Gene Therapy Market Size and Growth 2026 to 2035

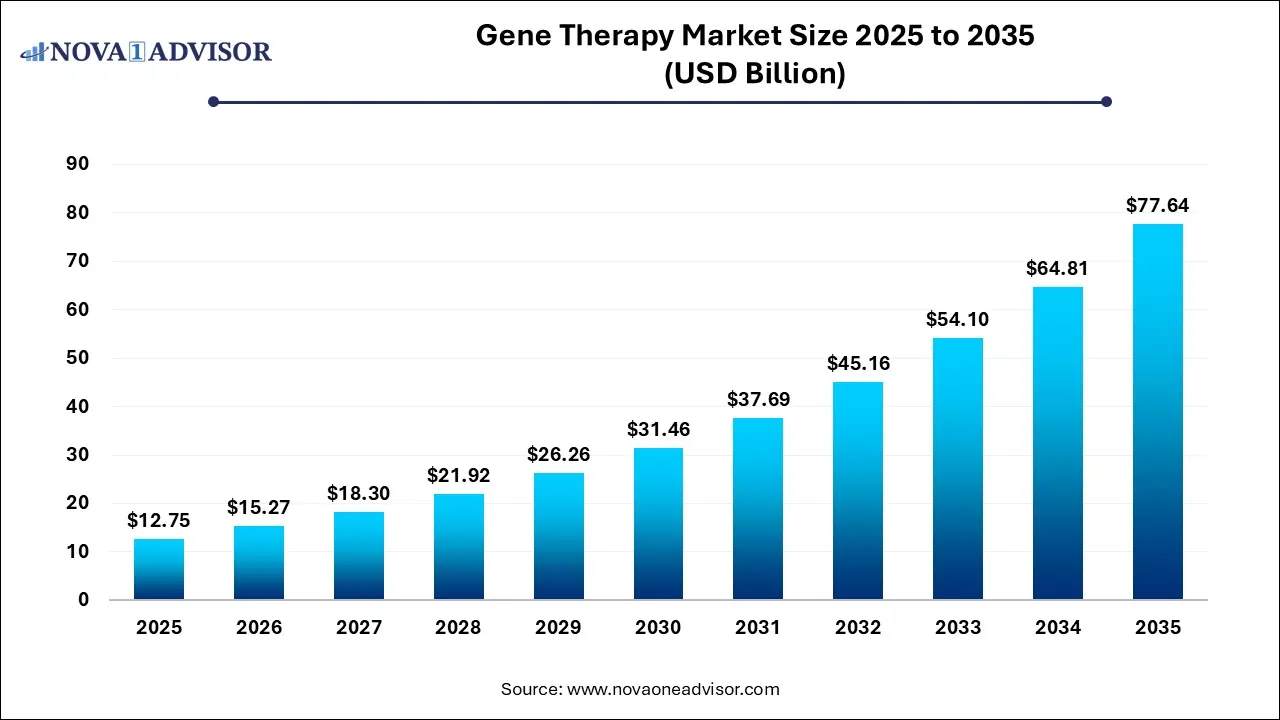

The global gene therapy market size was exhibited at USD 12.75 billion in 2025 and is projected to hit around USD 77.64 billion by 2035, growing at a CAGR of 19.8% during the forecast period 2026 to 2035.

Key Takeaways:

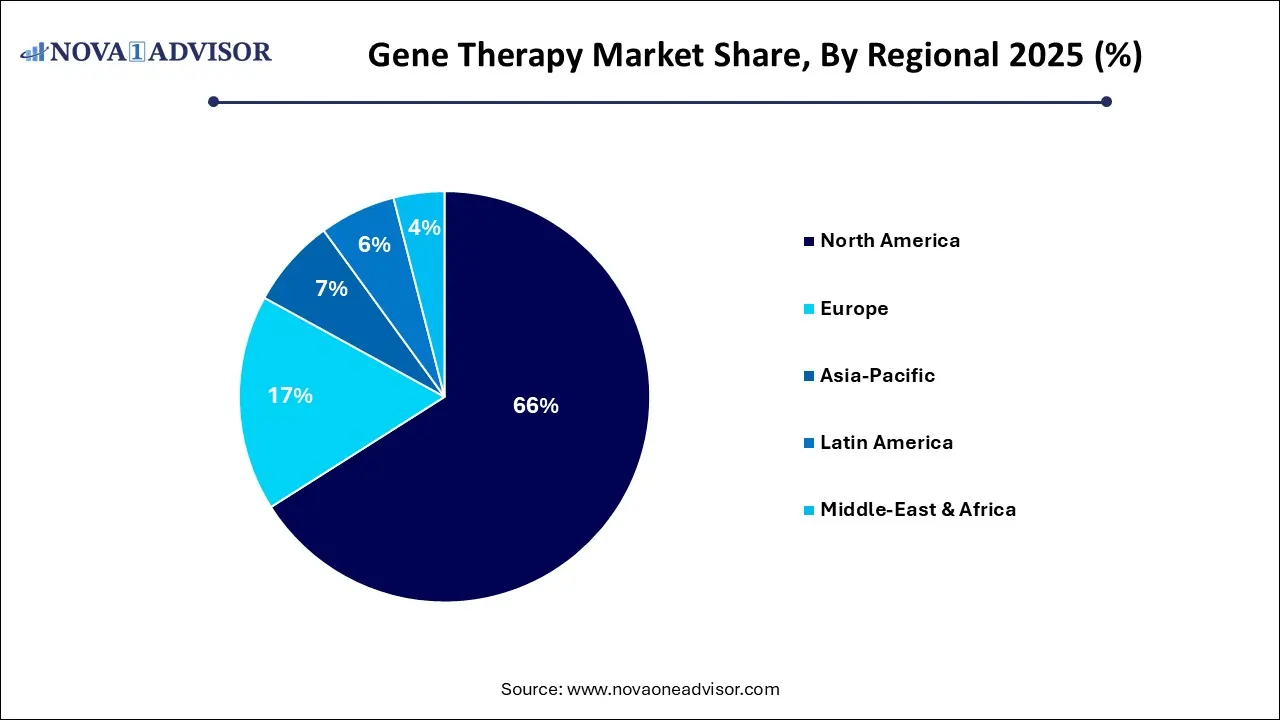

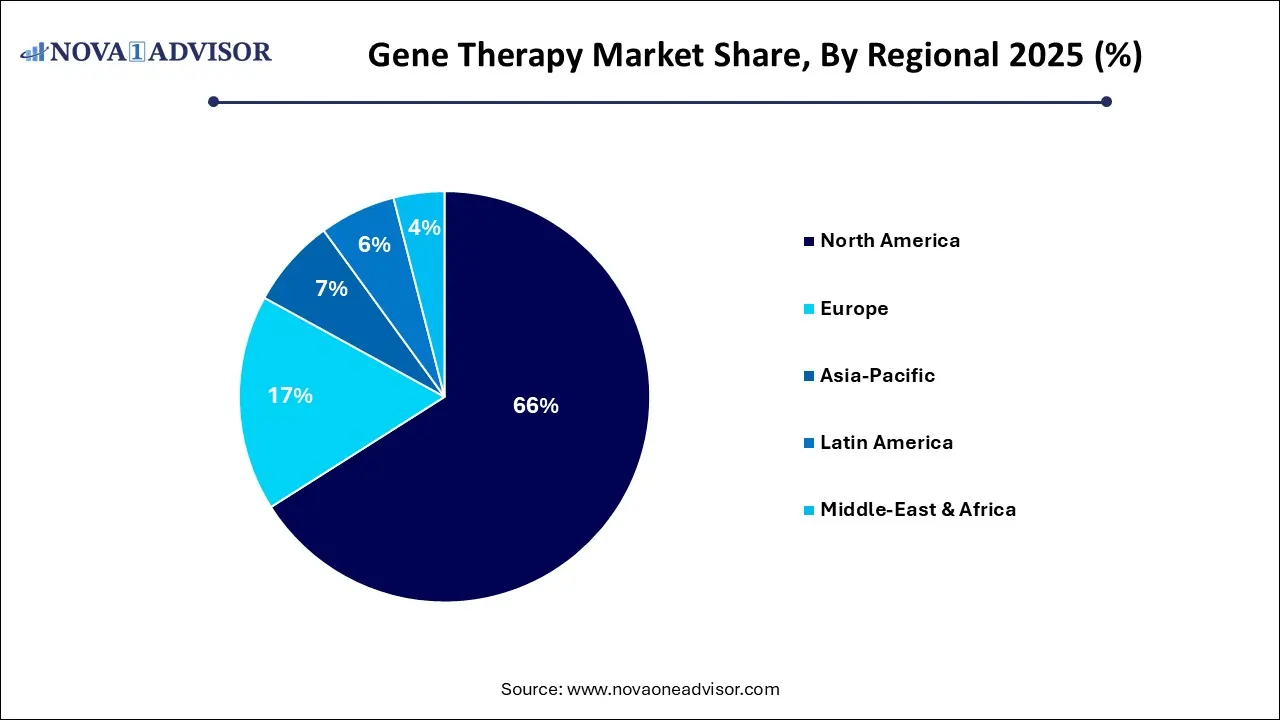

- North America dominated the market in 2023 with the largest revenue share of 66% in 2025.

- Europe is estimated to be the fastest-growing regional segment from 2026 to 2035.

- The AAV segment shows a significant revenue contribution of 22.9% in 2025.

- The spinal muscular atrophy (SMA) segment dominated the market in 2025.

- The Beta-Thalassemia Major/SCD segment is anticipated to register the fastest CAGR over the forecast period.

- The intravenous segment dominated the global gene therapy market in 2025.

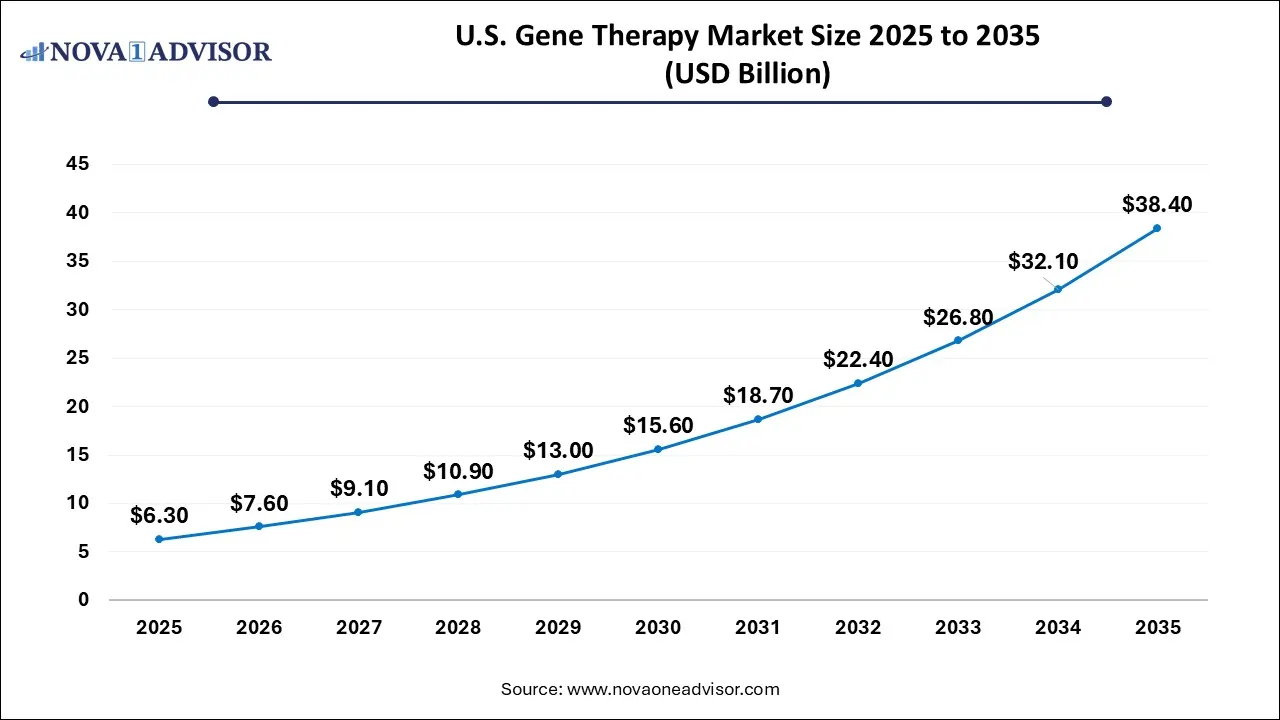

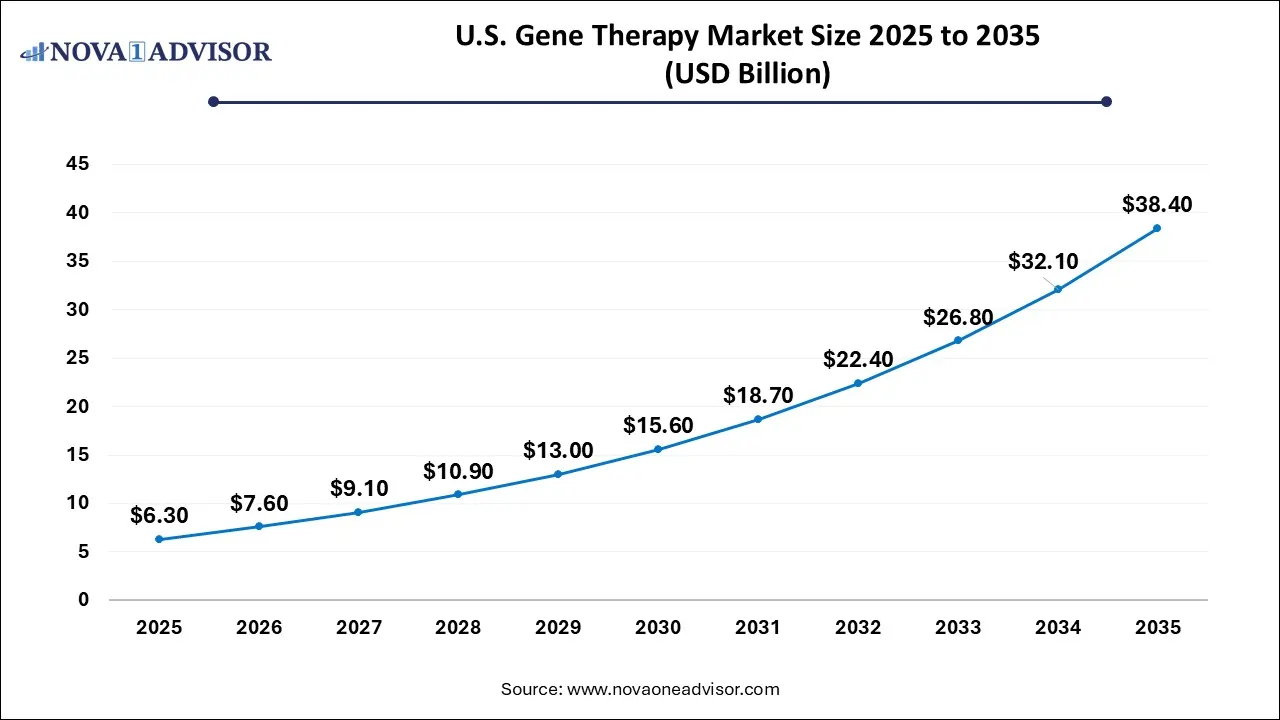

U.S. Gene Therapy Market Size in U.S. 2026 to 2035

The U.S. gene therapy market size was estimated at USD 6.3 billion in 2025 and is projected to surpass around USD 38.4 billion by 2035 at a CAGR of 17.81% from 2026 to 2035.

North America leads the global gene therapy market, driven by a highly advanced R&D ecosystem, early regulatory approvals, robust reimbursement structures, and a concentration of biopharmaceutical giants. The United States, in particular, houses leading players like Bluebird Bio, Novartis, Pfizer, and CRISPR Therapeutics, and hosts over 50% of the world’s gene therapy clinical trials. The FDA’s accelerated review processes, such as the Breakthrough Therapy and Orphan Drug designations, have enabled swift market entry for pioneering therapies.

The region’s strong presence of gene therapy manufacturing hubs, including CDMOs like Catalent, Thermo Fisher, and WuXi Advanced Therapies, further enhances its leadership. Additionally, patient advocacy groups and non-profits in the U.S. play a pivotal role in supporting clinical trials and influencing reimbursement decisions, creating a supportive commercial and social environment.

Asia-Pacific is the fastest-growing region, propelled by increasing healthcare investments, expanding clinical trial participation, and favorable regulatory reforms. Countries like China, Japan, and South Korea are emerging as hotspots for gene therapy innovation. China’s NMPA has streamlined approval pathways, and companies like JW Therapeutics, Legend Biotech, and CanSino Biologics are developing their own therapies, including CAR-Ts and AAV-based platforms.

Japan’s Sakigake designation system has facilitated early approvals of regenerative therapies, including gene-based solutions for rare diseases. Moreover, rising awareness, genetic testing availability, and improved infrastructure are accelerating adoption. Collaborative ventures between global pharma and regional biotech firms are also contributing to knowledge transfer and scalability in Asia-Pacific.

Market Overview

The Gene Therapy Market is at the forefront of biomedical innovation, representing a transformative shift in how we treat, manage, and potentially cure diseases at their genetic roots. Unlike traditional pharmaceuticals that treat symptoms or delay progression, gene therapy aims to correct or replace defective genes, offering curative potential for genetic, oncologic, neuromuscular, and hematologic disorders. Over the past decade, scientific advancements, favorable regulatory frameworks, and blockbuster approvals have catapulted gene therapy from experimental status to a promising therapeutic domain.

Gene therapy's emergence is timely. Diseases once considered untreatable such as Spinal Muscular Atrophy (SMA), Beta-Thalassemia, and ADA-SCID (Adenosine Deaminase Severe Combined Immunodeficiency) are now seeing remarkable clinical responses with a single-dose treatment. Approved therapies like Zolgensma (Novartis), Luxturna (Roche), and Zynteglo (Bluebird Bio) have validated gene therapy’s clinical efficacy and commercial viability, encouraging investment and accelerating research into broader applications.

As of 2025, over 1,000 gene therapy clinical trials are underway globally, spanning indications from oncology and cardiovascular disease to rare genetic disorders. The momentum is supported by technological strides in viral vector engineering, CRISPR/Cas9 gene editing, non-viral delivery systems, and synthetic biology. Governments and regulatory agencies, particularly the FDA and EMA, are actively fostering innovation with fast-track, orphan drug, and breakthrough therapy designations. With a growing pipeline, supportive policies, and expanding infrastructure, the global gene therapy market is poised to redefine 21st-century medicine.

Major Trends in the Market

-

One-Time Curative Therapies: A shift from chronic treatment to one-time gene therapies that offer long-term remission or cure.

-

Rise of CRISPR and Base Editing Platforms: Tools like CRISPR-Cas9 and prime/base editors are transforming precision gene correction.

-

Personalized and Targeted Approaches: Therapies are being developed based on patient-specific mutations or genetic profiles.

-

Hybrid Viral/Non-viral Vector Development: Innovation in combining viral efficiency with non-viral safety and scalability.

-

Manufacturing Expansion and CDMO Growth: Increasing investment in gene therapy manufacturing facilities and partnerships with CDMOs.

-

Gene Therapy for Common Diseases: Research expanding into prevalent disorders like heart failure, diabetes, and osteoarthritis.

-

Patient Advocacy and Rare Disease Alliances: Strong support from patient organizations is driving trial enrollment and public funding.

-

Advanced Biomarker-Based Patient Stratification: Precision diagnostics are being integrated to identify the best candidates for therapy.

Gene Therapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 15.27 Billion |

| Market Size by 2035 |

USD 77.64 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 19.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Vector Type, Indication, Route Of Administration, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

REGENXBIO, Inc.; Oxford BioMedica plc; Dimension Therapeutics, Inc.; Bristol-Myers Squibb Company; SANOFI; Applied Genetic Technologies Corp; F. Hoffmann-La Roche Ltd.; Bluebird Bio, Inc.; Novartis AG; Taxus Cardium Pharmaceuticals Group, Inc. (Gene Biotherapeutics); UniQure N.V.; Shire Plc; Cellectis S.A.; Sangamo Therapeutics, Inc.; Orchard Therapeutics; Gilead Lifesciences, Inc.; Benitec Biopharma Ltd.; Sibiono GeneTech Co., Ltd.; Shanghai Sunway Biotech Co., Ltd.; Gensight Biologics S.A.; Transgene; Calimmune, Inc.; Epeius Biotechnologies Corp.; Astellas Pharma, Inc.; American Gene Technologies; BioMarin Pharmaceuticals, Inc. |

Market Driver – Rising Prevalence of Genetic and Rare Diseases

One of the most influential growth drivers in the gene therapy market is the increasing recognition and diagnosis of rare and genetic disorders globally. According to estimates by the Global Genes Project, more than 400 million people worldwide are living with rare diseases, many of which have genetic origins and lack effective treatments. Traditional therapeutic options often involve lifelong management, repeated interventions, and high healthcare costs.

Gene therapy offers a single-intervention cure or long-term remission for such conditions. For instance, Zolgensma, approved by the FDA in 2019, treats SMA Type 1 with a single intravenous infusion and has been shown to transform fatal prognosis into near-normal development. The success of such therapies has catalyzed research into similar monogenic diseases such as Sickle Cell Disease (SCD), Beta-Thalassemia, and Hemophilia A & B. As next-generation sequencing (NGS) makes genetic screening more accessible, early identification of eligible patients will drive demand for targeted gene therapies.

Market Restraint – High Treatment Cost and Commercial Accessibility

Despite the remarkable clinical potential, the high cost of gene therapy presents a formidable barrier to market adoption and accessibility. Approved therapies like Zolgensma (~$2.1 million) and Zynteglo (~$2.8 million) represent some of the most expensive treatments globally. While these therapies often replace a lifetime of medical interventions, the upfront cost is prohibitive for many healthcare systems and insurers.

This economic challenge is further amplified in low- and middle-income countries, where reimbursement frameworks and healthcare infrastructure are underdeveloped. The complexity of manufacturing, storage, and logistics—particularly with autologous therapies—contributes to elevated prices. Payers are exploring value-based contracts, milestone payments, and outcomes-based reimbursement models, but wide-scale consensus remains elusive. Without scalable pricing and access strategies, the reach of gene therapy may remain limited to high-income settings in the short term.

Market Opportunity – Expansion into Chronic and High-Prevalence Conditions

A transformative opportunity lies in applying gene therapy beyond rare and monogenic diseases into more common and chronic conditions. Current research is exploring gene silencing, gene replacement, and genome editing to treat prevalent disorders such as heart failure, type 2 diabetes, macular degeneration, and Alzheimer’s disease. These expansions promise to multiply the addressable patient base significantly and offer new business models for scalability.

For example, REGENXBIO is developing RGX-314 for wet age-related macular degeneration (wAMD), a common cause of blindness in the elderly. Unlike current treatments requiring monthly intravitreal injections, RGX-314 offers a one-time dose. Similarly, companies like Verve Therapeutics are working on in vivo gene editing therapies for cardiovascular diseases, targeting PCSK9 and ANGPTL3 genes. These new indications, if successful, will not only diversify the gene therapy portfolio but also establish its role in mainstream chronic care.

By Vector Insights

AAV (Adeno-Associated Virus) vectors dominate the market, owing to their relative safety, low immunogenicity, and ability to achieve long-term gene expression. AAVs are commonly used in therapies targeting the eye, muscle, and central nervous system, as demonstrated by Luxturna, Zolgensma, and several ongoing programs. AAVs can be tailored for tissue-specific delivery and have a well-understood safety profile, making them a preferred choice for systemic and localized gene delivery.

Non-viral plasmid vectors are the fastest-growing segment, particularly due to their scalability, lower cost, and reduced immune response compared to viral vectors. With improvements in delivery technologies such as electroporation, nanoparticles, and lipid-based vectors, non-viral approaches are gaining attention for larger genes or repeat-dosing applications. Companies like Poseida Therapeutics and GenScript ProBio are pioneering this area, supported by increasing demand for safer, more affordable platforms.

By Indication Insights

Spinal Muscular Atrophy (SMA) dominates the indication segment, largely due to the blockbuster success of Zolgensma, the first FDA-approved gene therapy for SMA. SMA Type 1, one of the most severe forms of the disease, previously led to death or lifelong ventilation in early childhood. Zolgensma has reversed this prognosis with a single intravenous dose. Its efficacy and media attention have galvanized interest and investment in other neuromuscular gene therapy programs.

Beta-Thalassemia and Sickle Cell Disease (SCD) are the fastest-growing indications, with therapies like Zynteglo and exagamglogene autotemcel (exa-cel) from CRISPR Therapeutics/Vertex paving the way. These conditions affect millions globally, particularly in regions like South Asia, the Middle East, and Sub-Saharan Africa. The potential to reduce or eliminate transfusion dependency or painful vaso-occlusive crises makes gene therapy highly desirable. Clinical trials continue to show encouraging results, and broader approvals are expected in 2025–2026.

By Route of Administration Insights

Intravenous administration dominates the route of delivery, especially for systemic diseases like SMA, SCD, and beta-thalassemia. Intravenous infusion allows for widespread gene distribution throughout the body and is the standard method for autologous cell therapies like CAR-T and gene-modified stem cell therapies. Its well-established clinical use and manageable infusion protocols have made it the go-to approach for many approved and pipeline therapies.

Localized routes (ocular, intrathecal, intramuscular) are the fastest growing, particularly as researchers aim to target specific tissues while minimizing systemic exposure. Intrathecal delivery, for example, is preferred in neurological disorders to bypass the blood-brain barrier, as seen in investigational gene therapies for ALS and Parkinson’s disease. Ocular delivery is common in retinal diseases, where direct injection into the retina maximizes vector efficacy while reducing systemic risk. As targeted delivery technologies evolve, localized routes are expected to grow rapidly.

Recent Developments

-

April 2025 – CRISPR Therapeutics and Vertex Pharmaceuticals submitted a BLA for exa-cel, the first CRISPR-based gene therapy for SCD and beta-thalassemia, in the U.S. and Europe.

-

March 2025 – REGENXBIO received Fast Track Designation from the FDA for RGX-202, a gene therapy candidate for Duchenne Muscular Dystrophy.

-

February 2025 – Pfizer launched clinical trials of a novel AAV vector therapy for hemophilia B, aiming to replace its investigational fidanacogene elaparvovec.

-

January 2025 – Bluebird Bio regained full rights to its gene therapy platform in Europe after restructuring its commercial strategy for Zynteglo and Skysona.

-

December 2024 – Sarepta Therapeutics and Roche expanded their collaboration to develop gene therapy for Limb-Girdle Muscular Dystrophy, with preclinical studies moving into IND-enabling phases.

Some of the prominent players in the Gene therapy market include:

- REGENXBIO, Inc.

- Oxford BioMedica plc

- Dimension Therapeutics, Inc.

- Bristol-Myers Squibb Company

- SANOFI

- Applied Genetic Technologies Corporation

- F. Hoffmann-La Roche Ltd

- bluebird Bio, Inc.

- Novartis AG

- Taxus Cardium Pharmaceuticals Group, Inc. (Gene Biotherapeutics)

- UniQure N.V.

- Shire Plc

- Cellectis S.A.

- Sangamo Therapeutics, Inc

- Orchard Therapeutics

- Gilead Lifesciences, Inc.

- BENITEC BIOPHARMA

- Sibiono GeneTech Co., Ltd

- Shanghai Sunway Biotech Co., Ltd.

- Gensight Biologics S.A.

- Transgene

- Calimmune, Inc.

- Epeius Biotechnologies Corp.

- Astellas Pharma Inc.

- American Gene Technologies

- BioMarin Pharmaceuticals, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global gene therapy market.

Indication

- Acute Lymphoblastic Leukemia (ALL)

- Inherited Retinal Disease

- Large B-cell Lymphoma

- ADA-SCID

- Melanoma (lesions)

- Beta-Thalassemia Major/SCD

- Head & Neck Squamous Cell Carcinoma

- Peripheral arterial disease

- Spinal Muscular Atrophy (SMA)

- Others

Vector Type

- Lentivirus

- AAV

- RetroVirus & gamma RetroVirus

- Modified Herpes Simplex Virus

- Adenovirus

- Non-viral Plasmid Vector

- Others

Route of Administration

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)