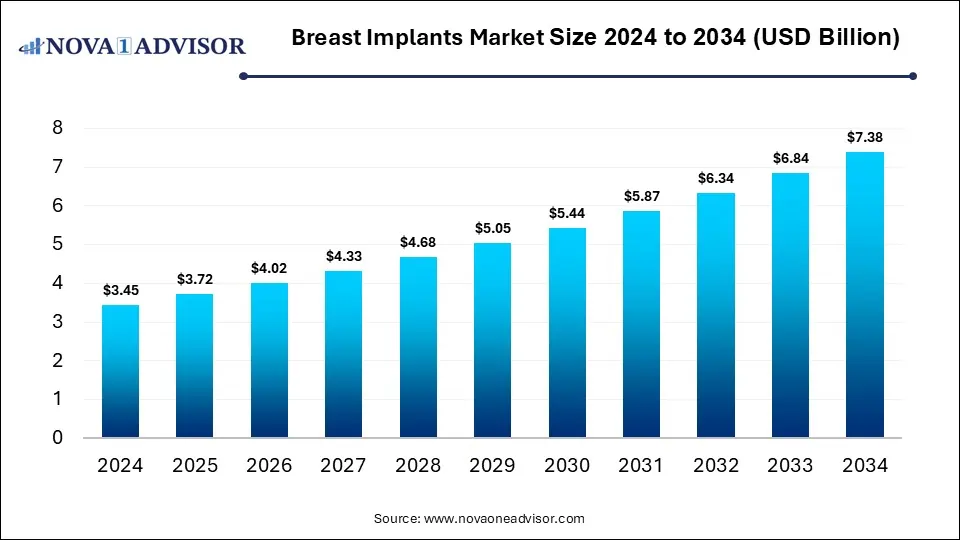

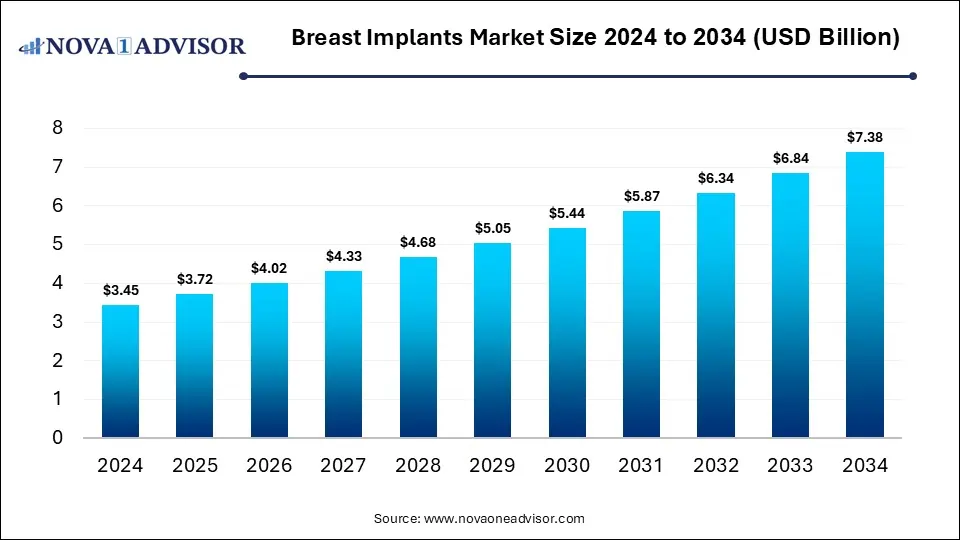

Breast Implants Market Size and Growth 2025 to 2034

The global breast implants market size was exhibited at USD 3.45 billion in 2024 and is projected to hit around USD 7.38 billion by 2034, growing at a CAGR of 7.9% during the forecast period of 2025 to 2034.

Key Takeaways:

- In 2024, North America dominated the market with 33%

- Amongst the product segment, silicone implants held the largest market share with 84% in 2024.

- Based on shape, round-shaped implants contributed the largest revenue in 2024 with 82.0% share.

- Based on application, cosmetic surgery contributed toward the largest revenue share in 2024 growing at a CAGR of 7.6%.

- Based on end-use, the hospital segment held the largest market share in 2024.

Breast Implants Market: Overview

The global breast implants market has witnessed significant growth in recent years, driven by factors such as increasing aesthetic consciousness, advancements in implant technology, and rising demand for breast augmentation procedures. This comprehensive overview delves into key aspects of the breast implants market, including market size, growth drivers, challenges, and emerging trends.

Breast Implants Market Growth

The growth of the breast implants market is propelled by several key factors. Primarily, increasing awareness and acceptance of cosmetic procedures, coupled with a growing desire for enhanced physical appearance, are driving the demand for breast augmentation surgeries worldwide. Technological advancements in implant materials and surgical techniques have also played a pivotal role, offering safer and more effective solutions for patients. Moreover, rising incidences of breast cancer and the subsequent increase in breast reconstruction surgeries further contribute to market expansion. Additionally, the expanding healthcare infrastructure and rising disposable income levels in emerging economies provide fertile ground for market growth. Overall, these growth factors collectively drive the breast implants market towards a promising trajectory, presenting opportunities for innovation and investment in the years to come.

Breast Implants Market Report Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.72 Billion |

| Market Size by 2034 |

USD 7.38 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Shape, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mentor Worldwide LLC; PMT Corporation; Allergan plc; Sientra, Inc.; GROUPE SEBBIN SAS; Guangzhou Wanhe Plastic Materials Co., Ltd.; KOKEN CO., LTD.; GC Aesthetics; POLYTECH Health & Aesthetics GmbH. |

Breast Implants Market Dynamics

The dynamics of the breast implants market are influenced by various factors, with two key dynamics standing out prominently. Firstly, technological advancements in implant materials and design have significantly impacted market dynamics. Innovations such as cohesive silicone gel implants and anatomically shaped implants offer improved safety, durability, and aesthetic outcomes, driving demand among both patients and surgeons. These advancements continue to reshape the competitive landscape, with manufacturers investing in research and development to stay ahead in the market.

Secondly, regulatory considerations and safety concerns play a crucial role in shaping market dynamics. Regulatory agencies closely monitor the safety and efficacy of breast implants, imposing stringent guidelines and requirements on manufacturers. Safety concerns, including the risk of complications such as capsular contracture and implant rupture, influence patient preferences and healthcare provider recommendations. Addressing these concerns through ongoing research, development of safer implant materials, and adherence to regulatory standards is essential for maintaining consumer trust and sustaining market growth. As a result, navigating the regulatory landscape and ensuring compliance are key determinants of success for players in the breast implants market.

Breast Implants Market Restraint

In the breast implants market, two significant restraints stand out prominently. Firstly, regulatory challenges pose a considerable obstacle to market growth. Regulatory agencies impose stringent requirements and standards on the approval and marketing of breast implants, often necessitating extensive clinical trials and documentation. Compliance with these regulations can be time-consuming and expensive for manufacturers, delaying product launches and increasing costs. Moreover, any adverse events or safety concerns related to breast implants can lead to heightened regulatory scrutiny, further impacting market dynamics.

Secondly, the high cost of breast augmentation procedures serves as a significant restraint on market expansion. The cost of breast implants and associated surgical fees can be prohibitive for many potential patients, limiting access to these procedures. Additionally, reimbursement policies for breast reconstruction surgeries vary across different healthcare systems, affecting patient affordability and healthcare provider reimbursement rates. As a result, affordability remains a key consideration for patients considering breast augmentation, particularly in regions with limited healthcare coverage or lower disposable incomes. Addressing cost concerns and enhancing affordability through innovative pricing models and reimbursement strategies is essential for overcoming this restraint and expanding market reach.

Breast Implants Market Opportunity

In the breast implants market, two significant opportunities present themselves prominently. Firstly, the increasing number of breast reconstruction surgeries post-mastectomy represents a significant growth opportunity. As awareness about breast cancer screening and treatment improves, more women are opting for mastectomy as a preventive or therapeutic measure. This trend has led to a growing demand for breast reconstruction procedures, driving the adoption of breast implants. Manufacturers and healthcare providers can capitalize on this opportunity by developing innovative implant solutions tailored to meet the unique needs of breast cancer survivors and collaborating with healthcare professionals to improve patient access to reconstructive surgery.

Secondly, the availability of minimally invasive procedures offers a promising opportunity for market expansion. Minimally invasive techniques, such as endoscopic breast augmentation and fat transfer procedures, have gained popularity due to their shorter recovery times, reduced scarring, and lower risk of complications compared to traditional surgical approaches. These procedures appeal to patients seeking subtle enhancements or minimal downtime, driving demand for breast implants as a part of these techniques. By investing in research and development of minimally invasive technologies and educating both patients and healthcare providers about their benefits, stakeholders in the breast implants market can leverage this opportunity to broaden their customer base and drive revenue growth.

Breast Implants Market Challenges

In the breast implants market, two significant challenges stand out prominently. Firstly, regulatory hurdles present a considerable obstacle to market growth. Regulatory agencies impose stringent requirements and standards on the approval and marketing of breast implants, necessitating extensive clinical testing and documentation to ensure safety and efficacy. Compliance with these regulations can be time-consuming and costly for manufacturers, leading to delays in product launches and increased development expenses. Moreover, any reports of adverse events or safety concerns related to breast implants can result in heightened regulatory scrutiny, further complicating market dynamics and impacting consumer confidence.

Secondly, safety concerns associated with breast implants pose a significant challenge for market stakeholders. While breast augmentation procedures are generally considered safe, there are risks of complications such as capsular contracture, implant rupture, and implant-associated anaplastic large cell lymphoma (BIA-ALCL). These safety concerns can deter potential patients from undergoing breast augmentation surgeries and prompt existing patients to seek alternative solutions. Addressing safety concerns through ongoing research and development of safer implant materials, enhanced surgical techniques, and improved patient education is essential for building trust and confidence in the breast implants market. Additionally, maintaining transparent communication with patients regarding the risks and benefits of breast implants is crucial for informed decision-making and ensuring patient satisfaction and safety.

Segments Insights:

Product Insights

Silicone breast implants accounted for the largest share of the product segment in recent years. Their popularity stems from their natural feel, shape retention, and lower risk of visible wrinkling. Highly cohesive silicone gel implants, also known as gummy bear implants, further reduce the risk of leakage and provide improved aesthetic outcomes. These factors have led to increased adoption among patients seeking both cosmetic augmentation and reconstructive procedures. Additionally, innovations in shell designs and gel consistencies have made these implants safer and more durable, enhancing patient and surgeon confidence.

In contrast, saline breast implants, though still in use, represent a smaller portion of the market. They are favored for their adjustability and use in younger patients, but tend to be less natural in feel and more prone to deflation. However, their use is supported by patients who prefer implants that contain only sterile salt water and want smaller incisions during surgery. In recent years, newer designs with structured internal chambers are attempting to bridge the gap between silicone and saline advantages, but adoption remains limited compared to silicone variants.

Shape Insights

Round-shaped implants dominated the shape segment due to their ability to enhance upper breast fullness and their reduced risk of rotation post-surgery. These implants are often chosen in cosmetic augmentation procedures, where patients prioritize prominent cleavage and volume. Their symmetrical design also simplifies surgical placement, making them a preferred option for many surgeons. Round implants are available in various profiles (low, moderate, high), giving patients a wide range of aesthetic possibilities depending on their body type and desired look.

However, anatomical or teardrop-shaped implants are emerging as the fastest-growing sub-segment. These implants mimic the natural slope of the breast, offering a subtler and more natural result. They are particularly popular in reconstructive surgeries and among patients seeking discreet enhancement. Despite the risk of rotation, which can cause an unnatural appearance, ongoing innovations in texturing and form-stability are helping mitigate these concerns, boosting their adoption.

Application Insights

Cosmetic surgery dominated the application segment of the breast implants market, driven by a surge in elective procedures aimed at enhancing appearance and self-confidence. The majority of breast augmentation surgeries fall into this category, where patients voluntarily opt for surgery to alter breast size or contour. With the rise of social media, influencer culture, and body-consciousness, cosmetic breast surgeries have become increasingly normalized. The availability of personalized consultations, virtual simulation tools, and installment-based payments further encourages individuals to opt for aesthetic procedures.

Meanwhile, reconstructive surgery is experiencing the fastest growth, fueled by a rise in breast cancer cases and mastectomy procedures. Breast implants are a critical component of post-mastectomy reconstruction, which is increasingly recognized as a part of comprehensive cancer care. In developed nations, such procedures are often covered by insurance, reducing financial burden and encouraging uptake. Moreover, advancements in surgical techniques like direct-to-implant reconstruction are shortening recovery times and improving results.

End-use Insights

Hospitals dominated the end-use segment due to their comprehensive infrastructure, experienced surgeons, and capacity to handle complex cases. Hospitals are often preferred for both cosmetic and reconstructive breast surgeries because they offer access to emergency care, specialized diagnostics, and multidisciplinary medical support. This is particularly important for patients with comorbidities or those undergoing reconstruction after cancer treatment. In many cases, hospitals are also involved in clinical trials for new implant designs, enhancing their reputation for safety and innovation.

Cosmetology clinics, however, are the fastest-growing end-use segment. These centers are proliferating rapidly, particularly in urban areas, offering convenient and cost-effective aesthetic procedures. Clinics often attract a younger demographic due to shorter wait times, personalized care, and the growing number of board-certified aesthetic professionals working outside hospital systems. These centers also benefit from strategic collaborations with implant manufacturers and aesthetic brands to offer package deals and promotional services, further driving their market share.

Regional Insights

North America remains the dominant region in the breast implants market, largely due to high per capita expenditure on healthcare, widespread acceptance of cosmetic procedures, and a strong presence of leading implant manufacturers. The U.S., in particular, has consistently recorded the highest number of breast augmentation surgeries globally. In addition to cosmetic preferences, the U.S. healthcare system also supports breast reconstruction surgeries through insurance mandates, further boosting implant demand.

The region is also a hub for clinical research and regulatory oversight. The U.S. FDA actively monitors and approves new implant technologies, ensuring product safety. Major players like Sientra, Mentor Worldwide (a Johnson & Johnson company), and Allergan (an AbbVie company) are headquartered or operate extensively in this region, enhancing its leadership in technological advancement and innovation.

Asia-Pacific is emerging as the fastest-growing region in the breast implants market, driven by increasing medical tourism, rising disposable income, and growing acceptance of aesthetic procedures. Countries like South Korea, Thailand, and India are positioning themselves as regional hubs for affordable, high-quality plastic surgeries. South Korea, in particular, is renowned for its cosmetic surgery culture, supported by state-of-the-art clinics and experienced surgeons.

Moreover, changing cultural attitudes and greater media exposure are encouraging more women in the region to consider cosmetic enhancements. Governments in countries like China and India are also investing in healthcare infrastructure, indirectly supporting the growth of the aesthetic surgery market. These trends, combined with the cost-effectiveness of surgeries, are making Asia-Pacific a hotbed for future growth in breast implants.

Some of the prominent players in the breast implants market include:

- ALLERGAN

- GC Aesthetics

- GROUPE SEBBIN SAS

- Mentor Worldwide LLC; Sientra, Inc.

- Sientra Inc.

- Polytech Health & Aesthetics GmbH

- Establishment Labs S.A.

- Shanghai Kangning Medical Supplies Ltd.

- Guangzhou Wanhe Plastic Materials Co., Ltd.

- LABORATOIRES ARION

- HANSBIOMED CO. LTD.

Recent Developments

-

January 2025 – Establishment Labs received CE Mark approval for its next-generation Motiva Implants with Q Inside Safety Technology, enhancing traceability and patient safety across the European market.

-

October 2024 – GC Aesthetics launched its new round silicone breast implant range called PERLE™, designed for a natural look and improved tissue compatibility.

-

August 2024 – Sientra Inc. expanded its direct sales force in the U.S. and partnered with top-tier cosmetic clinics to accelerate its national footprint and enhance surgeon support.

-

June 2024 – Mentor Worldwide (a J&J company) announced the development of new smooth-surface implant models, focusing on long-term safety and aesthetic outcomes after facing growing demand for textured implant alternatives.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global breast implants market.

Product

- Silicone Breast Implants

- Saline Breast Implants

Shape

Application

- Reconstructive Surgery

- Cosmetic Surgery

End-use

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)