Business Process Outsourcing Market Size and Trends

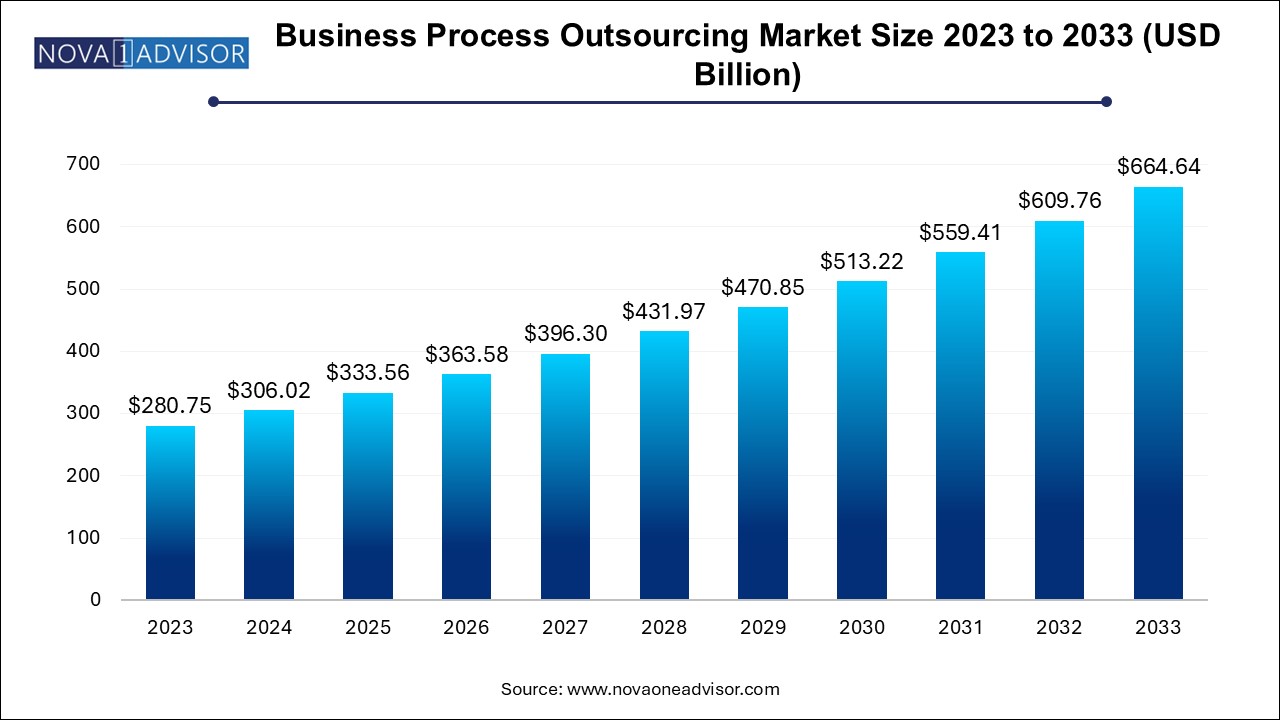

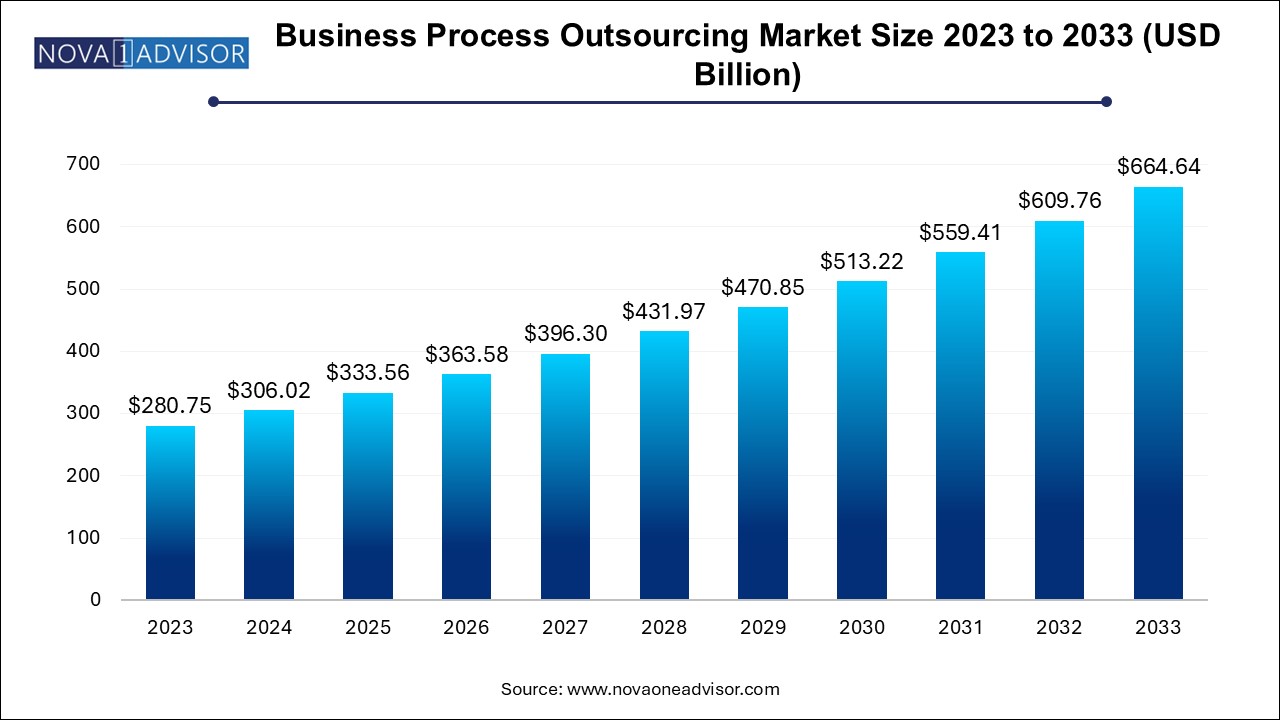

The global business process outsourcing market size was exhibited at USD 280.75 billion in 2023 and is projected to hit around USD 664.64 billion by 2033, growing at a CAGR of 9.0% during the forecast period 2024 to 2033.

Business Process Outsourcing Market Key Takeaways:

- The customer services segment dominated the market with a revenue share of 22.7% in 2023.

- The IT & telecommunication segment held the largest revenue share around 25.0% in 2023.

- The onshore segment held the largest revenue share in 2023, accounting for 45.2% of the overall market.

- The offshore segment is expected to witness significant growth at a CAGR of over 9.0% from 2024-2033.

- The cloud segment accounted for the largest market share over 51.0% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030.

- North America accounted for over 36.0% revenue share in 2023 and is expected to retain its dominance from 2024 to 2033.

Market Overview

The global business process outsourcing (BPO) market has evolved into a cornerstone of operational efficiency for companies across industries. BPO refers to the practice of contracting specific business operations to third-party service providers, either domestically (onshore), regionally (nearshore), or internationally (offshore). Initially centered around cost savings, BPO has matured into a strategic partnership model, enabling enterprises to leverage specialized expertise, adopt emerging technologies, improve agility, and focus on core competencies.

The market has expanded from traditional call centers and back-office functions to encompass a wide range of services such as finance and accounting, human resources, knowledge process outsourcing (KPO), procurement, logistics, and customer relationship management (CRM). Increasing globalization, digital transformation, and the need for 24/7 operations have made BPO a vital solution for businesses aiming to scale operations without proportionately increasing overhead.

A significant shift is underway from labor arbitrage to value-added outsourcing, powered by technologies such as cloud computing, robotic process automation (RPA), artificial intelligence (AI), natural language processing (NLP), and analytics. BPO vendors are now offering digital-first solutions, outcome-based pricing, and domain-centric services that align with the strategic goals of client organizations.

With macroeconomic uncertainties, talent shortages, and a hybrid work era reshaping the business landscape, the BPO market is playing a critical role in ensuring business continuity, resilience, and digital capability building. It is no longer simply a cost-cutting tactic, but a key enabler of transformation and innovation in the enterprise value chain.

Major Trends in the Market

-

AI and Automation Integration: BPO firms are deploying AI and RPA to automate repetitive tasks, enabling faster processing, better accuracy, and cost reduction.

-

Shift Toward Knowledge Process Outsourcing (KPO): High-value services such as legal research, financial modeling, and data analytics are in demand, especially from BFSI and pharma sectors.

-

Cloud-Based Delivery Models: Cloud-native BPO services are gaining popularity due to their scalability, security, and flexibility for remote and hybrid workforces.

-

Industry-Specific BPO Offerings: Vendors are tailoring services to verticals such as healthcare (medical coding), finance (claims processing), and retail (supply chain analytics).

-

Demand for Multilingual Support: Global expansion and diverse customer bases are fueling the need for multilingual contact centers and localized content services.

-

Onshore and Nearshore Growth: Political and data sovereignty concerns are prompting companies to rebalance their outsourcing mix with more nearshore and onshore options.

-

ESG and Ethical Outsourcing Practices: Clients are increasingly prioritizing vendors that demonstrate sustainability, data privacy compliance, and fair labor practices.

-

Hybrid Workforce Models: BPO providers are embracing remote and hybrid delivery models, ensuring continuity and access to global talent.

Report Scope of Business Process Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 306.02 Billion |

| Market Size by 2033 |

USD 664.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service Type, Outsourcing Type, Deployment, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Accenture plc; Amdocs; Capgemini; CBRE; Cognizant; Delta BPO Solutions; Go4Customer; HCL Technologies Limited; Infosys Limited (Infosys BPM); International Business Machines Corporation; NCR Corporation; SODEXO; Teleperformance SE; TTEC Holdings, Inc.; Wipro |

Market Driver: Rising Demand for Operational Agility and Cost Efficiency

A primary driver of the BPO market’s growth is the increasing enterprise demand for operational agility and cost optimization. In an increasingly volatile and competitive global business environment, organizations are under pressure to reduce fixed costs, scale flexibly, and focus resources on strategic priorities. BPO provides a solution by converting fixed costs into variable ones, offering access to skilled labor at lower rates, and enabling rapid scalability.

Beyond cost savings, modern BPO solutions allow organizations to respond to changing customer expectations, regulatory shifts, and technology disruptions with greater agility. For example, a global bank can outsource its mortgage processing to a BPO provider with specialized capabilities, freeing internal teams to focus on customer relationship building and product innovation. In this way, outsourcing becomes a key component of enterprise transformation and resilience.

Market Restraint: Data Privacy and Security Concerns

Despite its advantages, the BPO market is constrained by data security and privacy risks, particularly in sectors like healthcare, finance, and government. As BPO providers handle sensitive customer and operational data, breaches or mismanagement can have significant legal, financial, and reputational consequences for clients.

The complexity of cross-border data transfers also introduces compliance challenges, especially under regulatory frameworks like GDPR in Europe, HIPAA in the U.S., and data localization mandates in countries like India, China, and Brazil. Enterprises must rigorously assess vendor security protocols, governance structures, and incident response mechanisms before engaging in BPO relationships. These risks may discourage organizations from fully outsourcing critical processes or may necessitate onshore-only operations, impacting cost efficiencies.

Market Opportunity: Expansion into AI-Driven, Analytics-Intensive BPO Services

One of the most promising opportunities in the BPO market lies in the expansion of AI- and analytics-driven services. Businesses are increasingly seeking providers that can go beyond task execution to deliver insights, predictive models, and strategic value. This has opened up demand for next-generation BPO offerings, such as AI-powered customer service bots, fraud detection in BFSI, supply chain visibility dashboards, and healthcare analytics.

BPO firms that embed AI, ML, and business intelligence tools into their offerings are becoming integral to their clients’ decision-making processes. For instance, an e-commerce brand can outsource its sales and marketing analytics to a BPO partner that uses AI to optimize ad spend and personalize promotions. This trend is shifting BPO from being a back-office function to a revenue enabler and innovation partner. As data becomes the new currency in digital transformation, BPO providers with strong AI capabilities stand to gain significantly.

Business Process Outsourcing Market By Service Type Insights

Customer services dominate the BPO market by value, as organizations across retail, telecom, finance, and travel outsource their contact center operations to handle customer inquiries, complaints, and technical support. These services typically include voice and non-voice channels, email support, live chat, and social media response. With the shift toward omnichannel engagement, BPO providers have upgraded their capabilities to include AI chatbots, sentiment analysis, and proactive outreach.

However, knowledge process outsourcing (KPO) is the fastest growing segment, driven by demand for high-end services such as market research, legal processing, engineering design, and financial analytics. KPO providers offer domain expertise, data interpretation, and strategic insight that go beyond simple execution. For example, pharmaceutical companies are outsourcing clinical data analysis and regulatory submission documentation to specialized KPO firms, accelerating drug approval timelines. As businesses seek more strategic outcomes from outsourcing, KPO is evolving as a premium service tier.

Business Process Outsourcing Market By End-use Insights

BFSI is the largest end-use sector in the BPO market, outsourcing functions such as claims processing, loan servicing, customer onboarding, fraud monitoring, and financial reporting. Banks and insurers rely on BPO partners to manage seasonal volumes, maintain compliance, and improve customer satisfaction. Given the complex regulatory environment, providers servicing BFSI clients often invest in domain-trained teams, risk management systems, and data security infrastructure.

Healthcare is the fastest growing end-use segment, particularly in the U.S., where hospitals and providers face pressure to reduce administrative overheads. Services such as medical billing, revenue cycle management, patient records digitization, telehealth support, and insurance verification are commonly outsourced. The pandemic also accelerated the outsourcing of remote care support and health information management. With growing emphasis on value-based care, BPO in healthcare is evolving from transactional services to a partner model focused on outcomes and patient satisfaction.

Business Process Outsourcing Market By Outsourcing Type Insights

Offshore outsourcing continues to dominate, with countries like India, the Philippines, Poland, and Mexico acting as global delivery hubs. These regions offer a large, English-speaking, tech-savvy workforce at competitive costs. Offshore centers are especially common for customer support, IT helpdesk, and back-office processing, where location is less critical to the user experience.

However, nearshore outsourcing is growing quickly, as companies seek to balance cost savings with proximity and cultural alignment. U.S. firms increasingly look to Latin American countries like Colombia and Costa Rica, while Western European businesses turn to Eastern Europe and North Africa. Nearshoring reduces time zone gaps, enables easier collaboration, and addresses concerns around data localization and geopolitical risk. As client expectations for responsiveness and customization grow, nearshore BPO centers are gaining strategic importance.

Business Process Outsourcing Market By Deployment Insights

On-premise deployment remains significant, especially in regulated industries such as banking and healthcare, where data security and internal oversight are paramount. Large enterprises often maintain their own IT infrastructure and integrate BPO services into it for tighter control. On-premise models are also preferred when the BPO provider is co-located within the client facility for close coordination.

Yet, the cloud-based deployment model is growing the fastest, fueled by demand for flexibility, rapid onboarding, and support for distributed teams. Cloud platforms enable real-time collaboration, scalability, and integration with CRM, ERP, and communication tools. They also allow for AI augmentation, remote agent management, and pay-as-you-go pricing. The pandemic accelerated the shift to cloud-based outsourcing, and it continues to reshape the delivery models of the industry.

Business Process Outsourcing Market By Regional Insights

North America dominates the global BPO market, driven by high demand for digital transformation, mature outsourcing practices, and large service consumption across BFSI, healthcare, and retail sectors. U.S. companies are among the most frequent users of BPO services, with complex and highly diversified outsourcing portfolios. The presence of top-tier BPO providers, AI innovation hubs, and strong capital markets supports continuous evolution in this region.

The shift toward value-added services, cloud adoption, and compliance-driven outsourcing has led to rapid expansion of BPO centers in U.S. nearshore regions, including Canada and Latin America. Moreover, many North American firms are also seeking onshore and hybrid delivery models to ensure resilience, especially in light of cybersecurity concerns.

Asia Pacific is the fastest-growing BPO market, thanks to a combination of skilled labor availability, cost efficiency, and improving digital infrastructure. Countries like India and the Philippines continue to lead in voice-based and back-office services, while China, Vietnam, and Malaysia are emerging as key destinations for KPO, IT outsourcing, and legal services.

Government policies, talent development programs, and improved telecom networks are helping APAC countries move up the value chain. The region is also becoming a hub for multilingual and multicultural service delivery, catering to global brands across time zones. With continued investments in AI, cybersecurity, and cloud integration, APAC is positioned to be a long-term growth engine for the global BPO industry.

Business Process Outsourcing Market Recent Developments

-

March 2024 – Accenture announced the acquisition of AI-driven platform AcmeIQ, aimed at enhancing retail BPO capabilities through generative AI and automation. The acquisition bolsters Accenture’s ability to offer next-gen solutions in sales optimization and inventory management. [Source: BusinessWire]

-

January 2024 – Teleperformance launched a new digital CX (customer experience) suite integrating AI chatbots and multilingual support in 30+ languages, targeting BFSI and e-commerce clients in Europe and North America.

-

December 2023 – Wipro BPO introduced a cloud-native finance and accounting outsourcing (FAO) platform powered by analytics and predictive risk modeling. The launch aims to serve mid-sized enterprises seeking fast, scalable financial processing.

-

November 2023 – TCS (Tata Consultancy Services) signed a multi-year deal with a global healthcare network to manage revenue cycle, claims processing, and telehealth triaging, consolidating its position in healthcare BPO.

Some of the prominent players in the global business process outsourcing market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global business process outsourcing market

Service Type

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

Outsourcing Type

- Onshore

- Nearshore

- Offshore

Deployment

End-use

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)