Computer Numerical Control Machines Market Size and Research

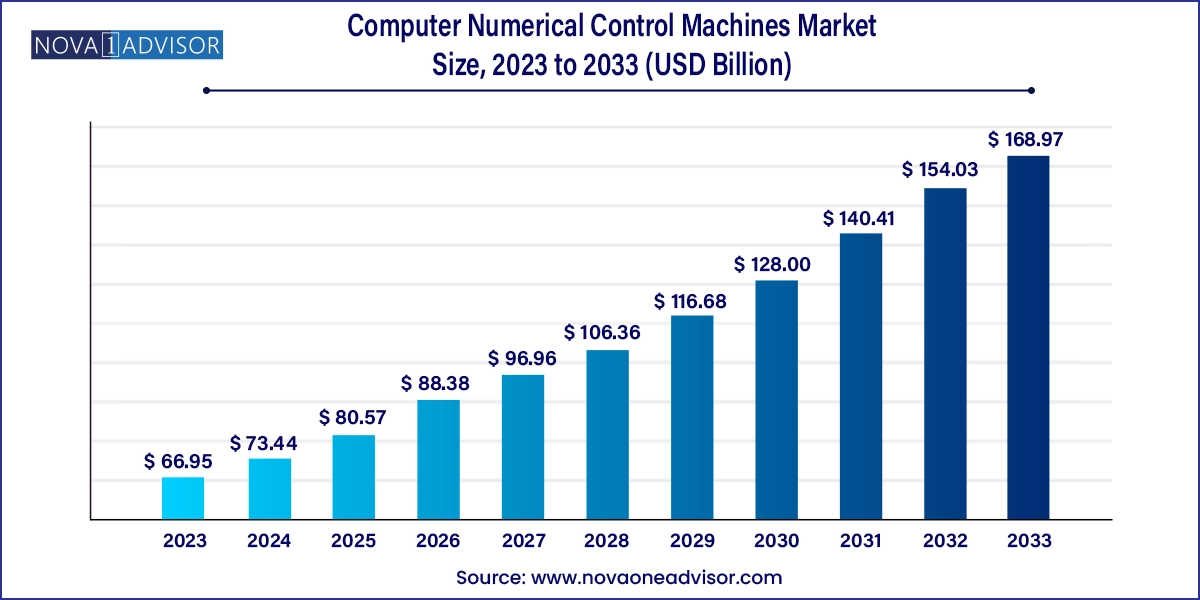

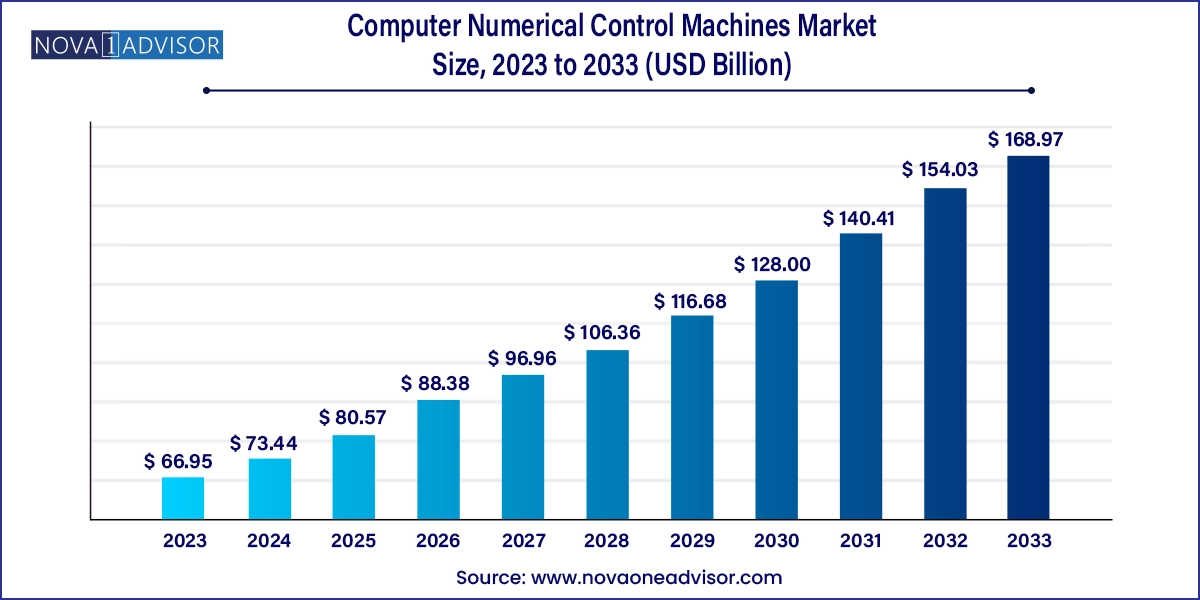

The global computer numerical control machines market size was exhibited at USD 66.95 billion in 2023 and is projected to hit around USD 168.97 billion by 2033, growing at a CAGR of 9.7% during the forecast period 2024 to 2033.

Computer Numerical Control Machines Market Key Takeaways:

- Based on type, the CNC lathe machines segment accounted for largest market share of over 28.0% in 2023.

- The CNC milling machines demand is expected to register highest CAGR of nearly 12.0% over forecast period.

- The industrial segment accounted for largest market share of approximately 26.0% in 2023.

- Moreover, the automotive sector is expected to register highest CAGR of nearly 12.0% over the forecast period.

- The CNC machines market in North America accounted for a market share of 14.5% in 2023.

Market Overview

The global computer numerical control (CNC) machines market is witnessing dynamic expansion, supported by the ongoing evolution in industrial automation and digital manufacturing. CNC machines utilize pre-programmed software and code to control complex machinery tools, ensuring high precision and repeatability in industrial production processes. From automotive component fabrication to aerospace part assembly, CNC technology is critical in delivering consistent, high-quality results at scale.

With the advent of Industry 4.0 and smart factories, CNC machines are increasingly integrated with IoT, cloud computing, and real-time analytics. These advancements allow for enhanced operational efficiency, minimized human error, and predictive maintenance strategies that reduce downtime and cost. As manufacturers across the globe pursue automation to counter labor shortages and meet rising consumer expectations, the demand for CNC machines is scaling rapidly across multiple industries including automotive, aerospace, power generation, and consumer goods.

Major Trends in the Market

-

Integration of AI and machine learning to enable self-correcting machining processes.

-

Adoption of 5-axis CNC machines for complex geometries in aerospace and medical devices.

-

Miniaturization and micro-machining trends, especially for electronics and precision tooling.

-

Rise of hybrid manufacturing systems combining additive and subtractive capabilities.

-

Deployment of CNC machines in flexible manufacturing systems (FMS) for mass customization.

-

Increased focus on energy-efficient and eco-friendly CNC operations.

-

CNC-as-a-Service (CNCaaS) models gaining traction among SMEs for operational scalability.

-

Real-time monitoring and remote diagnostics using industrial IoT (IIoT) platforms.

Report Scope of Computer Numerical Control Machines Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 73.44 Billion |

| Market Size by 2033 |

USD 168.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AMADA MACHINERY CO., LTD.; Amera Seiki; DMG MORI CO., LTD.; General Technology Group Dalian Machine Tool Corporation; DATRON AG; FANUC CORPORATION; Haas Automation, Inc; Hurco Companies, Inc.; Mitsubishi Electric Corporation; OKUMA Corporation; Shenyang Machine Tool Part Co., Ltd.; and YAMAZAKI MAZAK CORPORATION. |

Market Driver: Growing Demand for High-Precision Manufacturing

One of the leading drivers of the CNC machines market is the surging demand for high-precision manufacturing across diverse industry verticals. The need for intricate detailing, dimensional accuracy, and consistency in components has become indispensable, particularly in aerospace, automotive, and medical industries where tolerances are extremely tight. CNC machines offer the ability to produce complex parts with a precision of up to a few microns, which is unachievable through manual machining or traditional automation techniques.

For instance, aerospace companies like Boeing and Airbus use multi-axis CNC machining to manufacture engine components and airframe structures that comply with stringent safety and performance requirements. Similarly, in orthopedic implants, the capability of CNC machines to produce customized, biocompatible designs has opened new opportunities for patient-specific solutions.

Market Restraint: High Initial Investment Costs

Despite their long-term efficiency, CNC machines involve a substantial upfront investment that can deter small and medium-sized manufacturers. The costs include not only the machines themselves but also the associated software, operator training, tooling, and infrastructure requirements. High-end 5-axis CNC machines or hybrid variants can cost several hundred thousand dollars, making them financially inaccessible for many businesses.

Moreover, there is often a prolonged ROI period, particularly for businesses with low-volume or custom production needs. The technical complexity of setup and operation also mandates skilled personnel, adding further to operational costs. These barriers are particularly challenging in developing economies where capital expenditure budgets remain constrained.

Market Opportunity: Advancements in CNC Software and Simulation

The rapid evolution of CNC software platforms presents a transformative opportunity for the industry. Advanced simulation software now enables virtual testing of machining operations, reducing trial-and-error and improving production efficiency. CAD/CAM integration, real-time toolpath optimization, and machine-learning-enhanced error correction allow for a streamlined workflow and enhanced part quality.

Start-ups and established players alike are developing AI-powered CNC software that can predict tool wear, suggest process improvements, and even reprogram in real time. These smart solutions reduce dependency on skilled labor and make CNC more accessible to smaller manufacturers. With cloud-based platforms, remote monitoring and collaborative design are also becoming mainstream, paving the way for decentralized, agile manufacturing environments.

Computer Numerical Control Machines Market By Type Insights

Lathe machines dominated the CNC machine type segment in 2024, due to their widespread use in automotive and general manufacturing for turning operations. CNC lathes provide unmatched consistency in cylindrical parts such as shafts, bolts, and bushings. Their versatility and compatibility with various materials including metals, plastics, and composites make them a fundamental tool in any machine shop. The simplicity of setup and scalability for batch production has ensured their continued dominance in both industrialized and emerging markets.

Laser machines are the fastest growing type, propelled by their precision, contactless processing, and adaptability in industries such as electronics, medical devices, and automotive. CNC laser systems are increasingly used for engraving, cutting, and welding applications. Their ability to handle delicate or heat-sensitive materials without mechanical stress has widened their application scope. As demand for intricate components and decorative finishes rises, especially in consumer electronics and jewelry, CNC laser machines are seeing exponential growth.

Computer Numerical Control Machines Market By End-use Insights

The automotive sector held the largest share in 2024, driven by the need for high-volume precision component manufacturing. CNC machines are essential for producing engine parts, transmission systems, brake components, and more. Automotive OEMs and suppliers leverage CNC technology for rapid prototyping and large-scale production, reducing cycle time and increasing product quality. The push toward electric vehicles (EVs) has further increased CNC utilization for fabricating battery enclosures, electric motor parts, and thermal management systems.

Aerospace and defense are the fastest growing end-use industries, supported by increasing global air travel, military modernization, and satellite launches. CNC machines offer the precision, reliability, and repeatability required for critical aerospace components like turbine blades, landing gear, and structural elements. Government investments in defense aircraft and space exploration, particularly in the U.S., China, and India, are contributing significantly to the demand for advanced multi-axis CNC solutions.

Computer Numerical Control Machines Market By Regional Insights

Asia Pacific dominated the CNC machines market in 2024, thanks to its robust manufacturing ecosystem and cost-effective labor. China, Japan, South Korea, and India are major contributors, with China leading the world in both CNC machine production and consumption. The region's automotive, electronics, and industrial machinery sectors have integrated CNC technology at scale to improve quality and productivity. Government programs such as "Make in India" and "Made in China 2025" continue to prioritize advanced manufacturing, further propelling market expansion.

Europe is the fastest growing region, bolstered by automation in its well-established automotive and aerospace sectors. Germany, Italy, and France are key markets, emphasizing precision engineering and industry 4.0 practices. The rise of green manufacturing and sustainability initiatives has led European manufacturers to adopt energy-efficient CNC machines. Additionally, supportive EU policies for digital transformation and advanced manufacturing R&D are enhancing regional competitiveness.

Computer Numerical Control Machines Market Recent Developments

-

In March 2024, DMG Mori launched a new AI-powered CNC platform aimed at predictive maintenance and process optimization.

-

In February 2024, Mazak Corporation opened a new digital innovation center in Germany to support smart manufacturing.

-

In January 2024, Haas Automation expanded its production capacity in California with a $150 million investment, citing increased demand.

-

In December 2023, FANUC Corporation unveiled a new generation of collaborative CNC systems with enhanced human-machine interface (HMI).

-

In November 2023, Siemens AG announced the launch of Sinumerik ONE Dynamics, a high-performance CNC solution integrated with cloud-based services.

Some of the prominent players in the global computer numerical control machines market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global computer numerical control machines market

Type

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

End-use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)