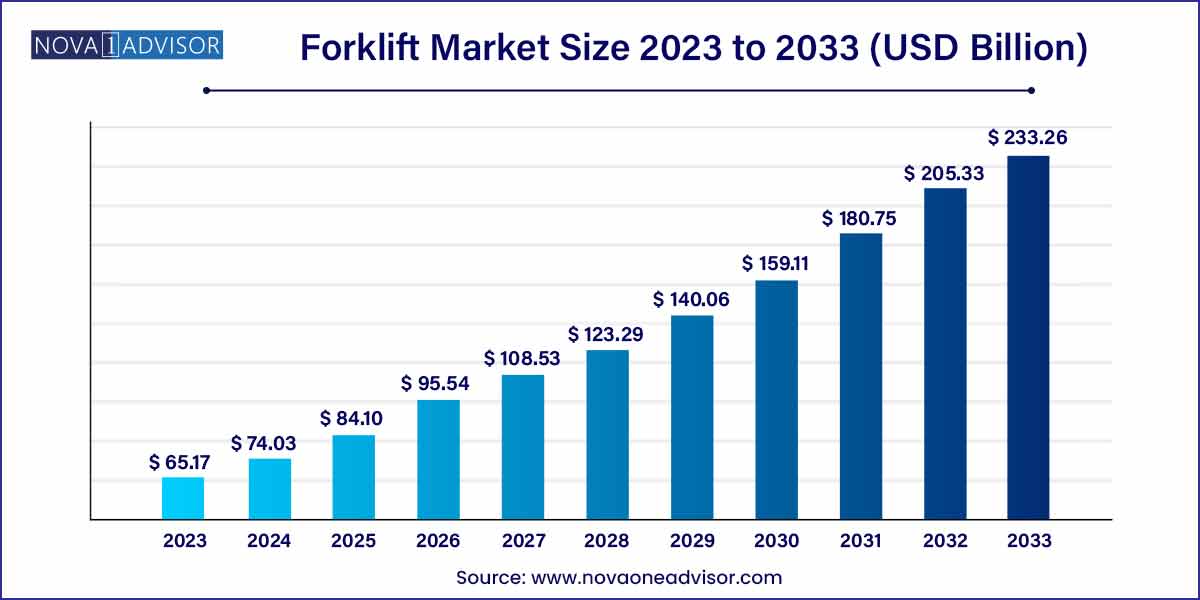

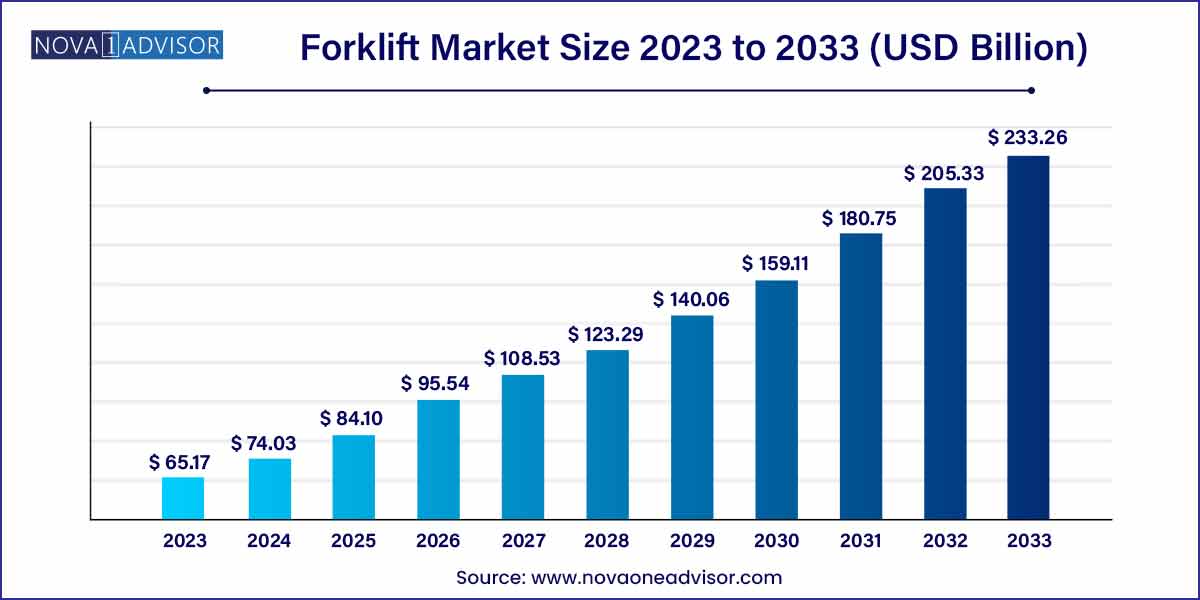

The global forklift market size was exhibited at USD 65.17 billion in 2023 and is projected to hit around USD 233.26 billion by 2033, growing at a CAGR of 13.6% during the forecast period of 2024 to 2033.

Key Takeaways:

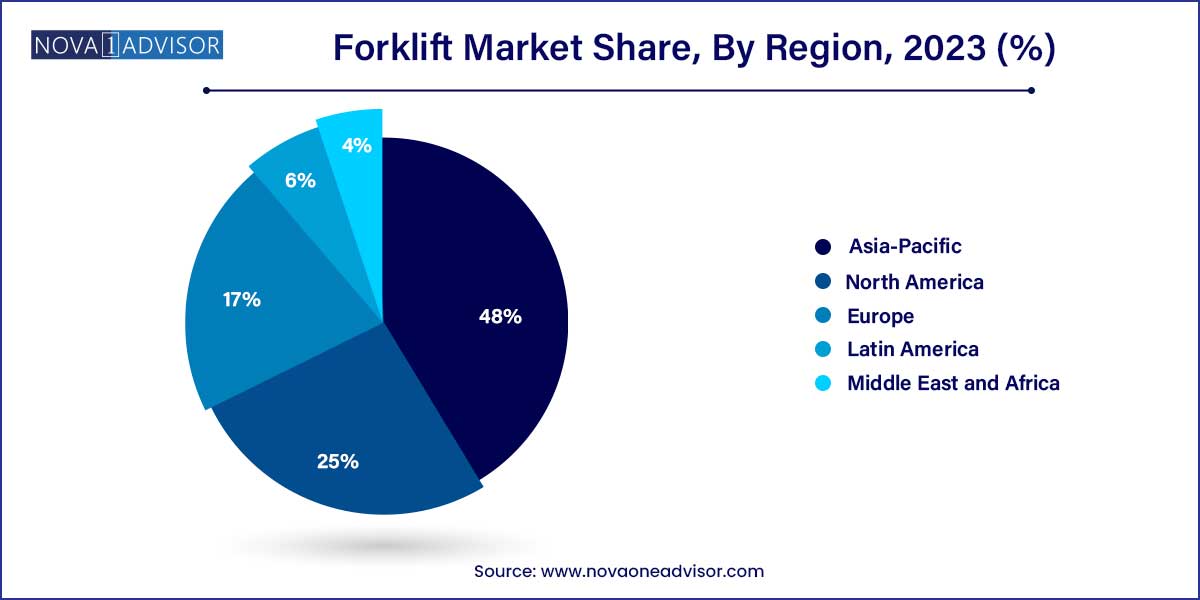

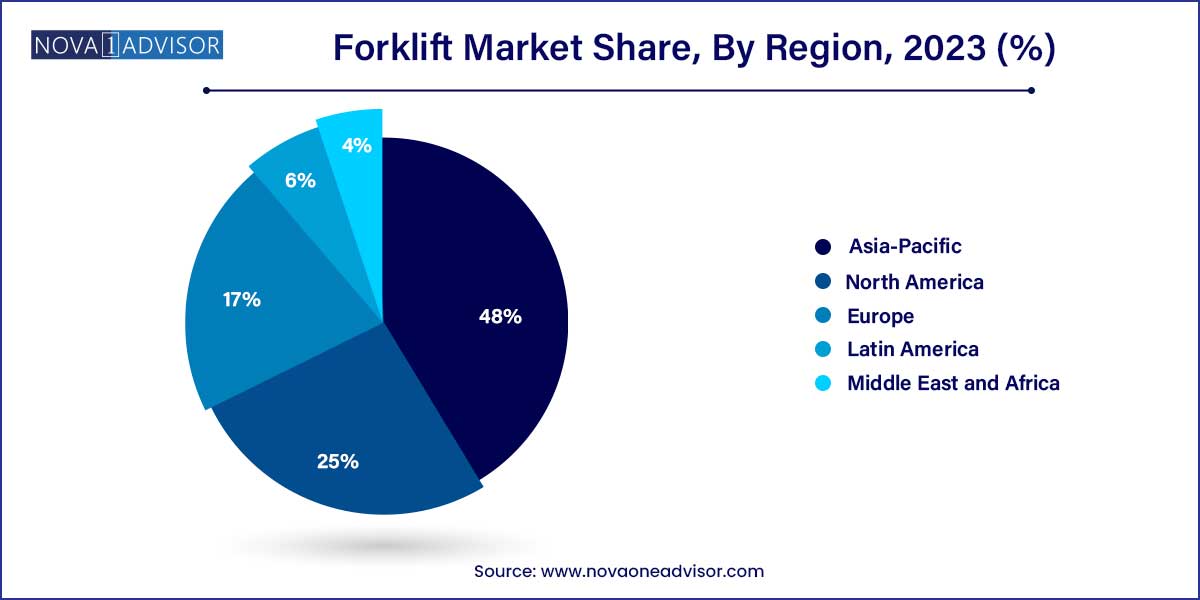

- Asia Pacific dominated the forklift market and accounted for 48.0% of the share in 2023.

- Class 3 segment led the market and accounted for 43.1% of the market in 2023.

- The electric segment accounted for the largest market revenue share in 2023.

- The 5–15-ton segment led the market in 2023.

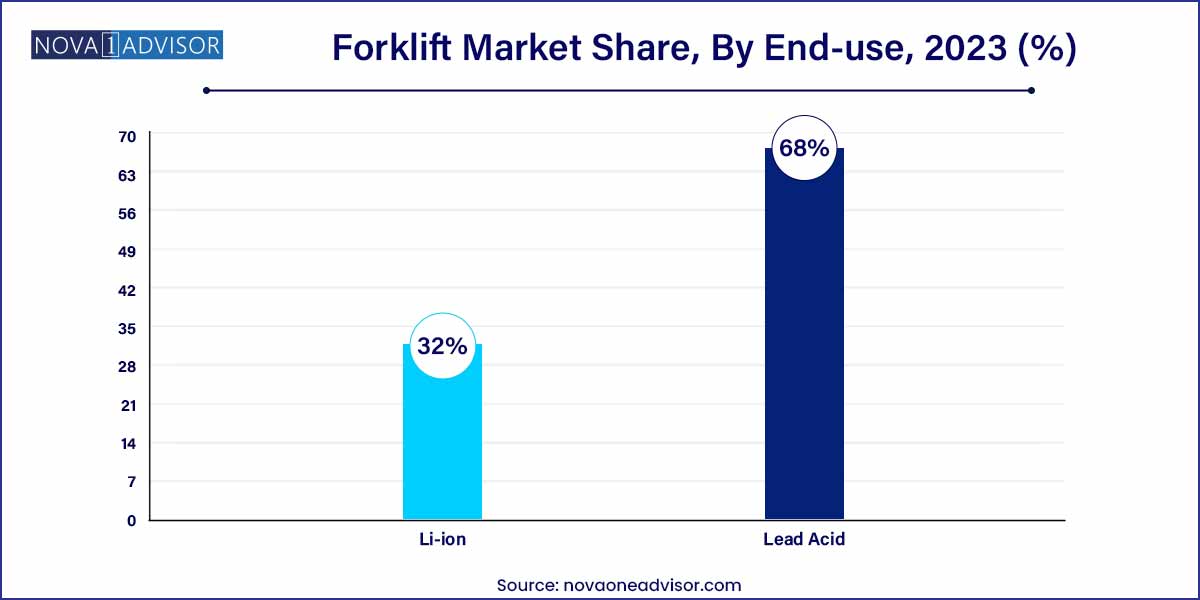

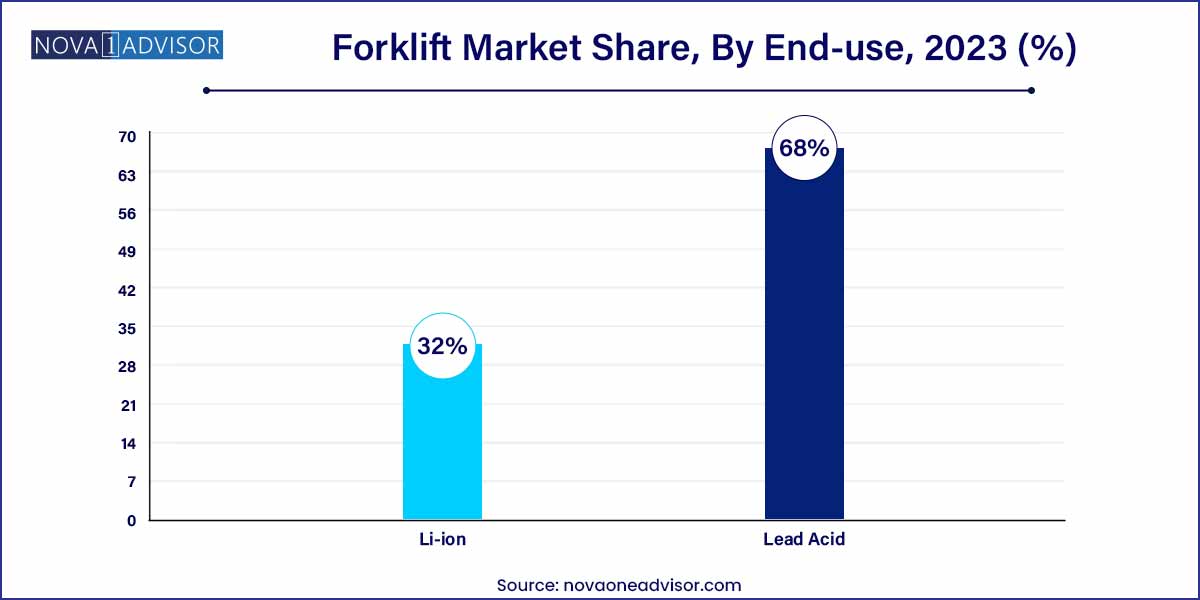

- The lead-acid segment held the largest revenue share of 68.0% in 2023.

- The industrial segment held the largest revenue share of 24.06% in 2023.

Forklift Market: Overview

The forklift market plays a pivotal role in the global logistics and material handling ecosystem. Forklifts are indispensable across a wide range of industries including manufacturing, warehousing, retail, automotive, food and beverage, and construction. As supply chains modernize and e-commerce growth drives warehouse expansions, the demand for advanced, reliable, and efficient forklift systems continues to rise. These machines are primarily used for lifting, transporting, and stacking heavy materials within confined spaces, enhancing operational efficiency and safety.

The market has evolved significantly from traditional internal combustion (ICE) engine-powered forklifts to electric and automated models. Today’s forklifts are being equipped with smart sensors, telematics, ergonomic enhancements, and zero-emission power systems. Demand is shaped by factors such as environmental regulations, automation trends, labor shortages, and the drive to improve material handling productivity.

As companies place increased emphasis on warehouse automation, sustainability, and energy efficiency, the forklift industry is undergoing a technological transformation. From lithium-ion-powered models to autonomous forklifts operating in high-density distribution centers, innovation is steering the market into the future. Forklift manufacturers, rental fleet operators, and aftermarket service providers are aligning their portfolios to capitalize on these emerging opportunities.

Forklift Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 65.17 Billion |

| Market Size by 2033 |

USD 233.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Class, Power Source, Load Capacity, Electric Battery Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Anhui Heli Co., Ltd.; CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Toyota Material Handling |

Forklift Market Dynamics

- Economic Trends and Global Trade Dynamics:

The forklift market is intricately linked to the global economic landscape and trade dynamics. Fluctuations in economic conditions, such as GDP growth, directly impact industrial activities and, consequently, the demand for forklifts. As economies expand, the need for efficient material handling and logistics solutions rises, driving the adoption of forklifts across diverse industries. Furthermore, the interconnectedness of supply chains in the era of globalization amplifies the significance of forklifts in facilitating the seamless movement of goods.

- Technological Advancements and Automation Integration:

Technological innovation stands as a primary driver of change in the forklift market. The integration of advanced technologies such as telematics, the Internet of Things (IoT), and automation has revolutionized the capabilities of forklifts, enhancing efficiency and safety in material handling operations. Automated guided vehicles (AGVs) are gaining prominence, offering a glimpse into the future of autonomous forklifts. These technological advancements not only improve the precision and speed of forklift operations but also contribute to reduced downtime and maintenance costs.

Forklift Market Restraint

- Initial Cost and Implementation Challenges:

While the adoption of advanced forklift technologies brings undeniable benefits, the initial costs associated with acquiring and implementing these solutions can pose a significant restraint. Businesses, particularly smaller enterprises, may find the upfront expenses prohibitive, impacting the rate of forklift technology adoption. Additionally, the integration of sophisticated technologies requires comprehensive training programs for operators, which further adds to the initial investment.

- Environmental and regulatory compliance pressures:

As environmental sustainability gains prominence, forklift manufacturers and users face challenges associated with meeting stringent emission standards and environmental regulations. The traditional reliance on internal combustion engine (ICE) forklifts raises concerns regarding air quality and carbon emissions. Transitioning to environmentally friendly alternatives, such as electric forklifts, can be constrained by the limitations of current battery technologies, impacting factors like range and charging infrastructure.

Forklift Market Opportunity

- Rising Demand for Electric Forklifts:

One of the prominent opportunities in the forklift market stems from the growing demand for electric forklifts. With an increasing emphasis on sustainability and environmental consciousness, businesses are actively seeking alternatives to traditional internal combustion engine (ICE) forklifts. Electric forklifts present a compelling solution, offering not only reduced emissions but also operational cost advantages over time. As advancements in battery technology continue, there is an opportunity for manufacturers to capitalize on this trend by developing more efficient and high-performance electric forklifts.

- Integration of IoT and Telematics for Smart Forklifts:

The integration of Internet of Things (IoT) and telematics presents a significant opportunity for the forklift market. Smart forklifts equipped with sensors and connectivity features enable real-time monitoring of key performance metrics, including maintenance status, fuel efficiency, and operator behavior. This data-driven approach enhances operational efficiency, reduces downtime through predictive maintenance, and improves overall safety. As businesses increasingly embrace Industry 4.0 principles, the demand for intelligent forklifts is on the rise.

Forklift Market Challenges

- Technological Adaptation and Training Requirements:

One of the primary challenges facing the forklift market lies in the swift pace of technological advancements and the associated need for workforce training. As forklifts evolve with features like automation, IoT integration, and advanced telematics, businesses encounter the challenge of ensuring their workforce is adept at utilizing these technologies effectively. The implementation of automated guided vehicles (AGVs) and other autonomous features demands a skilled workforce capable of managing, monitoring, and troubleshooting these complex systems.

- Global supply chain disruptions:

The forklift market is susceptible to challenges arising from global supply chain disruptions, as evidenced by events like natural disasters, geopolitical tensions, or pandemics. The interconnected nature of supply chains exposes the industry to potential delays in raw material procurement, manufacturing, and transportation. Such disruptions can lead to a shortage of critical components for forklift production, impacting manufacturers' ability to meet market demands.

Segments Insights:

Class Insights

Class 1 forklifts dominated the market, primarily due to their electric-powered operation, quiet performance, and zero-emission profile. These forklifts are commonly used in indoor warehouse environments and are well-suited for applications requiring precision handling and long duty cycles. The increasing focus on clean energy and sustainability has led many logistics and retail companies to replace ICE-powered units with Class 1 electric forklifts. Their efficiency and minimal maintenance requirements make them a favorable choice across distribution, manufacturing, and retail facilities.

Class 2 forklifts are expected to grow at the fastest rate, fueled by the rising adoption of narrow-aisle and high-rack warehouse configurations. Class 2 forklifts include reach trucks and order pickers designed to maximize vertical and horizontal space. With the ongoing trend of warehouse densification, these forklifts are gaining traction in fulfillment centers, particularly in urban areas where square footage is limited. Their ability to operate in tight spaces without compromising lifting height or safety makes them an increasingly important part of modern warehouse operations.

Power Source Insights

Electric forklifts have become the dominant power source segment, due to their lower operating costs, reduced emissions, and growing regulatory support for green equipment. Suitable for indoor use and sensitive environments such as food processing and pharmaceutical storage, electric forklifts are now offered in models that rival the performance of traditional diesel machines. OEMs are investing in fast-charging technologies and battery swapping infrastructure to eliminate range anxiety and downtime.

Internal combustion engine (ICE) forklifts continue to hold relevance, especially in heavy-duty outdoor applications such as construction, lumberyards, and ports. However, their market share is declining as cleaner electric models offer equivalent power with fewer emissions and lower maintenance. Hybrid models and biofuel-compatible engines are being explored to help ICE forklifts adapt to the green transition.

Load Capacity Insights

Forklifts with a load capacity below 5 tons dominate the market, as they cater to most warehouse and industrial operations. These forklifts are ideal for pallet movement, goods stacking, and indoor logistics in manufacturing units, food distribution, and retail environments. Their agility, affordability, and adaptability across diverse industries make them the default choice for mid-scale operations.

Forklifts above 16 tons are experiencing growing demand, particularly in ports, mining, and heavy equipment manufacturing. These high-capacity machines are used for container handling, steel coils, and large-scale palletized loads. Their growth is driven by increasing international trade volumes and expansion of logistics infrastructure, including inland freight terminals and intermodal yards. Manufacturers are enhancing safety and fuel efficiency features in this category to appeal to enterprise buyers.

Electric Battery Type Insights

Lead-acid batteries remain widely used, especially in traditional electric forklift models due to their low initial cost and established supply chain. These batteries are suitable for operations with fixed shift patterns and planned charging downtime. Despite their weight and slower charging, many SMEs still prefer lead-acid options for budget-conscious operations.

Lithium-ion batteries are the fastest-growing segment, favored for their high energy density, rapid charging, zero maintenance, and longer lifecycle. They support opportunity charging, allowing forklifts to top up power during short breaks without performance loss. Logistics companies aiming for high uptime and operational flexibility are increasingly transitioning to lithium-ion platforms.

End-use Insights

Industrial applications account for the largest market share, encompassing manufacturing plants, assembly lines, and production warehouses. Forklifts are indispensable in these environments for moving raw materials, finished goods, and heavy equipment. Automation in industrial production has also increased the reliance on smart and connected forklifts for synchronized material handling.

Retail and E-commerce is the fastest-growing end-use segment, driven by the explosion of online shopping, omnichannel distribution models, and micro-fulfillment centers. Forklifts are vital in handling high turnover inventory and tight delivery timelines. Small, maneuverable, and high-lift forklifts are being deployed in decentralized hubs and urban logistics centers to meet next-day or same-day delivery demands.

Regional Insights

Asia Pacific dominated the forklift market and accounted for 48.0% share in 2023. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness. As companies continuously develop advanced electric forklift models with enhanced performance and features, end-use industries upgrade their fleets to remain competitive and efficient. As the market evolves, collaborations among governments, manufacturers, and businesses are expected to play a pivotal role in driving further advancements and widespread adoption of forklifts in Asia.

In Europe, the market is expected to register a considerable growth rate over the forecast period. The forklift industry in Europe is expected to witness significant growth over the forecast period owing to the increasing demand for sustainable supply-chain solutions, the rising global awareness of climate change, and the need for sustainable practices. The concept of a sustainable supply chain has gained significant momentum in Europe, with various businesses focusing on reducing their carbon footprint and promoting eco-friendly practices throughout their operations.

Recent Developments

- In August 2023, Jungheinrich AG acquired Magazino, an automated solution provider. The acquisition helped the former company to its position in autonomous mobile robots and related software.

- In September 2023, Hangcha Forklift launched a high-voltage lithium battery-based electric rough terrain forklift. The forklift ranges from 2.5 to 3.5 tons and features such features as reduced noise, zero emissions, and fast charging time.

- In May 2023, Toyota Material Handling announced the launch of three new forklift models. The new forklifts have features such as standard power steering, an industrial tow tractor, an automatic parking brake, a side-entry end rider, and a center rider stacker. These features offer the user enhanced performance, efficiency, and a comfortable operating environment in the cabin. The models fall between the 6,000 and 8,000 lbs. weight classes and are ideal for order picking and cross-warehouse transportation.

- In January 2023, Crown Equipment Corporation announced the launch of an electric counterbalance forklift. The C-B series features electric forklifts equipped with 80-volt motors. The forklifts have application-oriented ergonomics such as a full suspension, adjustable seat, intuitive control system, compact mast, and overhead guard. These features provide enhanced safety and productivity and reduce operator strain and fatigue.

Some of the prominent players in the forklift market include:

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global forklift market.

Class

- Class 1

- Class 2

- Class 3

- Class 4/5

Power Source

Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

Electric Battery Type

End Use

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)