Geriatric Care Services Market Size and Growth

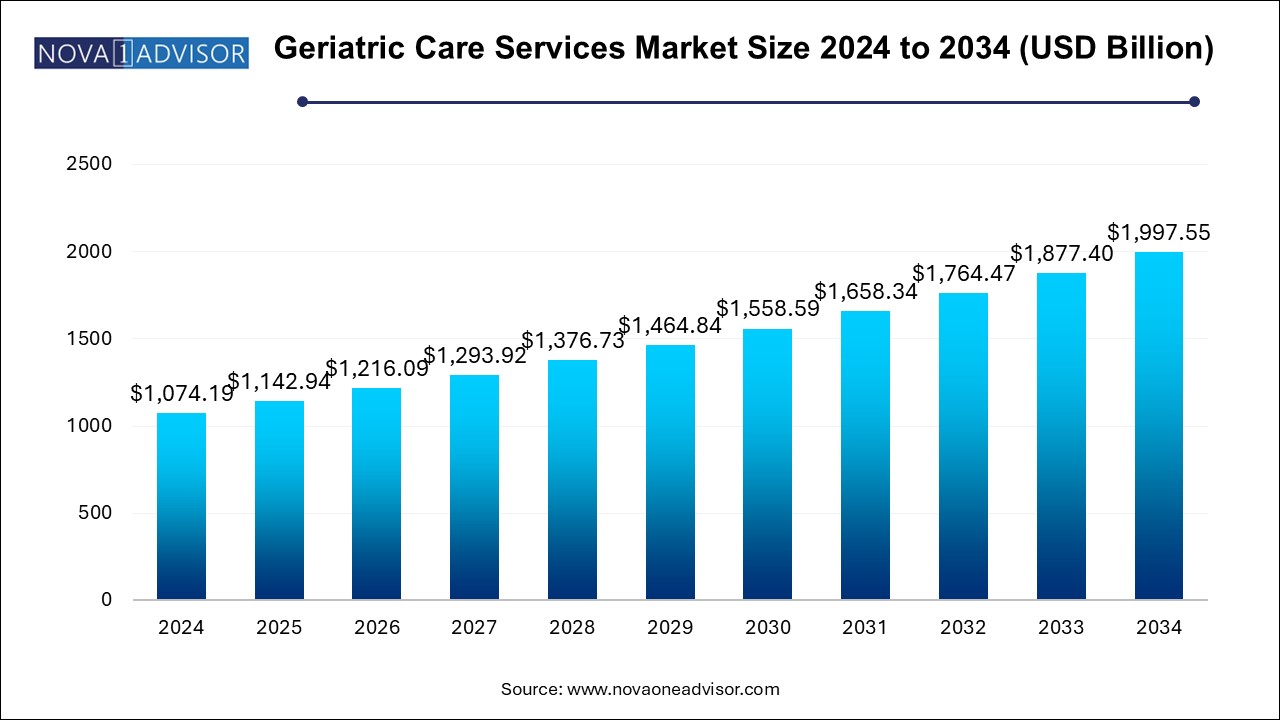

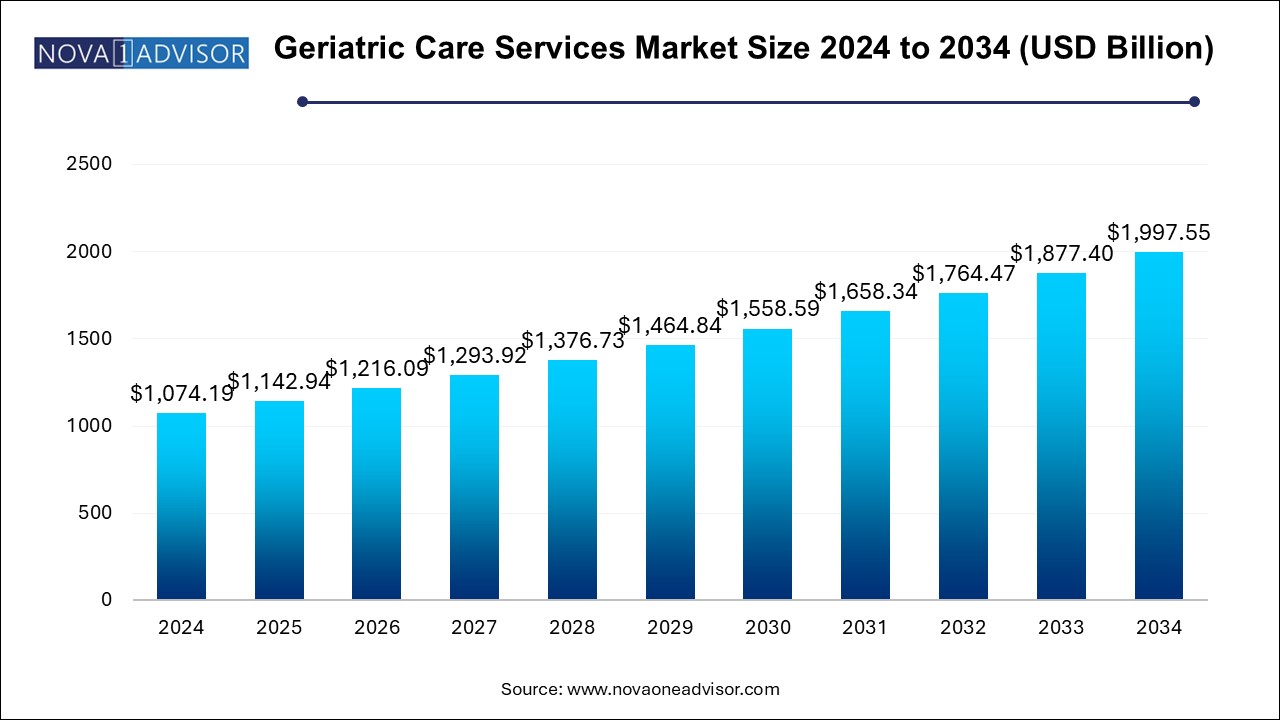

The geriatric care services market size was exhibited at USD 1,074.19 billion in 2024 and is projected to hit around USD 1,997.55 billion by 2034, growing at a CAGR of 6.4% during the forecast period 2024 to 2034.

Geriatric Care Services Market Key Takeaways:

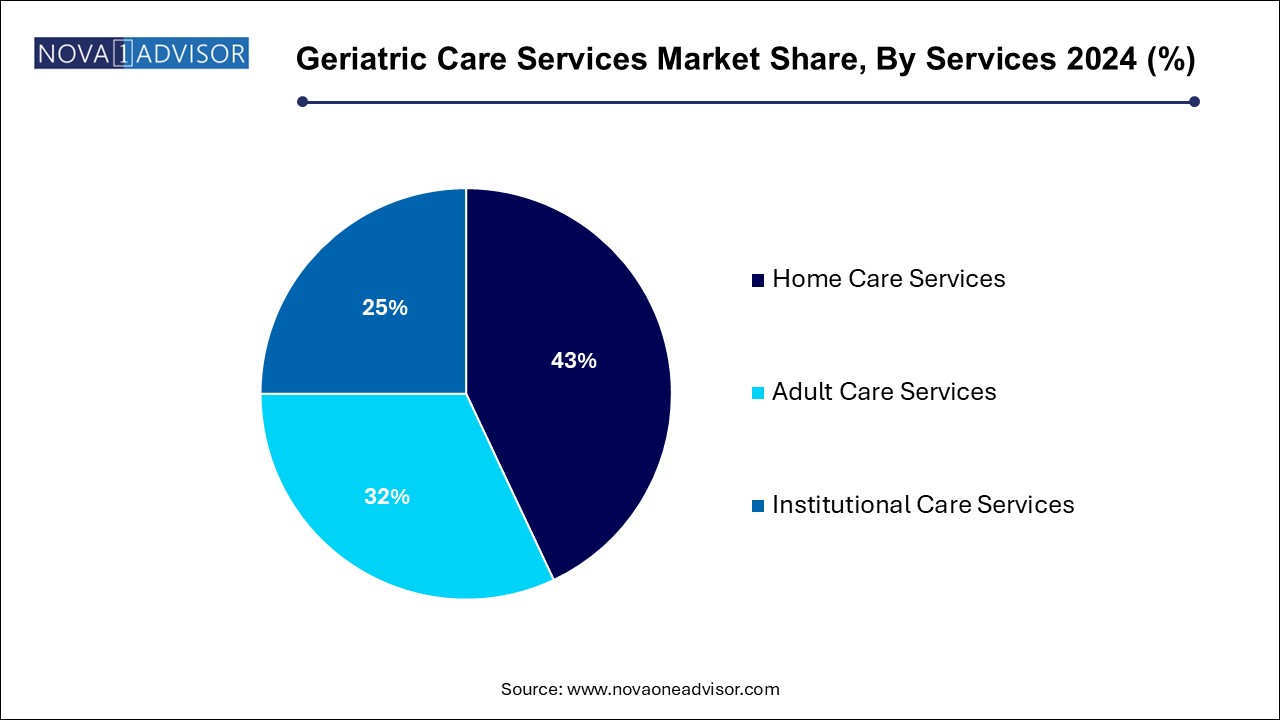

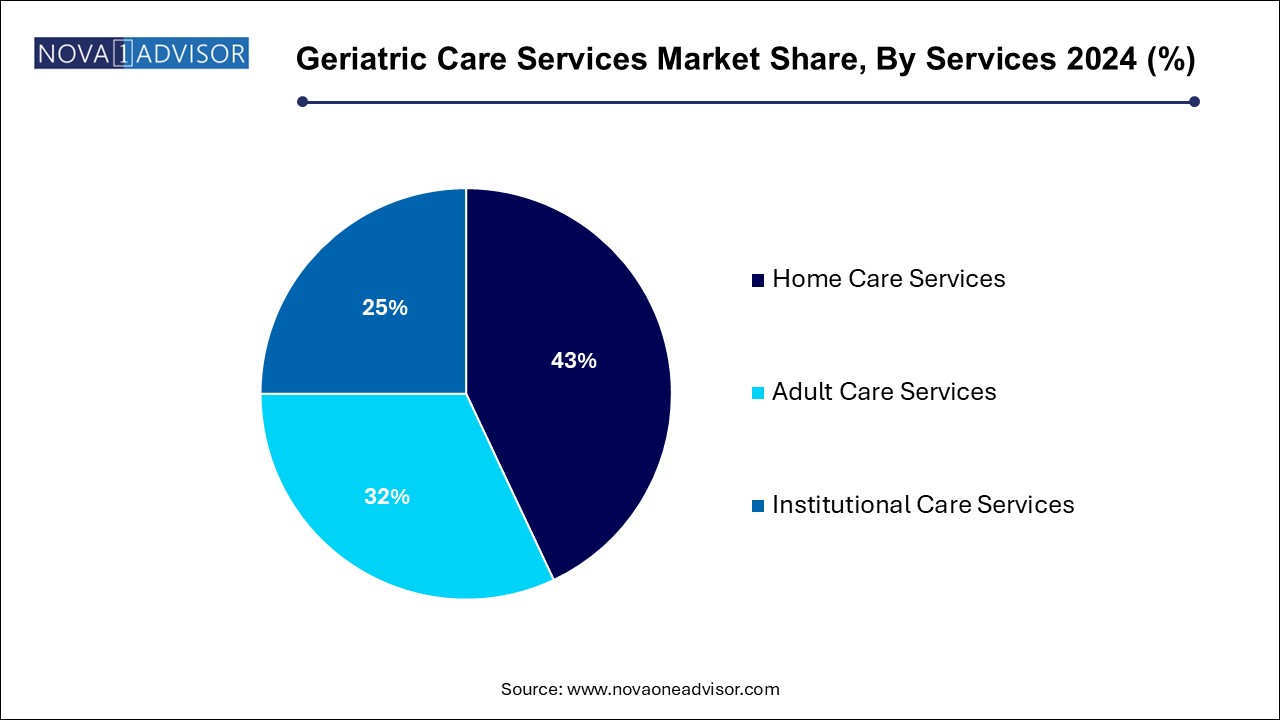

- The home care segment dominated the market with the largest revenue share of 43.0% in 2024 and is also expected to grow at the fastest CAGR of 6.8% over the forecast period.

- North America dominated the market and accounted for the largest revenue share of 41.8% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 8.3% during the forecast period.

Market Overview

The Geriatric Care Services Market is becoming a cornerstone of global healthcare transformation as the world’s population ages rapidly. Geriatric care refers to a broad spectrum of healthcare and personal services designed specifically to support the needs of the elderly typically individuals aged 65 years and older. These services range from basic daily assistance to advanced medical treatments and institutional care, addressing the multifaceted health, social, and psychological challenges faced by seniors.

As of 2024, over 771 million people globally are aged 65 and above, a number expected to surpass 1.5 billion by 2050, according to the United Nations. This demographic shift, fueled by increased life expectancy, improved medical technologies, and declining birth rates, has created an unprecedented demand for structured geriatric services. Governments, private healthcare providers, and families are increasingly seeking scalable and sustainable solutions to deliver quality elder care across varied socio-economic and geographic contexts.

The geriatric care services market encompasses home care (medical and non-medical), adult day care, and institutional services such as nursing homes, assisted living, and senior living communities. These services are often tailored to manage chronic conditions (like arthritis, diabetes, dementia, cardiovascular issues), post-acute recovery, mobility limitations, mental health issues, and palliative needs.

The market is witnessing a shift from institutional care toward home- and community-based services (HCBS), driven by cost-efficiency, patient preference, and technological advancements such as telehealth and remote monitoring. However, regional disparities in access, workforce shortages, and funding gaps remain key challenges.

With a growing elderly population seeking independence and quality of life, the geriatric care services market stands at the intersection of healthcare delivery innovation, public policy reform, and consumer-driven care models.

Major Trends in the Market

-

Growth in Home-Based Care Models: Families and governments are shifting focus from institutional care to aging-in-place models supported by home care agencies, telemedicine, and remote monitoring.

-

Expansion of Telehealth and Virtual Geriatric Consultations: The COVID-19 pandemic accelerated the adoption of digital care tools, which now play a central role in chronic disease management and mental health services for seniors.

-

Rise in Memory and Dementia Care Facilities: As Alzheimer’s disease and related dementias increase, specialized facilities and programs are emerging to offer tailored cognitive care.

-

Workforce Development and Training Initiatives: Governments and institutions are investing in geriatric nursing, caregiving, and therapy specialization programs to address labor shortages.

-

Integration of Smart Technologies and IoT in Senior Living: Smart homes, wearable health devices, fall detectors, and voice-assisted systems are enabling safer independent living.

-

Consumer-Driven Personalization of Non-Medical Services: Demand is rising for customized personal care, companionship services, meal preparation, and culturally competent care.

-

Growth of Insurance-Covered Long-Term Services: Both public and private insurers are gradually expanding coverage for home care, adult daycare, and assisted living under long-term care (LTC) plans.

-

Public–Private Partnerships in Elder Care Infrastructure: Especially in Asia-Pacific and Latin America, governments are collaborating with private sector players to build senior living facilities and care networks.

Report Scope of Geriatric Care Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,142.94 Billion |

| Market Size by 2034 |

USD 1,997.55 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.4% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Services, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Brookdale Senior Living Inc.; EXTENDICARE; Gentiva; Knight Health Holdings, LLC (Kindred Hospitals); Sunrise Senior Living; Genesis HealthCare; Home Instead, Inc.; GGNSC Holdings LLC |

Geriatric Care Services Market By Services Insights

Home care services dominate the market, particularly due to the rising preference for aging in place. Within this category, non-medical home care, which includes personal care, homemaking, and meal preparation, holds the largest share. This type of care supports daily living activities and improves quality of life without requiring hospitalization. Home care services also reduce hospital readmissions and are more affordable than institutional care, making them the preferred choice for families across North America and Europe. Increasing integration of telehealth and physiotherapy services into home care further enhances this segment’s value proposition.

Adult care services are the fastest-growing segment, particularly in urban centers. These facilities provide seniors with structured daytime care, meals, socialization, and limited medical attention, allowing family caregivers to work during the day. Adult care is a cost-effective alternative to 24-hour home or institutional care and is gaining traction in countries with high workforce participation and nuclear family models. The growing burden of cognitive decline and loneliness among the elderly is prompting the development of dementia-focused adult day centers, further accelerating this segment.

Geriatric Care Services Market By Regional Insights

North America leads the global geriatric care services market, largely due to its aging population, well-developed healthcare systems, and robust long-term care infrastructure. The United States and Canada have advanced reimbursement frameworks including Medicare, Medicaid, and private LTC insurance plans, which partially cover in-home and nursing facility care.

The region also benefits from a thriving telehealth ecosystem, increasing adoption of smart home devices among older adults, and high government focus on value-based care and aging-at-home initiatives. Leading companies such as Brookdale Senior Living, LHC Group, and Amedisys dominate the competitive landscape. The presence of a growing “silver economy” with disposable income has spurred investment in upscale senior living communities and home-based care franchises.

Asia-Pacific is the fastest-growing market, driven by an aging population, urbanization, and cultural shifts from multigenerational households to nuclear families. Countries like Japan, China, South Korea, and Australia are investing heavily in elder care infrastructure. Japan, with over 28% of its population aged 65 and above, is a global leader in robot-assisted eldercare and tele-nursing systems.

Meanwhile, China’s expanding middle class and government-backed policies such as the Healthy China 2030 Plan are catalyzing growth in home and institutional elder care. Startups offering app-based eldercare services, smart monitoring systems, and affordable elder housing are emerging throughout the region. While APAC faces challenges such as caregiver shortages and limited insurance coverage, the market potential remains vast due to sheer demographic weight and technological enthusiasm.

Some of the prominent players in the geriatric care services market include:

- Brookdale Senior Living Inc.

- EXTENDICARE

- Gentiva

- Knight Health Holdings, LLC (Kindred Hospitals)

- Sunrise Senior Living

- Genesis HealthCare

- Home Instead, Inc.

- GGNSC Holdings LLC

Recent Developments

-

March 2025: Brookdale Senior Living announced the launch of “Brookdale@Home,” a hybrid care model offering remote monitoring, teleconsultations, and in-person home visits to address growing demand for aging-in-place services.

-

January 2025: Honor Technology Inc. expanded its caregiver platform into new states across the U.S., focusing on real-time scheduling, digital case management, and personalized elder wellness planning.

-

November 2024: India-based Portea Medical raised $50 million in Series D funding to expand its home healthcare services targeting seniors with chronic conditions in tier-1 and tier-2 cities.

-

September 2024: Singapore’s Ministry of Health partnered with several tech companies to pilot AI-based geriatric triaging systems in public hospitals and assisted living facilities.

-

July 2024: Genesis HealthCare launched its “Senior Rehabilitation Reimagined” program, which integrates virtual physical therapy into post-acute elderly care using VR-assisted exercises.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the geriatric care services market

Services

-

-

- Medical Care

- Physiotherapy Services

- Telehealth

- Palliative Care

- Hospice Care

-

-

- Personal Care

- Homemaking

- Meals and Grocery

- Rehabilitation

- Others

-

- Health Care

- Non-Medical Care

- Institutional Care Services

-

-

- Palliative Care

- Hospice Care

-

- Hospital-based

- Assisted Living

- Independent Senior Living

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)