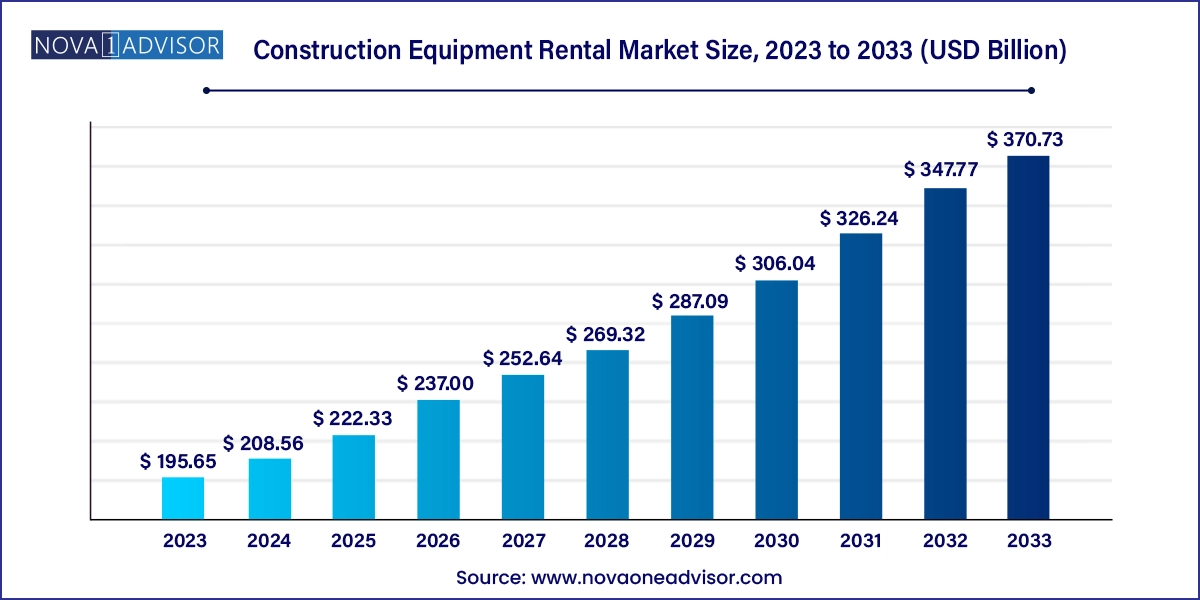

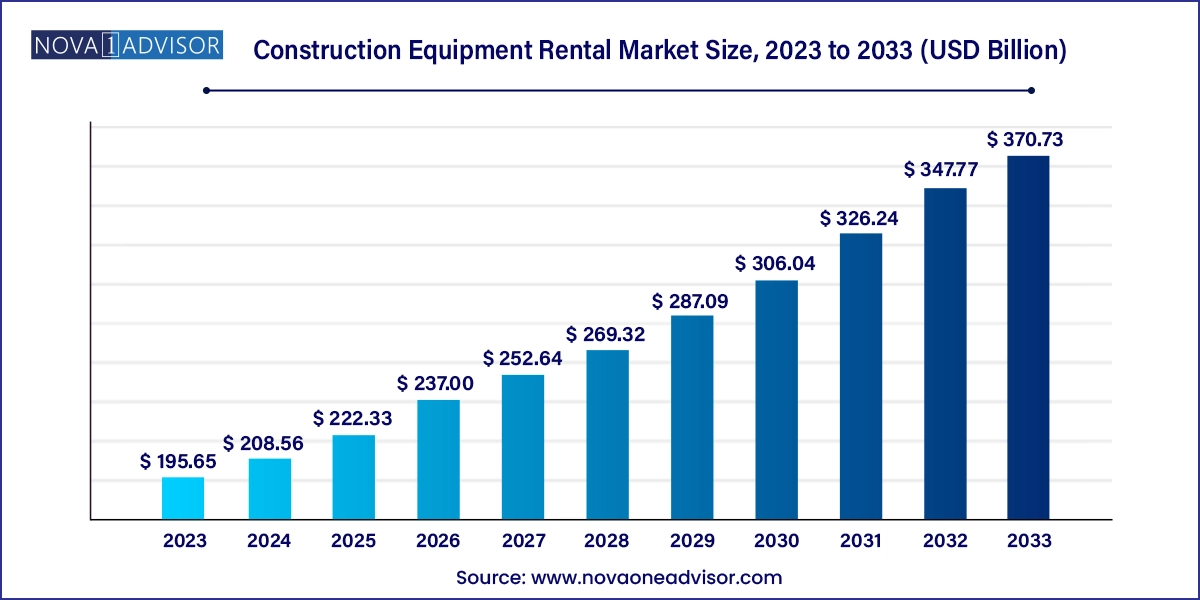

Construction Equipment Rental Market Size and Growth

The global construction equipment rental market size was exhibited at USD 195.65 billion in 2023 and is projected to hit around USD 370.73 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

Construction Equipment Rental Market Key Takeaways:

- The earthmoving machinery segment accounted for a major market share of over 55.76 % in 2023.

- The concrete and road construction machinery segment is anticipated to register a compound annual growth rate of 6.8% from 2023 to 2033.

- Asia Pacific is expected to witness significant growth of 6.3% during the forecast period.

- North America held a market share of 31.3 % in 2023. The region has maintained its dominance in the forecast period.

Market Overview

The Global Construction Equipment Rental Market has emerged as a pivotal force in reshaping the construction ecosystem worldwide. As infrastructure projects grow in complexity and scale, and companies seek more agile and cost-effective operational models, equipment rental has transitioned from being a supplementary option to a strategic necessity. Rental services offer construction firms access to modern machinery without the burden of ownership costs, storage, and long-term maintenance. This shift is enabling even small to medium-sized contractors to participate in large-scale projects competitively.

The market encompasses a range of heavy and compact machinery used in earthmoving, material handling, and concrete road construction. Companies across sectors—including infrastructure development, real estate, mining, and urban utilities—now rely on rental firms to meet project-specific equipment needs. Rental services not only provide access to well-maintained fleets but also offer technical assistance, operator support, and integrated software platforms for machinery tracking.

A growing emphasis on sustainability and emission regulations has also fueled demand for new-generation rental fleets equipped with hybrid engines, telematics, and energy-efficient systems. Rental companies are investing heavily in technology, offering real-time monitoring, predictive maintenance, and digital dashboards to improve uptime and cost-efficiency.

In 2025, the market is driven by the rising pace of global urbanization, governmental infrastructure spending, and the increasing adoption of asset-light business models across construction and allied industries.

Major Trends in the Market

-

Shift Toward Electrified and Hybrid Equipment Rentals

Rental companies are expanding their fleet with electric and low-emission machinery to meet environmental regulations and customer preferences.

-

Telematics and IoT Integration in Rental Fleets

Smart monitoring tools provide insights into equipment usage, fuel consumption, and maintenance schedules, enabling better fleet management.

-

Short-Term and Project-Based Rental Demand Surge

Contractors increasingly prefer short-term rentals tailored to project needs, reducing idle equipment and capital lock-ins.

-

Digital Rental Platforms and Online Booking

Companies are digitizing their operations, enabling customers to browse, book, and track equipment online, similar to an e-commerce model.

-

Rising Preference for Bundled Services

Equipment rental firms are offering packages that include operator training, insurance, on-site servicing, and technical consultation.

-

Expansion into Emerging Construction Markets

Rental businesses are targeting regions in Southeast Asia, Africa, and Latin America where infrastructure development is booming.

-

Mergers and Consolidation to Increase Market Share

Leading players are acquiring regional firms to increase their fleet size, geographical reach, and customer base.

-

Rental Equipment Customization Based on Industry Needs

Industry-specific equipment customization for tunneling, bridge building, or port construction is gaining popularity.

Report Scope of Construction Equipment Rental Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 208.56 Billion |

| Market Size by 2033 |

USD 370.73 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Caterpillar; CNH Industrial N.V.; Doosan Corporation; Escorts Limited; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Deere & Company.; Kobelco Construction Machinery Co., Ltd.; Komatsu Ltd.; Liebherr-International AG; Manitou BF; HÄ°DROMEK; Sany Heavy Industry Co., Ltd.; Sumitomo Heavy Industries, Ltd.; Terex Corporation; Volvo AB; Zoomlion Heavy Industry Science; Technology Co., Ltd |

Key Market Driver: Cost Efficiency and Operational Flexibility

A primary driver accelerating the adoption of rental models in the construction equipment sector is the cost-benefit advantage and enhanced operational flexibility it offers. Construction equipment ownership demands significant capital investment, ongoing maintenance, insurance, and depreciation accounting. For many small to mid-sized contractors, this can restrict financial mobility and limit project scalability.

Rental models eliminate these hurdles. Contractors can procure equipment when and where needed, pay only for usage time, and return machinery once tasks are completed. This model not only improves budgeting accuracy but also aligns with just-in-time project execution methodologies. Furthermore, rentals reduce the risk of technology obsolescence, as fleets are frequently updated and maintained by rental companies.

For instance, a contractor working on a six-month road construction project can rent a fleet of graders, compactors, and pavers instead of purchasing them. This ensures minimal idle machinery after project completion, better resource allocation, and avoidance of costly warehousing or resale challenges.

Key Market Restraint: Logistics and Equipment Downtime Risks

While equipment rental addresses many financial challenges, logistical delays and unexpected downtimes remain major concerns, particularly in high-pressure project environments. Construction schedules are tightly bound, and delays in equipment delivery, malfunction, or availability mismatches can significantly impact project timelines.

Smaller rental providers often lack the digital infrastructure and regional footprint to guarantee rapid replacements or technical support across remote or diverse job sites. Moreover, equipment failure during active use—without immediate technician response or spare availability—can stall operations and result in penalties or cost overruns for contractors.

In developing markets, the problem is compounded by poor transport infrastructure, customs delays (for imported rentals), and lack of standardized rental regulations. These variables can erode the benefits of the rental model unless mitigated by well-structured service-level agreements and digitally enabled logistics systems.

Key Market Opportunity: Rise of Public-Private Infrastructure Projects in Emerging Economies

Emerging economies present a significant opportunity for construction equipment rental providers, driven by government-backed infrastructure expansion and public-private partnerships (PPPs). Countries in Asia, Africa, and Latin America are investing heavily in highways, railways, metro systems, renewable energy plants, and urban development.

These projects demand diverse and high-performance equipment but are often spread across different terrains and operate on tight budgets. The rental model becomes indispensable in such contexts, allowing contractors to access a variety of equipment types without investing in large fleets.

Rental companies that expand into these regions, establish localized service centers, and offer flexible, multilingual, and credit-friendly rental programs will capture significant market share. Moreover, collaboration with government authorities on equipment compliance, operator safety training, and emissions tracking can position them as strategic enablers of sustainable development.

Construction Equipment Rental Market By Product Type Insights

Earthmoving machinery dominated the product segment, as this category includes equipment like excavators, bulldozers, and loaders critical to virtually every construction project. Whether for site clearance, trenching, grading, or excavation, these machines are foundational to initial construction phases. Their high acquisition cost, frequent usage, and need for flexibility make them ideal candidates for rental. Contractors prefer renting earthmoving equipment to match project timelines, avoid idle asset costs, and access the latest fuel-efficient or hybrid models.

Additionally, many rental firms now offer GPS-enabled and AI-monitored earthmoving machines, improving precision and productivity. These digital features provide fleet managers with data on fuel consumption, terrain suitability, operator efficiency, and predictive maintenance.

Material handling machinery is the fastest-growing segment, as modern construction increasingly involves high-volume lifting and transport activities. With high-rise buildings, prefabricated materials, and modular construction gaining traction, cranes, forklifts, and telehandlers are in greater demand. Rental companies offering multi-purpose and space-optimized handling machines attract both small and large contractors. Seasonal construction trends and logistics-based projects, such as port expansion and warehouse building, are also boosting the frequency of rentals in this segment.

The growing trend of leasing automated material handling machines, equipped with sensor-guided systems for safer and more precise operations, is accelerating growth. Operators prefer compact equipment for urban projects and specialized machines for high-capacity logistics hubs.

Construction Equipment Rental Market By Regional Insights

North America dominated the global construction equipment rental market, owing to its mature rental ecosystem, dense urban construction landscape, and strong regulatory support. In the United States and Canada, most contractors, including large EPCs and municipal authorities, rely on rental companies for flexibility and compliance. Moreover, advanced rental platforms, online booking apps, and value-added services like on-site technicians and safety audits have made renting highly efficient.

North American players such as United Rentals and Herc Rentals dominate the regional landscape with expansive fleets, regional hubs, and tailored project consultancy. In fact, in April 2025, United Rentals reported record quarterly revenue, attributing growth to a combination of infrastructure bill-related contracts, new warehouse builds, and upgrades in rental fleet technology (Source: KHL, April 2025).

Asia Pacific is the fastest-growing region, driven by rapid urbanization, manufacturing growth, and an expanding middle class demanding better infrastructure. Countries like India, Indonesia, Vietnam, and the Philippines are seeing a boom in road, airport, and housing construction. Due to tight project budgets, unpredictable terrains, and variable contractor sizes, equipment rental has become a practical and scalable solution.

In markets like China and India, global rental firms are partnering with local operators to establish regional presence, while also introducing cleaner, hybrid equipment to meet new emissions norms. Government initiatives like India's “Gati Shakti” infrastructure plan and Indonesia’s New Capital City development are generating strong rental demand.

Some of the prominent players in the global construction equipment rental market include:

Recent Developments

-

April 2025 – United Rentals announced a record-breaking Q1 revenue driven by growing infrastructure projects and a 12% increase in high-demand equipment categories like excavators and material lifters. The company is expanding its electric fleet and AI-integrated fleet management tools.

-

March 2025 – Ashtead Group (Sunbelt Rentals) launched an AI-enabled logistics dashboard for fleet optimization across U.S. and UK operations, reducing idle time by 18% and improving customer delivery accuracy.

-

February 2025 – Nishio Rent All announced new partnerships with Japanese OEMs to supply electric mini-excavators and compact track loaders for rental clients in Southeast Asia.

-

January 2025 – Loxam Group completed acquisition of a regional mid-sized equipment rental firm in Spain, expanding its European market share and service center network.

-

March 2025 – Aktio Corporation in Southeast Asia launched a subscription-based rental model for small contractors, including flexible terms and bundled insurance.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global construction equipment rental market

Product

- Earth Moving Machinery

- Material Handling Machinery

- Concrete and Road Construction Machinery

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa