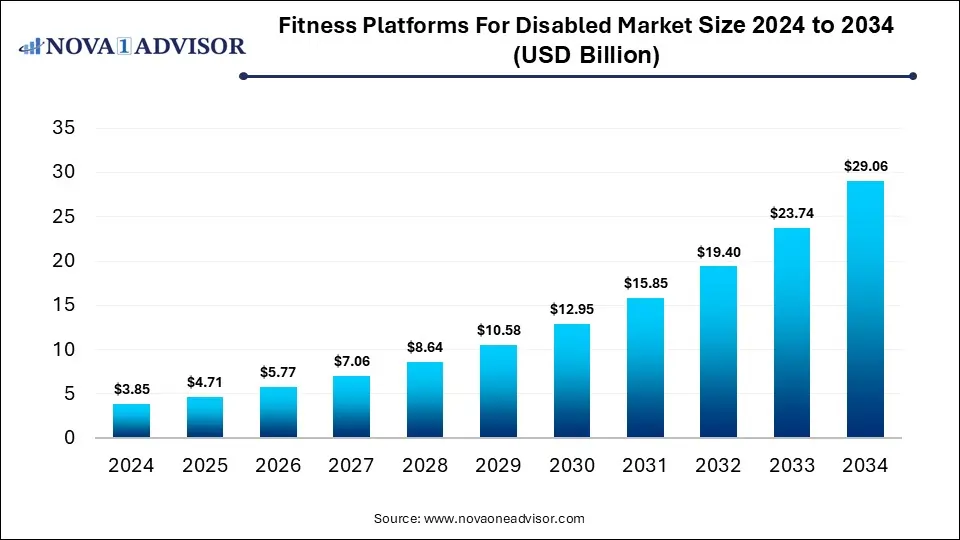

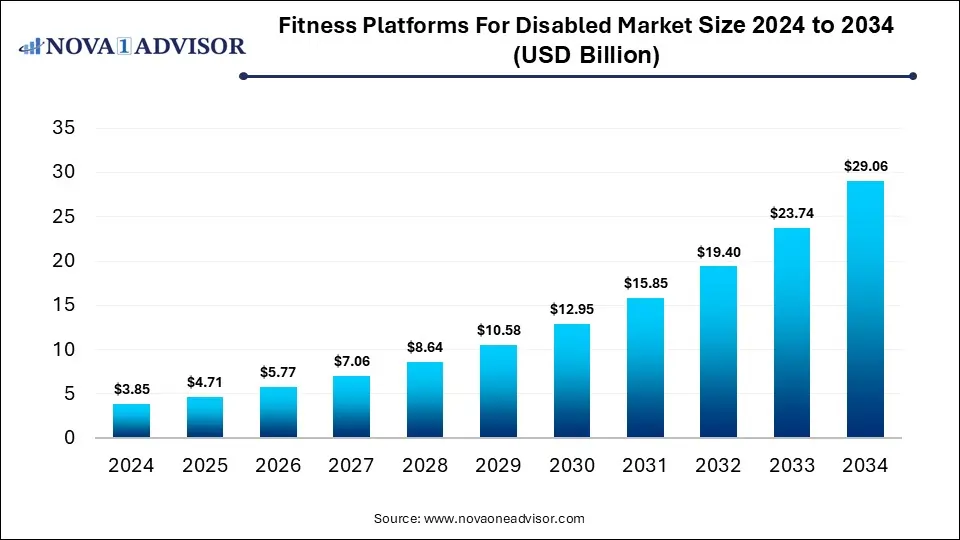

The global Fitness Platforms For Disabled market gathered revenue around USD 3.85 billion in 2024 and market is set to grow USD 29.06 billion by the end of 2034 and is estimated to expand at a modest CAGR of 22.4% during the prediction period 2025 to 2034.

Market Overview

The fitness industry has undergone a remarkable transformation in the last decade, shifting from traditional gyms and wellness centers to digital platforms that emphasize accessibility, inclusivity, and personalization. Among the most significant areas of growth is the fitness platforms for disabled market, a niche yet rapidly expanding domain dedicated to addressing the needs of people with disabilities. Globally, over 1.3 billion people live with some form of disability, representing nearly 16% of the population, according to the World Health Organization (2023). This presents a substantial audience in need of tailored solutions to improve their health, wellness, and quality of life.

These platforms, often delivered through mobile apps, wearables, and web-based systems, focus on accessible workouts, adaptive activity tracking, nutrition guidance, and wellness communities. They integrate with advanced technologies such as artificial intelligence (AI), gamification, and voice-enabled features to ensure usability for individuals with physical, sensory, or cognitive impairments. For example, platforms like Adaptive Yoga Live and Special Olympics Fit 5 provide virtual adaptive fitness programs that accommodate wheelchair users, visually impaired individuals, or those requiring low-impact exercises.

The market is influenced by growing societal emphasis on inclusion, government initiatives promoting digital health, rising prevalence of chronic diseases requiring rehabilitative fitness, and advancements in wearable devices. Moreover, the COVID-19 pandemic accelerated digital fitness adoption, providing a boost for disability-friendly solutions. With fitness increasingly being considered a cornerstone of preventive healthcare, the demand for specialized platforms is expected to see double-digit growth over the coming decade.

Major Trends in the Market

-

Integration of AI-driven personal trainers: AI tools are being used to provide real-time, adaptive workout feedback tailored to the physical limitations of disabled users.

-

Wearables with accessibility features: Companies like Apple and Fitbit have enhanced features such as haptic feedback, voice-over support, and gesture-based tracking to serve disabled users better.

-

Gamification for engagement: Platforms are incorporating reward systems, virtual competitions, and interactive challenges that motivate disabled users to stay active.

-

Tele-rehabilitation and virtual coaching: Partnerships between fitness app developers and healthcare providers are expanding opportunities for disabled individuals to access guided rehabilitation exercises remotely.

-

Community-focused platforms: Fitness applications are emphasizing peer support and social sharing for motivation, particularly targeting disabled individuals who may face social isolation.

-

Hybrid fitness ecosystems: Integration of diet and nutrition tracking alongside physical activity tracking to deliver holistic wellness solutions.

-

Corporate and insurance adoption: Employers and insurers are investing in disability-friendly wellness programs to enhance inclusivity and lower healthcare costs.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.71 Billion |

| Market Size by 2034 |

USD 29.06 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Platform, Device, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Apple, Inc.; Kakana; Adaptive Yoga LiveChampion’s Rx; Evolve21; Kym Nonstop; Exercise Buddy, LLC; Special Olympics; YouTube; Hulu, LLC |

By Type

Exercise & Weight Loss dominated the market.

Exercise and weight management platforms account for the largest share of the fitness platforms for disabled market. These platforms offer tailored physical activity routines, from strength training for amputees to seated aerobics for wheelchair users. Their popularity stems from the rising prevalence of obesity among disabled populations, where barriers to traditional gyms make digital alternatives highly attractive. Applications such as Adaptive Fitness Online have become critical tools in enabling disabled individuals to follow structured, trainer-led workout programs from the comfort of their homes.

In addition to dominance, Activity Tracking is emerging as the fastest-growing type. The growing penetration of wearables like Apple Watch, which now includes wheelchair-specific calorie burn metrics, is fueling adoption. Disabled users increasingly prefer continuous tracking of vital signs, activity levels, and sleep cycles to manage chronic conditions. The demand is expected to rise further as AI-enabled health monitoring becomes more personalized, ensuring better integration of fitness into daily healthcare routines.

Android-based platforms dominated the market.

Android applications lead due to the wider adoption of affordable Android smartphones across emerging economies. Their open-source flexibility allows developers to integrate accessibility features such as customizable voice navigation and haptic cues more effectively. Android’s dominance is particularly pronounced in Asia Pacific and Latin America, where budget-friendly smartphones are widespread.

However, iOS-based platforms are the fastest-growing. Apple’s strong commitment to accessibility, with features like VoiceOver, AssistiveTouch, and haptic feedback, has positioned iOS as the preferred platform for premium disability-focused fitness apps. Fitness app developers are increasingly prioritizing iOS integration to leverage Apple’s ecosystem of wearables, including the Apple Watch, which is a leader in adaptive activity tracking for disabled individuals.

By Device

Smartphones dominated the market.

Smartphones remain the most widely used devices for accessing fitness platforms for disabled users, primarily due to affordability, portability, and multifunctionality. Their high penetration rate and compatibility with both Android and iOS ecosystems make them the go-to device for adaptive fitness apps. Examples include apps like MyFitnessPal and Nike Training Club, which have introduced accessibility updates for broader use.

Meanwhile, wearable devices are the fastest-growing segment. The rise of smartwatches and fitness bands tailored with accessible features, such as vibration alerts and voice guidance, is driving demand. Wearables not only support fitness but also offer real-time health tracking, critical for disabled individuals managing chronic conditions. As wearables become more affordable and technologically advanced, this segment is expected to experience exponential growth.

Regional Analysis

North America dominated the fitness platforms for disabled market.

North America holds the largest share, driven by high technology adoption rates, strong healthcare infrastructure, and supportive government policies. The U.S., in particular, leads due to the presence of major players like Apple, Fitbit, and Peloton, who have integrated accessibility into their platforms. Programs such as the National Center on Health, Physical Activity and Disability (NCHPAD) further encourage participation in digital fitness programs. Additionally, the rising number of partnerships between healthcare providers and app developers positions North America as the market leader.

Asia Pacific is the fastest-growing region.

The Asia Pacific region is witnessing rapid growth due to increasing smartphone penetration, urbanization, and rising awareness of disability-inclusive wellness. Countries like India, Japan, and China are investing in digital health ecosystems, with startups creating affordable, localized fitness platforms for disabled individuals. For instance, Japan has seen a surge in demand for rehabilitation-focused fitness apps catering to its aging population with disabilities. Government initiatives, combined with growing venture capital investments in health-tech startups, are expected to make Asia Pacific the most dynamic growth hub over the next decade.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Key Players

- Apple, Inc.

- Kakana

- Champion’s Rx

- Adaptive Yoga Live

- Evolve21

- Kym Nonstop

- Exercise Buddy, LLC

- Special Olympics

- YouTube

- Hulu, LLC

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

Market Segmentation

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Platform

By Device

- Smartphones

- Tablets

- Wearable Devices

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

List of Figure

List of Tables

- Global Fitness Platforms for Disabled Market Size (USD Billion), 2025–2034

- Global Market Share by Type, 2025 & 2034

- Global Market Share by Platform, 2025 & 2034

- Global Market Share by Device, 2025 & 2034

- North America Fitness Platforms for Disabled Market Size, by Country, 2025–2034

- U.S. Market Size, by Type, 2025–2034

- U.S. Market Size, by Platform, 2025–2034

- U.S. Market Size, by Device, 2025–2034

- Canada Market Size, by Type, 2025–2034

- North America Market Size, by Platform, 2025–2034

- Europe Fitness Platforms for Disabled Market Size, by Country, 2025–2034

- Germany Market Size, by Type, 2025–2034

- France Market Size, by Type, 2025–2034

- U.K. Market Size, by Type, 2025–2034

- Rest of Europe Market Size, by Type, 2025–2034

- Europe Market Size, by Platform, 2025–2034

- Asia Pacific Fitness Platforms for Disabled Market Size, by Country, 2025–2034

- China Market Size, by Type, 2025–2034

- Japan Market Size, by Type, 2025–2034

- India Market Size, by Type, 2025–2034

- Southeast Asia Market Size, by Type, 2025–2034

- Rest of Asia Pacific Market Size, by Type, 2025–2034

- Asia Pacific Market Size, by Platform, 2025–2034

- Asia Pacific Market Size, by Device, 2025–2034

- Latin America Fitness Platforms for Disabled Market Size, by Country, 2025–2034

- Brazil Market Size, by Type, 2025–2034

- Rest of Latin America Market Size, by Type, 2025–2034

- Latin America Market Size, by Platform, 2025–2034

- Middle East & Africa Fitness Platforms for Disabled Market Size, by Country, 2025–2034

- GCC Market Size, by Type, 2025–2034

- North Africa Market Size, by Type, 2025–2034

- South Africa Market Size, by Type, 2025–2034

- Rest of MEA Market Size, by Type, 2025–2034

- MEA Market Size, by Platform, 2025–2034

- MEA Market Size, by Device, 2025–2034

- Company Market Share of Key Players, 2024

- Competitive Landscape of Major Players, 2025–2034

- Global Fitness Platforms for Disabled Market Outlook, 2025–2034 (USD Billion)

- Global Market Share, by Type, 2025

- Global Market Share, by Platform, 2025

- Global Market Share, by Device, 2025

- Global Market Share, by Type, 2034

- Global Market Share, by Platform, 2034

- Global Market Share, by Device, 2034

- North America Market Share, by Country, 2025

- U.S. Market Share, by Platform, 2025

- Europe Market Share, by Country, 2025

- Germany Market Share, by Device, 2025

- Asia Pacific Market Share, by Country, 2025

- China Market Share, by Platform, 2025

- Latin America Market Share, by Country, 2025

- Brazil Market Share, by Device, 2025

- Middle East & Africa Market Share, by Country, 2025

- GCC Market Share, by Platform, 2025

- Comparative Growth Rate of Fitness Platforms for Disabled Market across Regions, 2025–2034

- Adoption of Wearables Among Disabled Population, Global, 2021–2034

- Accessibility Features Integration in Fitness Platforms (AI, Gamification, Voice-enabled Tools), 2025–2034