Germany Legal Cannabis Market Size and Trends

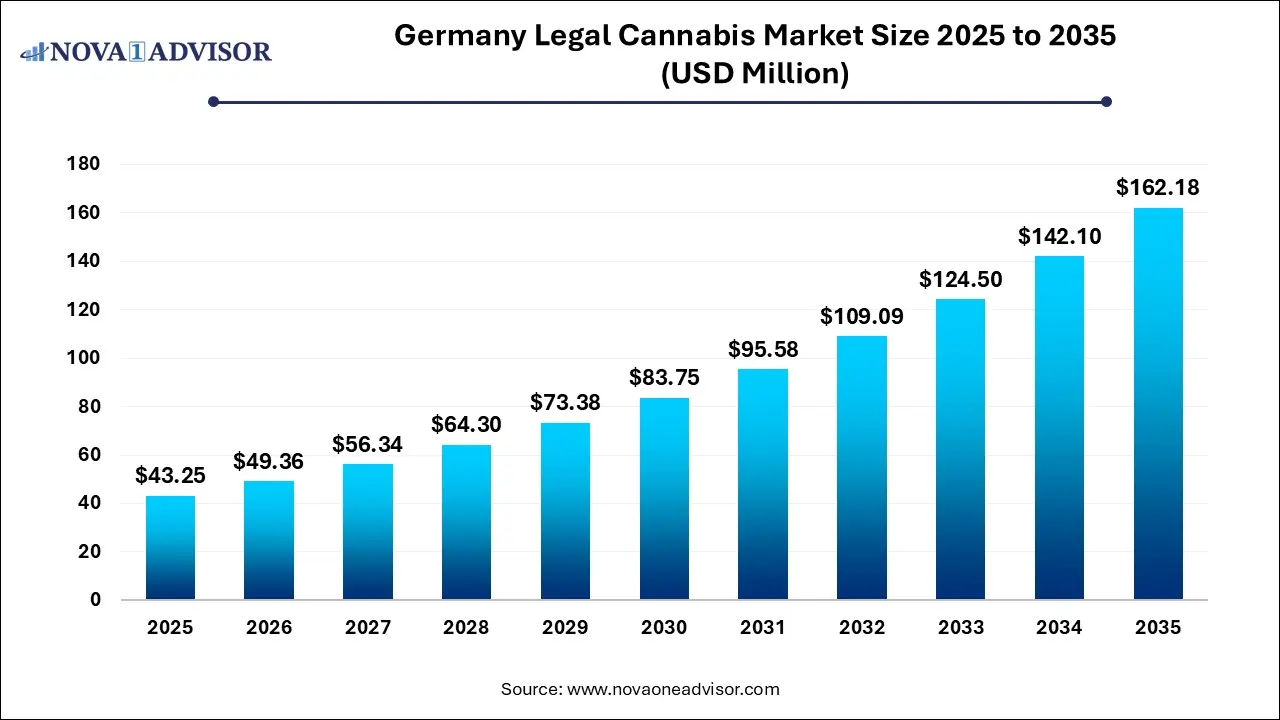

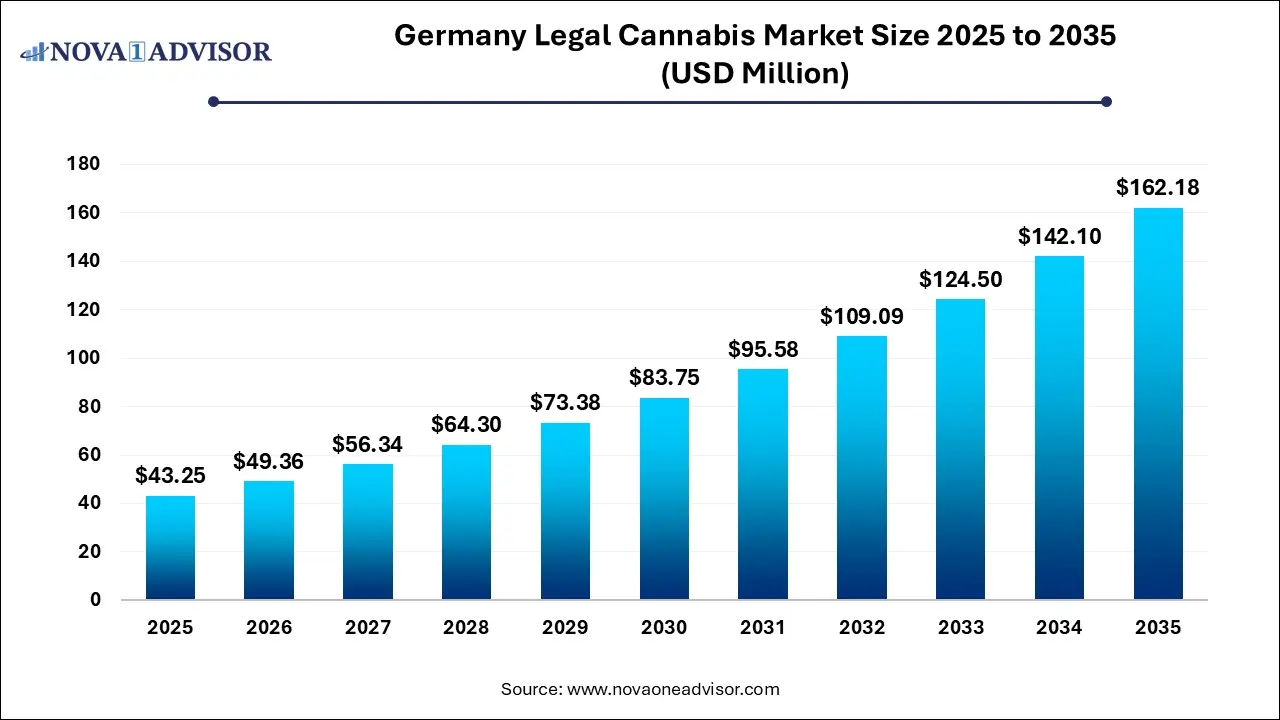

The Germany legal cannabis market size was exhibited at USD 43.25 million in 2025 and is projected to hit around USD 162.18 million by 2035, growing at a CAGR of 14.13% during the forecast period 2026 to 2035.

Key Takeaways:

- By source, the hemp segment dominated the market with the highest revenue share of 85% in 2025.

- By derivatives, the CBD segment dominated the market with the largest revenue share of 64% in 2025.

- By end use, the industrial use segment dominated the market with a revenue share of 81% in 2025.

Market Overview

The germany legal cannabis market in Germany stands at a pivotal juncture, poised to reshape the European landscape for medicinal and recreational cannabis. As the largest economy in Europe, Germany is not only a crucial economic player but also a trailblazer in establishing a regulatory framework that legitimizes the therapeutic use of cannabis. The country legalized medical cannabis in 2017, and since then, it has developed a robust distribution infrastructure involving pharmacies, licensed growers, and a regulated import system. In April 2024, Germany made international headlines by partially legalizing cannabis for recreational use an unprecedented move for a major European Union country.

The new law, officially enacted in April 2024, allows adults over the age of 18 to possess and grow limited quantities of cannabis for personal use and establishes cannabis clubs where members can cultivate and distribute the substance non-commercially. This semi-legalization approach reflects Germany’s cautious yet progressive strategy, aiming to reduce the black market while ensuring public health and safety. Meanwhile, the medical cannabis market continues to expand rapidly, driven by increasing physician acceptance, patient demand, and expanding therapeutic applications for chronic and neurological conditions.

Germany’s dual market consisting of a formal medical framework and a semi-regulated recreational model creates a unique landscape that is attracting international investors, pharmaceutical companies, startups, and growers from North America and the EU. The market is characterized by increasing research activities, rising consumption rates, product innovation, and evolving retail models.

Major Trends in the Market

-

Partial Recreational Legalization: With the April 2024 law, Germany became the first G7 country to partially legalize cannabis for adult use, creating a testbed for future EU regulatory developments.

-

Rise of Cannabis Social Clubs: Non-profit cultivation associations or “Cannabis Social Clubs” are being established across Germany, with strict membership limits and distribution rules.

-

Pharmaceutical Standardization: Increasing emphasis on GMP (Good Manufacturing Practices) and pharmaceutical-grade cannabis, especially for medical use in chronic pain and neurodegenerative diseases.

-

Dominance of Imports: Despite efforts to expand domestic cultivation, Germany still relies heavily on imports from countries like Canada, the Netherlands, Portugal, and Australia.

-

Technological Integration in Cultivation: High-tech greenhouse cultivation using AI, hydroponics, and IoT sensors is becoming more prevalent among licensed German growers.

-

Surge in CBD-Based Wellness Products: Non-psychoactive CBD products are rapidly expanding in both medical and consumer wellness segments, driven by strong demand in e-commerce and pharmacies.

-

Cannabis Education and Physician Training: German universities and medical associations are launching certified courses to train healthcare providers in prescribing and monitoring cannabis therapies.

-

Investment and M&A Activity: Global cannabis firms are entering the German market through mergers, acquisitions, and joint ventures to gain early-mover advantage.

Report Scope of Germany Legal Cannabis Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 49.36 Million |

| Market Size by 2035 |

USD 162.18 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 14.13% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Sources, Derivatives, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Cronos Group; Organigram Holding, Inc; Tilray Brands; Canopy Growth Corporation; Aurora Cannabis; SynBiotic; Cansativa GmbH; DEMECAN; Four 20 Pharma; Avextra Pharma GmbH |

Market Driver: Legislative and Regulatory Advancements

The primary driver of the German legal cannabis market is the evolving regulatory environment. Germany has taken a significant leap by passing laws that not only legalize medical cannabis but also introduce structured pathways for personal recreational consumption. This dual-approach regulatory framework especially the 2024 Cannabis Act has created a ripple effect across Europe. The partial legalization for recreational use includes decriminalization, legal possession limits, and the establishment of “Cannabis Social Clubs.” This structured liberalization reduces dependence on illicit sources, creates new demand channels, and provides opportunities for controlled, safe usage. Additionally, Germany’s medical cannabis legislation requires prescriptions and pharmacist dispensation, ensuring a high level of standardization and safety. This policy-driven market expansion is attracting institutional investors and global cannabis companies looking for a regulated and scalable European market.

Market Restraint: Supply Chain and Import Dependency

A key restraint in the market is Germany’s continued reliance on cannabis imports to meet growing demand. Despite regulatory approvals for domestic cultivation, bureaucratic delays, high compliance costs, and limited cultivation licenses have slowed domestic production. As a result, over 70% of Germany’s medical cannabis supply is imported, primarily from Canada, Portugal, and the Netherlands. This dependency not only exposes the market to supply chain disruptions but also leads to higher retail prices and inconsistent availability. Furthermore, the new recreational clubs require infrastructure and quality assurance systems that Germany is only beginning to develop. These challenges may impede market stability and limit access for both medical and recreational consumers, especially in rural areas or for less common product formulations.

Market Opportunity: Integration with Personalized and Digital Healthcare

Germany's advanced healthcare infrastructure and growing emphasis on personalized medicine offer a ripe opportunity for cannabis-based therapies. Increasing digitization through electronic health records (EHR), telehealth, and e-prescriptions allows for better monitoring, dosage optimization, and patient follow-up for medical cannabis users. Moreover, the opportunity to integrate cannabis into individualized treatment plans for conditions like multiple sclerosis, cancer-related nausea, epilepsy, and PTSD is gaining traction. Several German health insurers have started reimbursing cannabis prescriptions, especially for chronic illnesses, enhancing affordability and compliance. This convergence of medical cannabis with precision healthcare and digital tools presents a unique growth frontier where real-world data can validate clinical efficacy and drive long-term adoption.

Segmental Analysis

By Source Outlook

Marijuana dominated the source segment owing to its widespread use in both medical and recreational applications. Medical marijuana, typically characterized by high levels of both THC and CBD, is prescribed for a variety of conditions including chronic pain, multiple sclerosis, and chemotherapy-induced nausea. With the April 2024 legalization of recreational possession and non-commercial cultivation, the demand for marijuana flower has surged. Pharmacies and cannabis clubs report a sharp uptick in patient and adult-user inquiries for dried cannabis flowers, highlighting the familiarity and ease of use of this format. Domestic cultivators and licensed importers prioritize marijuana strains with known pharmacological profiles to ensure consistent therapeutic outcomes.

Hemp oil is the fastest-growing source segment, driven by its applications across both wellness and therapeutic verticals. Unlike high-THC marijuana, hemp-based products are associated with non-psychoactive CBD, which is legal and widely accepted across the EU. Germany's retail shelves both physical and online are seeing a proliferation of hemp oil-based supplements, skincare products, and tinctures aimed at stress relief, anxiety, and inflammation. Additionally, German startups are experimenting with nano-emulsified hemp oils for enhanced bioavailability, signaling a future of scientific innovation in hemp derivatives.

By Derivatives Outlook

CBD held the largest share in the derivatives segment due to its broad application spectrum, favorable legal status, and growing consumer acceptance. Germany's wellness and medical markets have increasingly turned to CBD products for conditions ranging from insomnia and anxiety to chronic pain and arthritis. The absence of psychoactive effects has made CBD an attractive choice for first-time users, elderly patients, and children with neurological disorders. Pharmacies across Germany now carry a wide range of CBD oils, capsules, and topicals, many of which are supported by clinical evidence and pharmacist recommendations.

THC is the fastest-growing derivative, especially after the partial recreational legalization in 2024. While historically more tightly regulated, THC-based products are now gaining visibility in social clubs and medical settings. Physicians are increasingly prescribing THC-rich cannabis for cancer pain, appetite stimulation in AIDS patients, and neurodegenerative conditions like Parkinson’s and Alzheimer’s. The shift in regulatory sentiment and growing clinical validation of THC’s benefits are driving a resurgence in its demand, especially among long-term chronic disease sufferers and recreational adult users.

By End Use Type Outlook

Medical use dominated the end-use segment, reflecting Germany’s emphasis on healthcare-regulated cannabis distribution. Chronic pain, arthritis, and multiple sclerosis are among the most common conditions treated with medical cannabis. Over 100,000 patients in Germany have registered under the medical cannabis system, and physicians are increasingly being trained to assess eligibility and manage treatment. With reimbursement available from statutory health insurance under certain criteria, cannabis is emerging as a legitimate pharmaceutical option.

Recreational use is the fastest-growing end-use, thanks to the April 2025 policy change. Adults are now permitted to grow up to three plants for personal use and possess up to 25 grams of cannabis in public. Cannabis clubs are emerging as a new model, expected to reach several thousand associations within a year. This trend has triggered a wave of entrepreneurship in cultivation, compliance consulting, and club management, reshaping Germany's social and legal perceptions of cannabis consumption.

Some of The Prominent Players in The Germany legal cannabis market Include:

- The Cronos Group

- Organigram Holding, Inc

- Tilray Brands

- Canopy Growth Corporation

- Aurora Cannabis

- SynBiotic

- Cansativa GmbH

- DEMECAN

- Four 20 Pharma

- Avextra Pharma GmbH

Recent Developments

-

April 2024 – Germany officially enacted the Cannabis Act, legalizing recreational possession and cultivation for adults, and creating a national framework for cannabis clubs.

-

March 2024 – Canadian firm Aurora Cannabis announced a partnership with a German wholesaler to expand its medical cannabis distribution across German pharmacies.

-

January 2024 – German startup Demecan received approval for a new indoor cultivation facility, doubling its production capacity to meet rising domestic demand.

-

November 2023 – Berlin-based Sanity Group raised €30 million in Series B funding to expand its product portfolio and develop digital health platforms for cannabis therapy.

-

September 2023 – Tilray Brands completed the acquisition of medical cannabis supplier CC Pharma, enhancing its supply chain control and German market penetration.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Source

By Derivatives

By End Use Type

- Industrial Use

- Medical Use

-

- Chronic Pain

- Depression and Anxiety

- Arthritis

- Post Traumatic Stress Disorder (PTSD)

- Cancer

- Migraines

- Epilepsy

- Alzheimers's

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Tourettes

- Diabetes

- Parkinson's

- Glaucoma

- Others