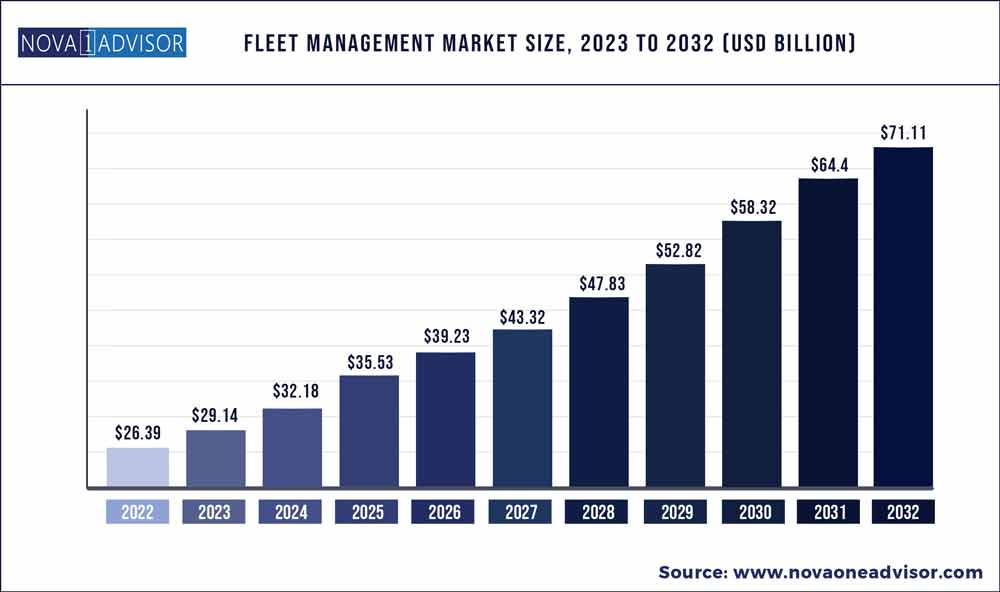

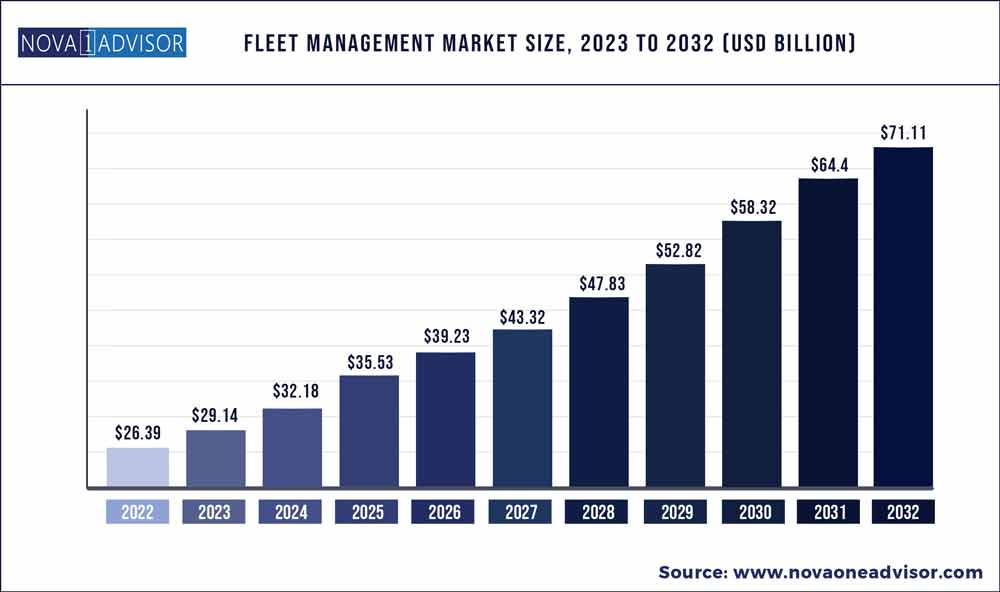

The global fleet management market size was exhibited at USD 26.39 billion in 2022 and is projected to hit around USD 71.11 billion by 2032, growing at a CAGR of 10.42% during the forecast period 2023 to 2032.

Key Pointers:

- By vehicle type, the commercial vehicle segment has dominated the market in 2022 with a revenue share of about 74.8%.

- By component, the solutions segment has dominated the market in 2022 with a share of about 65.6% in terms of revenue.

- North American region accounted for a share of about 34.8% in the past.

- Asia Pacific region is expected to grow at a CAGR of 12.4% over the forecast period 2023 to 2032.

Fleet management is the management of commercial vehicle operations at larger scale. It can be defined as the processes used by fleet managers to monitor fleet activities and make decisions from asset management, dispatch & routing, and vehicle acquisition. Businesses that rely on transportation utilize fleet management to control costs, productivity, fuel management, and compliance. Thus, fleet managers are responsible for maintaining costs, maximizing profitability, and reducing fleet vehicle risks. Furthermore, it involves vehicle financing, driver management, and vehicle telematics related to watercraft, aircraft, commercial vehicles (LCVs & HCVs) and railways. In addition, fleet management offers finance management, enhanced safety of vehicle & driver, and operational competency with real-time fleet tracking analysis. Most fleet managers use fleet management software to improve overall fleet safety, customer services, and increase visibility & profitability with process management & research.

Fleet Management Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 29.14 Billion

|

|

Market Size by 2032

|

USD 71.11 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 10.42%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Vehicle, Component, Communication Technology, Deployment Type, Industry

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

TomTom N.V. U.S, General Services Administration, Fleetmatics Group PLC, Telogis, Freeway Fleet Systems, IBM Corporation, AT&T Inc., Navico, Grupo Autofin de Monterrey, Grab, Scope Technologies, Troncalnet, FAMSA, Ola Cabs, I.D. Systems, MiTAC International Corporation, Cisco Systems, Trimble Transportation & Logistics, Uber Technologies, Didi Chuxing, DC Velocity, Fleet Robo, European GNSS Agency (GSA)

|

Fleet management Market Dynamics

Driver: Rising fleet safety concerns

Safety is the top priority for any fleet manager. Any crisis or accident could have severe effects. Therefore, fleet managers are becoming more interested in fleet management solutions that include safety management as one of the features. Businesses have a big opportunity to save money by running a safer fleet. Less at-fault crashes will result in lower insurance rates, less employee downtime, less need for costly overtime to cover missing drivers, and lower medical costs for the fleet. Vehicles would endure less wear and tear if safety violation occurrences like speeding and abrupt braking are reduced. This may lead to lower maintenance costs and less downtime for the vehicle. Vehicle usage rates will rise as accident rates decline and wear and tear on vehicles decreases. As a result, there may be less demand for standby cars, opening up possibilities for fleet size reduction. When you come to sell your car, it will be in better shape, which will lower the rate of depreciation.

Restraint: Atmospheric interference causing problems for GPS connectivity

One of the biggest issues preventing GPS connectivity is atmospheric inference. For the GPS system to work, it must provide a precise location. The most recent navigation service, like Google Maps, provides a location that is accurate to within 3–10 metres. These services also work best under specific circumstances, such as when users are in optimal circumstances, outdoors as opposed to indoors, in a city, and with robust internet access. To get to the cell phone, the GPS signal must travel over great distances in the atmosphere and pass through numerous satellites. Receiving information from at least three to four satellites and up to eight satellites will yield accurate results.

Receiving information from at least three to four satellites and up to eight satellites is necessary to obtain correct data. Additionally, there are some natural obstacles like trees, mountains, hills, and big buildings in cities that make it more difficult to receive a reliable GPS signal. The GPS tracking becomes more precise the more open sky the device experiences. Because of air interferences, the signal from the GPS satellite tower bounces back and takes longer to reach the GPS device. This would result in unexpected placement errors.

Opportunity: Development of transportation in logistics

Due to the development of transportation in logistics industry, more logistic providers now require new fleets to meet the demand. Due to this growing purchase, acquisition or leasing of new vehicles, their management also becomes a priority. The fleet management market thus becomes an indispensable tool for the companies owning large fleets to increase profits and ensuring operational efficiency and safety. Transportation is an important part of logistics services and a key link to improving the logistics efficiency. In China, the main modes of transportation are highway, railway, air, and waterway. The Chinese Government and the transportation enterprises are accelerating the transformation of transportation to modern logistics services. China’s comprehensive transportation network continually strengthens its logistics service functions by improving its transport infrastructure, upgrading the technical level of its facilities and equipment, and innovating its transportation organizational models. The growth of advanced technologies such as blockchain, digitalization, big data and data analytics, automation, and IoT are one of the major reasons for increasing demand for transportation in the logistics industry.

Challenge: Inaccurate Geocoding

An essential component of tleet routing IS accurate geocoding. Every route optimization method has a built-in geocoding feature that operates. It is difficult to translate addresses into a specific location on a map with accurate latitude and longitude coordinates, though. Accurate geocoding requires understanding confusing addresses and local circumstances in addition to a large database of neighbourhood addresses and apartment locations. The best route optimization algorithms cannot function effectively and may result in non-desired locations as well as time and fuel waste without a precise address to geocode search.

By Component, the services segment to have a higher CAGR during the forecast period

The component sector with the highest CAGR during the predicted period will be services. Services are essential to the overall process of putting fleet management solutions into place and keeping them maintained. Prior to deploying fleet management solutions, being aware of the installation and maintenance requirements is essential for figuring out the precise time and money investments needed. For instance, the length of time it takes to implement some solutions can reduce the efficiency of the IT team. Shorter installation periods are highly desired because fleet management solutions must be connected with the transportation industry' current IT infrastructure. For optimal operation, the services related to fleet management solutions are crucial. The intricacy of the fleet management solutions and the necessary integration factors influence the installation's final cost.

By Deployment Type, the cloud segment to grow at a higher CAGR during the forecast period

During the projected period, the cloud sector is expected to develop at a higher CAGR by deployment type. Digital content has expanded as a result of widespread internet use and widespread acceptance of numerous technologies, including mobile, web, and social media. In addition to integrating it with other fleet management systems like CRM and marketing resource management, enterprises want solutions to better manage and repurpose their native and web-based content. This will permit real-time content collaboration between staff members efficiently for analysis and other functions, assisting them in fortifying their marketing initiatives. However, the cost and scalability of such solutions are prohibitive. The adoption of cloud-based fleet management solutions by businesses is subsequently prompted by this. Due to their low initial expenses, these solutions provide all the advantages at lower rates. Additionally, they support business continuity by facilitating organisations' scalability and making organisational content easily accessible to all employees, regardless of where they are located.

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific is made up of nations with rapid technological development, such as China, Japan, and India. Asia Pacific is the market with the quickest rate of expansion for new fleet cars, with China posting the highest number of vehicle sales globally. The assistance provided by governments of countries such as China, Japan, and India that have established laws requiring mandatory GPS trackers is a significant factor in the region. This demonstrates the potential for the fleet management sector in Asia Pacific to expand. However, in addition to the region's economic unpredictability, another problem is that businesses frequently neglect to educate themselves on the advantages of adopting new technologies. Fleet safety is another important, urgent problem that worries fleet owners. Even in countries such as Australia and New Zealand, this presents a challenge for fleet management system suppliers who wish to improve their safety and security services (ANZ). The primary priorities for fleet managers are government rules pertaining to work, health, and safety, gaining from the enormous GDP growth. Rather from serving as the world's primary producer, it is now witnessing increased consumption.

Some of the prominent players in the Fleet Management Market include:

- TomTom N.V. U.S

- General Services Administration

- Fleetmatics Group PLC

- Telogis

- Freeway Fleet Systems

- IBM Corporation

- AT&T Inc.

- Navico

- Grupo Autofin de Monterrey

- Grab

- Scope Technologies

- Troncalnet

- FAMSA

- Ola Cabs

- I.D. Systems

- MiTAC International Corporation

- Cisco Systems

- Trimble Transportation & Logistics

- Uber Technologies

- Didi Chuxing

- DC Velocity

- Fleet Robo

- European GNSS Agency (GSA)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Fleet Management market.

By Vehicle

- Heavy Commercial Vehicle

- Aircraft

- Railway

- Watercraft

- Trucks/Cars/Buses

- Ships/Vessels

- Electric Vehicle

- Light Commercial Vehicle

By Component

- Solutions

- Operation Management

- Vehicle Maintenance and Diagnostics

- Performance Management

- Fleet analytics and reporting

- Others

- Services

- Professional Services

- Consulting & Advisory

- Integration & Implementation

- Managed Services

By Communication Technology

By Deployment Type

By Industry

- Construction

- Transportation

- Government

- Logistics

- Retail

- Automotive

- Oil and Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)