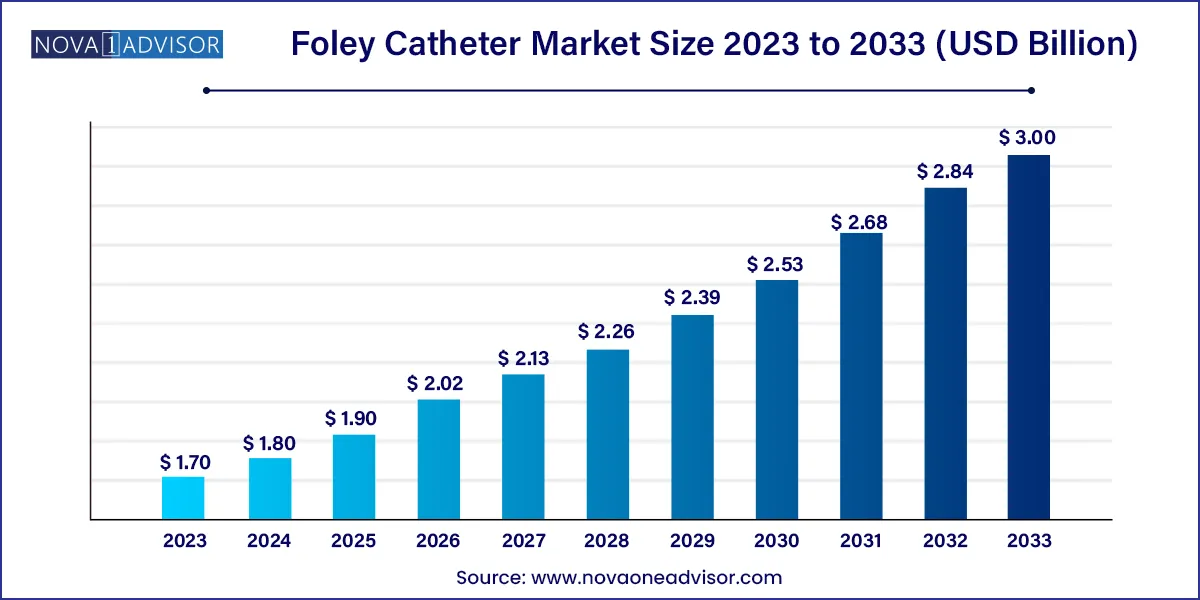

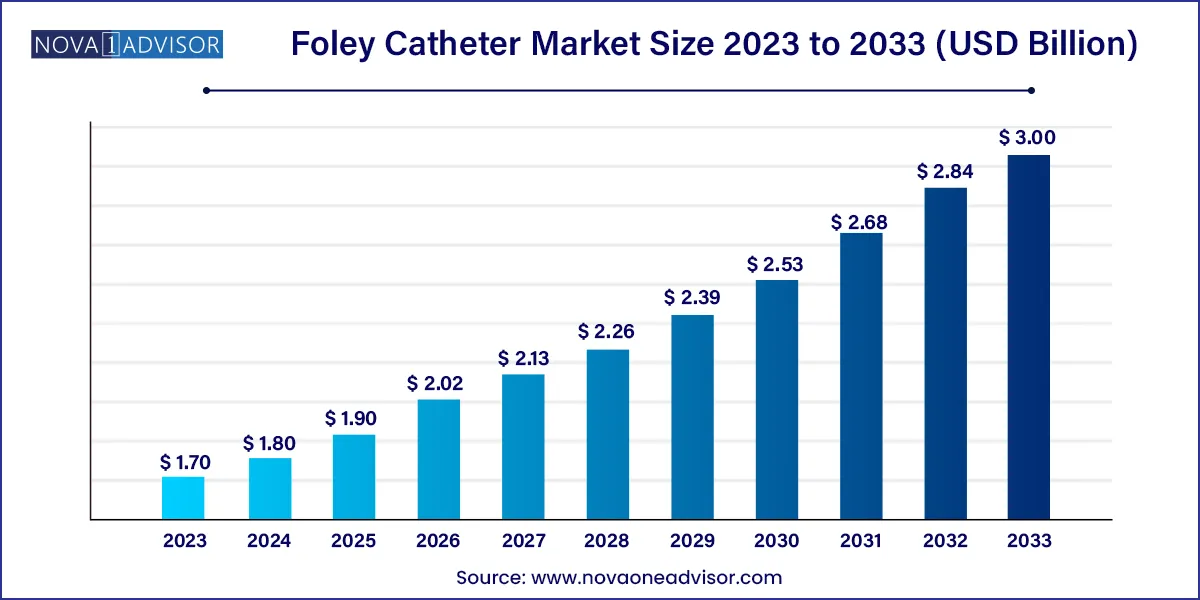

The global foley catheter market size was exhibited at USD 1.70 billion in 2023 and is projected to hit around USD 3.00 billion by 2033, growing at a CAGR of 5.58% during the forecast period of 2024 to 2033.

Key Takeaways:

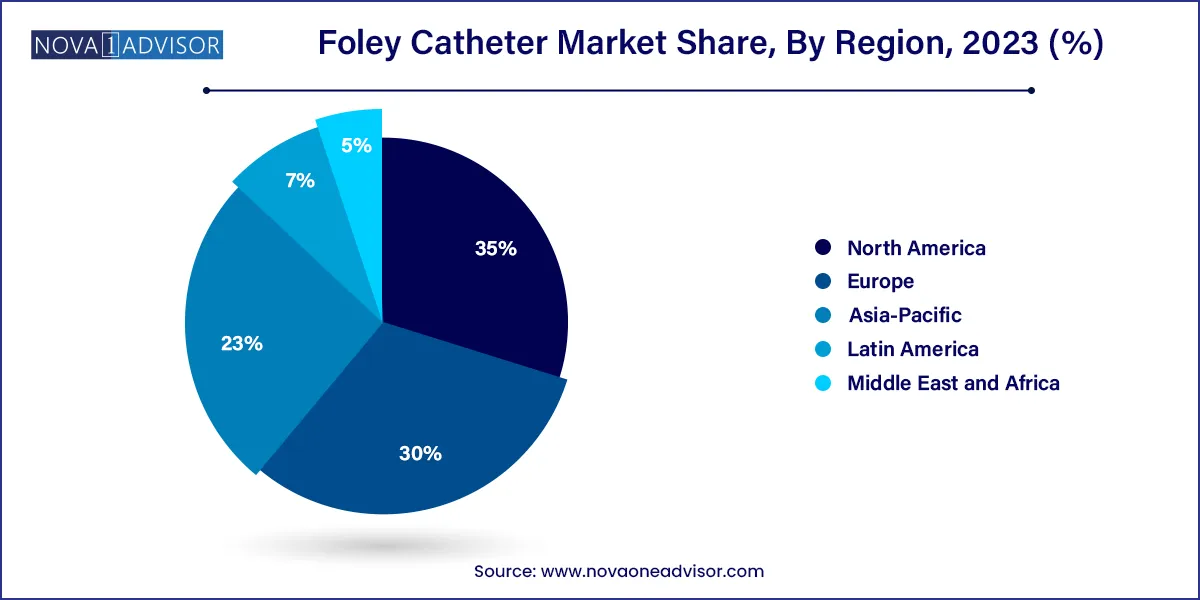

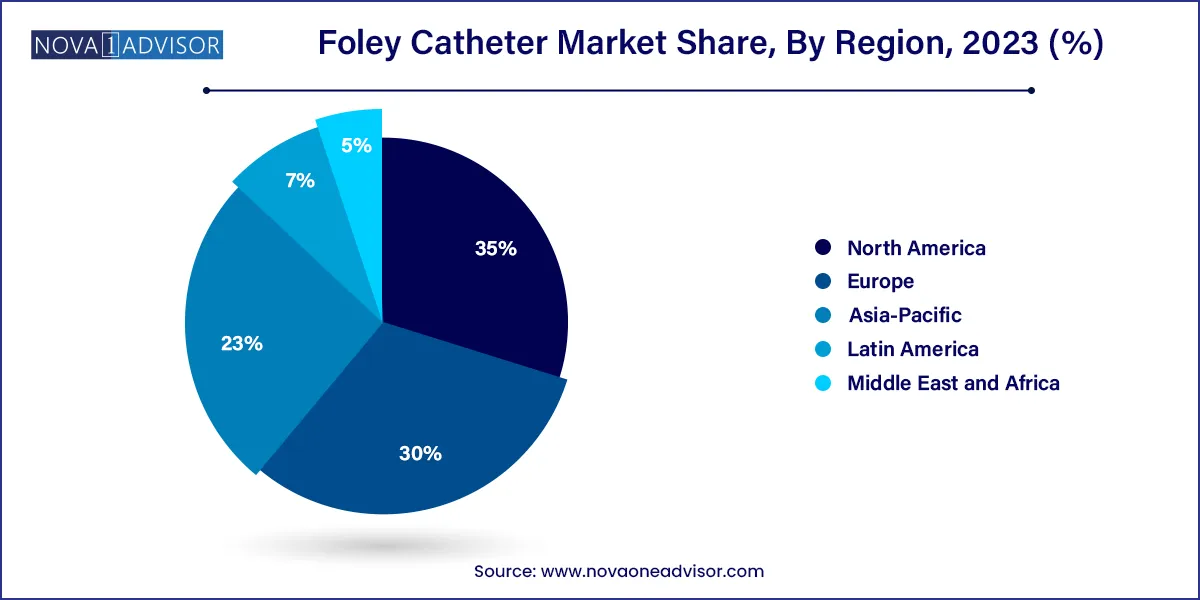

- North America dominated the foley catheters industry with the highest share of 35.0% in 2023.

- Based on product type, the 2-way foley catheters segment captured the largest market share with around 51.84% in 2023.

- Based on material, the silicone foley catheters segment captured the largest market share with around 59.09% in 2023.

- Based on the indication, the urinary incontinence segment dominated the market with around 35.80% of the revenue share.

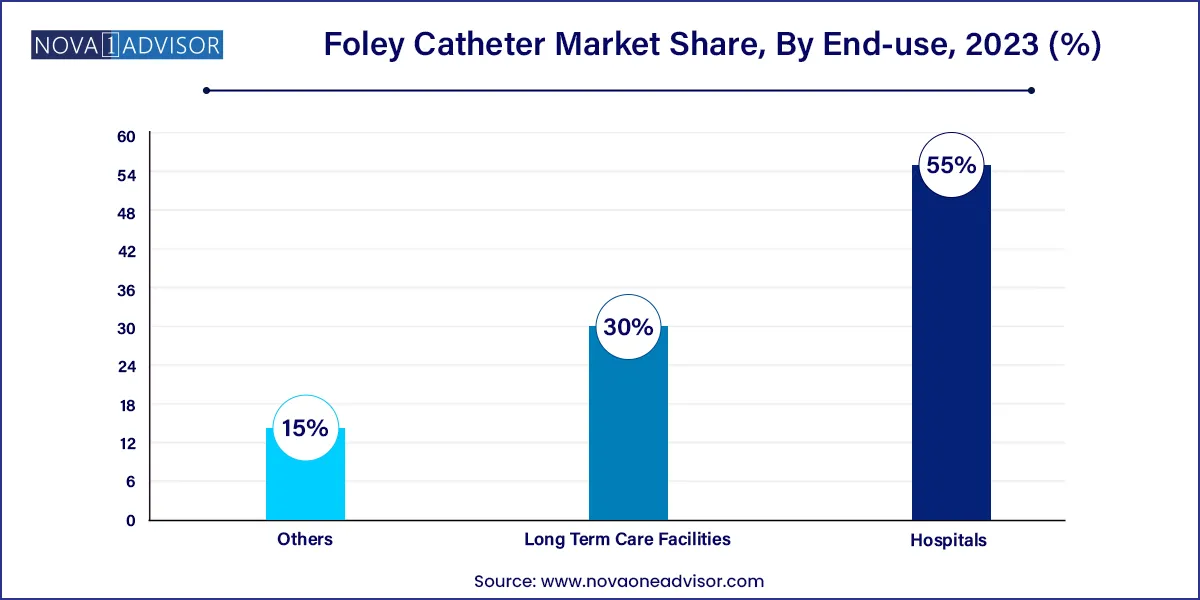

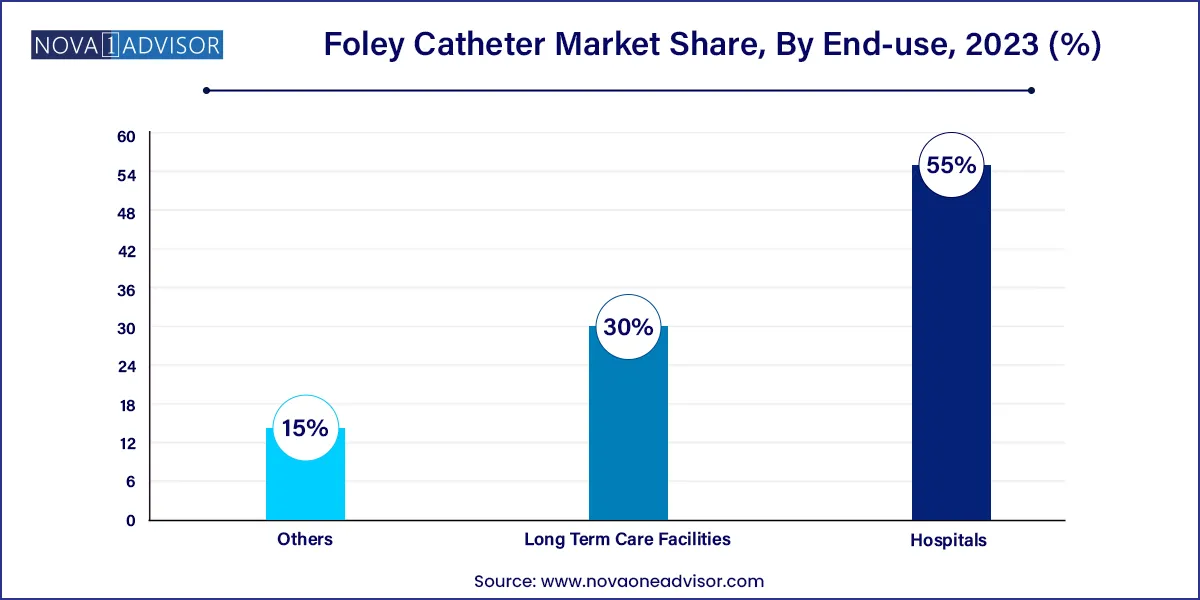

- The hospital segment dominated the market with a share of 55.0% in 2023.

Market Overview

The Foley catheters market occupies a critical space within the global urology and patient care landscape. These indwelling catheters, inserted into the bladder to drain urine, are used extensively in postoperative care, long-term urinary management, and in patients with neurological conditions, prostate enlargement, or chronic urinary incontinence. Their usage is widespread across hospitals, long-term care facilities, and homecare settings, especially among aging populations and patients with mobility impairments.

Originally developed in the 1930s by Dr. Frederic Foley, Foley catheters have undergone extensive refinement. Today’s market comprises catheters made from biocompatible materials such as silicone and latex, with variations including 2-way, 3-way, and even 4-way designs to accommodate irrigation, medication administration, or other clinical needs.

As global healthcare systems increasingly emphasize hospital efficiency, infection control, and home-based care, Foley catheters have emerged as essential tools for bladder drainage and urine output monitoring, especially in critical care and postoperative settings. However, concerns around catheter-associated urinary tract infections (CAUTIs) and growing emphasis on intermittent catheterization are also shaping product development and usage guidelines.

Technological innovation, including antimicrobial coatings, hydrophilic surfaces, and closed drainage systems, is enhancing catheter safety and usability. These innovations, combined with rising demand for chronic condition management and expanding geriatric care, continue to push the Foley catheters market forward globally.

Major Trends in the Market

-

Increasing Preference for Silicone over Latex Catheters: Due to biocompatibility and reduced allergic reactions.

-

Growth in Antimicrobial and Hydrophilic-coated Catheters: Addressing CAUTI risks through advanced materials.

-

Rising Demand from Long-term Care Facilities: Especially in high-income countries with aging populations.

-

Shift Toward Single-use and Disposable Devices: To improve hygiene and reduce infection risks.

-

Homecare and Tele-urology Expansion: Encouraging self-care and remote monitoring for chronic catheter users.

-

Smart Catheters and Connected Devices: Emerging technology to track urine output and alert for complications.

-

Focus on CAUTI Prevention Guidelines: Regulatory push for minimal use duration and infection control compliance.

Foley Catheter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.80 Billion |

| Market Size by 2033 |

USD 3.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.58% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Material, Indication, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Sterimed Group.; Angiplast Pvt Ltd; HEMC (Hospital Equipment Manufacturing Company); Cardinal Health; Advin Health Care; AdvaCare Pharma; Teleflex Incorporated; GWS Surgicals LLP; BACTIGUARD AB; Medtronic; Convatec Inc. B. Braun; VOGT MEDICAL; Ribbel International Limited; C. R. Bard (BD); Hollister Incorporated; Coloplast |

Market Driver: Aging Population and Rising Incidence of Urinary Disorders

A major driver for the Foley catheters market is the increasing prevalence of urinary disorders and age-related urological complications. The global population aged 65 and older is growing rapidly and is more susceptible to bladder dysfunction, prostate enlargement, and incontinence, conditions that often necessitate catheterization.

For example, benign prostatic hyperplasia (BPH) affects over 70% of men above 60, and the resulting urinary retention or obstruction frequently requires catheter placement. Additionally, post-operative patients, especially those undergoing pelvic or abdominal surgeries, often need Foley catheters during recovery.

The increase in spinal cord injuries, neurological diseases, and post-stroke complications also contributes to the expanding demand for indwelling urinary solutions. These demographic and clinical shifts ensure steady demand for safe and effective catheter solutions across healthcare systems.

Market Restraint: Risk of Catheter-associated Urinary Tract Infections (CAUTIs)

Despite their clinical value, Foley catheters are associated with a significant drawback: the risk of CAUTIs, which account for over 30% of healthcare-associated infections in hospitals. Indwelling urinary catheters provide a direct path for pathogens into the bladder, and long-term catheterization increases the risk of colonization and biofilm formation.

This issue has prompted healthcare systems to adopt "catheter-out" protocols and limit Foley catheter use to essential cases only, especially in the U.S. and parts of Europe. Regulatory bodies like the Centers for Disease Control and Prevention (CDC) and World Health Organization (WHO) recommend minimizing catheter dwell time, which in turn affects overall market volume.

Furthermore, rising emphasis on intermittent catheterization and external devices as alternatives, and the push from infection control committees, presents a challenging environment for sustained Foley catheter demand.

Market Opportunity: Development of Antimicrobial and Smart Catheter Technologies

An emerging opportunity lies in the development of antimicrobial Foley catheters designed to combat biofilm formation and reduce infection risks. Coatings such as silver alloy, nitrofurazone, and hydrophilic materials are increasingly integrated into catheters to improve biocompatibility and lower bacterial adhesion.

Furthermore, smart catheter technologies equipped with sensors that monitor urine output, pressure, or pH levels are gaining attention in intensive care units and post-operative care. These devices can potentially alert clinicians to early signs of infection or blockage, enabling timely intervention and preventing complications.

As hospital-acquired infection penalties increase and smart healthcare adoption rises, these next-gen Foley catheters could reshape clinical practices and open new high-value segments within the market.

By Product Type

2-way Foley catheters dominate the product type segment, owing to their standard use in routine urinary drainage and post-surgical care. These catheters, designed with one channel for drainage and another for balloon inflation, are cost-effective, easy to use, and meet the majority of clinical requirements. Their widespread acceptance in both acute and chronic care settings supports their market leadership.

3-way Foley catheters are the fastest-growing subsegment, particularly in urology and oncology units where bladder irrigation is necessary, such as post-TURP (transurethral resection of the prostate) or during hematuria. Their added channel enables continuous bladder flushing, making them essential for specific surgical recovery protocols and niche urological applications.

By Material

Silicone Foley catheters dominate the material segment, driven by their superior biocompatibility, hypoallergenic nature, and ability to remain indwelling for extended periods without causing tissue irritation. Silicone catheters are preferred for long-term use, especially in patients with latex allergies, and are increasingly replacing latex in high-income healthcare systems.

Latex Foley catheters remain prevalent in cost-sensitive markets, particularly across parts of Asia, Africa, and Latin America, due to their affordability and flexibility. However, rising awareness of latex sensitivity and regulatory pressure is gradually shifting demand toward silicone and coated alternatives.

By Indication

Urinary incontinence is the leading indication, particularly among elderly patients and those with chronic neurological diseases such as multiple sclerosis, spinal cord injuries, and Parkinson’s disease. Incontinence-related catheterization is common in homecare and long-term care settings, making this segment a consistent demand driver.

Enlarged prostate gland (BPH) and related urinary retention are growing fast, especially among aging male populations in North America, Europe, and Asia. BPH often leads to acute urinary retention (AUR), necessitating emergency catheter placement and sometimes long-term management.

By End-user Insights

Hospitals dominate the end-user segment, as Foley catheterization is standard in perioperative, ICU, and post-acute care settings. Acute-care hospitals continue to account for the highest catheter volumes due to surgical admissions, trauma care, and in-hospital urinary retention.

Long-term care facilities are the fastest-growing segment, especially in aging societies like Japan, Germany, and the U.S., where skilled nursing facilities and assisted living centers care for patients with chronic bladder dysfunction. As geriatric care models expand, this segment offers lucrative opportunities for long-term catheter solutions and services.

By Regional Insights

North America dominates the Foley catheters market, driven by advanced healthcare infrastructure, high surgical volumes, and proactive infection control policies. The U.S. benefits from a large base of chronic disease patients, aging demographics, and leading market players. Moreover, the rise of value-based care models incentivizes the adoption of advanced catheters that reduce hospital-acquired infections and readmissions.

Asia-Pacific is the fastest-growing region, owing to increasing healthcare investments, large aging populations, and expanding access to surgical and urological care. Countries like China, India, and Japan are witnessing growing catheter adoption in both hospitals and long-term care settings. Regional manufacturers are also introducing cost-effective and latex-free alternatives to cater to local markets, fueling regional growth.

Some of the prominent players in the Foley catheter market include:

- Sterimed Group.

- Angiplast Pvt Ltd

- HEMC (Hospital Equipment Manufacturing Company)

- Cardinal Health

- Advin Health Care

- AdvaCare Pharma

- Teleflex Incorporated

- GWS Surgicals LLP

- BACTIGUARD AB

- Medtronic

- Convatec Inc.

- B. Braun

- VOGT MEDICAL

- Ribbel International Limited

- C. R. Bard (BD)

- Hollister Incorporated

- Coloplast

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global foley catheter market.

Product Type

- 2-way Foley Catheters

- 3-way Foley Catheters

- 4-way Foley Catheters

Material

- Silicone Foley Catheters

- Latex Foley Catheters

Indication

- Urinary Incontinence

- Enlarged Prostate Gland/BPH

- Spinal Cord Injury

- Others

End-user

- Hospitals

- Long Term Care Facilities

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)