Glaucoma Surgery Devices Market Size and Trends

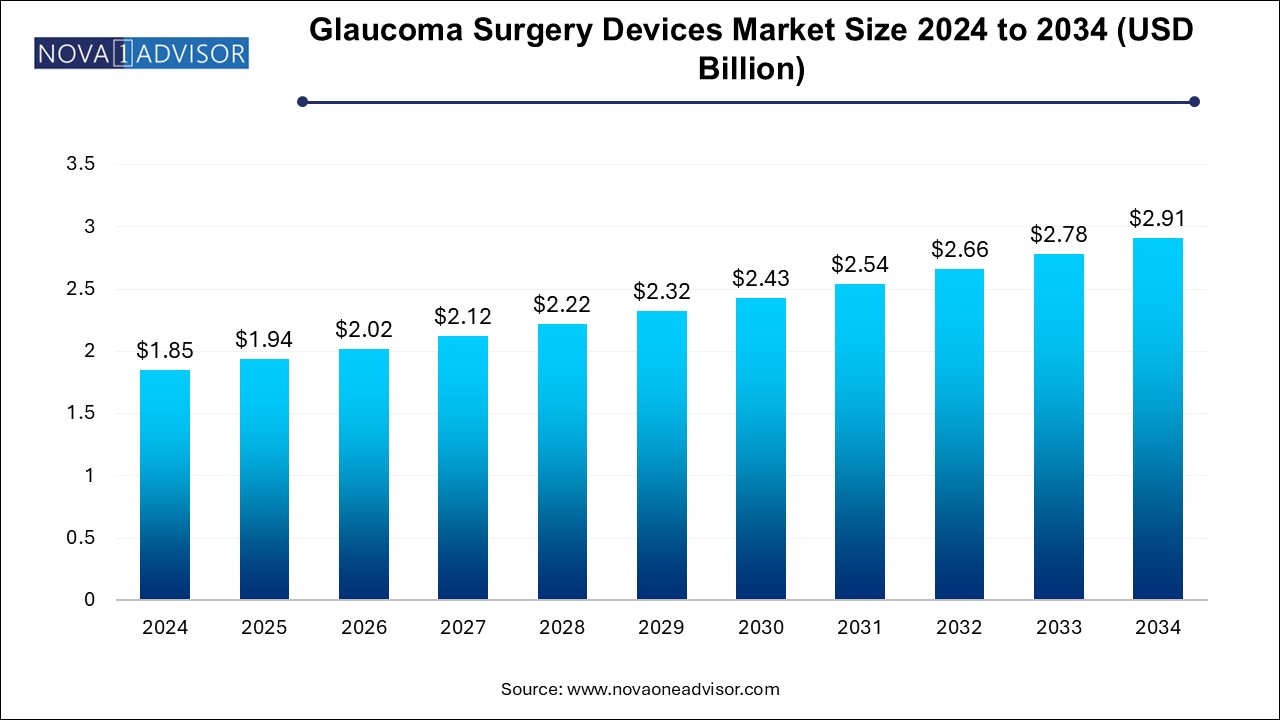

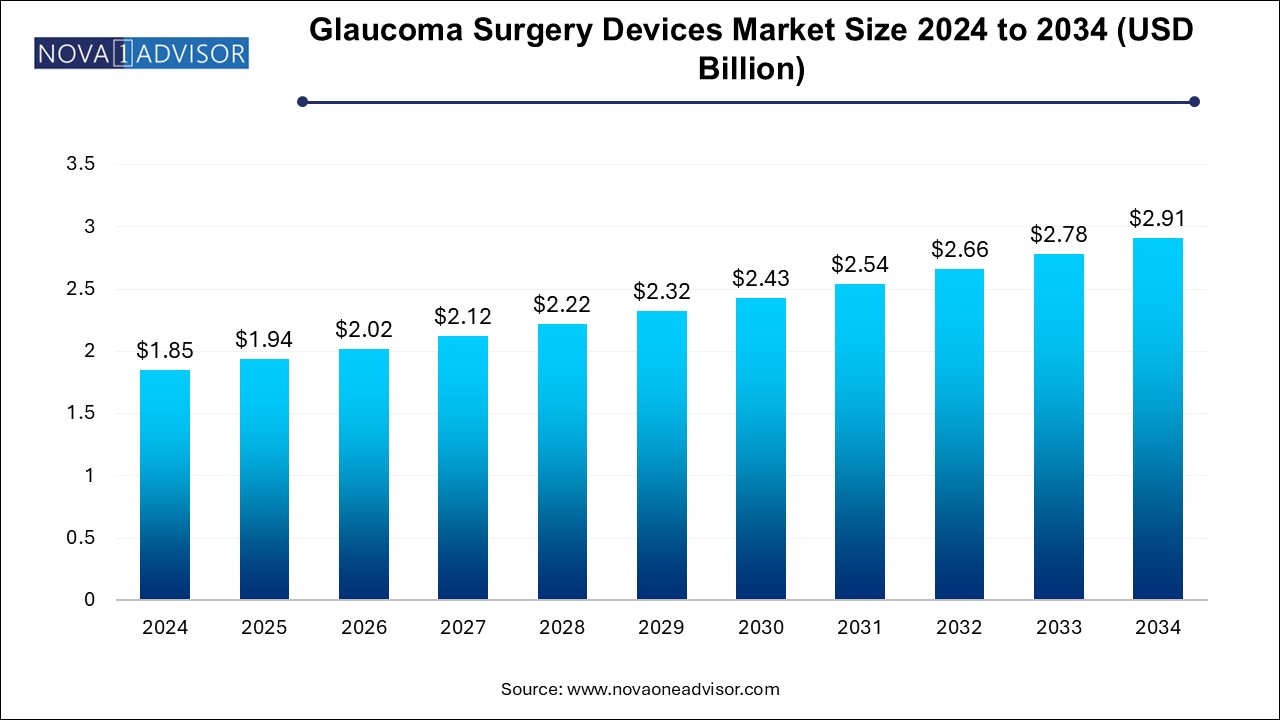

The glaucoma surgery devices market size was exhibited at USD 1.85 billion in 2024 and is projected to hit around USD 2.91 billion by 2034, growing at a CAGR of 4.62% during the forecast period 2024 to 2034.

Glaucoma Surgery Devices Market Key Takeaways:

- The traditional surgery devices segment dominated the market in 2024 by capturing over 40% of the global revenue share.

- The diamond knives segment is expected to witness the highest CAGR of 5.42% during the forecast period.

- The traditional glaucoma surgery segment held the largest share of 35.11% in 2024.

- Minimally invasive glaucoma surgery is expected to exhibit the fastest CAGR of 5.43% during the forecast period.

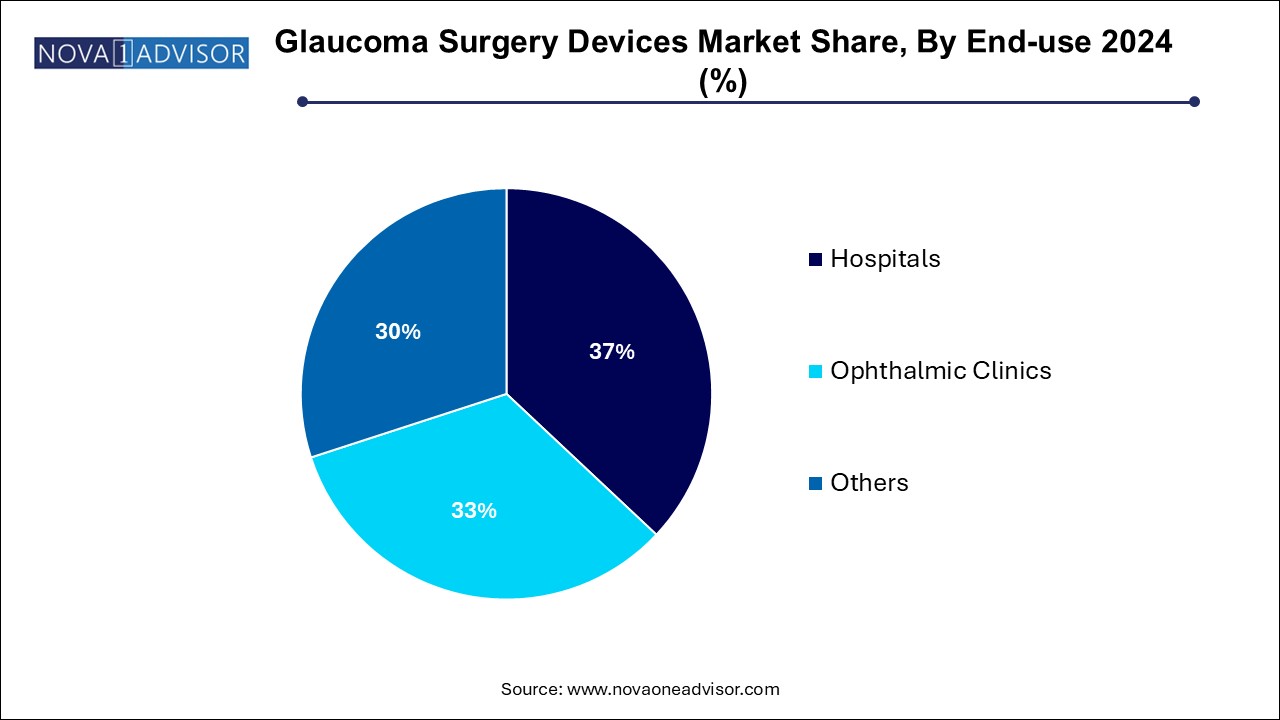

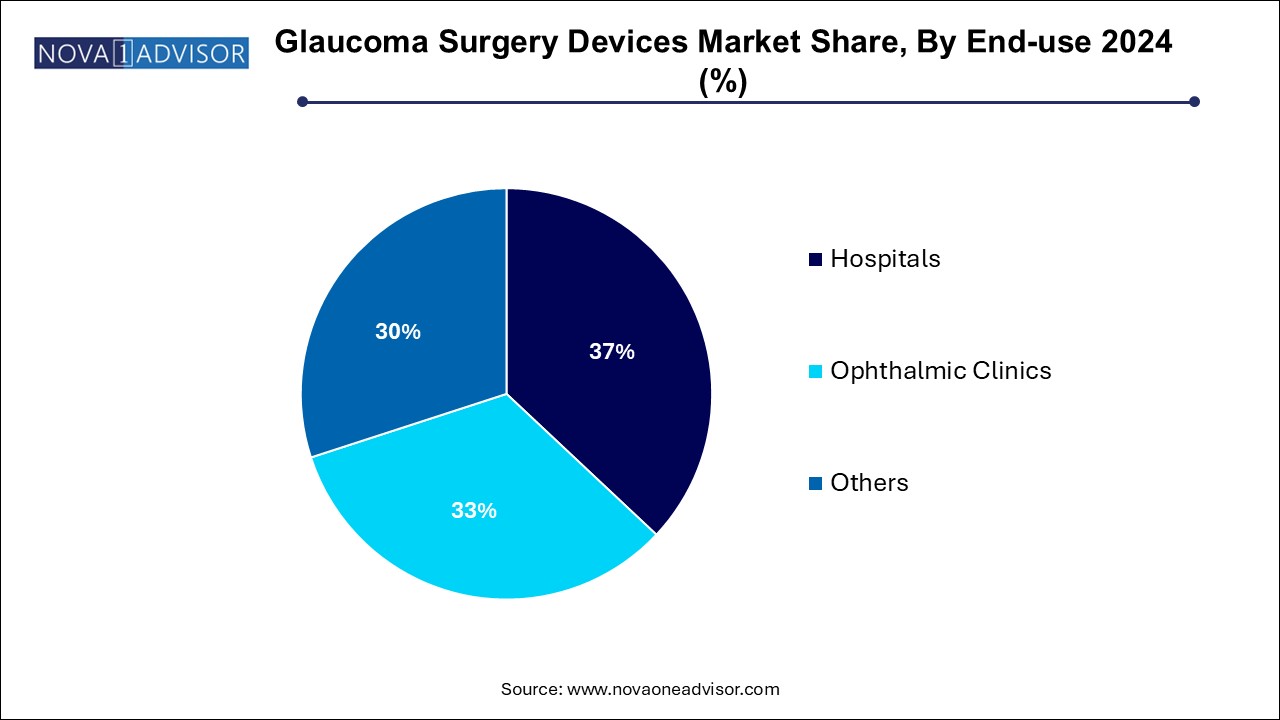

- The hospitals segment held the largest market share of 37.0% in 2024 and is expected to exhibit a lucrative CAGR over the forecast period.

- North America dominated the market in 2024 accounting for the largest share of 37.26% of the overall revenue.

Market Overview

The Glaucoma Surgery Devices Market represents a critical pillar of the ophthalmology sector, addressing one of the leading causes of irreversible blindness worldwide. Glaucoma, characterized by elevated intraocular pressure (IOP) leading to optic nerve damage, affects over 76 million people globally, with projections suggesting that this figure will surpass 110 million by 2040 according to the Glaucoma Research Foundation.

Although pharmaceutical therapy remains the first line of treatment, many patients require surgical intervention to achieve sustained IOP control, particularly those unresponsive to medications. This shift is driving robust demand for a wide array of glaucoma surgery devices, including drainage implants, stents, laser systems, and minimally invasive glaucoma surgery (MIGS) tools.

Technological advancements, the aging global population, and an increased focus on early diagnosis and proactive surgical intervention are fueling market growth. Innovations such as micro-stents, MIGS procedures, and sophisticated laser systems are transforming glaucoma management, offering safer, faster, and less invasive alternatives compared to traditional surgeries like trabeculectomy. As ophthalmologists seek solutions that provide effective pressure reduction with fewer complications, the glaucoma surgery devices market is poised for dynamic growth globally.

Major Trends in the Market

-

Shift Toward Minimally Invasive Glaucoma Surgery (MIGS): MIGS is becoming the preferred first-line surgical approach for mild-to-moderate glaucoma.

-

Integration of Combination Therapies: Simultaneous cataract and glaucoma surgeries using MIGS devices are increasing.

-

Technological Innovations in Micro-stents: New designs aim for better aqueous outflow and less tissue disruption.

-

Expansion of Laser-based Therapies: Selective Laser Trabeculoplasty (SLT) and other laser techniques are gaining traction as primary treatments.

-

Advancements in Drainage Implants: Novel biocompatible materials and adjustable devices are improving long-term outcomes.

-

Adoption of Single-use, Disposable Instruments: Hospitals and clinics are favoring disposable surgical tools to prevent cross-contamination.

-

Focus on Early Intervention Strategies: Greater emphasis on surgical options earlier in the disease course to preserve vision.

-

Global Regulatory Approvals for New Devices: Faster regulatory pathways for MIGS devices are aiding market entry.

-

AI-driven Surgical Planning: AI platforms are being developed to assist ophthalmologists in surgical decision-making.

-

Growing Investment in Outpatient Surgery Centers: Expansion of ambulatory surgery centers (ASCs) specializing in ophthalmic surgeries boosts device demand.

Report Scope of Glaucoma Surgery Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.94 Billion |

| Market Size by 2034 |

USD 2.91 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 4.62% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Surgery Method, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Alcon, Inc.; Glaukos Corp.; Johnson & Johnson Vision; AbbVie Inc. (Allergan Plc.); ASICO, LLC; Carl Zeiss Meditec AG; Katalyst Surgical; Lumenis Ltd.; Ziemer Ophthalmic Systems AG; Iridex Corp.; Altomed |

Key Market Driver: Rising Prevalence of Glaucoma and Aging Population

The increasing global prevalence of glaucoma, coupled with the growing aging population, is a major driver for the glaucoma surgery devices market. With age being a significant risk factor for primary open-angle glaucoma and angle-closure glaucoma, the market is directly benefiting from global demographic shifts.

In the United States alone, the National Eye Institute predicts that the number of people with glaucoma will double by 2050. Similar trends are observed across Europe, Japan, and emerging economies like China and India. As life expectancy rises and healthcare access improves, more patients are being diagnosed at earlier stages, creating sustained demand for surgical interventions. Furthermore, proactive surgical treatment to prevent progressive optic nerve damage is becoming a clinical priority, driving steady adoption of innovative devices.

Key Market Restraint: High Cost and Limited Access in Low-income Regions

Despite technological advancements, a major restraint for the glaucoma surgery devices market is the high cost of advanced surgical devices and limited accessibility in developing regions. MIGS implants, advanced drainage devices, and laser systems involve significant capital investment, both for procurement and maintenance.

In many low-income countries, glaucoma remains undiagnosed or untreated until advanced stages due to lack of screening programs and affordable care infrastructure. Moreover, reimbursement policies in certain markets do not adequately cover MIGS devices or modern laser surgeries, further limiting adoption. Bridging the gap through affordable innovations and healthcare policies is essential to unlock the full global potential of the market.

Key Market Opportunity: Growth of Minimally Invasive Glaucoma Surgery (MIGS)

The expansion of Minimally Invasive Glaucoma Surgery (MIGS) represents a significant opportunity for device manufacturers. MIGS procedures offer a safer, less invasive alternative to traditional surgeries like trabeculectomy, providing moderate IOP reduction with minimal recovery time and lower complication rates.

Devices like the iStent Inject®, Hydrus® Microstent, and XEN® Gel Stent have revolutionized the glaucoma treatment paradigm. Ophthalmologists increasingly recommend MIGS earlier in the disease course or alongside cataract surgery, broadening the eligible patient pool. Continued innovation to develop combination MIGS procedures, improved implant materials, and expanded indications for MIGS devices will further drive market expansion, particularly as surgeons gain more experience and long-term data validates effectiveness.

Glaucoma Surgery Devices Market By Product Insights

Glaucoma Drainage Devices dominated the product segment in 2024. Glaucoma drainage devices such as valves, tube shunts, and implants are critical for patients with moderate to severe glaucoma, where conventional medical management fails. Devices like the Ahmed Glaucoma Valve (New World Medical) and Baerveldt implants (Johnson & Johnson Vision) are well-established in clinical practice. Their ability to provide long-term IOP reduction with relatively fewer postoperative complications has ensured their widespread adoption, especially in complex or refractory glaucoma cases.

Minimal Invasive Stents are expected to be the fastest-growing sub-segment. MIGS stents like the iStent and Hydrus Microstent are experiencing exponential growth as first-line surgical interventions, especially when combined with cataract surgery. Their ease of implantation, favorable safety profiles, and strong clinical trial support make them highly attractive to surgeons and patients alike. Technological refinements, expanding indications (e.g., mild to moderate glaucoma), and growing payer acceptance are accelerating their market penetration.

Glaucoma Surgery Devices Market By Surgery Method Insights

Traditional Glaucoma Surgery dominated the surgery method segment in 2024. Despite the surge in MIGS popularity, traditional surgeries like trabeculectomy and tube shunt surgeries continue to be gold standards for patients with advanced or aggressive disease. These methods offer significant IOP reduction and are necessary when newer approaches are insufficient. Hospitals and academic centers with established glaucoma surgery programs continue to rely heavily on these procedures.

Minimal Invasive Glaucoma Surgery (MIGS) is the fastest-growing segment. MIGS procedures targeting the trabecular meshwork, suprachoroidal space, subconjunctival space, and Schlemm’s canal are growing rapidly. Gonioscopy-assisted Transluminal Trabeculotomy (GATT) and endocyclophotocoagulation (ECP) are being adopted across more surgical centers due to their minimal risk profiles and promising medium-term outcomes. As surgeon familiarity grows and long-term efficacy data matures, MIGS adoption will increasingly supplant traditional surgeries in early and moderate disease stages.

Glaucoma Surgery Devices Market By End-use Insights

Hospitals dominated the end-use category in 2024. Hospitals account for the largest share due to the volume of glaucoma surgeries conducted in inpatient settings, availability of multi-disciplinary care teams, and access to high-cost surgical equipment. Hospitals also serve as training centers for new techniques, ensuring the uptake of new devices through residency and fellowship programs.

Ophthalmic Clinics and Ambulatory Surgery Centers are expected to grow fastest. The shift toward outpatient ophthalmic surgeries, combined with the growth of standalone eye centers specializing in cataract and glaucoma procedures, is driving demand outside traditional hospital settings. These centers often offer faster turnaround, lower costs, and high surgeon specialization, making them ideal for MIGS and laser surgeries.

Glaucoma Surgery Devices Market By Regional Insights

North America led the glaucoma surgery devices market in 2024. The region’s dominance is driven by high disease prevalence, advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of innovative surgical techniques. The U.S. Food and Drug Administration (FDA)'s relatively faster approval processes for MIGS devices have also spurred early market entry for several pioneering products. Additionally, the presence of key players such as Glaukos Corporation, Alcon, and Johnson & Johnson Vision reinforces regional leadership.

Asia Pacific is emerging as the fastest-growing region due to a combination of demographic shifts, rising healthcare expenditure, and expanding access to ophthalmic care. Countries like China, India, and Japan are witnessing a surge in glaucoma cases driven by aging populations and increased myopia rates. Government initiatives to improve vision care services, along with growing investments by multinational corporations to establish local manufacturing and distribution, are fostering market expansion. Moreover, emerging economies are increasingly adopting cost-effective MIGS solutions, supporting robust future growth.

Some of the prominent players in the glaucoma surgery devices market include:

- Alcon, Inc.

- Glaukos Corporation

- Johnson & Johnson Vision

- AbbVie Inc. (Allergan Plc.)

- ASICO, LLC

- Carl Zeiss Meditec AG

- Katalyst Surgical

- Lumenis Lt.

- Ziemer Ophthalmic Systems AG

- Iridex Corporation.

- Altomed

Recent Developments

-

March 2025 – Glaukos Corporation announced the launch of iDose TR, a next-generation intraocular drug delivery implant for glaucoma management, receiving FDA approval.

-

January 2025 – Alcon introduced the Hydrus Microstent 2.0 in select European markets, featuring improved delivery mechanisms for easier implantation during cataract surgery.

-

November 2024 – Ivantis, Inc. (now part of Alcon) expanded its Hydrus Microstent distribution network across Asia Pacific to meet surging demand in emerging economies.

-

September 2024 – New World Medical launched an updated version of the Ahmed ClearPath drainage device, optimized for simplified implantation and enhanced patient outcomes.

-

July 2024 – Santen Pharmaceutical received CE Mark approval for its MicroShunt glaucoma drainage implant, positioning itself for expansion into European surgical markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the glaucoma surgery devices market

Product

-

- Valves

- Glaucoma Drainage Implant

- Glaucoma Tube Shunts

- Stents

- Traditional Surgery Devices

-

- Scalpel

- Forceps

- Ophthalmic Scissors

- Punch

- Sutures

- Surgical Drapes

- Microcatheter

- Others

- Diamond Knives

- Laser Systems

- Others

Surgery Method

- Traditional Glaucoma Surgery

-

- Trabeculectomy

- Tube Shunt Surgery

- Minimal Invasive Glaucoma Surgery

-

- Trabecular Meshwork Bypass

- Suprachoroidal Space Implants

- Subconjunctival Space Implants

- Schlemm’s Canal Implants

- Gonioscopy-assisted Transluminal Trabeculectomy

- Endocyclophotocoagulation

-

- Trabeculoplasty

- Iridotomy

- Cyclophotocoagulation

End-use

- Hospitals

- Ophthalmic Clinics

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)