Active Pharmaceutical Ingredients Market Size and Research

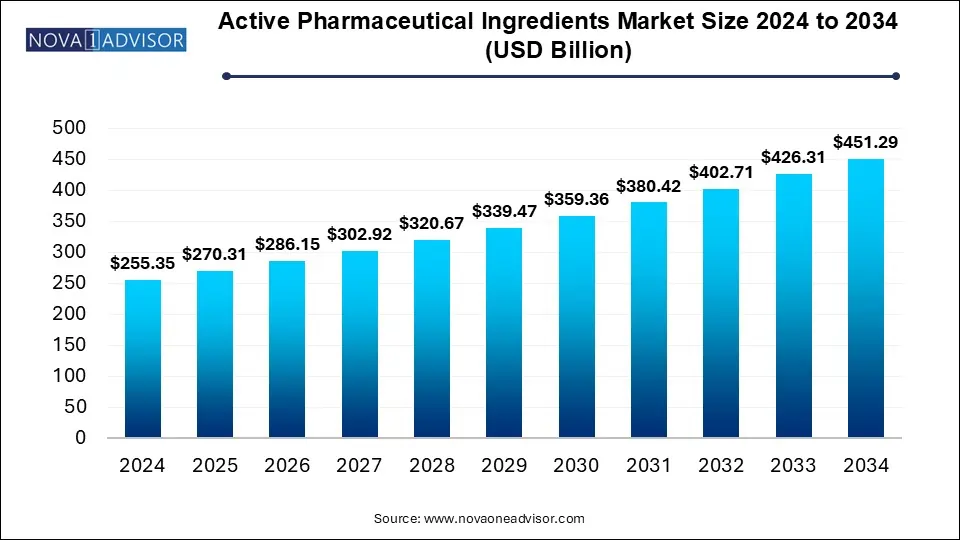

The active pharmaceutical ingredients market size was exhibited at USD 255.35 billion in 2024 and is projected to hit around USD 451.29 billion by 2034, growing at a CAGR of 5.86% during the forecast period 2025 to 2034.

Active Pharmaceutical Ingredients Market Key Takeaways:

- In 2024, North America held the leading position in the active pharmaceutical ingredients market, accounting for the highest revenue share of 39.0%.

- By synthesis type, the synthetic segment dominated the market, capturing the largest revenue share of 72.08% in 2024.

- Regarding type, the innovative APIs segment emerged as the market leader, contributing the highest revenue share of 64.20% in 2024.

- In terms of application, the cardiology segment held the top position, securing the largest revenue share of 22.14% in 2024.

- Based on manufacturer type, the captive APIs segment led the market with a revenue share of 51.40% in 2024.

- By drug type, the prescription segment held the majority share, contributing 80.0% of total revenue in 2024.

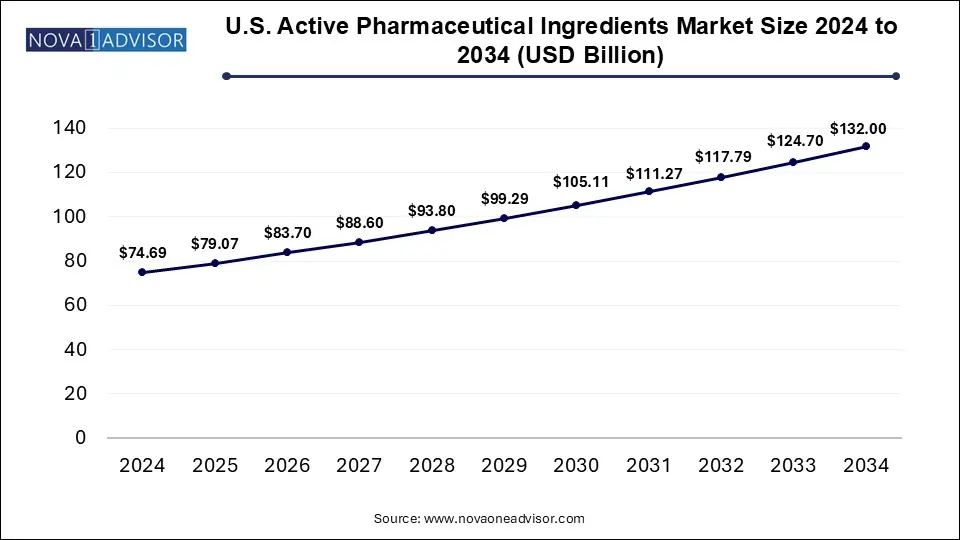

U.S. Active Pharmaceutical Ingredients Market Size and Growth 2025 to 2034

The U.S. active pharmaceutical ingredients market size was valued at USD 74.69 billion in 2024 and is expected to reach around USD 132.0 billion by 2034, growing at a CAGR of 5.31% from 2025 to 2034.

North America currently dominates the global API market, primarily due to strong pharmaceutical R&D, high healthcare spending, and a sophisticated regulatory framework. The U.S. alone accounts for a significant portion of global API consumption, especially for innovative and specialty drugs. Major players in North America also maintain captive API production units and have begun reshoring critical manufacturing to reduce dependence on imports.

On the other hand, Asia Pacific is the fastest-growing region, led by India and China. India is often dubbed the “pharmacy of the world,” exporting APIs to over 200 countries. Government initiatives such as India’s PLI scheme and China’s Made-in-China 2025 strategy are fueling local production and global competitiveness. Emerging biotech clusters in South Korea and Singapore are also contributing to regional growth, particularly in biologics manufacturing.

Market Overview

The Active Pharmaceutical Ingredients (API) Market stands as a cornerstone of the global pharmaceutical sector, underpinning the effectiveness and quality of medications used across diverse therapeutic areas. APIs are the biologically active components of drugs that yield the desired health effects, whether it is to combat infections, alleviate symptoms, or cure disease. The growing demand for effective and affordable medicines, particularly in the wake of rising chronic diseases and aging populations worldwide, has accelerated the growth of the API industry.

With the increasing complexity of diseases such as cancer, autoimmune disorders, and neurological conditions, the pharmaceutical industry has progressively leaned on sophisticated APIs, including synthetic and biotech-based variants. Furthermore, globalization of pharmaceutical manufacturing, government support for domestic API production, and rising prevalence of lifestyle-related disorders have been key accelerants for this market. The COVID-19 pandemic, while initially disruptive, brought renewed focus on resilient and localized API supply chains, especially in regions heavily reliant on imports from dominant players like China and India.

Innovative drug development continues to drive the API market forward, with blockbuster biologics and targeted therapies requiring specialized production capabilities. At the same time, the generic API market remains robust, fueled by patent expirations and increasing adoption of cost-effective alternatives in developing nations. Together, these trends present a dynamic and rapidly evolving API landscape that is integral to both the clinical and commercial success of pharmaceutical products.

Major Trends in the Market

-

Shift Toward Biotech APIs: There is a growing shift toward biotechnology-derived APIs, particularly monoclonal antibodies, recombinant proteins, and therapeutic enzymes.

-

Rise in Generic API Manufacturing: As patents expire on leading drugs, the global market is seeing a surge in generic API demand, especially in Asia and Latin America.

-

Growth in Contract Manufacturing: Pharma companies are increasingly outsourcing API production to merchant manufacturers to reduce cost and focus on core competencies.

-

Government Incentives for Domestic Production: Nations are introducing policy reforms and incentives to boost in-country API manufacturing (e.g., India's PLI scheme).

-

Green Chemistry and Sustainable Synthesis: There is a trend toward environmentally friendly synthesis routes that reduce chemical waste and improve efficiency.

-

Integration of Continuous Manufacturing: Adoption of advanced manufacturing technologies like continuous synthesis is increasing to enhance quality and scalability.

-

Regulatory Vigilance and Compliance: Strengthened regulatory frameworks globally are demanding stringent quality assurance and traceability in API supply chains.

-

Increased Demand for APIs in Oncology and CNS Therapies: Rising prevalence of cancer and neurological disorders is fueling the development of specialized, high-potency APIs (HPAPIs).

Report Scope of Active Pharmaceutical Ingredients Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 270.31 Billion |

| Market Size by 2034 |

USD 451.29 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.86% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type of Synthesis, Type of Manufacturer, Type, Application, Type of Drug, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Inc.; AbbVie Inc.; Aurobindo Pharma; Sandoz International GmbH (Novartis AG); Viatris Inc.; Fresenius Kabi AG; STADA Arzneimittel AG |

Key Market Driver: Expanding Generic Drug Market

A major driver fueling the growth of the API market is the expansion of the generic drug industry, particularly in emerging economies. With an increasing number of branded drugs losing patent protection each year, generic formulations are stepping in to provide affordable alternatives to a wider patient population. Generic drugs, which are therapeutically equivalent to their branded counterparts, rely heavily on high-volume, cost-effective API production.

India’s API sector, for example, has thrived on supplying low-cost, high-quality ingredients for generics to the U.S., Europe, and Africa. Similarly, companies like Teva Pharmaceuticals, Mylan, and Aurobindo Pharma continue to dominate the global generics space by leveraging their API production capabilities. The result is a consistent and growing demand for APIs—especially synthetic ones—that are used in chronic disease treatments such as hypertension, diabetes, and respiratory disorders. The pressure to lower healthcare costs globally further propels this trend, cementing generic APIs as a key growth driver for the overall API market.

Key Market Restraint: Regulatory Complexities and Quality Control

Despite the strong market potential, stringent regulatory requirements and quality assurance protocols pose significant challenges to API manufacturers. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and others maintain high standards for manufacturing, testing, and documentation of APIs. Any deviation from established protocols can result in production halts, import bans, or product recalls.

A notable example is the temporary ban placed on several Indian API producers in recent years due to manufacturing non-compliance and quality lapses. Furthermore, increasing scrutiny over traceability, data integrity, and Good Manufacturing Practices (GMP) compliance leads to higher operational costs and risk for smaller firms. Navigating these challenges requires substantial investments in infrastructure, skilled labor, and digital systems, making market entry and expansion difficult for many players.

Key Market Opportunity: Biotech APIs and Personalized Therapies

The rising demand for biotech APIs presents a significant opportunity in the market. Unlike conventional small molecules, biotech APIs (such as monoclonal antibodies, vaccines, and blood factors) are highly specific, potent, and essential for developing personalized medicines. These biologically sourced APIs are crucial in addressing complex and rare diseases where traditional therapies fall short.

As healthcare moves toward precision medicine and immunotherapy, demand for biotech APIs has grown, especially in oncology, endocrinology, and autoimmune disorders. For instance, monoclonal antibodies like trastuzumab (Herceptin) and pembrolizumab (Keytruda) have revolutionized cancer treatment, leading to a surge in demand for specialized API manufacturing platforms. Biotech firms, contract development and manufacturing organizations (CDMOs), and pharmaceutical giants are ramping up investments in biologic API production facilities, particularly in North America, Western Europe, and select Asian countries like South Korea and Singapore.

Active Pharmaceutical Ingredients Market By Type of Synthesis

Synthetic APIs dominated the market in terms of volume and historical presence. Synthetic APIs, produced through chemical synthesis, are widely used across various therapeutic areas including cardiovascular, CNS, and gastrointestinal disorders. Their ease of scalability, relatively lower production cost, and well-established regulatory pathways have made them the backbone of the pharmaceutical industry. A significant portion of synthetic APIs are manufactured in countries like India and China, which have mature infrastructure and regulatory experience. Generic synthetic APIs, in particular, account for a large share of exports to regulated markets.

However, Biotech APIs are the fastest-growing segment, driven by rising demand for biologics, targeted therapies, and personalized medicines. These APIs include monoclonal antibodies, recombinant proteins, hormones, and therapeutic enzymes. The complexity and specificity of these biologics necessitate advanced production capabilities and stringent quality controls. Biotech APIs also command higher prices compared to synthetic APIs, contributing significantly to revenue despite lower volumes. Companies are increasingly investing in biologics-focused R&D and manufacturing, signaling robust future growth in this segment.

Active Pharmaceutical Ingredients Market By Type

Generic APIs continue to dominate the global market, fueled by patent expirations, cost pressure in healthcare, and the widespread availability of generics. Generic APIs are crucial in treating high-burden diseases like hypertension, diabetes, and infections. Countries like India have emerged as global hubs for generic API production, with extensive capabilities and export networks to regulated markets.

Meanwhile, Innovative APIs are witnessing faster growth, driven by pharmaceutical R&D pipelines targeting unmet clinical needs. These APIs are typically novel molecules protected by patents, and they require significant investment in discovery, formulation, and testing. As biologics, orphan drugs, and specialty treatments gain ground, innovative APIs will continue to grow, particularly in developed regions where healthcare systems support high-cost, high-efficacy drugs.

Active Pharmaceutical Ingredients Market By Application

Cardiovascular diseases held the largest market share due to the global prevalence of conditions like hypertension, atherosclerosis, and heart failure. These conditions require long-term treatment with drugs like beta-blockers, statins, and ACE inhibitors—all of which depend on high-volume API production. Given the aging global population and sedentary lifestyles, cardiovascular APIs remain essential to global healthcare delivery.

Oncology is the fastest-growing application segment, owing to the explosion in cancer prevalence and the advancement of targeted therapies. Many anticancer drugs use complex APIs that are either biologically derived or high-potency synthetic compounds. Examples include tyrosine kinase inhibitors and monoclonal antibodies. With increasing investments in cancer research and personalized therapies, the oncology API segment is poised for exponential growth.

Active Pharmaceutical Ingredients Market By Type of Manufacturer

Captive API manufacturing held the majority share historically, especially among large pharmaceutical companies with integrated operations. These firms produce APIs in-house to maintain control over quality, intellectual property, and supply chain security. This model is particularly common among innovators that develop patented drugs and require specialized, high-purity ingredients. In-house production helps maintain regulatory compliance and streamline product development timelines.

Nonetheless, Merchant API manufacturers are gaining significant traction as companies look to reduce operational complexity and focus on core competencies such as drug discovery and marketing. Merchant manufacturers provide APIs to multiple clients, including generics and specialty pharma companies. The rising trend of outsourcing, especially for generic drugs and complex APIs, has bolstered the position of contract manufacturers. This model offers cost savings, scalability, and flexibility in production, making it increasingly popular among small and mid-sized pharma firms.

Active Pharmaceutical Ingredients Market By Type of Drug

Prescription drugs dominated the API market, accounting for the majority of API demand due to the sheer scale of chronic disease treatment and specialized therapies. These drugs are often covered by insurance, allowing for more expensive and complex APIs to be used in formulations. Regulatory approvals and long development cycles are common, requiring dependable API supply chains.

OTC (Over-the-Counter) APIs are growing steadily, supported by consumer preference for self-care and preventive health. APIs used in pain relief, gastrointestinal care, and allergy treatments are increasingly being sourced by OTC brands. The growing wellness trend, especially post-pandemic, is fueling demand for APIs in vitamins, supplements, and non-prescription medications.

Some of The Prominent Players in The active pharmaceutical ingredients market Include:

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Inc.

- AbbVie Inc.

- Aurobindo Pharma

- Sandoz International GmbH (Novartis AG)

- Viatris Inc.

- Fresenius Kabi AG

- STADA Arzneimittel AG

Recent Developments

-

In January 2025, Sun Pharma announced the expansion of its API manufacturing site in Gujarat, India, to increase production of cardiovascular and oncology-related APIs.

-

Pfizer and Samsung Biologics entered a collaboration in November 2024 to scale the production of biologic APIs for oncology therapeutics, with manufacturing in South Korea.

-

In September 2024, Dr. Reddy’s Laboratories received FDA approval for a new synthetic API manufacturing line at its Hyderabad facility.

-

Lonza Group, in October 2024, invested CHF 500 million to expand its biologics API capabilities in Visp, Switzerland, targeting increased demand in monoclonal antibody production.

-

Teva Pharmaceuticals, in December 2024, restructured its global API network to consolidate production in high-efficiency facilities across Europe and Israel.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the active pharmaceutical ingredients market

By Type of Synthesis

-

- Biotech APIs Market, By Type

-

-

- Generic APIs

- Innovative APIs

-

- Biotech APIs Market, By Product

-

-

- Monoclonal Antibodies

- Hormones

- Cytokines

- Recombinant Proteins

- Therapeutic Enzymes

- Vaccines

- Blood Factors

-

- Synthetic APIs Market, By Type

-

-

- Generic APIs

- Innovative APIs

By Type of Manufacturer

- Captive APIs

- Merchant APIs

By Type

- Generic APIs

- Innovative APIs

By Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

By Type of Drug

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)