Aluminum Curtain Wall Market Size and Trends

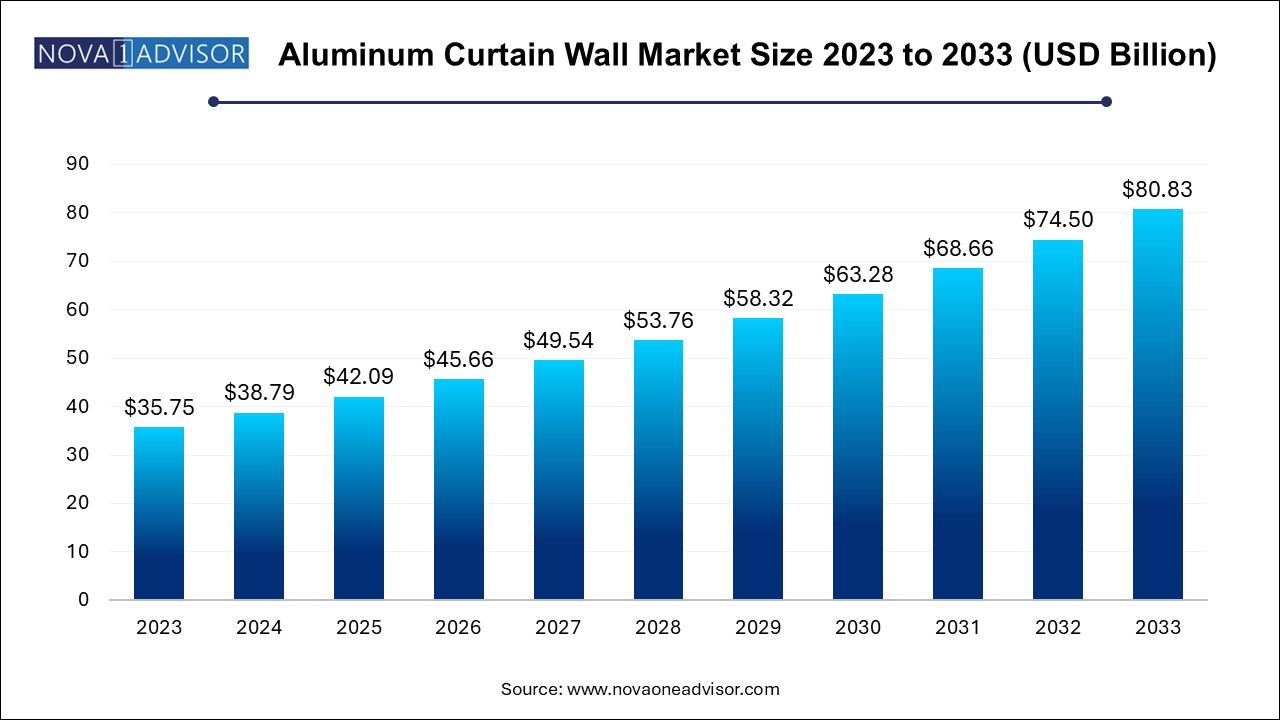

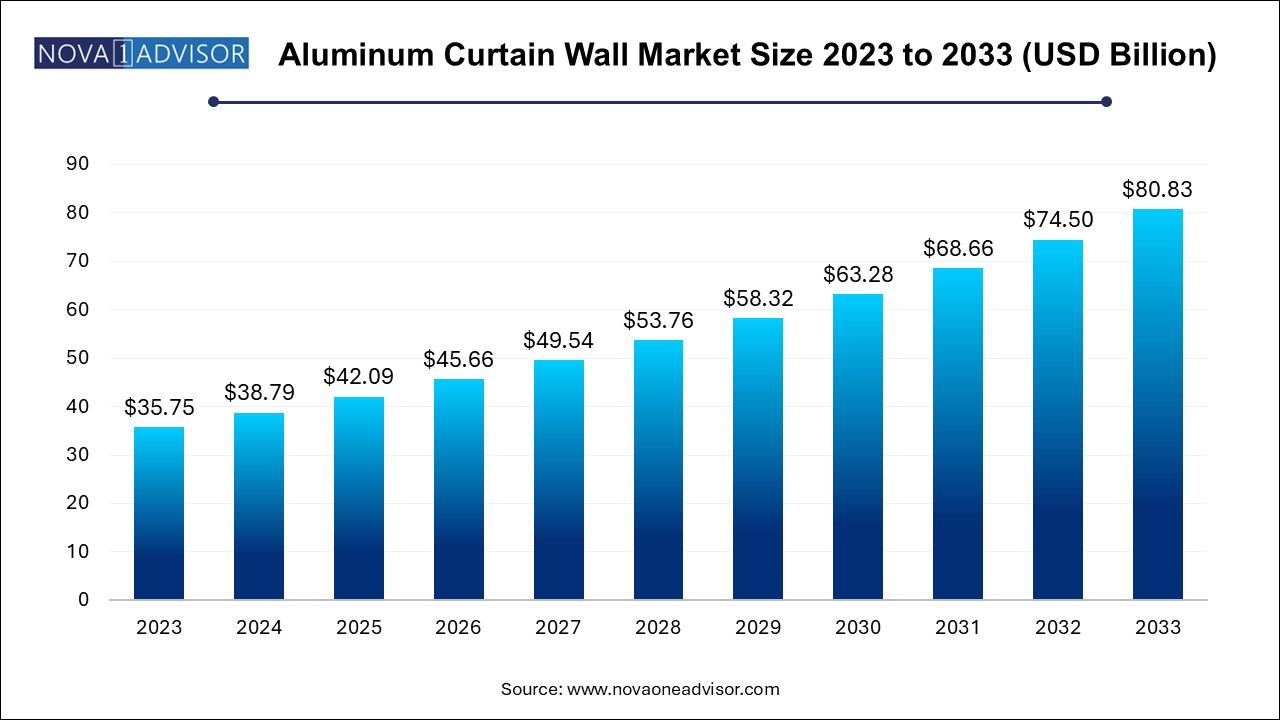

The global aluminum curtain wall market size was exhibited at USD 35.75 billion in 2023 and is projected to hit around USD 80.83 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2024 to 2033.

Aluminum Curtain Wall Market Key Takeaways:

- The commercial segment held the largest market revenue share of 72.4% in 2023.

- The unitized segment held the largest market revenue share in 2023.

- The North American market is projected to witness significant growth in the coming year.

Market Overview

The global aluminum curtain wall market is witnessing substantial growth, driven by architectural innovation, rising demand for energy-efficient building materials, and the rapid pace of urbanization worldwide. Aluminum curtain walls are non-structural cladding systems used extensively in modern architecture to enclose buildings while allowing ample natural light and providing superior aesthetic appeal. Comprising aluminum frames and infill panels—usually made of glass, metal, or stone—curtain walls are attached to the building’s structural frame and serve as an envelope without bearing any load other than their own weight and environmental forces.

Historically favored in high-rise office complexes and commercial towers, aluminum curtain walls are now penetrating the residential and mixed-use real estate markets, thanks to their durability, corrosion resistance, ease of installation, and low maintenance. The growing importance of sustainable architecture has also made aluminum curtain walls a desirable solution, as they improve thermal insulation, reduce energy consumption, and are recyclable, contributing to green building certifications such as LEED and BREEAM.

In the face of rising environmental concerns and regulatory mandates for energy-efficient building design, manufacturers are increasingly focused on developing thermally broken, double-glazed, and solar-integrated curtain wall systems. These enhancements not only improve indoor comfort but also reduce HVAC loads and operational costs, making them attractive to developers, architects, and facility owners. The convergence of aluminum curtain wall design with smart building technologies, photovoltaics, and modular construction is expected to transform the industry in the coming years.

Major Trends in the Market

-

Growth in High-Rise Construction: Rapid urbanization and land scarcity are driving the construction of high-rise towers, particularly in Asia and the Middle East, boosting curtain wall demand.

-

Integration of Solar Panels: Building-integrated photovoltaics (BIPV) are being embedded within curtain wall systems to generate renewable energy.

-

Smart and Adaptive Facades: Intelligent curtain walls that respond to light, temperature, and occupancy patterns are emerging in commercial buildings.

-

Adoption of Modular and Prefabricated Systems: Pre-assembled unitized curtain wall systems are gaining traction due to reduced onsite labor and installation time.

-

Energy-Efficient Innovations: Thermally broken aluminum frames and double/triple glazing units are becoming standard to improve building insulation.

-

Lightweight and Recyclable Materials: Eco-conscious builders are opting for lightweight aluminum frames for their sustainability and recyclability.

-

Digital Design and BIM Integration: Use of building information modeling (BIM) and AI in facade design is improving accuracy and cost-efficiency.

-

Retrofitting Older Buildings: There’s a growing market for refurbishing existing structures with modern curtain wall systems to enhance aesthetics and performance.

Report Scope of Aluminum Curtain Wall Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 38.79 Billion |

| Market Size by 2033 |

USD 80.83 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.;GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; Kalwall; Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco India; Skansa |

Aluminum Curtain Wall Market By Application Insights

The commercial segment currently dominates the aluminum curtain wall market. Curtain walls are ubiquitous in commercial buildings such as corporate headquarters, retail malls, hotels, and government complexes. These structures typically require large spans of glass and metal to achieve modern aesthetics, natural lighting, and brand distinction. Aluminum curtain walls, being both sleek and functional, meet these needs while providing excellent thermal insulation and acoustic performance.

However, the residential segment is witnessing the fastest growth, especially in high-end and high-rise apartment developments across urban centers. With rising incomes and growing demand for luxury living spaces, developers are incorporating curtain wall designs into premium condominiums and mixed-use skyscrapers. Homebuyers are increasingly attracted to the expansive views, natural light, and energy savings enabled by curtain walls. In cities like Dubai, Singapore, and New York, residential towers feature fully glazed facades, setting architectural benchmarks and boosting aluminum curtain wall adoption in the sector.

Aluminum Curtain Wall Market By Type Insights

Unitized curtain wall systems dominate the market due to their modular construction and faster installation times. These systems are factory-fabricated and assembled as complete units including glazing, aluminum framing, gaskets, and insulation which are then transported and installed floor by floor. This method ensures better quality control, minimizes on-site labor, and reduces construction time, especially for skyscrapers and large commercial buildings. The unitized approach also allows for easier integration of energy-saving features such as double-glazed panels, solar shading devices, and thermal breaks.

The semi-unitized segment is growing rapidly, especially in mid-rise and budget-sensitive projects. Semi-unitized systems strike a balance between the customization of stick-built systems and the efficiency of unitized designs. Typically, the vertical mullions are installed on-site, while the horizontal elements and panels are prefabricated. This hybrid approach offers flexibility in installation and can adapt to varying building geometries without the high costs associated with fully prefabricated units. Developers in emerging markets and secondary urban zones are favoring semi-unitized systems for their cost-effectiveness and adaptability.

Aluminum Curtain Wall Market By Regional Insights

Asia Pacific is the dominant region in the global aluminum curtain wall market, driven by rapid urbanization, infrastructure investment, and high-rise construction in countries such as China, India, Japan, and South Korea. China alone accounts for a significant portion of global demand, with ongoing mega projects in business districts, transportation hubs, and smart city initiatives. Moreover, local manufacturers and global players have established production bases in the region, reducing costs and improving supply chain efficiency.

Additionally, regulatory mandates for energy-efficient building envelopes are gaining traction across Asia Pacific, fueling demand for low-emissivity glass, thermally broken aluminum frames, and solar-integrated facades. Real estate developers and municipal authorities are increasingly embracing green building standards, further supporting the use of advanced curtain wall systems in both commercial and residential construction.

The Middle East and Africa (MEA) region is experiencing the fastest growth in the aluminum curtain wall market, thanks to an unprecedented boom in urban development, tourism infrastructure, and smart cities. Iconic projects in Dubai, Riyadh, Doha, and Cairo are driving demand for visually striking, energy-efficient facades that can withstand extreme weather conditions. For instance, developments like the NEOM smart city in Saudi Arabia are expected to heavily rely on high-performance aluminum curtain walls to meet sustainability and futuristic design goals.

MEA’s growing emphasis on diversification beyond oil, particularly through real estate, hospitality, and business infrastructure, is propelling construction activity. With large-scale investments in mixed-use towers, airports, and cultural centers, the demand for curtain walls with integrated solar shading, heat reflection, and structural resilience is rising rapidly, making MEA a high-growth frontier for global manufacturers.

Aluminum Curtain Wall Market Recent Developments

-

March 2024 – Kawneer launched its new energy-efficient aluminum curtain wall system, tailored for modern skyscrapers. The system incorporates advanced thermal breaks, triple-glazing compatibility, and solar control features. It aims to support high-rise developments in North America and Europe with superior energy ratings and design flexibility. [Source: GlobeNewswire]

-

January 2024 – Permasteelisa Group announced its collaboration with a Saudi real estate giant for supplying unitized curtain wall systems to a flagship mixed-use tower in NEOM city. The project emphasizes sustainability, using recycled aluminum and high-performance glazing.

-

December 2023 – Reynaers Aluminium introduced a next-generation facade design tool integrating AI and BIM, enabling architects to simulate curtain wall performance across lighting, thermal insulation, and acoustics in real-time.

-

October 2023 – Yuanda China Holdings expanded its international footprint with new contracts in Australia and Africa, offering semi-unitized and unitized curtain wall systems for civic buildings and transport hubs.

Some of the prominent players in the global aluminum curtain wall market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aluminum curtain wall market

Aluminum Curtain Wall Market Application

Aluminum Curtain Wall Market Type

- Stick-built

- Semi-unitized

- Unitized

Aluminum Curtain Wall Market Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)