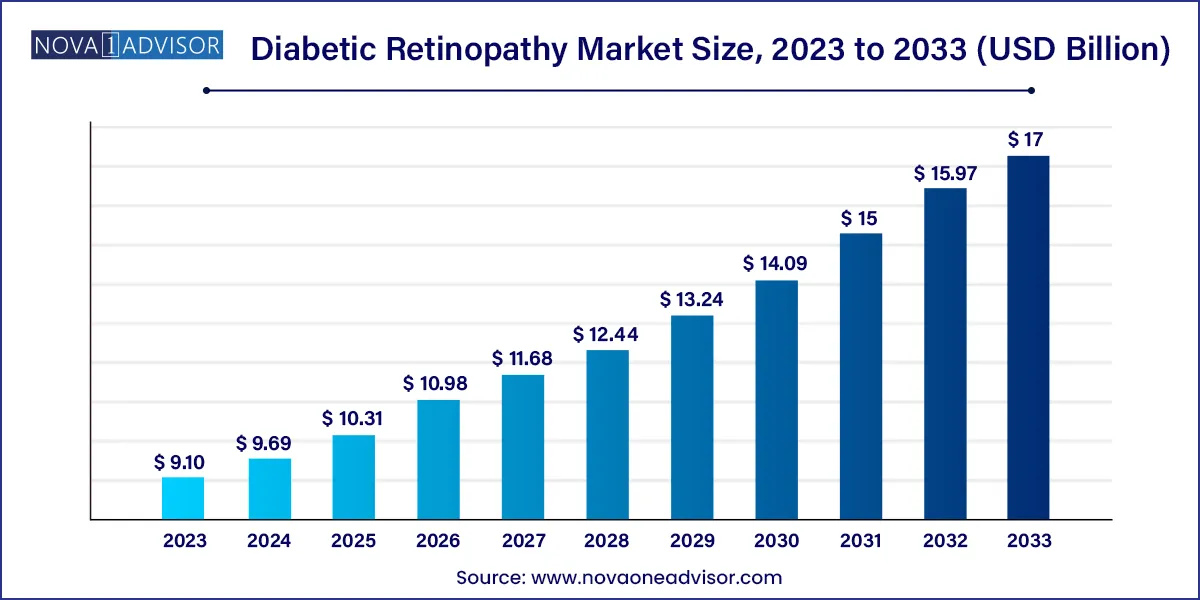

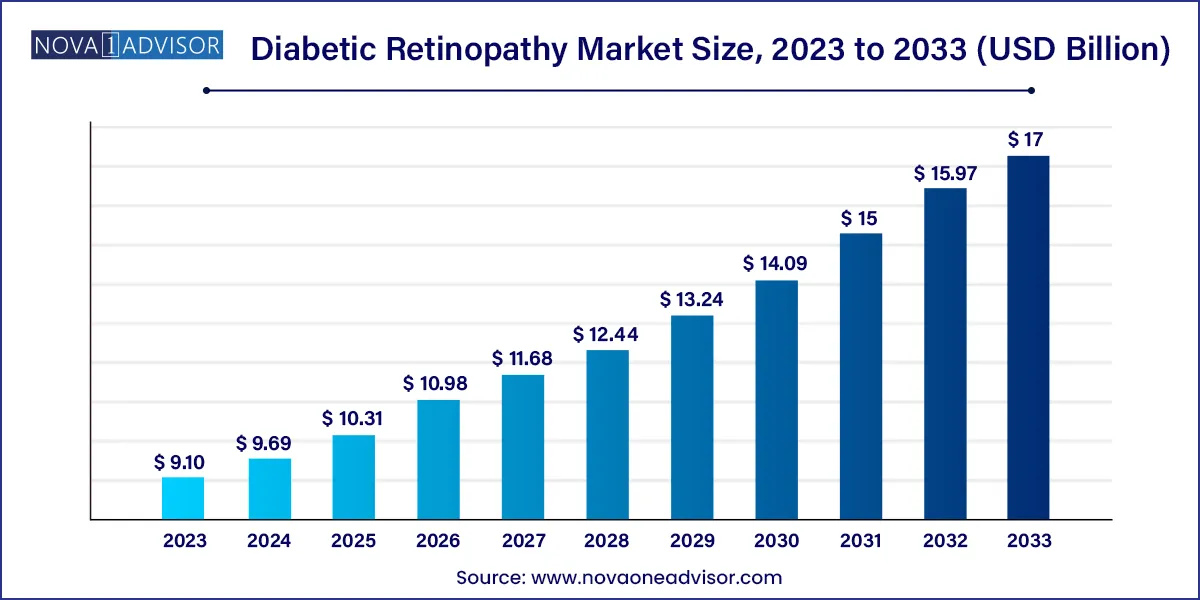

The global diabetic retinopathy market size was exhibited at USD 9.10 billion in 2023 and is projected to hit around USD 17.00 billion by 2033, growing at a CAGR of 6.45% during the forecast period of 2024 to 2033.

Key Takeaways:

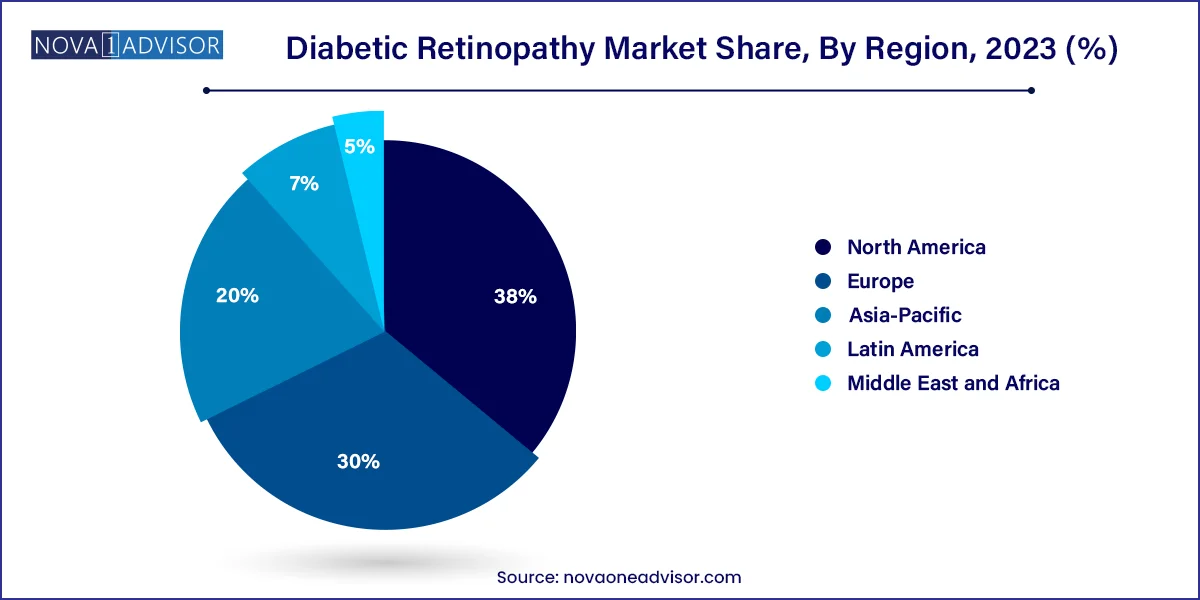

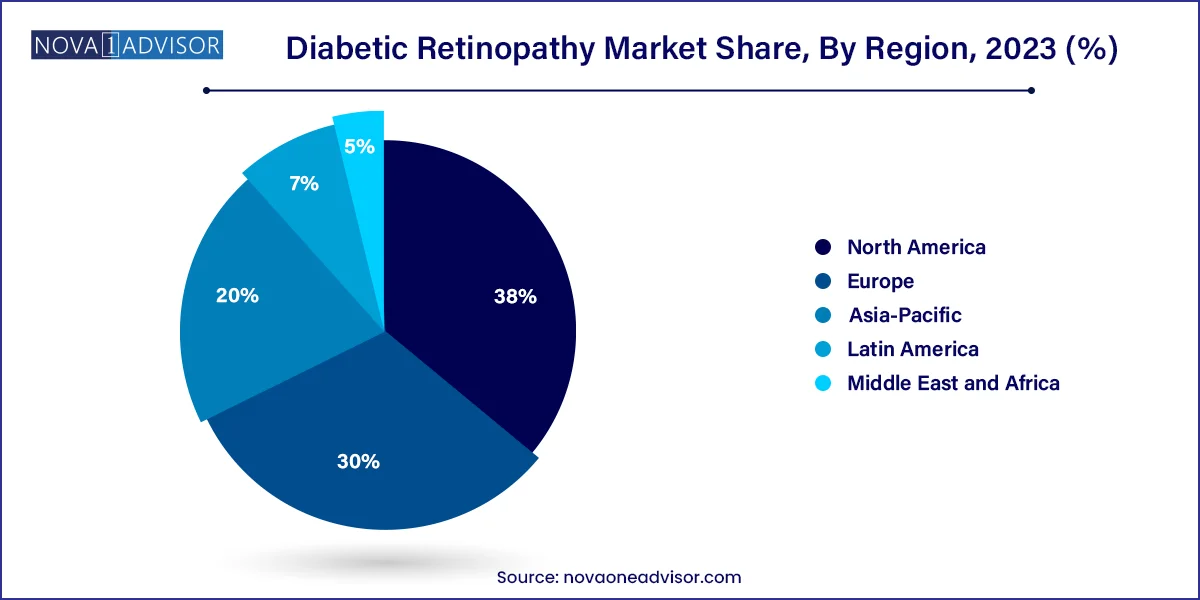

- North America captured the largest revenue share of 38.0% in 2023.

- The non-proliferative diabetic retinopathy (NPDR) segment dominated the market and accounted for the largest revenue share of 71.0% in 2023.

- The anti-VEGF drugs segment captured the largest revenue share of 92.33% in 2023

Market Overview

The global diabetic retinopathy (DR) market is poised for significant expansion, driven by the increasing prevalence of diabetes worldwide and a growing awareness of diabetes-related complications. Diabetic retinopathy, a progressive eye disease caused by chronic high blood sugar levels, remains one of the leading causes of vision impairment and blindness among working-age adults globally. It affects nearly one-third of all diabetic patients and is particularly insidious due to its often asymptomatic nature in early stages.

As of 2025, there are over 530 million individuals living with diabetes, a figure expected to reach 640 million by 2030 according to the International Diabetes Federation. This dramatic rise, especially in middle-income nations undergoing urbanization and lifestyle changes, is significantly contributing to the increase in DR cases. Diabetic retinopathy is broadly categorized into non-proliferative diabetic retinopathy (NPDR)—the early stage with blood vessel leakage and microaneurysms—and proliferative diabetic retinopathy (PDR), the more advanced form characterized by abnormal blood vessel growth, retinal detachment, and potential blindness.

Early diagnosis, aggressive glycemic control, and timely ophthalmic interventions are essential for preventing vision loss. The market comprises several interventional approaches, including anti-VEGF therapy, laser photocoagulation, steroid injections, and vitrectomy surgery. These treatment modalities have undergone substantial evolution over the past decade, and with the rise of artificial intelligence (AI)-assisted screening and imaging diagnostics, the industry is entering a new era of precision ophthalmology.

Healthcare policies supporting diabetic eye screenings, robust investment in R&D, and increasing patient access to specialty eye care services are also contributing to market growth. However, challenges such as therapy costs, disparities in access, and treatment adherence remain hurdles in certain regions, especially in underserved or rural populations.

Major Trends in the Market

-

Rising Adoption of Anti-VEGF Agents: Targeted biologics such as ranibizumab and aflibercept are increasingly used as first-line therapy in managing diabetic macular edema (DME) and PDR.

-

Integration of AI in Retinopathy Screening: AI-driven diagnostic platforms are improving early detection and referral accuracy in primary care and low-resource settings.

-

Shift Toward Long-Acting Drug Formulations: Sustained-release implants and long-acting biologics are gaining traction to reduce injection frequency and enhance compliance.

-

Expansion of Mobile Screening Units: Community-based diabetic eye screening programs are being deployed in rural and semi-urban areas to increase outreach.

-

Growth in Minimally Invasive Vitrectomy Techniques: Advanced surgical instrumentation and smaller gauge systems are making vitreoretinal procedures safer and more accessible.

-

Government and NGO-Led Eye Health Campaigns: National screening programs and collaborations with global NGOs are improving diagnosis rates in emerging markets.

-

Teleophthalmology for Remote Monitoring: Virtual consultation and image-sharing technologies are helping ophthalmologists monitor DR progression in follow-up patients.

-

Combination Therapies: Clinicians are exploring combined use of steroids, anti-VEGF, and laser for more comprehensive disease control.

Diabetic Retinopathy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.10 Billion |

| Market Size by 2033 |

USD 17.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.45% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Management, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bayer AG; Abbvie Inc.; Novartis AG; Oxurion NV; Sirnaomics; Alimera Sciences; Ampio Pharmaceuticals Inc.; BCNPeptides; Kowa Company Ltd.; Genentech, Inc. |

Key Market Driver: Increasing Global Prevalence of Diabetes

The most significant driver fueling the diabetic retinopathy market is the increasing global burden of diabetes mellitus, particularly type 2 diabetes, which constitutes over 90% of all cases. Urbanization, sedentary lifestyles, unhealthy diets, and rising obesity rates are propelling the incidence of diabetes in both high-income and developing countries. This sharp rise directly correlates with increased DR prevalence, given that almost all long-standing diabetics eventually develop some form of retinal damage.

For instance, studies show that after 20 years of living with diabetes, over 60% of type 2 diabetics and nearly all type 1 diabetics develop DR. This trend places immense pressure on health systems to manage and monitor vision-related complications. Governments and healthcare providers are increasingly focusing on preventive eye screening and early-stage intervention, creating a favorable environment for diagnostic technologies and treatment solutions.

As a consequence, pharmaceutical companies, medical device manufacturers, and healthcare institutions are aligning their strategies to target this rapidly expanding patient base with integrated, cost-effective, and minimally invasive solutions for DR management.

Key Market Restraint: Limited Access and Adherence in Developing Regions

A critical restraint hampering the growth of the global diabetic retinopathy market is the limited accessibility to ophthalmic care and poor treatment adherence in low-income and developing regions. In many parts of Sub-Saharan Africa, Southeast Asia, and Latin America, eye care infrastructure remains underdeveloped. Patients in rural areas often face logistical, financial, and educational barriers to timely screening and follow-up treatments.

Even when services are available, many patients do not adhere to regular anti-VEGF injections or follow-through with surgical procedures due to fear, cost, or lack of perceived necessity—especially in early stages when symptoms are minimal. Additionally, reimbursement limitations and lack of insurance coverage for expensive biologic therapies can deter patients from receiving optimal care.

These challenges contribute to late-stage diagnoses and higher rates of irreversible vision loss, undercutting the impact of technological advances and driving up healthcare system costs. Overcoming these hurdles will require significant investment in teleophthalmology, training programs, and affordable treatment models tailored to resource-constrained environments.

An emerging and transformative opportunity in the diabetic retinopathy market lies in the integration of artificial intelligence (AI) and machine learning (ML) into screening and diagnostics. AI-powered retinal imaging systems can analyze fundus photographs and OCT scans with high accuracy, detecting early signs of DR even before a patient becomes symptomatic. This innovation is particularly impactful in regions where access to trained ophthalmologists is limited.

In 2023, the FDA approved the IDx-DR system, a fully autonomous AI-based screening tool for DR detection, marking a significant milestone in ophthalmic AI. Since then, several startups and tech giants have developed similar platforms, many of which are being integrated into primary care clinics, diabetes centers, and community health programs.

These tools not only enable earlier detection and treatment but also reduce specialist workload and improve referral efficiency. As data sets grow and algorithms become more refined, AI-assisted screening could become the standard for diabetic eye care, especially in remote or underserved settings.

Segments Insights:

Type Insights

Non-proliferative diabetic retinopathy (NPDR) dominates the market, representing the most common and early stage of the disease. This form includes mild, moderate, and severe levels of retinal microaneurysms, hemorrhages, and capillary abnormalities. NPDR typically precedes any vision loss and is most responsive to preventive interventions such as blood sugar control and laser treatment. Due to increased screening efforts and diagnostic improvements, NPDR cases are being identified more frequently, supporting early and less invasive treatment strategies.

Proliferative diabetic retinopathy (PDR) is the fastest-growing segment, driven by an increasing number of late-diagnosed or poorly controlled diabetic cases. PDR involves abnormal neovascularization, tractional retinal detachment, and severe hemorrhage, often requiring more aggressive intervention such as vitrectomy or anti-VEGF injections. As diabetes management remains suboptimal in many parts of the world, the incidence of advanced-stage DR is rising, underscoring the need for surgical and biologic therapies designed to address complex ocular complications.

Management Insights

Anti-VEGF therapy is the dominant treatment modality in the DR market. These biologics—such as ranibizumab (Lucentis), aflibercept (Eylea), and bevacizumab (Avastin)—work by inhibiting vascular endothelial growth factor (VEGF), which is responsible for pathological blood vessel growth in the retina. They are particularly effective in controlling diabetic macular edema (DME), a leading cause of vision impairment in DR patients. Due to their efficacy and relatively low complication risk, anti-VEGF drugs are now first-line therapies in many treatment protocols.

Intraocular steroid injections are the fastest-growing segment, especially in patients unresponsive to anti-VEGF treatment or with inflammatory-driven DME. Long-acting corticosteroid implants such as Ozurdex and Iluvien provide months of therapeutic effect and are ideal for reducing treatment burden in chronic cases. The rising preference for personalized care and combination therapies is encouraging ophthalmologists to tailor treatment plans using both anti-VEGF and steroidal agents based on disease phenotype and patient tolerance.

Regional Insights

North America leads the global diabetic retinopathy market, supported by high diabetes prevalence, widespread access to eye care specialists, and strong reimbursement frameworks for diagnostic and therapeutic procedures. The United States, in particular, benefits from advanced screening systems, integrated diabetic care, and early adoption of anti-VEGF and AI-based technologies. The region also hosts several top-tier pharmaceutical and biotech companies engaged in continuous innovation and product development for retinal diseases.

Asia-Pacific is the fastest-growing regional market, driven by a sharp rise in diabetes incidence in countries such as India, China, Indonesia, and the Philippines. Rapid urbanization, changing lifestyles, and expanding middle-class populations have resulted in a diabetes epidemic across the region. While awareness and infrastructure still lag behind developed nations, significant efforts are underway to expand screening coverage and accessibility to affordable treatments. Government programs, international collaborations, and private sector initiatives are helping improve DR diagnosis and management, particularly in metro cities and semi-urban centers.

Recent Developments

-

Regeneron Pharmaceuticals (March 2025): Announced successful Phase III trial results for aflibercept 8 mg, a high-dose formulation for DME and PDR that extends injection intervals up to 16 weeks.

-

Roche (January 2025): Received FDA approval for Vabysmo, a bispecific antibody that simultaneously targets VEGF and Ang-2, offering enhanced durability and effectiveness in DR treatment.

-

Bayer AG (December 2024): Expanded access to Eylea biosimilars in emerging markets through partnerships with local biotech firms in India and Brazil.

-

Topcon Healthcare (October 2024): Launched its AI-integrated fundus screening platform in Japan and Australia for automated DR detection in primary care settings.

-

EyeNuk Inc. (August 2024): Secured CE mark for its cloud-based AI screening platform, EyeScreen, now being deployed in clinics across Europe and Southeast Asia.

Some of the prominent players in the Diabetic retinopathy market include:

- Bayer AG

- ABBVIE INC.

- Novartis AG

- Oxurion NV

- Sirnaomics

- Alimera Sciences

- Ampio Pharmaceuticals Inc.

- BCNPeptides

- Kowa Company Ltd.

- Genentech, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global diabetic retinopathy market.

Type

- Proliferative Diabetic Retinopathy

- Non-proliferative Diabetic Retinopathy

Management

- Anti-VEGF

- Intraocular Steroid Injection

- Laser Surgery

- Vitrectomy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)