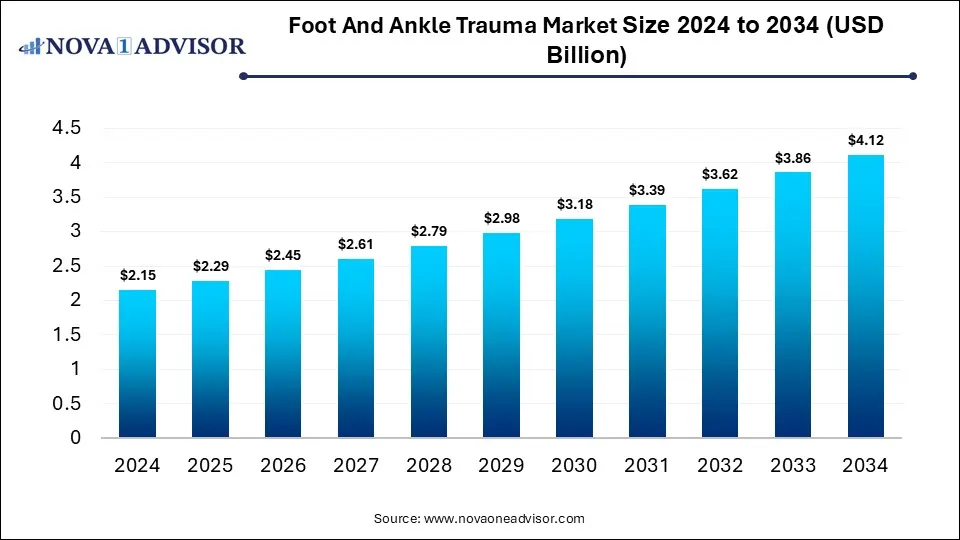

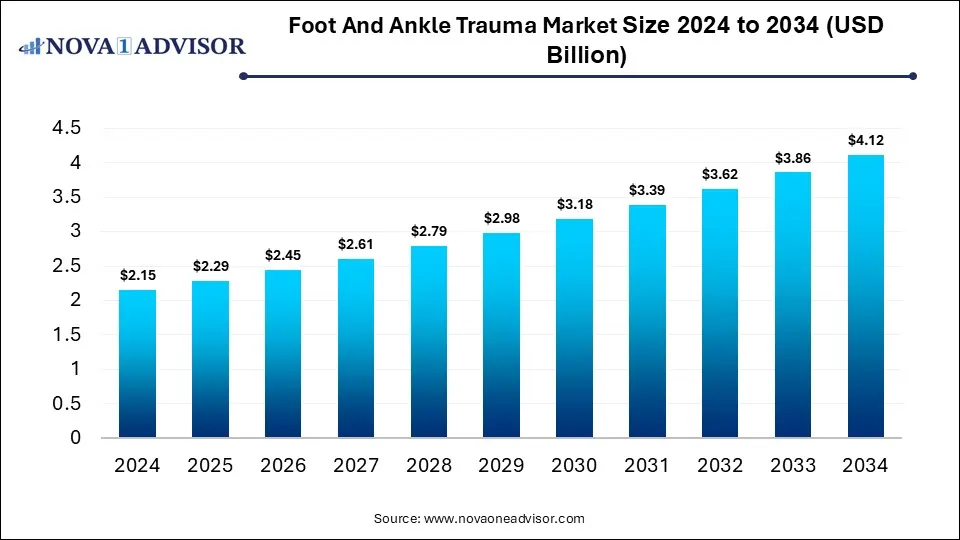

The global foot and ankle trauma market size is calculated at USD 2.15 billion in 2024, grows to USD 2.29 billion in 2025, and is projected to reach around USD 4.12 billion by 2034, growing at a CAGR of 6.73% from 2025 to 2034. The market is growing due to rising incidence of sports injuries, accidents, and an aging population prone to fractures. Advanced surgical techniques and implant innovations are also driving market expansion.

- North America dominated the foot and ankle trauma market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the ankle trauma segment led the market with the largest revenue share in 2024.

- By product, the fibula fixation and syndesmosis repair segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the ankle segment held the largest market share in 2024.

- By application, the talus segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end use, the hospitals segment dominated the market with the major revenue share.

- By end use, the outpatient facilities segment is expected to grow at the fastest CAGR in the market during the forecast period.

Foot and ankle trauma refers to injuries involving the bones, ligaments, or soft tissues of the foot and ankle caused by accidents, falls, or sports activities. The foot and ankle trauma market is growing due to the increasing incidence of sports injuries, road accidents, and age-related fractures. Rising awareness about advanced treatment options, improved healthcare infrastructure, and technological innovations such as minimally invasive surgeries and customized implants are also driving market expansion. Additionally, the growing elderly population and higher demand for rapid recovery solutions are contributing to the overall growth of the foot and ankle trauma market globally.

- For Instance, In July 2024, OIC introduced the Flex-Fix System, a new solution for managing ankle syndesmotic injuries, whether or not accompanied by fractures. The system is engineered to provide controlled micromotion for better healing while reducing the need for subsequent hardware removal procedures.

- In October 2024, Globus Medical broadened its orthopedic trauma line by introducing the TENSOR Suture Button System, designed for use with ANTHEM Ankle and One-Third Tubular Plates to offer surgeons an integrated solution for treating syndesmotic ankle injuries.

- In August 2024, DePuy Synthes, a Johnson & Johnson MedTech division, launched the TriLEAP Lower Extremity Anatomic Plating System in the U.S., featuring titanium plates optimized for precise foot and ankle trauma reconstruction.

AI is transforming the market by enhancing diagnostic accuracy, treatment planning, and post-surgical recovery monitoring. Advanced algorithms analyze imaging data to detect fractures, predict healing outcomes, and assist surgeons in creating personalized treatment plans. AI-powered tools also enable faster decision-making and improve surgical precision, reducing complications and recovery time. These innovations are driving efficiency, cost-effectiveness, and better patient outcomes in foot and ankle trauma care.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.29 Billion |

| Market Size by 2034 |

USD 4.12 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.73% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Technique, By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Smith+Nephew, Arthrex, Inc., DePuy Synthes (Johnson & Johnson), CONMED Corporation, Stryker, Globus Medical, Atreon Orthopedics, Zimmer Biomet, Osteocare Medical Pvt Ltd., Auxein, Eurofins Scientific, IDEXX Laboratories, Inc., BioMérieux SA, Neogen Corporation, Agilent Technologies, Inc., Nova Biomedical Corporation, LuminUltra Technologies Ltd. |

Market Dynamics

Driver

Increasing Incidence of Sports-related injuries and accidents

The increasing in sports-related and accidents drives the foot and ankle market by creating a higher demand for effective treatment solutions. Athletes and active individuals are more prone to fractures, ligament tears, and ankle sprains, requiring advanced fixation devices, surgical interventions, and rehabilitation services. This rising injury rate encourages healthcare providers and medical device companies to develop innovative implants, minimally invasive techniques, and personalized treatment options, thereby expanding the market and improving patient outcomes.

- For Instance, In March 2024, the NFL reported over 150 players sidelined due to ankle and foot injuries, boosting demand for advanced fixation devices, surgeries, and rehabilitation, driving growth in the foot and ankle trauma market.

Restraint

High Cost of Advanced Surgical Devices And Procedures

The expensive nature of food and ankle trauma treatments restricts market growth because many patients cannot afford cutting-edge implants or surgical procedures. High device and procedure costs often lead to delayed or conservative treatments, impacting recovery outcomes. In addition, smaller clinics and hospitals may avoid investing in advanced technologies due to budget constraints. This financial barrier, combined with uneven healthcare funding across regions, limits the widespread adoption of innovative trauma solutions and slows overall market expansions.

Opportunity

Integration of Advanced Technologies

The adoption of advanced technologies offers a promising opportunity in the foot and ankle trauma market by enabling minimally invasive surgeries and enhancing implant design. Innovations such as robotic-assisted procedures, bioresorbable implants, and wearable recovery monitoring devices can reduce complications, shorten hospital stays, and improve rehabilitation outcomes. As awareness of these benefits grows among surgeons and patients, demand for such cutting-edge solutions is expected to increase, driving market expansion and opening new avenues for medical device companies globally.

- For Instance, In September 2024, Yashoda Hospitals in Hyderabad performed the first 3D-printed titanium talus replacement on a 38-year-old patient, restoring ankle function using a custom implant.

Segmental Insights

What made the Ankle Trauma Segment Dominant in the Foot and Ankle Trauma Market in 2024?

In 2024, the ankle trauma segment dominated the market due to the high prevalence of ankle fractures, ligament injuries, and sprains, especially from sports and road accidents. The complexity of ankle anatomy and the need for precise surgical intervention have increased demand for specialized implants and fixation devices. Additionally, growing awareness of early treatment and advancements in minimally invasive techniques have further strengthened the prominence in managing foot and ankle injuries effectively.

- For Instance, In January 2024, GLW Foot & Ankle introduced the Apollo Ankle Fracture Plating System, offering TI-PEEK plates and screws designed for better anatomical fit, enhanced surgical visibility, and reduced complication risks.

The fibula fixation and syndesmosis repair segment is projected to grow rapidly due to technological advancements such as bioresorbable implants and patient-specific fixation systems. Increasing geriatric fractures and sports-related ankle injuries are fueling demand for reliable stabilization methods. Furthermore, hospitals are increasingly adopting minimally invasive surgical techniques that reduce recovery time and complications, making fibula and syndesmosis repair procedures more attractive and accessible, thereby driving faster growth in this segment compared to other foot and ankle trauma treatments.

- For Instance, In September 2024, Paragon 28 introduced the R3FLEX Stabilization System, developed to anatomically treat ankle syndesmotic injuries and restore stability following fractures or high ankle sprains.

How did Ankle Dominate the Foot and Ankle Trauma Market in 2024?

In 2024, the ankle segment led the market owing to its complex anatomy and high vulnerability to injuries requiring surgical intervention. Growing awareness of early treatment and rehabilitation, combined with the availability of advanced implants and stabilization systems, has increased demand. Moreover, rising cases of workplace accidents and recreational injuries have contributed to the segment's prominence, making ankle-focused solutions the most sought-after in managing foot and ankle trauma during the year.

- For Instance, In February 2025, Bioretec obtained CE mark approval for its RemeOs Trauma Screw, allowing treatment of ankle trauma in both adults and children across Europe, promoting bone healing without the need for hardware removal.

The talus segment is projected to experience rapid growth during the forecast period due to its critical role in ankle mobility and the increasing number of high-impact injuries, such as falls and sports accidents. Innovations like patient-specific implants, bioresorbable screw, and enhanced imaging for precise surgical planning are fueling demand. Additionally, rising focus on early intervention and rehabilitation for talus injuries is encouraging adoption of advanced treatment options, making this segment one of the fastest-growing areas in the foot and ankle trauma market.

Why the Hospitals Segment Dominated the Foot And Ankle Trauma Market in 2024?

The hospital segment dominated the market due to the availability of specialized orthopaedic departments, advanced surgical facilities, and experienced surgeons capable of handling complex trauma cases. Hospitals provide comprehensive care, including diagnosis, surgery, and post-operative rehabilitation, making them the preferred choice for patients. Additionally, the adoption of advanced fixation devices and minimally invasive techniques in hospitals ensures better treatment outcomes, driving higher patient inflow and contributing to the segment's leading position in the market.

The outpatient facility segment is projected to grow rapidly during the forecast period as more patients seek accessible, low-cost care for foot and ankle injuries. Growing awareness of early intervention, coupled with the expansion of outpatient orthopedic clinics in urban and semi-urban areas, is increasing patients' preference. Additionally, the availability of advanced, compact surgical devices and streamlined rehabilitation programs in these centers allows for effective treatment of minor to moderate trauma cases, driving faster adoption compared to traditional hospital settings.

- For Instance, In June 2025, HSS at NCH launched a new outpatient musculoskeletal surgery center in North Naples, FL, providing advanced orthopedic care for foot, ankle, and trauma surgeries, as well as joint replacements in a modern facility.

Regional Insights

How is North America contributing to the Expansion of the Foot And Ankle Trauma Market?

North America dominated the market in 2024 due to high incidences of sports injuries, road accidents, and age-related fractures. The region benefits from advanced healthcare infrastructure, widespread adoption of minimally invasive surgical techniques, and availability of state-of-the-art orthopedic devices. Additionally, growing awareness of early diagnosis and effective treatment options, combined with strong reimbursement policies and well-established hospitals and trauma centers, has reinforced North America’s leading position in managing foot and ankle trauma compared to other regions.

- For Instance, In December 2024, article in the Journal of Clinical Medicine highlights that traffic accidents, workplace incidents, and sports activities are leading causes of trauma. Many patients with lower extremity injuries require surgical intervention, making these injuries a major contributor to orthopedic emergency admissions.

Asia Pacific is expected to grow at a faster CAGR in the market due to increasing incidence of sports injuries, road accidents, and an aging population. Expanding healthcare infrastructure, rising awareness of advanced treatment options, and growing adoption of modern surgical devices are driving demand. Additionally, improving insurance coverage and government initiatives to enhance orthopedic care in emerging countries like India and China are accelerating market growth, making the region one of the fastest-growing globally.

- For Instance, In November 2024, a review in Foot & Ankle Clinics focused on chronic ankle instability caused by trauma-related ligament injuries, noting that anatomic repair or reconstruction of the anterior talofibular and, when needed, calcaneofibular ligaments is the main treatment approach.

- In March 2025, Nelson Labs introduced rapid sterility testing at three locations in the U.S. and Germany, cutting incubation times from 14 to 6 days while remaining compliant with USP <71> standards.

- In January 2025, Rapid Infection Diagnostics Inc. (RID) introduced the BSIDx system, enabling identification of bloodstream pathogens and antibiotic sensitivity testing in under 5 hours, cutting the time by about 30 hours compared to traditional methods.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the foot and ankle trauma market.

Segments Covered in the Report

By Product

- Instruments

- Reagents & Kits

- Accessories

By Technique

- Growth-based Testing

- Nucleic Acid-based Testing

- Cellular Component-based Testing

- Viability-based Testing

- Other Techniques

By Application

- Raw Material Testing

- Microbial Limit Testing

- Bioburden Assessment

- Sterility Testing

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Foot and Ankle Trauma Market Size (USD Billion) by Product, 2024–2034

- Table 2: Global Foot and Ankle Trauma Market Size (USD Billion) by Technique, 2024–2034

- Table 3: Global Foot and Ankle Trauma Market Size (USD Billion) by Application, 2024–2034

- Table 4: North America Market Size (USD Billion) by Product, 2024–2034

- Table 5: North America Market Size (USD Billion) by Technique, 2024–2034

- Table 6: North America Market Size (USD Billion) by Application, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Product, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Technique, 2024–2034

- Table 12: Germany Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 13: France Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 14: UK Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 15: Italy Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 16: Asia Pacific Market Size (USD Billion) by Product, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Technique, 2024–2034

- Table 18: China Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 19: Japan Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 20: India Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 21: South Korea Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 22: Southeast Asia Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 23: Latin America Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 24: Brazil Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 25: Middle East & Africa Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 26: GCC Countries Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 27: Turkey Market Size (USD Billion) by Product, Technique & Application, 2024–2034

- Table 28: Africa Market Size (USD Billion) by Product, Technique & Application, 2024–2034

List of Figures

- Figure 1: Global Market Share by Product, 2024

- Figure 2: Global Market Share by Technique, 2024

- Figure 3: Global Market Share by Application, 2024

- Figure 4: North America Market Share by Product, 2024

- Figure 5: North America Market Share by Technique, 2024

- Figure 6: North America Market Share by Application, 2024

- Figure 7: U.S. Market Share by Product, 2024

- Figure 8: U.S. Market Share by Technique, 2024

- Figure 9: U.S. Market Share by Application, 2024

- Figure 10: Canada Market Share by Product, 2024

- Figure 11: Canada Market Share by Technique, 2024

- Figure 12: Canada Market Share by Application, 2024

- Figure 13: Mexico Market Share by Product, 2024

- Figure 14: Mexico Market Share by Technique, 2024

- Figure 15: Mexico Market Share by Application, 2024

- Figure 16: Europe Market Share by Product, 2024

- Figure 17: Europe Market Share by Technique, 2024

- Figure 18: Germany Market Share by Product, 2024

- Figure 19: Germany Market Share by Technique, 2024

- Figure 20: France Market Share by Product, 2024

- Figure 21: France Market Share by Technique, 2024

- Figure 22: UK Market Share by Product, 2024

- Figure 23: UK Market Share by Technique, 2024

- Figure 24: Italy Market Share by Product, 2024

- Figure 25: Italy Market Share by Technique, 2024

- Figure 26: Asia Pacific Market Share by Product, 2024

- Figure 27: Asia Pacific Market Share by Technique, 2024

- Figure 28: China Market Share by Product, 2024

- Figure 29: China Market Share by Technique, 2024

- Figure 30: Japan Market Share by Product, 2024

- Figure 31: Japan Market Share by Technique, 2024

- Figure 32: India Market Share by Product, 2024

- Figure 33: India Market Share by Technique, 2024

- Figure 34: South Korea Market Share by Product, 2024

- Figure 35: South Korea Market Share by Technique, 2024

- Figure 36: Southeast Asia Market Share by Product, 2024

- Figure 37: Southeast Asia Market Share by Technique, 2024

- Figure 38: Latin America Market Share by Product, 2024

- Figure 39: Latin America Market Share by Technique, 2024

- Figure 40: Brazil Market Share by Product, 2024

- Figure 41: Brazil Market Share by Technique, 2024

- Figure 42: Middle East & Africa Market Share by Product, 2024

- Figure 43: Middle East & Africa Market Share by Technique, 2024

- Figure 44: GCC Countries Market Share by Product, 2024

- Figure 45: GCC Countries Market Share by Technique, 2024

- Figure 46: Turkey Market Share by Product, 2024

- Figure 47: Turkey Market Share by Technique, 2024

- Figure 48: Africa Market Share by Product, 2024

- Figure 49: Africa Market Share by Technique, 2024