Civil Engineering Market Size and Trends

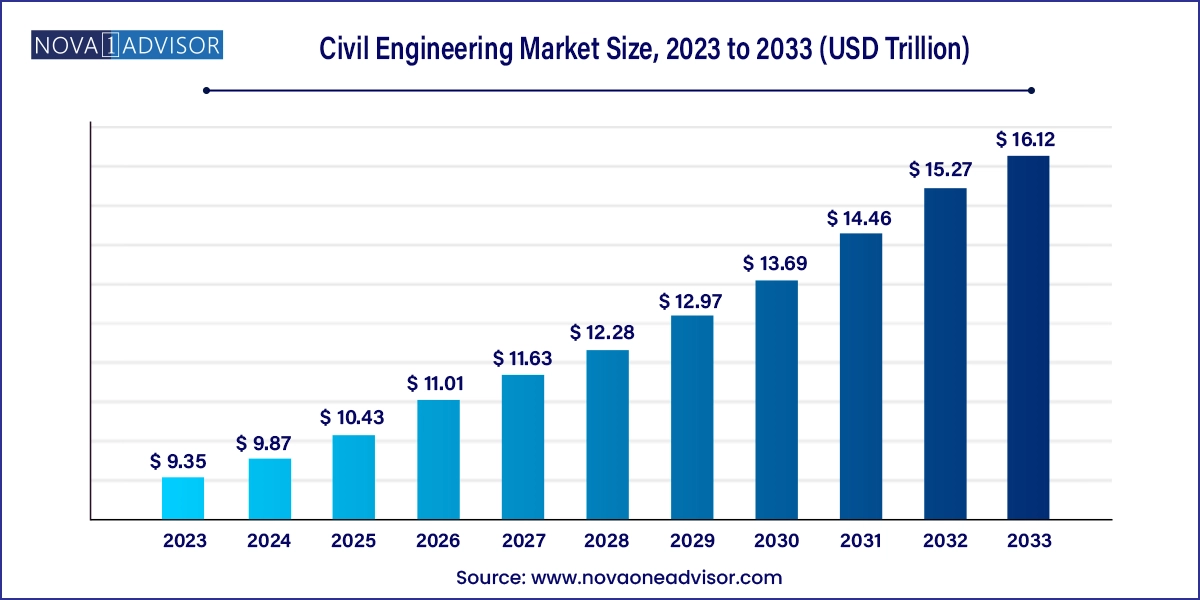

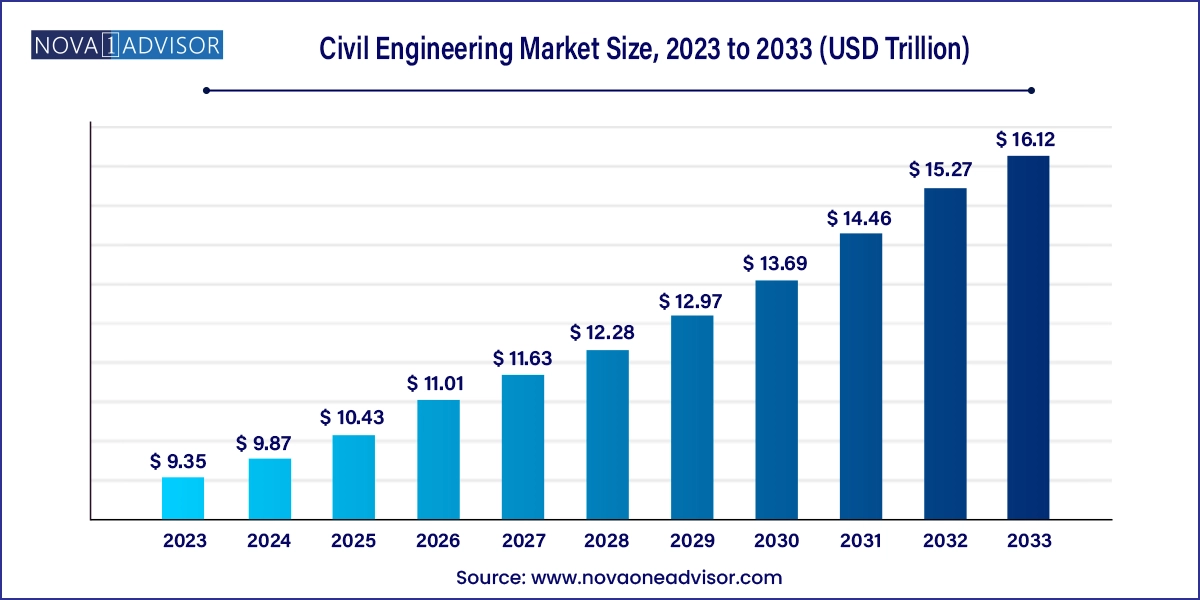

The global civil engineering market size was exhibited at USD 9.35 trillion in 2023 and is projected to hit around USD 16.12 trillion by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

Civil Engineering Market Key Takeaways:

- Construction services was the largest segment and accounted for a global revenue share of 27.4% in 2023.

- The maintenance service segment is anticipated to witness the fastest CAGR of 6.6% over the forecast period.

- The real estate segment accounted for a global revenue share of 40.7% in 2023 and is expected to witness significant growth over the forecast period.

- The infrastructure segment is estimated to register the fastest CAGR of 6.7% from 2024 to 2033.

- The industrial application segment is expected to witness a significant CAGR of 6.3% over the forecast period.

- The government was the largest customer segment and accounted the global revenue share of 41.3% in 2023.

Market Overview

The global civil engineering market serves as a cornerstone of economic development and societal advancement, playing a vital role in building and maintaining the infrastructure that supports modern life. Civil engineering encompasses the design, construction, and maintenance of physical infrastructure such as roads, bridges, buildings, water systems, and other public works. With the continued expansion of urban environments and growing populations, the demand for robust and efficient infrastructure has surged across developed and developing regions alike.

Globally, the civil engineering market has been witnessing significant growth due to increased government spending on infrastructure modernization, technological advancements in construction techniques, and rising investments from private players. The market encompasses a wide array of services, ranging from planning and design to execution and long-term maintenance. The integration of digital tools such as Building Information Modeling (BIM), Geographic Information Systems (GIS), and artificial intelligence in project planning and execution has significantly improved project outcomes, reducing time and cost overruns.

Civil engineering not only addresses functionality and safety but also increasingly incorporates sustainability and resilience, especially in the face of climate change. Infrastructure projects are now required to withstand more frequent and intense environmental events, pushing the sector toward innovative materials, smart construction, and climate-conscious urban planning. As nations embark on green transitions and smart city development, civil engineering is evolving into a technologically rich and environmentally responsible industry. The market’s future outlook remains optimistic, with continuous innovation and increasing demand acting as primary growth catalysts.

Major Trends in the Market

-

Digital Transformation in Engineering Practices: Widespread adoption of digital twins, BIM, and AI is reshaping civil engineering workflows, enabling predictive maintenance and more efficient planning.

-

Green and Sustainable Infrastructure: Environmental concerns are driving a shift towards eco-friendly designs, use of recycled materials, and energy-efficient construction techniques.

-

Public-Private Partnerships (PPPs): Governments are increasingly relying on PPPs to fund and execute large infrastructure projects, particularly in developing economies.

-

Smart City Developments: Urbanization trends are leading to investments in smart mobility, intelligent transport systems, and digital infrastructure, requiring advanced civil engineering input.

-

Pre-engineered and Modular Construction: Precast and modular construction methods are gaining popularity for their cost efficiency and reduced build time, especially in housing and industrial projects.

-

Increased Investment in Resilient Infrastructure: Climate-resilient infrastructure is becoming a focus, with designs tailored to withstand extreme weather events and natural disasters.

-

Talent Shortage and Skill Development: The demand for qualified engineers continues to outpace supply, pushing firms to invest in training and collaborative platforms.

Report Scope of Civil Engineering Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.87 Trillion |

| Market Size by 2033 |

USD 16.12 Trillion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Application, Customers, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key Companies Profiled |

AECOM; Amec Foster Wheeler plc; United States Army Corps of Engineers; SNC-Lavalin; Jacobs; Galfar Engineering & Contracting SAOG (Galfar); Fluor Corporation.; HDR Inc.; Tetra Tech Inc.; Stantec Inc. |

Market Driver: Global Infrastructure Investment Boom

One of the most compelling drivers of the global civil engineering market is the robust global push toward infrastructure development. Across continents, governments are significantly increasing budget allocations to enhance connectivity, expand utility networks, and revamp outdated systems. Initiatives like the U.S. Bipartisan Infrastructure Law (2021), worth over USD 1.2 trillion, aim to modernize roads, bridges, railways, and broadband networks. Similarly, China’s ongoing Belt and Road Initiative (BRI) continues to develop trade routes and infrastructure across Asia, Africa, and Europe, benefiting hundreds of civil engineering firms.

In emerging economies such as India, Indonesia, and Brazil, urban expansion and economic growth are closely tied to infrastructure enhancement. India's Smart Cities Mission and AMRUT (Atal Mission for Rejuvenation and Urban Transformation) target sustainable urban development, driving opportunities for both domestic and global civil engineering service providers. These large-scale, multi-year projects create a sustainable pipeline of demand across civil engineering segments like planning, construction, and maintenance.

Market Restraint: Regulatory Complexities and Bureaucratic Delays

Despite the market's promising outlook, regulatory challenges and bureaucratic delays remain significant hurdles. Civil engineering projects often require multiple permits, clearances, and approvals from local, regional, and national bodies. In many regions, particularly in developing economies, navigating the legal and regulatory frameworks can be time-consuming and inconsistent. Delays due to land acquisition issues, environmental clearances, and community disputes further aggravate the situation.

For example, infrastructure projects in Latin America often face hold-ups due to political instability or changes in leadership. In India, while regulatory reforms have improved the ease of doing business, land acquisition remains a bottleneck in many states. These delays inflate project costs, create uncertainty for investors, and strain public-private partnerships. As a result, companies must build specialized compliance teams and maintain robust stakeholder engagement practices to mitigate risks.

Market Opportunity: Rise of Smart Infrastructure and Urban Development

The global movement toward smart cities and intelligent infrastructure presents a major opportunity for civil engineering firms. As urban centers look to incorporate digital technologies to enhance livability, energy efficiency, and transportation networks, the demand for integrated engineering solutions is soaring. This includes smart water management systems, traffic control mechanisms, sensor-based bridges and roads, and digital public utilities.

In 2024, Singapore announced the expansion of its Smart Nation initiative, which includes AI-powered traffic monitoring, automated waste systems, and digitized infrastructure diagnostics—all requiring precision civil engineering. Similarly, European cities like Amsterdam and Helsinki are integrating IoT into public transport and utility management. Engineering firms capable of integrating technology with infrastructure design and execution are poised to benefit from these transformative developments. This trend also aligns with sustainability goals, as smart systems can reduce emissions, optimize resource use, and support climate adaptation strategies.

Civil Engineering Market By Services Insights

Construction services dominated the global civil engineering market, accounting for the largest share due to the sheer volume of physical infrastructure activities taking place worldwide. This segment includes the physical realization of engineering designs roads, tunnels, buildings, power plants, and bridges and requires labor-intensive, capital-intensive execution. With large-scale projects such as China's South-North Water Transfer Project and Europe’s high-speed railway expansions, demand for construction services has remained strong. Moreover, public housing developments in Africa and post-disaster reconstruction efforts in earthquake-prone countries like Turkey and Japan have further driven this segment’s growth.

Planning & Design services represent the fastest-growing segment, driven by the adoption of advanced technologies and the need for precise project conceptualization. Modern urban planning demands digital modeling, 3D simulations, and sustainability impact assessments—services often provided during the design phase. Increasing awareness about lifecycle costs, safety standards, and environmental concerns has pushed both governments and private developers to emphasize thorough planning. The popularity of BIM, VR-based walkthroughs, and AI-driven traffic flow analysis tools underlines the growing complexity and value of this phase in the engineering process.

Civil Engineering Market By Application Insights

The infrastructure segment leads the global civil engineering market due to ongoing investments in roads, ports, airports, energy plants, and transport corridors. This dominance is reinforced by global programs such as the African Union’s Program for Infrastructure Development in Africa (PIDA) and the European Union’s Connecting Europe Facility. The infrastructure segment also benefits from multilateral financing from institutions like the World Bank and Asian Infrastructure Investment Bank (AIIB), ensuring a steady flow of capital and project opportunities. Rail electrification, renewable energy infrastructure, and smart mobility corridors have further diversified this segment’s scope.

The fastest-growing segment is the real estate sector, fueled by urban population growth, changing lifestyles, and growing housing demand. Residential complexes, commercial towers, and mixed-use developments are transforming cityscapes across Asia, North America, and the Middle East. In India, for example, the Real Estate Regulatory Authority (RERA) reforms have revitalized investor confidence, leading to a surge in real estate construction. Similarly, migration trends in North America have shifted demand toward suburban real estate, requiring civil engineers to design new neighborhoods, roadways, and drainage systems.

Civil Engineering Market By Customers Insights

Government customers are the largest contributors to the civil engineering market, largely due to their role in financing and executing public infrastructure projects. Roads, water supply systems, sewage networks, and public transport systems are typically state-funded or state-mandated, ensuring civil engineering firms receive stable contracts. Governments often enter into long-term agreements with engineering firms through tenders, public-private partnerships, or direct investment projects. For instance, the U.S. Department of Transportation allocates billions annually to state-level projects, directly engaging engineering firms for execution and oversight.

Private customers are emerging as the fastest-growing segment, especially in real estate, industrial parks, and commercial infrastructure. Tech campuses, logistics centers, manufacturing hubs, and luxury townships are primarily funded by private entities that demand efficiency and customization. The corporate push toward sustainability has also increased demand for green-certified campuses, requiring advanced engineering input. With economic liberalization in countries like Vietnam, Bangladesh, and Colombia, private infrastructure investment is expected to further accelerate, expanding the market beyond traditional public-sector clientele.

Civil Engineering Market By Regional Insights

Asia Pacific dominates the global civil engineering market, supported by rapid urbanization, industrial growth, and massive public infrastructure investments. China continues to lead with its state-driven development model and megaprojects like the Greater Bay Area initiative and the One Belt One Road strategy. India is investing heavily in roads, ports, and energy with schemes like Bharatmala and Sagarmala. Southeast Asian nations, particularly Vietnam, the Philippines, and Indonesia, are catching up with smart city initiatives and transport network upgrades. The sheer scale of construction, coupled with lower labor costs and fast-tracked approvals in some regions, makes Asia Pacific the leader.

Middle East & Africa (MEA) is the fastest-growing region, driven by ambitious transformation agendas in the Gulf countries and infrastructural needs in Sub-Saharan Africa. Saudi Arabia’s Vision 2030, which includes projects like NEOM, Qiddiya, and the Red Sea Project, has created a boom in civil engineering demand. Similarly, the UAE continues to evolve with world-class infrastructure, including the expansion of Abu Dhabi’s Etihad Rail and Dubai’s vertical smart city concepts. In Africa, infrastructural needs remain immense, with major road and energy projects underway in Ethiopia, Kenya, and Nigeria—often supported by Chinese and European engineering firms.

Civil Engineering Market Recent Developments

-

February 2024 – AECOM was awarded a major contract by the UK government to lead design services for the Lower Thames Crossing Project, aimed at reducing congestion and improving connectivity in southeast England.

-

January 2024 – China Communications Construction Company (CCCC) announced a strategic partnership with Kenya’s Ministry of Transport to develop a new highway linking Nairobi to Mombasa, reinforcing China’s influence in African infrastructure.

-

November 2023 – Fluor Corporation secured a multibillion-dollar contract for infrastructure modernization at the Los Angeles International Airport (LAX), including terminal and runway upgrades.

-

September 2023 – Jacobs Engineering Group collaborated with the Australian government on a coastal resiliency program in Queensland to design climate-resilient flood control and transport infrastructure.

-

July 2023 – Stantec Inc. launched its Smart Infrastructure Practice, combining AI and IoT with urban engineering services to serve clients in North America and Europe.

Some of the prominent players in the global civil engineering market include:

- AECOM

- Amec Foster Wheeler plc

- United States Army Corps of Engineers

- SNC-Lavalin

- Jacobs

- Galfar Engineering & Contracting SAOG (Galfar)

- Fluor Corporation.

- HDR, Inc.

- Tetra Tech, Inc.

- Stantec, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global civil engineering market

Services

- Planning & Design

- Construction

- Maintenance

- Others

Application

- Real Estate

- Infrastructure

- Industrial

Customers

- Government

- Private

- Other Customers

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa