Coronary Stents Market Size and Research

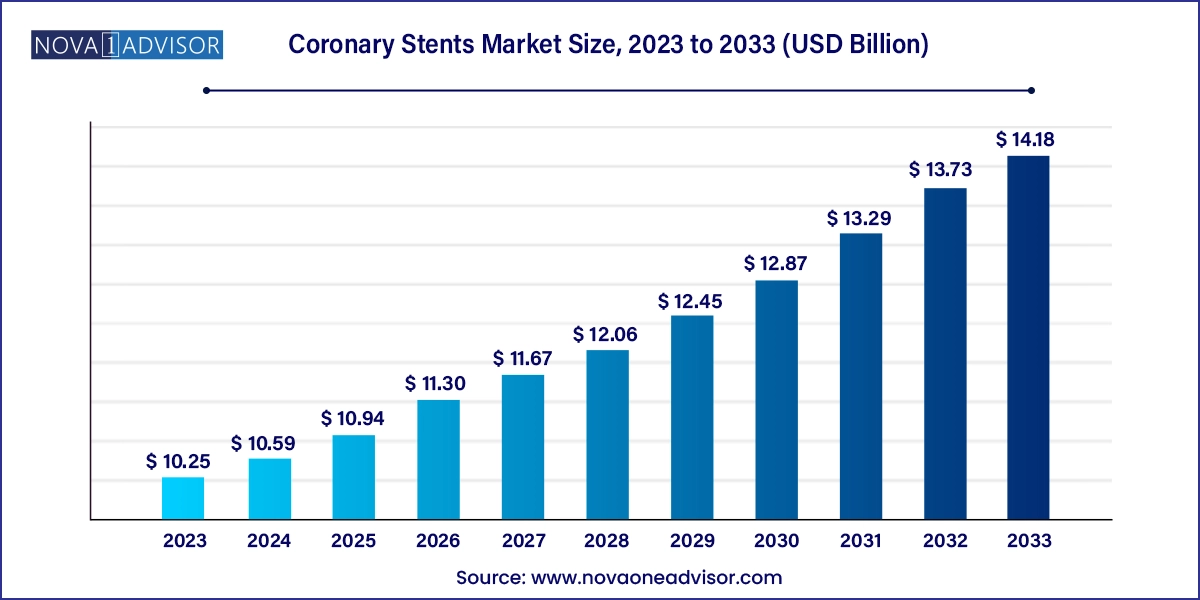

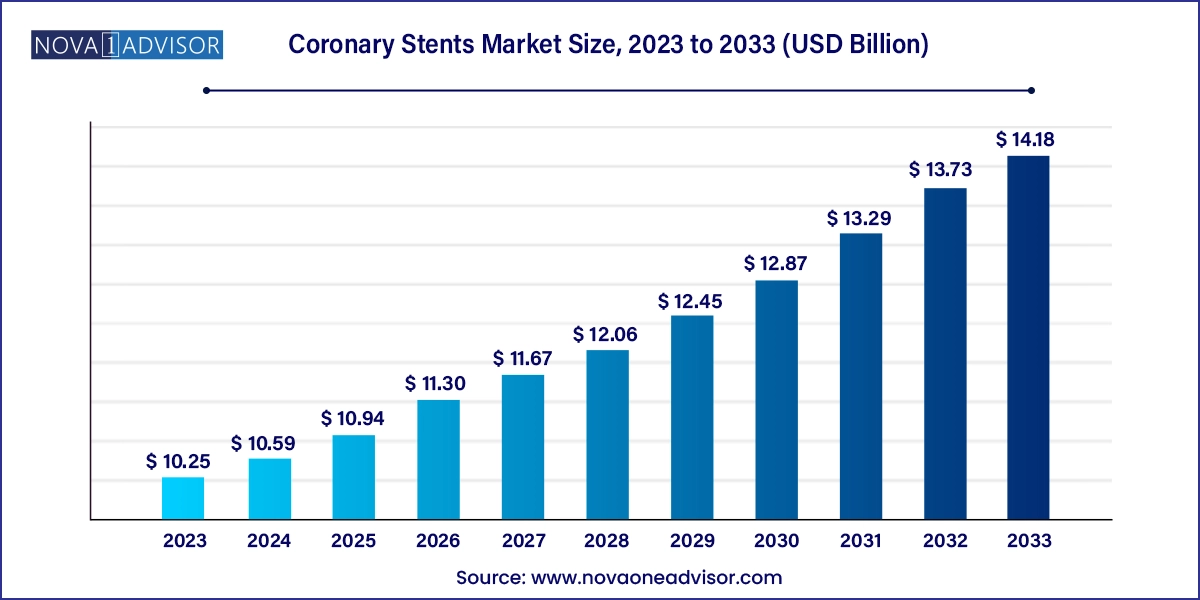

The coronary stents market size was exhibited at USD 10.25 billion in 2023 and is projected to hit around USD 14.18 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2024 to 2033.

Coronary Stents Market Key Takeaways:

- The Drug-Eluting Stents (DES) segment dominated the market for coronary stents and held the largest revenue share of 66.5% in 2023.

- North America dominated the coronary stents market and accounted for the largest revenue share of 32.6% in 2023

- The Asia Pacific market for coronary stents is expected to exhibit the fastest growth rate in terms of revenue generation.

Market Overview

The coronary stents market is a vital segment within the broader cardiovascular devices landscape, playing a pivotal role in the management and treatment of coronary artery disease (CAD)—the leading cause of death worldwide. Coronary stents are small, mesh-like tubes implanted in narrowed or blocked coronary arteries to restore blood flow to the heart muscle, often following procedures such as percutaneous coronary intervention (PCI) or angioplasty.

With the global rise in obesity, diabetes, hypertension, and sedentary lifestyles, the incidence of CAD has grown alarmingly, especially in aging populations and emerging economies. In response, demand for safe, effective, and technologically advanced stent solutions has increased sharply. This has triggered continuous innovation in stent design and materials—from bare metal stents (BMS) to drug-eluting stents (DES), and most recently to bioresorbable vascular scaffolds (BVS), which disappear after healing the artery.

The market is driven by several forces, including a rise in minimally invasive procedures, advancements in stent coatings and drug delivery mechanisms, and the development of next-generation biodegradable and polymer-free stents. Key global players are investing heavily in clinical trials, product innovation, and strategic mergers and acquisitions to maintain market leadership.

Coronary stents are now regarded as essential components in cardiology, not just for life-saving emergency interventions but also for elective surgeries and long-term management of angina and ischemic heart disease. As healthcare systems pivot toward value-based care and patient-centric outcomes, the coronary stents market is poised for robust growth through 2030 and beyond.

Major Trends in the Market

-

Shift from Bare Metal to Drug-Eluting Stents (DES): DES now dominate due to their lower restenosis rates and improved clinical outcomes.

-

Growing Adoption of Biodegradable Stents: These stents reduce long-term risks such as inflammation and late thrombosis and are gaining regulatory momentum.

-

Emergence of Polymer-Free DES: To address long-term safety concerns, manufacturers are designing stents that eliminate durable polymers while maintaining controlled drug release.

-

Technological Innovation in Stent Materials: Cobalt-chromium and platinum-chromium alloys are replacing stainless steel for better flexibility, visibility, and deliverability.

-

Use of AI and Imaging for Stent Placement: Integration of intravascular ultrasound (IVUS), OCT (optical coherence tomography), and AI-guided placement is enhancing procedural success.

-

Rise in Outpatient and Ambulatory PCI Centers: Minimally invasive nature of PCI with stent placement is shifting care from hospitals to ambulatory surgical centers (ASCs).

-

Market Consolidation and M&A Activity: Companies are expanding their cardiovascular portfolios through strategic acquisitions to strengthen market reach and technology capabilities.

-

Increased Focus on Emerging Markets: Asia-Pacific and Latin America are witnessing aggressive market entry strategies due to the growing burden of cardiovascular diseases and improving healthcare access.

Report Scope of Coronary Stents Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10.59 Billion |

| Market Size by 2033 |

USD 14.18 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

| Key Companies Profiled |

Abbott; Medtronic; Boston Scientific Corporation; Terumo Corporation; B Braun Melsungen AG; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical |

Market Driver: Rising Global Prevalence of Coronary Artery Disease

The surging prevalence of coronary artery disease (CAD) is the most significant driver propelling the coronary stents market forward. CAD is primarily caused by the buildup of plaque in the coronary arteries, leading to narrowed arteries and reduced blood flow, which may result in angina, myocardial infarction, and heart failure. The condition is not only widespread in high-income countries but is increasingly prevalent in developing nations due to lifestyle shifts.

According to the World Health Organization, 17.9 million people die annually from cardiovascular diseases (CVDs), with CAD being the leading contributor. This growing health burden has led to an uptick in PCI procedures worldwide. The need for revascularization therapies has increased among aging populations with multiple comorbidities, creating a constant demand for coronary stents that provide both durability and bio-compatibility.

Additionally, technological advancements have made PCI and stenting safer, more accessible, and suitable for a wider patient population, further amplifying global adoption.

Market Restraint: Product Recalls and Post-Procedure Complications

While coronary stents have revolutionized CAD management, the market is not without its challenges. A major restraint is the risk of complications associated with stent implantation, including late stent thrombosis, restenosis, allergic reactions to polymers, and long-term inflammation. Despite improvements in stent technology, no product is entirely free from risks, particularly in high-risk patients or those with complex lesions.

Moreover, product recalls due to manufacturing defects or clinical safety concerns negatively impact market sentiment and confidence. For instance, concerns about scaffold collapse in early-generation bioresorbable stents led to multiple product withdrawals in recent years. These safety concerns necessitate rigorous testing, longer clinical trials, and cautious regulatory approvals, which can delay product launches and limit market growth.

Liability issues and stringent regulatory scrutiny, particularly from agencies like the FDA and EMA, add further complexity to the stent development and commercialization pipeline.

Market Opportunity: Advancement in Bioresorbable Vascular Scaffold (BVS) Technology

A significant market opportunity lies in the advancement of bioresorbable vascular scaffolds (BVS) stents that naturally dissolve in the body after supporting the artery during the healing process. Unlike traditional metal stents that remain permanently, BVS provide temporary mechanical support and drug delivery, then degrade into harmless by-products, reducing long-term complications such as late thrombosis or chronic inflammation.

Although early BVS products faced safety issues, next-generation scaffolds made from magnesium alloys and novel polymers are under clinical evaluation and are showing promising results in terms of strength, flexibility, and safety profiles. Companies that succeed in optimizing the balance between bioresorbability and mechanical support will unlock a new frontier in coronary interventions.

This technology has particular appeal for younger patients and those requiring repeat interventions, and as awareness of its benefits grows, demand is expected to rise. Regulatory approvals and favorable outcomes from long-term trials could position BVS as the next big leap in interventional cardiology.

Coronary Stents Market By Product Insights

Drug-Eluting Stents (DES) dominate the coronary stents market, accounting for the largest share due to their superior clinical outcomes, particularly in reducing restenosis rates compared to bare metal stents. DES are coated with antiproliferative drugs (e.g., sirolimus, everolimus, zotarolimus) that inhibit neointimal growth, ensuring longer patency. Most DES now feature biocompatible or biodegradable polymers, offering enhanced healing and fewer complications.

Within DES, biodegradable stents are the fastest-growing sub-segment, as they address long-term safety issues associated with permanent implants. They degrade over time, reducing the risk of late-stage thrombosis and allowing for better vascular remodeling. While still under regulatory scrutiny, these stents represent the future of PCI and are being increasingly studied in clinical trials across Europe and Asia.

Bare Metal Stents (BMS) still retain some utility, particularly in regions with limited access to DES or in patients where prolonged dual antiplatelet therapy is contraindicated. However, their use has dramatically declined.

Bioresorbable vascular scaffolds (BVS) are gaining renewed interest as newer, safer materials enter the market. They represent a frontier in stent technology with the potential to replace conventional stents over the next decade, contingent upon improved clinical outcomes.

Coronary Stents Market By Regional Insights

North America leads the coronary stents market, supported by its advanced healthcare infrastructure, high procedural volumes, and rapid adoption of innovative medical technologies. The United States alone performs over 1 million PCI procedures annually, creating a robust demand for both DES and neurovascular innovations. A well-established reimbursement system, coupled with high patient awareness and availability of specialized cardiologists, further supports regional dominance.

In addition, North America is home to key industry leaders such as Abbott Laboratories, Boston Scientific, and Medtronic, which consistently launch next-gen stents with enhanced drug coatings, flexible delivery systems, and digital integration. Regulatory bodies like the FDA play a crucial role in shaping clinical guidelines, ensuring that only high-efficacy, safe stents enter the market.

Asia-Pacific is the fastest-growing market, fueled by rising incidences of CAD, increasing healthcare expenditure, and rapidly improving access to advanced cardiovascular care in countries such as China, India, Japan, and South Korea. This region is undergoing rapid urbanization and lifestyle shifts, resulting in a sharp rise in metabolic syndromes and related heart conditions.

Government initiatives to expand healthcare infrastructure, coupled with favorable reimbursement schemes for interventional procedures, are attracting global and domestic manufacturers. India and China have also emerged as manufacturing hubs for cost-effective stents, boosting regional production capacity and making stents more affordable for local populations.

The high patient population, untapped rural markets, and evolving regulatory landscape position Asia-Pacific as a strategic focus for both multinational and local market players.

Some of the prominent players in the coronary stents market include:

Recent Developments

-

April 2025: Abbott Laboratories announced CE mark approval for its next-generation Xience Skypoint™ drug-eluting stent, featuring enhanced deliverability for complex anatomies.

-

February 2025: Medtronic initiated a global Phase III trial for its biodegradable polymer DES, designed to fully resorb within 12 months while maintaining drug efficacy.

-

December 2024: Boston Scientific acquired a controlling interest in a Chinese stent manufacturer to expand its market presence in Asia-Pacific and enhance local production capabilities.

-

October 2024: Biotronik launched its Orsiro Mission DES in India and Southeast Asia, targeting emerging markets with a focus on affordability and precision delivery.

-

July 2024: Terumo Corporation received PMDA approval in Japan for its new Ultimaster Tansei biodegradable stent, which is expected to reduce long-term adverse events in diabetic patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the coronary stents market

Product

- Bare Metal Stents (BMS)

- Drug-Eluting Stents (DES)

-

- Biodegradable

- Non-Biodegradable

- Bioresorbable Vascular Scaffold

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa