Genotyping Assays Market Size Trends Analysis and Forecast till 2034

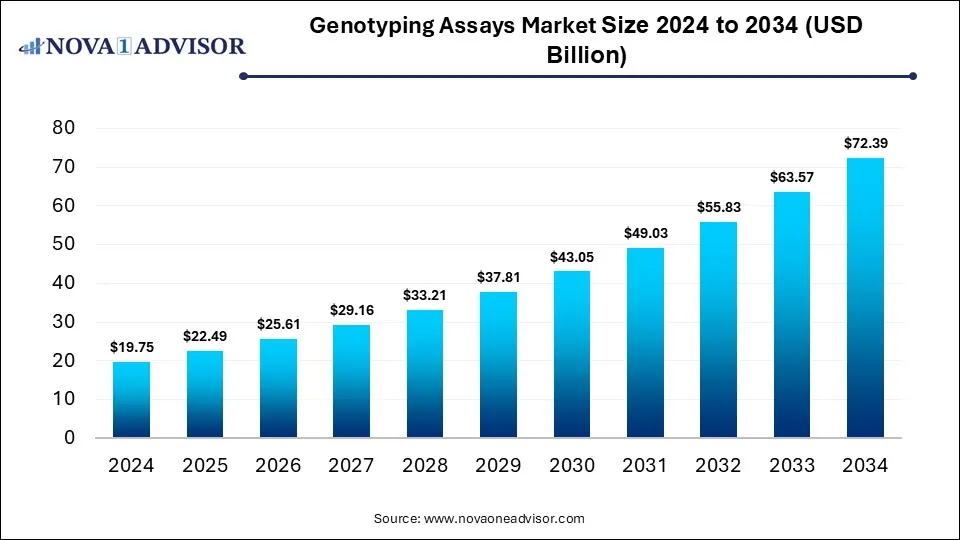

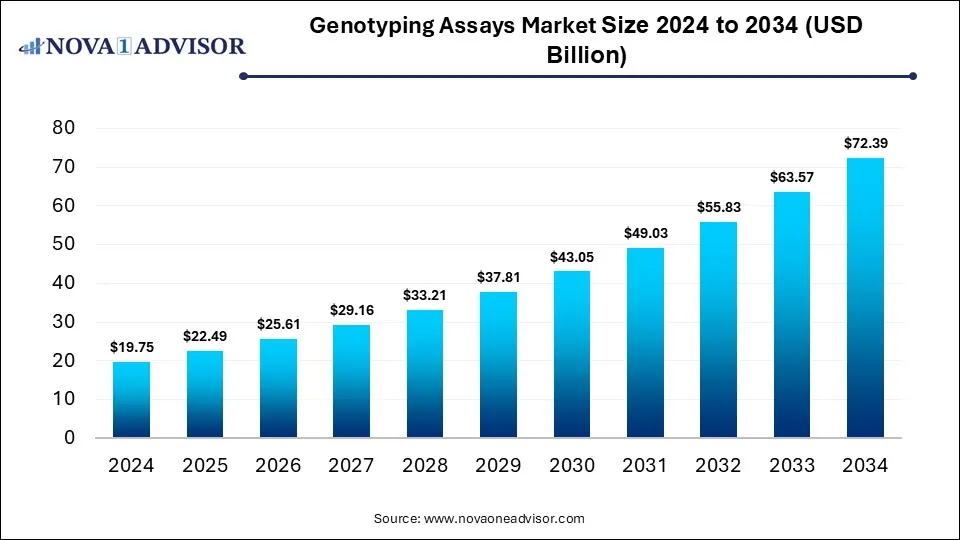

The global genotyping assay market size is calculated at USD 19.75 billion in 2024, grows to USD 22.49 billion in 2025, and is projected to reach around USD 72.39 billion by 2034, expanding at a CAGR of 13.87% from 2025 to 2034. The market is growing due to rising demand for personalized medicine and precision diagnostics. The increasing prevalence of genetic disorders and advancements in molecular testing technologies further drive its expansion.

Genotyping Assays Market Key Takeaways

- North America dominated the genotyping assay market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the Polymerase chain reaction (PCR) segment held the largest market share in 2024.

- By technology, the next generation (NGS) is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the reagent & Kits segment led the market with the largest revenue share in 2024.

- By product, the software & services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the diagnostic segment dominated the market, particularly the oncology subsegment held the highest market share.

- By application, the pharmacogenomics segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the pharmaceutical & biopharmaceutical companies segment held the largest revenue shares in 2024.

- By end user, the contract research organizations (CROs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By workflow stage, the DNA amplification segment dominated the genotyping assay market.

- By workflow stage, the data analysis & interpretation segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is the Genotyping Assay Market Evolving?

A genotyping assay is a laboratory method used to analyze DNA sequencing to identify genetic variations, such as single-nucleotide polymorphisms (SNPs), mutations, or alleles, in an individual's genome. The genotyping assay market is evolving as healthcare systems increasingly prioritize early disease detection and preventive care. The surge in direct-to-consumer genetic testing and growing awareness about ancestry and lifestyle-related genetics are boosting market penetration. Collaborations between diagnostic companies and research institutes are expanding assay applications. Moreover, regulatory approvals for novel assays and the rising focus on companion diagnostics in oncology are reshaping the industry, making genotyping more accessible and clinically relevant across diverse sectors.

What are the Key trends in the Genotyping Assay Market in 2024?

- In February 2025, Yourgene Health introduced the IONA® Care+ non-invasive prenatal testing (NIPT) service, offering a safer and more advanced option for expecting mothers to assess fetal health without the risks linked to traditional invasive methods.(Source: https://yourgenehealth.com/)

- In November 2024, BD introduced the BD Onclarity HPV assay, approved by the FDA, to enhance cervical cancer prevention. The test provides extended genotyping to identify HPV types by risk level, enabling targeted follow-up, such as direct colposcopy for high-risk strains like HPV 16 and 18. (Source: https://www.contemporaryobgyn.net/ )

How Can AI Affect the Genotyping Assay Market?

AI is influencing the market by enabling advanced pattern recognition in genetic datasets, which helps uncover hidden correlations between genotypes and diseases. It also supports drug discovery by predicting gene–drug interactions more effectively. Through machine learning, AI refines assay design, improving sensitivity and specificity. Moreover, AI-powered predictive analytics aid in identifying at-risk populations for clinical studies, while integration with wearable health data expands the scope of genotype-based health monitoring beyond traditional laboratory settings.

Report Scope of Genotyping Assays Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 22.49 Billion |

| Market Size by 2034 |

USD 72.39 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.87% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Product, Application, End User, Workflow Stage, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Illumina Inc., Bio-Rad Laboratories Inc., Agilent Technologies, QIAGEN, Danaher Corporation, PerkinElmer Inc., Roche Diagnostics, Takara Bio Inc., Fluidigm Corporation, Luminex Corporation, Pacific Biosciences, BGI Genomics, Genewiz (Part of Azenta Life Sciences), Sequenom (A Laboratory Corporation of America Holdings subsidiary), Affymetrix (now part of Thermo Fisher), Eurofins Genomics, Analytik Jena, Merck KGaA, and New England Biolabs. |

Market Dynamics

Driver

Rising Demand for Personalized Medicine

The rising demand for personalized medicine drives the genotyping assay market as it supports early disease risk prediction and preventive care strategies. By detecting genetic predispositions, genotyping assays allow patients to make informed lifestyle or medical choices before conditions progress. This proactive approach not only enhances patient outcomes but also reduces long-term healthcare costs. As awareness of genetic health grows and preventive medicine gains traction, the adoption of genotyping assays continues to accelerate worldwide.

- For Instance, In June 2024, A multi-center trial in Australia implemented DPYD genotyping to guide fluoropyrimidine chemotherapy dosing. Patients with DPYD variants received dose adjustments, significantly lowering severe toxicity and hospitalizations compared to standard care. (Source: https://pmc.ncbi.nlm.nih.gov/)

Restraint

High Cost of Advanced Technologies and Data Analysis

The high cost of advanced genotyping technologies restrains the market because reimbursement policies often fail to cover the full expenses of these tests, discouraging their use in routine healthcare. Many hospitals and smaller labs face budget limitations, making it difficult to adopt such assays despite their clinical benefits. Moreover, the need for continuous upgrades in equipment and software creates additional financial pressure, reducing long-term affordability and slowing down integration of genotyping into mainstream medical practice.

Opportunity

Integration of Genotyping Assays in Clinical Diagnostics

The integration of genotyping assays in clinical diagnostics is a future opportunity as it can streamline companies' diagnostics for targeted therapies, especially in oncology and rare diseases. By linking genetics insights directly to drug selection, it helps physicians choose the most effective treatments while avoiding ineffective options. This not only improves therapeutic success rates but also accelerates drug approval pathways. As pharma-diagnostics partnerships grow, genotyping assays are positioned to become an essential bridge between diagnostics and precision therapeutics.

Segmental Insights

What made the Polymerase Chain Reaction (PCR) Segment Dominant in the Genotyping Assay Market in 2024?

In 2024, the polymerase chain reaction (PCR) segment dominated the genotyping assay market due to its cost-effectiveness and adaptability across diverse applications, from prenatal testing to oncology. PCR enables high sensitivity even with minimal DNA samples, making it ideal for early disease detection. Its integration with automated and multiple platforms allows simultaneous analysis of multiple genes, increasing efficiency. Growing investments in laboratory infrastructure and continuous innovation, such as rapid and portable PCR devices, further reinforced its leading market position.

Next-generation sequencing (NGS) is projected to grow fastest in the genotyping assay market because it offers unparalleled scalability and resolution, allowing detailed analysis of complex genetic variation that traditional methods cannot detect. Its ability to provide multi-gene panels, whole-exome, and whole-genome sequencing in a single run meets the rising demand for comprehensive diagnostics. Additionally, growing investments in research, precision agriculture, and population turnaround times, are accelerating NGS adoption across diverse sectors.

Genotyping Assay Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Polymerase Chain Reaction (PCR) |

5.14 |

5.78 |

6.50 |

7.32 |

8.23 |

9.26 |

10.42 |

11.72 |

13.18 |

14.81 |

16.65 |

| Microarray |

2.17 |

2.42 |

2.69 |

2.99 |

3.32 |

3.69 |

4.09 |

4.53 |

5.02 |

5.56 |

6.15 |

| Next-Generation Sequencing (NGS) |

5.53 |

6.43 |

7.48 |

8.69 |

10.09 |

11.72 |

13.61 |

15.79 |

18.31 |

21.23 |

24.61 |

| Mass Spectrometry |

1.78 |

2.04 |

2.35 |

2.69 |

3.09 |

3.55 |

4.08 |

4.69 |

5.38 |

6.18 |

7.09 |

| Electrophoresis |

1.58 |

1.78 |

2.00 |

2.25 |

2.52 |

2.84 |

3.19 |

3.58 |

4.02 |

4.51 |

5.07 |

| MALDI-TOF |

1.38 |

1.59 |

1.82 |

2.09 |

2.40 |

2.76 |

3.17 |

3.64 |

4.18 |

4.79 |

5.50 |

| Others |

2.17 |

2.45 |

2.77 |

3.13 |

3.53 |

3.99 |

4.50 |

5.08 |

5.74 |

6.48 |

7.31 |

How did the Reagents & Kits Segment Dominate the Genotyping Assay Market in 2024?

In 2024, the reagents & kits segment dominated the genotyping assay market because they provide convenient, all-in-one solutions that save time and reduce technical errors. Growing demand from hospitals, diagnostic labs, and research centers for standardized, ready-to-use products fueled revenue growth. Innovations such as multiplexed kits and pre-validated reagents enhanced test accuracy and efficiency, while increasing awareness of genetic testing and the rise of decentralized laboratories further strengthened adoption, making this segment the largest contributor to market revenue.

The software and services segment is projected to grow fastest because the rising complexity of genotyping assays requires robust data management, storage, and interpretation solutions. Integration of digital platforms enables seamless workflow automation, remote access, and regulatory compliance. Additionally, the increasing adoption of precision medicine and large-scale population genomics studies drives demand for customized bioinformatics support and consultancy services. Continuous advancements in AI, machine learning, and cloud computing further enhance the value of software and services, accelerating their market growth.

How did the Diagnostic Segment Dominate the Market?

The diagnostic segment led the market as genotyping assays are widely adopted for identifying infectious agents, hereditary conditions, and cancer biomarkers. Their ability to provide accurate, rapid, and actionable results in clinical settings drives extensive use. Growing government initiatives for genetic screening programs and increased awareness among healthcare providers and patients further boosted demand, making diagnostics the primary revenue-generating application in 2024.

The oncology sub-segment held the highest market share because genotyping assays are critical for detecting cancer-related genetic mutations and guiding targeted therapies. Rising cancer prevalence, growing adoption of precision medicine, and the need for personalized treatment strategies have significantly increased the use of genotyping assays in oncology.

The pharmacogenomics segment is projected to grow fastest as healthcare systems increasingly focus on optimizing drug therapy based on genetic profiles. Rising prevalence of chronic and lifestyle-related diseases drives demand for genotype-guided dosing to enhance safety and effectiveness. Furthermore, pharmaceutical companies are integrating genotyping assays into clinical trials to develop targeted therapies, while advancements in automation and AI-powered analysis make pharmacogenomic testing faster and more accessible, fueling rapid adoption across clinical and research settings.

Why the Pharmaceutical & Biopharmaceutical Companies Segment Dominated the Genotyping Assay Market in 2024?

In 2024, pharmaceutical & biopharmaceutical companies led the market as end users because they rely on genotyping assays to accelerate pipeline development and reduce clinical trial failures. These assays help in understanding patient genetic variability, supporting biomarker-driven drug development, and optimizing therapeutic efficacy. Growing focus on personalized medicine, increasing adoption of next-generation sequencing, and partnerships with diagnostic technology providers have further boosted their reliance on genotyping solutions, making this segment the largest contributor to market revenue.

The contract research organization (CROs) segment is projected to grow fastest as pharmaceutical and biotech companies increasingly rely on CROs for outsourced genotyping due to their specialized technology and skilled workforce. CROs can rapidly implement advanced assays for multiple therapeutic areas without the need for in-house infrastructure. Growing demand for decentralized clinical trials, expanding genomic research, and cost-efficiency in handling large-scale genetic data further boost the adoption of genotyping services through CROs, driving their market growth at a high CAGR.

How does the DNA Amplification Segment dominate the Market in 2024?

The DNA amplification segment led the genotyping assay market because it forms the foundation for most genetic testing workflows, enabling the detection of low-abundance or degraded DNA samples. Its versatility across applications, including infectious disease testing, oncology, and pharmacogenomics, ensures consistent demand. Growing adoption of high-throughput and automated amplification platforms, along with increasing focus on rapid and point-of-care diagnostics, has further strengthened its dominance, making DNA amplification the most widely used and revenue-generating workflow stage in 2024.

The data analysis & interpretation segment is projected to grow fastest as healthcare and research sectors increasingly rely on actionable insights from genotyping results. Rising demand for real-time decision-making in clinical trials, companion diagnostics, and personalized therapies fuels adoption. Enhanced software solutions, integration of AI and machine learning, and the need to manage large-scale genomic databases efficiently make this workflow critical. As laboratories seek to reduce errors and accelerate reporting, investment in analysis and interpretation tools continues to rise rapidly.

Regional Insights

How is North America Contributing to the Genotyping Assay Market?

In 2024, North America led the market owing to widespread integration of next-generation sequencing and high-throughput technologies in clinical and research settings. Strong collaborations between academic institutions and biotech firms, along with rising awareness of personalized medicine among healthcare providers and patients, boosted market adoption. Additionally, favorable regulatory frameworks, robust reimbursement policies for genetic testing, and growing investment in pharmacogenomics and companion diagnostics contributed to the region securing the highest revenue share globally.

How is Asia-Pacific Accelerating the Genotyping Assay Market?

Asia-Pacific is expected to grow at the fastest CAGR because of the region’s rising number of genomics research centers and expanding diagnostic laboratories. Affordable genotyping solutions, increasing collaborations between local and international biotech companies, and government support for healthcare innovation are boosting adoption. Moreover, the growing prevalence of chronic and hereditary diseases, coupled with a large population increasingly seeking personalized medicine, is driving demand for genotyping assays, making the region a rapidly expanding market during the forecast period.

Genotyping Assay Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

7.31 |

8.25 |

9.31 |

10.51 |

11.86 |

13.38 |

15.10 |

17.04 |

19.22 |

21.69 |

24.46 |

| Europe |

5.33 |

6.03 |

6.83 |

7.73 |

8.75 |

9.90 |

11.20 |

12.67 |

14.33 |

16.22 |

18.35 |

| Asia Pacific |

4.94 |

5.72 |

6.62 |

7.67 |

8.88 |

10.27 |

11.88 |

13.74 |

15.89 |

18.37 |

21.23 |

| South America |

1.19 |

1.36 |

1.55 |

1.77 |

2.03 |

2.32 |

2.65 |

3.03 |

3.47 |

3.96 |

4.53 |

| Middle East & Africa |

0.99 |

1.13 |

1.29 |

1.48 |

1.70 |

1.94 |

2.22 |

2.54 |

2.91 |

3.33 |

3.81 |

Genotyping Assay Market Size Analysis

Currently, the genotyping assays market size is estimated to be valued at USD 19.75 billion in 2024 and is projected to reach USD 72.39 billion by 2034. The market is poised to grow at a higher CAGR of 13.87% during the projected period. This highest growth potential is likely to be the result of growing demand for target specific therapies for the treatment of chronic diseases.

Top Companies in the Genotyping Assay Market

- Thermo Fisher Scientific

- Illumina Inc.

- Bio-Rad Laboratories Inc.

- Agilent Technologies

- QIAGEN

- Danaher Corporation

- PerkinElmer Inc.

- Roche Diagnostics

- Takara Bio Inc.

- Fluidigm Corporation

- Luminex Corporation

- Pacific Biosciences

- BGI Genomics

- Genewiz (Part of Azenta Life Sciences)

- Sequenom (A Laboratory Corporation of America Holdings subsidiary)

- Affymetrix (now part of Thermo Fisher)

- Eurofins Genomics

- Analytik Jena

- Merck KGaA

Recent Developments in the Genotyping Assay Market

- In February 2025, Illumina introduced advanced solutions to enhance multiomics research, featuring a single-cell platform for CRISPR studies, a 5-base system for methylation and variant analysis, and the Illumina Connected Multiomics (ICM) software for seamless data integration and analysis. (Source: https://investor.illumina.com/)

- In February 2025, Yourgene Health obtained IVDR certification for its Yourgene QST*R Base assay, designed to detect cancer patients who may experience severe adverse reactions to specific chemotherapy treatments. (Source: https://yourgenehealth.com/)

Segments Covered in the Report

By Technology

- Polymerase Chain Reaction (PCR)

-

- Real-Time PCR

- Digital PCR

- Others

- Microarray

- Next-Generation Sequencing (NGS)

- Mass Spectrometry

- Electrophoresis

- MALDI-TOF

- Others

By Product

- Instruments

- Reagents & Kits

- Software & Services

-

- Data Analysis Software

- Genotyping Services

By Application

- Pharmacogenomics

- Diagnostics

-

- Oncology

- Infectious Diseases

- Others

- Animal Genetics

- Agricultural Biotechnology

- Research (Academic & Clinical)

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Laboratories

- Academic & Research Institutions

- Contract Research Organizations (CROs)

- Others

By Workflow Stage

- Sample Preparation

- DNA Amplification

- Genotyping/Detection

- Data Analysis & Interpretation

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa