Continuous Glucose Monitoring (CGM) Devices Market Size and Trends

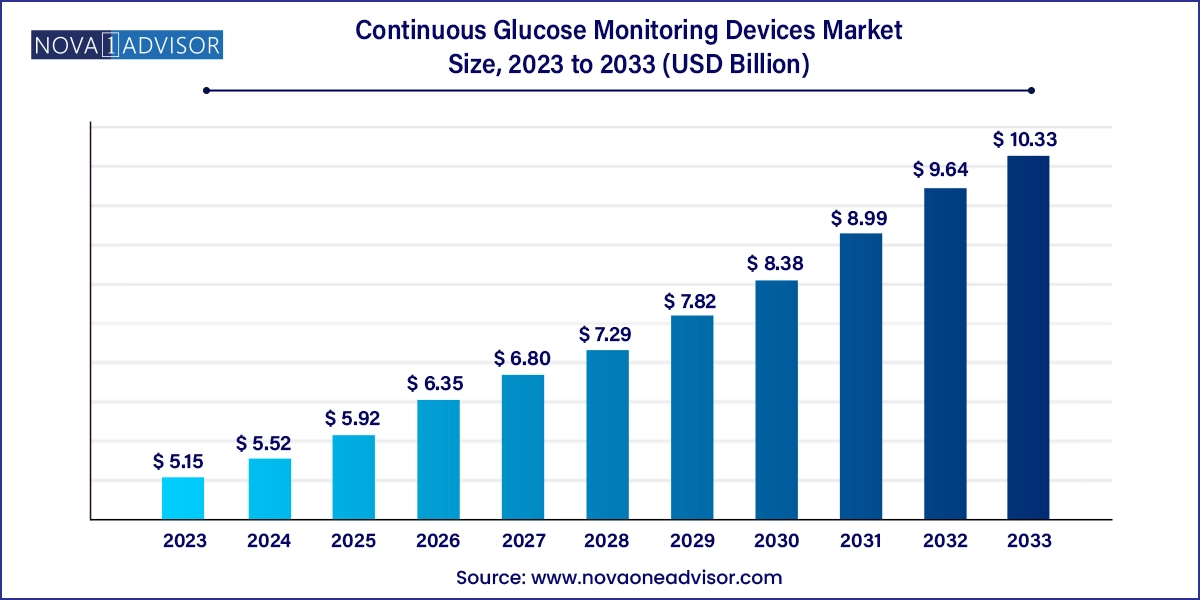

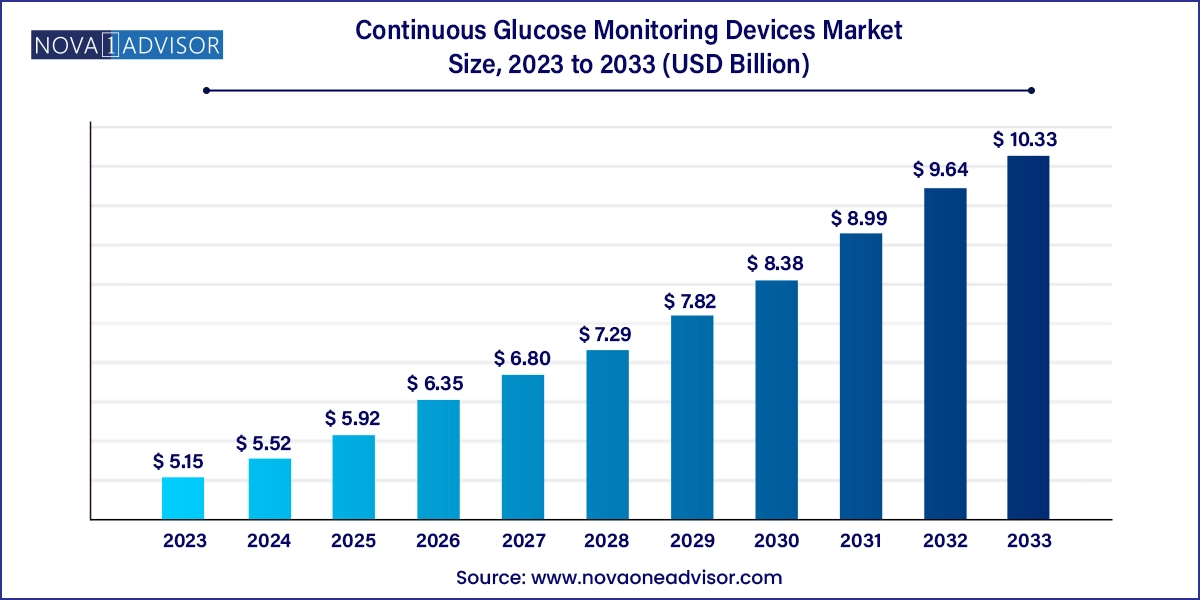

The continuous glucose monitoring devices market size was exhibited at USD 5.15 billion in 2023 and is projected to hit around USD 10.33 billion by 2033, growing at a CAGR of 7.21% during the forecast period 2024 to 2033.

Continuous Glucose Monitoring Devices Market Key Takeaways:

- Based on the components, the sensors segment led the market with the largest revenue share of 40.66% in 2023.

- The transmitters segment is expected to witness the highest CAGR of 7.83% during the forecast period.

- Based on the connectivity, the Bluetooth segment led the market in 2023 with the largest revenue share of 59.63%.

- The 4G network segment is experiencing fastest CAGR of 7.75% during the forecast period.

- Based on the end-use, the homecare segment led the market with a largest revenue share of 46.7% in 2023 and is anticipated to witness the highest CAGR of 7.73% during the forecast period.

- The hospital segment accounted for the significant market share in 2023

- The North America region captured the largest market share of 38.66% in 2023.

- The U.S. continuous glucose monitoring devices market has captured almost 85% of the North America market shares in 2023.

Market Overview

The Continuous Glucose Monitoring (CGM) devices market is witnessing a transformative shift driven by increasing diabetes prevalence, technological innovations, and a heightened demand for personalized health management. These devices provide real-time blood glucose readings by measuring interstitial glucose levels, offering a significant improvement over traditional blood glucose meters which rely on intermittent finger-prick blood samples. As diabetes becomes a global public health crisis—with the International Diabetes Federation reporting over 537 million adults living with diabetes globally as of 2021—the CGM market has become an integral part of diabetes management strategies.

Unlike traditional glucometers, CGMs offer continuous feedback, which enables users and healthcare providers to proactively manage glucose fluctuations. This leads to improved glycemic control, reduced incidence of hypoglycemia, and better quality of life for patients. The growing demand for minimally invasive or non-invasive glucose monitoring solutions has encouraged both startups and established medical technology companies to invest heavily in CGM R&D, boosting the innovation pipeline.

Government initiatives promoting diabetes awareness, favorable reimbursement policies in developed economies, and growing health consciousness among consumers are adding fuel to market expansion. Moreover, CGM is increasingly being integrated with insulin pumps and artificial pancreas systems, paving the way for fully automated diabetic care.

Major Trends in the Market

-

Integration with Insulin Pumps and Artificial Pancreas: Leading companies are working towards integrating CGM with closed-loop insulin delivery systems for real-time, automated insulin dosing.

-

Rise of Wearable Health Tech: Growing consumer preference for wearable, comfortable, and user-friendly devices has led to the development of compact and discreet CGM patches and sensors.

-

Cloud-Based Data Analytics: The inclusion of cloud connectivity and AI for remote patient monitoring and predictive analytics is transforming CGM into a digital health solution.

-

Personalized Medicine: The use of CGM data to customize treatment plans and dietary choices has gained traction among both healthcare providers and fitness enthusiasts.

-

Adoption in Non-Diabetic Populations: There is a rising trend of CGM usage among athletes and biohackers who monitor glucose levels for performance and wellness purposes.

-

Regulatory Support and Reimbursement: Expanded insurance coverage and faster FDA approvals are lowering barriers to CGM adoption.

-

Miniaturization of Components: Advances in microelectronics have enabled manufacturers to shrink sensors and transmitters without compromising on performance.

Report Scope of Continuous Glucose Monitoring Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.52 Billion |

| Market Size by 2033 |

USD 10.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.21% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Connectivity, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; China; India; Japan; Thailand; South Korea; Australia; Mexico; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

| Key Companies Profiled |

Abbott; Medtronic; Boston Scientific Corporation; Terumo Corporation; B Braun Melsungen AG; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical |

Market Driver: Rising Diabetes Prevalence

One of the most compelling drivers for the CGM market is the surging global diabetes burden. According to the World Health Organization, diabetes was the ninth leading cause of death in 2019, with type 2 diabetes accounting for the majority of cases. Sedentary lifestyles, rising obesity rates, and aging populations are fueling this epidemic. Continuous glucose monitoring has emerged as a frontline tool for mitigating this burden, offering a preventive and proactive approach to disease management.

Unlike traditional monitoring systems that provide a single snapshot in time, CGMs track glucose fluctuations throughout the day and night, offering granular data that empowers users to modify behaviors, adjust medications, and prevent emergencies. This level of control is especially beneficial for type 1 diabetes patients and insulin-dependent type 2 diabetics, thus boosting the demand for CGM systems across healthcare settings.

Market Restraint: High Cost of Devices and Limited Accessibility

Despite their clinical value, the high cost of CGM devices remains a significant barrier, particularly in low- and middle-income countries. Initial purchase costs, recurring expenses for sensors (which often require replacement every 7 to 14 days), and limited reimbursement in some regions constrain broader adoption. Moreover, rural and underserved populations often lack access to specialized diabetes care and advanced medical technologies.

Even in developed nations, insurance policies may not uniformly cover all CGM brands or components, leading to out-of-pocket expenses that deter potential users. This disparity in access and affordability underscores the need for policy interventions, price competition, and innovations that reduce manufacturing costs without compromising accuracy.

Market Opportunity: Expansion into Preventive and Wellness Applications

An emerging opportunity for the CGM market lies beyond diabetic populations. Fitness enthusiasts, endurance athletes, and individuals interested in metabolic health are adopting CGMs to optimize nutrition, sleep, and physical performance. Companies like Levels Health and NutriSense have capitalized on this trend by offering CGM-based wellness programs that do not require a diabetes diagnosis.

The growing popularity of biohacking and personalized health analytics has created a new niche market where users monitor glucose responses to food, stress, and exercise. This wellness-focused segment offers a massive untapped customer base, especially in markets with high disposable income and health consciousness. Strategic marketing, partnerships with fitness influencers, and app-based subscription services are key levers to unlock this opportunity.

Continuous Glucose Monitoring Devices Market By Component Insights

Sensors form the most crucial and consumable part of any CGM system, and they dominated the market share in 2023. These tiny devices are inserted under the skin to continuously measure glucose levels in interstitial fluid. Because sensors need to be replaced frequently—ranging from every 7 days to 14 days depending on the brand—they represent a recurring source of revenue for manufacturers. Dexcom’s G6 and Abbott’s FreeStyle Libre sensors are prime examples of how this sub-segment drives sustained customer engagement and brand loyalty.

Moreover, advancements in sensor technology have enabled the development of long-wear and factory-calibrated models that eliminate the need for finger-prick calibration. These features enhance patient comfort and compliance, contributing to their widespread adoption. The segment is also benefiting from miniaturization and biocompatible materials that reduce irritation and improve wearability.

Transmitters Fastest Growing Due to Enhanced Wireless Communication

While sensors are the revenue backbone, the transmitter segment is witnessing the fastest growth due to increasing demand for wireless communication and integration capabilities. Transmitters are responsible for collecting data from sensors and wirelessly sending it to receivers or smartphones. With the rise of connected healthcare, transmitters are evolving rapidly, integrating Bluetooth Low Energy (BLE) and even 4G LTE for real-time data sharing with caregivers and healthcare professionals.

Leading companies are now embedding transmitters within wearable patches or integrating them directly with insulin pumps to reduce the burden on the user. The increasing trend of remote patient monitoring, especially post-COVID, is further accelerating innovation and demand in this segment.

Continuous Glucose Monitoring Devices Market By Connectivity Insights

Bluetooth-based CGM devices dominated the connectivity segment due to their universal compatibility with smartphones, tablets, and wearables. Bluetooth technology allows real-time data transmission, alerts for hypoglycemia or hyperglycemia, and seamless integration with mobile health apps. Most leading CGM devices, including the Dexcom G7 and FreeStyle Libre 3, utilize Bluetooth connectivity as a standard feature.

Bluetooth-enabled CGMs are particularly appealing to younger, tech-savvy populations who value mobile-based health tracking. Moreover, their ability to function offline (without the need for cellular data) makes them reliable in low-connectivity regions, enhancing their global usability.

4G Connectivity is Growing Fast with Remote Patient Monitoring

While Bluetooth is widely adopted, 4G-enabled CGM devices are emerging rapidly, especially in clinical and institutional settings. These systems offer cloud-based data transfer, making them ideal for remote patient monitoring and telehealth services. 4G connectivity ensures seamless, high-speed communication without relying on a paired mobile device, which is advantageous in elder care, ICU settings, and remote diagnostics.

With hospitals increasingly investing in IoT and cloud infrastructure, the use of 4G-connected CGMs in multi-patient monitoring setups is expected to surge. The ability to monitor multiple patients in real-time across geographies makes 4G connectivity a strategic asset in the post-pandemic world.

Continuous Glucose Monitoring Devices Market By End-use Insights

Hospitals remained the dominant end-user of CGM devices, accounting for the largest market share in 2024. Inpatient and emergency care settings require continuous monitoring of diabetic patients to prevent acute complications like diabetic ketoacidosis or severe hypoglycemia. CGMs offer a reliable and non-invasive method to track glucose levels without frequent blood draws, which is especially useful in ICU settings.

Additionally, CGMs in hospitals help clinicians assess patient response to insulin therapy, adjust medication doses dynamically, and reduce nursing workload. Institutional adoption is also supported by better insurance coverage and bulk procurement policies.

Homecare Settings Are the Fastest Growing End-Use Segment

The homecare segment is witnessing the fastest growth owing to the increasing trend of self-management and telemedicine. Users are adopting CGM systems that sync with mobile apps, allowing them to manage their condition independently. This is especially relevant in aging populations who prefer home-based care over institutional visits.

Companies have responded with user-friendly CGM devices that are easy to apply and operate, making them ideal for non-clinical environments. Subscription models, mobile support, and AI-based insights have made CGM adoption at home both accessible and empowering.

Continuous Glucose Monitoring Devices Market By Regional Insights

North America, particularly the United States, holds the dominant share of the global CGM market. The region benefits from early adoption of medical technologies, robust healthcare infrastructure, and favorable reimbursement policies. As of 2024, the U.S. Food and Drug Administration (FDA) has approved several CGM systems including the Dexcom G7 and Abbott’s FreeStyle Libre 3, facilitating broad market access.

Furthermore, high awareness about diabetes management and a strong focus on digital health integration have propelled CGM adoption. Government-backed initiatives such as Medicare’s inclusion of CGMs under durable medical equipment have enhanced affordability for senior citizens.

The Asia Pacific region is poised to witness the fastest CAGR over the forecast period, driven by the rising prevalence of diabetes in densely populated nations like India and China. Increasing disposable income, rapid urbanization, and government campaigns to promote diabetes screening are catalyzing the market’s growth.

For instance, India’s National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) includes mass awareness campaigns that indirectly support CGM market penetration. Additionally, local players are emerging with cost-effective CGM solutions tailored for regional needs, expanding access beyond urban centers.

Continuous Glucose Monitoring Devices Market Recent Developments

-

Dexcom Inc. (January 2025): Dexcom received FDA clearance for its Dexcom G7, which features a 30-minute warm-up time and integrated smartphone alerts, enhancing convenience for users.

-

Abbott Laboratories (February 2025): Abbott announced a strategic partnership with WeightWatchers to expand the use of FreeStyle Libre 3 in wellness and metabolic health tracking beyond diabetic populations.

-

Medtronic (March 2025): Medtronic launched the Guardian 4 CGM sensor in select European markets with a 14-day wear time and real-time alarms, aiming for a broader rollout later this year.

-

Senseonics Holdings (April 2025): Senseonics reported a 22% quarterly revenue increase due to higher adoption of Eversense E3, the only implantable CGM sensor approved for 180-day wear.

Some of the prominent players in the continuous glucose monitoring devices market include:

- Dexcom, Inc.

- Abbott

- Medtronic

- Ypsomed AG

- Senseonics Holdings, Inc.

- A. Menarini Diagnostics S.r.l.

- Signos, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the continuous glucose monitoring devices market

Component

- Transmitters

- Sensors

- Receivers

Connectivity

End-use

- Hospitals

- Homecare Settings

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa