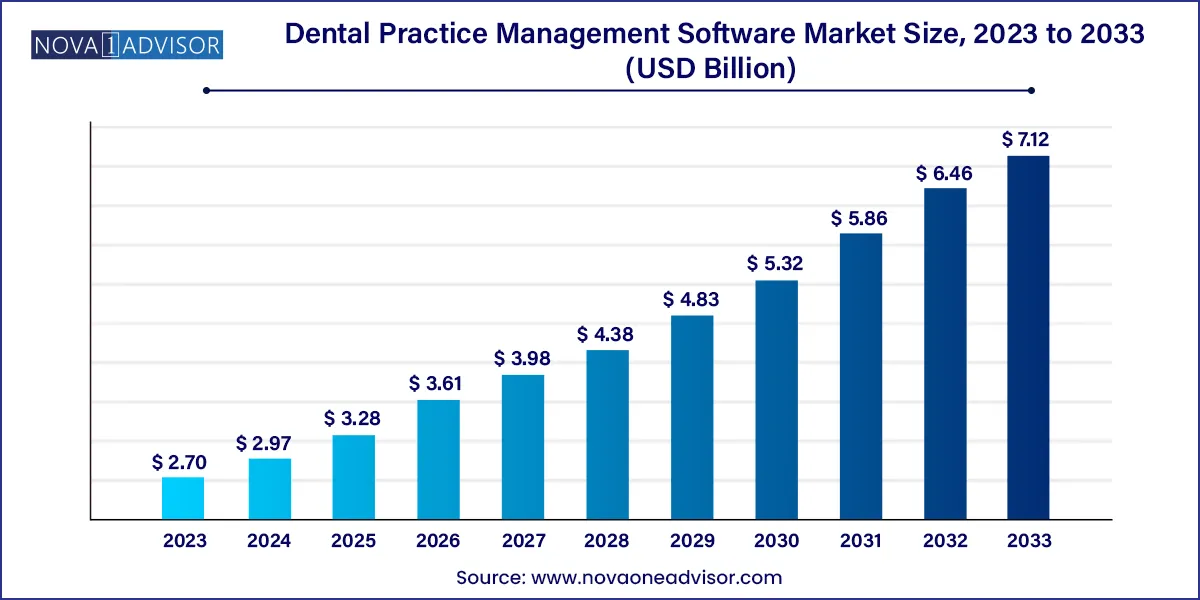

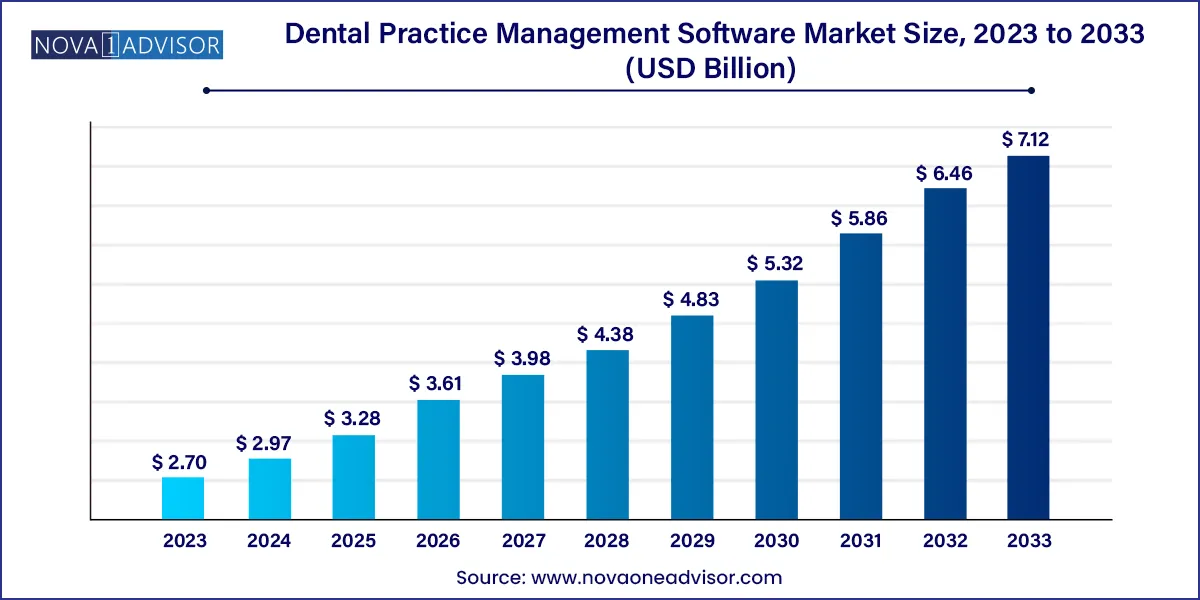

The global dental practice management software market size was exhibited at USD 2.70 billion in 2023 and is projected to hit around USD 7.12 billion by 2033, growing at a CAGR of 10.18% during the forecast period 2024 to 2033.

Key Takeaways:

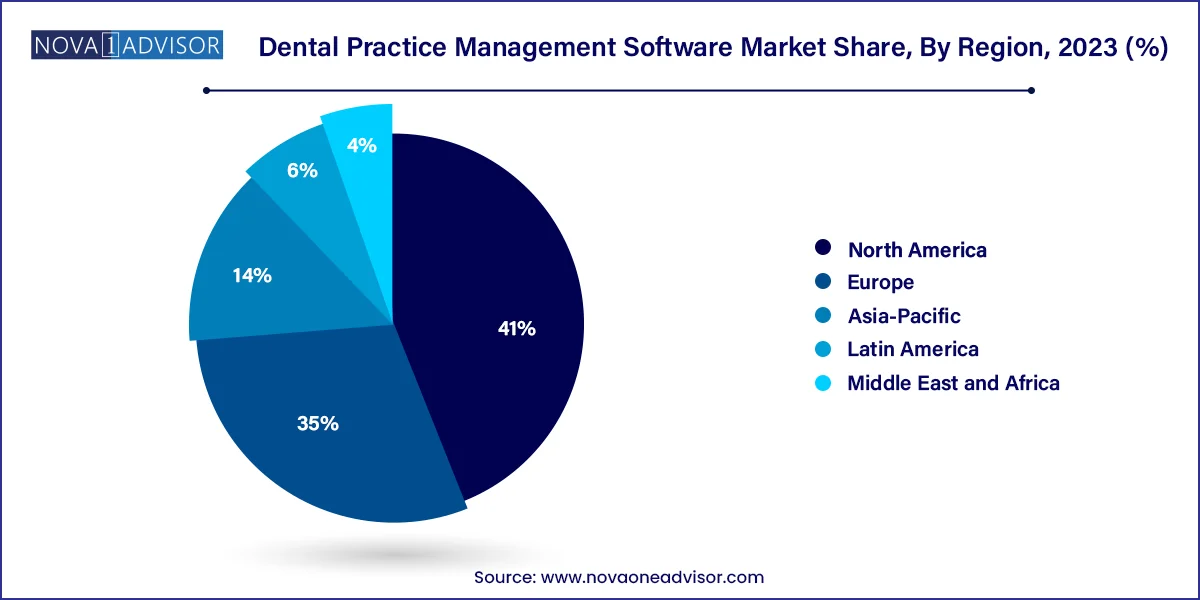

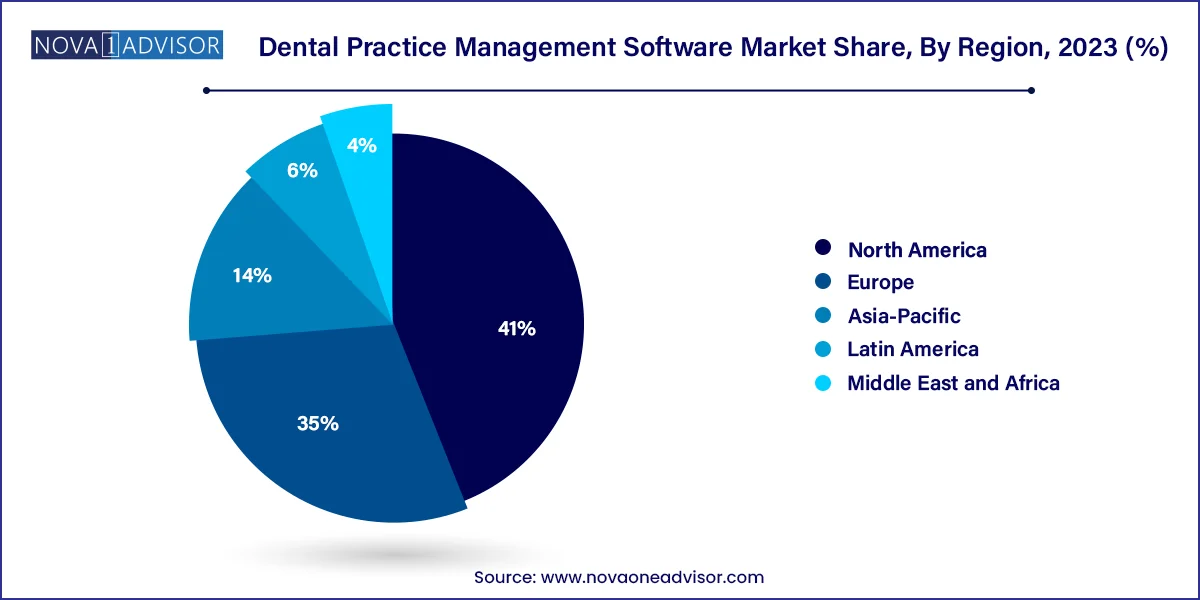

- North America dominated the market with the revenue share of 41.0% in 2023.

- Based on deployment mode, the web-based segment held the market with the largest revenue share of 56.3% in 2023.

- Based on application, the insurance management segment led the market with the largest revenue share of 22.18% in 2023.

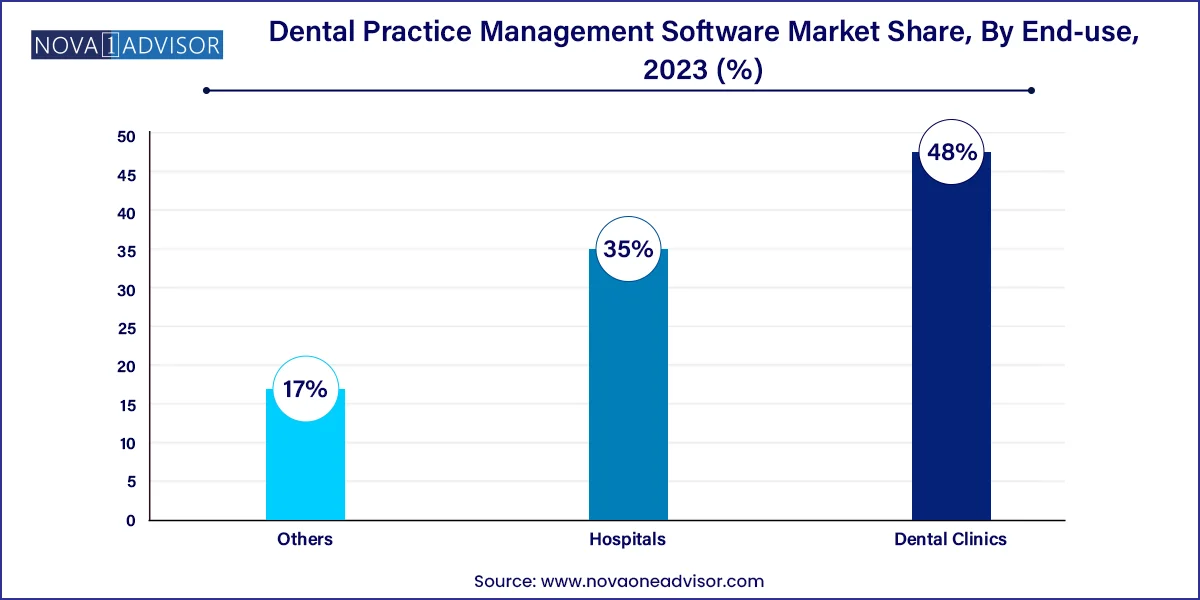

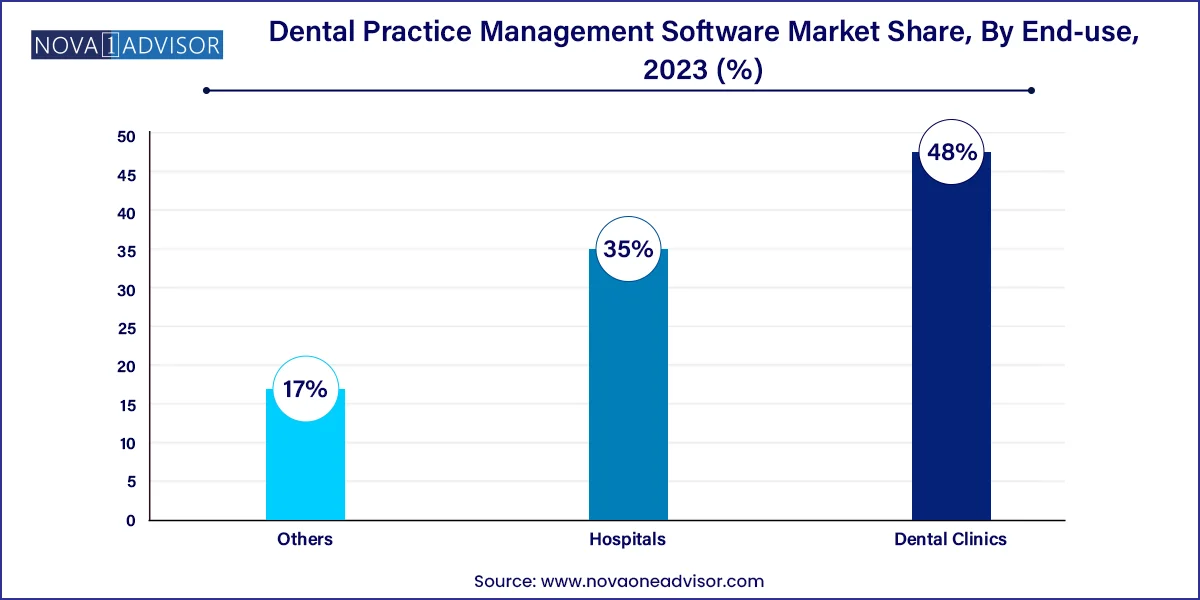

- Based on end-use, the dental clinics segment led the market with the largest revenue share of 48.0% in 2023.

Market Overview

The Dental Practice Management Software (DPMS) market has emerged as a vital enabler of operational efficiency and enhanced patient care in the rapidly evolving dental healthcare sector. This specialized category of health information technology (HIT) is designed to streamline the administrative, clinical, and financial aspects of dental practices, making workflows smoother and more integrated. With growing patient volumes, complex billing structures, rising insurance claims, and the increasing importance of personalized patient engagement, the demand for sophisticated software solutions in dental settings has significantly accelerated.

DPMS solutions offer a range of functionalities—from scheduling and patient record management to treatment charting, insurance processing, and revenue cycle management. These systems not only simplify back-office processes but also improve patient satisfaction by reducing wait times, facilitating easy communication, and enabling access to dental history and imaging. Integration with digital radiography, analytics, and cloud-based storage has further positioned these platforms as indispensable tools for both solo practitioners and large dental chains.

Technological convergence with cloud computing, artificial intelligence (AI), and telehealth tools is reshaping how dentists manage their practices. The global trend toward digitization in healthcare, coupled with supportive regulations and rising oral health awareness, continues to drive market growth. As dental service providers prioritize efficiency, patient engagement, and compliance, the DPMS market is poised to expand substantially over the coming years.

Major Trends in the Market

-

Shift Toward Cloud-Based and SaaS Models: Dental practices are increasingly migrating from legacy systems to cloud-based platforms for scalability, remote access, and reduced IT maintenance.

-

Integration with AI and Analytics: AI-powered analytics tools are helping dentists personalize treatments, predict patient behavior, and optimize resource utilization.

-

Tele-dentistry Integration: Remote consultations and virtual follow-ups have prompted DPMS vendors to embed telehealth features.

-

Mobile Accessibility: Mobile-compatible DPMS interfaces enable dentists and staff to manage schedules and review records on the go.

-

All-in-One Platforms: Practices are preferring unified systems that combine scheduling, billing, imaging, and patient communication within a single platform.

-

Increased Adoption Among Small and Solo Practices: As affordable cloud options proliferate, even small clinics are investing in DPMS for competitive advantage.

-

Regulatory Compliance Focus: New HIPAA and GDPR guidelines are prompting vendors to emphasize data privacy and secure system architectures.

Dental Practice Management Software Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.70 billion |

| Market Size by 2033 |

USD 7.12 billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.18% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Deployment Mode, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

CareStack (Good Methods Global Inc.); CD Newco; LLC (Curve Dental); Dentiflow; Dental Intelligence, Inc; Jarvis Analytics; Practice Analytics; ABELMed Inc. |

Key Market Driver: Growing Demand for Operational Efficiency in Dental Practices

A significant driver of the global dental practice management software market is the growing demand for streamlined operations and improved clinical efficiency. With patient expectations rising and administrative workloads increasing, dental clinics are under pressure to modernize their workflows without compromising patient experience. DPMS platforms address this need by automating routine tasks, reducing human errors, and providing real-time data visibility.

For example, rather than using paper charts and appointment books, modern clinics can schedule appointments online, send automated reminders to reduce no-shows, and instantly retrieve medical histories. Integrated billing and insurance processing modules allow seamless claims management, minimizing revenue leakage. Moreover, by digitizing these tasks, staff can focus more on patient interaction, which enhances satisfaction and retention. This operational leap is particularly valuable for multi-location practices that require centralized control and standardized processes across branches.

Key Market Restraint: High Initial Cost and Training Barriers

Despite clear advantages, the high initial implementation costs and training requirements associated with advanced DPMS platforms act as a significant barrier to adoption, especially for small and mid-sized dental practices. While cloud-based models have eased the financial burden to some extent, many practices still perceive comprehensive solutions as costly due to licensing fees, customization charges, hardware upgrades, and staff retraining.

Moreover, the learning curve involved in transitioning from paper-based systems or basic scheduling tools to robust, multifunctional software can disrupt daily operations during the initial phase. In regions with low digital literacy or inadequate IT support, the risk of failed adoption remains a concern. Thus, vendors must invest in onboarding support, intuitive UI/UX design, and flexible pricing models to widen their market reach.

Key Market Opportunity: Expansion in Emerging Economies Through Cloud-Based Offerings

One of the most promising opportunities for the DPMS market lies in the growing demand for digitized dental services in emerging markets, particularly in Asia-Pacific, Latin America, and parts of the Middle East and Africa. These regions are witnessing a rise in dental tourism, increasing disposable income, and expanding private dental chains, creating fertile ground for software adoption.

Cloud-based and subscription-based models offer a strategic entry point into these markets, enabling practices to adopt cutting-edge technology without substantial upfront investment. Moreover, localized interfaces, language support, and mobile-first designs can attract independent clinics in urban and semi-urban settings. With growing awareness of oral health and governmental investments in digital healthcare infrastructure, these markets present immense potential for DPMS vendors to expand their footprint.

Segments Insights:

Deployment Mode Insights

Cloud-based deployment currently dominates the global DPMS market, accounting for the largest share due to its scalability, cost-efficiency, and ease of remote access. These solutions require minimal hardware investments and offer automatic updates, making them attractive for dental clinics that lack dedicated IT teams. With rising demand for work-from-anywhere models and the growing acceptance of remote data access, cloud-based DPMS platforms like Curve Dental, Dentrix Ascend, and CareStack have experienced accelerated adoption.

Furthermore, cloud-based systems support secure data backup and facilitate multi-site practice management, critical for growing dental service organizations (DSOs). Their monthly subscription model also provides flexibility for smaller practices hesitant to invest heavily upfront.

Web-based deployment is the fastest-growing segment, driven by its hybrid benefits—ease of access via browsers without fully relying on external cloud hosting. This model appeals to clinics transitioning from traditional on-premise setups, offering a more familiar user interface while supporting real-time updates. Web-based solutions are particularly popular in urban markets where internet connectivity is reliable, and data privacy regulations demand greater control over patient records.

Application Insights

Patient record management is the most widely used application, serving as the backbone of all DPMS platforms. Clinics rely heavily on digitized health records to track patient history, allergies, treatment plans, medications, and referrals. The ability to retrieve patient data instantly, share it across departments, and securely store it over time is central to effective dental practice.

Advanced platforms now integrate EMR (Electronic Medical Records) features with dental charting and imaging modules, enabling comprehensive patient profiling. For instance, tools like Denticon allow practitioners to customize chart layouts and track case progression digitally—reducing paperwork and enhancing clinical accuracy.

On the other hand, dental analytics is the fastest-growing application, transforming raw practice data into actionable insights. These modules track metrics such as revenue per chair, patient acquisition costs, treatment conversion rates, and insurance claim success ratios. This data-driven approach helps dentists make informed business decisions, identify bottlenecks, and enhance profitability. With the growing trend of viewing dental clinics as both medical and business entities, analytics is becoming an indispensable tool for competitive success.

End-use Insights

Dental clinics constitute the largest end-use segment, as they represent the primary users of DPMS solutions. Clinics vary in size from solo practices to multi-dentist centers and are under increasing pressure to optimize their workflows, reduce administrative overhead, and improve patient satisfaction. DPMS platforms tailored for dental clinics, such as Open Dental and Dentrix, offer features like chair-side charting, recall systems, and multi-location management, making them indispensable to day-to-day operations.

Dental service organizations (DSOs), in particular, are driving demand for scalable and customizable platforms to manage numerous clinics under a single umbrella. Their reliance on cloud-based analytics and centralized dashboards makes DPMS software a strategic asset for managing operations and growth.

Hospitals are the fastest-growing end-user segment, especially in integrated health systems where dental departments must coordinate with general healthcare records. Hospitals require robust, interoperable DPMS platforms that align with hospital information systems (HIS) and electronic health records (EHR). The growing awareness about the link between oral and systemic health is pushing hospitals to invest in specialized dental modules within their IT ecosystems. This segment is also fueled by public healthcare investments in oral health programs.

Regional Insights

North America dominates the global dental practice management software market, driven by a high level of dental service penetration, advanced digital infrastructure, and early adoption of cloud technologies. The United States, in particular, leads in dental IT innovation, with a large number of private practices, dental chains, and DSOs investing in sophisticated software platforms. Regulatory bodies like HIPAA have also set high data compliance standards, pushing providers toward secure and efficient solutions.

Prominent players such as Henry Schein (Dentrix), Patterson Companies (Eaglesoft), and Curve Dental are headquartered in North America, contributing to the region’s technological edge. Additionally, dental education institutions and professional organizations have played a role in familiarizing future practitioners with digital workflows, ensuring sustained market growth.

Asia-Pacific is the fastest-growing region, fueled by rising dental tourism, increased oral health awareness, and significant investment in healthcare IT infrastructure. Countries such as India, China, South Korea, and Thailand are witnessing a surge in private dental clinics and chains adopting software to manage growing patient volumes.

The region's large population base, improving internet connectivity, and government initiatives promoting digitization have created an ideal environment for DPMS adoption. Furthermore, local vendors and startups are offering cost-effective, localized solutions, catering to the unique regulatory and cultural contexts of each country. As urbanization accelerates and patient expectations evolve, Asia-Pacific is set to become a focal point for DPMS innovation and expansion.

Recent Developments

-

April 2025 – Henry Schein Inc. announced a strategic upgrade of its cloud-based platform Dentrix Ascend, incorporating AI-powered patient analytics and real-time treatment suggestions.

-

February 2025 – CareStack secured $25 million in Series C funding to expand its all-in-one cloud dental software across Southeast Asia and the Middle East.

-

January 2025 – Patterson Dental integrated its Eaglesoft software with a new imaging suite, allowing enhanced diagnostics through AI-enhanced dental radiographs.

-

October 2024 – Tab32, a U.S.-based cloud dental software provider, introduced a voice-enabled clinical documentation module, reducing manual entry for dentists.

-

August 2024 – Curve Dental launched Curve Hero 2.0, featuring multi-location analytics and mobile-optimized interfaces, aimed at DSOs and growing clinics.

Some of the prominent players in the dental practice management software market include:

- Henry Schein, Inc.

- Carestream Dental, LLC

- DentiMax

- Practice-Web, Inc.

- Nextgen Healthcare, Inc.

- ACE Dental Software

- Datacon Dental Systems, Inc.

- CareStack (Good Methods Global Inc.)

- CD Nevco, LLC (Curve Dental)

- Dentiflow

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global dental practice management software market.

Deployment Mode

- On-Premise

- Web-based

- Cloud-based

Application

- Patient Record Management

- Appointment Scheduling

- Treatment Planning and Charting

- Digital Imaging and Radiography Integration

- Invoice/Billing

- Payment Processing

- Insurance Management

- Lab & X-Ray Orders

- Dental Analytics

- Others

End-use

- Dental Clinics

- Hospitals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)