements.

-

Efforts to Develop FBS Alternatives

Research into serum-free and chemically defined media is growing, though complete substitution remains limited due to the complexity of FBS components.

-

Price Volatility Due to Supply Chain Fluctuations

Variability in cattle slaughter rates and geographic regulations have caused intermittent price surges and disrupted supply continuity.

Report Scope of The Fetal Bovine Serum Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.93 Billion |

| Market Size by 2033 |

USD 9.62 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; HiMedia Laboratories; Bio-Techne; PAN-Biotech; Atlas Biologicals, Inc.; Rocky Mountain Biologicals; Biowest |

Market Driver: Acceleration in Biopharmaceutical R&D

A central driver of the fetal bovine serum market is the rapid expansion of biopharmaceutical research and development. The growing number of preclinical and clinical studies involving biologics, monoclonal antibodies, vaccines, and cell therapies demands scalable and reliable cell culture systems. FBS provides the biochemical consistency necessary to support complex cellular behaviors during drug screening, genetic manipulation, and biomarker discovery.

Pharmaceutical companies require cell lines that mirror human physiological responses, particularly for oncology, immunology, and metabolic disease models. FBS, with its rich nutrient profile and ability to support multiple mammalian cell lines, remains a staple in this effort. In high-throughput screening systems and bioassay validation, the presence of FBS ensures reproducibility, a crucial factor in regulatory submissions.

Moreover, the COVID-19 pandemic has re-emphasized the need for rapid vaccine and therapeutic development both of which rely heavily on viral propagation and antigen production in FBS-enriched culture media.

Market Restraint: Ethical and Regulatory Sourcing Challenges

Despite its utility, fetal bovine serum is surrounded by ethical and logistical challenges. The collection process extracting blood from bovine fetuses post-slaughter has raised concerns among animal welfare organizations, consumers, and even regulatory agencies. As a result, increased emphasis is now placed on traceability, humane treatment, and documentation.

Regions such as the European Union have implemented strict regulations governing FBS origin, collection methods, and viral inactivation processes. These rules can hinder supply consistency and complicate global trade. Additionally, ensuring batch-to-batch consistency due to the biological variability inherent in serum collection is an ongoing technical challenge for manufacturers.

This ethical complexity not only influences procurement but also opens discussions on alternatives, complicating market stability and shaping procurement strategies.

Market Opportunity: Growth in In-vitro Fertilization (IVF) and Personalized Medicine

A promising opportunity in the FBS market is the growing application in in-vitro fertilization (IVF) and personalized medicine. FBS is increasingly used in the culture of gametes and embryos, as well as in preparing oocyte and sperm storage media. As fertility rates decline globally and IVF demand increases, clinics are adopting more stringent laboratory protocols involving certified culture supplements.

In personalized medicine, particularly stem cell and immune cell therapies, autologous and patient-derived cells are grown under carefully optimized conditions, often requiring clinical-grade serum during development. The shift toward autologous therapeutics creates demand for high-quality, contamination-free FBS that complies with GMP standards.

Suppliers that can offer traceable, pathogen-tested, and regulatory-approved FBS products are poised to tap into these growing, high-margin sectors.

Segments:

Fetal Bovine Serum Market By Application Insights

Cell-based research dominates the application segment, as the majority of academic and industry-based life sciences research relies on mammalian cell culture models. Whether studying cancer cell lines, stem cells, or engineered tissues, FBS is the primary supplement used to support cellular activity and maintain homeostasis in vitro.

Researchers depend on the consistency, growth factor profile, and metabolic support provided by FBS to conduct gene expression studies, protein assays, and cellular imaging. In particular, the proliferation of immortalized lines such as HeLa, CHO, and HEK293 in research labs has kept this segment at the forefront of FBS consumption.

The fastest-growing application is vaccine production, especially after the global impact of COVID-19 and the increasing demand for preventive healthcare. Viral vaccines like those for influenza, rabies, and hepatitis often rely on cell cultures for antigen production. FBS is used to nourish the cells during virus propagation, particularly in Vero and MDCK cell lines.

With mRNA and vector-based vaccine platforms gaining momentum, upstream process optimization requires dependable growth media, in which FBS still plays a key role. The global push for pandemic preparedness and regional vaccine manufacturing is anticipated to sustain high growth in this segment.

Fetal Bovine Serum Market By End-user Insights

Pharmaceutical and biotechnology firms are the dominant end-users due to their substantial involvement in preclinical drug discovery, toxicology studies, and large-scale biologic production. These companies prioritize reproducibility, scalability, and regulatory compliance, often requiring bulk quantities of high-grade FBS.

Moreover, biopharma players increasingly partner with suppliers who provide certificates of analysis (CoA), endotoxin levels, and virus screening data. Long-term supply agreements between biomanufacturers and FBS vendors ensure batch consistency for critical development phases, reinforcing the dominant role of this segment.

Contract research organizations are rapidly expanding their market share as outsourcing becomes a standard practice in drug development. Pharmaceutical firms increasingly rely on CROs to manage early-stage screening, pharmacology studies, and assay development activities that extensively use FBS-enriched media.

CROs operate under strict timelines and often require flexible procurement of serum grades. As they take on more roles in oncology, virology, and personalized therapies, their need for high-quality FBS is increasing. Suppliers who cater to this fast-growing sector with agile logistics and customized solutions are likely to gain a competitive edge.

Fetal Bovine Serum Market By Regional Insights

North America dominates the FBS market due to its robust biopharmaceutical infrastructure, high investment in life sciences R&D, and presence of global biotech companies. The U.S., in particular, hosts a large number of cell-based research labs, CROs, and GMP-compliant production facilities that consistently require certified FBS.

Regulatory compliance is high in this region, which also favors suppliers offering USDA-approved, traceable serum products. Moreover, the presence of biotech innovation hubs in Boston, San Francisco, and Toronto has created concentrated zones of FBS demand. Academic research, fueled by NIH and other grant funding, further drives regional dominance.

Asia-Pacific is the fastest-growing market, propelled by government investments in biotechnology, increasing academic research output, and the expansion of regional pharma companies. Countries such as China, India, South Korea, and Japan are building new R&D labs and manufacturing plants, many of which use imported FBS due to local supply constraints.

Moreover, the growing fertility treatment market in countries like India and Thailand is contributing to FBS demand in IVF applications. With regional regulatory frameworks maturing and life sciences education expanding, Asia-Pacific is rapidly emerging as both a demand hub and potential supplier base.

Some of the prominent players in the Fetal bovine serum market include:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- HiMedia Laboratories

- Bio-Techne

- PAN-Biotech

- Atlas Biologicals, Inc.

- Rocky Mountain Biologicals

- Biowest

Recent Developments

-

January 2025 – A U.S.-based FBS supplier announced a new partnership with a South Korean vaccine manufacturer to supply GMP-grade serum for pandemic preparedness pipelines.

-

March 2025 – An Australian biosciences company launched an AI-assisted traceability tool for FBS batches, offering real-time tracking of origin, quality tests, and storage conditions.

-

February 2025 – A European biopharma company initiated the construction of a new R&D facility in the Netherlands, with dedicated high-throughput labs requiring certified FBS for monoclonal antibody development.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global fetal bovine serum market.

Application

- Drug Discovery

- In-vitro Fertilization

- Vaccine Production

- Cell-based Research

- Diagnostics

- Others

End-user

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CRO)

- Academic And Research Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)