Construction Chemicals Market Size and Research

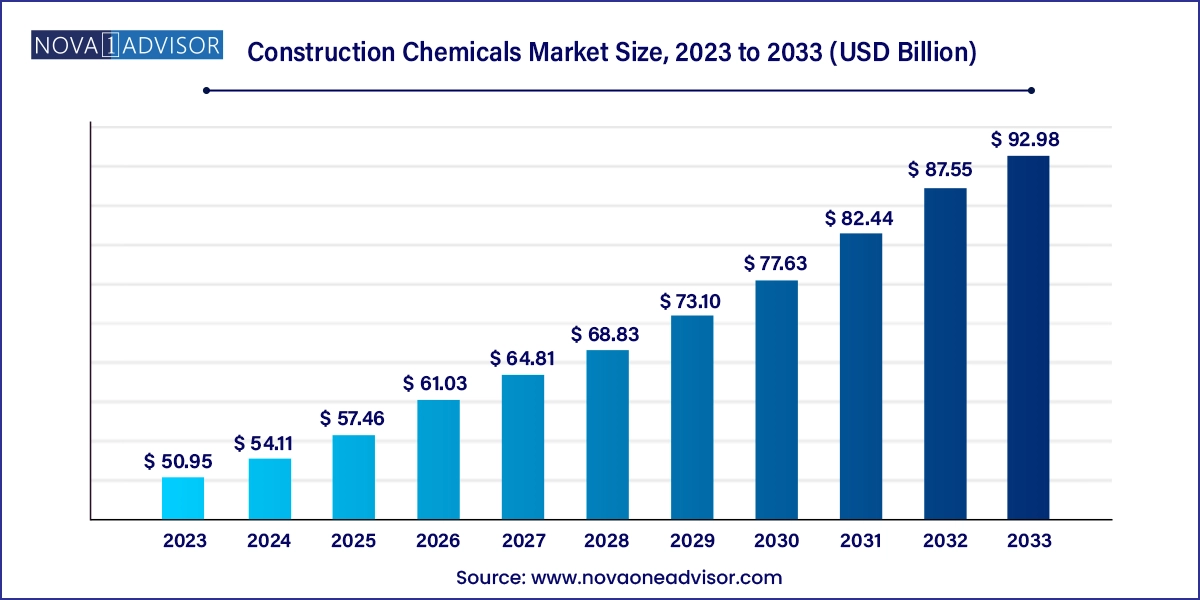

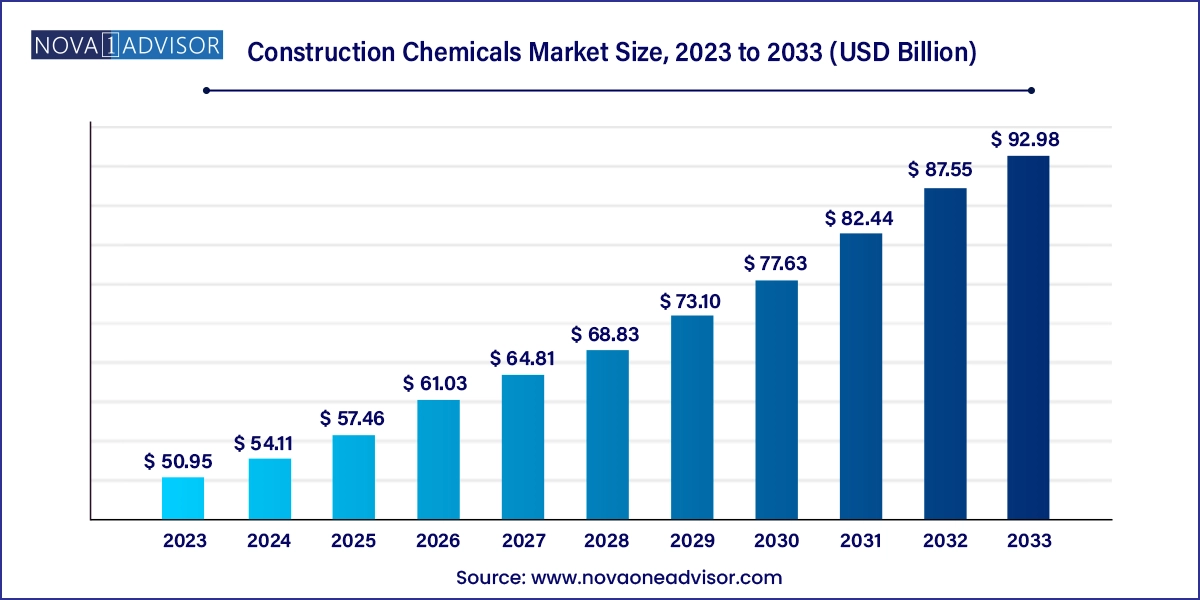

The construction chemicals market size was exhibited at USD 50.95 billion in 2023 and is projected to hit around USD 92.98 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

Construction Chemicals Market Key Takeaways:

- The concrete admixture was the largest product segment with a share of 64.7% in 2023.

- Construction chemicals are widely used in non-residential and infrastructure sectors, accounting for over 67.0% of the global volume in 2023.

- Asia Pacific was the largest regional market for construction chemicals owing to the rapid expansion of the construction sector over the past few years

Market Overview

The construction chemicals market is an integral part of the modern construction industry, playing a pivotal role in enhancing the strength, durability, sustainability, and overall performance of buildings and infrastructure. Construction chemicals are specialized formulations used in various stages of construction—from foundations and waterproofing to finishing and protective treatments. These chemicals include concrete admixtures, adhesives, sealants, and protective coatings, among others.

The global construction sector is undergoing rapid transformation, driven by urbanization, population growth, and the increasing need for resilient infrastructure. In this dynamic environment, construction chemicals are helping address challenges such as faster construction timelines, extreme weather conditions, structural fatigue, and sustainability requirements. They contribute significantly to the development of long-lasting, energy-efficient structures that meet modern regulatory and environmental standards.

From large-scale commercial complexes and airports to housing, roads, tunnels, and dams, construction chemicals have become indispensable for ensuring structural integrity, minimizing repair needs, and optimizing costs over the lifecycle of a building. Additionally, the emphasis on green buildings and LEED certification is fueling demand for low-VOC and environmentally friendly chemical formulations.

Governments worldwide are investing in infrastructure upgrades, affordable housing, and smart cities—creating a steady pipeline of projects that require advanced construction materials. Meanwhile, manufacturers are focused on innovation, offering hybrid solutions that combine chemical and physical reinforcement, improving ease of application and compatibility with diverse substrates.

Major Trends in the Market

-

Rising adoption of sustainable and eco-friendly construction chemicals to comply with green building standards and reduce carbon footprints.

-

Increased use of advanced admixtures for high-performance concrete, improving workability, water resistance, and early strength.

-

Growing integration of nanotechnology in coatings and sealants, enhancing surface protection and self-healing properties.

-

Expansion of construction chemicals in emerging markets, especially in Asia Pacific and Latin America due to urban infrastructure development.

-

Development of one-component systems and pre-mixed formulations to reduce application time and increase labor efficiency.

-

Adoption of intelligent construction materials, including self-compacting concrete enabled by high-tech admixtures.

-

Shift toward waterproofing systems for underground, high-rise, and marine structures, driven by climate resilience efforts.

-

Rising demand for restoration and repair chemicals, as aging infrastructure becomes a global challenge.

Report Scope of Construction Chemicals Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 54.11 Billion |

| Market Size by 2033 |

USD 92.98 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Germany; Italy; France; U.K.; China; India; Japan; South Korea; Brazil |

| Key Companies Profiled |

Sika AG; Chembond Chemicals Ltd.; RPM International Inc.; Cera-Chem Private Limited.; MAPEI Corporation; Fosroc International Ltd.; Bostik; Inc.; H.B. Fuller; Henkel AG & Company; BASF SE; The Dow Chemical Company; Pidilite industries |

Key Market Driver: Urbanization and Infrastructure Boom in Emerging Economies

One of the strongest drivers of the construction chemicals market is the massive urbanization trend and the associated infrastructure boom in emerging economies. Countries such as India, China, Brazil, Indonesia, and Nigeria are experiencing unprecedented growth in population and urban migration, creating immense pressure on cities to expand housing, transportation, water supply, and sanitation facilities.

For instance, India’s Smart Cities Mission and China’s Belt and Road Initiative have led to a surge in civil engineering projects that depend on high-performance construction chemicals for durability and speed. Admixtures, for example, enable concrete to set quickly and uniformly in hot or cold climates, while waterproofing agents protect foundations in flood-prone areas.

Infrastructure investments typically involve long project durations and strict safety standards. Construction chemicals help optimize cement usage, minimize cracks, improve bonding, and increase load-bearing capacities—key factors in modern urban development. The rise in megaprojects such as airports, metros, industrial zones, and highways further underlines the pivotal role of construction chemicals in enabling timely and cost-effective completion.

Key Market Restraint: Volatility in Raw Material Prices and Supply Chain Disruptions

A key restraint in the construction chemicals market is the volatility in raw material prices and the vulnerability of global supply chains. Many construction chemicals are derived from petrochemicals and specialty raw materials, including epoxy resins, polymers, silanes, and additives. The cost and availability of these inputs are influenced by fluctuations in crude oil prices, geopolitical tensions, and environmental regulations.

For example, disruptions during the COVID-19 pandemic and the Russia-Ukraine conflict significantly impacted the sourcing of chemical ingredients, leading to price spikes and delays. Many regions faced shortages of epoxy resins and polyurethanes—affecting the production of adhesives and coatings.

Additionally, freight costs, container availability, and regulatory barriers have further increased the procurement burden for manufacturers. These issues not only squeeze profit margins but also delay project timelines when construction chemicals are not delivered on time. This supply instability is prompting a shift toward regional sourcing and backward integration, though such transformations take time and investment.

Key Market Opportunity: Rising Focus on Green Building and Sustainable Construction

The transition to sustainable construction practices presents a powerful opportunity for the construction chemicals market. With mounting concerns over climate change, resource efficiency, and energy consumption, governments, developers, and end-users are increasingly demanding construction chemicals that support green building certifications and sustainable development goals.

Green construction chemicals are characterized by low VOC emissions, enhanced energy efficiency, reduced water usage, and recyclable or biodegradable compositions. For instance, bio-based adhesives and water-borne sealants are replacing solvent-based options, while fly ash-based admixtures reduce cement consumption and associated carbon emissions.

Moreover, the use of cool roof coatings, thermal barrier sealants, and anti-microbial paints contributes to healthier and more sustainable building environments. Regulations such as the EU Green Deal, India’s ECBC, and the U.S. LEED guidelines are accelerating this shift.

Manufacturers investing in R&D to develop environmentally friendly, performance-optimized products are poised to gain a competitive edge. Collaborations with certification bodies and construction firms can further strengthen adoption and market visibility.

Construction Chemicals Market By Product Insights

Concrete admixtures held the largest share of the product segment, due to their indispensable role in improving the workability, setting time, strength, and durability of concrete. Admixtures are added to the mix either during or before mixing to achieve specific performance outcomes. These include water reducers, superplasticizers, air-entraining agents, retarders, accelerators, and shrinkage-reducing agents.

In mass construction projects like dams, bridges, and metro tunnels, the use of high-performance admixtures is critical for temperature management and structural stability. Similarly, precast concrete components benefit from admixtures that accelerate curing and maintain uniformity. In developing countries, admixtures are also essential to ensure concrete quality despite labor skill gaps and environmental variability.

Protective coatings are the fastest-growing sub-segment, driven by the need to shield concrete and steel structures from moisture, chemicals, abrasion, and environmental degradation. Protective coatings are widely used in marine construction, chemical plants, sewage treatment facilities, and warehouses. Innovations in epoxy, polyurethane, and hybrid polymer coatings have enabled longer service life and easier application. With aging infrastructure becoming a global issue, protective coatings are seeing increased use in repair and rehabilitation projects.

Construction Chemicals Market By End-Use Insights

The non-residential and infrastructure segment dominated the construction chemicals market due to the sheer scale and complexity of commercial, industrial, and civil engineering projects. Airports, bridges, highways, stadiums, shopping centers, and industrial parks require superior construction materials that ensure high load-bearing capacities, corrosion resistance, and longevity.

These projects often operate under strict deadlines, requiring chemicals that enhance early strength gain and support continuous pouring operations. In high-rise construction, admixtures and adhesives support vertical pumping and efficient bonding of facade elements. Infrastructure projects in particular—such as tunnels and ports—demand specialized waterproofing and corrosion-inhibiting chemicals to withstand environmental extremes.

Residential construction is the fastest-growing end-use segment, fueled by increasing housing demand, especially in urban and semi-urban areas of developing countries. Affordable housing programs and smart city initiatives are accelerating the use of ready-mix concrete, tile adhesives, and surface protection chemicals in residential developments. The rise of multi-family housing, condominiums, and gated communities is pushing builders to adopt high-quality chemical products that improve aesthetics, reduce maintenance costs, and enhance occupant comfort.

Construction Chemicals Market By Regional Insights

Asia Pacific emerged as the dominant region in the construction chemicals market, accounting for the largest market share due to its booming construction sector, rapid urbanization, and government-led infrastructure expansion. China and India are key contributors, collectively witnessing massive investments in roadways, railways, airports, housing, and smart cities.

China’s Belt and Road Initiative and India’s National Infrastructure Pipeline (NIP) have created a steady demand for construction chemicals. Moreover, the region hosts a large number of domestic and international manufacturers, supported by cost-effective production and abundant raw material availability. Southeast Asian countries like Vietnam, Indonesia, and the Philippines are also seeing increased demand due to industrial development and urban sprawl.

The Middle East & Africa region is the fastest-growing market, driven by ambitious mega-projects and the shift toward tourism and diversified economies. Countries such as the UAE, Saudi Arabia, and Egypt are investing in futuristic cities (like NEOM), luxury resorts, and transportation infrastructure to reduce reliance on oil revenues.

In Saudi Arabia alone, Vision 2030 has allocated billions for infrastructure development, which includes high-speed rail, airports, ports, and commercial zones. These projects require high-performance chemicals that can withstand desert climates, saline environments, and sand erosion. The African continent is also witnessing strong growth, particularly in Nigeria, Kenya, and Ethiopia, where urbanization is driving residential and infrastructure demand.

Construction Chemicals Market Recent Developments

-

March 2025 – BASF Construction Chemicals announced the launch of a new range of bio-based superplasticizers under its “MasterEase Green” brand, aimed at reducing COâ‚‚ emissions in concrete mixes.

-

January 2025 – Sika AG opened a new production plant in Egypt to strengthen its presence in Africa and support infrastructure projects under Egypt Vision 2030.

-

November 2024 – MBCC Group introduced a spray-applied waterproofing membrane for underground tunnels in high-moisture regions, tested successfully in Southeast Asia.

-

September 2024 – Pidilite Industries partnered with a UAE-based developer to supply high-performance tile adhesives and sealants for a luxury resort complex.

-

June 2024 – Mapei S.p.A. expanded its product portfolio with low-VOC sealants designed for eco-certified commercial buildings in Europe.

Some of the prominent players in the construction chemicals market include:

Key construction chemical manufacturers include Sika AG, Chembond Chemicals Ltd., RPM International Inc., Cera-Chem Private Limited., MAPEI Corporation, Fosroc International Ltd., Bostik, Inc., H.B. Fuller, Henkel AG & Company, BASF SE, The Dow Chemical Company, and Pidilite industries among others.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the construction chemicals market

Product

- Concrete Admixtures

- Concrete Adhesives

- Concrete Sealants

- Protective Coatings

End-use

- Residential

- Non-residential & Infrastructure

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)