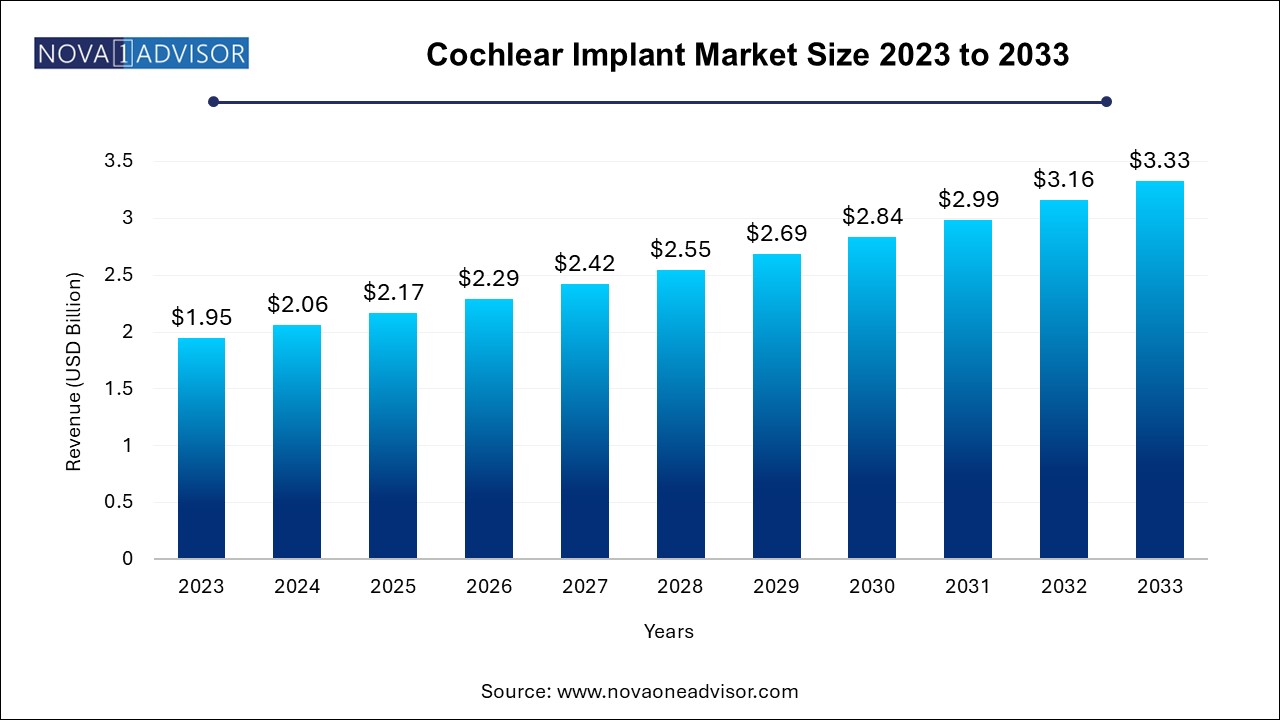

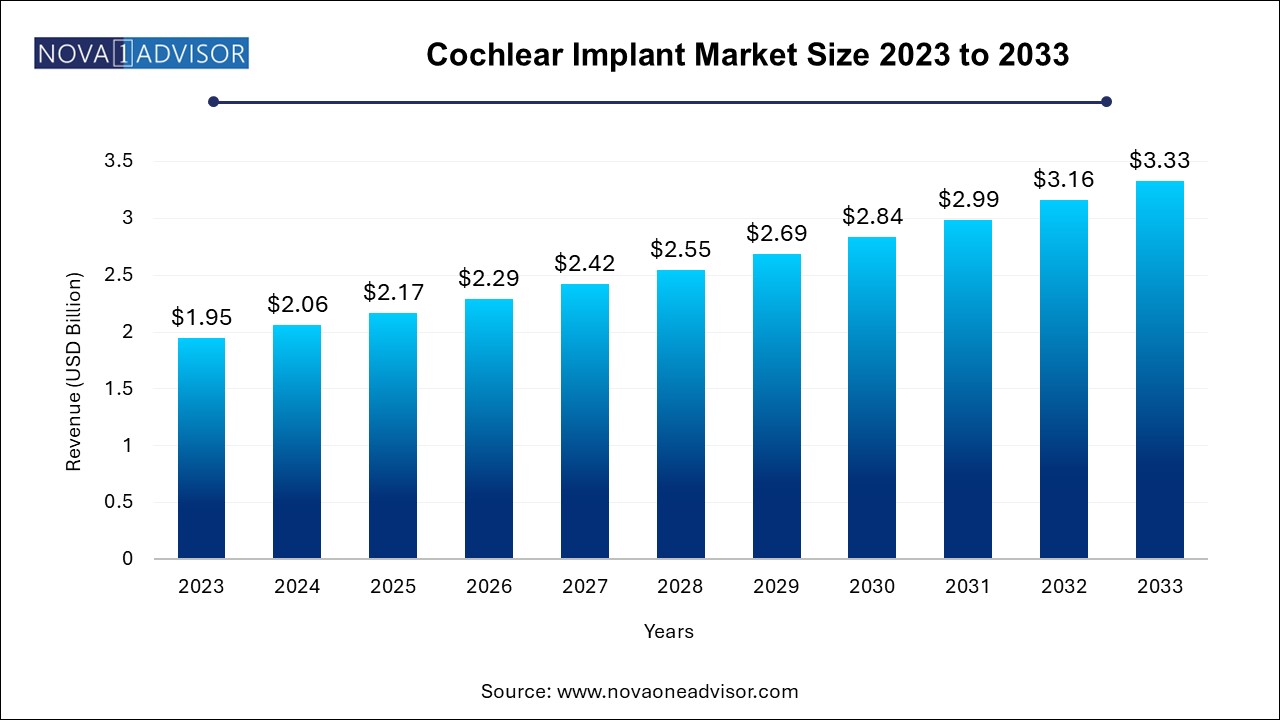

Cochlear Implant Market Size and Growth

The cochlear implant market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 3.33 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

Cochlear Implant Market Key Takeaways:

- The adult segment held the largest revenue share of 57.70% in 2023 and is expected to maintain its dominance from 2024 to 2033.

- The pediatric segment is expected to register the fastest CAGR from 2024 to 2033.

- The clinics segment is anticipated to dominate the global market with maximum share in 2023.

- The others segment is expected to register the fastest CAGR from 2024 to 2033.

- North America held the largest market share of 36.83% in 2023.

- Asia Pacific is expected to register the fastest CAGR from 2024 to 2033.

Market Overview

The cochlear implant market plays a critical role in the hearing healthcare industry, offering advanced medical devices that restore hearing in individuals with severe to profound sensorineural hearing loss. Unlike conventional hearing aids that amplify sound, cochlear implants bypass damaged parts of the ear and directly stimulate the auditory nerve. This revolutionary approach allows individuals, particularly those who do not benefit from hearing aids, to perceive sound and engage more fully in communication, education, and work.

Globally, hearing impairment affects over 430 million people, according to the World Health Organization (WHO). With hearing loss significantly impacting quality of life and economic productivity, early intervention using cochlear implants has gained medical and societal importance. The growing prevalence of age-related hearing loss, congenital hearing disabilities, and noise-induced hearing damage has widened the eligible population for these devices. In parallel, public health systems in many countries are expanding insurance coverage and cochlear implant programs, making the devices more accessible.

Technological advancements have further fueled market momentum. Today’s cochlear implants feature wireless connectivity, noise-canceling microphones, MRI compatibility, and real-time audio streaming, offering users enhanced sound clarity and lifestyle integration. Leading companies such as Cochlear Ltd., MED-EL, and Advanced Bionics are investing in next-generation devices and surgical innovations. These innovations are designed not only to improve hearing outcomes but also to reduce complications and make surgery more efficient and less invasive.

As global awareness of hearing health improves and clinical guidelines evolve, the cochlear implant market is witnessing robust growth across pediatric and adult populations. With a promising pipeline of device upgrades and the increasing incorporation of AI and machine learning, the market outlook remains positive for the next decade.

Major Trends in the Market

-

Technological Integration with Smart Devices: Bluetooth-enabled cochlear implants now allow users to stream phone calls and media directly to their processors, enhancing convenience.

-

Rise of Bilateral Implants: Clinicians are increasingly recommending bilateral implants—particularly in pediatric patients—for improved spatial hearing and speech understanding.

-

Pediatric Focus and Early Intervention Policies: Governments and healthcare providers are pushing for universal newborn hearing screening and early cochlear implantation.

-

MRI-Compatible Implants: Advancements in implant design now allow for safe MRI scans, reducing device limitations for diagnostic imaging.

-

Minimally Invasive and Outpatient Surgeries: Surgical techniques are being refined to reduce hospitalization time, making implants more accessible.

-

AI-Based Sound Processing Algorithms: Machine learning is being used to adapt sound environments dynamically, improving speech perception in noisy settings.

-

Improved Reimbursement Frameworks: Expanded insurance coverage for cochlear implants in regions like Asia and Latin America is driving uptake.

-

Development of Hybrid Devices: These combine cochlear and acoustic stimulation for individuals with residual low-frequency hearing.

Report Scope of Cochlear Implant Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.06 Billion |

| Market Size by 2033 |

USD 3.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Age Group, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Cochlear Ltd; Sonova; MED-EL Medical Electronics; Demant A/S; Zhejiang Nurotron Biotechnology Co. Ltd.; Amplifon S.p.A. (GAES) |

Market Driver: Increasing Global Burden of Hearing Loss and Need for Functional Rehabilitation

One of the most significant drivers of the cochlear implant market is the growing global burden of hearing impairment and the increasing societal and medical recognition of the importance of early auditory rehabilitation. According to the WHO, unaddressed hearing loss costs the global economy over $980 billion annually due to healthcare costs, lost productivity, and educational support needs.

Cochlear implants offer a clinically validated and long-term solution for individuals who derive little to no benefit from traditional hearing aids. In pediatric populations, early implantation is directly linked to better speech development, language acquisition, and cognitive outcomes. In adults, cochlear implants reduce social isolation and enhance employment opportunities. These outcomes have prompted governments to implement newborn screening programs and broaden eligibility for implants.

As awareness campaigns and advocacy initiatives grow, more patients are being diagnosed early and referred for cochlear implant evaluation, driving steady market growth.

Market Restraint: High Cost of Devices and Limited Access in Developing Regions

Despite technological advancements and improved awareness, the high cost of cochlear implants remains a significant barrier, particularly in low- and middle-income countries (LMICs). The total cost including device, surgery, post-operative rehabilitation, and follow-up care—can range from $30,000 to $50,000 per ear in many markets.

While developed countries may offer insurance coverage or government-funded programs, in LMICs, such support is often unavailable or limited to a small demographic. The need for lifelong maintenance, audiologist visits, and processor upgrades adds to the burden, deterring widespread adoption. Even within developed countries, access disparities exist based on rural-urban divides, income levels, and provider availability.

This affordability gap remains a challenge to realizing equitable hearing healthcare worldwide. Bridging this barrier will require global partnerships, public health funding, and affordable device models tailored to underserved markets.

Market Opportunity: Expansion of Pediatric Implantation Programs and School-Based Screening

A major opportunity for the cochlear implant market lies in pediatric implantation and school-based hearing screening programs. Early hearing intervention significantly improves speech-language development, academic performance, and long-term cognitive health. Recognizing this, many countries are making cochlear implants accessible under universal healthcare programs or offering subsidies for children under 5 years of age.

For instance, the United Kingdom’s National Health Service (NHS) funds bilateral cochlear implants for qualifying pediatric patients. Similarly, India’s government-run ADIP scheme offers cochlear implants for children from economically weaker sections. School-based screening programs in countries like China and Brazil are also identifying children with undiagnosed hearing loss, leading to higher referrals for implants.

By developing low-cost devices and investing in outreach and follow-up services, cochlear implant companies can tap into this vast pediatric segment, particularly in regions with high birth rates and limited access to early hearing care.

Cochlear Implant Market By Age Group Insights

Adults remain the dominant segment in the cochlear implant market, primarily due to the large prevalence of acquired hearing loss in this population. Age-related sensorineural hearing loss (presbycusis) is highly common, with nearly one-third of adults over 65 affected. Many adults who initially use hearing aids eventually transition to cochlear implants as their hearing deteriorates. Unilateral implants have traditionally been more common among adults due to cost considerations and surgical conservatism. However, increasing awareness of quality-of-life improvements is driving more adults to consider bilateral implantation.

Pediatric bilateral implants, on the other hand, represent the fastest-growing segment. Bilateral implantation in young children—especially before the age of 3 has been shown to dramatically enhance auditory development, speech clarity, and sound localization. Many high-income countries now recommend and reimburse bilateral cochlear implants in children, making it a standard of care. The integration of wireless accessories, waterproof processors, and MRI-safe designs has made these devices more child-friendly and acceptable to caregivers. With rising neonatal screening rates and proactive ENT referrals, pediatric bilateral implants are gaining significant market traction globally.

Cochlear Implant Market By End-use Insights

Hospitals dominate the end-use segment, especially tertiary care and academic hospitals with dedicated otolaryngology departments. These institutions are equipped with the infrastructure, surgical expertise, and post-operative rehabilitation services necessary for cochlear implantation. In many countries, hospitals serve as the referral and diagnostic centers for cochlear implant candidacy evaluations, and they often work closely with manufacturers for device trials and clinical validations.

However, specialty clinics and private ENT centers are the fastest-growing end-use segment. With minimally invasive surgical techniques becoming more prevalent, implantation procedures are increasingly being conducted in ambulatory or outpatient clinic settings. These clinics offer faster turnaround times, personalized care, and follow-up services, appealing to both pediatric and adult patients. Furthermore, hearing care chains and cochlear implant-focused rehabilitation centers are emerging in urban hubs, especially across Asia and Europe, contributing to this trend. As demand for decentralized care grows, clinics are expected to play a larger role in market expansion.

Cochlear Implant Market By Regional Insights

North America holds the largest share in the global cochlear implant market, with the United States accounting for the majority. This dominance is due to well-established healthcare infrastructure, advanced surgical capabilities, and robust insurance coverage, including Medicare and Medicaid provisions for cochlear implantation. High public awareness, presence of leading manufacturers like Advanced Bionics, and large numbers of audiologists contribute to widespread device adoption.

The U.S. has also led in FDA approvals for pediatric and bilateral implants, encouraging early adoption. Moreover, consumer demand for advanced technologies such as AI-based sound processing and direct smartphone connectivity has supported higher spending on premium implants. In Canada, national healthcare systems provide universal access to implants for qualifying individuals, further strengthening regional growth.

Asia Pacific is experiencing the fastest growth, driven by a large pool of untreated hearing loss cases, growing middle-class income, and improving healthcare access. Countries like China and India have seen a rise in public health initiatives targeting hearing loss, including newborn screening programs and government-funded cochlear implant surgeries. For instance, China’s cochlear implant initiative provides financial assistance for eligible children, while India's ADIP scheme has implanted over 20,000 children as of 2024.

Private hospitals and ENT clinics in Southeast Asia are also expanding cochlear implant services to urban populations. Moreover, domestic players in countries like South Korea and China are entering the market with cost-effective devices, increasing competition and accessibility. Rising awareness campaigns, educational outreach, and collaborations between local governments and manufacturers are expected to drive double-digit growth in this region.

Cochlear Implant Market Recent Developments

-

March 2024 – Cochlear Limited announced the launch of its next-generation Nucleus implant system, incorporating improved sound processor technology and enhanced MRI compatibility. The system also integrates with smartphones and assistive listening devices to improve user experience. [Source: BusinessWire]

-

January 2024 – MED-EL released a new bone conduction implant for patients with mixed or conductive hearing loss, expanding its portfolio and targeting patients unsuitable for standard cochlear implants.

-

December 2023 – Advanced Bionics (Sonova Group) introduced firmware updates for its Naída CI Marvel platform, enabling more seamless streaming from Bluetooth devices and personalized listening experiences.

-

October 2023 – Oticon Medical, following its acquisition by Cochlear Ltd., integrated its hearing aid and implant R&D teams, signaling the development of hybrid electro-acoustic stimulation systems.

-

August 2023 – India’s Ministry of Health expanded cochlear implant eligibility to include bilateral procedures under its government schemes, aiming to improve auditory outcomes in pediatric populations.

Some of the prominent players in the cochlear implant market include:

- Cochlear Ltd.

- Sonova

- MED-EL Medical Electronics

- Demant A/S

- Zhejiang Nurotron Biotechnology Co., Ltd. (Nurotron)

- Amplifon S.p.A. (GAES)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the cochlear implant market

Age Group

- Adult

- Adult Unilateral Implants

- Adult Bilateral Implants

- Pediatric

- Pediatric Unilateral Implants

- Pediatric Bilateral Implants

End-use

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA