Fitness Tracker For Sleep Monitoring Market Size, Share, Growth, Report 2025 to 2034

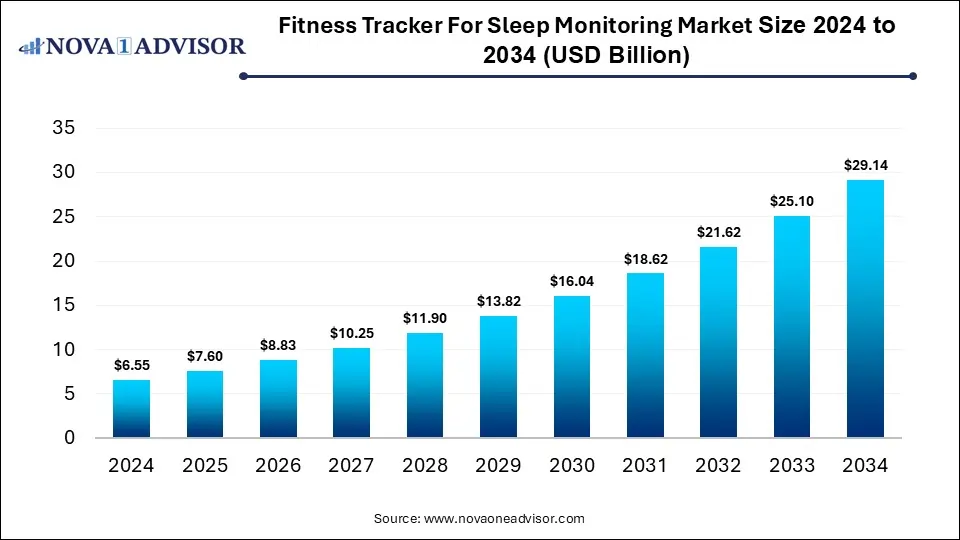

The global fitness tracker for sleep monitoring market size was estimated at USD 6.55 billion in 2024 and is expected to reach USD 29.14 billion by 2034, expanding at a CAGR of 16.1% during the forecast period of 2025 to 2034. The growth of the market is driven by rising health awareness, increasing adoption of wearable technology, and growing demand for personalized sleep and wellness solutions.

Fitness Tracker For Sleep Monitoring Market Key Takeaways

- By region, North America dominated the fitness tracker for sleep monitoring market in 2024.

- By region, Asia Pacific is expected to experience rapid growth throughout the forecast period.

- By type, the smart watches segment dominated the market in 2024.

- By type, the smart bands segment is expected to expand at the highest CAGR between 2025 and 2034.

- By distribution channel, the online segment held the largest share of the market in 2024.

- By distribution channel, the offline segment is expected to grow at a significant rate in the upcoming period.

How is AI Impacting the Fitness Tracker for Sleep Monitoring Market?

AI is significantly transforming the fitness tracker for sleep monitoring market by enhancing the accuracy, personalization, and utility of sleep data. Advanced algorithms use machine learning to analyze patterns in movement, heart rate, and oxygen levels, offering deeper insights into sleep stages and quality. AI enables predictive insights and personalized recommendations, helping users improve sleep habits and overall wellness. Integration of AI-driven virtual assistants and smart alarms further enhances user experience by adapting to individual sleep cycles. As AI capabilities continue to evolve, they are driving innovation and expanding the value proposition of sleep monitoring wearables.

Market Overview

The fitness tracker for sleep monitoring market focuses on wearable devices designed to track and analyze users' sleep patterns, providing insights into sleep duration, quality, and disturbances. These trackers offer key benefits such as improved sleep awareness, early detection of sleep disorders, and personalized recommendations for better sleep. The growing health consciousness among consumers, rising prevalence of sleep-related issues, and increasing adoption of wearable technology are major factors driving market growth. Advancements in sensor technology and integration of AI for more accurate sleep tracking are further enhancing the functionality and appeal of these devices. As individuals prioritize holistic health, demand for smart, user-friendly sleep monitoring solutions continues to rise globally.

What are the Major Trends in the Fitness Tracker for Sleep Monitoring Market?

- Integration of AI and Machine Learning: Fitness trackers are increasingly incorporating AI and machine learning algorithms to analyze sleep patterns more accurately and offer personalized insights. These technologies enhance the device’s ability to detect sleep stages, disturbances, and recommend improvements.

- Rise of Smartwatches as Sleep Monitors: Smartwatches with built-in sleep tracking features are gaining popularity due to their multifunctionality. Users prefer all-in-one devices that combine fitness tracking, sleep monitoring, and health alerts in a single wearable.

- Increased Demand for Non-Wearable Sleep Tracking Devices: There is growing interest in non-invasive, non-wearable sleep trackers like under-mattress sensors and bedside monitors. These cater to consumers who prefer not to wear devices while sleeping, expanding the market’s reach.

- Focus on Mental Health and Holistic Wellness: As consumers prioritize mental health and overall wellness, sleep tracking has become a key component of broader health management. Many fitness trackers now integrate sleep data with stress, mood, and recovery tracking features to offer a more holistic view of well-being.

Report Scope of Fitness Tracker for Sleep Monitoring Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.60 Billion |

| Market Size by 2034 |

USD 29.14 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growing Awareness About the Importance of Sleep

Growing awareness among people about the importance of sleep and its impact on overall health is a key factor driving the growth of the fitness tracker for sleep monitoring market. As more people recognize the link between quality sleep and physical, mental, and emotional well-being, demand for tools that can monitor and improve sleep patterns is rising. Fitness trackers offer users actionable insights into their sleep duration, stages, and disruptions, enabling them to make lifestyle changes that promote better rest. This increasing focus on preventative health and wellness is encouraging individuals to invest in wearable technology that supports healthier sleep habits. Consequently, manufacturers are responding with more advanced, user-friendly sleep tracking features, further fueling market growth.

Rising Prevalence of Sleep Disorders

The rising prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome is significantly driving the growth of the market. As more individuals experience disrupted or poor-quality sleep, there's a growing demand for accessible and non-invasive tools to monitor and manage sleep health. Fitness trackers help users detect irregular sleep patterns and gain insights that may prompt early medical consultation or lifestyle changes. This surge in sleep-related health issues is prompting both consumers and healthcare providers to adopt wearable technologies as part of broader wellness strategies.

- For instance, over 16% of the global population is affected by insomnia, with higher prevalence among females than males. ( https://www.sciencedirect.com/)

Increasing Adoption of Wearable Health Technology

The increasing adoption of wearable health technology is also a major driver of growth in the market. Consumers are becoming more health-conscious and are turning to smart wearables that offer real-time insights into various aspects of their well-being, including sleep quality. The convenience, portability, and continuous monitoring capabilities of fitness trackers make them ideal for tracking sleep patterns over time. As wearables become more affordable and technologically advanced, their widespread acceptance is accelerating the demand for integrated sleep monitoring features.

Restraints

Limited Accuracy of Consumer-Grade Sleep Trackers

The limited accuracy of consumer-grade sleep trackers compared to clinical devices is a significant factor restraining the growth of the fitness tracker for sleep monitoring market. While these wearables provide general insights into sleep patterns, they often lack the precision of medical-grade tools like polysomnography, leading to potential misinterpretation of sleep data. This accuracy gap can reduce consumer trust and limit their use for serious sleep health monitoring or diagnosis. Healthcare professionals may hesitate to rely on data from these devices, further restricting their integration into clinical settings. As a result, skepticism around data reliability can hinder broader adoption, especially among users seeking medically actionable insights.

Concerns Over Data Privacy and Security

Concerns over data privacy and security significantly restrain the growth of the market. These devices collect sensitive personal health information, including sleep patterns, heart rate, and stress levels, raising fears about how this data is stored, shared, and protected. Incidents of data breaches or misuse by third-party apps have heightened consumer apprehension, leading some users to avoid or limit the use of wearable health devices. Additionally, unclear or complex privacy policies can discourage adoption, especially in regions with strict data protection regulations. This lack of trust in data handling practices can act as a barrier to market expansion, particularly among privacy-conscious consumers.

High Cost of Advanced Wearable Devices

The high cost of advanced wearable devices also affects the growth of the market. Many feature-rich trackers with accurate sleep monitoring capabilities remain expensive, making them inaccessible to a large segment of price-sensitive consumers, especially in developing regions. This pricing gap limits market penetration and restricts widespread adoption, particularly among lower-income demographics. As a result, despite growing interest in sleep health, affordability remains a significant barrier to expanding the user base for these devices.

Opportunities

Technological Advancements

Technological advancements, especially in sensor technology, are creating immense opportunities in the fitness tracker for sleep monitoring market. Modern sensors can now track a wide range of physiological signals such as heart rate variability, blood oxygen levels (SpO2), skin temperature, and even breathing patterns with greater accuracy and sensitivity. These improvements enable more precise detection of sleep stages and disturbances, enhancing the reliability of data provided to users. As a result, fitness trackers are evolving from basic sleep monitoring tools into comprehensive health assessment devices, appealing to both consumers and healthcare professionals. This continuous innovation opens doors for new product development and expands applications in sleep disorder management.

Integration with Telehealth and Personalized Healthcare Platforms

The integration of sleep tracking with telehealth and personalized healthcare platforms is unlocking significant opportunities in the market. By connecting wearable devices with telemedicine services, users can share real-time sleep data with healthcare providers, enabling remote diagnosis and personalized treatment plans. This seamless data exchange improves patient engagement and supports proactive health management, particularly for those with chronic sleep disorders. Additionally, personalized healthcare platforms leverage sleep data to tailor wellness recommendations, enhancing overall care quality. Such integration not only boosts the value proposition of fitness trackers but also drives wider adoption across the healthcare industry.

What Macroeconomic Factors Influence the Growth of the Fitness Tracker for Sleep Monitoring Market?

GDP and Economic Growth

Economic growth and rising GDP generally drive the growth of the market. As economies expand, consumers have higher disposable incomes, enabling them to invest in health and wellness technologies, including advanced sleep tracking wearables. Additionally, stronger GDP growth often leads to improved healthcare infrastructure and increased government support for digital health initiatives, further boosting market growth.

Inflation Rates

High inflation rates generally restrain the growth of the market. As inflation drives up the cost of goods and reduces consumer purchasing power, non-essential spending on items like wearable fitness devices tends to decline. Additionally, rising production and logistics costs can lead to higher device prices, further limiting market expansion.

Government Policies

Government policies drive the growth of the market. Supportive initiatives such as digital health missions, incentives for local manufacturing, and awareness campaigns encourage the adoption of wearable health technologies. Additionally, regulations that promote data security and interoperability further build consumer trust, boosting market expansion.

Monetary Policy

Monetary policy can have both positive and negative impact on the growth of the market, depending on its direction. Expansionary policies, such as low interest rates and increased money supply, boost consumer spending and investment, positively impacting demand for health and wellness devices. Conversely, tight monetary policies aimed at controlling inflation can reduce disposable income and limit consumer spending, thereby restraining market growth.

Segment Outlook

Type Insights

Why Did the Smart Watches Segment Dominate the Market in 2024?

The smart watches segment dominated the fitness tracker for sleep monitoring market with a major revenue share in 2024. This is mainly due to their multifunctionality and widespread consumer adoption. Unlike basic fitness bands, smartwatches offer advanced features such as continuous heart rate monitoring, blood oxygen tracking, and sleep stage analysis, all integrated into a single device. Their compatibility with smartphones and health apps enhances user experience and long-term engagement. Additionally, major tech brands like Apple, Samsung, and Fitbit have heavily promoted smartwatches as comprehensive health tools, boosting consumer trust and demand. This combination of advanced technology, brand influence, and all-in-one convenience positioned smartwatches as the leading choice for sleep monitoring.

The smart bands segment is expected to expand at the highest CAGR over the projection period due to their affordability, lightweight design, and ease of use. These devices offer essential sleep tracking features, such as sleep duration, quality, and patterns, at a lower price point, making them accessible to a broader consumer base, especially in emerging markets. As health awareness rises globally, more users are seeking budget-friendly options to monitor their sleep without the complexity of high-end smartwatches. Additionally, continuous innovation in sensor accuracy and battery life is enhancing the value proposition of smart bands, supporting segmental growth. Several companies in the market are introducing innovative products to gain a competitive advantage, further supporting segment growth.

- In June 2025, Garmin launched the Index Sleep Monitor, an upper-arm band that tracks key sleep metrics like blood oxygen, heart rate variability, respiration, and sleep stages. Designed to rival Whoop Inc., it offers in-depth insights into sleep quality and overall health. (https://www.bloomberg.com/)

Fitness Tracker For Sleep Monitoring Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Smart Watches |

3.80 |

4.44 |

5.20 |

6.08 |

7.12 |

8.32 |

9.74 |

11.39 |

13.32 |

15.58 |

18.22 |

| Smart Bands |

1.97 |

2.24 |

2.56 |

2.92 |

3.33 |

3.80 |

4.33 |

4.94 |

5.62 |

6.40 |

7.29 |

| Smart Clothing |

0.46 |

0.54 |

0.64 |

0.75 |

0.88 |

1.04 |

1.22 |

1.43 |

1.69 |

1.98 |

2.33 |

| Others |

0.33 |

0.38 |

0.43 |

0.50 |

0.57 |

0.66 |

0.75 |

0.87 |

0.99 |

1.14 |

1.31 |

Distribution Channel Insights

How Does Online Segment Contribute the Largest Market Share in 2024?

The online segment held the largest share of the fitness tracker for sleep monitoring market in 2024 due to the convenience, wide product variety, and competitive pricing offered by e-commerce platforms. Consumers increasingly preferred online channels for comparing features, reading reviews, and accessing exclusive discounts, especially for tech products like smartwatches and fitness bands. The rise of digital payments, doorstep delivery, and easy return policies further boosted consumer confidence in online shopping. Additionally, brands expanded their direct-to-consumer strategies via their own websites and major marketplaces like Amazon and Flipkart, increasing online visibility and sales. This shift in buying behavior, driven by digital convenience and better deals, solidified the dominance of the online segment.

The offline segment is expected to grow at a significant rate during the forecast period, owing to increasing consumer preference for hands-on product experience and in-person consultation before purchase. Retail stores and brand outlets allow customers to physically test devices, assess comfort and design, and receive immediate support, which is especially valuable for first-time buyers. As health and wellness become a priority, more consumers are turning to trusted retail environments, including electronics stores and health-focused outlets. Additionally, the expansion of organized retail in emerging markets and promotional partnerships with fitness brands are driving offline sales. This growing emphasis on personalized customer service and product assurance is fueling the offline segment’s growth.

Fitness Tracker For Sleep Monitoring Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Online |

4.19 |

4.91 |

5.76 |

6.74 |

7.90 |

9.26 |

10.84 |

12.70 |

14.88 |

17.42 |

20.40 |

| Offline |

2.36 |

2.69 |

3.07 |

3.51 |

4.00 |

4.56 |

5.20 |

5.92 |

6.75 |

7.68 |

8.74 |

Regional Insights

What Made North America the Dominant Region in the Fitness Tracker for Sleep Monitoring Market?

In 2024, North America dominated the fitness tracker for sleep monitoring market by holding the largest share. This is primarily due to its advanced healthcare infrastructure, high consumer awareness of health and wellness, and strong adoption of wearable technology. The presence of major market players such as Apple, Fitbit, and Garmin in the region contributed to rapid innovation and widespread product availability. Additionally, a tech-savvy population and high disposable income enabled consumers to invest in premium devices with advanced sleep tracking features. The growing prevalence of sleep disorders further fueled demand.

- According to the National Institutes of Health (NIH), around 50 to 70 million Americans suffer from sleep disorders, and 1 in 3 adults (about 84 million) don’t get the recommended amount of uninterrupted sleep for good health. (https://www.nhlbi.nih.gov/)

The U.S. is the major contributor to the North America fitness tracker for sleep monitoring market due to its substantial tech-savvy population and high awareness of personal health and wellness. The country is home to leading wearable brands like Apple, Fitbit, and Garmin, which continue to innovate and expand their sleep monitoring features. High healthcare spending, rising concerns over sleep disorders, and the growing trend of using wearables for preventive health have also boosted demand. Additionally, widespread internet access and e-commerce infrastructure support strong distribution and consumer engagement, further solidifying the country’s position in the market. Supportive government initiatives promoting digital health also ensure the long-term growth of the market.

- On June 24, 2025, in a hearing before the U.S. House of Representatives Committee on Energy and Commerce, HHS Secretary Robert F. Kennedy Jr. announced plans for a major ad campaign promoting wearable health devices—one of the largest in HHS history. The initiative aims to empower Americans to take control of their health through informed, data-driven decisions. (https://www.akingump.com/)

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience rapid growth during the projection period due to rapid urbanization, rising health awareness, and increasing adoption of smart wearables. Growing middle-class populations in countries like China, India, and Southeast Asian nations are driving demand for affordable health tracking devices. Additionally, the presence of major regional manufacturers such as Huawei, Xiaomi, and Samsung is making advanced sleep monitoring technology more accessible. Government initiatives promoting digital health and increasing penetration of smartphones and internet services are further supporting market expansion.

- For instance, the Indian government’s PLI scheme for wearables promotes local manufacturing by Indian and global firms, aiming to make wearable tech more affordable and accessible. Through supportive policies and digital health initiatives, the government is boosting adoption across fitness, healthcare, and wellness sectors. (https://www.livemint.com/)

China is a major contributor to the Asia Pacific fitness tracker for sleep monitoring market, driven by its large population, rapid urbanization, and widespread adoption of smart technology. The presence of leading domestic brands like Huawei, Xiaomi, and Oppo has made fitness trackers with sleep monitoring features highly affordable and accessible to the masses. Growing health awareness, increasing disposable income, and a strong e-commerce ecosystem further support high product uptake. Additionally, China's emphasis on digital health and innovation continues to propel its leadership in the regional market.

Fitness Tracker For Sleep Monitoring Market Size Analysis

Currently, the fitness tracker for sleep monitoring market size is estimated to be valued at USD 6.55 billion in 2024 and is projected to reach USD 29.14 billion by 2034. The market is poised to grow at a higher CAGR of 16.1% during the projected period. This highest growth potential is likely to be the result of growing demand for target specific therapies for the treatment of chronic diseases.

Region-Wise Breakdown of the Fitness Tracker for Sleep Monitoring Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 2.7 Bn |

5.95% |

High health awareness, advanced healthcare infrastructure, strong presence of tech companies, technological innovations |

High device costs, data privacy concerns |

Leading market with robust growth |

| Asia Pacific |

USD 1.9 Bn |

7.0% |

Rising disposable incomes, growing tech-savvy population, government investments in digital health |

Limited awareness in rural areas, affordability issues |

Rapid expansion, particularly in China, India, and Japan, with significant market potential |

| Europe |

USD 1.5 Bn |

10.5% |

Focus on preventive healthcare, high disposable incomes, widespread adoption of wearable technologies |

Data privacy regulations, varying reimbursement policies |

Steady growth |

| Latin America |

USD 0.5 Bn |

5.49% |

Emerging health consciousness, increasing smartphone penetration, interest in wellness products |

Economic instability, lower disposable incomes |

Emerging market with potential for growth |

| MEA |

USD 0.3 Bn |

4.75% |

Growing interest in health and wellness, increasing smartphone adoption |

Limited healthcare infrastructure, economic challenges |

Nascent market with opportunities for growth |

Value Chain Analysis of the Fitness Tracker for Sleep Monitoring Market

1. Research & Development (R&D)

This stage involves innovation and development of advanced sensor technologies, software algorithms, and integration of AI for accurate sleep monitoring. Companies invest heavily in R&D to improve device accuracy, battery life, and user experience, which is critical for gaining a competitive edge.

2. Component Manufacturing

This stage includes the production of hardware components like sensors, microchips, batteries, and display units. High-quality component manufacturing is essential to ensure the durability and performance of fitness trackers, as well as to maintain cost efficiency in production.

3. Device Assembly and Integration

In this stage, various components are assembled and integrated into the final wearable device. This includes embedding software for sleep monitoring and connectivity features such as Bluetooth and Wi-Fi to enable data transmission to smartphones or cloud platforms.

4. Software Development and Platform Integration

Software firms develop mobile apps and cloud-based platforms that collect, analyze, and visualize sleep data. Integration with health ecosystems, telehealth platforms, and personalized healthcare apps enhances the overall value proposition for end-users.

5. Marketing and Sales

This stage involves promoting the fitness trackers through online channels, retail outlets, and partnerships with healthcare providers. Effective marketing strategies focus on educating consumers about the benefits of sleep monitoring and building brand loyalty.

6. Distribution and Logistics

Efficient distribution networks ensure the availability of products across global markets, including e-commerce platforms and physical stores. Streamlined logistics are crucial for timely deliveries and reducing costs, especially in emerging markets.

7. After-Sales Service and Support

Providing technical support, software updates, and warranty services helps maintain customer satisfaction and encourages repeat purchases. This stage also includes data privacy and security management, which is vital to build trust among users.

Fitness Tracker for Sleep Monitoring Market Players

1. Fitbit (Google LLC)

Fitbit is a pioneer in wearable fitness technology, offering a wide range of trackers with advanced sleep monitoring features. Their devices combine sensor accuracy with user-friendly apps, promoting consumer awareness about sleep health.

2. Garmin Ltd.

Garmin provides fitness trackers and smartwatches with robust sleep tracking capabilities, known for precise biometric sensors. Their integration of sleep data with overall fitness and wellness metrics appeals to health-conscious users.

3. Apple Inc.

Apple’s Apple Watch integrates sophisticated sleep tracking with a comprehensive health ecosystem, leveraging its large user base. The company continuously innovates with features like blood oxygen monitoring and sleep stage analysis.

4. Xiaomi Corporation

Xiaomi offers affordable fitness bands with reliable sleep monitoring, making sleep tracking accessible to a broader demographic. Their Mi Band series has gained popularity, especially in emerging markets, due to cost-effectiveness.

5. Samsung Electronics

Samsung combines advanced hardware and AI-powered sleep analytics in its Galaxy Watch series. Their integration with Samsung Health provides personalized sleep insights and holistic wellness tracking.

6. Huawei Technologies Co., Ltd.

Huawei’s wearable devices offer detailed sleep tracking using AI algorithms to analyze sleep quality and disorders. They focus on combining affordability with advanced health monitoring features, especially in Asia Pacific markets.

7. Withings (Nokia Health)

Withings specializes in hybrid smartwatches and dedicated sleep trackers that provide clinical-grade sleep data. Their focus on medical-grade accuracy and integration with health apps serves users seeking detailed sleep insights.

8. Amazfit (Huami Corporation)

Amazfit delivers cost-effective fitness trackers with comprehensive sleep monitoring functions. Their growing product portfolio targets price-sensitive consumers while ensuring technology adoption in emerging regions.

9. Oura Health Ltd.

Oura Ring offers a unique, non-wearable ring design with highly accurate sleep tracking, focusing on detailed sleep stage and readiness metrics. Their device is popular among athletes and wellness enthusiasts looking for in-depth sleep data.

10. Polar Electro Oy

Polar offers fitness trackers with advanced sleep and recovery monitoring features tailored for athletes. Their technology helps users optimize training schedules based on sleep quality and overall recovery.

Recent Developments

- On August 28, 2025, Amazfit launched the screen-free Amazfit Helio Strap and the premium Amazfit Balance 2 smartwatch in India. The Helio Strap delivers deep fitness, recovery, and sleep tracking with real-time BioCharge scores by integrating sleep, exertion, and stress data, while the Balance 2 offers military-grade durability and 170+ sports modes. (https://www.thehindu.com/)

- In September 2025, Apple launched the Apple Watch Series 11. It offers advanced health features, including chronic high blood pressure alerts and enhanced sleep quality insights with a new sleep score, making it a powerful health and fitness companion. (https://www.apple.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the fitness tracker for sleep monitoring market.

By Type

- Smart Watches

- Smart Bands

- Smart Clothing

- Others

By Distribution Channel

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)